Forced closures, withheld rent and suspended dividends, the real estate sector had a tumultuous 2020. There were, however, some property sectors and companies that performed well during the year.

So, what can be gleaned from looking at the performance of individual property companies during an unprecedented year of disruption, especially as we enter a third national lockdown?

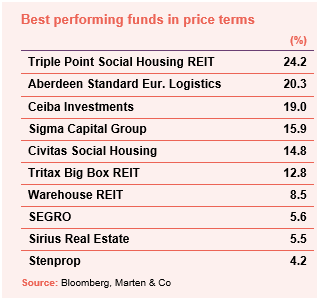

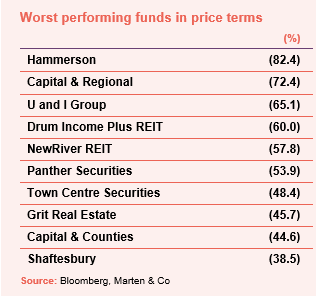

There are no surprises of the constituents of the top 10 and bottom 10 performing companies in price terms over the year. As you would expect, companies that had resilient rent collection figures and/or were focused on sectors that are expected to benefit from trends accelerated due to COVID, did well.

Social housing specialists Triple Point and Civitas were buoyed by the fact their income is government backed. Five of the top 10 – ASLI, Tritax Big Box REIT, Warehouse REIT, SEGRO and Stenprop – are focused on the thriving industrial and logistics sector, which is set to benefit further from increased online retail demand.

Again, there were no surprises in the bottom 10 performing funds, with six of the 10 (Hammerson, Capital & Regional, NewRiver REIT, Town Centre Securities, Capital & Counties and Shaftesbury) focused entirely or significantly on the retail sector.

Enforced retail closures had a huge impact on already under-pressure retail businesses and inevitably retailer failures ensued. Add to this many businesses were unable (or in some cases unwilling) to pay rent, income at the retail focused property companies collapsed.

Opportunities?

There are a few surprising omissions from the top performing companies. With online retailing trends accelerating and expected to prevail, one would expect to have seen Urban Logistics REIT (-1.4%) and Tritax EuroBox (+4.0%) to have performed better.

Urban Logistics REIT, which owns smaller logistics units on the edge of towns and cities and leases them to parcel delivery companies, is trading at a 1.0% premium to net asset value (as of 7 January 2021). However, having raised more than £90m in October (and more than £220m in 2020) the company is in growth mode, and its focus on last mile delivery hubs is hitting the sweet spot in terms of tenant demand and rental growth prospects.

The same can be said for Tritax EuroBox. Although focused on big box logistics facilities across Europe, it too has seen strong tenant demand in its locations. It recently tweaked its acquisition strategy to focus more on value-add opportunities (developments and leasing opportunities) to capture higher returns. It is trading at a discount of 15% (as of 7 January 2021).

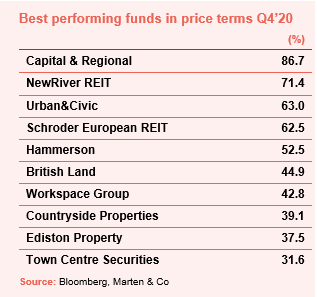

With retail focused property companies seeing huge share price falls in 2020 and the vaccine roll out ramping up, there could be some opportunities here.

Hopes that life will get back to normal – shops trading, workers returning to the office, leisure destinations opening their doors – by the second half of this year have grown and it would appear investors are taking a punt on this.

The final quarter of 2020, when news of vaccine effectiveness and approvals were announced, saw many of the companies that have performed so poorly in the year make a resurgence.

Here’s hoping for a safer and more prosperous 2021. Look out for QuotedData’s real estate annual review coming soon, which includes more in-depth analysis of fund performance during 2020.