In QuotedData’s morning briefing 11 February 2021:

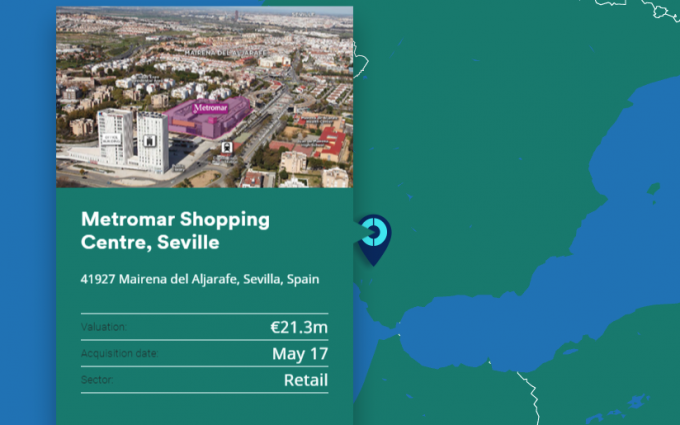

- Schroder European Real Estate says that at its Metromar shopping centre in Seville (which it owns in a 50/50 joint venture) one of the fashion anchor tenants will exercise its lease termination right. This termination accounts for approximately 3,000 sqm (14%) of the total space. The rent due will continue to be collected until the end of July 2021. Current occupancy at the centre is 84%. the centre was 3.6% or €7.4m of the last published 30 September 2020 NAV. Based on the 31 December 2020 valuation, the asset level LTV was 55%, providing 8.4% headroom to the LTV covenant of 60%. The income from this centre was already subject to a cash trap with the lender [income was being held within the joint venture structure to shore up its finances] and therefore any reduction in income from this vacancy will not have a material impact on the company’s current dividend expectations. The debt secured against the asset has no recourse back to the company or any other property in the portfolio.

- Baillie Gifford China Growth Trust notes that a number of stock markets in Asia will be closed for Chinese New Year. Consequently, the company will not be in a position to issue shares from 11 February 2021 until 16 February 2021. [Not really a problem for most trusts but this fast-expanding company could see a moderate but temporary rise in its premium.]

- BMO Managed Portfolio Trust has entered into a one year unsecured revolving credit facility with The Royal Bank of Scotland International Limited (“RBSI”) for £5m, on top of the existing £5m unsecured fixed rate term loan to 10 February 2022 with the same lender.

- LXI REIT says that it is targeting a dividend of 1.46p for the quarter that commenced on 1 January 2021, as a result of its 98% rent collection, and it is targeting an annual dividend of 6p for the 12-month period commencing 1 April 2021, up from 5.75p. [This is impressive stuff given the problems that many property companies are having.]

We also have some more news from Syncona and an acquisition by Warehouse REIT.