Tritax Big Box REIT reported a whopping 15.7% jump in EPRA net tangible assets (NTA) in full year to the end of December 2020, as the strong fundamentals of the logistics sector continued apace.

The group’s portfolio grew in value over the year by 11.9% to £4.41bn, driven by development gains, asset management and the strength of the market.

Record demand for logistics space saw earnings per share increase by 8% to 7.17p in 2020 (2019: 6.64p). The board declared a fourth quarter dividend of 1.7125p, resulting in a total dividend per share in 2020 of 6.4p, down from 6.85p a year prior.

The company posted a total accounting return for the year of 19.9%, up from 3.8% in 2019.

Operationally, the company said it saw record demand for logistics space during the year, driven by an acceleration of structural changes in the sector as a result of ongoing growth in e-commerce, and the increasing need for “modern, efficient and resilient” supply chains, which the COVID-19 pandemic and the impact of Brexit reinforced.

Rent collection was strong, with 99.4% of 2020 rent collected and all arrears expected to be received in 2021.

During 2020, contracted annual rent roll grew by £13.9m, or 8.4%, to £180.6m, which the board said was driven by asset management and the letting of development assets.

A total of 21.7% of the portfolio was subject to rent review or variation in 2020, achieving a 5.4% increase and adding £2m to contracted rent, while lettings of development assets added £16.9m to the contracted rent roll.

The company let four buildings, including two to Apple and a recent 20-year lease to Ocado, adding £3.9m to rent, while planning consent was received on a further 5.4 million square feet of prime logistics space during the year.

It said its near-term development pipeline stood at 10.2 million square feet across 12 sites, of which 74% had planning consent as at 31 December 2020.

The company disposed of four assets for £134m during the year, delivering a weighted levered internal rate of return of 12.9% per annum.

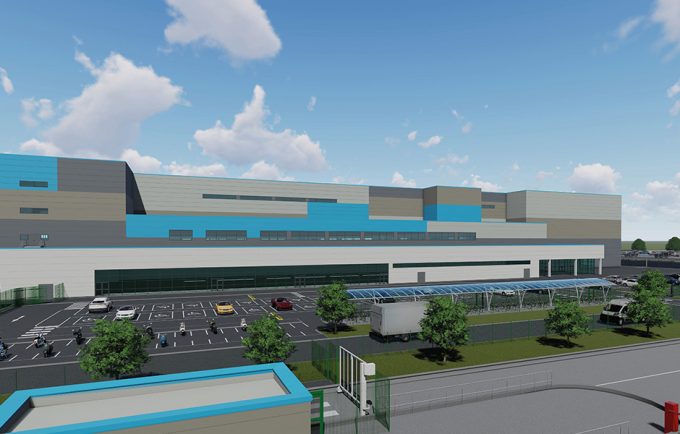

It said it was redeploying the disposal proceeds into higher-returning development opportunities and the acquisition of a prime 325,000 square foot distribution logistics building in Southampton, which it said had “significant” value-add potential.

The group said it had a strong balance sheet with a loan-to-value ratio of 30%.

BBOX : Tritax Big Box reports impressive results