VPC Speciality Lending lifted by Dave – VPC Impact Acquisition Holdings III, a special purpose acquisition company (SPAC) sponsored by an affiliate of Victory Park Capital has agreed to combine with Dave Inc. VPC Specialty Lending Investments currently owns 1,021,630 Class B Shares and 829,154 private placement warrants in the SPAC, which it bought for an aggregate cost of $1,247,795 and which it was valuing at this level. The transaction implies an approximately US$4 billion post-merger enterprise value for Dave (based on a $10.00 price for the Class A Common Stock).

Once the transaction completes, 75% of the fund’s Class B Shares automatically convert into Class A Common Stock (on a one-for-one basis). This implies a value of $7,662,230, a 1.6% increase to the 30 April 2021 NAV (before fees). The other 25% of the fund’s Class B Shares have a vesting period of five years from the consummation of the transaction but are fully vested if the volume weighted average price (VWAP) reaches defined levels for 20 out of 30 trading days at any time during this period. Of the remaining Class B Shares, 60% will vest at a VWAP of $12.50 price for the Class A Common Stock and the remaining 40% will vest at a VWAP of $15.00.

Note: VPOC Speciality Lending will apply a 30% haircut to the implied value to take into account deal closing risk and illiquidity relating to its lock up on the Class A Common Stock. The initial uplift to the NAV will be 1.0%, therefore (before fees). There will be no value assigned to the remaining 25% of the Class B Shares until the shares have vested and convert into Class A Common Stock.

Similarly, each private placement warrant gets converted into a warrant to purchase one share of Class A Common Stock of Dave. VSL holds 829,154 warrants, which maintain a $11.50 per share strike price and expire five years after closing of the transaction. No value is assigned to the private placement warrants as long as the Class A Common Stock traded price is below the strike price.

VSL’s Class A Common Stock is subject to a one-year post-closing lockup unless otherwise accelerated based on average trading performance measured six months post-closing. The transaction is expected to close in the third quarter of 2021.

About Dave

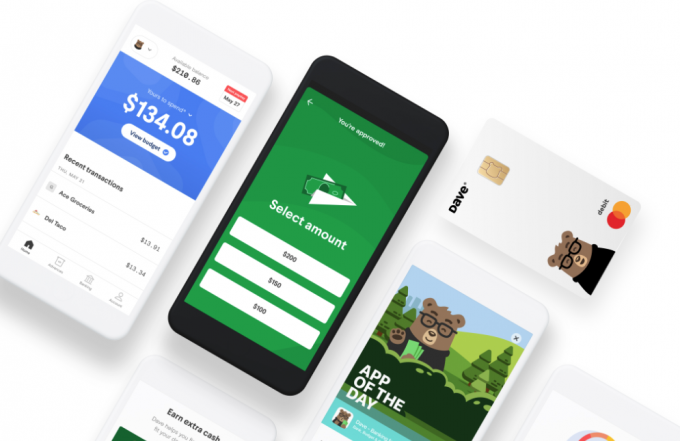

Dave’s mission is to create financial opportunity that advances America’s collective potential. Dave helps its more than 10m customers with banking, financial insights, overdraft protection, building credit and finding side gigs. Institutional investors committed $210m in a PIPE (private investment in public equity) deal led by Tiger Global Management, with participation from Wellington Management and Corbin Capital Partners.

Launched in 2017 as an app to help Americans avoid billions of dollars in overdraft fees charged by traditional banks, Dave is now a financial platform helping 10 million customers with banking, financial insights, overdraft protection, building credit and finding side gigs. Dave aims to help foster the financial health of its members while also giving back to the community, having pledged over 13 million meals to Feeding America since launch. To date, Dave estimates that it has helped customers avoid nearly $1bn in overdraft fees through its flagship feature, ExtraCash, and earn over $200 million in income through its gig-economy job board, Side Hustle.

In December 2020, the company launched Dave Banking, a spending account and debit card with no monthly fees, which has already accumulated more than 1.3m members.

VSL : VPC Speciality Lending lifted by Dave