There has been an awful lot of conjecture surrounding the future of the office and not of lot of data on which to pin anything on. Well, that seems to be changing as some of the big London developers update the market on recent activity and letting brokers’ deal flow data start to reveal trends.

We had Craig Wright, head of European real estate research at abrdn, give a keynote speech at our Property Webinar this week (which also included presentations from the managers of Stenprop, Triple Point Social Housing and Aberdeen Standard European Logistics Income) on this very topic and it is now becoming apparent that a two-tier office market is forming.

Two-tier market

As more and more people work from home for at least one or two days a week, the company head office is going to have to change. Employees will expect certain things from the office to entice them back, Wright argued. A good location close to mainline stations, provision of amenities and collaboration areas, and tech enabled space (for things like desk booking apps and air quality control) will be some of the top office needs.

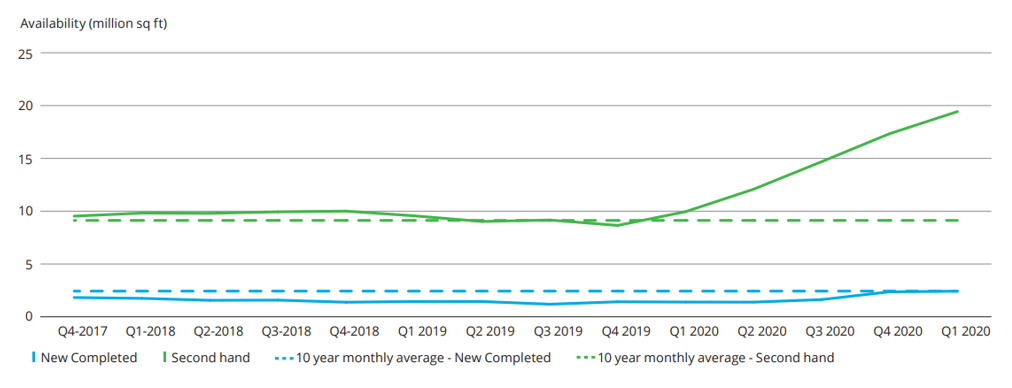

This can only be provided by new built stock. Availability of second-hand office space has gone up dramatically since the start of the pandemic, as can be seen in the figure below. However, new build offices have fared well.

This has been borne out in recent trading updates from Great Portland Estates and Helical and statistics released by JLL, which show that overall central London vacancy rates remain at around 7%, but Grade A space is below 1%.

Helical, which has office developments focused around the City of London, reported a marked increase in enquiries from potential tenants for its vacant space, while Great Portland Estates (office developments across central London) signed lettings worth £12.7m of new annual rents in the three months to the end of June, with a further £14.9m under offer. “As momentum in our markets builds, we can expect demand for our flexible and sustainable spaces to grow,” chief executive Toby Courtauld said.

Stranded assets

The sustainability credentials of not just offices but all property should be right at the top of the agenda of all developers. Helical’s chief executive Gerald Kaye said the momentum in letting activity in central London reflected the “divergence in the market and reinforces our view that there will be a clear ‘green premium’ for the best-in-class office space and a ‘brown discount’ for the rest.

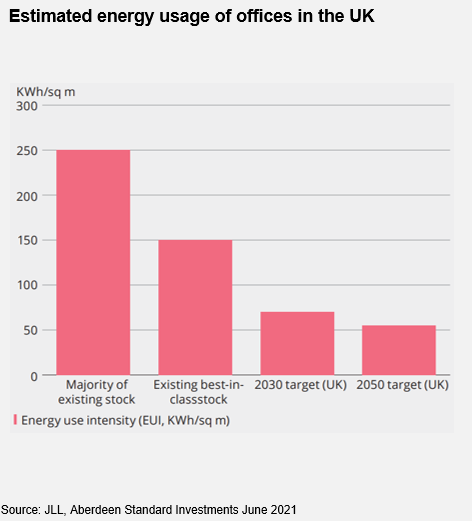

Abrdn’s Wright argued there will be many “stranded assets” in the market that are not appealing to tenants or investors. This will become even more apparent over the next few years when energy efficiency target dates near.

Estimated energy usage of existing offices in the UK is three times greater than the 2030 target, while current ‘best-in-class’ stock is still double the target.

Best-in-class to outperform

Strong evidence is starting to come through that a two-tier office market is developing and best-in-class offices that meet the needs of tenants and their employees and meet sustainability credentials will continue to outperform. The big central London office developers look in good shape to deliver this and look good value. Helical is trading at a discount to net asset value of 17.2%, while Great Portland and Derwent London are on discounts of 6.0% and 10.4% respectively.

QD view – defining future fit offices