With valuations in biotech having fallen substantially in the last year, BB Biotech (SWX: BION) sees compelling opportunities in the small-to-mid cap space this year and believes some of its core portfolio companies, such as Neurocrine, Incyte and Ionis Pharmaceuticals, could see interest from strategic investors, including as M&A targets.

The comments come in the Swiss company’s preliminary report for 2021, published earlier today. BB Biotech updated the market on what turned out to be a very challenging year for biotech investing, in which its portfolio value (NAV) fell by 11.5% in the year and by 14.2% in the fourth quarter. Nevertheless, for 2021, the total share return was +8.3%, beating benchmark biotech stock indices.

BB Biotech reported that it made some small additions to existing portfolio positions in the fourth quarter: in oncology-focused (Relay Therapeutics, Macrogenics and Fate Therapeutics); in commercial stage (Neurocrine and Myovant), and in genetic medicines companies (Wave Life Sciences, Generation Bio and Ionis). However, no entirely new investments were made in the quarter, making 2021 unusually low in terms of this feature, with just two made in 2021 – both in the first quarter. The investment level (gearing) rose by around 4% points vs the third quarter, ending 2021 at 111%.

BB Biotech has proposed a dividend in respect of 2021 of CHF3.85/share (to be paid in March), a 7% rise over the 2020 figure and a sum that corresponds to a yield of 5.5% based on the current share price.

BB Biotech’s shares closed at CHF69.4 yesterday and are down by 10.1% year to date in 2022, while its NAV has fallen by 18% at CHF48.7/share. Biotech stocks have been in a bear market since early last year and the XBI is now down by 48% from its February 2021 peak.

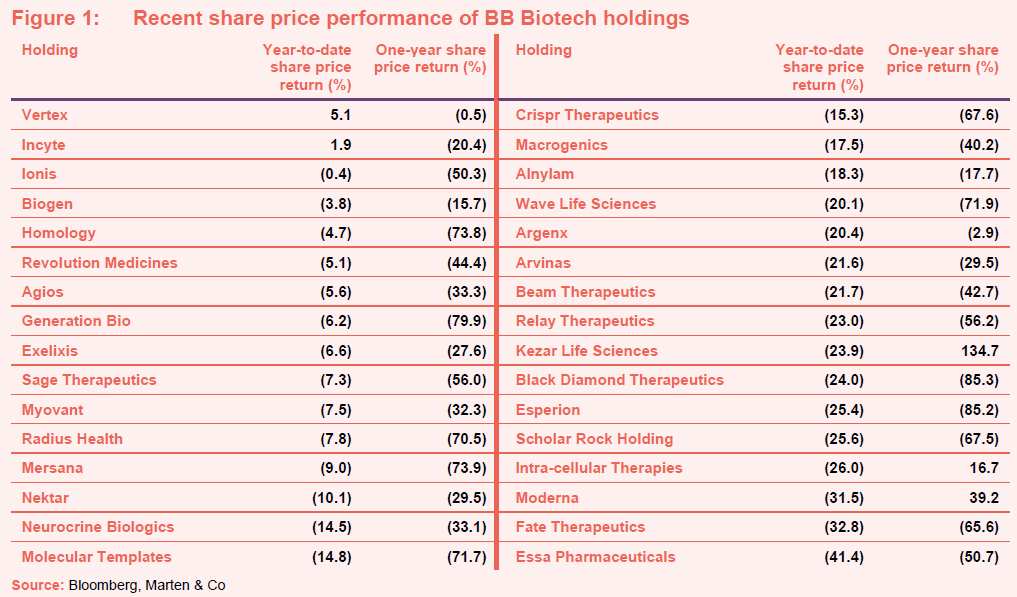

As can be seen in the table below, just two holdings in BB Biotech’s portfolio have seen share price rises this year, while 30 are down. Looking over a one-year period from 20 January 2021 (which was very close to the last peak), just three stocks have traded higher (Kezar Life Sciences, Intracellular Therapies and Moderna), although two are fairly robustly so. However, the magnitude of the declines for the rest, highlights the extent of the current bear market in biotech.

BB Biotech portfolio stock price performance over the YTD period and one-year (as of close 20 January 2022).

[QuotedData comment: As noted in previous articles, biotech investing can be extremely challenging at times when the sector is falling out of favour, but opportunities are presented for those with a sufficiently long-term horizon. Most commentators believe biotech stock prices will recover this year, especially if there is an upsurge in M&A which valuations would seem to make much more attractive. BB Biotech remains, in our view, a well-managed collective investment vehicle that has delivered out-performance over the long-term timescales, even if currently its premium to NAV puts it at something of an anomaly situation versus peers.]