Swiss investment company BB Biotech (SWX:BION) closed 2021 with its shares trading at CHF77.15, a rise by 8.3% over the year. However, the positive stock performance contrasts with an 11.4% fall in its NAV to CHF59.4/share in 2021, which was adversely affected by the severe bear market for biotech – and particularly its small to mid-caps stocks – over most of last year.

Both share price and NAV have been quite volatile of late, which is a reflection of current stock market conditions. Yesterday, which was a trading day in Switzerland and the US, the stock price rose by 1.4% and the NAV by 2.5%.

As is evident, BB Biotech’s stock stands at a considerable premium to NAV, currently 29%, a figure that has grown from 9% at the start of 2021. This reflects, in our view, the high regard in which the manager Bellevue Asset Management is held by investors as well as the fact that BB Biotech’s share price tends not to be particularly sensitive to NAV movements.

BB Biotech’s investment performance in 2021 was strongly correlated with the share price of Moderna, its largest holding (14.7% of NAV at 30 September). This moved strongly upward one a one-year basis, but also gyrated as investor sentiment changed during the pandemic in relation to its Covid vaccine. Moderna’s shares closed up by 143% at $254/share on the year, but this was also little more than half of its all-time high of $484, reached in early August.

Moderna was also one of just six stocks in BB Biotech’s 30-strong portfolio that are above their end-2020 levels, while many – indeed most – of the others have seen substantial declines. The median change for stocks in the portfolio in 2021 was a decline of 24%. Furthermore, illustrating the extent of the bear market, BB Biotech had four stocks in its portfolio (Generation Bio, Mersana, Esperion and Black Diamond Therapeutics) that lost 75% or more of their value.

The best performance from within the portfolio came from Kezar Life Sciences, which was up by 220% in 2021, although this was one of the smaller holdings (0.9% of NAV), so this will have had a relatively limited impact on overall performance. This stock price gain was driven positive interim Phase 2 clinical data for a lupus nephritis candidate, KZR-616, which was reported in November. Kezar was also the top performer among the 192 stocks included within the XBI, a key index of small and mid-cap biotechs, in 2021. According to an analysis by QuotedData, Kezar showed the sixth highest gain of all Nasdaq-quoted biotech stocks in 2021, behind Prothena (+311%), Bicycle Therapeutics (+239%), Oramed (237%), Gritstone Oncology (+226%) and Anavex Life Sciences (221%).

Other strong positive contributors in BB Biotech’s portfolio included Argenx (6.6% of NAV, +19.1%), Alnylam (4.8% of NAV, +30.5%) and Intra-Cellular Therapies (3.1% of NAV, +64.6%). However, there were of course many detractors to performance, included notably Ionis Pharmaceuticals (7% of NAV, -46.2%) and Sage Therapeutics (3.2% of NAV, -50.8%).

Essa Pharmaceuticals (0.9% of NAV), which is one of just two new investments made by BB Biotech in 2021, saw a 19% gain over the year. However, the other new portfolio addition, Revolution Medicines (2.1% of NAV), fared less well and fell 36% in the year.

2022 – a better year for biotech?

Many observers predict a better year for biotech in 2022, as there is potential for big pharma M&A to return – several examples of this were seen in December. Alnylam is perennially rumoured to be a takeover candidate, as is Ionis, albeit to a lesser extent. A number of BB Biotech portfolio stocks have appeared in sell-side top recommendations for 2022, including Moderna, Alnylam, Argenx CRISPR and Fate.

Nektar (1.1% if NAV) has an important stock catalyst expected in January, in the form of interim (PFS) data from a Phase 3 trial of its lead drug, bempegaldesleukin in melanoma. One sell-side firm is predicting 50-200% upside in the stock on a positive result (and 20-50% downside for a negative one).

Comparison against peers

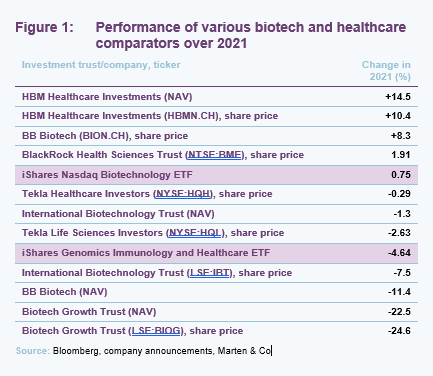

BB Biotech’s investment performance in 2021 would place it in the middle of 24 biotech-focussed, closed-end funds/ETFs (excluding geared ones), monitored by QuotedData. These funds showed a NAV return ranging from +15% (VanEck Vectors Biotech ETF, which has mostly large cap biotech/pharma stocks) to -34% (ARK Genomic Revolution ETF). Around three-quarters of these investment vehicles showed a negative return last year, again highlighting the extent of the biotech bear market in 2021.

BB Biotech managed to beat the XBI (SPDR S&P Biotech ETF), which showed a decline of 20.5%, but fell short of the IBB (Nasdaq biotechnology industry ETF, which is heavily biased towards large caps stocks), was up by 0.75% on the year. Thus, its performance falls between the two most widely followed investment benchmarks for biotech stocks.

BB Biotech’s NAV performance was, however, at the lower end of the smaller group of more direct comparator funds (investment trusts) that focus on the small to mid-cap biotech space. The best performance from this group came from HBM Healthcare, although it should be noted this fund has a short position on biotech indices so would be expected to do well in a bear market (it is an absolute return, market-neutral hedge fund). The poorest performance from this group was from Biotech Growth Fund (LSE: BIOG) at -22.5%. One-year returns for these stocks for share price and NAV (where known) are shown in the table below (all are closed end funds listed on European/US exchanges that invest exclusively in biotech).

BB Biotech is expected to report its Q4 portfolio on 21st January.

[QuotedData comment: Notwithstanding the somewhat disappointing investment performance in 2021, BB Biotech remains a well-managed collective investment vehicle that has delivered out-performance in comparison with peers over the long-term timescales. It offers investors an attractive vehicle to gain exposure to a focussed group of biotech drug developers.]