There is a natural bias with financial analysis and commentators towards writing about securities that are perceived as being cheap and less so about those that may, at least optically, look expensive. There is a lot of emphasis placed on trusts trading at marked discounts to net asset value but much less focus on trusts that are trading at premiums, or at levels that look expensive relative to their history.

There’s a lot of sense to this – everybody loves a bargain, right? Well, there is a problem in that funds are not static and they evolve over time. Sometimes, a fund may undergo a structural change for the better, which leaves it trading on a more expensive rating but one that is deserved and may even still be inexpensive. In this scenario, the simple and widely used screening tool of comparing discounts to their longer-term averages can be potentially misleading and investors, who do not understand the full context, could miss an opportunity.

I should caveat this by saying that I am not immune to this. Discounts and premiums have a tendency to mean revert, often quite quickly, and so I’m not given to favouring trusts that are trading at ratings much above their long-term averages, unless I can see a good reason.

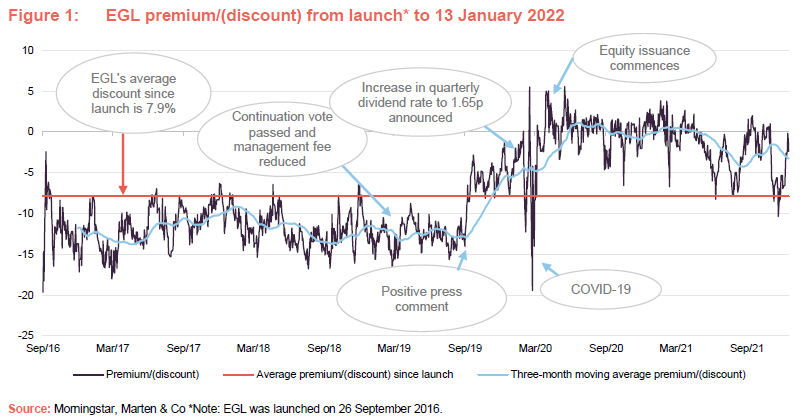

Ecofin Global Utilities and Infrastructure (EGL) is an interesting case to illustrate the point. It published a good set of annual results (for the year ended 30 September 2021 – click here to read), but these were barely noticed against the background noise of Christmas, COVID, and the revelations regarding government parties. I think that they are worth revisiting and it is also an opportune time to look at how the trust’s rating has improved so markedly. The results also marked five years since EGL’s launch, a key record to have for assessing longer-term performance as well as premium/discount performance.

A rollover with a need to prove

EGL listed on 26 September 2016, having been established as a rollover vehicle for Ecofin Water & Power Opportunities Plc (EWPO). Although perhaps not immediately obvious, the new trust was a markedly different vehicle to its predecessor, but given EWPO’s chequered history, EGL was going to have to prove itself.

While both aimed to provide a high secure dividend yield and long-term capital growth, EGL has a much more focused investment remit and, with the world focusing on reducing its carbon emissions, its investments are exposed to long-term structural growth areas.

Another key difference was in the approach taken to gearing. EWPO had been shackled with long-term structural gearing in the form of zero dividend preference shares (ZDPs) and convertible unsecured loan stock (CULS), which hurt its performance over time. Instead, EGL uses a prime brokerage facility, which gives the manager complete flexibility to add gearing when markets are depressed and to take money off the table when markets look frothy (something that Jean-Hugues de Lamaze, EGL’s portfolio manager, has been very adept at).

EWPO also invested in unquoted investments and had a greater capacity to invest in companies outside of the OECD (up to 20%). With the benefit of hindsight, these had tended to weigh on its performance too.

A five-year record of hitting returns at the top end of its target range

Five-years on and EGL has clearly been a success. EGL aims to deliver a 6-12% per annum (total return) over time and, with the passing of its fifth anniversary, it has achieved this comfortably. From launch on 26 September 2016 to 30 September 2021, EGL’s NAV total return averaged 11.3% per annum, which is right at the top of its target range. However, reflecting a hefty narrowing of the discount during the period, shareholders have done much better than this, with a share price total return that averaged 17.1% per annum.

The market awakens

Full disclosure – EGL is a research client of QuotedData’s and I have been covering it in detail since it was about eight months old (my initiation note was published in May 2017 and you can click here to read our most recent note published in October 2021, which takes a more detailed look at the last five years). When I was first writing on EGL, I highlighted factors such as its double-digit discount, the anticipated strong demand for infrastructure spending globally and the attractive returns the EGL’s manager expected to accrue to the providers of capital. As we followed it, the manager delivered on its promises to grow EGL’s NAV, while investor interest in areas such as renewables and clean energy generation has expended massively, but the discount remained stubbornly wide until EGL was around three-years old.

By the time EGL had reached its third birthday, it had provided NAV and share price total returns of 43.1% and 61.8% respectively, putting it ahead of the MSCI World Utilities Index (+42.1%), the S&P Global Infrastructure Index (+32.9%), global equities more generally (as represented by the MSCI World had returned +43.5% during the same) and the MSCI UK (+21.0%). Fast forward to its fifth birthday and EGL’s performance is even more impressive (cumulative NAV and share price total returns of 71.3% and 120.2%). These sorts of returns are, unsurprisingly, attractive to investors. However, the market was not finally shaken awake until the end of September 2019 when a respected market commentator added it to his portfolio and wrote an article explaining that EGL could be acquired at a then 12% discount to NAV and effectively offered exposure to listed infrastructure which was trading at an average 14% premium. This let the genie out of the bottle and as you can see in Figure 1, it’s never gone back.

Where is EGL today?

As at 13 January 2021, EGL was trading at a discount of 1.5%, which compares to an average discount since launch of 7.9%, a five-year discount of 7.4% and a three-year discount of 4.6%, all of which suggest that, at the margin, EGL looks expensive relative to its history. However, if you compare its current discount to the average since the market decided to rerate it (2.0%), EGL looks to be close to fair value. In addition, if you take out the market distorting effects of COVID, EGL looks modestly cheap versus an average discount of 1.0%.

When EGL is trading at a modest premium, it has tended to issue stock (allowing the trust to expand for the benefit of all shareholders) and we think there is scope for this to happen again (EGL is once again looking cheap versus the renewables and infrastructure funds). With a decent growth runway ahead, now could actually prove to be a good entry point.