F&C cuts fees and ups dividend – F&C Investment Trust beat its benchmark over 2021, delivering an NAV return of 21.7% against 19.5% for the All-World index. The share price lagged the NAV a little and delivered a return to shareholders of 19.4%. The company’s private equity holdings did well as did its investments in listed North American stocks. The dividend is upped by 5.8% to 12.8p – marking the 51st consecutive year of dividend increases for the trust. This was not covered by revenue; revenue per share was 10.99p. The company has vast distributable reserves to tap into, however.

Russian exposure was just 0.3% of the portfolio at the end of 2021 and this is now valued at zero. Once it can, all the Russian exposure will be sold.

Management fee cut

Following constructive discussions with the manager, the management fee rate has been reduced and with effect from 1 January 2022 it will be charged at a rate of 0.325% per annum of market capitalisation up to £3.0bn, then at 0.3% up to £4.0bn and 0.25% beyond that. Then the fee will drop again with effect from 1 January 2023. The rate of 0.3% will be applied to a revised first tier of up to £4.0bn and of 0.25% thereafter. The ongoing charges ratio for 2021 was 0.54%, down from 0.59%. These changes should help, all else being equal, that level to fall further.

Hedging

The £300m of sterling that the company bought as a currency hedge in 2020 was cut to £200m in 2021, crystallising a £9.1m profit. The remaining £200m position was sitting on an unrealised £4.8m loss at the end of 2021, however.

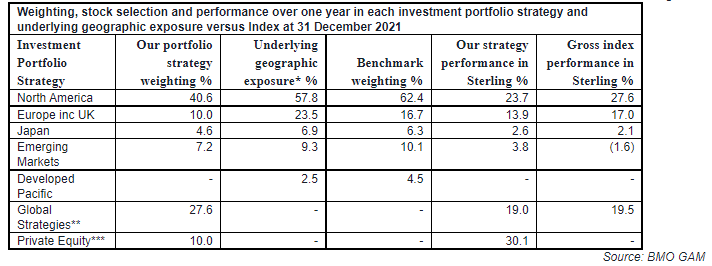

Underlying performance

There’s no managers’ commentary to go with the above table but we expect it will be available in the report and accounts once that is published.

FCIT : F&C cuts fees and ups dividend