Majedie says that it plans to appoint Marylebone Partners as its investment manager and AIFM and change its approach to that of a ‘liquid endowment model’.

Founded in 2013, Marylebone Partners is an independent firm, currently managing approximately $400m for professional and institutional clients who include charities, foundations, family offices, high-net worth individuals, and trusts. Majedie would receive, for no consideration, an interest in Marylebone Partners entitling it to 7.5%. of residual profits and capital. Marylebone Partners would reduce the management fee payable by Majedie by half for a period of twelve months and make a significant ongoing contribution to the cost of marketing the company.

Marylebone Partners’ investment approach includes three core strategies, comprising eclectic special investments, allocations to specialist funds managed by third parties and a focused portfolio of listed equities. It sources investments through a global network, which its principals have built over nearly three decades at industry leading firms. The board believes it will be increasingly important to identify differentiated sources of performance from the large and growing set of less researched opportunities that are available within this wider investment mandate, in addition to those in the major asset classes.

In conjunction with the appointment of a new manager, if shareholders approve, Majedie will adopt a new investment policy, following which it will target annualised total returns (net of fees and expenses, in GBP) of at least 4% above the UK Consumer Price Index, measured over rolling five-year periods. The target total return will include an annual dividend, paid quarterly. Each quarterly dividend payment is initially expected to comprise 0.75% of the relevant quarter-end’s NAV, equating to an annual dividend of about 3% of NAV.

The meeting to approve the change would take place alongside the AGM in January and the new manager would start immediately afterwards.

Over the three years to 30 September 2022, Marylebone Partners’ representative track record delivered net annualised performance in GBP of +8.4%, four percentage points more than UK CPI.

Majedie has shrunk considerably in recent years. The board says that it is aware of investors (including parties connected to Marylebone Partners) who have expressed an interest in becoming shareholders in the revamped vehicle. That could help narrow, maybe even eliminate the discount, which could in turn allow it to grow.

Further information on Marylebone Partners.

Marylebone Partners is an owner-operated investment manager, based in London and regulated by the FCA. It was founded in 2013, with the vision of bringing a distinctive investment approach to clients seeking a manager to protect and grow their wealth in real terms. Marylebone Partners’ defining characteristic is its ability to identify and access differentiated fundamental investment opportunities, sourced through a global ideas network.

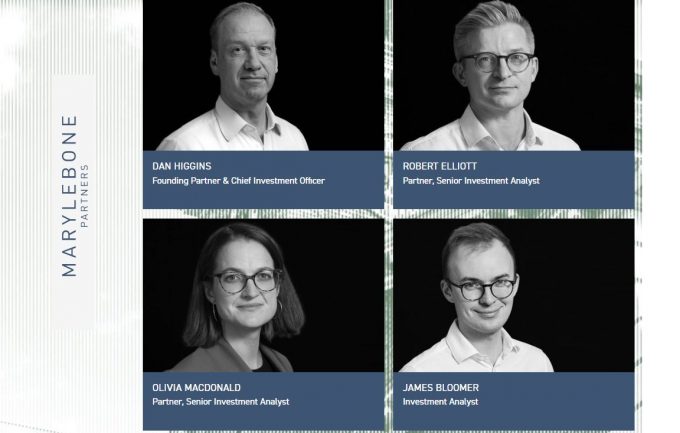

Team

Marylebone Partners’ principals have previously held senior positions at industry-leading firms and have prior experience of managing investment trusts. Decisions are made collaboratively, by a team with varied backgrounds that bring differing perspectives. The firm’s culture encourages continuous improvement and diversity of thought. Marylebone Partners’ investment committee comprises its three senior investment professionals, and three highly respected non-executive partners:

Dan Higgins: Dan was formerly chief investment officer of Fauchier Partners LLP, a multi-billion AUM alternatives firm with a reputation for uncorrelated returns and capital preservation in difficult markets. At Fauchier Partners, he gained extensive experience of the closed-ended fund structure through the firm’s flagship listed vehicle, The Absolute Return Trust Limited. Previously, Dan was a senior fund manager at Mercury Asset Management plc, where he ran equities portfolios for large pension-fund clients. He holds a degree in Philosophy, Politics and Economics from Magdalen College, University of Oxford.

Olivia Macdonald: Olivia joined Marylebone Partners in 2017 from The Wellcome Trust’s investment team, where she focused on private and public direct investments. Prior to this, she worked for Goldman Sachs in both sell-side equities research and in their asset management division. Olivia holds a degree in Philosophy, Politics and Economics from New College, University of Oxford, and is a CFA charter holder.

Robert Elliott: Robert joined Marylebone Partners in 2014. Previously, at THM Partners, he advised companies on operational and financial restructurings. Prior to this, he was a lawyer working on corporate finance and M&A transactions for Jones Day. Robert holds a degree in Law from the University of Nottingham, a Masters in Finance from the London Business School and a corporate finance qualification from the Institute of Chartered Accountants (England & Wales).

Stuart Roden (non-executive): Stuart has chaired Marylebone Partners’ investment committee since inception in 2013. Until January 2019 he was chairman of Lansdowne Partners, having previously co-managed the firm’s Developed Markets funds. He began his career at SG Warburg & Co, McKinsey & Company and Mercury Asset Management plc. He is non-executive chairman of Hetz Ventures and Tresidor Investment Management. Stuart received a first-class honours degree in Economics (BSc) from the London School of Economics.

Marc Jonas (non-executive): Marc is a co-founder of Sun Capital Partners and has extensive experience as an investor in the Leisure, Financial Services and Real Estate sectors. He served as chairman of Pearl Group’s Asset/Liabilities Investment Management Committee and co-founded Wellington Pub Company in 1997 (where he was managing director) and Punch Group in 1997, serving as a non-executive director until 2004. Mr. Jonas is a director of Carnegie Capital Estates and holds several other directorships, including Apex2100, Clarendon Park Estate and Zeta Shares. He holds a degree in Philosophy, Politics and Economics from Christ Church, University of Oxford.

David Haysey (non-executive): David was formerly head of Marylebone Partners’ public equities investments and has held senior positions at prior firms including as head of European equities for SG Warburg plc and Deutsche Bank AG and CIO and co-CEO of Deutsche Asset Management’s European Absolute Return business. Before joining Marylebone Partners, David worked for RIT Capital Partners plc, where he was a board member and head of public equities. He is a non-executive director of Augmentum Fintech plc and an advisory board member of Cluny Capital Limited. He has a degree in Philosophy, Politics and Economics from the University of Oxford.

Proposed investment strategy

Marylebone Partners will build a bespoke portfolio for Majedie, which will combine the three core strategies that have driven returns for Marylebone Partners’ flagship open-ended strategy since inception in 2013. They are as follows:

- Special Investments. Marylebone Partners sources eclectic opportunities comprising co-investments, special purpose vehicles and opportunistic / thematic funds. These hard-to-access situations target potential IRRs of 20 per cent. or better, with monetisation typically expected within 24-36 months. Importantly, these Special Investments are independently marked-to-market on a frequent basis and do not entail the multi-year lockups one would expect of venture-capital or private-equity situations.

- External Managers. Drawing upon its extensive network, Marylebone Partners allocates to a focused selection of funds that are managed by specialist investors in their respective areas. These managers pursue fundamental strategies with a defined sector, geographic or style bias, which Marylebone Partners believes are structurally inefficient and therefore receptive to skill-based approaches. Marylebone Partners has a strong preference for backing talent within independent, owner-operated firms. Through its long-standing relationships, it can often access funds that are not widely known and/or may be otherwise closed to new investment.

- Direct Investments. Marylebone Partners is a long-term investor in a portfolio of rigorously researched stocks, favouring high-quality companies that participate in secular tailwinds. Marylebone Partners invests in liquid securities, primarily listed in the developed markets, which exhibit attractive growth, business profitability and strong balance sheets. It seeks situations with unappreciated earnings potential or strategic value. Valuation plays an important role in Marylebone Partners’ decision-making.

Reflecting its assessment of the prevailing opportunity set, Marylebone Partners will allocate proactively between these three strategies, within identified ranges. Equities will lie at the heart of Marylebone Partners’ new portfolio for Majedie, although the team is equally comfortable allocating across other asset classes such as fixed income, real assets, or distressed debt. Marylebone Partners will seek to add value through security selection and by biasing the portfolio towards the industries, regions and style factors they expect to outperform over time. Risk management and sustainability considerations are embedded within the investment process.

Marylebone Partners will receive an annual management fee of 0.90% of the market capitalisation of the company up to £150m; 0.75% between £150m-£250m; and 0.65% above £250m. The market capitalisation for the calculation of this fee shall be subject to a cap of a 5 per cent. premium to Net Asset Value.

As a contribution to the costs of the change of investment manager, Marylebone Partners will waive one half of the management fee payable by Majedie for a period of 12 months from Marylebone Partners’ appointment as investment manager and make a significant contribution to the cost of marketing the company.

Following an initial term of two years, the investment management agreement shall be terminable by either party serving six months’ notice.

Expected timing

A circular regarding the change of management arrangements and the new investment policy, including a notice convening the General Meeting, will be produced in due course. It is expected that the General Meeting will be held alongside the AGM in January 2023. Assuming shareholders approve the new investment policy, Marylebone Partners will be appointed as the company’s investment manager and AIFM immediately following the General Meeting.

MAJE : New direction for Majedie