Over the 12 months ended 30 September 2022, JPMorgan Indian Investment Trust generated a return on NAV of 6.3% and a return to shareholders of 0.6%, lagging the 8.8% return on the MSCI India Index. The trust has not been geared into the rising market and has not renewed its borrowing facilities.

In an effort to address its widening discount, the trust repurchased 1,615,011 shares during the reporting period, and since the financial year end, a further 345,770 shares have been bought back at a cost of £2,845,822 and an average discount of 21.8%.

Manager change

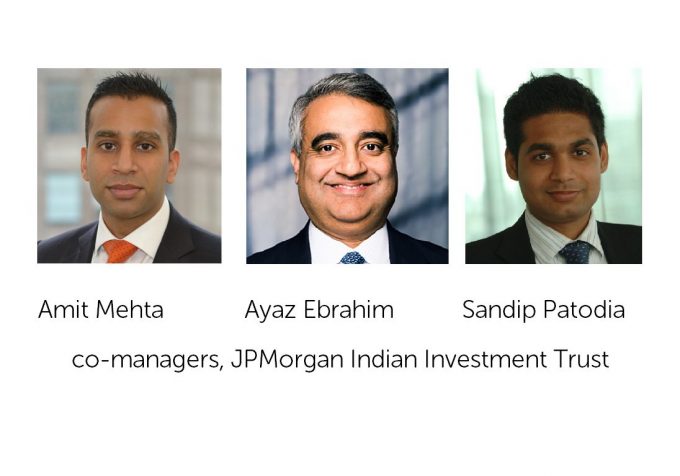

In September 2022 the manager told the board that Rajendra (“Raj”) Nair, one of the trust’s joint portfolio managers, would be leaving JPMorgan Asset Management (JPMAM) after 24 years’ service. The board has worked with the manager and agreed that Ayaz Ebrahim, who has co-managed the portfolio alongside Raj since June 2020 would stay on, and with effect from 30 September 2022, would be joined by Amit Mehta and Sandip Patodia as co-managers.

Amit is a London-based portfolio manager responsible for global emerging markets portfolios. He has been a JPMAM employee since 2011, having previously worked at Prusik Investment Management and Atlantis Investment Management, where he was an Asian equities analyst and portfolio manager. Sandip is a country specialist, also based in JPMAM’s London office. He is responsible for the India portfolios within the Emerging Markets and Asia Pacific Equities team. Sandip joined JPMAM in September 2022 from Fundsmith, where he was an assistant portfolio manager for Fundsmith’s Emerging Markets fund, with primary responsibility for India.

NAV publication

Following changes to the India-Mauritius treaty, the trust now holds its investments in India directly rather than through a Mauritian subsidiary. Consequently, the trust is subject to Indian capital gains taxes. Going forward, the trust will publish its NAV after tax daily, as before, but once a month will also publish a NAV excluding the impact of accrued capital gains taxes. That adjusted NAV is the one that the board is using to measure the managers’ performance for the potential performance-triggered tender offer (based on returns over the five years to 30 September 2025).

Extract from the managers’ report

The company’s underperformance during the review period was primarily due to stock selection in two areas of the portfolio, although decisions on asset allocation at the sector level also detracted modestly, mainly as a result of underweight exposure to utilities, along with an overweight in Information Technology, the sector hit hardest by the global sell-off. These adverse influences on relative returns were partially offset by the favourable impact of stock selection decisions in several other areas of the portfolio.

At a stock level, the largest detractor to performance was an underweight position in Adani Group companies, which accounted for more than half of the total underperformance during the review period (-3.47%). Adani Group has diverse interests across commodity trading, energy generation and distribution, gas distribution, consumer staples and infrastructure assets such as ports and airports. The group has also announced significant investment plans in renewable energy. We are underweight this group of companies relative to the benchmark given the high capital intensity of the underlying businesses combined with significant levels of debt on the balance sheet. However, over the review period, the share price of these group companies defied the volatility in broader markets and surged, driven by a stream of new business announcements.

The other significant negative impact on returns was our overweight position in financials such as HDFC Bank, Kotak Bank, HDFC Bank and HDFC Life Insurance, given the backdrop of rising rates and significant foreign outflows. Financials have the largest weight in the benchmark and are the portfolio’s largest overweight. This sell-off occurred despite an improving operating environment that has been reflected in the strong recent results of the largest, best-run private banks. However, our overweight position in ICICI Bank was a positive contributor thanks to the company delivering strong operating performance over the year and starting from lower valuations.

Stock selection in several other areas of the portfolio made positive contributions to performance. In the consumer sector, a notable overweight in Maruti Suzuki, the leading passenger car maker, was among the largest contributors, along with our holdings in Zomato, a leading food delivery service which floated in July last year, and beauty retailer FSN E-Commerce (which runs the Nykaa branded online retail store), which listed in November 2021. Both Zomato and FSN E-Commerce possess strong long-term growth prospects. However, their valuations became overstretched following their listings, pricing in most of their growth potential over the next decade. We therefore exited both, realising decent profits.

Our overweight positions in Hindustan Unilever, a leading supplier of household and personal products, and Britannia Industries, India’s largest biscuit producer, also added meaningfully to returns, as did our underweight exposure in Reliance Industries. Reliance’s activities in various sectors including telecoms, omni-channel retail and renewable energy make it a proxy for India’s growth, but we believe current valuations are excessive, as they do not fully capture the execution challenges the company faces in these new areas.

Elsewhere, our overweight exposure to several idiosyncratic opportunities such as Lemon Tree Hotels, a mid-tier hotel business, and Power Grid Corporation, a power transmission company, also enhanced returns. We opened an exposure to Lemon Tree Hotels over the past year on the view that it is particularly well-placed to benefit from the resumption of domestic travel, while Power Grid Corporation appeals to us given the long-term opportunity in transmission investment required by the country. Holdings in several small and mid-cap companies also performed well. These included L&T Technology Services, an engineering and IT company, the ratings agency CRISIL, and ABB India, which develops and sells specialist industrial machinery.

JII : Manager line-up changed at JPMorgan Indian