Law Debenture (LWDB) has published its annual results for the year ended 31 December 2022. During the year, LWDB provided an NAV total return with debt and Independent Professional Services (IPS) business at fair value for FY 2022 of 0.6% (-6.8% with debt at par). Similarly, it provided a share price total 0.4% for 2022 and so, in fair value terms, LWDB says that it marginally outperformed the All-Share’s total return of 0.3%. LWDB reports that it was another period of consistent performance from the IPS business with net revenue increasing by 8.6%, profit before tax up by 8.1% and valuation up 18.7% to a record £201.7m. LWDB issued 5.2m new ordinary shares at a premium to NAV during 2022, generating net proceeds of £41.4m to support ongoing investment.

Dividend

LWDB increased its total dividend for the 2022 year by 5.2% to 30.5p per ordinary share (2021: 29.0p), which is a dividend yield of 3.7% (based on LWDB’s closing share price of 827 pence on 24 February 2023). This includes a proposed Q4 dividend of 8.75p per ordinary share. LWDB has provided a 7.91% CAGR in dividends over the last ten years, reflecting strong cashflow from its IPS business and good portfolio performance.

IPS business summary

LWDB’s chairman, Robert Hingley, says that the IPS business is a unique offering that lends an advantage compared to other UK income funds. He comments that it has grown from strength to strength in recent years with a compound annual growth in profit before tax of 8.2% over the last five years. Robert thinks that, in a year where global uncertainty badly affected capital markets, the value of IPS for shareholders became more evident. Some of LWDB’s businesses benefit from a degree of counter-cyclicality. Robert says that this is why, in part, IPS had another year of mid-high single digit revenue and profit growth. Employee engagement and satisfaction scores are improving and with ongoing investment in talent and technology, LWDB’s board is confident that the IPS business should have the potential to sustain mid to high single digit growth over the medium term.

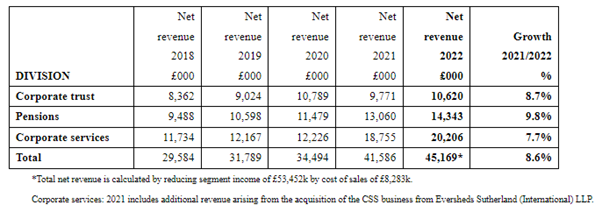

LWDB’s CEO, Denis Jackson, comments that the IPS business’s net revenues (gross revenue less direct costs incurred) for the full year 2022 were up 8.6% at £45.2m (2021: £41.6m) and profit before tax was up 8.1%. He says that the diversification of LWDB’s income streams has served it well, but notes that the IPS business has had to compete with the challenging recruitment environment to retain its people who underpin the quality of service that it delivers. Nonetheless, Denis says that they are active in the management of their cost base and are working hard to ensure IPS’s profit margins are sustainable.

Corporate trust

Law Debenture was incorporated to act as a bond trustee in 1889. The role of a bond trustee is to act as a bridge between the issuer of a bond and the individual bondholders. LWDB’s responsibilities as bond trustee can vary materially, whether servicing or performing or defaulted bond issues.

Following a difficult 2021, when LWDB reported a 9.4% decrease in revenues for the Corporate Trust business, it is able to report revenue growth of 8.7% in 2022, despite challenging market conditions.

As noted in its half year results, the majority of the capital markets transactions that sit on LWDB’s books have been built up over many decades and have contractual inflation-linked fee increases for corporate trust services. These fee increases are applied on each transaction anniversary. As 2022 progressed and inflation remained at elevated levels, the more such inflation-linked increases fed through to LWDB’s book of business.

Despite the extremely tough primary market conditions, the corporate trust business completed some notable new transactions, including an appointment Trustee for the Real Estate Investment Trust, SEGRO plc’s €1.15 billion senior unsecured Green Bond issue. The proceeds of the issue will principally be used to finance and/or refinance Eligible Green Projects as outlined in the SEGRO Green Finance Framework, as well as providing funding for general corporate purposes. Later in the year, LWDB was also appointed as Trustee on the €750 million senior unsecured Green bond issue for the SEGRO European Logistics Partnership (‘SELP’) joint venture.

LWDB’s escrow business continues to build momentum and broaden its diversification of use. During 2022, LWDB was appointed to a range of roles that included M & A, litigation, commercial real estate, sporting events, sales of ships, and to support global trade in commodities.

Pensions and Pegasus

2022 was another strong year for LWDB’s Pensions and Pegasus business with growth in revenues of 9.8%. Over the past five years, compound revenue growth is a healthy 12%. In its core Trustee business, there were incremental appointments that included names such as Riverstone, SEI Master Trust and Invesco.

During the year, Pegasus continued to grow, with more full outsourced pension management wins, alongside interim resource and project support. Pegasus offers a range of services from simple pension scheme secretarial services through to fully outsourced pensions management and professional sole trustee solutions. After five years, this business now has revenues of approximately £4m per annum.

Corporate Secretarial Services (CSS)

The CSS business was unable to expand its client base as much as it would have liked during the year because the demand for its products and services in 2022 exceeded its ability to offer appropriate resourcing, particularly in the interim and corporate governance services areas. LWDB says that increasing its capability with appropriately qualified people is something that it is continuing to address. It transferred across 46 people at the time of the acquisition in 2021 and, at 2022 year end, its headcount in this business was 64. It says that it will continue to hire and develop the right people, skills, technology and infrastructure that we require in order to deliver a first-class service. Despite the capacity constraints noted above, the CSS business added to its client roster, winning work to support several Investment Trusts managed by Schroders, as well as the LXI REIT.

Whistleblowing: Safecall

The Whistleblowing business provided a record number of reports to its clients in 2022, up 20% on 2021. Increasingly, digital channels are being used to raise and manage issues and the business has rolled out a new client portal during the year to address this. In order to compete more effectively, the business will invest in further digital capability throughout 2023. The sales team has also been expanded and the business has invested in expanding its account management set up. It says that results to date have been encouraging, with increasing demand from existing clients for its training and investigations offerings. During the course of 2023, it will look to expand these offerings. Revenues from new clients were a record and among the 134 new clients it took on in 2022 were EDF Renewables, WHSmith, The Entertainer Ltd and CFC Underwriting.

Structured finance services

Despite capital markets new issuance levels being particularly challenged during 2022, the business received repeat appointments from a number of names operating in the sector. Quotes for new business and wins were both new records. LWDB says that its challenge is to raise its profile with a broader universe of clients. Its paying agency business also grew steadily during the year to record levels, with the number of professional firms referring business to it continuing to increase.

Service of process

Following an encouraging first half of the year, the surge in inflation and interest rates and the corresponding slowdowns reported in GDP growth around the world unsurprisingly made for a much tougher second half of the year. The business ended the year essentially flat to 2021. Given the significant reduction in primary capital markets activity (a key source of appointments), LWDB believes this is a result with which it can be satisfied. The business’s upgraded technology, together with its increased headcount, has built capacity.

Investment portfolio performance

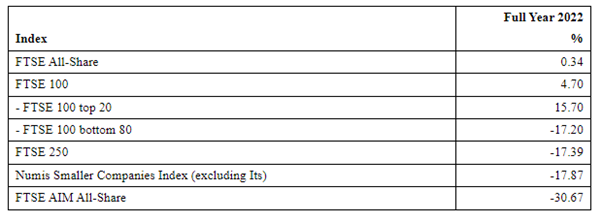

The under-performance of the Portfolio was driven by holding a larger weighting in smaller size companies relative to the benchmark. In comparison, the benchmark is heavily weighted in the largest 20 stocks in the UK market. The manager says that as illustrated by the table below (taken from LWDB’s annual report), the 100 Index top 20 made positive returns during the year, and it is within the top 20 that the very large oil and resource companies reside. At the same time the rise in the price of oil and gas has hurt energy using companies and this led to a slowdown in UK economic activity. In the largest 20 companies in the UK, more than 80% of their earnings are derived from overseas. The smaller quoted companies are more closely tied to the fortunes of the UK economy. During the year, funds with a broad list of companies large, medium and small were very likely to underperform when virtually only a select few very large international companies could prosper.

Stock attribution

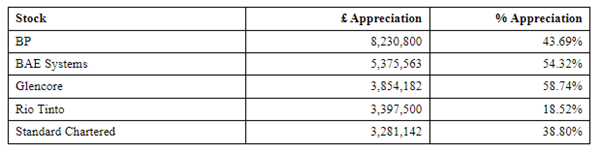

The five largest gains during the year were:

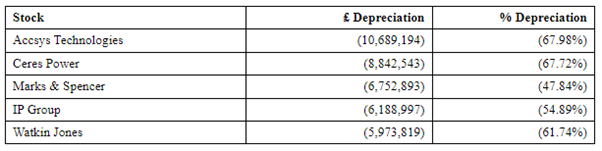

The five largest losses during the year were:

Portfolio income

The income that was generated by the portfolio rose from £26.3m in 2021 to £34.4m for 2022, an increase of 31%. The managers say that there are several reasons behind this. Some companies returned to paying dividends having stopped paying during the pandemic. The level of special dividends was particularly high, the most notable being NatWest Bank of £1.2m, and a distribution of capital from Aviva of £3.4m. The managers comment that was underlying good repeatable dividend growth across the portfolio’s holdings. The reduction of the US holdings and the increased exposure to the UK has also benefitted the income account. The dividend yield on the UK market is substantially higher than other major stock markets. The managers think it is likely the dividend growth from the underlying stocks will continue in 2023.

Portfolio activity

The portfolio managers say that the relative low turnover of stocks and value bias approach has been behind the activity. The valuation on US stocks, particularly early on in the year, looked stretched, so holdings in Applied Materials and Schlumberger were sold. The managers say that these are both excellent companies; the issue was valuation. Applied Materials fell as economic slowdown concerns surfaced. The fall was substantial and has allowed them to buy the stock back towards the end of the year. High valuations among the select few companies in favour in the UK meant the holding in Relx was sold. It has been in the Portfolio for many years adding considerable value, but the valuation offered the opportunity to recycle the proceeds into other UK stocks offering better oportunities. Among the new purchases within the Portfolio were Cranswick which produces and supplies meat products. The managers comments that it has been a consistently successful company and this is expected to continue. A holding in Castings was added. It is a UK foundry business that has weathered recessionary conditions many times. The managers note that there is a lack of foundry capacity in the UK, which should mean it will keep performing well in operational terms and this is not reflected in the valuation.

The Portfolio in recent years has benefited from an exposure to alternative energy stocks. During the year, the managers made a purchase in an unquoted company, Britishvolt, that intended to manufacture batteries for EV cars. Britishvolt had been seen as a landmark project to boost the country’s production of EV components. The project was saved from administration in November 2022 after securing additional funding, only to re-enter administration in January 2023. The investment was written down to zero before the year end, but the managers say that this illustrates the problems facing the alternative energy sector and the lack of access to meaningful amounts of capital which will be needed if EV car manufacturing is to flourish in the UK. The only other unquoted investment of note in the Portfolio is Oxford Science Innovation. This is a company that helps early-stage businesses that come out of Oxford University. It has been a successful investment since LWDB invested in it in 2015 with the NAV up over 60%. The managers say that the unquoted exposure in the Portfolio will remain small. The low level of valuations has led to corporate activity, with companies taking the opportunity to take over quoted companies. The notable example during the year for the Portfolio was Euromoney that received a successful cash bid.