JPMorgan American (JAM) has released its annual results for the year ended 31 December 2022. During 2022, financial markets have been heavily impacted by rising inflation and central banks’ interest rate hikes in response to this. Principal among these are the seven interest rate hikes in 2022 by the US Federal Reserve – taking the Fed Funds rate range from 0% to 0.25% to 4.25% to 4.50% over the year. Unsurprisingly the result of this was rising US Treasury bond yields, which put downward pressure on US share prices, particularly the valuation of growth companies. The on-going war in Ukraine has also directly affected energy and other supply chains, contributing heavily to inflation and impacting financial markets accordingly. Perhaps not surprisingly then, JAM’s NAV total return was -8.7% during the year, just underperforming its benchmark, the S&P 500, which fell by 8.0% in sterling terms. Interestingly, since JAM changed its investment approach on 1 June 2019, it has outperformed the benchmark index by 6.9% in the subsequent 45 months through to the end of February 2023, providing a NAV total return to shareholders of 65.3% compared with a benchmark return of 58.4%. This is an annualised outperformance of 1.3% since the change in investment approach.

Portfolio update

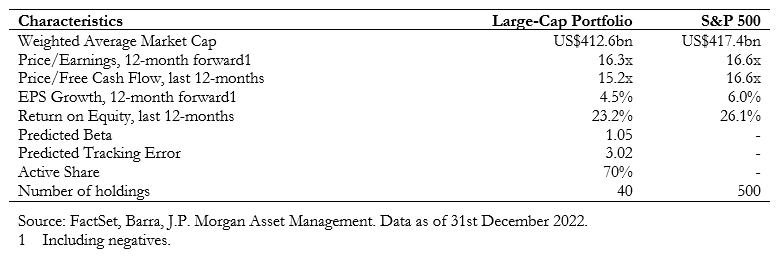

At the year-end, 90.4% of JAM’s assets were invested in US large cap stocks. The proportion of the growth and value weighting can vary between 60% and 40% either way and was 52% in value and 48% in growth at period end. The overall allocation to the small cap portfolio was maintained at approximately 5% during the first six months of the year. As the small cap growth sell-off intensified, the allocation was increased and ended the year at 7.1%. The balance of the portfolio was invested in liquidity funds.

Gearing update

The board has set the current tactical level of gearing at 5%, with a permitted range around this level of plus or minus 5%, meaning that currently gearing can vary between 0% and 10%. This tactical level of gearing remained unchanged throughout the year. The company ended the year with gearing of 5.9%.

JAM believes it is prudent for gearing to be funded from a mix of sources including short and longer term tenors and fixed and floating rate borrowings. JAM has in issue a combined US$100 million of unsecured loan notes issued via private placements, US$65 million of which are repayable in February 2031 and carry a fixed interest rate of 2.55% per annum and US$35 million of which mature in October 2032 and carry a fixed interest rate of 2.32%. JAM’s £80 million revolving credit facility at ING Bank expired in August 2022 and this was replaced with a new £80 million revolving credit facility (with an additional £20 million accordion) with Mizuho Bank Ltd. Both were drawn in US dollars to match the currency of the company’s asset base.

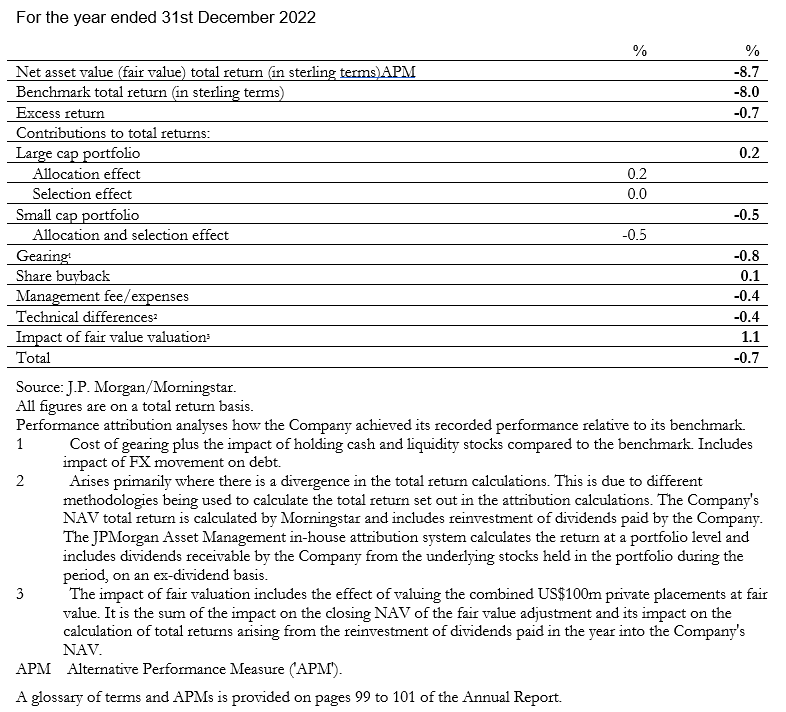

Performance and asset allocation

Although the large cap portion of JAM’s portfolio posted a negative return, it outperformed its benchmark for the period, as shown in the table above. The company’s small cap allocation, which averaged 6% of the portfolio over the period, detracted from relative returns, and this, along with the use of gearing, was the reason for the portfolio’s underperformance relative to the S&P 500.

Performance attribution

Large cap portfolio

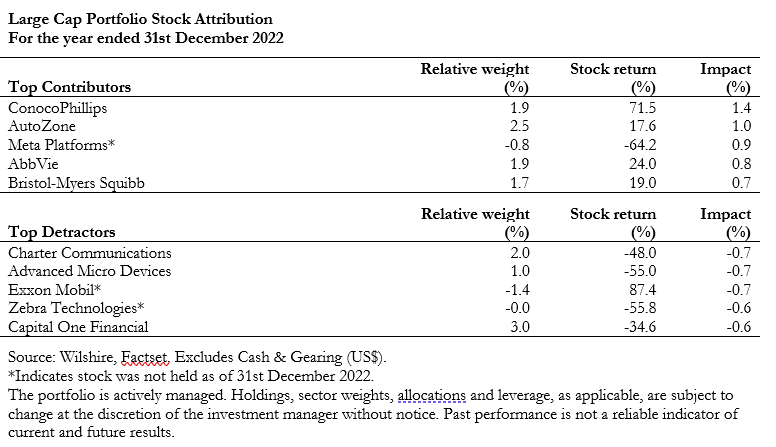

Strong stock specific contributors included ConocoPhillips, an oil and gas producer, and auto parts retailer AutoZone. ConocoPhillips’ share price rallied more than 70% during the review period, thanks to elevated oil and gas prices. The company reported solid earnings that exceeded expectations. AutoZone benefited from the fact that the stock of cars is ageing, increasing demand for repairs. The non-discretionary nature of such repairs, and AutoZone’s associated healthy pricing power, supported performance. Furthermore, after several years of investment, the company is finally gaining traction in the commercial vehicle area of the market.

The company’s large cap portfolio also benefited from stock selection in the communication services and healthcare sectors. Communication services was the worst performing sector of the S&P 500 over the year, but JAM’s holdings in this sector outperformed their benchmark peers. In particular, a lack of exposure to Meta Platforms (formerly Facebook) and an overweight position in telecoms services company T-Mobile US, proved beneficial. Meta Platforms’ shares came under significant pressure, to the point where the stock looks interesting from a valuation perspective although JAM’s manager has not been tempted to add this name to the portfolio, as it sees continued risk due to regulatory and data privacy concerns. It says that Meta also needs to invest more heavily in areas such as artificial intelligence (AI) to maintain its competitive positioning. T-Mobile US, along with other wireless carriers, performed relatively well, as investors sought the safety of more defensive names. The pandemic boosted T-Mobile US’s subscriptions and that momentum continued in 2022, with 6.4 million new subscriptions over the calendar year. The company posted strong quarterly results and raised its earnings guidance.

Within healthcare, top contributors to performance included pharma companies AbbVie, Bristol Myers Squibb (BMS) and Regeneron Pharmaceuticals. AbbVie benefited from the growth-to-value rotation, experiencing a nice resurgence as fundamentals improved and investors seemed confident that the impact of new competitors on Humira, Abbvie’s successful arthritis treatment, will be more modest than originally expected. In addition, the company has an impressive drug pipeline. Bristol Myers Squibb is also delivering on important growth drivers and drug approvals, and the market reacted favourably to its planned acquisition of Turning Point Therapeutics, which will expand BMS’s presence in the precision/targeted medicine field and generate synergies with its existing oncology franchise. The manager says that it continues to like both AbbVie and BMS given their undemanding valuations, healthy dividends and strong free cash flows. Regeneron Pharmaceuticals traded higher after the company announced better than expected trial results for Eylea, a drug used to fight eye disease.

The largest detractors to relative performance at the stock level were broadband communications provider Charter Communications, and Advanced Micro Devices, a semiconductor producer. Shares of Charter Communications dropped due to investor concerns about slowing growth in broadband subscriptions. However, the manager remains comfortable with JAM’s position, as it expects Charter Communications to benefit over time from its efforts to expand the reach of its broadband business. Advanced Micro Devices has been under pressure over the last six months due to rising inventories across the semiconductor industry, but the manager believes the company can continue to take meaningful market share from its central processing unit (CPU) competitor, Intel. In its view, Advanced Micro Devices is also benefiting from the fact that customers enjoy having a viable alternative to Intel for the first time in decades.

Performance was also hindered by JAM’s underweight position in consumer staples and the manager’s stock selection in industrials. While the consumer staples sector generated a negative return over the period, it significantly outperformed the S&P 500. The manager recognises that this sector offers some defensive characteristics. However, it continues to struggle to find attractively valued names that offer long-term growth opportunities, especially now, after such a risk adverse period. JAM’s exposure within the sector is focused on Procter & Gamble (P&G), a producer of household and personal products, which detracted modestly over the period as its share price came under pressure. However, the manager believes there are good reasons to maintain this position. The company has navigated supply concerns better than its smaller competitors, enhancing its competitive position. In fact, it has been gaining market share in many of its product categories over the last few years. These trends accelerated during the pandemic, as many consumers experienced an improvement in their purchasing power and indulged themselves by buying more expensive brands. While the current cost of living crisis may see some consumers trade down to lower priced brands, the manager believes that the quality of P&G’s brands will ensure it continues to increase market share over the long term.

Within industrials, the portfolio’s holdings lagged their benchmark peer group. In particular, JAM’s exposure to FedEx detracted. The company announced a large earnings and revenue miss in the second quarter, and lowered its full year guidance as a result of economic weakness in Asia and service challenges in Europe. After reviewing the company’s fundamentals, the manager decided to exit the name. In addition, JAM’s lack of exposure to defence names within the sector also hindered relative performance.

Portfolio activity

JAM’s manager says that the recent market pullback has created some opportunities to acquire attractive, high growth companies at more reasonable prices. However, it is being very selective, only adding names with differentiated and compelling fundamentals. During the review period, it purchased nine new names and exited the same number, substantially fewer than in 2021, when it swapped out of 16 positions.

One new acquisition was SolarEdge Technologies, which provides solar power equipment to residential and commercial customers. Its products include smart modules to optimise and monitor power usage, solar inverters, electric vehicle (EV) chargers and energy battery banks to support EV charging. The manager believes renewable energy has very favourable long-term prospects, as the global transition to net zero carbon emissions gathers momentum. The Biden administration’s Inflation Reduction Act (IRA) is also hugely beneficial to the sector, as is Europe’s electricity price shock. SolarEdge is a sector leader, with a healthy balance sheet, positive free cash flow and a comprehensive range of products.

This and other acquisitions were funded by the outright sale of several positions, including JAM’s holding in PayPal, a digital payments company. While the manager still likes this sector, it has concerns about PayPal’s ability to remain competitive given the emergence of newer entrants and large players like Apple Pay. Later in the year, the manager also exited Global Payments, a payments technology company, on similar concerns and used the proceeds to build a position in Hubbell, a leading electrical components manufacturer. In the manager’s view, electrical infrastructure spending is at the start of a multi-year investment cycle, as growth in EV penetration, renewables, distributed energy, and increasing storm activity will bolster demand at the same time that ageing grid infrastructure will require significant maintenance and modernisation. Hubbell has improved its portfolio mix substantially and as a result, it is now a higher quality, less cyclical business, with improved margin and growth profiles, and potential for a further positive rerating.

On the value side of the portfolio, the apparel retailer GAP was exited early in the year. GAP’s management team has made considerable efforts to reduce the footprint of its stores, in favour of its higher growth Old Navy and Athleta brands, but the company has struggled to execute these plans effectively. GAP also faces structural challenges including e-commerce disintermediation, associated downward pressures on clothing prices and a shift in consumer preferences away from expenditure on clothing. While the stock remains very attractive from a valuation perspective, JAM’s manager views its structural and cyclical risks as too high to justify continued exposure. As previously mentioned, FedEx was sold on concerns around its fundamentals. The proceeds were redeployed into M&T Bank, a US regional bank. This company came under pressure due to its interest rate sensitivity, as investors worried about potential Fed rate cuts in 2023 and JAM’s manager used the sell-off as an opportunity to build a position in a name it believes has a best-in-class management team, an impressive balance sheet and a history of consistent performance during difficult environments.

These acquisitions and disposals have not had a significant impact on the portfolio’s structure. Financials and information technology remain the largest sectoral allocations, which together represent approximately 39% of the overall large cap allocation. Financials make up the largest overweight relative to the benchmark and the manager has been adding selectively to JAM’s exposure to higher quality names in this sector, such as Bank of America, as well as the newer holding in M&T Bank. JAM remains underweight technology, but the manager has begun to moderate that underweight slightly as valuations have corrected quite meaningfully. The portfolio also remains underweight consumer staples, as the manager sees better opportunities elsewhere.

Small cap portfolio

The small cap portfolio is allocated solely to growth stocks. Its underperformance of the S&P 500 negatively impacted returns over this period. Small cap growth stocks were caught up in the sharp sell-off of much larger growth names discussed above. The overall allocation to the small cap portfolio was maintained at approximately 5% during the first six months of the year. As the sell-off intensified, the manager increased the allocation, which ended the year at 7.2%. The manager comments that small cap valuations look very compelling relative to large caps..

Outlook

JAM’s manager expects inflation pressures to continue to ease during 2023. It comments that the labour market is showing signs of softening, global supply chain pressures are dissipating and, along with declining commodity prices, these developments should allow prices to stabilise, although inflation is unlikely to return to its previous lows any time soon. Nonetheless, slower inflation is important for financial markets as it means that interest rates should peak during the year. The manager expects the Fed to put rates on hold during the second half of 2023, while it assesses the inflation outlook. This viewpoint seems even more likely as the recent events in the banking space have shown that central banks now appear to be prioritising financial stability over inflation.

However, the manager thinks that any policy pause may come too late to stop the US economy tipping into recession, although it says that recession is not inevitable and if it does happen, it should be fairly mild and short-lived. This assessment is based on its view that there is limited excess in the economy. Activity across many sectors over the last decade was relatively sluggish and debt in the system is quite low (except at the federal government level). And as mentioned above, discretionary spending is slowing, as is housing activity. Lending standards have been tightening and are likely to continue to do so at a more aggressive pace.

The S&P 500 forward P/E ratio is now at 17x, well below the 21x level at which it started the year. However, consensus estimates of around 1% earnings growth for the S&P 500 for 2023 still seem too optimistic in the manager’s view. It thinks that the weakening economic backdrop will result in a modest, 4%, contraction in earnings, commenting that, after last year’s market decline, US equities are already discounting weaker growth and a significant amount of future damage to cash flows and corporate earnings.

On the positive side, it comments that the past year’s market fall, and any further drawdown, should set investors up for better returns in the long run, particularly if the current uncertain climate is eventually replaced by one reminiscent of the last decade, which was characterised by slow growth, low inflation, low interest rates and high profitability. This is the case because current low valuations represent a great opportunity for active managers to take advantage of the lower prices of high-quality companies to position portfolios for the subsequent stock market recovery..