Murray International (MYI) has released its annual results for the year ended 31 December 2022. During the period, MYI provided an NAV total return of +8.8%, which compares favourably with that of its reference index, the FTSE ALL World Total Return Index, which MYI says returned -7.3%. However, the chairman, David Hardie, comments that MYI’s performance could not match what has been an abnormal rise over the same period of +13.4% for the UK Retail Price Index (RPI). The share price posted a higher total return of +20.6%, reflecting a marked narrowing of the discount over the period. Increased income per share amounted to 60.1p for the year (2021: 51.7p), enabling an ongoing improvement in the level of dividend and a return to a fully covered dividend.

Dividends

MYI has paid three interim dividends of 12.0p per share (2021: three interims of 12.0p) in relation to the year ended 31 December 2022 and its board is now recommending an increased final dividend of 20.0p per ordinary 25p share (2021: final dividend of 19.0p). If approved at the Annual General Meeting, this final dividend will be paid on 5 May 2023 to holders of ordinary shares on the register on 11 April 2023 (ex dividend 6 April 2023). Assuming that the final dividend is approved, total dividends for the year will amount to 56.0p (2021: 55.0p), an increase over the previous year of 1.8%. Hardie comments that the level of increase reflects the fact that MYI already pays a competitively high dividend yield which stood at 4.2% at year end. This represents the 18th year of dividend increases for the company, which remains an AIC ‘Next Generation Dividend Hero’.

Growth in revenue reserves

MYI had £69.2m of distributable reserves on its balance sheet at 31 December 2022, which have been accumulated over many years from retained earnings. The payment of the final dividend, if approved, will result in the movement of £5.2m to the revenue reserves to strengthen them for the future. The dividend cover at year end was 1.07x (2021: 0.94x). The replenishment of reserves this year is in line with MYI’s dividend policy. MYI’s board intends to maintain a progressive dividend policy. This means that, in some years, revenue will be added to reserves while, in others, some revenue may be taken from reserves to supplement revenue earned during that year, in order to pay the annual dividend. Hardie says that shareholders should not be surprised or concerned by either outcome as, over time, MYI will aim to pay out what the underlying portfolio earns in sterling terms.

Proposed five-for-one sub-division of ordinary shares

MYI notes that the market price of its existing ordinary shares has increased in recent years to the point where these regularly trade at over 1300 pence. In order to assist monthly savers, those who reinvest their dividends and those who are looking to invest smaller amounts such as younger investors, the board is proposing a sub-division of each of the existing ordinary shares of 25 pence each into five new ordinary shares of 5 pence each, thereby resulting in a lower market price per ordinary share. The sub-division will not itself affect the overall value of any shareholder’s holding in MYI and the board believes that the sub-division may also improve the liquidity in and marketability of MYI’s shares to the benefit all shareholders. Shareholder approval is required to proceed with the sub-division and this is being sought at MYI’s forthcoming AGM (see resolution 12).

Manager’s comments on portfolio activity

“Portfolio turnover was 11% of gross assets relative to 12% in 2021 and reflects a continuing decline to more normal levels over the twelve month period. Although market volatility occasionally spiked higher, most notably during the Russian invasion of Ukraine and the UK’s politically induced meltdown of late September, periods of extended price distortions seldom prevailed. That said, the former presented opportunities to increase exposure to European equities, the latter to reflect on the beauty of the Trust’s unconstrained, globally diversified mandate!

“Exposure to Emerging Market Bonds continued to be reduced, thereby increasing overall equity exposure by year end to 103.1% compared to 102.5% at financial year-end 2021.

“North American exposure decreased by the greatest amount on selective divestment of three established positions which had performed extremely well and were deemed to be fully valued. Consequently Nutrien, Pepsico and Schlumberger were sold outright, with a new purchase of leading global pharmaceutical company Merck slightly offsetting overall regional reduction.

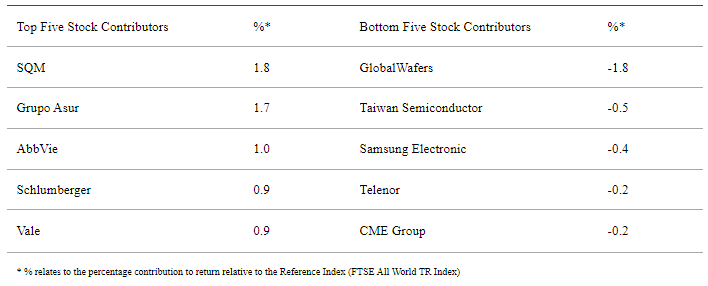

“Latin American exposure once again witnessed significant profit taking purely for reasons of valuation and strong performance. The reduction of Chilean lithium producer Sociedad Quimica (SQM) and Mexican airport operator Grupo Asur echoed similar capital re-allocation trades made last year, but large residual positions remain reflecting positive, long-term prospects for both companies.

“Overall Asian exposure slightly declined on a net basis, with outright sales of Castrol India and Indocement. Profit taking in Taiwan Semiconductor and GlobalWafers also raised cash which was partially offset by additional investment in existing holdings of Hon Hai Precision and Samsung Electronics plus a newly established position in Woodside Energy in Australia.

“European exposure increased significantly with the lion’s share of re-cycled profits invested in the region. New positions were established in Dutch technology company BE Semiconductor, in leading global industrial conglomerate Siemens of Germany and in worldwide food processing company, Danone in France. Various existing holdings, such as Nordea, Zurich Insurance and Enel were added to during periods of weakness. Over the period there were no transactions within UK equities. Two bond holdings were fully divested, namely Mexican communications company America Movil and the shorter-dated Indian corporate ICICI Bank, taking the total number of equity and bond holdings at year end to 51 and 18 respectively.

“From an overall investment perspective, the emphasis continues to favour diversified asset exposures in companies deemed beneficiaries of the evolving backdrop, maintaining a “barbell” strategy of owning both growth and cyclical stocks. Structurally higher inflation is supportive of companies owning real assets and those possessing pricing power, whilst selective growth companies should benefit from accelerating trends in industrial automation, semiconductor miniaturisation and digital communications. The greatest potential for positive cyclical momentum upside surprises can still be identified in Asia and other countries where substantial pent up demand from prolonged Covid effects still exists. Corporate earnings may be under recessionary threat elsewhere, but scope exists for upwards earnings and dividends revisions in Latin America and Asia. In such regions, sectors and businesses the portfolio remains meaningfully invested.”

Manager’s comments on performance

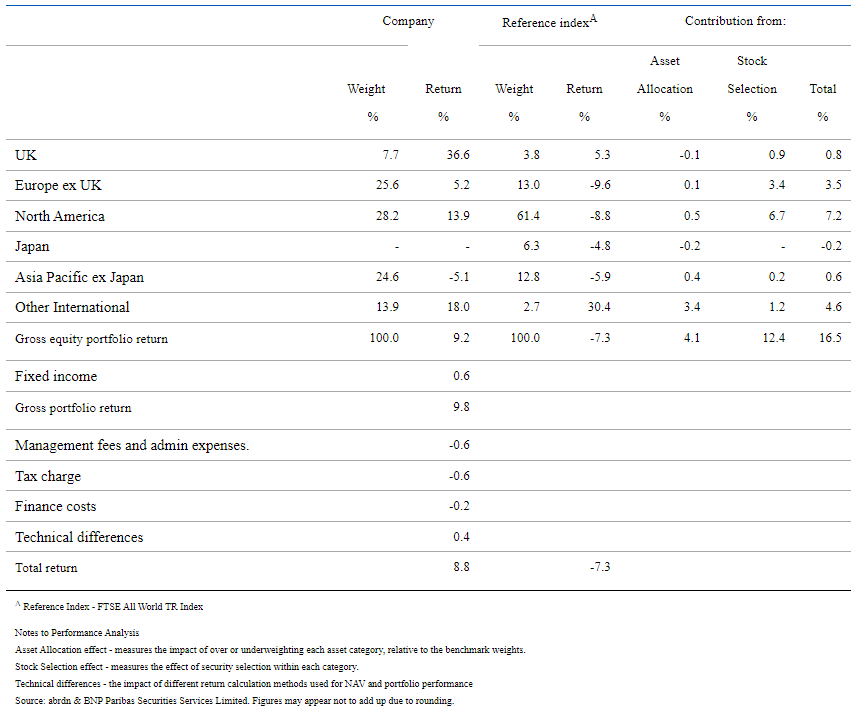

“The NAV total return for the year to 31 December 2022 with net dividends reinvested was +8.8%. This compared favourably with the Reference Index (FTSE All World) total return of -7.3%. The top five and bottom five stock contributors are detailed below:

“Over the full financial year, the high single-digit total return on gross assets was welcomed although, in real terms the exceptionally high 13.4% rate of UK Retail Price Inflation proved a tough hurdle to match. Overall global equity market weakness was not reflected in the total gross asset return primarily due to broad portfolio diversification and strong defensive stock performance. In capital terms, Latin America delivered by far the strongest regional index returns in what proved to be a very tough year for capital growth. This was very much reflected in portfolio returns with a +38% contribution to overall performance from the Latin American region. Although the UK equity market proved to be the only other ‘region’ to deliver a positive return over the twelve month period, the portfolio’s regional exposures faired much better with positive contributions recorded from five of the six regional asset areas. Strong stock selection prevailed in most areas, with only Asian holdings marginally declining in absolute terms. Sterling weakness against most portfolio currencies was modestly supportive, most noticeably against the US Dollar. European markets suffered the negative ripple effect consequences of war in Ukraine and Russian energy dependency, whilst Asia also declined in Sterling terms as China’s zero Covid policy kept most investors cautious on equity markets. North America witnessed its weakest market returns for over a decade, with the Technology heavy Nasdaq declining -25.0% in Sterling terms. A positive North American portfolio return of +13.9% was achieved through high quality, defensive stock selection. Despite significant reductions to Emerging Market Bond exposures since the outbreak of Covid, portfolio returns in Sterling terms also continued to be positive. In what proved a particularly, problematic period for over-extended markets and growth stocks, it was gratifying to record robust individual stock performance across a variety of sectors and industries. Companies operating in Basic Materials, Energy, Healthcare, Consumer Staples, Real Estate and Financials all contributed to overall positive returns, once again emphasising the importance of the diversified, quality-focused strategy.

“Predicting dividend income over the financial year proved slightly more straight-forward than in the preceding two Covid-infected financial periods. As supply-side interruptions waned, some semblance of corporate normality was restored, albeit with business conditions constantly being impacted by higher wage and input costs plus growing fears over recession. Positive cash flows became an increasingly precious commodity, particularly when faced by equity markets beginning to be squeezed by tighter liquidity. Currency movements against Sterling experienced relatively normal volatility within an historical context (outwith the farcical forty-four days of the Truss Premiership), with the usual unpredictability of magnitude and direction. Sterling weakness against practically all portfolio currencies over the period proved modestly positive in translation of dividend income accrued from the portfolio’s diversified global holdings. Dividend increases from portfolio companies generally exceeded conservative estimates, with 80% falling into this category. Whilst notoriously difficult to predict, sectors such as Basic Materials and Energy experienced familiar fluctuating income expectations, yet over the financial period the net effect from positive and negative “surprises” was negligible. Overall gross income accrued increased +12.8% year-on-year, with earnings per share growth of +16.3% reflecting the positive impact of share buybacks during the period.”

Manager’s comments on attribution analysis

“The attribution analysis below details the various influences on portfolio performance. In summary, of the 1650 basis points (before expenses) of performance above the Reference Index, asset allocation added 410 basis points and stock selection contributed 1240 basis points. Structural effects, relating to the fixed income portfolio and gearing net of borrowing costs, added 40 basis points of relative performance.