Boussard & Gavaudan Holding (BGHL/BGHS) has published its annual results for the year ended 31 December 2022. During the year, BGHL’s NAV for the euro and sterling shares decreased by 4.90% and 3.47%, respectively, while the associated market prices decreased by 4.72% for the euro shares and increased by 5.26% for the sterling shares. As at 17 April 2023 the share price discount to NAV for the euro shares stood at circa 17.20%.

Performance summary

The manager says that performance attribution for 2022 was mixed. Volatility strategies were positive across all sub-strategies including mandatory convertible bond arbitrage, convertible bond arbitrage and volatility trading. Generally, as central bank attitudes on interest rates became less dovish and expectations for a tapering of global quantitative easing increased, the manager successfully identified mispricing and arbitrage opportunities within volatility strategies. Conversely credit strategies, trading and equity strategies were negative overall. Detracting the most from returns were the equity risk arbitrage and special situations sub-strategies. Notably specific positions in these categories were impacted by the Russian invasion of Ukraine where a combination of disruption to energy supply chains and a significant increase in energy prices created some very tough operating conditions for specific corporates. This led several special situation and risk arbitrage deals to fail to proceed as expected. The affected positions were unwound and there is no longer any exposure to these situations.

2023

The manager says that it began the new year cautiously but optimistic given the growing opportunities in convertible bonds and credit special situations. However, the year has subsequently seen a series of bank failures in the US and Europe starting with Silicon Valley Bank in the US, and then, albeit unrelated, Credit Suisse in Europe. The manager says that the continued hawkish stance of central banks and their robust interest rate tightening path has been questioned by markets, and that this has resulted in some unprecedented reversals and short term turmoil in many asset classes. For example, the price of the US 2 year Treasury fell by over 100bp in the course of 3 days, which was the biggest one day move in decades.

The manager comments that it generally takes a very prudent approach to risk management, and seeks to avoid macro risks where possible, however the scale of this interest rate move led to significant equity rotations during March which impacted performance. Looking forward the manager expects the resulting environment to be very fruitful especially for convertible bond arbitrage and mandatory convertible bond arbitrage. Corporates are facing increasing re-financing costs and in conjunction are finding it much harder to refinance debt through normal bank channels. They are instead having to use private credit and capital markets, and often using volatility to subsidise their borrowing through issuance of convertible bonds. The manager comments that a tighter financing environment and macro backdrop also paves the way for a distressed credit cycle where it says companies will be unable to refinance, which will provide it with many opportunities.

Discount to NAV

The euro share class traded at a discount within the range of 14.2% to 22.9% during the year. Whilst the discount has continued to narrow, it remains wider than the maximum of 15% that is targeted. Share buy back activity during the year amounted to 83,611 shares, representing 0.67% of the issued share capital.

The manager comments that, since the corporate action which took place at the end of 2019, 21.15% of the company’s shares have been bought back. It comments that, whilst the share buy back mechanism remains the principal instrument being used to address the share price discount, a combination of (i) strong investment performance (attracting new buyers of the shares) and; (ii) a deliberate policy of retaining liquidity to take advantage of market opportunities, saw it being more opportunistic with the use of the share buy back mechanism.

Performance within the master fund

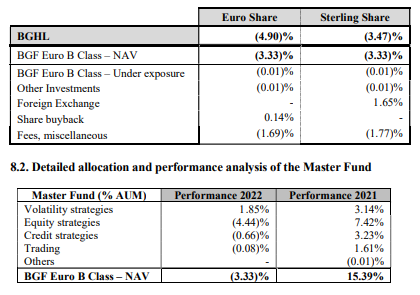

The Master Fund contributed negatively at 3.34% ((3.33)%NAV and (0.01)% Leveraged) to BGHL’s performance during the year. The following table, taken from the annual report, shows how BGHL’s assets performed.

During the year BGF Euro B was down (3.33)%. For market context the Eurostoxx 50 total return was down (9.5)% and the S&P 500 total return down (18.1)% over the year, with the VIX finishing the year at 20.9%, up from 19.3% and the iTraxx Crossover Generic at 474bps, up from 215bps.

Volatility strategies – Mandatory convertible bond arbitrage

Mandatory convertible bonds had a slightly positive contribution this period. The secondary market was subdued overall and there was just one primary issue in Europe in which the investment manager participated. The mandatory convertible bond was used to partially finance the tender offer. The market really needs some new issues to reinvigorate the opportunity set and the investment manager is hopeful that the environment will see more companies coming to market.

Volatility strategies – Convertible bond arbitrage

Convertible bonds were amongst the biggest contributors during the year. Despite a challenging environment for convertible bonds with falling equities, flat credit spreads, continued inflation pressures and increasing risk-free interest rates, both the European and US convertible bond investments performed well through a mix of good stock selection, well-managed hedges and careful trading. In Europe, the primary and the secondary markets have been muted overall. The investment manager remains strongly of the view that hybrid new issues will come back with renewed vigour and will lead to new and interesting opportunities. The US convertible bond market was also under pressure throughout the year. Nevertheless, the investment manager managed to deliver a positive performance thanks to a combination of the hedging of a substantial portion of the interest rate exposure, the relatively high model delta of the book and active trading of positions. There were several new issues from US companies and the investment manager thinks these signal further demand for hybrid issuance from corporates.

Volatility strategies – Volatility Trading

The big trend seen throughout the year 2022 was the underperformance of skew: despite the market correction, the volatility did not pay as much as priced by the market. This pattern was driven by investors overall being underweight the market and already very well-hedged. In this context most of the performance from volatility trading came from the relative value strategies. The big interest rate moves triggered significant sector rotations and exacerbated sector performance dislocations especially during the first half of the year. In the second part of the year, realised volatility stayed remarkably calm and contained however the investment manager managed to generate profits by actively trading around existing positions and implementing tactical trades.

Volatility strategies – Warrant arbitrage & SPACs arbitrage

Warrant arbitrage and SPACs arbitrage contributed slightly negatively during the year.

Equity strategies

The equity strategies were the largest detractors during the year. A large proportion of the loss was attributable to an idiosyncratic special situation position in a German utility business which was severely impacted by the consequential effects of the invasion of Ukraine by Russia. Except for this position, the equity portfolio fared well overall during the initial market turmoil and the general risk-off environment that persisted during the year. The investment manager continues to keep the portfolio closely hedged. With the economic environment seemingly stabilising towards the end of the year, the investment manager believes that corporates have become increasingly adjusted to the new environment and are already becoming much more active. This sets a very encouraging tone for the opportunity set for BG Fund’s strategies in 2023.

Credit strategies – Capital Structure Arbitrage

Capital structure arbitrage was flat during the year.

Credit strategies – Credit long / short

Credit long / short contributed positively this period primarily thanks to various bridge finance and direct lending positions. The core long short book remains relatively small.

Credit strategies – Bridge finance / Direct Lending

The Master Fund invests in loans originated by Fiduciam Nominees Limited (https://fiduciam.co.uk). Fiduciam makes loans to small and medium sized enterprises in several Western European jurisdictions. The loans are secured on physical property assets. The size of the portfolio at the end of the period was circa €66 million and the contribution to the Master Fund’s performance was positive. An ongoing risk monitoring process is carried out by Fiduciam and BG to monitor the value of the collateral.

Credit strategies – Credit special situations

Credit special situations contributed negatively over the period with holdings impacted by a combination of lower economic growth forecasts and the overall market sell-off as well as an idiosyncratic position which had minority exposures to Russian oil. The investment manager remains positive about the prospects of these positions despite some short-term mark to market volatility.

Trading

Trading contributed overall slightly negatively this year with a strong performance from systematic trend following offset by weak performance from equity quantitative trading.