Fortune favours the brave, or so they say, and, as it turns out, so do the markets. One of the most important factors in investing is simply being first to bat, as by the time your turn comes, the game could be already over. Putting aside the metaphors, there is a distinct possibility that we may soon enter a phase of economic slowdown and investors who wish to capitalise on the shifting environment would be best rewarded if they position their portfolios early. The bigger players in the space will move faster than most, moving markets in the process, any opportunity will be quickly priced in.

Slowdown or contraction?

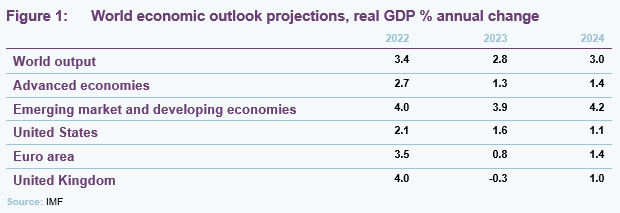

We may be standing on a knife-edge today, teetering between a slowing – but still growing – economy and a full-blown contraction. Figure 1, which is sourced from the IMF’s World Economic Outlook, shows that the picture is mixed. In Europe and the US, for example, the GDP outlook is currently indicative of slower growth, particularly in Europe. In the UK, the picture is more depressing – the economy is predicted to move from 4.0% real growth in 2022 to a small contraction, and it is by no means alone in this. Thankfully, emerging markets are predicted to fare much better than more-developed nations, thanks in part to the inherent trends supporting the growth of these nations and China’s reopening, but also because they have much more conservative fiscal policies.

Overall, it seems that the world is likely to experience a mild slowdown in the pace of growth in 2023, but that growth will remain firmly positive. However, economic forecasts are notoriously difficult, and there are plenty of unknowns that could still derail the global economic trajectory. It would therefore take a braver man than I to bet on a strong recovery from here – there are still many factors in play.

Can central banks achieve a soft landing?

While there is considerable uncertainty about the trajectory of the global economy, we believe that the overwhelming question is whether or not central banks can achieve the much-lauded ‘soft landing’. That is, can central banks bring inflation under control without tanking their respective economies in the process. Interest rates, and the market’s expectations around their future levels, have been the dominant force driving global equity markets over 2022 (these macroeconomic considerations have continually over-ridden the micro). The nominal shift in interest rates over 2022 has been huge, and there have been some marked shifts in asset prices as markets have factored in a higher cost of capital. Growth stocks that have a larger amount of their value discounted back from the future have found themselves at the sharper end of the selloff. In contrast, higher interest rates are good for banks, which are a stalwart of value-style portfolios, as they are generally able to expand their net interest margins. Although this is not good news for borrowers, some of who had got used to what seemed to be a never-ending era of cheap money and so this could have an impact on the credit quality of banks’ loan books.

A soft landing might seem like a forlorn hope, as the US Federal Reserve has only achieved one soft landing in the past six decades (1994-5). However, given that the market expects only one more rate-rise from the Fed (and the Bank of England), and as the impact on energy prices from Russia’s invasion of Ukraine is washing through, there is still hope that a soft landing may be possible.

A mixed picture in markets

At present, market valuations reflect an equally mixed picture. While we have seen a resurgence of growth stocks in equity markets in recent months – where, for example, Nvidia’s share price is approaching its COVID-19 highs – in the debt market, developed market yield curves remain inverted (short-term debt is yielding more than long term), which is usually a sign of impending recession.

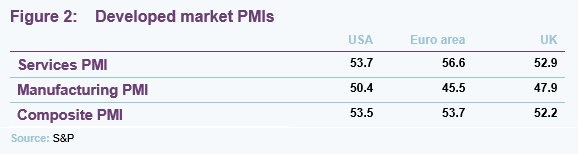

Even business confidence indicators such as purchasing managers indices (PMI) for the UK, Europe, and the US paint an uncertain picture. All three regions have composite PMIs above 50 (a value above 50 indicates expansion, and below that contraction), but this is being carried by the services sectors of each region, as their manufacturing sectors are close to, or already, indicating economic contraction.

Quality dominates in slowdown and contraction

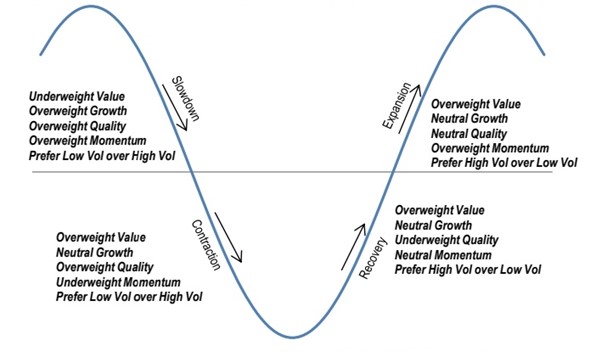

While I wish I had a crystal ball, it is not possible to give a definitive answer as to the severity of any possible slowdown. Thankfully, we can look back to past cycles to see what styles of investing have historically outperformed, as shown in Figure 3.

In both a slowdown and a contraction, the quality factor dominates – well-run companies with strong balance sheets are better able to survive economic downturns. While you will be hard pressed to find investment trust managers who intentionally purchase ‘low quality’ companies, we note that abrdn’s suite of strategies are often characterised by having a strong focus on the quality factor, for example. We feel that proactive allocation around the ‘growth’ and ‘value’ styles could offer the greatest potential return, given the historical swings between these two styles are often fairly violent, with one primed to make gains at the other’s expense.

Discounts prevail in both growth and value

Interestingly, the recent market downturn has widened discounts in both styles of strategies. There are plenty of opportunities for investors to capitalise on either scenario, with most regions having some form of growth or value strategy on an attractively wide discount.

US opportunities

For those interested in making an allocation to the US, there is Baillie Gifford US Growth (USA), a poster child for US growth investing, as well as The North American Income Trust (NAIT), a US equity income strategy that has a natural preclusion to holding high-income value stocks. Both US and NAIT are trading on z-scores above 1, indicting a current discount that is more than one standard deviation above its 1-year average, which represents a reasonable discount opportunity. While NAIT is trading on a 10.3% discount, USA is on a 21.8% discount, and while the Baillie Gifford fund’s discount is noticeably wider, it is worth remembering that this partially reflects the uncertainty around the valuations of its unlisted holdings.

Looking to the UK

Back home, discounts were already wide. Unsurprisingly, once again Baillie Gifford offers investors a way to capitalise on a potential resurgence in growth stocks, with Baillie Gifford UK Growth offering one of the widest discounts and largest z-scores amongst its peers (it being the most growth-biased trust in the UK All Companies peer group). However, the majority of UK growth strategies are to be found in the small cap sector, with the likes of Montanaro UK Smaller Companies (MTU), BlackRock Throgmorton (THRG) and abrdn UK Smaller Companies Growth (AUSC) all offering strong growth biases. Of the three, MTU is the most growth biased (according to Morningstar’s style rating system), while AUSC offers the largest z-score of any UK growth trust, as well as the largest discount at 15.4% currently. Both MTU and THRG trade on single digit discounts currently, 7.7% and 6.7% respectively.

When it comes to finding value, the UK has the widest selection of strategies, with most of the UK equity income sector offering some type of value-biased strategy. Predictably, those with the greatest value bias are those that trade on the narrowest discounts, as investors have sought to capitalise on the rally in UK high-income stocks, specifically energy and banks. Temple Bar is probably the most value-orientated trust within the group (it has a substantial allocation to energy and financial firms).

Tricky Europe

Europe is a bit trickier, as the members of both the large and small cap sectors have strategies that encompass a mix of quality and growth, with no dedicated value or income strategy to be found. As a result, there is no shortage of dedicated growth strategies, with the Baillie Gifford European Growth (BGEU) and Montanaro European Smaller Companies (MTE) both ranking amongst the most growth-biased strategies. Two other trusts worth noting are BlackRock Greater Europe (BRGE) and Henderson EuroTrust (HNE). MTE, BGEU and HNE trade at noteworthy discounts, 11.9%, 14.8%, and 15.0% respectively.