A brave WhiteOak Capital Management is trying to prop up the entire UK investment company IPO market almost single handed (although we are still waiting for the result of the AT85 Infrastructure IPO). The team behind Ashoka India Equity is looking to be the first to bring an investment company to market in over 18 months, with its planned IPO of the Ashoka WhiteOak Emerging Markets Trust (awemtrust.com). WhiteOak Capital Management has some US$5.5bn under management; which is overwhelmingly focused on Indian equities. However, the new trust, as its name suggests, will have a broader remit of emerging market equities and will follow an approach similar to the manager’s existing open-ended emerging market fund, which was launched in June 2022.

Will fortune favour the brave?

The IPO is looking to raise £100m; a lofty figure, given that the UK market has only raised £81m in new flotations, across all equity sectors, so far this year. While my inner capitalist applauds the animal spirits of WhiteOak, its capital-raising efforts have given me reason to reflect on the history of the emerging market investor, and I wonder if the odds are with them, or against them when it comes to launching its new endeavour.

For a start, it is far easier to launch a new fund during a bull market, as optimism breeds risk taking (or more crudely, investors have an unfortunate tendency to buy what has already gone up and sell what has already gone down), but today’s markets are a far cry from the bullish sentiments we last had in 2021. While we are technically out of the 2022 bear market, thanks to the 2023 rally, there still remains a tremendous amount of uncertainty about the need for further interest rises and to what extent this will further slow the global economy.

Said uncertainty has prompted this analyst to do a modest amount of data analysis, to see if emerging market equities have offered investors some of their much-touted advantages: diversification relative to, and stronger long-term growth trends than, global developed markets. And, perhaps more importantly, does the combination of these two factors mean that emerging market equities can help protect investors during global market sell offs?

Can emerging markets provide protection in down markets?

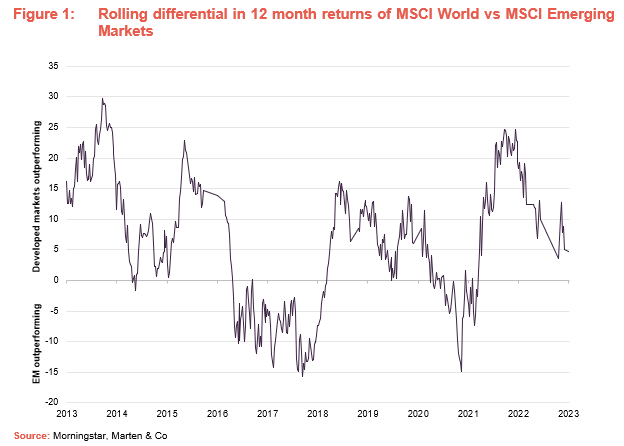

On the face of it, the simple answer is no. Emerging market equities have, for the last 10 years at least, fallen substantially behind global equity markets. As can be seen in Figure 1, which shows the difference in the rolling 1 year performance of developed market equities versus the same for emerging market equities (I have based this on weekly performance data). There were only two periods in which emerging markets were able to generate consistence outperformance (the periods where the line is below zero), during 2016 and 2017, and briefly during 2021, periods where investors were less risk averse than they are today.

Emerging markets do, however, offer some diversification benefits (using the same sampling methodology as above), with an average one-year correlation of 0.67 over the last 10 years. Unfortunately, the secular tailwinds that theoretically underpin emerging markets have not shone through during times of distress. Over the last decade, in every one of the 70 12-month periods that the MSCI ACWI (an index which combines both developed and emerging indices) was down over the last 10 years, emerging markets underperformed developed market equities, by an average 8.9%. Emerging markets are not the place to be when investors are bearish.

Potential diworsification, although inefficient markets create opportunities

Emerging market equities may have an average correlation of 0.63 to developed market equities in down markets. However, given the greater drawdowns during these periods, emerging markets may end up being a prime example of ‘diworsification’. The data suggests that this has been the case for at least the last 10 years – developed markets have averaged a Sharpe ratio of more than twice that of the emerging markets. This means that a well-diversified portfolio of emerging and developed stocks may have produced a worse risk/return profile than a purely developed one.

However, as the emerging market bulls will point out, my limited research is backward-looking and may not reflect all the wonderful tailwinds supporting the relative performance of emerging markets in the near future. Be it China’s post-COVID recovery, the developed world’s failure to grapple with the complexities of monetary policy, the still-inflated valuations of developed market companies relative to emerging, or the simple fact that the developed world is facing an economic slowdown that the emerging world may avoid thanks to their domestic growth trends. Maybe this time is different, and the post-inflation world will be kinder to the emerging market investor, though as value investors will remind us, the market has a painful habit of remaining irrational.

Nevertheless, the WhiteOak team does point out that its approach to emerging market investing is not about making macroeconomic calls, but rather about taking advantage of inefficient markets to buy undervalued companies. It feels that the relative lack of research coverage in many emerging markets should provide a greater opportunity to add alpha. However, it must achieve this where others have not – the average open-ended fund (using the IA sector) has failed to beat the MSCI Emerging Markets index over the last five years and nudged out a mere 2.8% outperformance over three years.

Stock selection is key, but so is asset allocation

We have one final reservation. Emerging markets are not created equal and while WhiteOak’s stock selection can add substantial value, it could be undone by asset allocation. Selecting the right region may be just as important the selecting the right company.

A few region-specific investment trusts can demonstrate the promised benefits of emerging market investing. The likes of the Gulf Investment Fund, Vietnam Holding, India Capital Growth, and Ashoka’s own India trust have all generated three-year NAV returns in excess of 100%, easily surpassing the 58% of the MSCI World (as of 31 March 2023). All of four of these trusts have also considerably outperformed their regional indices, and act as testaments to the potential for successful active managers to add value in the right markets.

For a more detailed description of how one may add value in emerging market investing, we point to our recently published notes on Gulf Investment Trust and Vietnam Holding. The successes of these trusts have brought with them discount narrowing, with all three of these trading on single digit discounts to NAV. This suggests that there remains some investor appetite for good emerging market managers.

Ultimately time will tell if Ashoka WhiteOak Emerging Markets Trust can make it over the line, it probably helps that the manager has built up a fanbase on the back of its success with Ashoka India Equity. We wish WhiteOak every success in its fundraising endeavours. With signs that inflation may be moderating and that the pace of interest rate rises in developed markets could slow, this could be a tailwind for the strategy. It will also be a litmus of whether the UK market is prepared to re-open the IPO window a crack.