Vietnam Holding Limited

Investment companies | Annual overview | 15 December 2022

A real growth story that remains intact

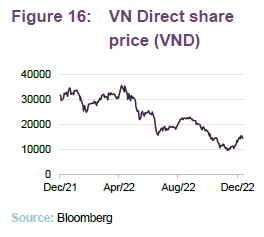

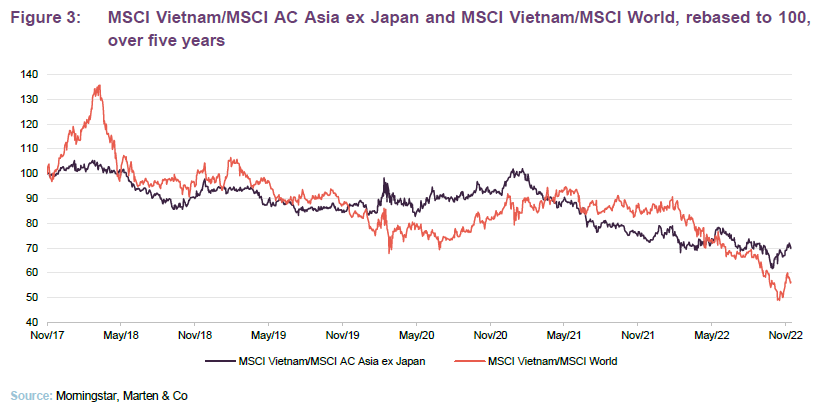

Despite having coped well with COVID and offering very strong growth prospects over the next five years (see page 5), the Vietnamese market has been weighed down by severe negative sentiment towards Asia in recent months. This is likely a function of lockdowns in China, slowing global growth and rising interest rates in the West.

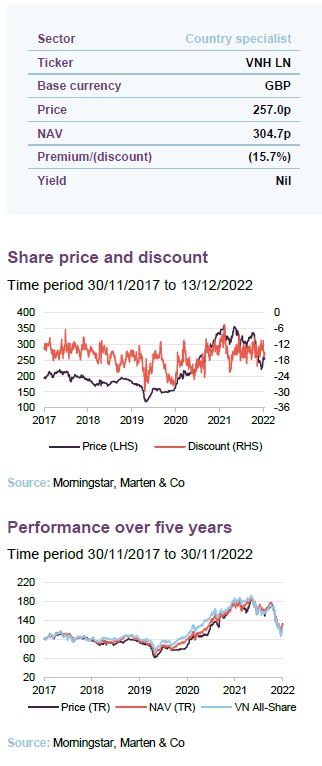

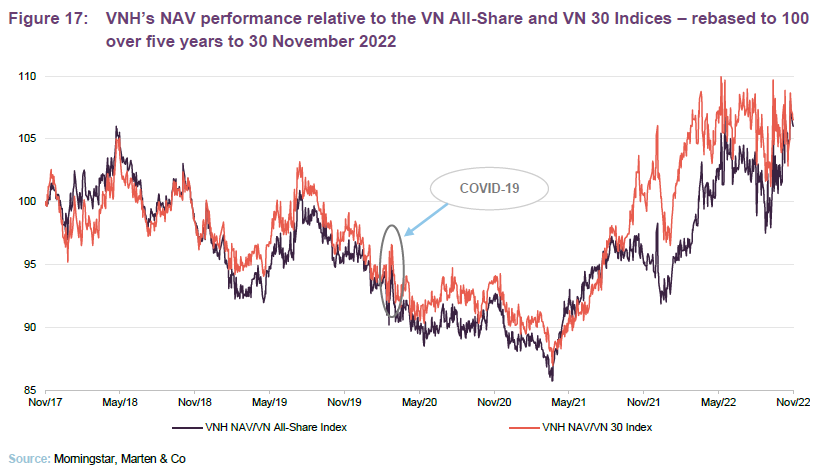

Vietnam Holding (VNH) has outperformed local market indices by good margins. Nevertheless, it has lost value during the last twelve months and, reflecting this, its discount has widened.

This could represent a significant opportunity. The Vietnamese market is cheap versus both global and emerging Asian peers. It could see a significant rerating as growth comes through, with the potential for a narrower discount too.

Capital Growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high-growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

Fund profile – listed Vietnamese equities with a strong ESG focus

Further information on VNH can be found at the company’s website: www.vietnamholding.com.

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also – subject to certain restrictions – invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity-like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). More information on Dynam Capital, VNH’s investment manager, is provided on pages 26 and 27, while further information on the manager’s Environmental, Social and Governance (ESG)-orientated investment process, including investment restrictions, is provided on pages 9 to 11.

VNH does not have a formal benchmark. However, for the purposes of performance evaluation, the manager has traditionally included comparisons against the VN Index, the VN All-Share, the VN 30 Index and the MSCI Emerging Markets Index in its literature. We have used these as well as the MSCI Vietnam Index in this report.

Market outlook and valuations update

Recent history and valuations

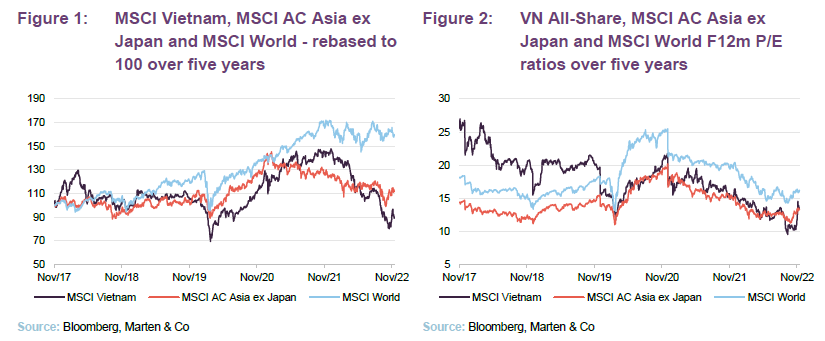

As is illustrated in Figure 1, Vietnam and emerging Asia appear to have decoupled from global markets during the last 12-18 months, giving back some of their previously strong performance during the post-pandemic period.

Vietnam and its emerging Asia peers have suffered from negative sentiment towards Asia, largely a function of problems within China. This is despite their superior growth trajectories, which appear to not only remain intact but have been accelerated in some cases by the pandemic, which Vietnam dealt with relatively well.

Adverse sentiment has been driven by lockdowns in China (which strained supply chains globally and ate away at the economic gains made by China in recent years); a slowing global economy; rising interest rates in response to inflation, particularly in developed markets; and, to a certain extent, negative sentiment towards growth stocks and markets (emerging Asia may offer a mixture of value and growth opportunities, but investors correctly view these as growth markets and have been rejecting this in all of its forms, irrespective of whether the fundamental drivers are markedly different). As illustrated in Figure 2, this has left Vietnam and emerging Asia cheap relative to global equities, despite the fundamental attractions of these markets.

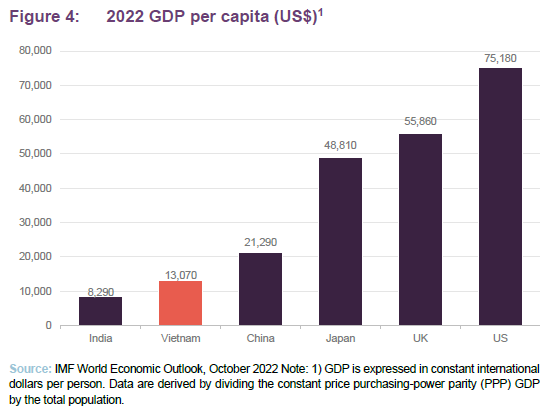

Vietnam – strong GDP per capita catch-up potential

Vietnam is still at a very early stage of development, and therefore continues to offer significant catch-up potential.

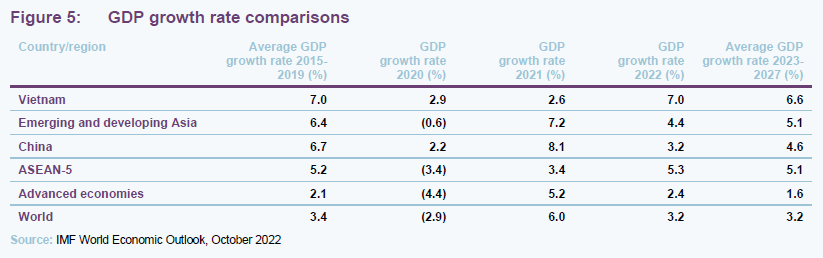

As we have highlighted in previous notes, Vietnam offers a long-term structural growth opportunity. Despite the strong performance of the Indian equity market during the last year, its GDP per capita growth continues to outpace India’s, is now over half of China’s, yet remains significantly below those of more developed nations (see Figure 4). It is clear from both Figures 4 & 5 that Vietnam is still at a very early stage of development, and therefore continues to offer significant catch-up potential.

The IMF’s World Economic Outlook for October 2022 forecasts average annual growth for Vietnam for the period 2023-2027 of 6.6%. This is in excess of China’s, above the average of ASEAN peer group and significantly above world and developed market averages. It is also worth noting that whilst the IMF’s estimated growth rate for China is on a slightly increasing trend for the next three years (from 4.4% in 2023 to 4.5% in 2024 and 4.6% in 2025) it is flat at 4.6% through to 2027. In comparison, Vietnam is expected to grow (from 6.2% in 2023 to 6.8% in 2027). As we have previously highlighted, Vietnam has a favourable demographic profile (a median age of 32.5 years) and it is relatively resource-rich, with substantial coal reserves and commercially-viable reserves in a range of metals and minerals.

Manager’s view – Vietnam is confident and recovering strongly

Unlike China, which has been dogged by lockdowns and the associated political unrest, Vietnam’s economy is now in the post-COVID era and, in contrast to a number of its peers and the developed world, is growing quickly again. For example, the economy grew 13.7% in the third quarter of 2022 versus the same period in 2021 (the prior year’s period having been hampered by an outbreak of COVID that seriously impacted business activities). Versus the prior year, retail sales of goods and services were up some 21% while foreign direct investment reached new highs of some US$15.4bn. The S&P Global Vietnam Manufacturing PMI moved down ever so slightly to 52.5 in September 2022, from 52.7 in the prior month, but this still places Vietnam firmly on an expansionary trajectory. Furthermore, recent data from the World Bank estimates growth in the ASEAN region of 7.2% this year and 6.7% next year, placing Vietnam in good company, despite China’s woes.

The Vietnamese central bank has also said that it is sticking to a monetary policy that is supportive of economic growth. Inflation has remained positive in Vietnam, so businesses are already used to having to manage its effects yet remains lower than its peers.

Overall, the Vietnamese growth story is still intact, and the country is relatively well positioned to navigate the challenges of a slowing global economy.

Vietnam – on track to become a top 20 global economy by 2050

As we have discussed in our previous notes, Vietnam has benefited from a high and stable growth rate during the last 30 years, and with strong structural growth drivers firmly in place, the manager expects this to continue. Inevitably, its economy suffered some relatively short-term disruption as a consequence of COVID but, as we discussed in detail in our May 2020 note, Vietnam has been a standout success story in terms of its handling of the virus (see ‘COVID19: Vietnam – a case study in epidemic management’ on pages 3 to 5 of that note). This has been reflected in the rebound in its GDP growth and the relative performance of its stock market, during the last couple of years.

Unlike China, which developed and deployed its own home-grown vaccine, Vietnam purchased western-developed mRNA vaccines which have shown far greater efficacy than China’s Sinovac. This has allowed Vietnam’s economy to remain open and, while China’s zero-COVID policy has had an impact (China is Vietnam’s largest trading partner), Vietnam has not needed to resort to the economically crippling restrictions that have been imposed in China.

In fact, over the medium-term, Vietnam may actually be a net beneficiary as many companies are looking to diversify their supply chains away from China to make them more resilient and, for the reasons discussed below, Vietnam is a natural alternative.

Despite the short-term distractions, VNH’s manager continues to believe that Vietnam is still on track to become a top 20 global economy by 2050. Vietnam has benefited from increasing exports in recent years, but its growth has been largely domestically driven, which gave it resilience as the global economy was slowed by the pandemic. Vietnam is also set to expand its digital economy. According to data from Google, the value of Vietnam’s digital economy will be around US$22bn for 2022 and is expected to rise to US$50bn by 2025 – a CAGR of 37% if it comes to pass. VNH’s manager says that this reflects a strong push towards digitalisation post-COVID.

A growing middle class is driving consumption

By 2035, there could be an additional 35m middle class Vietnamese consumers.

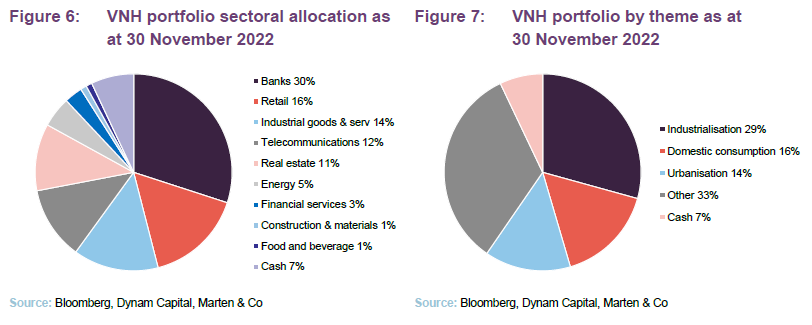

A growing middle class and an increasingly consumer-driven society are driving GDP growth, which drives incomes, creating a virtuous circle. Dynam believes that by 2035, there could be an additional 35m middle-class consumers, around 50% of the population. To capture the benefits of these developments, the managers are focusing on three major themes within the portfolio:

- industrialisation;

- the consumer; and

- urbanisation.

Structurally well-positioned for ongoing growth

Vietnam benefits from a number of structural growth drivers that suggest it is well-positioned for further economic expansion for years to come. For example, Vietnam:

- benefits from a large and youthful population;

- has a relatively well-educated workforce (Vietnam’s literacy rated reached 97.75% in 2021, ranking second-highest among the top 10 investable frontier-market countries);

- is an industrious nation. At 73% (in 2021), it has one of the highest employment-to-population ratios globally (the global average is 55% (2021), while the average for East Asia and the Pacific is 66.2% (2019) – all sourced from the World Bank);

- is benefiting from increasing urbanisation;

- is a natural manufacturing hub. It has a low manufacturing labour cost (around half that of China and around two-thirds that of Mexico). It is also centrally positioned within ASEAN and is well-positioned relative to other major economies in the region (China, Japan and Korea);

- benefits from a relatively stable socio-political environment (85% of the population is ethnic Kinh, which reduces the likelihood of internal conflict);

- At 70.3% (2020) of its population, Vietnam has high internet penetration compared to wider emerging markets – the global average including developed markets is 60% (2020). As noted above, Vietnam’s internet economy is forecast to reach US$50bn by 2025;

- has an increasingly open economy, driven by a variety of free trade agreements. It moved from 77th place in 2018 to 67th place in 2019 in the global competitiveness index (this being the largest increase between these two years);

- has 15 free trade agreements in place and has concluded negotiations on a further two. The newly-signed RCEP and UKVFTA are expected to boost foreign trade;

- is well-diversified in terms of its foreign trade partners and is not overly reliant on any particular one. China is the largest partner at around 22% of foreign trade. The next-largest is the US, at around 15%;

- is a strategic alternative to China for global product sourcing. Despite concerns to the contrary, Vietnam has benefited from a recent surge in exports as trade tensions have escalated between the US and China; and

- has seen healthy development within its capital markets in recent years. These have grown in size, boosted by new IPOs and privatisations of former SOEs. However, the foreign ownership limits (FOLs) remain a challenge (30% for banks and 49% for other listed companies).

As a consequence of the above, Vietnam has been attracting high levels of foreign direct investment in recent years.

Nervous markets – cash levels increased

VNH’s manager comments that Vietnamese financial markets have been nervous during the last couple of months, which they ascribe to a number of factors:

- Slowing global growth

- The impact of the war in Ukraine, particularly as we enter the winter months

- A slowdown in the corporate bond market, which has previously been very buoyant

- A slowdown in the real estate market, which has also been very buoyant

- A high-profile arrest of the Vietnamese property tycoon Truong My Lan, the chair of Van Thinh Phat Holdings Group, as part of a year-long anti-corruption drive. VNH is not invested in Van Thinh Phat (which is an unlisted company), but the arrest of the chair of one of the biggest property developers in Vietnam added more difficulties in a slowing corporate bond market, which then resulted in poorer sentiment in the listed equity market.

As we explain later in this note, the key themes of telecoms, real estate and banking remain in the portfolio, but the manager has been trimming exposures to areas such as financials and real estate which are sensitive to rising interest rates. The manager has not been quick to redeploy the proceeds and, instead, has allowed VNH’s cash balance to rise significantly with the aim that it will be able to redeploy these at more attractive valuations going forward.

Investment process

Dynam Capital is searching for high-growth, compounding businesses that it can hold for the long-term.

In managing VNH’s portfolio, Dynam Capital (www.dynamcapital.com) is looking for high-growth, compounding businesses that it can hold for the long term. This can be summarised as growth at an attractive valuation. Dynam manages its portfolios using a mixture of top-down and bottom-up investment strategies. The top-down element of the investment process guides the manager towards the key sectors and sub-sectors on which to focus its attention, with the aim of achieving superior long-term returns. The bottom-up element of the process uses extensive fundamental research to select the best companies in those sectors and sub-sectors.

ESG incorporated into all investment and monitoring procedures

ESG research is fully integrated into its investment process.

ESG criteria are central to Dynam’s approach, and have been part of its DNA since the beginning. Vu Quang Thinh, Dynam’s CIO, is very well-regarded in this area. He is a founding member and former chairman of the Vietnam Institute of Directors (VIOD). Established in April 2018, VIOD was the first private and independent organisation in Vietnam, aimed at promoting the highest standards and best practices in corporate governance among domestic firms.

Four-stage investment process: internal screening, due diligence, investment decision and investment monitoring

Dynam’s investment universe comprises around 1,500 companies split across three exchanges in Vietnam (the two major exchanges are Ho Chi Minh City and Hanoi), with a combined market capitalisation in the region of US$200bn. The overwhelming majority of these are deemed to be not suitable for investment. Many are too small, and others will not fit Dynam’s ESG criteria.

The initial screening process reduces the investable universe to around 150 companies. Further analysis reduces this to around 70, on which Dynam speaks to company management and conducts extensive due diligence. Ultimately, this is narrowed to a portfolio of around 23 that fully reflects Dynam’s philosophy.

Internal screening and due diligence

Dynam regularly screens the Vietnamese market against its investment screening criteria to identify new potential investments. This includes an assessment against the manager’s critical risk table and its initial ESG checklist. Companies that pass this phase undergo a concept discussion at the weekly team meeting. If they pass, they enter the investment pipeline.

Of the 70 or so companies that make it through the initial screening phase and enter Dynam’s investment pipeline, the manager conducts extensive due diligence to assess a company’s suitability for inclusion in Dynam’s portfolios.

In this phase, a company is assessed in detail against Dynam’s investment criteria (see below). The manager conducts site visits, interviews company management, scores the company against its ESG matrix in greater depth, and builds a detailed valuation model. Broker reports and sector reviews feed into this process. Dynam’s investment criteria can be summarised as follows:

- Compounding long-term EPS growth (approximately 20% per annum);

- Attractive valuation with built in safety margin;

- Strong balance sheet and cashflow management;

- Rigorous adherence to ESG principles;

- Industry leader with strong competitive position; and

- Best management teams amongst peers.

The due diligence process is fully documented and conclusions of all of this analysis are pulled together into a draft investment proposal, which is presented to the investment team. The investment team critically appraises the proposal and it is revised based on their feedback. Assuming that an investment clears this stage, the investment proposal is then finalised.

Investment decision and monitoring

Once an investment proposal has been finalised, it is reviewed by the investment committee at its weekly meeting and, where appropriate, the client. Assuming that an investment receives approval, it is passed to the trading team for execution.

Investment monitoring may lead to company engagement to propose improvements or suggest remedial action.

Dynam operates a process of ongoing investment monitoring. This includes attending analyst meetings, regular company visits, reviewing results and periodically rescoring a company against Dynam’s ESG matrix. Following such an event, an internal update on the company is produced and this is reviewed by the investment committee. Where appropriate, this may lead to company engagement, to propose improvements or suggest remedial action. It may also lead to a divestment proposal, which is also reviewed by the investment committee, before being acted thereon.

Investment restrictions

VNH’s articles of association impose the following investment restrictions, VNH:

- will not invest more than 10% of its NAV (at the time of investment) in the shares of a single investee company;

- will not invest more than 30% of its NAV (at the time of investment) in any one sector;

- will not invest directly in real estate or real estate development projects. However, it may invest in companies that have a large real estate component, if their shares are listed or are traded on the OTC Market;

- will not invest in any closed-ended investment fund unless the price of such investment fund is at a discount of at least 10% to its prevailing net asset value (at the time of investment);

- may invest up to 25% of its NAV (at the time of investment) in companies with shares traded outside of Vietnam, if a majority of their assets and/or operations are based in Vietnam;

- may invest up to a maximum of 20% of its NAV (at the time of investment) in direct private equity investments;

- may invest up to 20% of its NAV (at the time of investment) in other listed investment funds and holding companies which have the majority of their assets in Vietnam;

- may borrow money, and grant security over its assets, provided that such borrowings do not exceed 25% of the latest available NAV (at the time of the borrowing);

- may also invest in securities that have equity features, such as bonds that are convertible into equity;

- may also invest its available cash in domestic bonds or international bonds issued by Vietnamese entities; and

- may utilise derivatives contracts for both hedging purposes and efficient portfolio management, but it will not utilise derivatives for investment purposes.

Investment restrictions – based on the United Nations Principles for Responsible Investment

VNH is a signatory of the UNPRI.

VNH is a signatory of the United Nations Principles for Responsible Investment (UNPRI). This imposes a number of ESG-related restrictions. As a signatory, it will not invest in companies:

- known to be significantly involved in the manufacturing or trading of distilled alcoholic beverages, tobacco, armaments or in casino operations or other gambling business;

- known to be subject to material violations of Vietnamese laws on labour and employment, including child labour regulations or racial or gender discriminations; or

- that do not commit to reducing, in a measurable way, pollution and environmental problems caused by their business activities.

Asset allocation

Concentrated and low turnover portfolio of Vietnamese stocks

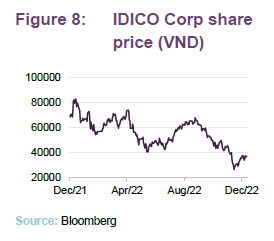

As at 30 November 2022, VNH’s portfolio had exposure to 21 securities, a marked reduction from the 27 securities that it held a year earlier. As we have previously discussed, VNH’s portfolio is highly concentrated; it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%), but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction). As illustrated in Figure 9, the top 10 holdings accounted for 66.4% of VNH’s portfolio as at 30 November 2022, which is a noticeable increase in concentration from the 59.9% a year earlier. IDICO Group, discussed below, is a new addition to VNH’s portfolio.

Distinctly different from the index

VNH’s portfolio has a high active share.

As we have highlighted in our previous notes, VNH’s portfolio is distinctly different from the VN All-Share (or any Vietnamese-focused ETF for that matter). VNH’s portfolio has a high active share – typically 75–80% – and it should be noted that the index does not benefit from the manager’s strong focus on ESG considerations.

Trimming real estate and building up cash

Traditionally, the portfolio has had a markedly higher allocation to mid- and small-cap stocks (the VN All-share, by contrast, is heavily weighted towards stocks with market caps in excess of US$1bn). We have previously commented how, during 2020, the manager generally took profits in small-mid cap holdings and reallocated capital into areas, such as the banks, which traditionally have higher market caps. The rationale was that the manager considered these to be better geared to an improving Vietnamese economy.

In late 2021 and early 2022, the manager took profits in the banks, financials, and real estate sectors and reallocated capital into sectors benefiting from the reopening of the economy, such as retail and export-related businesses. More recently, the manager further reduced real estate exposure, which it thinks may be negatively impacted by rising interest rates. Finally, during the sharp correction in the third quarter of 2023, the manager used the opportunity to add to selected positions including banks.

Real estate exposure has also been reduced. This is both because the manager has been reducing holdings as the outlook becomes more challenging and the scandal that we discussed on page 8, which has weighed on the property sector. The net of these moves is that VNH’s cash level increased significantly, reaching 11% as at 31 October 2022, but this has since reduced a little so that it stood at 7% as at 30 November 2022. These are some of the highest levels of cash that VNH has held apart from when it has been building up cash to fund previous tender offers. By way of illustration, a more natural level of cash is 2-3%.

IDICO Corp – benefiting from long-term structural growth

IDICO Corp (www.idico.com.vn), more formally known as the Viet Nam Urban And Industrial Zone Development Investment Corporation, is a former SOE that was established in 2000 by the Vietnamese Ministry Of Construction to develop and construct industrial zones/parks, hydro power plants, road traffic schemes and urban and Housing schemes. The company was privatised a decade ago and has continued to develop and expand and now has one of the biggest landbanks in Vietnam.

VNH’s manager thinks that the industrial parks side of IDICO’s business is particularly attractive and well positioned to benefit from a number of long term structural growth trends. It highlights two of IDICO’s industrial park assets in particular: the Phu My 2 Industrial Park in Ba Ria – Vung Tau province and the Huu Thanh Industrial Park in Long An near Ho Chi Minh City.

Phu My 2 is located near the ports of Cai Mep, Phu My and SP-PSA. These are deep-sea ports that are able to accommodate large vessels (80,000-120,000DWT) and are located on key international water transportation routes within the region. These ports have modern warehouse, loading and unloading systems. Phu My 2 also has a natural gas supply, an internal port system (for barges up to 3,000 tonnes, good road connections to south-eastern provinces and the southern key economic region, and a wastewater system with 4,000m3 capacity a day.

Huu Thanh is located close to Ho Chi Minh City – the largest economic centre in Vietnam, with a population in excess of 10m people (making it larger than London). The park is located within the Southern economic region, which plays a key role within Vietnam’s development strategy and its proximity to Ho Chi Minh gives it access to a large labour force. The land price is competitive versus surrounding areas and the park also benefits from a number of investment incentives, including corporate income tax incentives (corporate income tax, usually 20% in Vietnam, is charged at a rate of 17% for the first 10 consecutive years from the first year that the project generates taxable income).

VNH’s manager thinks that both these assets, as well as the wider industrial parks portfolio, will be a major beneficiary from the development of infrastructure in Vietnam, particularly in Southern Vietnam, which will drive increases in value for these assets. For example, Huu Thanh is expected to benefit from the development of a ring road around Ho Chi Minh City.

The manager comments that Vietnam is still seeing strong FDI inflows and very strong leasing activity. The company also has good ESG credentials – for example, it produces power for some of its tenants using rooftop solar and is well positioned to benefit from the ‘made in Vietnam’ policy. The manager thinks that the company has huge potential and the structural growth trends it is exposed to are enduring. The manager observes that Northern Vietnam is benefiting from investment by Korean companies, while the South is benefiting from investment by Thai companies. Furthermore, Singapore and Ho Chi Minh City are separated by just a one-hour flight.

Top 10 holdings

Figure 9 shows VNH’s top 10 holdings as at 30 November 2022, and how these have changed over the previous year. Six of the top 10 holdings as at 31 October 2022 were constituents of VNH’s top 10 at the end of October 2021, although some of the relative positions have changed. New entrants to the top 10 are Phu Nhuan Jewelry and Vietcombank, while VNDirect and Nam Long Group have moved out.

We discuss some of the more interesting developments in the next few pages. However, readers interested in more detail on these top 10 holdings, or other names in VNH’s portfolio, should see our previous notes (see page 29 of this note).

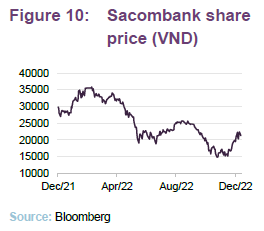

Sacombank (7.4%) – reaping the rewards of restructuring

Saigon Thuong Tin Commercial Bank (sacombank.com.vn/en), more commonly known as Sacombank, is one of the top ten commercial banks in Vietnam. It employs around 17,000 people, has a network of over 550 transactions offices spread across 48 provinces in Vietnam, and serves around 6m retail customers and 100,000 corporate customers.

VNH’s manager describes Sacombank as the most dynamic private bank in Vietnam. It has cleaned up its loan book during the decade and has grown by acquisition, absorbing smaller banks along the way. In this regard, Sacombank has been instrumental in the restructuring of Vietnam’s fragmented banking sector during the last seven years as well as addressing the issue of non-performing loans, which previously plagued the sector.

In 2015, The State Bank of Vietnam approved the merger of Sacombank with a local lender Phuong Nam Bank (this was the result of a hostile takeover by the Tycoon Tram Be). As part of the reform package, the central bank took possession of all of the Sacombank shares that were owned by then deputy chairman, Tram Be. However, in 2017, the central bank removed Tram Be and his son from Sacombank’s board and split the company into a good bank (Sacombank) to deal with the ongoing business and a bad bank (Vietnam Asset Management Company) to deal with the non-performing loans.

After five years of restructuring, Sacombank has dealt with most of its legacy issues. Sacombank booked a lot of losses to address both the NPLs and to deal with COVID but, with its restructuring now complete, VNH’s manager thinks that the bank’s earnings could triple in the next two years. The manager notes that the bank’s earnings have been depressed by provisioning in recent years, so this offers strong recovery potential. Sacombank is also focused on the retail sector, which is booming in Vietnam and its total assets are still growing in line with the sector (it is a top seven Vietnamese bank). It is trading at a P/B ratio of around 0.6x, which VNH’s manager thinks is cheap.

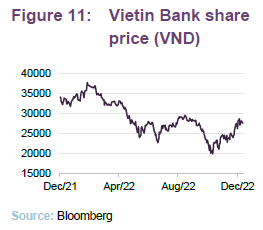

Vietin Bank (5.1%) – pivoted towards retail banking

Vietin Bank (vietinbank.vn), more formally known as the Vietnam Joint Stock Commercial Bank for Industry and Trade, is one of the country’s largest state-owned commercial banks, with around 140 branches and 700 transaction centres. The bank, which offers an extensive range of consumer and corporate banking products, is backed by Bank of Tokyo-Mitsubishi UFJ (which owns a strategic 20% stake) and International Finance Corporation. VNH’s manager describes it as a high-quality bank that has been a consistently strong performer since its IPO in 2009.

Previously, Vietin Bank had a high exposure to public sector business assets, but it has restructured its business and it now has a greater focus on retail banking. VNH’s manager says that, reflecting this, the structure of the bank’s income is very healthy – around 20% comes from retail banking and around another 20% is non-interest income. At the same time as it has decreased its lending to SOEs, the bank has also raised its underwriting standards. It has also applied Basel II, while increasing the efficiency of its lending practices.

Vietin Bank has applied more than US$2bn in COVID-related provisions, a lot of which it has been able to reverse. Its return on equity (ROE) is around 20% and while VNH’s managers think that its net interest margin may fall this year (in common with its peers, its cost of capital is increasing), it believes an ROE of 17% is still readily achievable and the bank is relatively cheap with a P/B of less than 1x.

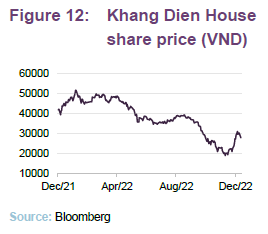

Khang Dien House (4.2%) – impacted by negative sentiment towards real estate

Khang Dien House (khangdien.com.vn) is a Vietnamese real estate company focused on middle-income buyers, providing small ready-built villas and townhouses at relatively-affordable prices. It has been a VNH holding since March 2015 and we last discussed it in our December 2019 note (see page 17 of that note). Khang Dien House is now one of the largest private property developers in Vietnam and has a landbank of some 400 hectares in the South West of Ho Chi Minh City, where it intends to develop an urban ‘city.’

VNH says that Khang Dien House was, compared to its peers, an early adopter of sustainable practices and has been publishing a sustainability report since 2016 (achievements include an increased use of unbaked brick, exterior paints with high thermal insulation and landscaping that combines open spaces in high-rise buildings and planting trees at height to reduce heat absorption).

Khang Dien House has performed strongly during the market recovery following the pandemic, pushing it up VNH’s rankings. More recently, it has suffered following Truong My Lan’s arrest. Truong has no business relationship with Khang Dien House, but her arrest has weighed on the sector.

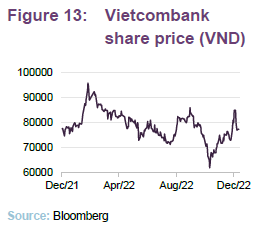

Vietcombank (3.5%) – high quality commercial bank

We discussed Vietcombank (vietcombank.com.vn), more formally known as the Joint Stock Commercial Bank for Foreign Trade of Vietnam, in our May 2020 update note (see pages 10 and 11 of that note for more details). It is one of the largest commercial banks in Vietnam and operates from around 600 locations (including 111 branches and 472 transaction offices), providing a full range of personal and corporate banking services.

When we discussed Vietcombank in that note, we commented that Vietcombank was one of two banks that the manager identified as being high quality and added to the portfolio, while it felt these stocks were cheap following the market’s COVID-19-related rout. The stock recovered strongly as markets recovered and following the vaccine rally in November 2020 the manager took profits, reallocating the proceeds to VNH’s broader bank portfolio. More recently, share price growth has pushed it back up VNH’s rankings.

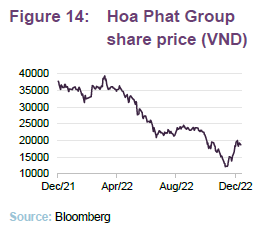

Hoa Phat Group – manager took profits following strong run

Hoa Phat Group (hoaphat.com.vn/en) is a long time VNH holding that we have discussed in our previous notes (most recently in our March 2021 note – see page 21 of that note), also in our May 2020 update note (see pages 9 and 10 of that note for more on Hoa Phat and its ESG credentials). To recap, Hoa Phat is a Vietnamese company that describes itself as “the leading industrial manufacturing group in Vietnam”.

It is primarily engaged in the steel sector (this is the core of the business accounting for over 80% of revenue and profit), where Hoa Phat is the largest domestic manufacturer, and it also has some agricultural and real estate interests. The business is organised into four key areas: steel, industrials, agriculture and real estate. VNH’s managers say that Hoa Phat has a uniquely integrated operation in Vietnam (from iron ore and coking coke production through to its finished products).

Reflecting both a re-opening of both Vietnam and the global economy, as well as a shortage of certain commodities, Hoa Phat’s share price doubled. While VNH’s manager continues to like the company, it felt that Hoa Phat’s share price had got ahead of itself significantly. It has taken profits on the holding and has significantly reduced the position, so that it is now less than a 2% holding. VNH’s manager says that it was able to do this because its size allows it to be nimble.

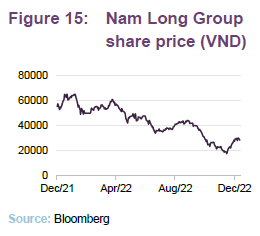

Nam Long Group – attractive arbitrage opportunity

Nam Long Group (www.namlongvn.com) is a Vietnamese property development that we last discussed in our December 2021 note (see page 10 of that note). The company is structured around three main business segments: land development, housing development and commercial property (these are discussed in greater detail in our December 2021 note). Nam Long has a strong customer focus and sustainability is an integral part of its business (it lists ownership, professionalism and integrity as being its three core values).

Nam Long’s land development arm is focused on land, and land and township development. It has some 650 hectares of land that has been cleared in the south of Vietnam (within Can Tho, Long An, Ho Chi Minh City and Dong Nai).

VNH’s manager describes Nam Long as a pioneer in the affordable housing sector with very strong ESG credentials. It has a very good land bank; is focused on the apartment segment, which is very affordable; and is very active around Ho Chi Minh City where there is ongoing strong demand. It has been working with Japanese developers and finance providers to help improve its offering. Previously, Nam Long was a top three VNH holding but the manager has been selling down the holding as the outlook is becoming more challenging. It says that the company did a private placing that offered an attractive arbitrage opportunity to existing holders. VNH took advantage of this, effectively recycling its existing shares, making 100% profit on the transaction. However, subsequent sales have brought the holding down to less than 1% position, moving it outside of VNH’s top 10 holdings.

VNDirect – profits locked in at strong prices

VNDirect Securities Corporation (www.vndirect.com.vn/en) offers brokerage and associated services to both retail and institutional clients in Vietnam. In addition to securities brokerage, the company provides depositary, corporate finance advisory, underwriting and portfolio management services. It also undertakes proprietary trading. The holding plays into the broad themes of both a growing middle class in Vietnam as well as increasing financial inclusion, aided by high and growing internet penetration in Vietnam. We have followed its progress in more detail in our last two notes (see page 29 of this note).

VNH’s managers observe that confidence continues to be high, which has been reflected in significant growth in domestic retail investor activity during the last couple of years. The corporate bond market has also boomed in Vietnam and VN Direct has also been a beneficiary of this, having created a very good platform to capture the opportunity. Reflecting this, VNDirect experienced a strong share price, which pushed it up VNH’s rankings. VNH’s managers continue to like the company but took profits around six months ago at very high prices. They felt that significant headwinds were coming as the global economy slows and interest rates rise, so took the opportunity to divest the position.

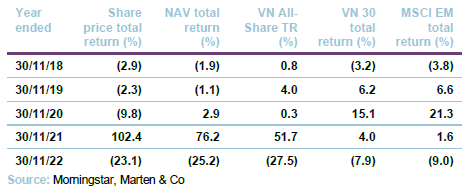

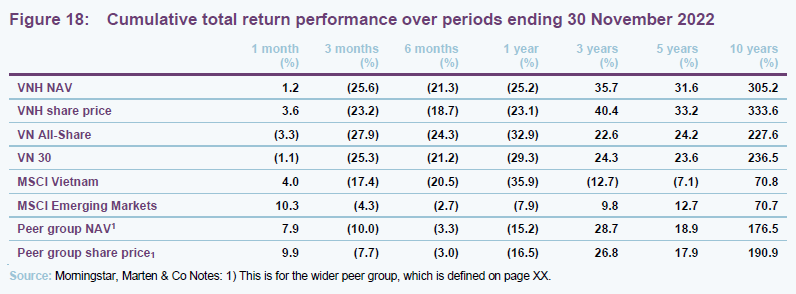

Performance

Figure 18 illustrates VNH’s share price and NAV total return performances in comparison with those of its country specialists: Asia Pacific ex Japan peer group, the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices. An obvious feature of Figure 18 is the marked turnaround in performance for VNH, its peers and the Vietnamese market over the last 12 months, which is particularly apparent in the three-, six- and 12-month periods. The reasons for this are discussed earlier in this note but VNH, its peers and the Vietnamese market have suffered from negative sentiment towards Asia (a function of Chinese lockdowns, a slowing global economy, rising interest rates and, to a certain extent, negative sentiment towards growth).

Interestingly, both VNH’s NAV and share price total returns are markedly ahead of the various local market indices provided over six-months and one-year although, more importantly, it is significantly ahead over the longer-term three, five and 10-year periods. Absolute returns over the 10-year periods are very strong, particularly for VNH and its peers. Furthermore, over 10 years, VNH strongly outperforms all of the indices as well as the average of the peer group for both NAV and share price.

Peer Group

Please click here for an up-to-date peer group comparison of VNH versus its Country Specialist peers.

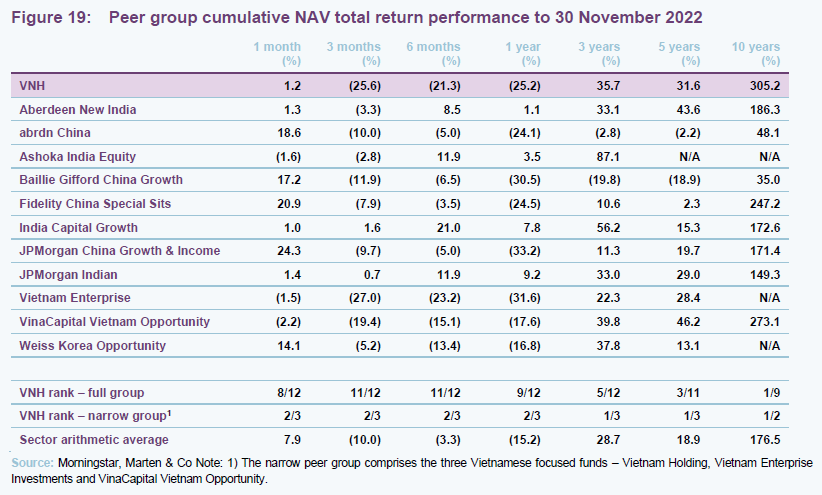

Since the end of March 2021, VNH has been a member of the AIC’s Country Specialist sector, having previously been a member of the discontinued Country Specialist: Asia Pacific-ex Japan sector. As we have discussed in our previous notes, this change has had a limited effect on our peer group analysis as, reflecting the diverse range of funds in its previous sector (there were 12 different funds with a range of remits) we previously provided figures for both the broader sector as well as a narrower peer group that looked at the three pure Vietnamese funds.

In the analysis in Figures 19 to 21, we have included performance numbers for both the direct peer group as well as the former Asia Pacific ex Japan sector. Keen eyed readers might note that abrdn China now features instead of Aberdeen New Thai – the former was created when the latter was merged with Aberdeen Emerging that was accompanied with change of remit – as we feel that it provides a useful comparison.

VNH’s current peer group comprises the three Vietnamese funds as well as Weiss Korea Opportunity Fund. It used to include JPMorgan Emerging Europe, Middle East & Africa Securities (JEMA – formerly JPMorgan Russian Securities), but this fund has moved to the Global Emerging Markets sector following its change of remit. We are excluding it altogether from our analysis as it is overwhelmingly invested in Russian equities. These are effectively untradeable as a result of the various sanctions imposed in the aftermath of the invasion of Ukraine and we think this should therefore be treated as more of a special-situations type of investment. We include Weiss Korea Opportunities in our broader peer group, but not in our direct peer group as we don’t believe that a fund of Korean preference shares provides a meaningful comparison for VNH.

As illustrated in Figure 19, most funds in the wider peer group and all funds in the direct peer group are showing negative absolute returns over the three-months, six-months and one-year periods, which is not surprising given the headwinds that emerging Asia has faced during the last 12 months. However, it can also be seen from Figure 19 that, when compared to its direct Vietnamese peers, VNH’s performance is middle of the pack for all of the periods provided up to and including 12 months.

Interestingly, it has outperformed VEIL, which is also focused on listed equities, but underperformed VOF. However, some caution should be exercised as VOF has a significant exposure to unlisted assets and there may be a lag in changes in the value of these feeding through to its NAV. Over the longer-term three-, five and ten-year periods, VNH is the top performing fund within its direct peer group.

When compared to the wider peer group, its recent NAV performance has clearly pushed it down the rankings but has outperformed the wider peer group average by seven percentage points over three years, 12.7 percentage points over five-years and 128.7 percentage points over 10 years. We continue to believe that a long-term strategy such as VNH’s is best assessed over longer-term time periods.

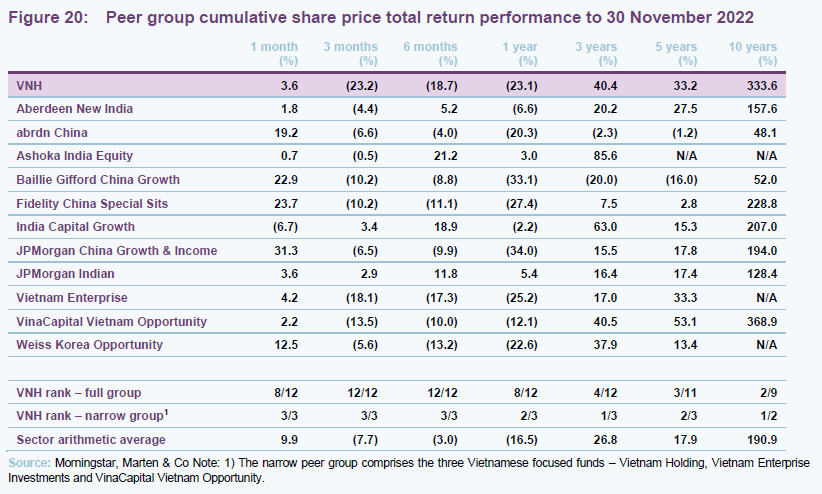

Looking at Figure 20, a similar pattern is seen in VNH’s share price total return performance against both its wider and direct peer group, although, over the shorter periods (up to and including one-year), VNH’s performance ranking has tended to be slightly inferior, suggesting that its discount has widened more than the peer group averages. Of course, given the strong mean-reversion that we have seen historically (see discussion on page 23), this suggests that it has more recovery potential.

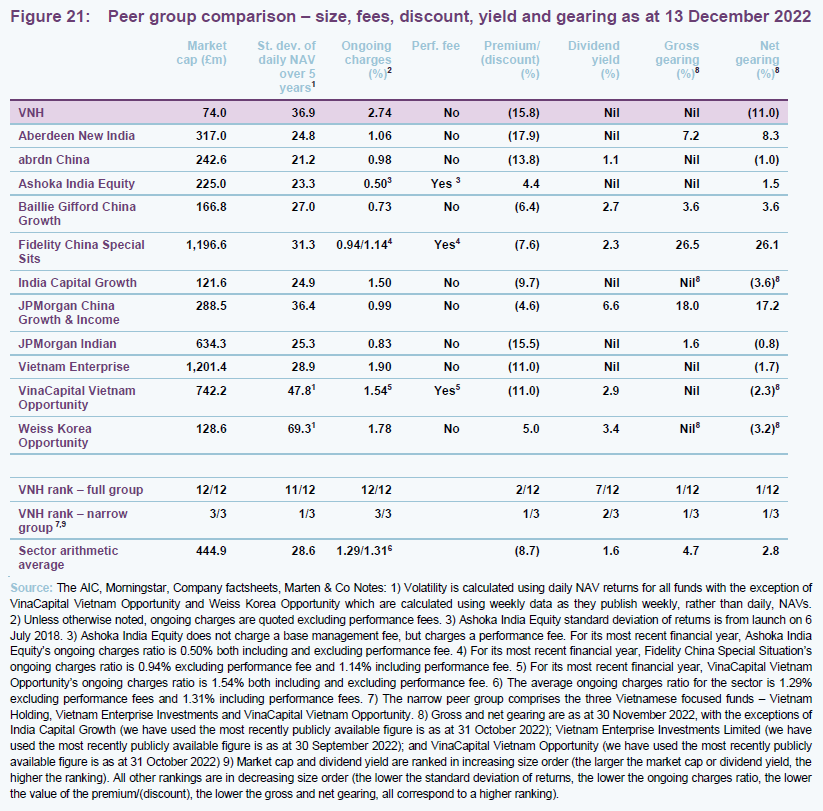

Looking at Figure 21, the volatility of VNH’s NAV returns is the lowest of its Vietnam’s focused peers although, of the wider peer group, it is one of the widest. However, it should be noted that for the majority of the five years over which this NAV volatility has been calculated, abrdn China and Baillie Gifford China Growth (BGCG) have operated with markedly different strategies. abrdn China was Aberdeen New Thai (before its merger with Aberdeen Emerging and the accompanying change of strategy), while BGCG was Witan Pacific (this operated a multi-manager funds of funds approach, which is inherently more diversified, and therefore likely to exhibit lower volatility than a more focused single country fund, but returns are similarly diversified – it was Witan Pacific’s ongoing underperformance that saw the change of mandate and investment manager).

At 2.74%, VNH has the highest ongoing charges ratio, both for the wider peer group and for the three Vietnamese-focused funds. The higher-than-average ongoing charges ratio does in part reflect its relatively-small size. However, it is notable that while VNH’s ongoing charges ratio is 84bp higher than VEIL’s, VEIL is a significantly larger fund (VEIL’s market cap is 16.2x that of VNH). Like the majority of the funds in the wider peer group, VNH does not charge a performance fee. Of its direct peers, VOF charges a performance fee, while VEIL does not.

Like many funds in the sector, VNH does not pay a yield reflecting both its capital growth focus and the underlying market in which it invests. In terms of gearing, whilst VNH is permitted to borrow, the managers have chosen not to and, instead, to maintain a modest cash balance that is sufficient to meet its ongoing cash needs. All of the Vietnam-focused funds tend to run with net cash position to some degree. VNH has the highest level of net cash within both its direct and wider peer groups. This leaves it well positioned should markets be difficult although it would likely be left behind if markets were to rally strongly.

No dividend – capital growth focused

VNH is not required to pay a dividend and has not paid one since launch.

VNH’s investment objective is to achieve long-term capital growth by focusing on high-growth companies in Vietnam that demonstrate strong awareness of ESG principles. VNH does not have a formal dividend policy and has not paid a dividend since its launch. As a Guernsey-domiciled investment company, there is no requirement to pay out a minimum of 85% of its net revenue income that would apply if it was a UK-domiciled investment trust. During the year ended 30 June 2022, VNH earned dividend income of US$1.81m (2021: US$2.39m), which is equivalent to USc5.66 per share (2021: USc5.22 per share).

The year-on-year reduction in dividend total income is in part a reflection in the contraction of VNH’s asset base that occurred as a result of the 15% tender offer that was conducted in November 2021, as well as other share repurchases. However, it is noteworthy that income per share has risen during the period, which reflects a degree of recovery as the economy has re-opened following COVID.

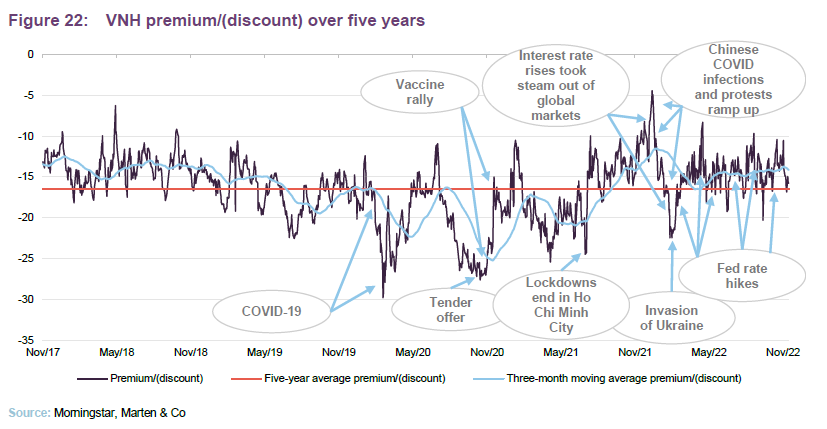

Premium/(discount)

As illustrated in Figure 22, VNH’s discount continues to exhibit the strong mean-reversion tendencies that we have discussed in previous notes. The discount appears to have exhibited higher volatility in the post pandemic period but has narrowed as the Vietnamese economy has emerged from lockdowns. However, more recently, it has also been impacted both by negative sentiment towards Asia and the wider region as markets fret about the damage being caused by China’s economic woes (largely a consequence of an ineffective vaccine, a poorly targeted vaccination programme and the strangling effects of President Xi’s zero-COVID policy. There also appears to have been some short-term widening in response to rising interest rates in the West, but this does not appear to have a sustained impact).

Discount control and tender offers

VNH has an active discount control policy.

VNH is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, as well as having an active discount control policy that seeks to address the imbalance between the supply of and demand for its ordinary shares (this process is overseen by VNH’s broker, finnCap Ltd, and is monitored by the board).

VNH has provided bi-annual tender offers for a number of years. The last was a 15% tender offer at the beginning of November 2021. The tender was taken up by most shareholders (including both VNH directors and members of VNH’s management team) and was conducted at a 2% discount to NAV. As at 13 December 2022, VNH was trading at a discount of 15.7%, which is wider than its one-year average of 14.3%, but narrower than its three- and five-year averages of 17.3% and 16.5% respectively. It is also at the wider end of its one-year trading range (4.4% to 22.5%).

Given the extent of the Vietnamese growth story and VNH’s long-term trend of outperformance of its peers and Vietnamese equity markets, we think that there is good potential for the discount to tighten from here. Potential catalysts would include signs that inflation is coming under control in the west, thereby reducing the pace of interest rate rises; signs of an improving outlook for China, particularly if it can get COVID under control and ease back significantly on the current restrictions; and signs emerging that Vietnamese companies are remaining profitable despite the current headwinds.

Fees and costs

Tiered management fee structure with no performance fee

Tiered base management fee starting at 1.75% of net assets per annum and reducing.

Dynam Capital is entitled to receive a basic management fee of:

- 75% (previously 1.50%) per annum of net assets up to US$300m;

- 50% (previously 1.25%) per annum for net asset in excess of US$300m up to US$600m; and

- 1% of net assets in excess US$600m.

The management fee is paid monthly in arrears, and the management agreement can be terminated on six months’ notice by either side. There is no performance fee element. The ongoing charges ratio for the year ended 30 June 2022 was 2.74% (2021: 2.52%). Part of the reason for the rise in the ongoing charges ratio has been the shrinkage in AUM that has resulted from the tender offer in late 2021 (VNH is spreading its fixed costs over a smaller asset base).

Fund administration and company secretarial services

Sanne Group (Guernsey) Limited is VNH’s administrator and company secretary. The administrator receives a fee of 0.08% per annum for of net assets up to US$100m and 0.07% per annum for net assets in excess of this, subject to a minimum fee of US$140k per annum. The administration fees are accrued monthly and are payable quarterly in advance. VNH has also entered into a separate accounting services agreement with the administrator. The combined administration and accounting fees were US$216.9k for the year ended 30 June 2022 (2021: US$219.3k).

Custody and audit fees

Standard Chartered Bank (Singapore) Limited and Standard Chartered Bank (Vietnam) Limited are VNH’s custodian and the sub-custodian respectively. Custodian fees are charged at 0.08% on the assets under administration (AUA) per annum, subject to a minimum of US$12,000 per annum. Safekeeping of unlisted securities is charged separately at US$12,000 per annum for up to 20 securities (2022: US$12,000). KPMG Channel Islands Limited is VNH’s auditor and audit fees were £56,000 for the year ended 30 June 2022 (2021: £52,000).

Capital structure and life

VNH follows an ungeared strategy.

VNH has a simple capital structure with one class of ordinary share in issue. It is also permitted to borrow up to 25% of its net assets, although, in practice, VNH does not have any debt facilities in place and maintains a small cash balance that is sufficient to meet its operating requirements. VNH’s ordinary shares have a premium main market listing on the LSE and, as at 13 December 2022, there were 28,789,719 of these with voting rights in issue with none held in treasury. VNH has had a listing on the Official List of The International Stock Exchange since 8 March 2019.

Unlimited life; continuation vote in 2023

VNH does not have a fixed winding-up date, but previously, it offered shareholders a continuation vote at every third AGM. However, following the major overhaul that began in September/October 2017, shareholders were asked at the 2018 AGM to approve a resolution for VNH to continue for a further five years, if the company migrated from the Cayman Islands to Guernsey. Shareholders approved the resolution and the migration of the domicile was completed in February 2019. VNH’s next continuation vote is therefore scheduled for the 2023 AGM.

Financial calendar

VNH’s year-end is 30 June. The annual results are usually released in September/October (interims in March) and its AGMs are usually held in October/November of each year.

Management team

More information on the manger can be found at its website: www.dynamcapital.com.

VNH is managed by Vietnam specialist Dynam Capital. Dynam is a partner-owned business whose sole focus is asset management in Vietnam. Its investment strategy is based on fundamental research, with a strong focus on companies that have a strong commitment to ESG principles. Vu Quang Thinh and Craig Martin (see biographies below) are both executive directors and founding partners of Dynam. The lead portfolio manager is Nguyen Hoang Thanh (see biography overleaf). He is supported by a portfolio analyst, a data analyst and a trader. Further information on Dynam Capital’s Investment process can be found on pages 9 to 11.

Vu Quang Thinh (CIO and managing director of Dynam Capital)

Vu Quang Thinh has over 30 years’ business experience, including 15 years in asset management, 12 years in corporate restructuring and seven years in an information technology business. He joined Vietnam Holding Asset Management (VNHAM) in 2011 as CEO and, he was appointed to the board of VNHAM in 2014.

Before joining VNHAM, Thinh served as chief executive officer of a local asset management company. Previously, he was managing partner of MCG Management Consulting, which he founded. Prior to this, he was head of the management consulting practice of KMPG Vietnam where he did extensive restructuring work with several state-owned enterprises.

Thinh holds an MBA from Washington State University and a BS degree in Mathematical Economics from Hanoi National Economic University. He is a Certified Asset Management Practitioner in Vietnam. As noted on page 9, he is a founding member and former chairman of the Vietnam Institute of Directors (VIOD).

Craig Martin (chairman of Dynam Capital)

Craig Martin has over 26 years’ investment and fund management experience in emerging markets. He has lived and worked in Southeast Asia since 1993. This includes seven years in Cambodia, five years in Vietnam and 13 years in Singapore.

Until early 2018, Craig was co-CEO of CapAsia, a Singapore headquartered private equity fund manager, focusing on investments in Asia’s emerging markets. He joined CapAsia in 2010, and served on the boards of companies in Thailand, Malaysia, Philippines, Vietnam, Singapore, Indonesia and Pakistan. Prior to CapAsia, Craig was head of private equity for Prudential Vietnam (now Eastspring), and he was previously part of the founding management team at Standard Chartered Private Equity.

Craig has a Masters degree in Engineering from the University of York and a MBA with Distinction from INSEAD. He is also a member of the Singapore Institute of Directors. Craig is also a non-executive director of several private companies.

Craig has a significant personal investment in VNH.

As at 13 December 2022, Craig has a personal investment in VNH of 54,686 shares, representing 0.19% of VNH’s issued share capital.

Nguyen Hoang Thanh (portfolio manager)

Nguyen Hoang Thanh has over 10 years of experience in banking and finance in Vietnam, including eight years in asset management and more than two years in banking. He started his career at LienVietPostBank, as a corporate banking officer, before joining Vietnam Holding Asset Management in 2011 as an analyst (he was promoted to manager in 2014). Thanh then spent one year at Dragon Capital as a senior banking analyst, and in late 2017, he worked at Pavo Capital as a Senior Investment Manager covering IPOs and pre-listing investment opportunities. He holds a Masters degree from Clark University, Massachusetts, and a BA in Finance from Can Tho University, Vietnam. He is also a CFA charterholder.

Board

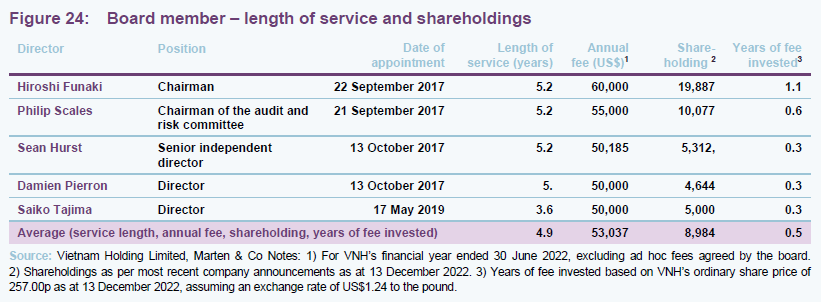

VNH has a relatively young board with an average length of service of just 3.1 years.

VNH’s board is comprised of five directors, all of whom are non-executive and considered to be independent of the investment manager. Other than VNH’s board, its directors do not have any other shared directorships. As part of the major changes that were made in September/October 2017 (see our December 2019 initiation note for more detail), VNH’s board underwent a complete refresh. As a consequence, VNH has a board with a number of members that were appointed within a short space of time of one another. Board policy is that all of VNH’s board members retire and offer themselves for re-election annually. VNH has adopted a formal policy that neither the chairman nor any other director shall serve for more than nine years. The board will therefore need to give thought to succession planning in the next few years although, with an average length of service of 4.9 years, this is not a pressing issue.

Director’s fees

VNH’s articles of incorporation limit the aggregate directors’ fees to a maximum of US$350k per annum. With the exception of Sean Hurst’s fee, which actually fell from US$55,829 to US$55,185, the level of base fees for all of the directors remained unchanged between the years ended 30 June 2021 and 2022. The total directors’ fees for the year ended 30 June 2022 was US$270,185; which is well within the US$350k limit.

Recent share purchase and disposal activity by directors

None of the directors have made any purchases or sales of shares during the last 12 months. Most recently, Hiroshi Funaki added 6,000 shares to his holding in October 2021; Philip Scales added 3,350 shares to his holding in October 2021; and Sean Hurst added 3,300 shares to his holding in October 2021. As discussed in our December 2021 note (see page 20 of that note), Hiroshi Funaki, Philip Scales, Sean Hurst and Damien Pierron all participated in the December 2021 tender offer. For those purchasing shares in October 2021, these largely replaced the shares previously tendered.

Hiroshi Funaki (chairman)

Hiroshi Funaki has been actively involved in raising, researching and trading Vietnam funds for 23 years. Previously, he worked at Edmond de Rothschild Securities (between 2000 and 2015) where he led the Investment Companies team, focusing on Emerging Markets and Alternative Assets. Prior to that, he was head of research at Robert Fleming Securities, also specialising in closed-end funds. He currently acts as a consultant to a number of emerging market investors.

Hiroshi has a BA in Mathematics and Philosophy from Oxford University, and is a UK resident. He became chairman at the conclusion of VNH’s AGM on 8 November 2019, taking over the position from Sean Hurst.

Philips Scales (chairman of the audit and risk committee)

Philip Scales has over 40 years’ experience working in offshore corporate, trust, and third-party administration. For 18 years, he was managing director of Barings Isle of Man (subsequently to become Northern Trust), where he specialised in establishing offshore fund structures, latterly in the closed-ended arena (both listed and unlisted entities). He subsequently co-founded IOMA Fund and Investment Management Limited (now named FIM Capital Limited), where he is deputy chairman. Philip is a Fellow of the Institute of Chartered Secretaries and Administrators, and holds a number of directorships of listed companies and collective investment schemes. He is an Isle of Man resident.

Sean Hurst (senior independent director)

Sean Hurst was co-founder, director and chief investment officer of Albion Asset Management, a French regulated asset management company, from 2005–2009. He is an experienced multi-jurisdictional director, including roles at Main Market and AIM traded funds and numerous offshore and UCITS funds. In addition to advising companies on launching both offshore and onshore investment funds, he is currently non-executive chairman of JPEL Private Equity Ltd and a non-executive director at CIAM Opportunities Fund and Satellite Event Driven UCITS Fund. Sean was formerly a non-executive director of AIM listed ARC Capital Holdings Ltd. He holds an MBA in Finance from CASS Business School and is a resident of France.

Damien Pierron (director)

Damien Pierron is currently managing director at Société Générale in Dubai, where he heads the coverage for Family Offices and Wealthy Families in Middle East and Russia. He has 15 years’ experience in M&A, private equity, equity derivatives, wealth management and investment banking gained at, among others, Lafarge Holcim, OC&C Strategy Consultants and Natixis. Damien is a CFA charterholder and holds a Degree in Mathematics, Physics and Economy from École Polytechnique in Paris. He also holds a Masters Degree in Quantitative Innovation from École Nationale Superieure des Mines de Paris. He is a Dubai resident.

Saiko Tajima (director)

Saiko Tajima has over 20 years’ experience in finance, including eight years spent in Asian real estate asset management and structured finance. She has worked for Aozora Bank and group companies of both Lehman Brothers and Capmark, where she focused on financial analysis, monitoring and reporting to lenders, borrowers, auditors, regulators and rating agencies. Over the last five years, she has invested in and helped develop tech start-ups in Tokyo, Seoul and Sydney.

Previous publications

Readers interested in further information about VNH may wish to read our previous notes (details are provided in Figure 25 below). You can read the notes by clicking on them in Figure 25 or by visiting our website.

Figure 25: QuotedData’s previously published notes on VNH

Source: Marten & Co

Legal

This marketing communication has been prepared for Vietnam Holding Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.