We have previously espoused the notion that the widespread discounts in the unlisted investment trust sectors are often unjustified. It is certainly true that many viable investment strategies are trading on ever wider discounts, if not their historically widest levels, with investors for example selling down their holdings out of fear of valuations cuts, or operational disruptions. While we, as a team, believe that many of these strategies have been hard done by the wider investment community, I will use this article to examine the possibility that maybe there are some fires out there to accompany all this smoke.

More than simply trying to provide some balance to QuotedData’s rhetoric, my thinking has also been spurred on by the loss of two investment companies: Civitas Social Housing (CSH) and Blackstone Loan Financing (BGLF), both of which hold unlisted investments. The board of CSH has accepted a buyout offer from a Hong-Kong based investment group, at a premium to its current market cap but still at substantial discount to its reported NAV; while BGLF has elected to initiate a managed wind-up of the trust, highlighting the shift in the investment environment for bond strategies. In both cases the boards have chosen to hang up their boots and try their best to return value to shareholders via closing their fund, rather than continue to operate at ever widening discounts. Given that these boards have accepted the new reality that the increasingly difficult current market environment presents – primarily due to the dramatic rise in global interest rates – maybe the discounts on other trusts are also justified.

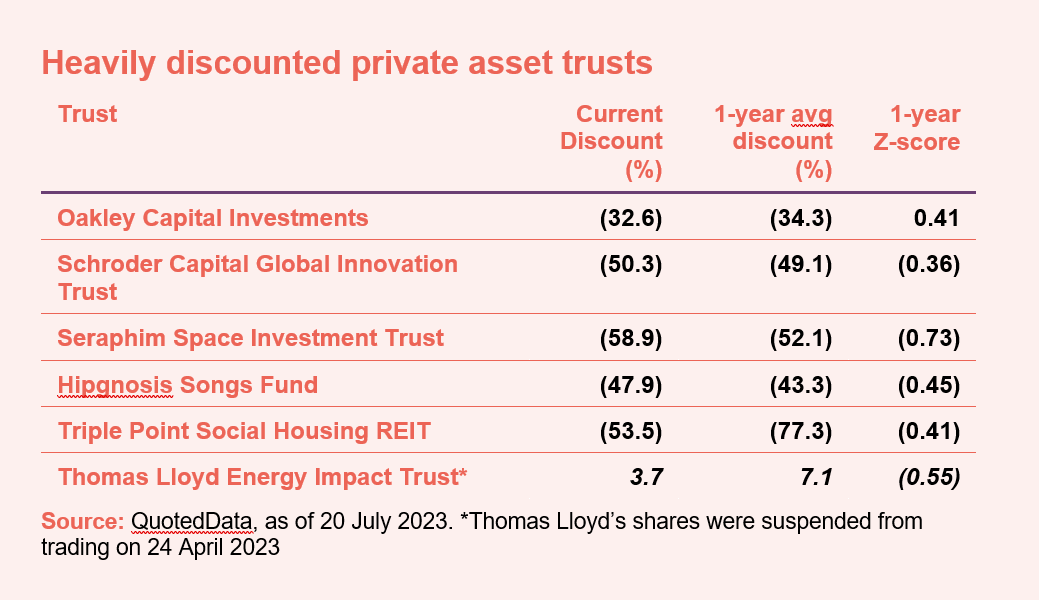

While almost every private-asset strategy could be discussed in this article, I have elected to look at a handful of trusts, most of which are trading at a discount close to or greater than 50%, to help illustrate my thesis.

Hipgnosis

My colleague, James Carthew, has covered the issues surrounding Hipgnosis (SONG) in some detail in a recent article (just following the release of its annual results). However, given that there is a possible ‘fire’ here, it is worth examining the smoke signals.

The perennial issue in my mind, other than the static discount rate that it has been using to value its future cash flows (the same today as it was pre-2021, despite the jump in interest rates), is that SONG’s share price discount to NAV may be more than an example of market aversion to NAV uncertainty. It may, in fact, be a reflection of SONG’s overexuberance during the easy/cheap money years.

Having launched during the heyday of rock-bottom interest rates and gung-ho valuations, SONG’s discount could reflect a lack of valuation discipline when the portfolio was being assembled. Many investors have called for sales of assets to prove the NAV and fund buybacks. However, the trust may simply not have the ability to sell its song royalties at the same price it paid for them which would have the knock-on effect of making its already high debt levels more unsustainable. This sits alongside its static discount rate and disappointing cash generation as a reason to be fearful of a smouldering fire.

Home REIT

The raging inferno in the sector is Home REIT. On the face of it, its shares are on about a 70% discount, but we have no idea what the true NAV is. The trust’s shares have now been suspended for almost seven months. The results of an internal investigation launched by the board into the wrongdoing alleged by short-seller Viceroy Research were published at the end of May and catalogued a litany of failings. These include what look like attempts to pretend that rent was being paid on time and from sustainable sources when it was not. Evidence that some properties were unfit for habitation, allegations that not all tenants were homeless, an ongoing investigation by the National Crime Agency, a collapse in rent collection, and a legal case against the company by a group of shareholders make it one of the worst examples of governance failure within our sector.

ThomasLloyd Energy Impact

The idea of the current share price discounts reflecting manager hubris is not only evident in SONG. Strategies like ThomasLloyd Energy Impact (TLEI) and Triple Point Social Housing REIT (SOHO) are already reeling from the earlier decisions of their managers. In the case of TLEI, its managers bit off more than they could chew when attempting to construct a solar plant in India. Rising construction costs mean that it is now no longer commercially viable, as we discussed previously, placing TLEI on the hook for a multi-million loss, leading to the suspension of its shares, and a possible windup of the company.

Triple Point Social Housing REIT

SOHO is not at the same critical juncture as TLEI, it is nonetheless feeling the heat from the increased scrutiny being placed on social housing strategies. This has not been helped by the debacle of Home REIT.

SOHO has been hit by concerns around the governance and viability of some of its tenants. For example, in April 2023, Auckland Home Solutions (which accounts for 4.6% of the group’s portfolio) faced question marks about its governance standards, even questions about whether all of its properties qualified as specialist supported housing. It had failed to pay c.£40,000 in rent at 31 March 2023.

However, SOHO had bigger rent arrears problems with two other tenants – Parasol Homes and My Space, and when it last commented in May 2023, SOHO was busy trying to reassign properties to other registered providers.

Private equity and growth capital

Even in the private equity and growth capital sectors, which we have long highlighted have been oversold, there likely remains justifiable concerns around the valuations of some of these vehicles.

Consider Schroder Capital Global Innovation (INOV), previously Schroder UK Public Private and before that Woodford Patient Capital, which trades on a 50% discount, for example. Its most recent results showed that its unlisted investments (which make up about 57% of its portfolio) fell in value by 8.6% on average, while its listed equities fell by 31.7%.

There is a reasonable question as to why did INOV’s unlisted portfolio remain relatively unscathed, these are the same sorts of businesses after all. In addition, the most commonly adopted valuation method for private equity is to use listed comparables as an indicator of value.

INOV is the unfortunate inheritor of Neil Woodford’s ill-fated venture into private equity, and it appears that despite Schroders’ past successes in private equity, they have been unable to replicate the same success as peers, despite having three years to do so. It seems that the legacy assets are a millstone on the trust.

We could also add that there are many examples of good companies investing in growth areas that have been consumed by the smoke that the INOV fire is emitting. Take Oakley Capital Investments (OCI) for example, which was the best-performing private equity fund by some distance last year yet trades on a 33% discount. Yes, it also has a focus on growth stocks and sectors such as technology and consumer that have been hit by rising interest rates, but its track record suggests that the quality of its portfolio is far superior.

Seraphim Space

Then there are even more exotic trusts, such as Seraphim Space Investment Trust (SSIT), where there is a lack of publicly-traded companies to base its valuations on, likely amplifying the uncertainty around its valuations.

Understandably, SSIT’s wide discount reflects the little-understood cutting-edge technology and opaqueness of the business models of its investments. Given the sell-off of optically similar listed ‘growth’ funds, investors may have used the only comparable investment style that they have available to them when assessing the validity of its unlisted valuations.

However, SSIT’s most recent update, published on 13 July, tells a very different story, with the values of six of its companies moving higher thanks to recent investment rounds. The board of SSIT is confident in the fund’s attractions, having recently announced a share buyback programme. Investors are making the leap of faith as evidenced by its recent share price recovery. Investors may be right to be cautious but there are bargains out there.

While I have proposed several examples that may vindicate these discounts, I believe that should not be the key takeaway from my article.

I believe that the apprehension investors may have in the current environment, one defined by higher costs of capital and slowing growth, is not entirely unjustified. However, individual fires seem to be unfairly engulfing the entire sector in smoke and preventing investors from seeing the genuine opportunities.

The issues these investment companies are facing are not entirely due to sector-wide factors, but rather a reflection of a more difficult market shaking out the weaker trusts.

These kinds of environments are often prime hunting grounds for informed, courageous investors who can capitalise on the possibility of powerful share price returns. If you can peer through the smoke, there may be more fire-resistant opportunities within the private asset sectors than you would think.