JPMorgan UK Smaller Companies (JMI) has published its annual results for the year ended 31 July 2023, during which it provided an NAV total return of -5.0% and a share price total return of -4.4%, which compare to a return on its benchmark, the Numis Smaller Companies plus AIM Index (excluding investment companies), of -4.6%. While JMI’s NAV return was modestly behind its benchmark, it was ahead of the peer group average. JMI’s chairman, Andrew Impey, comments that this is the second financial year in a row that UK smaller companies faced a challenging environment. Despite recovering quickly from the October 2022 lows, induced by the policies of the short lived Truss premiership, market conditions did not improve. Stubbornly high UK inflation, stoked by high energy and food prices, led to rapid interest rate rises not seen in a generation and subsequently dwindling consumer confidence and house prices. These factors weighed heavily on UK markets and, in particular, the more domestically facing smaller companies whose already relatively cheap valuations became even more attractive.

Revenue income and dividends

Net revenue increased strongly for the second year in a row, growing by 9.1%, which partly reflected a continued post-COVID-19 recovery but also the strong financial position of the businesses in the portfolio. JMI’s board is recommending a final dividend of 7.7p (2022: 6.9p) per share, an increase of 11.6%.

Ongoing charges

JMI says that costs have increased in general with inflation and there have been some specific items, such as the auditor’s fees, which have been driven up by changes in regulation. These pressures have coincided with decreasing asset values resulting in an increase in the ongoing charge ratio from 0.99% to 1.02%. The board says that it is acutely aware of the increase and has focused on containing costs as far as is possible. This is reflected in a reduction in other administrative expenses and, since the year end, and effective from 1st August 2023, the board has negotiated a reduction in the management fee. The reduced rate is 0.65% on net assets up to £300 million and 0.55% thereafter. If applied in the year under review, this would have reduced the OCR by approximately 0.1%.

Gearing

On 29th September 2023, JMI’s £50m borrowing facility expired and was renewed with Scotiabank for a period of 364 days. The cost of debt of the facility has increased with rising interest rates though, after reviewing various options, the board believes that the terms agreed remain competitive. At the year-end, £27m (2022: £25m) was drawn on the loan facility with the gearing level of 9.5% (2022: 5.8%) of net assets. As at 9th October 2023, gearing was 10.2%.

Manager’s comments on performance and market background

“The financial year to July 2023 was a turbulent one. The atrocious war in Ukraine raged on and geopolitical uncertainties increased. Both the US and the UK avoided recession, surprising many economists, although the threat of a mild recession in both regions has not completely dissipated. Inflation in developed markets peaked, but the UK became an outlier, with stubbornly higher inflation than in Europe or the US. Interest rates rose at an astonishingly rapid pace and the Bank of England has now raised rates fourteen times from the absolute low in December 2021 to 5.25%. Markets are now pricing in peak rates of 5.5-6%, which is notably higher than forecasts one year ago. Political stability was re-established in the UK under Prime Minister Rishi Sunak. However, public sector strike action grew in response to the stark cost of living increase over the year, although the more recent decline in energy prices and the increase in nominal wages should provide some relief, as should the very low rate of unemployment.

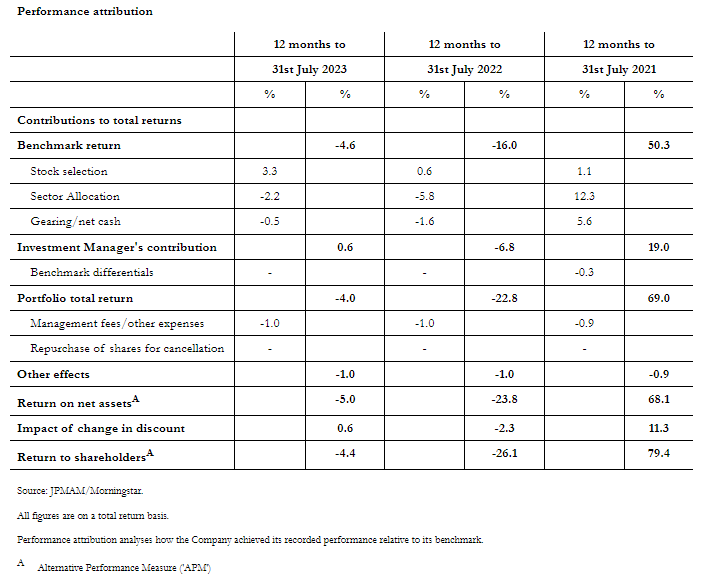

“Against this backdrop, the Numis Smaller Companies plus AIM (ex Investment Trusts) Index was down 4.6% for the financial year. The Company produced a total return on net asset value of -5.0% in the period, while the share price total return was marginally ahead of the index at -4.4%. As can be seen in the attribution table below, once again, stock selection contributed positively to performance during the year under review. The main detractor was an unfavourable sector bias in the portfolio. Gearing was also a small negative during the year.”

Manager’s comments on the portfolio

“The three largest positive contributors to performance over the year were our sizeable positions in Bank of Georgia (one of the two dominant banks in the flourishing economy of Georgia), Ashtead Technology (sub-sea rental equipment into the oil and gas and renewables markets) and Alpha Group International (formerly named Alpha FX, a provider of FX management to corporates and alternative banking solutions to financial institutions). All three continued to grow significantly and produce strong results ahead of market expectations. In addition, two of our smaller positions in Warpaint London (affordable cosmetics) and Niox (a company focused on improving asthma diagnosis and management) produced outsized returns in the year.

“On the negative side, the main detractors included Serica Energy, the North Sea gas producer, following the Government’s extra tax levy on North Sea oil and gas producers and OSB, the buy-to-let bank which, despite strong current trading, disappointed the stockmarket with a negative update on the impact of higher term revisionary mortgage rates on short term profitability. Not owning Aston Martin also hurt performance on a relative basis. Two other disappointments were Jadestone Energy and TP ICAP, both of which were sold.

“The portfolio continued to evolve as we adapted to the changes in the economic environment. New additions included XPS Pensions following significant positive changes to pension fund dynamics and Vertu Motors on improved trading and lowly valuation. We also bought a small position in hVIVO, the world leader in the small but growing market of testing infectious disease vaccines via human trials, and in Mitchells & Butler, the bar and pub company, as the consumer outlook improved and inflationary pressures began to ease. Over the year we also sold out of certain holdings including Wincantion and FRP Advisory on concerns over current trading, and Liontrust Asset Management on the proposed deal to buy GAM.

Manager’s comments on outlook

“The trajectory of inflation and interest rates are clearly key for the outlook. While we had expected a mild recession in the UK in the second half of 2023, the economy looks likely to avoid this – but UK growth prospects are pedestrian at best. Following the encouraging inflation figures over the summer we believe inflation has peaked in the UK, and we foresee a significant further decline from the current levels over the course of 2023, which will hopefully bring the UK more in line with other developed markets. Interest rates at 5.25% have risen significantly and we believe are close to peak levels. Consumer confidence has staged a significant recovery from its abject lows – largely we believe due to continuing very low unemployment rates and the wage increases that have been seen this year – although the recent spike in mortgage rates caused a setback in what had been an upward trend.

“Clearly the stockmarket is currently extremely focused on the macro economic outlook. In this regard, the very recent historic revisions to GDP by the ONS are a notable positive, demonstrating that the growth of the UK economy post the pandemic has not been out of line with that of Europe. However, as always our focus is on the companies themselves. Overall the message we are hearing from them is a positive one. The majority of smaller companies are successfully navigating their way through the headwinds of cost inflation, labour inflation, labour shortages and higher interest costs. We continue to find exciting and undervalued (and often fairly unknown) investment opportunities, some of which we have outlined above.

“History tells us that stockmarkets rally when investors believe that interest rates are close to peak levels – and this has especially been the case for the UK smaller companies sector. When this occurs, we believe the upside from current lowly valuation levels could be substantial. In addition, investors will be aware there is a significant focus by the Government on the future of the UK equity market, and a strong desire to improve its allure. Although not an instant fix, the change to pension investing proposed by the Mansion House reforms this summer, with DC pension providers being strongly encouraged to invest at least 5% of their funds in unlisted assets, should also be beneficial for small cap companies. This is because stocks on the AIM market are included in the definition of ‘unlisted’. Additionally, M&A continues apace, and post year end we have received a bid for our holding in Ergomed.

“The current gearing level of just under 10% in the portfolio, compared to 7.3% as at 12th October 2022, reflects our view of the compelling opportunities and valuations currently available.”