Five countries dominate the MSCI AC Asia Pacific ex Japan Index – China, Australia, India, Taiwan, and South Korea – collectively, accounting for over 85% of the market cap of that index. However, most of investors’ focus seems to be on China and India, Australia is usually regarded as a resource play, Taiwan’s market is usually represented in portfolios by Taiwan Semiconductor (the largest stock in the index). It is a similar story in South Korea, where Samsung Electronics dominates (accounting for over 30% of the MSCI Korea Index). Korea’s other listed companies attract less attention, and that may be one of the reasons why they are relatively cheap. On a forward price/earnings basis, MSCI Korea is trading on a modest discount to the MSCI Emerging Markets Index, but on a price/book basis, the discount is quite pronounced (1.0x to MSCI EM’s 1.6x as at end September 2023).

There are ways of accessing Korean companies even more cheaply. Preference shares form part of the equity capital of many South Korean companies. There is a difference between preference shares as we generally understand them in the UK (where the preference shares usually rank ahead of ordinary shares in their claim to dividends and capital) and preference shares in Korea where they generally rank alongside the common shares (ordinary shares) issued by Korean companies and are entitled to receive the same dividends as the common shares but tend to have no voting rights.

Korean preference shares often trade at a substantial discount to equivalent common shares. Consequently, an investment in preference shares may offer access to South Korean companies at price/earnings and price/book ratios that are typically lower, and dividend yields that are typically higher than an investment in their common shares.

But, apart from the valuation opportunity, why would you want exposure to South Korea? Well in GDP terms it ranks 13th globally, not that many rungs down from the UK. It is well known for its record of technological and industrial innovation and has some of the leading players in sectors such as electronics, batteries, automobiles, ship building and steel. This is underpinned by heavy investment in research and development. It can also boast a burgeoning entertainment industry, with Oscar-winning Korean films and the K-pop phenomenon.

There are two structural issues that weigh on the stock market. First is an official reluctance to relax foreign exchange controls completely. This is the principal reason why, despite the relative wealth of its citizens, South Korea is still categorised as an emerging rather than a developed market by MSCI, which is problematic as that deters many investors. MSCI considered whether to upgrade Korea’s status earlier this year and opted not to make the move yet. It wants to monitor the effects of reforms that the government enacted designed to improve access to the Korean market.

Second, is a record of poor corporate governance, which stems in part from the historic dominance of family-controlled chaebols – led by Samsung, SK and Hyundai. Many Korean companies have inefficient, over-capitalised balance sheets (hence the low price/book ratio), low dividend pay-out ratios and cross-shareholdings (which tend to be valued at book rather than market value).

Improved corporate governance would help positively re-rate the Korean market and narrow its valuation discount versus other global markets. The government has been making positive changes. A Stewardship Code was introduced at the end of 2016, and this has been the foundation for reforms, with new measures still being introduced that strengthen the rights of minority shareholders. Some companies are taking action – higher dividend pay-out ratios are evidence of this – which is particularly beneficial for income investors holding discounted preference shares.

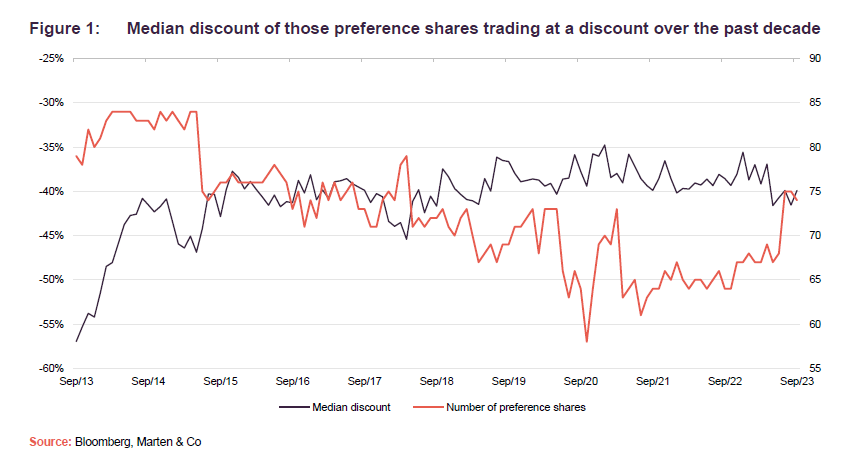

For those that can access the Korean preference share market, we have identified 123 preference share issues. Of those, at the end of September 2023, 74 preference shares were trading at a discount to the price of the equivalent common shares. The median of those discounted preference shares was trading at a 40% discount.

As you can see from Figure 1, the number of preference shares trading at a discount had been falling but has picked up again in recent weak markets. The median discount number has not changed much for some years. Individual issuers seem content to retain the common share/preference share structure of their equity base – and why not, if they can issue preference shares and thereby get cheaper funding? There is some discount volatility, however, and so an active approach to investing in Korean preference shares can add value.

For example, Samsung Electronic’s preference share issue – which is the largest and most liquid – was trading on a sub 9% discount at the start of the year and that had widened to over 20% by end September. The price of the common shares was up about 24% over that period, but the price of the preference shares was only up by about 8%. The yield on the preference shares is higher – about 2.6% to the common share’s 2.1% – but this is not enough to compensate for the discount widening.

By contrast, the discount on LG Chem’s preference share issue narrowed from about 54% to about 37%. The preference shares rose in value by about 12% while the common shares fell in value by about 17%. As the preference share yield is about 3.2% to the common share’s 2.0%, they were definitely the right part of the capital structure to be holding.