The real estate sector got a boost from the lower-than-expected UK inflation figure that was released on Wednesday, which followed a similarly positive update on inflation in the US.

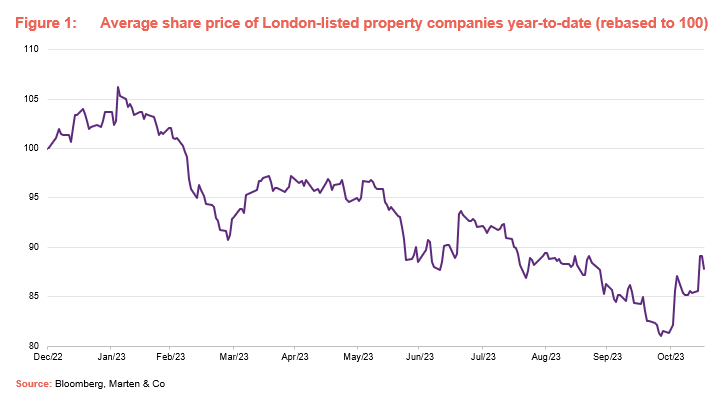

The share prices of the London listed property stocks that we track (67 companies in total) were up 2.6% this week on average. November has been a good month for property, after the Bank of England held interest rates at the start of the month (for a second consecutive time), with an average uplift of 7.5% in the month so far.

Interest rates seem to have peaked, and the bond market reacted in a similarly positive way to the news with five-year swaps falling to 4%. With REITs still looking particularly cheap, is now the right time to be buying or is it a false dawn?

Price discovery

Headline inflation in the UK dropped sharply in October to 4.6% from 6.7% in September. This was below the forecast of 4.8% the Bank of England provided earlier this month when it decided to hold its rates. US headline inflation fell to 3.2% from 3.7%, which was also below market expectations, and with the eurozone also reporting falling inflation, investors are becoming more confident that inflation is on its way down towards the 2% target and that further rates hikes are no longer necessary.

However, core inflation (which excludes volatile energy, food, alcohol and tobacco) remains elevated in the UK at 5.6%, down from 6.1% in September. Wage growth also remains high in the UK, which could undo the effects of higher interest rates on inflation and mean higher rates for longer.

The performance of real estate is intrinsically linked with interest rates – higher interest rates mean higher property investment yields and lower capital values, and vice versa. Now that interest rates have seemingly peaked, a period of price discovery should ensue when assets start trading again.

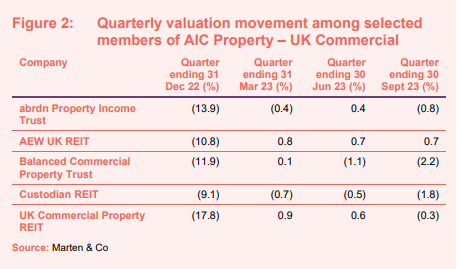

Values across real estate sub-sectors have fallen hugely over the last 12 months – as the snapshot of companies in the AIC Property – UK Commercial peer group in Figure 2 shows.

Unlike in previous cycles, valuers in the UK took a more stringent mark-to-market approach and cut values by an average 11.9% in the final quarter of 2022 – instead of a drawn-out and painful decline (as was the case after the GFC).

Despite this, the sector is still trading on large discounts to net asset value (NAV) – the average discount to NAV in the Property – UK Commercial peer group is 23.9%.

With values already adjusted for higher interest rates and the peak rate rhetoric growing, the sector does look attractive.

Leasing markets strong

Focus will now shift to leasing trends and earnings growth. As we have mentioned previously, occupational markets have remained pretty healthy with most sub-sectors coming off record low vacancy rates. The low level of supply of property has acted as a cushion for low levels of take-up and has meant rents have still been rising.

This is especially so in the logistics sector. Urban Logistics REIT (SHED) has seen a 12.1% uplift in net rental income in the 12-months to 30 September, for example. While sector-wide vacancy rates have expanded to 4.6% from a low of 2.9% last year, historically, a vacancy rate of 8% has translated into static rents but anything below triggers rental growth, according to CBRE.

SHED’s earnings per share grew 2.4% in the six months to 30 September and is expected to grow further on the back of its active asset management approach. It was trading at a 28% discount to NAV yesterday (16 November) with a dividend yield of 6.5%.

Chink of light for offices

Investor sentiment towards the office sub-sector has been as low as it has ever been, as it has come under pressure from all sides, including new hybrid working patterns.

However, the latest JLL research shows occupiers continue to commit to new offices in central London with around 3.4m sq ft of space subject to negotiation across the market, up 24% on the 10-year average.

London office developer Great Portland Estates (GPE) was buoyant in half-year results, despite posting a 10.3% drop in the value of its portfolio (driven by yield expansion). It has upgraded its rental growth guidance for prime offices to between 3% and 8%.

Its confidence is coming from the occupancy market, which it says is “increasingly demanding the very best, sustainable spaces, and discounting the rest”. Therefore, businesses are “competing in a market increasingly starved of new, Grade A supply, putting further upward pressure on prime rents”.

It concluded 37 leasing deals in the six months to the end of September at an average 13.4% above the estimated rental value (ERV). This contributed to rent roll increasing 4.2%.

The company develops and owns some of the very best offices in London – predominantly in the West End. It has committed £392m in a substantial capex programme that will deliver more offices that the market demands and is looking to recycle more capital into buying development opportunities – exploiting the subdued investment market.

All eyes on the Bank

Peak interest rates seem to have been reached, investor sentiment towards real estate should improve and a much-needed re-rating follow. All eyes will be on the Bank of England’s rates decision on the 14 December and the November inflation figures, which will be released on 20 December, to see if the positivity continues.

Thank You, for the article.