An early Christmas present

We hope that all of our readers are getting into the festive spirit, and to help with that the gracious team at JPMorgan has given us an early Christmas present. For those who are not yet aware, JPMorgan Asset Management (JPM), which runs numerous investment trusts such as JPMorgan Japan (JFJ) and JPMorgan Multi Asset Growth & Income (MATE), regularly publishes two lexicons of investment outlooks and data. Specifically, their periodic Investment Outlook and their Guide to the Market.

MATE’s team is part of the committee that helps formulate the Investment Outlook, and the strategic asset allocation which results from this is directly used to construct MATE’s portfolio. We are due to publish an update note on MATE in the near future – so keep an eye out for that.

The content of the Investment Outlook is as you might expect, providing clarity around the direction they believe the UK (and global) markets will move in the coming months and years. The Guide to the Market is their tome of financial data, one which is regularly updated and is a well-used tool of this author. The purpose of this article is to succinctly present some of the key points of JPM’s outlook for 2024 and hopefully help readers ready their portfolios for the new year.

Politics of the day

Politics will be arguably the single biggest issue in 2024, as not only does the UK need to call a general election before the end of the year, but the US is also scheduled to vote on its next president on 5 November 2024. The political reverberations could be huge for both countries. The US could see a replay of Trump vs Biden, which would not only mark two political extremes vying for leadership, but it would also be the first presidential rematch since 1956. The UK on the other hand may finally see the first non-Tory government for thirteen years.

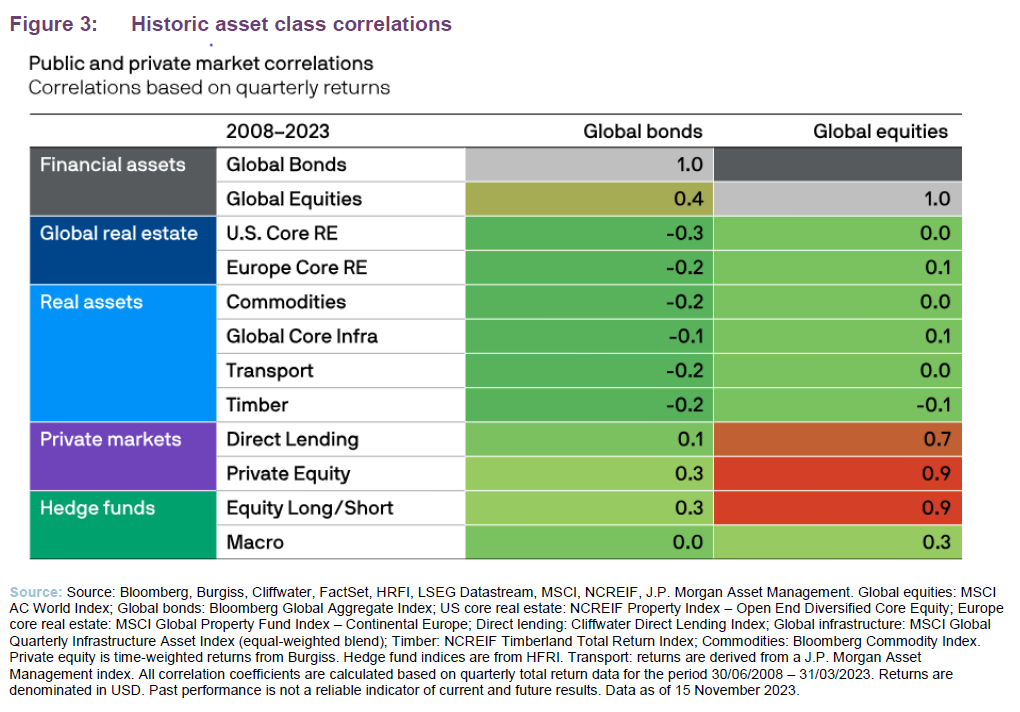

However, JPM appears sanguine in the face of these potentially huge political reverberations, pointing out that predicting the outcome of elections is incredibly challenging, highlighting the failings of polling data. They also note that few campaign promises actually make it to law. For example, in the case of the last three US elections, the successful candidates made a combined 700 campaign promises. But so far less than half of these have made it into law according to data from Politifact, in large part due to Congressional opposition. Most importantly, there has been no clear correlation between the political leanings of the ruling party and market performance, as can be seen in Figure 1, with market specific factors trumping political.

Market outlook – Cash is no longer king?

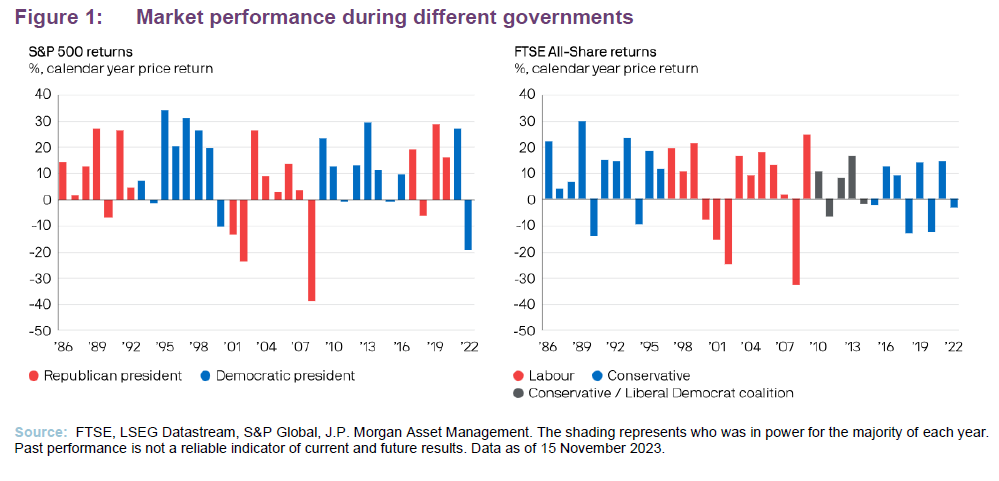

JPM note that today’s high returns on cash deposits are likely to disappear as we get closer to a recession. JPM’s base case for the global economy is a mild recession, with consumer spending running out of steam, businesses pulling back on investment and weakening labour markets leading to a mild recession that helps to bring inflation back towards target. In such a scenario, cash returns will fall, reflecting the decline in interest rates as central banks adopt less restrictive policies. Whereas it will only be a moderate downside for stocks, it will be positive for bonds (on the back of falling interest rates).

However, the markets are, in JPM’s view, currently pricing in a ‘soft landing’, whereby growth remains close to, or modestly below, trend across developed markets, while inflation falls back towards 2% and interest rates are gradually lowered to a neutral level without substantial cuts. Such an environment would keep to the current trend, with asset prices range bound, but cash materially underperforming. The only scenario in which cash could outperform is in the dreaded event of stagflation, with sticky inflation forcing interest rates to remain high, and the global economy heading into a deeper recession. However, given the views of the markets and JPM, indications are that such a scenario is unlikely, and investors will likely need to look to be more proactive with their savings.

Equities – Quality pickings

JPM‘s highest conviction view across equity markets is to focus on higher quality stocks, which they deem as those with “robust balance sheets, proven management teams and a stronger ability to defend margins”. Beyond this, their conviction is broad based, effectively taking a balanced approach between growth and value styles, and identifying opportunities in a range of sectors, from tech to financials.

European investors may finally have their day in the sun, as JPM believes that European stock valuations look reasonable in absolute terms but compelling relative to the US, with a 30% discount to the S&P 500 (equivalent to levels last seen in the aftermath of the financial crisis) and felt across many sectors. For the US to deliver another year of performance it will again need to rely on the “super 7” largest stocks to deliver. However, earnings expectations of these companies have ballooned over 2023, with the market expecting a c.30% earnings increase over the next 12 months relative to the 10% of the wider S&P 500, making the bar of expectations for US equities exceptionally high to pass.

At home in the UK JPM note that the UK equity market is unfortunately unlikely to see a major re-rating, likely persisting at its cheap valuations. However, they do note the attractiveness of the UK’s defensive characteristics, whereby the FTSE 100 has the highest dividend yield of any developed market and UK stocks offer a relatively low beta to global stocks. The large presence of the energy sector “could prove a useful diversifier if higher oil prices challenge the disinflation narrative”.

In relation to JPM’s market views we outlined previously, a soft landing will likely be beneficial to more cyclical regions such as Europe and emerging markets, while in the event of a deeper downturn, the more defensive characteristics of the UK market may come to the fore. However, given the split between the market’s projections and JPM’s, they recommend that “a regionally diversified approach appears prudent”.

Bonds – Buy while the going is good

JPM views the current market as an opportunity to lock in yields and compelling prices, despite their heightened volatility, as JPM is becoming more confident that both short and long-term interest rates have peaked. Like equities, JPM favour high-quality bond issuers, with an element of selection being required.

In the US and UK JPM believes that the market core bonds offer not only attractive income levels for investors but also potential capital gains in a recessionary scenario. However, we will have to wait and see which direction yields go in the coming months. For if economies remain resilient, and/or inflation is not showing signs of returning to 2%, then the rate cuts that are currently priced into the US and UK bonds will have to be removed, which could put upward pressure on yields. Though if the economy underperforms expect even larger cuts (and lower yields) being priced in. JPM note that a 2% decline in the US 10-year Treasury yield over the next 12 months would result in a total return of 21%.

In Europe JPM feels that fiscal expansion is still a real possibility, and given that the spread between higher and lower quality sovereign debt is low (the 10-year bond yield spread between Italy and Germany is below 200bps) they favour higher quality European issuers.

For corporate issuers, JPM feels that the greatest risk will be in the higher yield market, as they will face much greater pain when it comes to refinancing debt. While more investment grade debt is expected to be refinanced in 2024, the gap between the current nominal repayments and the market yield is higher for high yield debt, meaning more pain will be felt when refinancing.

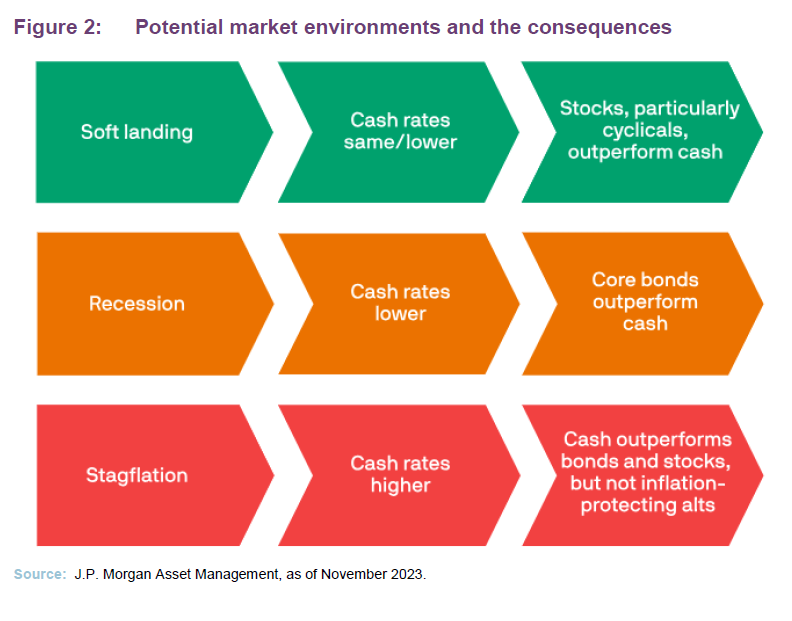

Alternatives – A sharper tool for the kit

Alternatives are looking ever more useful within portfolios, not simply because close ended alternative strategies are trading on wide discounts, but because the historical diversification benefits of combining stocks and bonds have begun to break down. Investors will, therefore, need to look to alternatives when creating their portfolios. JPM is predicting that while stock-bond correlation will return to being negative next year, it will be less reliable due to higher inflation volatility, which itself will be the result of increasingly volatile energy and food prices. Alternative assets will retain their historic diversification benefits however, which should act as a tailwind behind the various asset classes the make up the sector. This may end up being a particularly important tailwind for many unlisted investment trusts, as their closed ended structure may be the only way UK investors can directly invest into certain alternative asset classes.