The start of a new year often brings optimism and that was certainly the case in the real estate sector as inflation around the world continued its downward trajectory, raising the prospect of interest rate cuts this year.

That optimism, which had seen share prices among the UK listed property companies jump 15.5% over the final two months of 2023, was curtailed this week with the shock announcement that inflation went up in December to 4.0%.

This is likely to push the timing of any interest rate cuts back, bringing with it a return of investor caution on real estate stocks. Much of the sector has given back the gains from the end of last year with bellwethers SEGRO, Land Securities and British Land all down more than 5% this week alone.

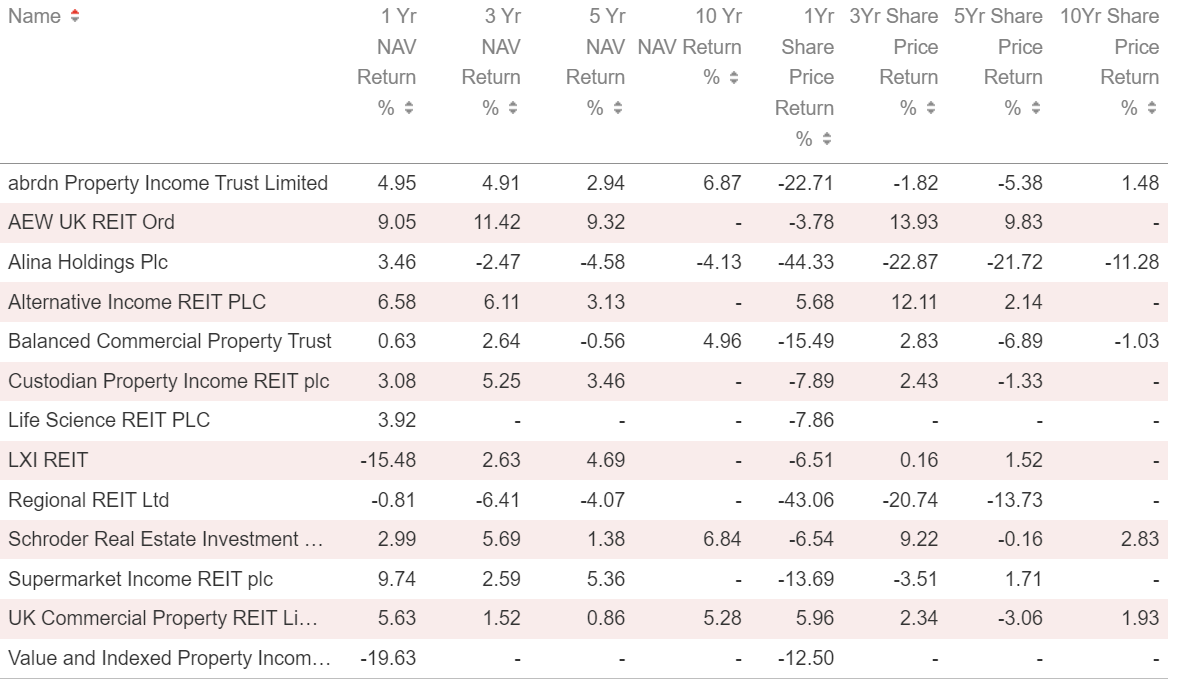

Values have stabilised in most sub-sectors (as shown in the table below in the one-year NAV returns of the constituents of the AIC’s Property – UK Commercial peer group), and after 18 months of share price pain for REITs this still feels like a good entry point.

Take the recent merger and acquisition (M&A) activity as an example. Last week LondonMetric (LMP) and LXi REIT (LXI) announced a recommended merger, while this week it was the turn of Custodian Property Income REIT (CREI) and abrdn Property Income Trust (API) to declare their potential coming together.

In the case of LMP and LXI, the deal valued LXI at £1.9bn – a 9% premium to its share price (13% premium to its one-month average share price). This implies that LMP sees significant value in LXI’s portfolio that the market was not pricing in.

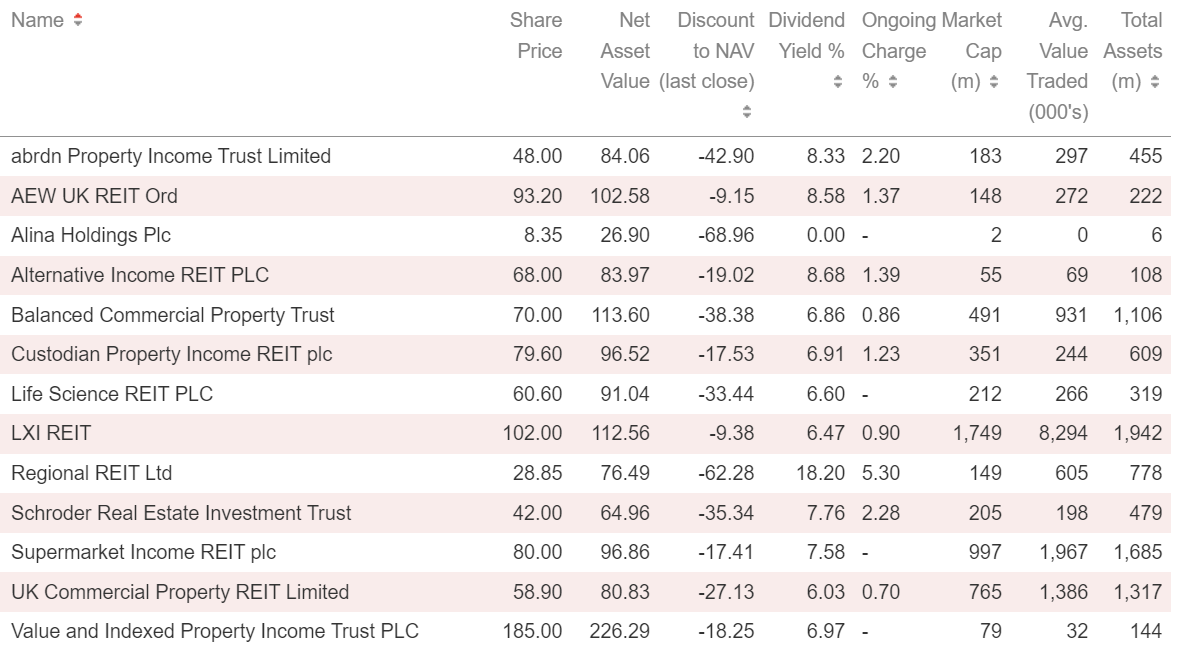

This disconnect was even greater for API. Its shares were trading on a discount to NAV of over 40% when the CREI merger deal was announced. Although the agreed merger price was still a discount to NAV, it was an almost 30% premium to its closing share price immediately prior to the deal’s announcement.

You can add to this several deals last year, including Industrials REIT (MLI – which was taken private by US private equity giant Blackstone at a 42% premium to its prevailing share price) and Ediston Property Investment Company (EPIC – which sold its entire portfolio to US REIT giant Realty Income at a 14% premium to the share price).

Companies being snapped up at substantial discounts to NAVs should result in an uplift in share prices across the sector. However, these deals have done little to move the dial, with little to no reaction in the share prices of the peer group.

My feeling is that with an improving macroeconomic environment (even after factoring in this week’s inflation announcement) and a stabilisation in values, we may see some sort of reaction over the coming months as and when the LMP/LXI and CREI/API mergers complete.

These deals show that much of the listed real estate sector is underpriced, with discounts ranging from 9% and 62%.

It is a similar story across the pond, where JPMorgan Global Core Real Assets (JARA) has a sizable exposure to US real estate and US REITs (the portfolio is weighted 43% to real estate – in the US and Asia Pacific, 10% real estate debt and the rest in global infrastructure – utilities, renewable energy – and transport – maritime and energy logistics).

Its managers Phil Waller and Shay Schmidt are bullish on the prospects for the US real estate sector. In an analyst call this week, they said a reset in values witnessed in the US (similar to the UK with market values down around 25%) provides a highly attractive entry point.

The fundamentals of the sector are strong, they argue, and the economic outlook clearer, with a ‘soft landing’ on the cards and rate cuts forecast.

Their views mirror that of the JPMorgan Asset Management’s Long-Term Capital Markets Assumptions forecast, which has US core real estate returning 7.5% this year (5.6% for European core) and US REITs returning 8.2% (7.9% for global REITs).

The reset in real estate valuations on both sides of the Atlantic has thrown up opportunities. This is heightened in the UK REIT sector where discounts remain wide and offer an attractive entry point.