After an extended period of trading at wide discounts, private equity funds seem to be more responsive to the idea of using share buybacks to tackle the problem. Is it time to pick up these bargains before they disappear?

HarbourVest launching distribution pool

The latest to make a move on this is HarbourVest Private Equity (HVPE) whose shares are trading on a 41% discount despite it having an impressive long term NAV track record – an average of 16.2% per year for the last 10 years.

HVPE will create a ‘distribution pool’ using 15% of all cash realisations from its portfolio. The size of the pool will be capped – but unhelpfully there is no clue as to where that cap will be set (this is at the board’s discretion). There is also no set way of distributing the contents of the pool to shareholders. This makes more sense to me; the choice of distribution routes – buybacks or special dividends – will depend on the level of HVPE’s discount, amongst other factors. Again, it will be down to the board to determine the appropriate route and the timing of any distribution.

It is good news, therefore, that HVPE has finally decided to make its board fully independent of its manager. As I said at the time, this was well overdue. Unlikely as it may be in this case, given the phenomenal track record, any board must have complete freedom to take any action it deems to be in shareholders’ best interests (and subject to their approval in certain circumstances) including terminating the management agreement.

The distribution pool started to fill from 1 February onwards so it will likely take a few months before distributions start. In the meantime, HVPE already has a share buyback programme in operation that has room for a further $12m of repurchases. Although, with a market cap of about $2bn, that will only make a small dent in the discount.

abrdn Private Equity Opportunities results extend impressive track record

Last week, as I discussed on the news show, abrdn Private Equity Opportunities (APEO) said that it had sold a stake in European supermarket chain Action for £35m and it intended to use part of the proceeds to repurchase its shares.

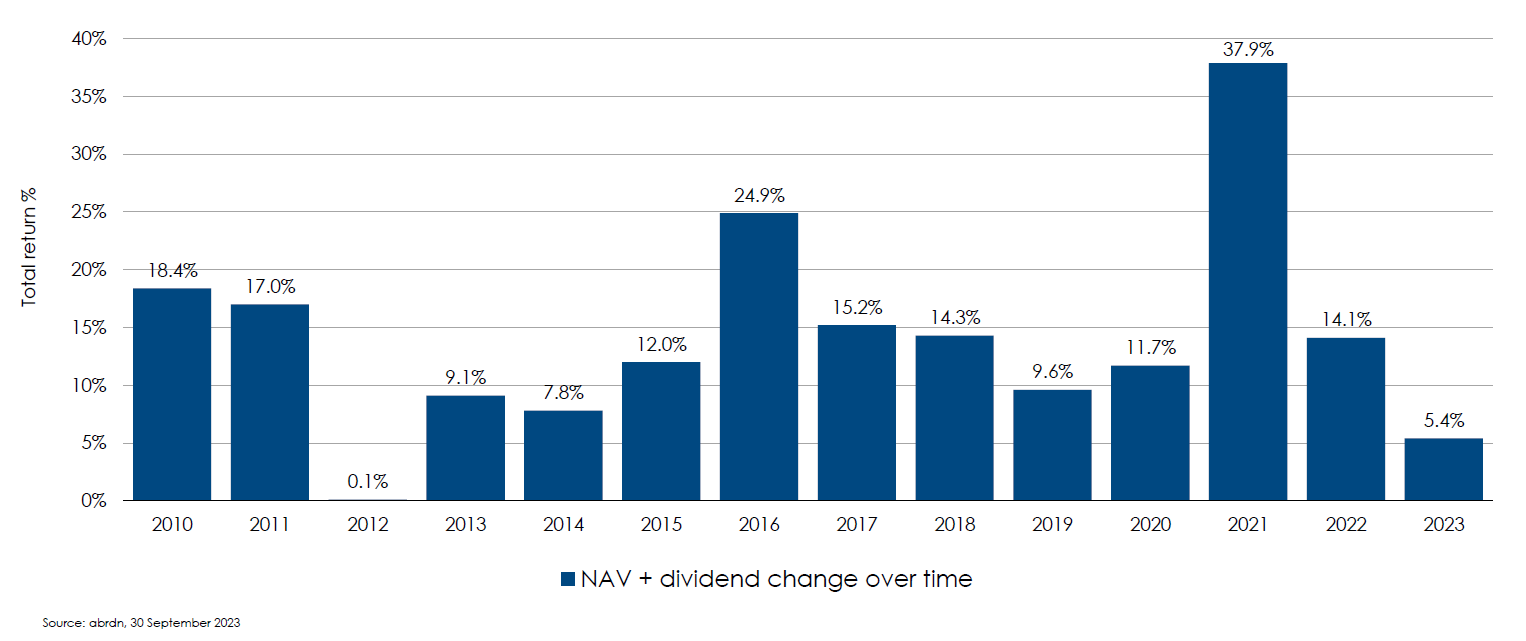

APEO’s long term returns are marginally behind those of HVPE at an average of 14.6% per year but that still ranks amongst the top performing of all funds over 10 years. However, while the NAV has roughly tripled over that period, the share price has ‘only’ doubled, leaving it trading on a discount of 34%. Impressively, and ‘one in the eye’ for the cautious flexible investment funds that have disappointed investors recently, APEO has made investors money every year for the last 14 years.

This week, it announced its annual results covering the 12 months ended 30 September 2023. The NAV return was positive, but a much slower exit environment had an effect. The pace of new investments eased too but the trust still committed £175m over the period. The managers do not attempt to time markets and their policy is to be consistently fully deployed in the market. The argument is that these things take time to get invested anyway and this is the best way of capturing returns across all vintages.

APEO’s chairman also highlighted the impact of misleading cost disclosures on the sector – as we have highlighted, we are hopeful that a resolution to this is getting closer and this removes one significant barrier to professional investors holding APEO’s shares.

Pantheon led the charge but wants to do more

The current clutch of share buyback initiatives really kicked off with Pantheon (PIN) back in August 2023, when it said that it would commit up to £200m to fund share buybacks. The trust’s discount has narrowed from about 43% to about 35% since then, but there is clearly still a long way to go.

PIN’s board was lauded for its actions, but it acknowledges that there is more to do and it aims to keep the pressure up on discount narrowing efforts.

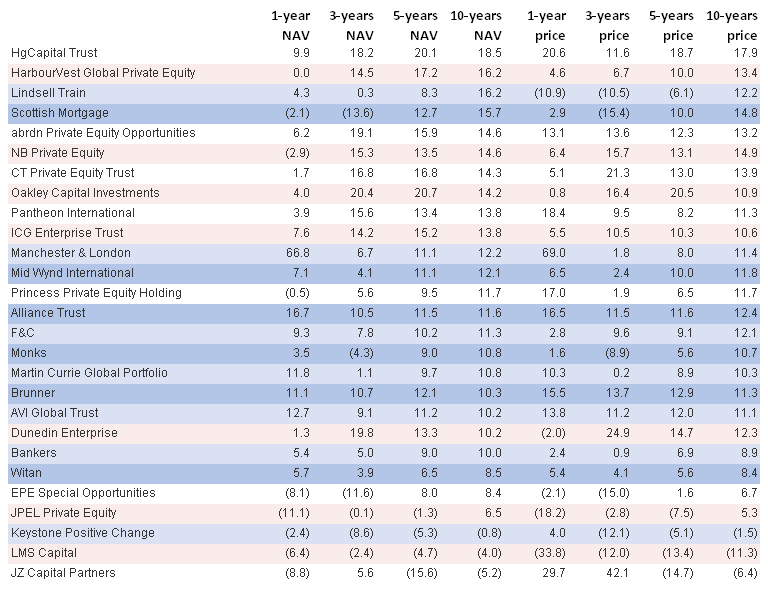

PIN’s 10-year average return of 13.8% may be a little behind the other two trusts I have mentioned, but it is still very respectable. To illustrate why, here is an updated version of the table that I used in last week’s show. As you can see, the long-term NAV returns of the average private equity fund are well above those of the average equivalent global equity fund.

Private equity (pink and white) versus listed equity (blue)

Data from QuotedData as at 2 February 2024

Why would that be? Well for a start, without the distraction of relatively short-term investors breathing down their necks, companies owned by private equity funds are freer to make long term decisions even if they have a short-term negative impact.

Private equity funds tend to be happier to fund bolt on acquisitions and capital investment. They are also more likely to take a counter-cyclical view, providing funding for opportunistic investment during downturns, for example. Private equity investors are also happy to shake up, strengthen, and re-incentivise management teams where necessary.

The focus is on growing revenue, earnings and cashflow over the medium to long term; deriving valuation uplifts from this rather than financial engineering. For example, APEO’s 50-largest underlying companies grew their EBITDA by 23.4% over the 12 months ended 30 September 2023.

Private equity firms are increasingly frustrated about the ratings of their listed funds, but as more funds join in the efforts to tackle discounts and barriers to investment are removed, the trend may finally be in the right direction. The listed private equity sector is doing a great job bringing access to private equity opportunities to ordinary investors. These funds are buying their shares, maybe you should too.