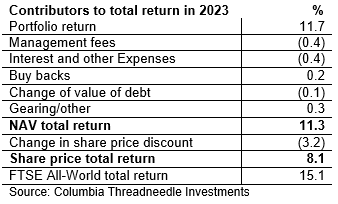

F&C Investment Trust (FCIT) has announced its results for the year ended 31 December 2023, during which it provided NAV and share price total returns of 11.3% and 8.1% respectively, both underperforming its All-Share benchmark, which it says returned 15.1%. 2023 was a good year for global equity markets after significant losses during 2022 and, for most of the year overall, market returns were driven by a handful of the largest US listed companies – the ‘Magnificent Seven’ group of stocks, which includes Amazon, Apple, Microsoft and Nvidia. 2023 saw a reversal of the losses seen amongst this cohort in 2022, which were driven, in part, by optimism over artificial intelligence (‘AI’). Each of these stocks is held in FCIT’s portfolio but it began 2023 with a greater weighting to more lowly-rated, value stocks relative to the more expensive, faster growing, growth stocks.

This stance was adjusted during the early part of the year to provide a more balanced exposure and growth stocks subsequently delivered material outperformance against cheaper value stocks. However, with market concentration being at its highest for decades as investors focused on the AI theme, FCIT’s portfolio wasn’t able to keep pace. Nonetheless, the long-term performance record is strong – see below – and FCIT proposes a 4.5p final dividend (fully covered), which will bring the total dividend for the year to 14.7pps; an 8.9% increase over the prior year and the 53rd consecutive annual increase in the dividend. Gearing added value during the year.

As well as investor enthusiasm for the AI theme, the global economy performed significantly better than had been feared during 2023. Despite further rises in interest rates by major central banks during the year, the US and global economy avoided recession, delivering a better outcome than had widely been expected at the start of the year. As the year progressed investors had increasing conviction that an economic soft landing would unfold, with economic growth slowing but remaining reasonably robust, and inflation rates would continue to decline in 2024. This led to the view that central banks would be able to embark on a course of meaningful cuts in interest rates and a global recession could be avoided. This propelled equity markets more broadly to strong gains in the latter months of the year, leading to a period of what FCIT’s chair, Beatrice Holland, describes as “solid returns” for its listed portfolio.

Developed equity markets performed well, with the US S&P 500 index delivering dollar returns of greater than 25%, while the Japanese market produced its strongest annual return for decades. The largest capitalised growth stocks which had suffered material losses during 2022 recovered meaningfully despite further rises in interest rates and lingering concerns over inflation.

FCIT says that it delivered strong absolute performance from most of its underlying strategies, most notably European equities, but under exposure relative to its benchmark index to some of the very largest stocks in the market in several of its US and global strategies led to modest underperformance within the listed equity portfolio. At the same time, FCIT’s private equity holdings, in aggregate, lost value over the year and produced returns well behind those of listed equivalents. It should be noted that as the bulk of FCIT’s portfolio is invested outside of the UK, the rise in sterling, which gained 6.0% against the US dollar, had a negative absolute returns.

Long-term performance

Over the ten years to the end of 2023, FCIT has delivered a total shareholder return of +203.0%, equivalent to +11.7% per annum, which it says compares with a return of +178.6% (equivalent to +10.8% per annum) from its benchmark index. As well as strong returns over the decade, returns for shareholders have been consistent, with only two years of negative returns, which in each case were less than 1% per annum.

FCIT says that, over the twenty-year period to 31 December 2023 the Company’s NAV return was +561.8%, equivalent to +9.9% per annum and its NAV capital-only return over the past twenty years was +410.3% (8.5% per annum), while its shareholder total return was 667.9%, or 10.7% per annum. Dividends paid to shareholders have risen by 5.0% per annum over the past decade and by 7.1% over the past twenty years.

53rd Consecutive annual dividend increase

It was another positive year for FCIT’s earnings, with its gross income exceeding £100m for the first time and the net return rising to another record high of £81.7m. Special dividends increased to £4.4m (2022: £1.6m), although the impact of currency movements reduced FCOT’s income by £0.6m (2022: +£4.9m). FCIT’s net revenue return per share rose by 13.7%, to 15.83 pence, from 13.92 pence per share in 2022. This is a lower rate of increase than the previous year but, nonetheless, represents another period of decent income growth.

FCIT’s board says that it still aims to deliver real rises in dividends for shareholders over the long-term that are sustainable. Subject to approval at its AGM, shareholders will receive a final dividend of 4.5 pence per share on 9 May 2024, bringing the total dividend for 2023 to 14.7 pence: an increase of 8.9% over that of 2022. The increase compares to the 4.0% rate of inflation and, according to FCIT, this means that the growth in its total dividend has exceeded the UK inflation rate over three, five and ten years. At 63.3%, dividend growth over the last decade is almost double that of UK inflation.

FCIT has a revenue reserve (£107.3m), which represents almost one year of dividend payments to shareholders, and it also has capital reserves which stood at £4.66bn at the year end and so remains very well placed to continue its track record of increasing annual dividends well into the future.

Ongoing charges

FCIT’s Ongoing Charges ratio declined to 0.49%, down from 0.54% in 2022. Management fees declined by 9.5%, reflecting the benefits of firstly its revised fee arrangement with Columbia Threadneedle Investments (0.3% on FCIT’s market capitalisation up to £4 billion and at 0.25% thereafter), secondly a lower level of equity assets managed by third party managers and thirdly a lower fee arrangement with JPMorgan, FCIT’s newly appointed US large cap growth manager.

Gearing

FCIT began 2023 with £244m of cash and cash equivalents, reflecting the impact of long-term borrowings which it had drawn but not invested during 2022 and the relatively cautious view of its Fund Manager. It did not undertake any new borrowings over the course of the year, but did deploy some of the cash. FCIT’s overall borrowings stood at £581.0m at the end of the year, meaning that its effective gearing level (with debt at par and including its £80m holding of Government bonds) rose to 9.9% from 7.3% at the start of the year.

Excluding its very small perpetual debenture, FCIT has debt with maturities out to 2061 that have a blended fixed interest rate of approximately 2.4%. FCIt says that low interest rates present a low hurdle for its investments held against these borrowings to add value for shareholders over the life of the loans.