Mercantile (MRC) has published its annual results for the year ended 31 January 2024, during which it provided NAV and share price total returns of 5.4% and 6.1% respectively, outperforming its benchmark, which returned 1.8%. Its chairman, Angus Gordon Lennox, says that existing portfolio holdings have been performing well, despite the challenging conditions of the past year, and should do even better as and when the economy strengthens. He goes on to say that “current very attractive valuations mean that new investment opportunities among mid and smaller cap stocks are numerous, and the Portfolio Managers’ track record attests to their ability to identify and capitalise on the most compelling of these opportunities.”

MRC’s outperformance was driven by stock selection. Gearing, which averaged 12% over the year, was additive to performance on a gross basis but the benefit was not quite enough to offset its costs. Performance was aided by MRC’s substantial holdings in the investment banking and brokerage services sector and portfolio turnover has remained lower than long-term averages.

Returns and dividends

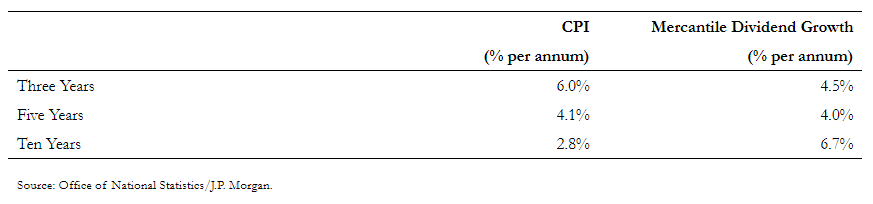

MRC aims to provide long term dividend growth at least in line with the rate of inflation over a five-to-ten-year period and while it is behind over three years, it is only modestly behind over five years and comfortably ahead over 10 years. MRC has paid three interim dividends of 1.45p per ordinary share in respect of the year to 31st January 2024 and the board has declared a fourth quarterly interim dividend of 3.30p per share. This brings the total dividend for the year to 7.65p per share, an increase of 7.0% over last year.

While MRC used its revenue reserves to support the dividend during the three financial years impacted by COVID, its dividend has been covered for the last two financial years. Revenues per share over the past year increased by 25.3%, to 9.01p, from 7.19p in the previous year. This means that MRC has been able to increase its dividend for the year ended 31 January 2024 by a healthy margin, while also adding a meaningful amount to its reserves, to support dividends in any future lean years. After payment of the fourth interim dividend, MRC will have revenue reserves of more than 6.5p per share (2023: 4.9p).

Discount management

MRC’s discount to NAV fluctuated between 9.7% and 16.7% during its last financial year. Its discount at the year end of 12.6% was largely the same as where it began a year ago. During the year, MRC repurchased just over 8m shares at a cost of £16.5 million. These shares were purchased at an average discount to NAV of 12.7%, producing a modest accretion to the NAV for continuing shareholders.

Gearing

The board intends the MRC will continue to operate with gearing in the range of 10% net cash to 20% geared, under normal market conditions. MRC ended the financial year with gearing of 13.4%, up from 9.5% at the same time the previous year. This is the highest level of gearing in over ten years, reflecting the portfolio managers’ positive outlook. Having gone into the downturn modestly geared – positioning which detracted from performance – the board says it is especially keen to ensure that the level of gearing enhances MRC’s exposure to a market upturn. Gearing is achieved via the use of long-dated, fixed-rate financing, from several sources. MRC has in place a £3.85m perpetual debenture and a £175 million debenture repayable on 25th February 2030, together with £150m of long-term debt raised in September 2021 via the issuance of three fixed rate, senior unsecured, privately placed notes. These notes mature between 2041 and 2061 and were secured at a blended rate of 1.94%, at a time when interest rates were near their lows.

Performance attribution

Contributors to performance

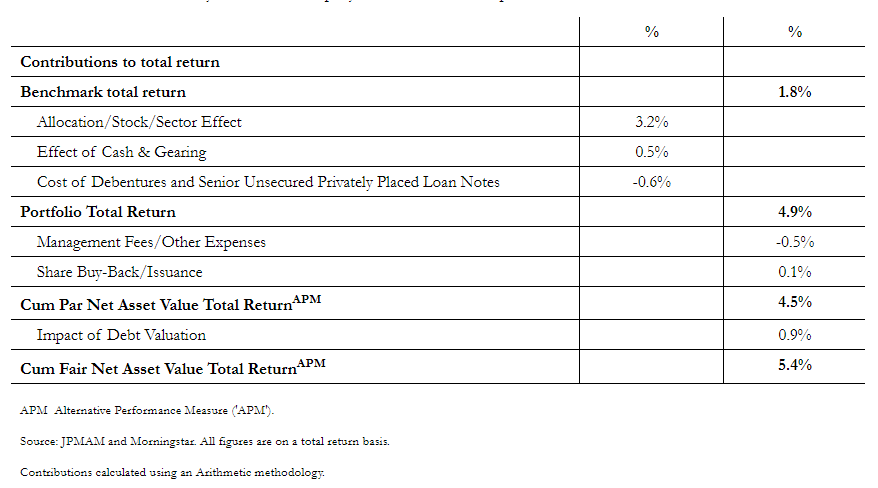

As is illustrated in the table below, MRC’s outperformance was driven by stock selection, while gearing, which averaged 12% over the year, was was positive for performance on a gross basis but the benefits were not sufficient to cover its costs. As noted above, performance this year was aided by a strong outturn from several of MRC’s longer-standing investments, led by its investments in the investment banking and brokerage services sector.

substantial holdings in the investment banking and brokerage services sector. Private equity group 3i continued to deliver better than expected sales growth thanks to Action, a retailer that now accounts for close to two thirds of its net assets, while the fund-raising and financial performance of Intermediate Capital, an alternative asset manager, remained strong despite a well-reported industry-wide softening in demand for such strategies.

substantial holdings in the investment banking and brokerage services sector. Private equity group 3i continued to deliver better than expected sales growth thanks to Action, a retailer that now accounts for close to two thirds of its net assets, while the fund-raising and financial performance of Intermediate Capital, an alternative asset manager, remained strong despite a well-reported industry-wide softening in demand for such strategies.

Other portfolio highlights this year include MRC’s significant holdings in the software and computer services sector, in companies such as Bytes Technology, Softcat and Computacenter, which have benefited from robust corporate demand for IT infrastructure. These companies have also seen gains in market share and there is scope for revenue to accelerate further as customers begin to adopt generative AI solutions.

The managers say that, given the overwhelmingly bearish views of the prospects for the domestic economy, it was particularly pleasing to see a strong contribution to returns from MRC’s holdings in the household goods and home construction sector, led by its longstanding investment in Bellway but also from Redrow. They say that the market had been quick to mark down these shares aggressively given their high economic sensitivity, but valuations had reached extreme levels, which is why they increased these holdings materially, which was then well rewarded once the shares repriced more favourably as the probability of the most negative scenarios diminished through the year.

Detractors from performance

MRC’s holding in Watches of Switzerland, a luxury watch retailer, was the largest detractor by some margin. The managers had reduced the position size somewhat on the back of a moderating growth profile, but a move by their key supplier Rolex into retail, via the succession-driven acquisition of Bucherer, exacerbated market concerns. This was then compounded by a material profit warning, following weaker than expected trading over the Christmas period. While this is the first profit warning that the company has issued since its listing in 2019, it raises significant questions over the deliverability of their long-range growth targets, so the managers have exited the investment in full, preferring to reallocate the capital elsewhere while continuing to monitor their progress.

Future, the specialist media platform, also came under pressure as audience figures and thus revenue – particularly in their important consumer technology products offering – declined, leading to a reduction in expected earnings. In addition, the managers say that fears around the potential impact of AI and third-party cookies changes, combined with a management transition, placed further downward pressure on the company’s share price. However, with the shares at an extreme valuation, which the managers do not believe gives fair credit to their Go-Compare price comparison website business, MRC remains a shareholder, and with the new CEO now in place, they are monitoring progress closely.