Same as it ever was…

Same as it ever was…

Ian “Franco” Francis, the manager of CQS New City High Yield (NCYF), says that, since we last published nothing much has changed, which is what we think you should expect from this “conservative and boring” fund.

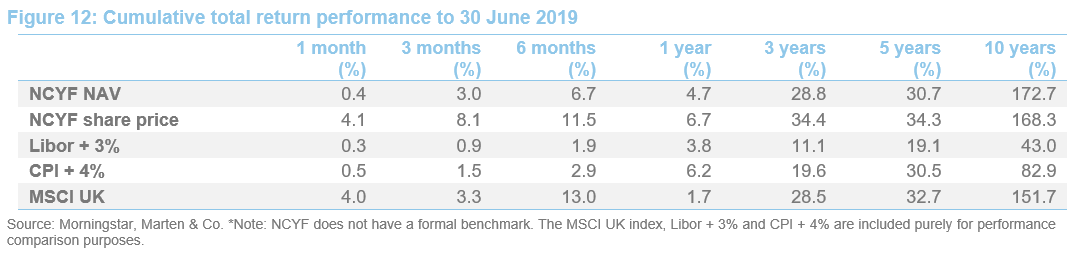

However, we reiterate that NCYF offers a compelling yield (7.3%) and has beaten the consumer price index, Libor and the MSCI UK Index by significant margins over the last 10 years (see pages 13 and 14); all while providing low volatility returns. Furthermore, the manager says that the market continues to offer opportunities, but it is important that investors remain selective (Ian sees 10–15 issues a week, but will buy about one a month for the fund) and position themselves appropriately, as the cycle is advanced and markets are buoyant. In this regard, NCYF’s portfolio has a relatively short duration, to protect against rising interest rates and to allow the manager to take advantage of opportunities in a market downturn.

High-dividend yield and potential for capital growth

High-dividend yield and potential for capital growth

NCYF aims to provide investors with a high-dividend yield and the potential for capital growth by investing mainly in high-yielding fixed interest securities. These include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government stocks. The company also invests in equities and other income-yielding securities. The manager has a strong focus on capital preservation and is conservative in its approach to growing NCYF’s capital.

Fund profile

Fund profile

A predominantly higher-yielding fixed income exposure

A predominantly higher-yielding fixed income exposure

NCYF’s aim is to provide a high level of quarterly income, with the prospect of capital growth, through investment in a portfolio of predominantly higher-yielding fixed income securities, with the flexibility to invest in equities and equity-related securities.

Investments are typically made in securities which the manager has identified as undervalued by the market and which it believes will generate above average income returns relative to their risk, thereby also generating the scope for capital appreciation. The manager seeks to exploit opportunities presented by the fluctuating yield base of the market and from redemptions, conversions, reconstructions and take-overs to generate capital growth.

CQS Group and New City Investment Managers

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been NCYF’s investment manager since its launch in March 2007. NCIM also managed NCYF’s immediate predecessor (NCYT) from 2004 until its assets were rolled over into NCYF in March 2007 (see page 21).

On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with AUM of US$17.7bn as at 30 April 2019.

Ian “Franco” Francis – “plenty of life in the old dog yet”

Ian “Franco” Francis – “plenty of life in the old dog yet”

Ian Francis, a partner at CQS and Head of New City, has day-to-day responsibility for managing NCYF’s portfolio. Ian joined NCIM in 2007. He has over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, having worked for Collins Stewart, West LB Panmure, James Capel and Hoare Govett. Ian is able to draw on the expertise of a 28-strong credit analysis team at CQS.

When we last met Ian, he commented that, having recently turned 60, he is increasingly being asked about his plans to continue working. In his own words, he continues to enjoy what he’s doing, has no plans to retire and says, “there’s plenty of life in the old dog yet”.

Constructed without reference to a benchmark

Constructed without reference to a benchmark

Reflecting its fixed income focus, the manager’s absolute return mindset and the diversity of its holdings, NCYF’s portfolio is not constructed with reference to any benchmark index. NCYF uses the FTSE 100 index for performance comparison purposes in its reports but its board explicitly says that this is used in the absence of a meaningful benchmark index. We have included comparisons against the MSCI UK index in this report. We also believe that, over the longer term, NCYF should be able to provide both a real return (one that exceeds consumer inflation by a margin) as well as a return that exceeds the Libor rate by a margin. We are therefore including comparisons against Libor + 3% and CPI + 4% but we would stress that these are not formal benchmarks for NCYF.

Manager’s view – nothing much has changed

Manager’s view – nothing much has changed

In our last note on NYCF, ‘Escalators do not go to the sky!’ published in November 2018, we discussed how NCYF’s manager, Ian “Franco” Francis, shares the view of many market commentators that we are increasingly late-cycle. He sees many examples of what he calls “typical top of the market stuff” and, pointing to a range of challenges and uncertainties (he looks at political risk on a daily basis), Ian says that there are many reasons why investors should be very wary of markets at the moment. Since we last published, Ian says that nothing much has changed. His strategy is to keep the portfolio diversified, and to continually monitor developments.

Markets continue to be driven primarily by sentiment and not by fundamentals. The recent trend in developed economies has been one of falling unemployment, labour markets tightening, wage rates edging up and signs that consumer prices are also on the rise, although the jury is still out as to whether labour has enough bargaining power for this to lead to a wage price spiral (if so, this could trigger further monetary tightening and ultimately a recession), or worries about job security in the face of technological advances leading to reductions in real income that curtail growth, with the developed world becoming trapped in a Japanese-style deflationary spiral.

Moderating financials exposure

Moderating financials exposure

The Financials sector has traditionally been a fertile hunting ground for NCYF, primarily issues from banks and insurance companies. As discussed on page 4 of our November 2018 note, Ian observes that these institutions are now much better capitalised than they were as we approached the top of the last cycle in 2007-08, but the market’s attitude towards them has seen remarkably little change. As such, their issues tend to pay a relatively high yield for their level of risk, making them natural candidates for NCYF’s portfolio.

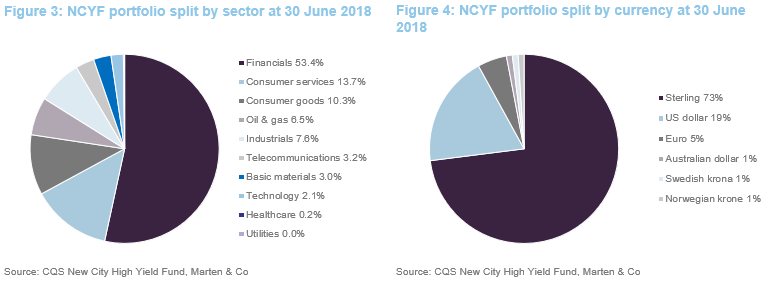

As illustrated in Figure 3 on page 9, NCYF’s financials exposure accounted for 53.4% of the portfolio as at 30 June 2018. Given the lateness of the economic cycle, and the general uncertainty (both economic and geopolitical), Ian has been moderating NCYF’s financials exposure and making sure that its holdings are well diversified. NCYF’s financials exposure includes diversified banks, life and health insurance, thrifts and mortgages, regional brokers, property and casualty insurance, multiline insurance, asset management and custody banks, real estate, insurance brokers as well as other diversified financials.

Abundance of new issues coming to market

Abundance of new issues coming to market

Ian says that there is an abundance of new issues coming to market, particularly from Scandinavia. He feels that many of these are not of sufficient quality to be candidates for NCYF’s portfolio and that investors need to be selective. In contrast, Ian says that it is quite easy to add to existing holdings at the moment. He is happy with the quality of these and there are a significant number of issues trading just below par. These factors have driven an uptick in concentration recently as Ian has sought to redeploy capital that has been returned to NCYF as issues have been called.

Brexit – shifting currency exposures

Brexit – shifting currency exposures

In our November 2018 note (see page 3 of that note) we discussed Brexit and its potential impacts on NCYF’s portfolio (in summary, Ian says that while the potential negative impacts of Brexit are significant, the prospects for the UK companies in NCYF’s portfolio are good). Nonetheless, Ian sees political risk as elevated and believes, under a possible Labour government, that people’s savings are at serious risk and the business climate will deteriorate.

With Brexit dividing the Tories and the party struggling to unite, Ian felt that there was (and remains) a serious risk that the party could fracture. He said that he may look to put more money offshore and this has now happened. Having previously had approximately 70% exposure to sterling, 20% US dollar, with other currencies making up the balance, NCYF’s portfolio is now approximately 50% US dollar, 10% Euro with much of the balance in sterling. Ian says that, if we get a hard Brexit, sterling will depreciate, and he will look to downsize NCYF’s Euro and dollar exposures and invest in the UK. In contrast, if we get a smooth Brexit, sterling should appreciate, and Ian will look to sell down sterling and add to NCYF’s US dollar positions.

Woodford as a forced seller has created opportunities

Woodford as a forced seller has created opportunities

Ian says that the recent well-documented problems faced by Woodford Investment Management, and in particular its flagship fund, the LF Woodford Equity Income Fund, have created opportunities for equity income and growth managers recently. The presence of a large forced seller in the market has seen downward pressure on pricing for a number of stocks, which Ian expects to be temporary, elevating yields and creating the prospects of future capital gains. NCYF has been able to take advantage of this to a limited extent. For example, Ian purchased a small position in VPC Speciality Lending at a yield in excess of 8%, which has performed well since acquisition. Ian does comment, however, that the woes of Woodford illustrate what can go wrong when positions are sized inappropriately.

The US and Europe

The US and Europe

Ian considers that President Trump’s actions are having the effect of slowing the US economy and that this will inevitably lead to an interest rate cut. He sees a 70% chance of a rate cut in July and a 90% chance of a cut by October. He thinks it likely that Trump will be re-elected, so we will likely see another chaotic four years, but the US will carry on regardless. He thinks that, reflecting the balance of these considerations, the risk-reward ratio is about okay in the US. However, given he is overweight the US relative to history, he is not upping NCYF’s US dollar exposure at current prices.

Europe continues to be mixed, while Italy appears to be a crisis in the making. Ian highlights that GDP has not seen any meaningful real growth for 18 years and debt is high at around 130% of GDP. Italy’s size (circa 10x that of Greece) makes it a much bigger problem for the ECB than that of Greece in 2012. Ian thinks that it will be much harder to “do whatever it takes” this time around.

Bottom-up investment process

Bottom-up investment process

NCYF’s portfolio is constructed using a bottom-up process that is based on extensive fundamental analysis of the credit risk and return prospects for potential investments. This analysis, which is conducted in house, includes:

- an assessment of the free cash flow available to the various security holders within a corporate’s capital structure (for example, equity holders, debt holders, preferred stockholders and convertible security holders);

- the prospect of changes to cash flows (for example, from changes in interest rates or the competitive landscape);

- as well as an assessment of the company’s track record in managing its obligations and the quality of the company’s management.

Ian Francis makes the final decision on what enters NCYF’s portfolio, but he is able to draw on the expertise of a 28-strong team, of credit analysts globally, at CQS when assessing and comparing potential investments.

When selecting candidates for the portfolio, the manager seeks to identify securities that it considers to be undervalued by the market. He expects these to generate superior income returns relative to their risk, with the scope for capital appreciation as the market rerates them. While income generation and the sustainability of income are key, capital preservation is also a major focus and the manager is not prepared to sacrifice capital in the pursuit of income.

Low turnover portfolio

Low turnover portfolio

The manager maintains a portfolio of around 110-120 issues. This tends to be moderately concentrated, with the top 10 issues accounting for around 25%–30% of the portfolio. The manager maintains a core set of holdings that are well understood, with the top 10 being relatively liquid in normal market conditions. The portfolio is inherently low turnover, excluding called positions. Many positions do not have an active secondary market and so the manager selects positions based on the view that they offer an attractive return, relative to their risk, all the way through to their ultimate maturity. As such, the manager is not looking to trade positions. If holdings leave the portfolio prior to their maturity, it is usually because they have been called by the issuer, although the issuer frequently pays a decent premium for the privilege of doing so. Turnover for a typical year is in the region of 50%, but Ian expects that 30% to 40% will be due to forced redemptions.

The portfolio tends to have a relatively short duration, of around three-and-a-half to four years and earns a geared return of around 8% per annum, while paying out a 7% yield. This has been achieved without the use of options or dividend stripping. The manager does not hedge currency risk although he will take a macro view on currencies and avoid those that he does not favour. For example, NCYF’s portfolio has not held any Australian dollar denominated assets since 2014/15.

Exposure to niche issues and unrated bonds

Exposure to niche issues and unrated bonds

The manager’s ability to calculate its own internal ratings on any bond, allows it to properly assess smaller niche and unrated issues. These issues will tend to earn a premium of 150-200bp for an equivalent level of risk, which is key in allowing NCYF’s portfolio to generate superior risk-adjusted returns.

Investment restrictions

Investment restrictions

In addition to fixed income securities, NCYF also invests in equities and other income-yielding securities. There are no defined limits on type of securities, countries, issue size or sectors, although the board has set a limit whereby NCYF will not invest more than 5% of its total investments in securities issued by the same investee company.

NCYF may invest in derivatives, financial instruments, money market instruments and currencies, for the purpose of efficient portfolio management, although it is not obliged to do so. NCYF can invest in both closed-end and open-ended funds but will not invest more than 10% of its total assets, as at the time of investment, in such collective undertakings.

NCYF may invest up to 10% (calculated at the time of any relevant investment) of its total assets in other securities that are neither listed nor traded at the time of investment. It may also acquire securities that are unlisted or unquoted (at the time of investment) but which are about to be convertible, at the option of NCYF, into securities which are listed or traded on a stock exchange. NCYF is permitted to hold securities that cease to be listed or traded if the manager considers this appropriate, but such securities are limited to 10% of NCYF’s total assets (calculated at the time of any relevant investment).

NCYF is permitted to borrow and the board has set a gearing limit of 25% of net assets, at the time of borrowing, which it reviews periodically (see page 20). The manager expects that NCYF’s portfolio will normally be fully invested. However, during periods in which changes in economic circumstances, market conditions or other factors so warrant, NCYF is permitted to reduce its exposure to securities and increase its positions in cash, money market instruments and derivative instruments in order to seek protection from stock market falls or volatility.

Risk management

Risk management

In addition to the above investment restrictions, the board monitors the spread of investments to ensure that it is adequate to minimise the risk associated with particular countries or factors specific to particular sectors. The manager also employs risk management disciplines which monitor NCYF’s portfolio and to quantify and manage the associated market and other risks.

CQS has established a permanent department, independent of the portfolio manager, to perform the risk management function. This risk management and performance analysis team (RMPA) is not involved in the performance activities of NCYF and has policies, processes and procedures designed to identify, quantify, analyse, monitor, report on and manage all material risks relevant to NCYF’s investment strategy. The systems include third party vendor applications such as Tradar, Sungard Front Arena and MSCI Risk Metrics, complemented by a number of proprietary applications.

Asset allocation

Asset allocation

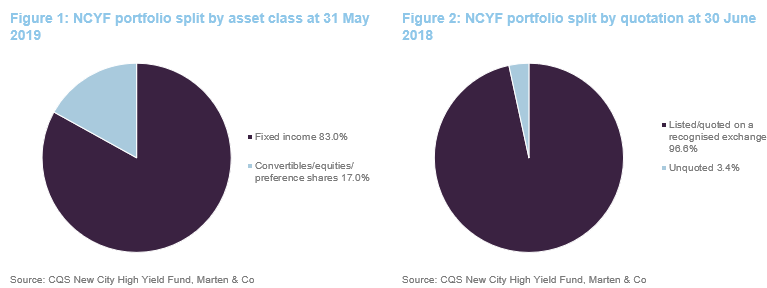

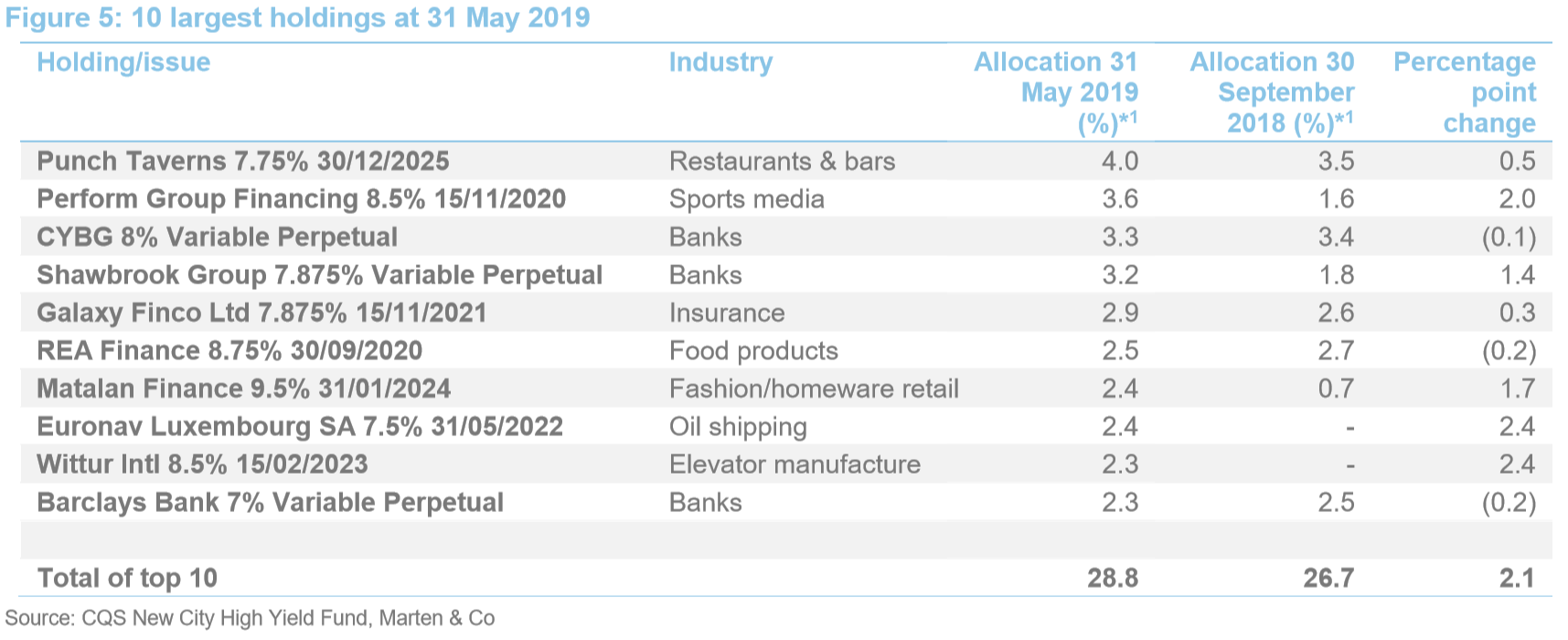

As at 31 May 2019, NCYF’s portfolio had had exposure to 103 issues (down from 111 issues as at 30 September 2018 – the most recently available data when we published our update note in November 2018) and, as illustrated in Figure 5, the top 10 issues accounted for 28.8% of the portfolio (up from 27.2% as at 30 September 2018). Figures 1 to 4 show various splits of the portfolio (asset class, quotation, sector and currency), with the data provided being the most recent data that is publicly available.

These charts continue to illustrate a number of themes:

- The portfolio is overwhelmingly invested in pure fixed income securities.

- All but a tiny percentage of the portfolio is quoted on a recognised exchange (although around 70% trades OTC and so will be relatively illiquid).

- The portfolio has exposure to issues from companies in a diverse range of sectors, with a heavy concentration in financials that reflects the manager’s views on bank and insurance issues (see page 5).

Although not illustrated in Figure 4, the portfolio’s exposure to sterling has been reduced significantly. Historically, the portfolio’s exposure to sterling has been around 70%, with US-dollar exposure of around 20%. We highlighted in our November 2018 update note (see page 3 of that note) that the manager may look to reduce exposure to sterling if the political climate deteriorates, and this has now been done with NCYF’s portfolio being circa 50% US dollar, exposure, 10% Euro exposure, with the balance mostly in sterling. Looking at Figure 3, it is also noteworthy that there is no exposure to utilities in NCYF’s portfolio as Ian has concerns as to how safe their dividends are.

Our November 2018 note provided detailed commentary on Perform Group Financing 8.5% 15 November 2020, Shawbrook Group 7.875% Variable Perpetual, Matalan Finance 9.5% 31 January 2024 and Pizza Express Financing 8.625% 1 August 2022. Similarly; while our March 2018 initiation note provided commentary on Punch Taverns 7.75% 30 December 2025 and CYBG 8% Variable Perpetual.

Some discussion of new top ten holdings, Euronav and Wittur, is provided below and overleaf respectively, while commentary on American Tanker, TiZir Limited and ShaMaran Petroleum is provided within the portfolio activity section (see pages 11 to 13). There is also some commentary on Greene King, which has been sold in its entirety. These represent the more interesting portfolio developments in our view.

Top 10 holdings

Top 10 holdings

Figure 5 provides a summary of the top 10 issues within NCYF’s portfolio as at 31 May 2019. Reflecting the manager’s long-term, low-turnover approach, most of the securities will be familiar to regular followers of NCYF’s portfolio announcements.

However, there are two new names that have appeared in this list since we last wrote (Euronav and Wittur International) while OneSavings Bank Plc 9.125% Variable Perpetual and Garfunkelux Holdco 11% 01/11/2023 have both moved just out of the top 10 (spots 11 and 12 respectively). Euronav is a new addition to the portfolio; it is discussed in more detail below.

Euronav Luxembourg SA 7.5% 31 May 2022

Euronav Luxembourg SA 7.5% 31 May 2022

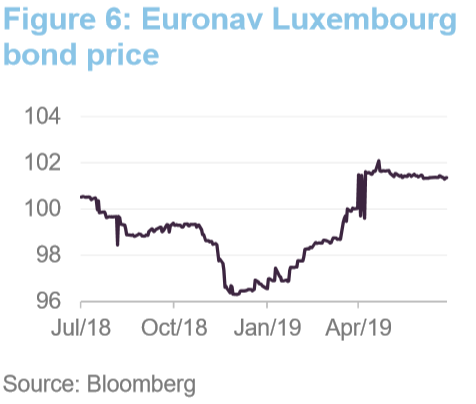

Euronav (www.euronav.com) is an international shipping company focused on transporting oil by sea. It describes itself as the largest NYSE listed independent crude oil tanker company in the world (its ordinary shares are also listed on Euronext Brussels).

Headquartered in Antwerp, Belgium, Euronav has offices throughout Europe and Asia. Its owned and operated fleet consists of two ultra-large crude carriers (ULCCs), 43 very large crude carriers (VLCCs), 25 Suezmaxes (a suezmax is the largest ship size that is capable of transiting the Suez Canal when fully-laden) and two floating storage and offloading (FSO) vessels (both of which are owned in 50%-50% joint venture). Euronav operates its fleet both on the spot and period market. VLCCs on the spot market are traded in the Tankers International pool of which Euronav is one of the major partners.

A global oil supply glut, accompanied by concerns that global stockpiles were already high, saw the oil price fall sharply towards the end of 2018. Concerns over their profitability saw oil stocks fall near-universally, with oil services companies affected as well. However, Ian considers Euronav to be well capitalised with markets not fully appreciating the quality of the credit. He says that Euronav is flexible, focused on its core competencies and he trusts management to be able to deliver in a more challenging environment.

Wittur International 8.5% 15 February 2023

Wittur International 8.5% 15 February 2023

Wittur (www.wittur.com) describes itself as, “one of the world’s leading providers of components, modules and systems for the elevator industry”. It is a German engineering business with various subsidiaries in Europe, Asia and Latin America, which operate under four main brands: Wittur, Selcom, Sematic and Liftmaterial. Ian considers Wittur to be a very solid, well managed business that is well capitalised. He thinks that its credit quality is high relative to its yield and, while the company could see orders for new lifts fall in a downturn as the construction industry retrenches, Wittur’s business is both cash-generative and resilient and its premium product should be supportive should the economic cycle rollover.

Portfolio activity

Portfolio activity

Since we last published in November 2018, portfolio activity has been limited (Ian estimates in the region of 25-30 trades). Much of this has been adding to existing holdings as other issues have reached maturity or have been called (Ian says that this is relatively easy at present as many of these are trading around par value). In addition to Euronav (discussed on page 10), new positions have also been initiated in American Tanker, TiZir Limited and ShaMaran Petroleum.

Positions in Greene King (discussed on page 13) and GlaxoSmithKline (GSK) have been sold in their entirety. With regards to GSK, this was a very small (circa £30k) position, which, in Ian’s view, was offering a yield that wasn’t particularly attractive. This drove the decision to dispose of the holding.

American Tanker Inc 9.25% US dollar drop lock bonds 2017 (2020/22) 22 February 2022

American Tanker Inc 9.25% US dollar drop lock bonds 2017 (2020/22) 22 February 2022

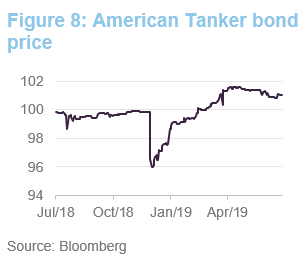

The bonds are issued by American Tanker Inc, which is a wholly owned subsidiary of American Shipping Company ASA (formerly American Shipping ASA), but they effectively provide finance to the parent company, American Shipping. This is a ship finance company (and yieldco), established in 2005, that is focused on the intercoastal US Jones Act market. It owns a fleet of “nine modern handy size product tankers and one modern handy size shuttle tanker” that it charters on long-term bareboat charters. The American Shipping fleet services the crude oil and refined petroleum products logistics needs of oil majors and refiners in the US coastal trade.

The US Jones act is a federal law that requires all goods, shipped between US ports, to be transported on ships that are built, owned, and operated by US citizens or permanent residents. American Shipping is part of Norway’s Aker Group. Aker ASA originally owned 53.2% of the company but reduced its ownership share to 19.9% in 2008 (it remains the company’s largest shareholder).

Like ShaMaran Petroleum below, American Shipping’s share price came under pressure as the oil price fell in the second half of 2018, putting pressure on the American Tanker bonds. However, Ian felt comfortable with the credit and considered that it offered good value. American Shipping’s fleet is let out to good quality counterparties on long-term charters (it has four bareboat contracts expiring in 2020, five bareboat contracts expiring in 2022 and the shuttle tanker bareboat contract expires in June 2025) that are not volume dependant. The company benefits from stable, predictable cash flows and managers analysis indicated that the company retained strong capacity to meet its coupon obligations. There is also the prospect of some capital uplift if the market reassesses the credit risk (Ian thinks that there’s decent dividend paying capacity for American Shipping’s ordinary shares, meaning that there’s plenty of scope to meet the bonds obligations, and there is the potential for additional cash flow from a profit sharing mechanism with Overseas Shipholding Group Inc. (OSG – www.osg.com), which charters the company’s vessels). American Shipping’s fleet also benefits from evergreen extension options on all of its vessels with OSG.

Note: a drop lock bond is a floating-rate bond that converts into a fixed coupon obligation when a reference interest rate drops below a pre-specified level at a coupon reset date.

TiZir Limited 9.5% US dollar drop lock bonds 2017 (20/19-22)

TiZir Limited 9.5% US dollar drop lock bonds 2017 (20/19-22)

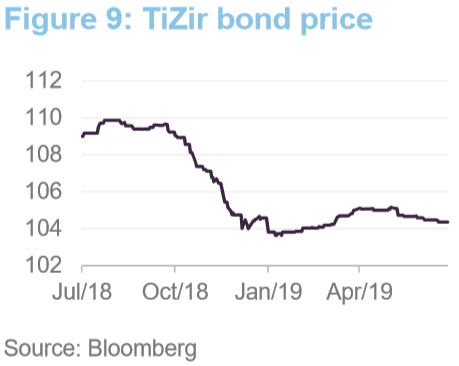

A small position has been initiated in TiZir Limited’s (TiZir’s) 9.5% 2017-2022 drop-lock bonds, which are listed on the Oslo Børs.

TiZir (www.tizir.co.uk) is a 50/50 joint venture between Eramet and Mineral Deposits Limited of Australia (MDL). It describes itself as “a vertically integrated zircon and titanium business”. Headquartered and domiciled in the UK, TiZir business produces ilmenite, zircon, rutile, leucoxene, titanium slag and high-purity pig iron. It is one of the main suppliers of raw materials for the titanium dioxide industry. The business has two key assets: the Grande Côte mineral sands mine (GCO) in Senegal, west Africa; and a smelter in Tyssedal, Norway. It earns most of its revenues in US dollars, which is one of the attractions for NCYF’s manager.

GCO is the largest single dredge mineral sands operation in the world. It primarily produces high-quality zircon and ilmenite as well as small amounts of rutile and leucoxene and has an expected mine life of at least 25 years. The operations comprise a dredge, a wet concentrator plant (WCP), a mineral separation plant (MSP), rail, port facilities and a power station. The mine benefits from its close proximity to Africa’s largest international shipping port in Dakar. More information is available at: www.tizir.co.uk/projects-operations/grande-cote-mineral-sands.

The Tyssedal Titanium & Iron ilmenite upgrading facility is one of only six such operating facilities of its type in the world, and the only one in Europe. It upgrades ilmenite to produce a high-value titanium slag, primarily sold to pigment producers; and a high-purity pig iron, a valuable bi-product, which is sold to ductile iron foundries.

Positioned on the edge of the Hardanger fjord in Tyssedal, Norway (approximately 180 kilometres south-east of Bergen and 365 kilometres from Oslo), it is well positioned to access cheap and clean power and year-round shipping (it is equipped for on-site ship handling).

This holding is an example of how NCYF can benefit from the experience of the wider CQS team as Ian works closely with the managers of CQS Natural Resources Growth and Income Trust (also a Marten & Co client – Click here to read our June 2019 initiation note). The CQS team consider that TiZir has high quality assets that are well located, a good management team and strong joint venture partners in the form of Eramet and Mineral Deposits Limited of Australia (MDL). The business is highly cash-generative is well positioned to meet its coupon obligations in their view.

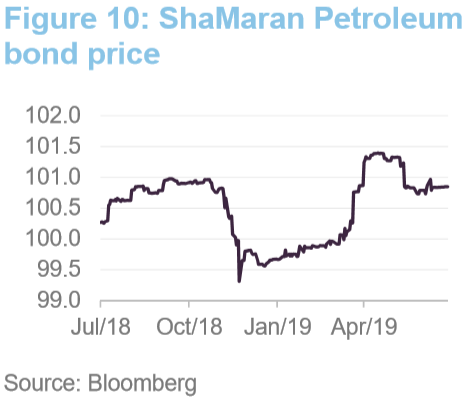

ShaMaran Petroleum 12% US dollar 5 July 2023

ShaMaran Petroleum 12% US dollar 5 July 2023

A small position has been initiated in Kurdistan oil exploration and development company, ShaMaran Petroleum (www.shamaranpetroleum.com), While the issue is Scandinavian (it is listed on the Nasdaq First North Exchange), ShaMaran Petroleum Corporation is a Canadian incorporated oil and gas exploration company with a 27.6% direct interest in the Atrush Block production sharing contract. The Atrush Block is located in the Kurdistan region of northern Iraq.

ShaMaran Petroleum says that the total discovered oil in place in the Atrush Block is a low estimate of 1.5 billion barrels, a best estimate of 2.1 billion barrels and a high estimate of 2.8 billion barrels with Total Field Proven plus Probable (2P) reserves (on a property gross basis) estimated at 85.1 MMbbl. Phase 1 of the field development plan has been completed with first oil achieved in July 2017. It was originally planned that production would ramp up 30,000 barrels of oil equivalent per day but, in June 2019, the company announced that Atrush had been producing at approximately 32,000 barrels of oil per day.

In common with other oil stocks, ShaMaran’s share price came under pressure as the oil price fell in the second half of 2018 as investors factored in potential reduced profitability. This had a similar impact on ShaMaran’s bonds, but Ian considers that it is well positioned to meet its obligations and that, in a world where tensions with Iran have increased, and may increase further, the market is under-estimating the company’s credit worthiness and the bonds offered an attractive risk-reward ratio.

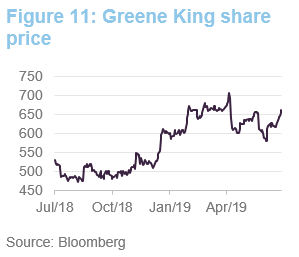

Greene King

Greene King

A modest position in Greene King (www.greeneking.co.uk) was added to NCYF’s portfolio in the aftermath of its second profit’s warning in September 2017 (this followed an earlier profit warning in December 2017). Ian felt that, while the business faced challenges, it did not justify such a hefty price fall (it fell 28% on the day of the announcement and continued to fall during the months that followed). He considers that the underlying assets are of good quality and it offers a decent yield, which he felt to be secure. Following an announcement in November that Rooney Anand, CEO for 14 years, would be stepping down at the end of the financial year, the stock has recovered strongly. Ian had a target price of 620p and so when it reached 655p, he was happy to sell (having bought it at around 565p). However, Ian continues to like the business and would consider adding to NCYF’s portfolio again should the price fall.

Performance

Performance

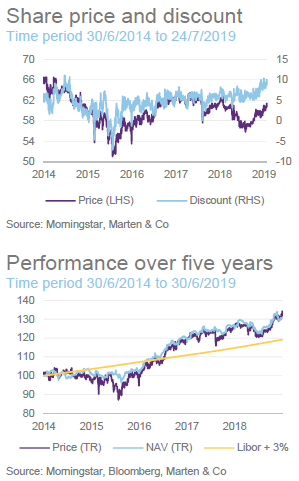

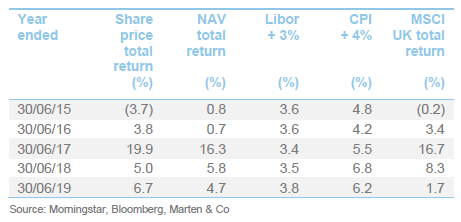

We think that a strategy such as NCYF’s (one that is focused on generating a high level of income while protecting and modestly growing capital) is best assessed by looking at the size and consistency of its total returns over longer-term horizons. In the short term, at least, we think it inevitable that NCYF will lag equities, particularly when these markets surge ahead in risk on phases. Similarly, it is likely to lag cash returns in difficult periods when both fixed income and equity markets are struggling. However, as illustrated in Figure 12, NCYF has provided NAV and share price total returns, over the longer-term 10-year period, that have outperformed both the UK equity market (as represented by the MSCI UK Index), Libor + 3% and CPI + 4% – all by some margin. Whilst it falls mildly behind equities over five years in NAV terms (it’s still ahead in share price total return terms), it beats both Libor +3% and CPI+4% significantly. It is also the top performer over the three-year period, in both share price and NAV terms. We think this is impressive given NCYF’s fixed income focus.

In the shorter one-year and six-month periods, the market retrenchment at the end of 2018 and subsequent rally in 2019 is clearly visible. The MSCI UK Index strongly outperforms the rest of the comparators over six months as equities recovered, but provides the most meagre returns over one year, which includes the period where the market fell back sharply. Ian would like to have taken greater advantage of the retrenchment, but he says that this was, in practical terms, impossible. Spreads widened but there was very little liquidity.

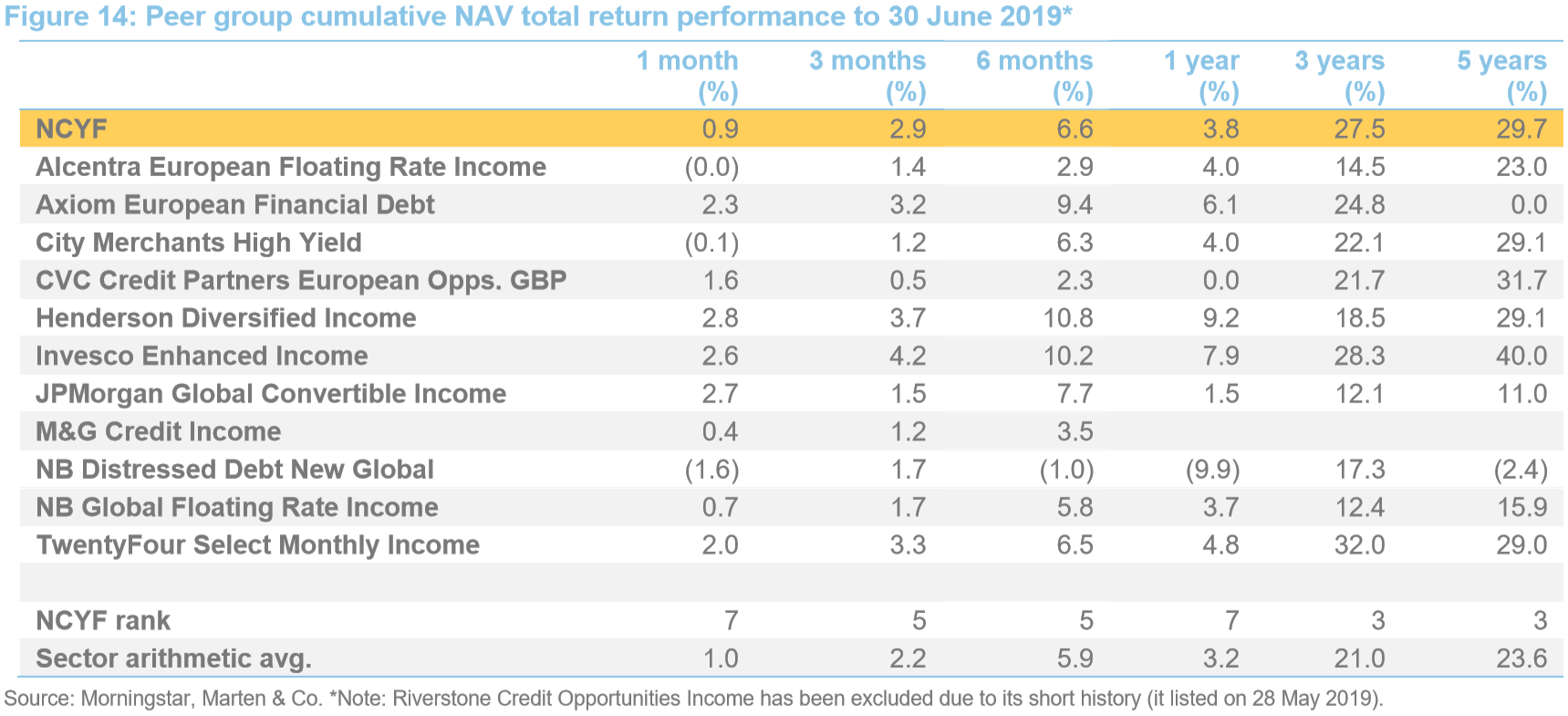

As discussed in the peer group section below, the Association of Investment Companies (AIC) has recast its sectors since we last published on NCYF. NCYF is now a member of the Debt – Loans & Bonds sector and is arguably now being compared against a more relevant group of peers. Although the new sector is more fixed income focused, it does not have the same emphasis on generating high income. It is therefore not surprising that, as is illustrated in Figure 13, NCYF tends to exhibit higher volatility than the peer group average, but, as illustrated in the peer group section, this is compensated for by its above average returns. The previous trend of NCYF being generally less volatile than the MSCI UK Index, despite providing superior long-term performance, remains intact.

Peer group

Peer group

New peer group – Debt – Loans & Bonds

New peer group – Debt – Loans & Bonds

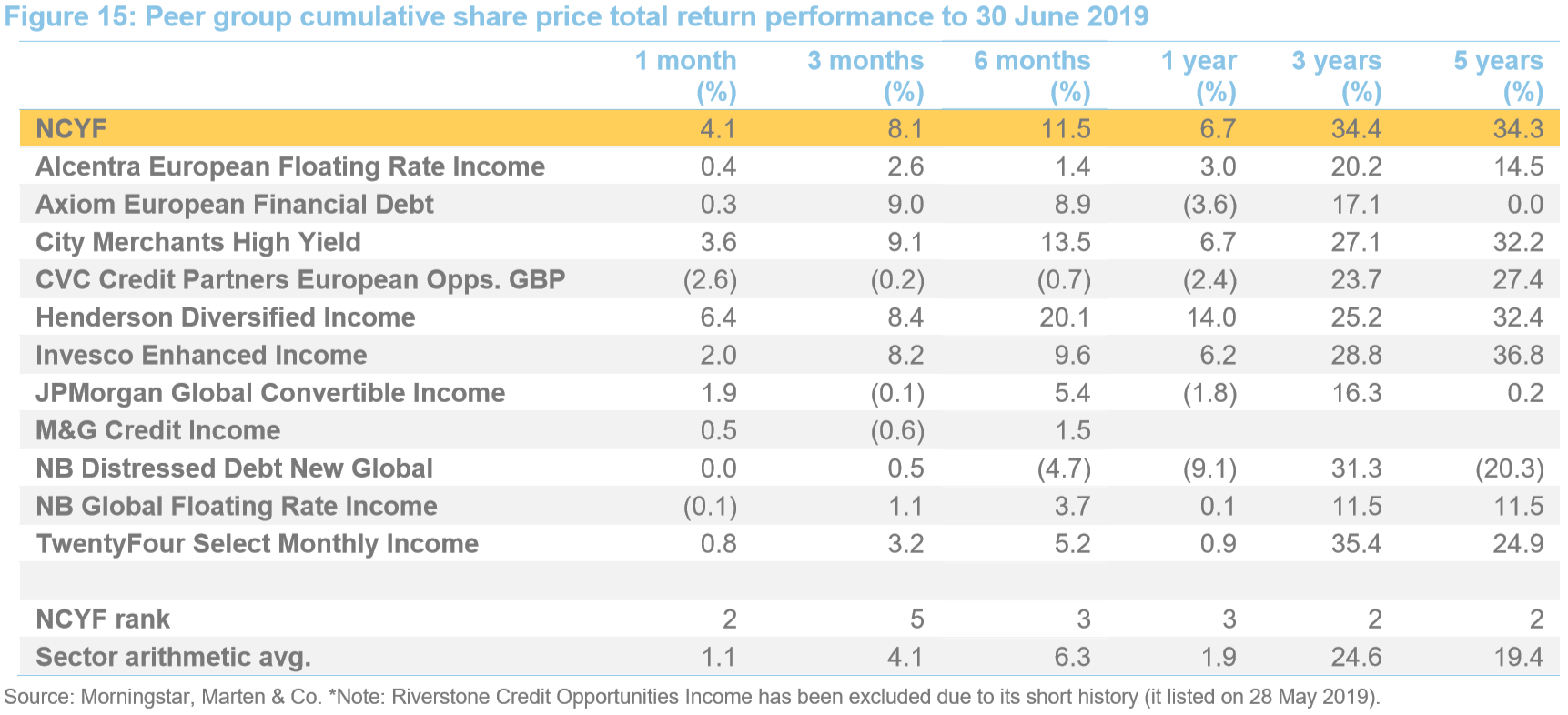

Since we last published on NCYF, the AIC has recast its sectors. NCYF, which was formerly in the UK equity and bond income sector, has been allocated to Debt – Loans & Bonds. This is comprised of 13 members, which are detailed in Figures 14 to 16 (readers interested in details of NCYF’s former peer group should see pages 10 and 11 of our March 2018 initiation note). For the purposes of this analysis, we have excluded Riverstone Credit Opportunities Income from the peer group comparisons in Figures 14 and 15. We consider that its relatively short history (it listed on 28 May 2019) does not make it a useful comparator.

As noted in the performance section above, NCYF’s new peer group is more focused towards debt investment rather than generating high levels of income.

Members of Debt – Loans & Bonds will typically:

- have over 80% invested in general debt instruments such as secured loans and bonds and syndicated lending; and

- an investment objective/policy to invest in general debt instruments such as secured loans and bonds and syndicated lending.

As illustrated in Figure 14, NCYF’s cumulative NAV total return performance is ahead of the peer-group average for most of the time horizons provided; the exception is the one-month period, but, as previously noted, we consider longer-term time frames to be more relevant to this strategy.

Figure 15 illustrates a similar story for share price total return, although NCYF is ahead of the peer group average for all of the time-periods provided. Its sector ranking is high over the longer-term periods and, perhaps reflecting the consistency of returns provided by NCYF, there isn’t a fund that consistently outperforms it.

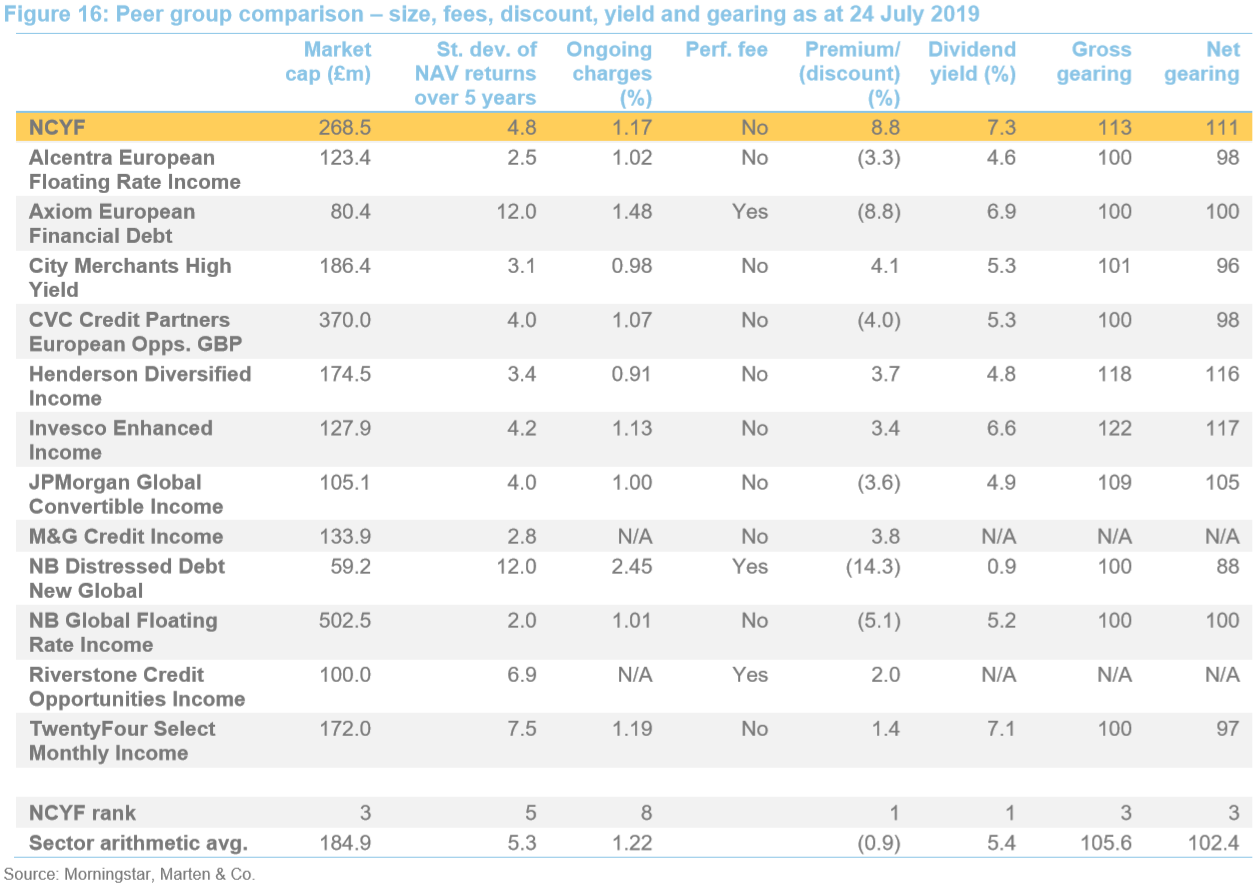

NCYF is one the larger funds in the peer group (it is third largest in terms of market capitalisation) and, whilst it is markedly smaller than the top two funds (CVC Credit Partners European Opportunities and NB Global Floating Rate Income), NCYF is well positioned to grow. NCYF is trading at a premium rating (it has the largest premium which arguably reflects that it also offers the highest yield), which has allowed NCYF to continue to issue stock. Its return volatility is also modestly below the peer group average.

NCYF’s ongoing charges are below the sector average for the peer group (the peer group average of 1.22% is pulled up by NB Distressed Debt) although they are above the sector median (1.17% versus 1.07%). However, all things being equal, these should continue to fall as NCYF grows and its fixed costs are spread over a larger asset base. NCYF like most of the funds in this peer group, does not pay a performance fee.

For income funds such as these, the yield level is a key determinant in the attractiveness of the fund to investors and so, perhaps, it is not surprising that NCYF, with its peer-group-topping yield (some 40bp above its closest peer), has the highest premium/lowest discount. Gearing is another consideration and can be more of a concern for investors when markets are at more elevated levels. NCYF’s gearing levels are above to the sector average although they are not the highest in the sector.

Quarterly dividend payments

Quarterly dividend payments

Subject to market conditions and the company’s performance, financial position and financial outlook, the board intends to pay an attractive level of dividend income to shareholders on a quarterly basis. The company intends to pay all dividends as interim dividends.

For a given financial year, the first interim dividend is paid in November (2018: 1.00p) with the second, third and fourth interims paid in February, May and August. As illustrated in Figure 17 below, the quarterly dividend rate paid for the first quarter has been maintained for the second and third interims in December and March, which is followed by a larger ‘balloon payment’ for the fourth quarter. Although not a formal aspect of NCYF’s dividend policy, the total annual dividend has increased every year since launch.

As illustrated in Figure 17, for the year ending 30 June 2018 NCYF paid a total dividend for the year of 4.42p (2017: 4.39p), which is a yield of 7.3% on NCYF’s share price of 60.70p as at 24 July 2019. However, NCYF has maintained its interim dividend at 1.0p per share for the first three interim dividends of the year ended 30 June 2019 and has now announced its fourth interim dividend at 1.45p matching last year’s final dividend payment of 1.45p per share, a total dividend of 4.45p per share.

Approximately one year’s worth of dividends in reserve

Approximately one year’s worth of dividends in reserve

As Figure 17 shows, NCYF’s revenue income has also exceeded its dividend in recent years allowing the company to build on its revenue reserve. As at 31 December 2018, NCYF had a revenue reserve of 4.16p per share (30 June 2018: 4.25p). While this has fallen modestly during the last 12 months, NCYF still has revenue reserves that are close to one year’s worth of dividend payments. Although the board has not indicated an intention to do so, these reserves could be used to maintain the dividend should it become uncovered in future years. It should also be noted that the board is conscious of the diluting effects of share issuance on the revenue reserve and avoids issuing stock close to ex-dividend dates.

Premium/(discount)

Premium/(discount)

Persistent premium indicates strong demand for NCYF’s strategy

Persistent premium indicates strong demand for NCYF’s strategy

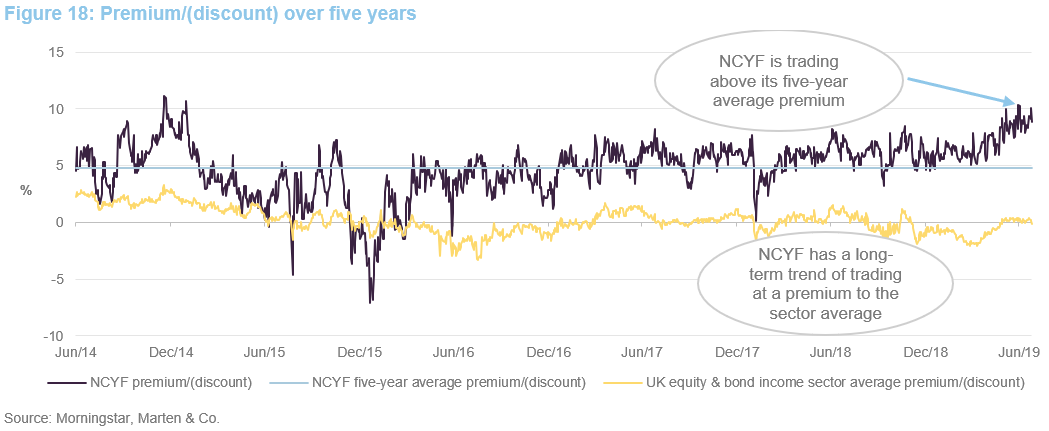

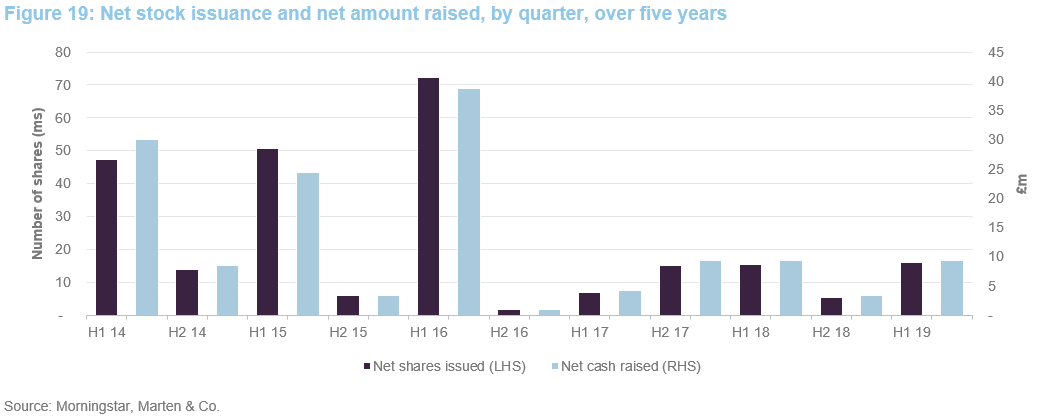

As illustrated in Figure 18, NCYF has predominantly traded at a premium during the last five years. This suggests good demand for NCYF’s strategy, which is reflected in an ongoing programme of share issuance. During the last 12 months, NCYF has issued 21.5m shares, or 5.4% of its issued share capital, raising £12.5m.

NCYF has the authority to issue up to 10% of its issued share capital and repurchase up to 14.99% of its issued share capital, which gives it mechanisms through which it can moderate its premium or discount. The board says that it monitors the level of the company’s discount or premium to NAV although there is no formal target for either and there is no formal discount control mechanism in place.

NCYF is currently trading above its five-year average premium. Whilst this is consistent with moves in the sector average (see Figure 18), NCYF hasn’t issued any shares since 12 June 2019 and the lack of new issuance to satisfy ongoing demand is a likely contributory factor in the rising premium. As discussed overleaf, NCYF’s managers are keen to see the fund grow in a measured way. Considerable care is taken not to dilute the revenue account, and the managers wanted to be sure that any new issuance would cover itself in terms of revenue income generated until the next ex-dividend date (the latest ex-dividend date was the 25 July 2019). This explains the pause in issuance from 12 June. Irrespective of this, it is clear from Figure 18 that NCYF generally trades at a premium to the wider Debt – Loans and Bonds peer group.

Stock issuance continues at a 5% to 7% premium

Stock issuance continues at a 5% to 7% premium

Using the closing cum-fair NAV on the day of the trade, we estimate that the average premium at which NCYF has issued shares is 6.1% during the last 12 months. The premium to the closing price ranges between 5.3% and 7.6% but it would appear that the board is open to providing liquidity to the market at the 5% to 6% premium level, although this is by no means guaranteed. However, issuing new shares at a premium to NAV is accretive to existing shareholders.

Significant room to grow

Significant room to grow

The managers say that NCYF’s strategy could comfortably support an AUM that is a multiple of its current size, without negatively impacting on their ability to generate returns, and so there is considerable room to expand the fund from here. The managers are keen to do this in a controlled and measured way that allows them to be selective in their asset purchases, but subject to this proviso, we would welcome further issuance as it should not only improve liquidity in NCYF’s shares but, all things being equal, should reduce its ongoing charges ratio by spreading its fixed costs over a larger asset base.

As discussed on pages 13 and 14 of our March 2018 initiation note, NCYF previously created treasury shares as an efficient means of raising capital (see pages 13 and 14 of that note). The last of these treasury shares were issued on 17 May 2018 and, since this time, NCYF has been issuing new shares using a blocklisting facility.

Factors affecting NCYF’s ongoing premium/(discount)

Factors affecting NCYF’s ongoing premium/(discount)

Assuming that the board continues to issue shares at similar premium levels, this should prevent the average premium from expanding much beyond the current level. Rising interest rates, or perhaps a surge in equity markets, could see a reduction in demand for NCYF’s shares, putting downward pressure on the premium. However, the prospects for this could be limited, given that equity markets are trading at valuations that are moderately high compared to history and that the duration of NCYF’s portfolio is relatively short, limiting its sensitivity to interest rate rises.

NCYF’s strong yield is a key factor driving the demand for its shares, in our view. We believe that, provided NCYF continues to deliver its high yield and attractive returns, and investors continue to seek assets that are less correlated with traditional equity markets, there is clear support for the current premium level, and further asset growth from here.

Fees and costs

Fees and costs

Base management fee of 0.8% per annum; no performance fee

Base management fee of 0.8% per annum; no performance fee

Under the terms of the investment management agreement, CQS is entitled to receive a basic management fee of 0.8% per annum of total assets (less current liabilities other than bank borrowings) up to £200m and 0.7% per annum above this. The management fee is paid monthly in arrears and there is no performance fee element. The management agreement can be terminated on 12 months’ notice by either side.

Secretarial and administrative services

Secretarial and administrative services

Company secretarial services are provided by R&H Fund Services (Jersey) Limited. Administration functions, including UK compliance oversight, has been delegated to Maitland Administration Services (Scotland) Limited (formerly R&H Fund Services Limited). Custody and settlement services are undertaken by HSBC Bank Plc.

The UK administrator is entitled to a fixed fee of £130,000 per annum and a variable fee of 0.01% of total assets (less current liabilities excluding any bank borrowings) in excess of £200m.

Allocation of fees and costs

Allocation of fees and costs

In NCYF’s accounts, the investment management fees are allocated 25% to capital and 75% to revenue. The ongoing charges ratio for the year ended 30 June 2018 was 1.17% (2017: 1.21%), and it seems likely that it will have fallen further over the year ended 30 June 2019.

Capital structure and life

Capital structure and life

Simple capital structure

Simple capital structure

NCYF has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 24 July 2019, there were 422,401,858 in issue with none held in treasury.

NCYF is permitted to borrow and the board sets borrowing limits, which it reviews on a regular basis, to ensure gearing levels are appropriate to market conditions. As at 30 June 2018, the maximum gearing level was set at 25% of net assets. NCYF has a £35m loan facility with Scotiabank, which bears an all-in rate of 2.01% and expires in December 2020. As at 31 May 2019, NCYF had gross gearing of 12.1% and net gearing of 8.8%.

Unlimited life with an annual continuation vote

Unlimited life with an annual continuation vote

NCYF does not have a fixed winding-up date, but at each annual general meeting (AGM), shareholders are given the opportunity to vote on the continuation of the company as an investment company. This is an ordinary resolution. If this resolution were not passed, the board would put forward proposals to liquidate or otherwise reconstruct or reorganise the company.

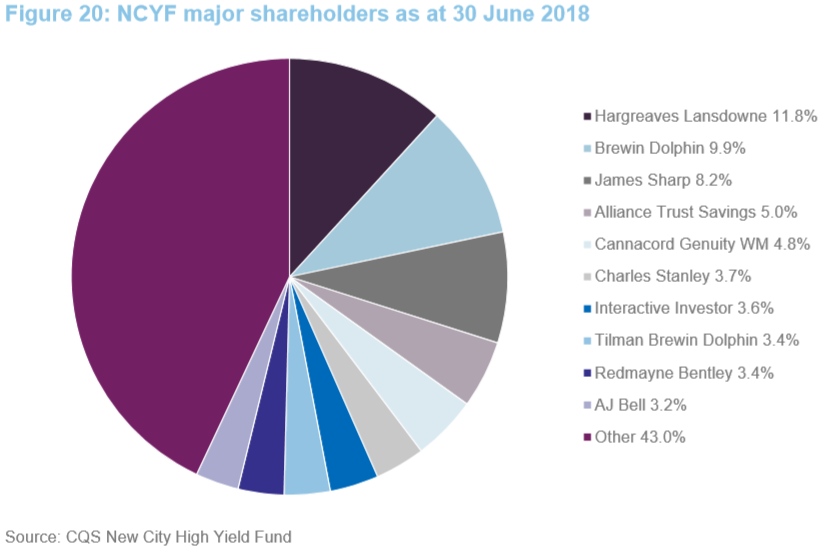

Major shareholders

Major shareholders

Financial calendar

Financial calendar

The trust’s year-end is 30 June. The annual results are usually released in October (interims in March) and its AGMs are usually held in November of each year. As discussed on page 17, NCYF pays quarterly dividends in November, February, May and August.

Corporate history

Corporate history

NCYF is a Jersey-domiciled closed-ended investment company incorporated on 17 January 2007. Its shares, which have a premium main market listing, have been listed on the London Stock Exchange since 7 March 2007. NCYF was established for the purposes of moving the domicile of its predecessor vehicle, New City High Yield Trust Plc (NCYT), from the UK to Jersey. On 6 March 2007, the net assets, which totalled £52.9m, were transferred from NCYT into NCYF and an additional £15m of new capital was raised at the same time. The primary rationale for this change was to enhance net distributable income and increase investment flexibility. Prior to becoming NCYT, the trust had been through a number of iterations but always had a high-yield focus. The original vehicle was launched by Lazards in 1993.

Board

Board

NCYF’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. Other than NCYF’s board, its directors do not have any other shared directorships. The company’s articles of association limit the aggregate fees payable to the directors to a total of £250,000 per annum.

NCYF’s articles of association require that board members offer themselves for re-election at least once every three years. Board members that have served for nine or more years must offer themselves for re-election annually. The last three years have seen all of the remaining directors that were appointed at NCYF’s 2007 launch retire (the last was the chairman, James West, who retired in December 2018 following the company’s AGM). Consequently, the average length of service is relatively short at 2.6 years.

The longest-serving director is Duncan Baxter, who joined the board in July 2015. Wendy Dorman is scheduled to stand for re-election at this year’s AGM; Ian Cadby and John Newlands and scheduled to stand for re-election at the 2020 AGM; and Duncan Baxter and Caroline Hitch are due to stand for re-election at the 2021 AGM. Caroline Hitch became chair at the conclusion of the company’s AGM on 14 December 2018, replacing James West.

Caroline Hitch (chair)

Caroline Hitch (chair)

Caroline has worked in the financial services industry since the early 1980s, mostly with the HSBC Group, where she spent 24 years, working in London, Jersey, Monaco and Hong Kong. During her time at HSBC, she had an investment focus on multi-asset portfolios and a particular interest in transparency and governance. She also held several different investment roles including managing institutional global fixed income portfolios. This included a period as head of wealth portfolio management at HSBC Global Asset Management (UK) Ltd. Prior to HSBC, Caroline spent a number of years with James Capel and Standard Chartered. She is also a director of Schroder Asian Total Return Investment Company Plc and Standard Life Equity Income Trust Plc. Caroline has a degree in Economics from the University of Cambridge.

Wendy Dorman (chair of the risk and audit committee)

Wendy Dorman (chair of the risk and audit committee)

Wendy is a chartered accountant with over 25 years’ experience in taxation, gained both in the UK and offshore. Initially an auditor, before specialising, Wendy’s career has included time both in practice and in industry. Previously based in London, Wendy moved to Jersey in 2001 where she was the partner in charge of Channel Islands tax practice of PwC until she retired in June 2015.

Wendy served as President of the Jersey Society of Chartered and Certified Accountants from 2008 to 2010. She also served as chairman of the Jersey branch of the Institute of Directors from 2014 to 2016. In addition to NCYF, Wendy is a non-executive director of 3i Infrastructure Plc, Jersey Electricity Plc and Jersey Finance Limited.

Duncan Baxter (director)

Duncan Baxter (director)

Duncan is a retired senior banker with over 25 years’ experience of international banking, latterly as managing director of Swiss Bank Corporation in Jersey. He began his banking career in 1973 with Barclays International Bank in Harare, Zimbabwe, before joining RAL Merchant Bank in 1978. From 1988 to June 1998, he served as managing director of Swiss Bank Corporation and was responsible for developing its operations in Jersey. Duncan left following the merger with UBS AG and has undertaken a number of consultancy projects for international banks and investment management companies.

Duncan has considerable experience as a non-exec director. He is currently a director of Highland Gold Mining Ltd, but has in the region of 50 former directorships, which include a number of investment companies (for example, 3i Quoted Private Equity Limited, Aberdeen Asian Income Fund Limited, Alternative Investment Strategies Limited, American Income Trust Limited, Exeter Smaller Companies Income Fund Limited and Premier Equity Income & Bond Trust Limited).

Duncan is a Fellow of Institute of Chartered Secretaries and Administrators, the Securities Institute, the Chartered Institute of Bankers, the Institute of Management and the Institute of Directors.

Ian Cadby (director)

Ian Cadby (director)

Ian has over 27 years’ experience as a board executive and investment manager within the hedge fund and derivatives trading industry, spanning a number of jurisdictions including Asia, USA, UK and Jersey. He also has extensive experience in board strategy, corporate governance and risk management. Ian was formerly the CEO of Ermitage Ltd and has held senior positions at Cadby Wauton, Regent Pacific and Citibank. A Jersey resident, he is founder and group CEO of Sequential Ermitage Limited (a fintech company) and is co-founder and CEO of Tiller Investments Limited (a wholly owned subsidiary of Sequential Ermitage).

Ian has a Combined Science degree from Coventry University; he has also completed the Advanced Management Programme, Business/Finance at the Harvard business School. Ian is also a director of Aberdeen Asian Income Fund Limited.

John Newlands (director)

John Newlands (director)

Following a 26-year career in the Royal Navy, John began his career in the city in 1995. Most recently, he was head of investment companies research for Brewin Dolphin from 2007 until his retirement in 2017, having previously held positions at Greig Middleton and Williams de Broë. John also formed his own consultancy, Newlands Funds Research, in 2003, and was a member of the Association of Investment Companies Statistics’ Committee from 2000 to 2017.

John has an MBA from Edinburgh University Business School and is a Chartered Engineer, having gained his degree in Electrical and Electrical Engineering from the University of Brighton. He is a member of the investment committee of Durham Cathedral and has written four books about financial history, the most recent charting the history of Dunedin Income Growth Investment Trust.

Previous publications

Previous publications

Readers interested in further information about NCYF may wish to read QuotedData’s previous notes:

- “Conservative and boring” – Initiation – 28 March 2018

- Escalators do not go to the sky! – Update – 13 November 2018

The legal bit

The legal bit

This marketing communication has been prepared for CQS New City High Yield Fund Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.