October 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in September 2023

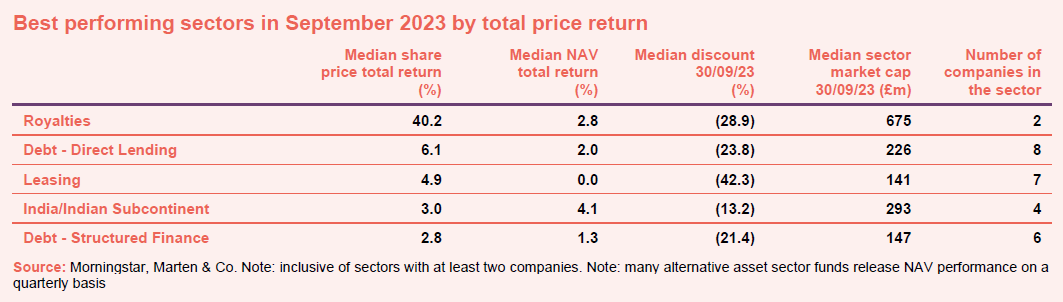

September was defined by the ongoing US bond selloff, with global markets trending down in sympathy. Investment trust returns were negative on average for the month, although several sectors still achieved positive returns.

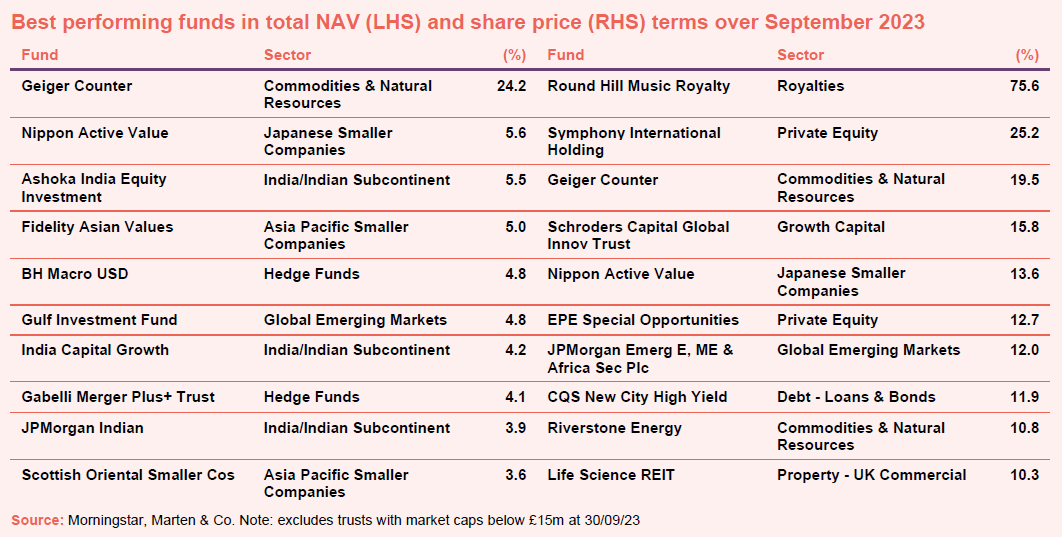

The Royalties sector was the standout performer following a cash offer from independent music company, Concord, for the outstanding share capital of Round Hill Music Royalty which represented a premium of approximately 67.3% to its closing share price. Direct lending was also strong, led by Biopharma Credit, which continues to benefit from an increasing number of floating rate loans which have a positive impact on the company’s earnings while also insulating the portfolio from rising rates.

Positive returns in the Leasing sector mark a reversion from a prolonged period of underperformance. Concerns around global growth and rising interest rates have weighed on companies like Tufton Oceanic and Taylor Maritime. Tufton’s results included an uplift in its dividend, while Taylor Maritime has been paying down debt and noted an improvement in charter rates. The India and Indian Subcontinent sector has continued its impressive run over the course of the year, benefiting from buoyant domestic markets. The economy is on track to achieve year-on-year GDP growth of 7% making it the fastest growing major economy in the world, in stark contrast to the rest of the Asia Pacific region.

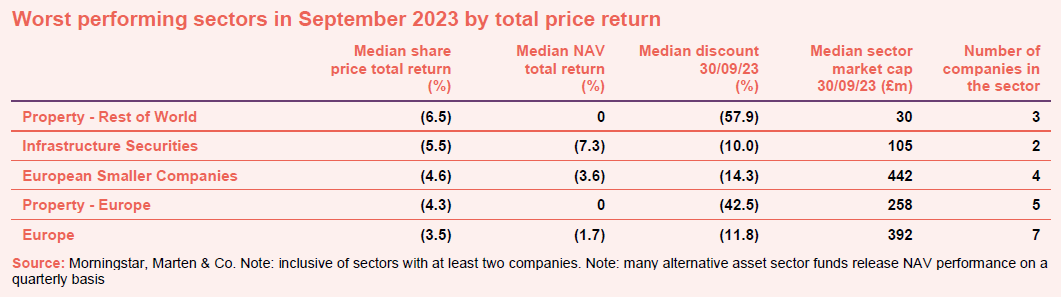

The worst performers list reflects a continuation of the year’s dominant themes, with rising rates and fears around financial stability still impacting sectors of the market sensitive to interest rates and reliant on debt financing (such as infrastructure). Of the five sectors featuring on the list, Europe is the only one with positive returns year to date, with a total price return of 9.3% despite a 3.5% drop in September. The selloff reflects the growing sense of stagflation in the region, as composite PMIs spent their fourth consecutive month in contraction, while inflation continued to track over 5%. The outlook has improved slightly since the end of the month, with flash inflation data offering a welcome reprieve, coming in below expectations at 4.3%, however there remains a long way to go in the economy’s fight for price stability.

Geiger Counter topped the list of best performing funds in total NAV return in September as uranium prices surged to their highest level in 12 years, underpinned by a global renaissance in nuclear power, as utilities race to lock in fuel supplies. Prices have been rising steadily over the course of the year. However, recent supply constraints and a growing urgency for energy security have seen these surge toward levels not seen since the 2011 Fukushima disaster.

Nippon Active Value was also up strongly for the month, bucking the trend of its Japanese Smaller Companies counterparts with the sector down -2.4% on average. The company had announced a merger with Atlantis Japan Growth the month prior, which was met with a rather tepid reaction, however the release of its interim report reaffirmed the underlying quality of the portfolio.

The bulk of the other best performers have benefited from exposure to Indian markets which, as noted above, have outperformed this year, boosted by world leading growth rates. The economy has been a benefactor of the diversification of global supply chains away from China, in addition to long running economic and capital market reforms which began prior to the pandemic. While the outlook for the region remains positive, recent reports have suggested some areas of the economy, particularly within the mid and smaller cap sectors, have been experiencing a surge in speculative interest which have driven up valuations dramatically, with some commentators comparing the rally to that of the meme stock surge seen in the US in 2021.

The BH Macro hedge funds returns were predominantly due to USD appreciation stemming from the rally in long end USD treasuries. Sentiment towards the Gulf markets was helped by a higher oil price.

In terms of share price return, Round Hill Music led the way following the buyout offer discussed on page one. Symphony International rallied on the back of an announcement that the fund will begin to return capital to shareholders following a strategic review. It Is not immediately clear what drove the returns of private equity peer, EPE Special Opportunities, with the company continuing to struggle in the current macro environment given the lack of alignment in pricing expectations, however management did note in its recent interim report that there are indications that the trading environment is stabilising.

Nippon Active Value’s share price rose as it moved to trade on the Premium-listed segment of the London Stock Exchange and shareholders approved the mergers with Atlantis Japan and abrdn Japan. Riverstone Energy’s tender offer was approved by shareholders.

Worst-performing

As noted on page two, the worst performing funds reflect a continuation of the year’s dominate themes. Higher rates have increased concerns around the availability and cost of financing, in addition to the added competition from money market funds which are now providing steady returns without the associated credit and duration risks. This has been particularly harrowing for the infrastructure and renewable energy sectors which have endured a horrid run, reflected in median discounts well above 20%. Premier Miton Global Renewables, whose returns are geared by its zero dividend preference shares, was particularly badly affected.

The latest surge in real bond yields has weighed heavily on gold with the precious metal falling almost 5% over the course of the month, driving down the Golden Prospect Precious Metal fund.

Higher long-term bond yields spell bad news for growth-focused funds such as Edinburgh Worldwide and Montanaro European. Global funds, Manchester & London, and Martin Currie Global Portfolio, both suffered from overweight exposures to large cap US tech, which pulled back over September. For example, NVIDIA, a dominant holding for both companies, was down 12% over the course of the month.

In terms of share price return, Digital 9 Infrastructure has found itself particularly vulnerable with concerns around funding translating into a decision to omit a dividend payment, and its discount has now stretched to more than 60%. It is a similar story for Regional REIT – both funds were discussed by Andrew McHattie in our weekly show on Friday 6 October.

Gresham House Energy Storage, which targets a still relatively nascent market, was trading at asset value in June, but its share price has now capitulated to the general selloff in renewable energy funds, with the company’s discount widening to 40%. Foresight Sustainable Forestry’s share price fall may be related to the collapse in UK carbon credit prices that followed the government’s watering down of its climate policies. The selloff in the Growth Capital and Smaller Companies sectors has been equally harrowing with Chrysalis Investments and Petershill Partners also feeling these effects.

The European sector also featured heavily on the NAV list. As noted on page two, the economy continues to deal with slowing growth and stubborn inflation which is weighing on performance in the region.

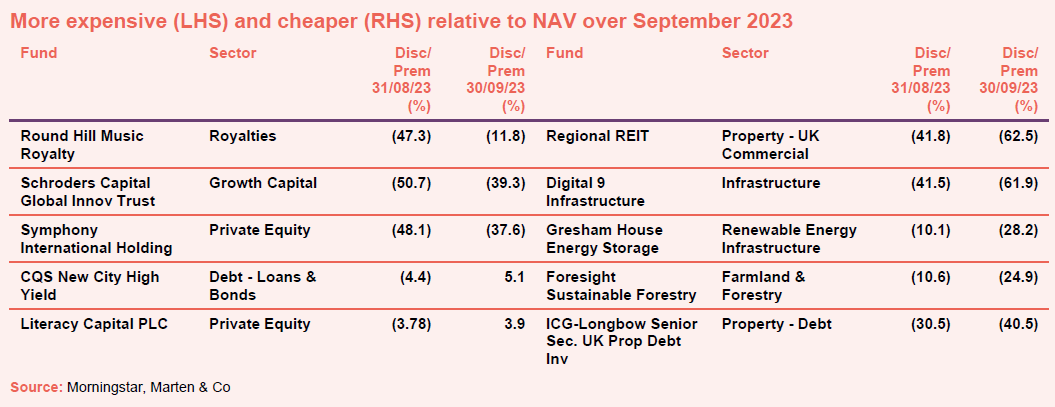

Moves in discount and premiums

In terms of discounts, Round Hill Music narrowed significantly following the buyout offer. The Schroders Capital Global Innovation trust saw its discount close as shares rallied over the course of the month. However, this comes on the back of relatively thin volume and should be put in context with the fund’s steadily falling NAV. Symphony’s wind-up proposal narrowed its discount. CQS New City High Yield has adapted to the higher rate environment, with the company able to rollover some of its loans at a higher coupon, in addition to the origination of several new loans helped by fundraising earlier in the year. The adviser did note, however, that this has been a double-edged sword with rising costs putting pressure on the operating activities of several of its portfolio companies. Literacy Capital saw a positive market reaction from the sale of one of its largest assets for a >50% premium to carrying value.

For those funds getting cheaper, shares of Regional REIT collapsed following the company’s interim report which showed net rental income continuing to fall, impacted by higher non-recoverable property costs and lower income from lease surrender, dilapidations payments and other income. Gresham House Energy Storage and Foresight Sustainable Forestry were discussed above. ICG-Longbow Senior Secured UK Property Debt Investments continues to experience challenges as it works through the orderly realisation of its assets, notably it has seen the appointment of receivers across several of its loans.

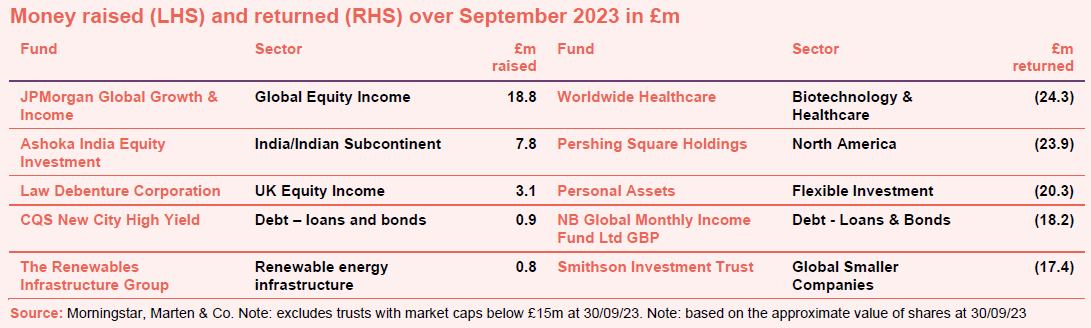

Money raised and returned

September saw minimal fundraising, a continuation of what has been a very subdued few months. JPMorgan Global Growth & Income maintained its steady momentum for the year, thanks to a solid period of outperformance, while Ashoka India Equity Investment has continued to benefit from the stability provided by markets in India.

It was a case of the regular suspects for those companies returning cash, outside of the NB Global Monthly Income Fund which announced a managed wind down back in January, with a partial compulsory payment being redeemed in September.

Major news stories and QuotedData views over September 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

| · abrdn Asia Focus Group Update – 18 October

· Tufton Oceanic AGM – 24 October |

· JPMorgan Mid Cap Investment Trust AGM– 1 November

· JPMorgan Global Growth & Income– 3 November. |

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 7 July | FP | Steve Marshall | Cordiant Digital Infrastructure |

| 14 July | SONG, TLEI, USF | David Smith | Henderson High Income |

| 21 July | DGN, DGI9, ABD | Ian Lance | Temple Bar |

| 28 July | RNEW, HDIV, ASCI | Uzo Ekwue & Pav Sriharan | Schroders British Opportunity Trust |

| 4 August | BPCR, TLEI | Fotis Chatzimichalakis | Impax Asset Management |

| 11 August | GCP/GABI/RMII, HGEN, NAVF/AJG | Helen Steers | Pantheon International |

| 18 August | TLEI, RSE, BSIF, NESF, EPIC, ESP | Richard Moffit | Urban Logistics |

| 25 August | USF, RICA, TLEI, EPIC, HOME | Iain Pyle | Shires Income |

| 1 September | HEIT, SOHO | Ed Simpson | GCP Infrastructure |

| 8 September | RNEW, RHM, RMII | Prashant Khemka | Ashoka WhiteOak |

| 15 September | EPIC, SONG, SUPR, TLEI | Dean Orrico | Middlefield Canadian Income |

| 22 September | AIG, GABI, GCP, HICL | Andrew Jones | LondonMetric Property |

| 29 September | DGI9, GIF, HICL, SONG | Carlos Hardenberg | Mobius Investment Trust |

| 6 October | ORIT, PSH, RGL | Alan Gauld | abrdn Private Equity |

| Coming up | |||

| 13 October | James de Uphaugh | Edinburgh Investment Trust | |

| 20 October | Tom Williams | Downing Renewables | |

| 27 October | Richard Sem | Pantheon Infrastructure | |

| 3 November | Craig Martin | Vietnam Holding | |

| 10 November | Ed Buttery | Taylor Maritime | |

| 17 November | Joe Bauernfreund | AVI Global Trust |

Research

Bluefield Solar Income Fund – Record year supports growth strategy

While share prices across the whole of the renewable energy infrastructure sector have been under pressure over the past 12–18 months, the execution by Bluefield Solar Income Fund (BSIF) has remained impressive, helping it to maintain its record of sector-leading distributions. The company’s record performance has been driven by locking in higher power prices through power purchase agreements (PPAs – which allow BFSI to sell energy at an agreed price, over a certain period of time). Thanks to the execution of these contracts, the board has good visibility over the bulk of company earnings for the next few years.

Henderson High Income / Henderson Diversified Income – Merger terms agreed

Henderson Diversified Income (HDIV) has agreed heads of terms for a combination with Henderson High Income (HHI). As part of the deal, shareholders in HDIV will have the option to take cash for all or part of their holding if they choose.

As the fund with most growth-orientated investment style amongst its peers (see page 21), Baillie Gifford UK Growth Trust (BGUK) has faced particularly strong headwinds during the last 18 months, as investors have either sought sanctuary in value and defensive stocks, or pulled money out of equities altogether, often in favour of fixed income stocks which are now offering a better rate of return than they have for some time.

Having concluded its acquisition of a leading property developer and asset manager, pan-African property company Grit Real Estate Income Group (Grit) has been reborn. Grit 2.0 has a greater and more achievable return target (of between 12% and 15% per annum) thanks to the controlling stake it now owns in Gateway Real Estate Africa (GREA) and its attractive pipeline of net asset value (NAV) accretive, risk-mitigated development projects – most notably diplomatic residences across the continent that are let to the US government.

Ecofin US Renewables Infrastructure Trust – Storm damage reparable

Ecofin US Renewables (RNEW) has been impacted by tornado damage to a substation in Texas, cutting off its wind farm’s connection to the local power grid. This is going to act as a temporary constraint on cash flows generated by this particular investment. As we explain on page 4, insurance will cover much of the loss. Nevertheless, the board has prudently reduced the company’s dividend for the third and fourth quarter of 2023.

Thanks to the combination of both high-yielding stocks and debt within its portfolio, Henderson High Income (HHI) gives its manager, David Smith, the toolkit he needs to navigate the higher inflationary environment that has dictated the fortunes of the UK stock market. David has greater ability to find investments with sufficient income payments to keep up with rising prices.

abrdn Private Equity Opportunities Trust – Unrecognised success

Given that abrdn Private Equity Opportunities Trust (APEO) is one of the few ways in which the average investor can access a diverse pool of private equity managers (many smaller investors do not meet the size threshold to invest directly in private equity LP funds), and has produced impressive long-term returns well ahead of comparable equity indices and its peer group average, one might expect its share price to trade close to its net asset value (NAV). However, that is clearly not the case currently. APEO continues to trade on a stubbornly wide discount to NAV of 42.0%, due to investors’ fears around valuations or market outlook, both of which may be misplaced.

Pantheon Infrastructure (PINT) is less than two years old and is still adding to its portfolio. The most recent commitment is to Zenobe, a battery storage and electric vehicle fleet specialist. This was in conjunction with Infracapital – see page 5. This follows an investment in GlobalConnect (a pan-Nordic data centre and fibre business), which offers the potential to participate in the growth of demand for data across Northern Europe. It also comes with a well-regarded sponsor in EQT – see page 6.

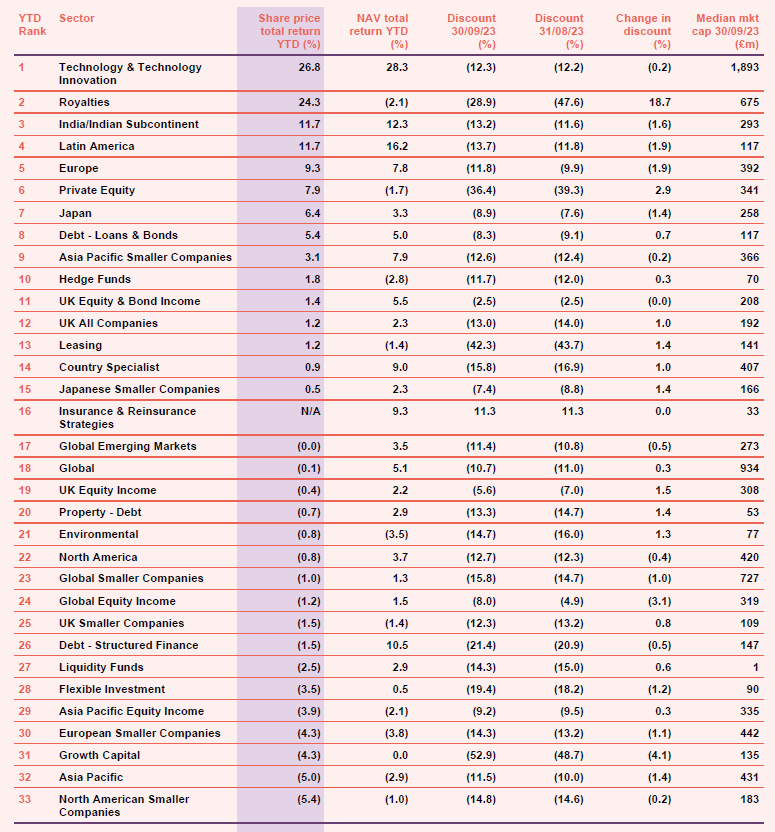

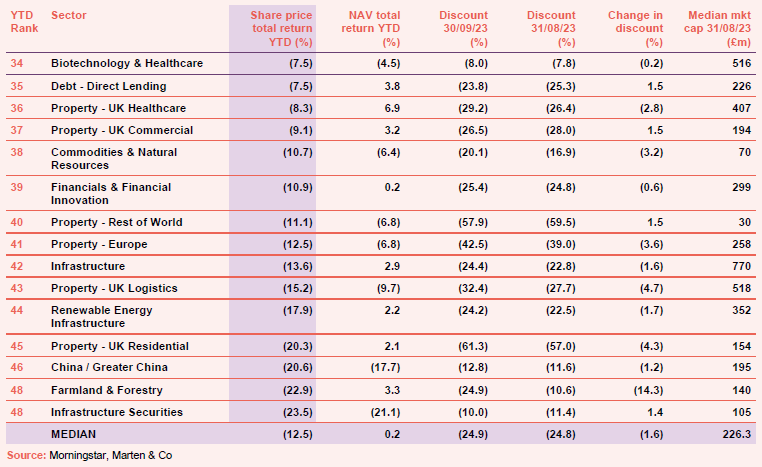

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.