Ecofin Global Utilities and Infrastructure Trust (EGL) has come through the crisis well (its NAV total return is 12.1% YTD to the end of November, outpacing the MSCI World’s 10.9%). Investors increasingly appreciate its proposition (earnings and cash flow growth in sectors with sound growth prospects and a dividend target of 4% of NAV) and the trust has seen a sustained improvement in its rating over the last 14 months. EGL’s manager, Jean-Hugues de Lamaze, considers that COVID-19 has provided a number of tailwinds to its strategy and sees a wealth of opportunities. The manager expects and is positioned for a multi-decade upswing in infrastructure development, reflecting the rapid development of renewables and the global mission to decarbonise and modernise. Valuations for listed infrastructure (including utilities) should increase to reflect this growth, and close the current valuation gap with private infrastructure assets.

Developed markets utilities and other economic infrastructure exposure

EGL seeks to provide a high, secure dividend yield and to realise long‐term growth, while taking care to preserve shareholders’ capital. It invests principally in the equity of utility and infrastructure companies which are listed on recognised stock exchanges in Europe, North America and other developed OECD countries. It targets a dividend yield of at least 4% per annum on its net assets, paid quarterly, and can use gearing and distributable reserves to achieve this.

Market outlook and valuations update

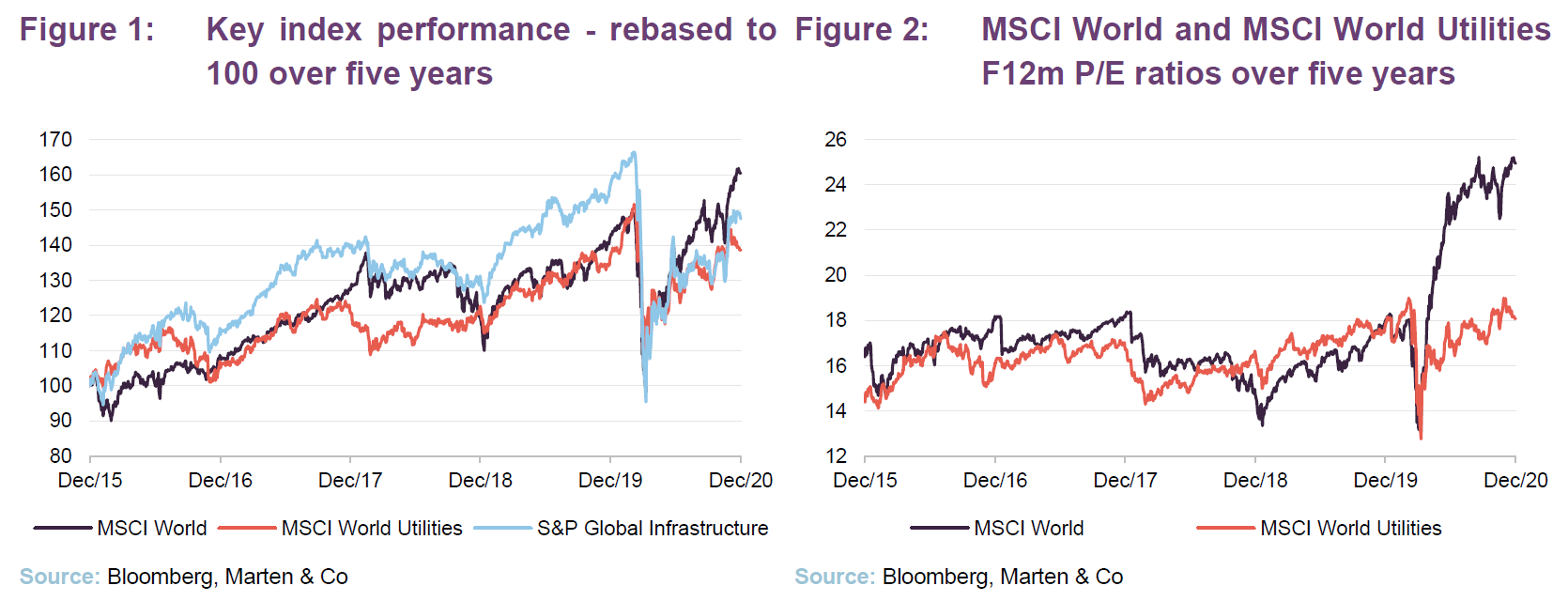

A comparison of Figures 1 and 2, provides a useful illustration as to why investors may wish to consider having an allocation to EGL’s sectors: utilities (power, water, environmental services) and other economic infrastructure (transportation services). As the number of COVID-19 cases grew and markets dived, governments and monetary authorities sought to shore up the system, pumping considerable stimulus and liquidity into markets and economies. This had the desired effect, with markets rebounding strongly over the course of the summer. However, while global utilities earnings have been resilient, the same cannot be said for all global equities and so, while the F12m P/E ratio for the MSCI World has rocketed, utilities with their more stable earnings look much more reasonably valued, even if they are trading at close to five year highs. As we discuss in the Manager’s view (the following section), EGL’s manager, Jean-Hugues de Lamaze, thinks that utilities and infrastructure sectors remain attractively valued given their long-term structural growth prospects. He also points out that on relative yield terms, utilities look very cheap on a long-term basis.

Manager’s view – strong underlying fundamentals

An interesting year for utilities so far

EGL’s manager, Jean-Hugues de Lamaze, says that it has been an interesting year for utilities so far, with lots of volatility in financial markets. Utilities have, in general, been reasonably immune from the large COVID-related falls in markets and the sharp leg-down in economic activity this year. Utilities resisted reasonably well in March during the market collapse, and earnings and dividends are proving to be resilient (EGL has only seen a few portfolio companies skip their dividends – see pages 20 and 21 – most of which were state owned groups). Not surprisingly, some transport names also cut or suspended their dividends following significant declines in toll road and especially airport traffic, but by May 90% of the portfolio had confirmed their dividends and provided earnings guidance.

November 2020 saw a significant rally in share prices generally, reflecting both the Biden electoral victory (discussed further below), and news of a couple of strong positive results in Phase III trials of COVID-19 vaccine candidates. The vaccine news led to a very dramatic recovery in infrastructure names and transportation infrastructure had an exceptional bounce, which EGL’s portfolio captured.

Recent strong performance has not put utilities into bubble territory

As discussed in the performance section on pages 17 to 20, EGL returned 9.1% and 9.2% in NAV and share price total returns respectively over November. Jean-Hugues says that, in periods of sudden strong performance such as this, you would usually expect an imminent correction but, in this instance he is feeling confident based on:

- the fundamentals of the companies that EGL holds and the structural growth coming from the economic and policy drive globally to decarbonise;

- EGL’s holdings’ recent results, as well as the guidance contained therein;

- The good news on the vaccine (the efficacy was higher than expected); and

- the election of Joe Biden.

In summary, Jean-Hugues considers that COVID-19 has provided a number of tailwinds to EGL’s strategy, the prospects for EGL’s holdings look good, utilities are not in a bubble, but are just catching up.

The election of Joe Biden is good news for US utilities and renewables

The start of November saw markets boosted by the US election result. Unlike his predecessor, President-elect Joe Biden is very supportive of moves to tackle climate change, which is hugely positive for investment in renewables. Biden has announced a $2trn investment plan to help tackle climate change and has stated that, on of his first day of office, he will be putting his signature to the COP 21 Paris Climate Agreement (an agreement that Trump famously pulled out of).

Jean-Hugues says that both measures send a very strong signal and brings the US – still the world’s largest economy, and second biggest emitter of greenhouse gases after China – back into the agreement, some 77 days after it officially left. As discussed below, progress has still been made despite the lack of support from the outgoing president, but the US will still need to put forward and implement an ambitious plan for reducing its emissions. It may also bode well for renewables development elsewhere, as by re-joining the agreement, it gives support to global diplomatic efforts to raise other countries’ decarbonisation ambitions. All of this bodes well for EGL with its renewables exposure.

Decarbonisation is a global structural trend

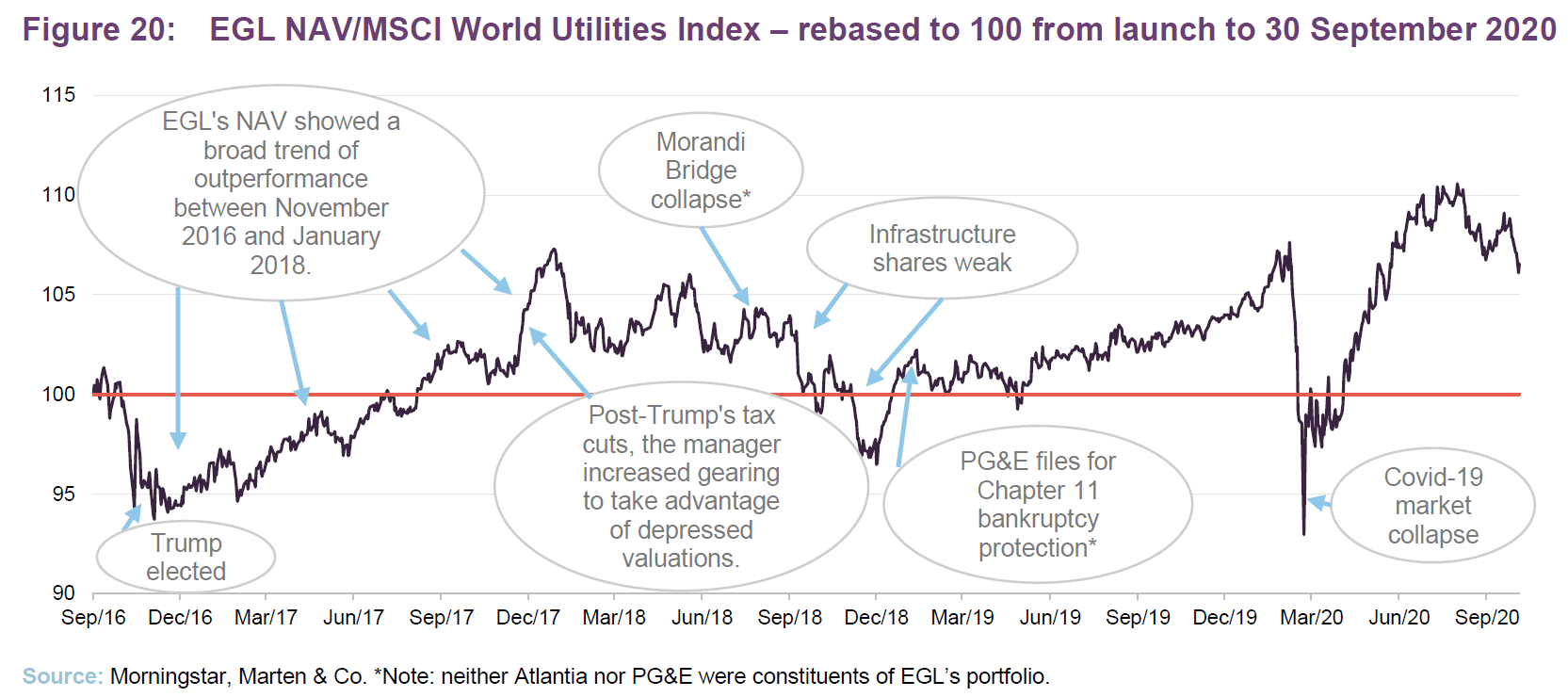

When President Trump, a vocal climate change sceptic who favours big oil, was elected back in November 2016, utilities found themselves at the sharp end of both a rotation into growth stocks (see our earlier notes on EGL for a discussion of the Trump reflation trade) and negative sentiment on the outlook for renewables (everything in the space collapsed by roughly 20%). However, the sector gradually recovered and Jean-Hugues increased EGL’s gearing to take advantage of the recovering market.

Looking back, Jean-Hugues says that Trump’s presidency did not turn out to be as negative for renewables as was expected when he was elected in 2016. In reality, states have been empowered and motivated to fix the regulation needed to advance the renewable energy space and this has been a trend, even in states that have traditionally been big proponents of fossil fuels, such as Texas and Arizona. Longer-term, Jean-Hugues thinks that the federal government has limited power to stop the development of renewables, and so this should not be a threat, even with a future change of administration.

Jean-Hugues says that the US has seen the acceleration of two key developments. First, an ongoing shift from coal to natural gas (for example, American Electric Power, which operates in states such as Texas and Indiana, has continued to phase out coal-fired units, despite these states traditionally being sceptical of climate change). Second, a growing acceptance, more generally, that renewables are the future of power production. This second development is a global trend that is now feeding through to the US. For example, in a decade much of Europe – and to a greater extent the UK – has largely phased out coal. Ten years ago, coal accounted for around 50% of UK generation; today it is 1–2%.

Even China, the largest emitter globally, is targeting net zero emissions by 2060. This is ground-breaking, as it is only 10 years behind the Paris agreement target of 2050, but it also means that a huge volume of coal-fired facilities will need to be replaced with alternative generation capacity. The shift appears to be largely demand-driven, reflecting a clear evolution of mentality. Decarbonisation is now a global structural trend that will add to the performance of utilities over the longer-term.

Further recovery prospects following market bounce?

As noted above, markets have recently been buoyed by positive news on vaccine development and the Biden win. Utilities proved to be resilient in the downturn, but what is their ability to capture the upside as markets recover? Jean-Hugues says that while the utilities in EGL’s portfolio have rallied strongly, utilities have, in general underperformed industrials and the MSCI World Index. He comments that EGL’s superior performance is a reflection of both stock selection within the utilities sector and EGL’s not insignificant exposure to improving economic activity through its investments in transportation infrastructure as well as waste services.

Looking back to the end of March when the Fed intervened, stabilising markets and thereby providing a huge fiscal and monetary response, some utilities names ran up by 60%. Jean-Hugues believes that the structural growth trends discussed above will continue to be highly supportive for certain renewables-orientated companies in the portfolio, notwithstanding short-term market conditions.

Interest rates – not such a sensitive subject?

Governments and central banks have pumped a huge amount of stimulus, both monetary and fiscal, into the global economy. Theoretically, this should be inflationary, but Jean-Hugues is not expecting interest rates to soar any time soon, as heavily indebted governments cannot afford this. In reality, it would help governments if interest rates are kept low and the real value of this debt is eroded. Consequently, if interest rates rise with a growth rebound, increases are likely to be modest leaving them still at very low levels, which Jean-Hugues says is favourable to utilities and infrastructure’s interests, and therefore EGL’s.

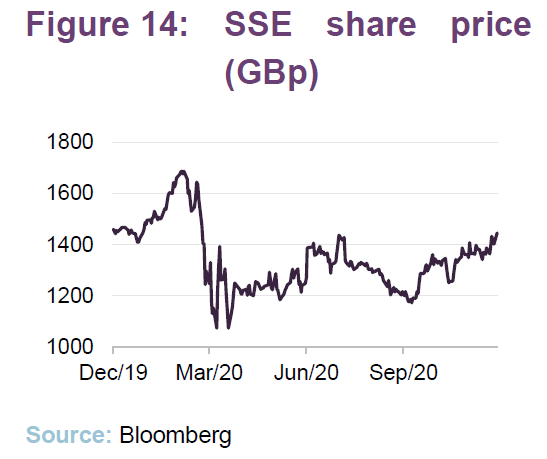

Jean-Hugues thinks the UK could end up with an inflation rate that is above the European average over the next few years, but he does not expect to see an explosion in either inflation or interest rates. However, he also thinks that with the development of renewables, most utilities (for example SSE) have quite diversified mixes of business with both regulated and contracted revenues. Consequently, few now act as bond proxies in the way that they previously did. Either way, Jean-Hugues is not looking to be smarter than the interest rate experts. Instead, he is aiming to build a portfolio that is relatively immune to interest rate movements. For example, EGL has limited exposure to UK water, which is more regulated.

An update on power prices and commodity prices

There has been an argument that an increase in the generation capacity of renewables, which effectively have a nil or very low marginal cost, has been driving down power prices and that this is a structural trend that will continue as more and more renewables come on-line. The proponents of this argument say that this is evidenced by low power prices that were evident before the onset of COVID. We think that this argument contains a number of significant flaws.

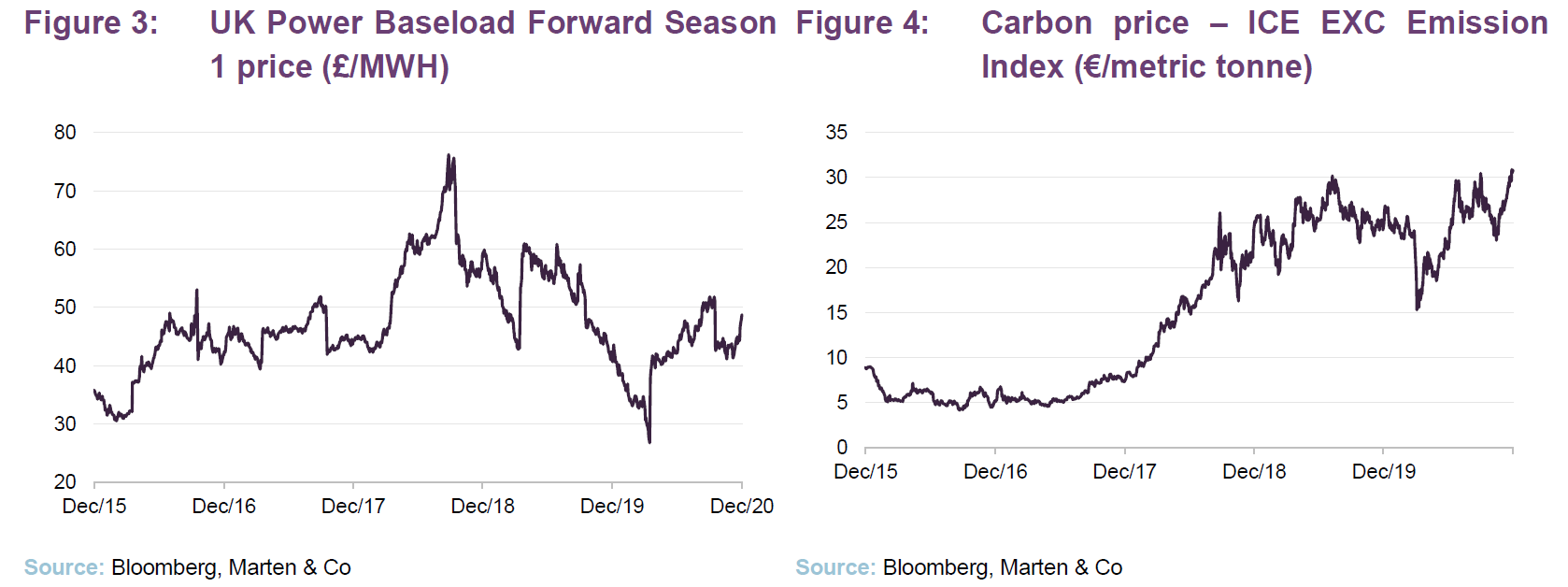

Prior to the onset of COVID-19, power prices had been on a gradually falling trend, reflecting low commodity prices, an oversupply of cheap gas and a mild winter. Restrictions imposed to control the virus have acted as a brake on certain forms of economic activity and this has driven power prices lower still. However, it was not that long ago that the reverse was also true, as is illustrated in Figure 3. In our October 2018 annual overview note (see pages 8 and 9 of that note), we explained that power prices increased meaningfully during 2018 with the primary drivers being rising commodity prices and a reform of the EU’s emission trading system (EU ETS), which led to a higher carbon price. From this perspective, the current lower power price looks to be temporary. Commodity prices, which have been depressed by a number of factors, including COVID, will likely rise again as economies recover. Furthermore, as governments press for decarbonisation, against a backdrop of higher energy demand, the carbon price will also likely rise as well.

In terms of an ongoing oversupply of renewable generation capacity, it seems highly unlikely that investors will continue to put capital into renewables projects where they cannot earn a suitable rate of return, which will act as a natural brake. Furthermore, looking to global targets for carbon emission reductions, it is clear that decarbonisation will lead to a huge increase in the demand for electricity as we shift to electric vehicles and electric heating, and so significant investment will be required before this becomes an issue. Predictions of over-capacity leading to power price slumps are not new; Jean-Hugues notes that, despite the recent falls, power prices are in fact significantly higher than was expected three to five years ago.

Valuation gap – listed versus private infrastructure

Ecofin’s manager has recently published a white paper comparing listed and private infrastructure (click here to read). Many of the themes explored in the paper are topics that we have discussed in our previous notes, such as that most infrastructure in the developed world was built post-WWII and, having aged significantly, is in need of replacement; and how government spending on infrastructure has been on a declining trend. However, the paper provides a clear illustration too of how a valuation gap has opened up between the valuations of listed and private infrastructure assets. For example:

- over the past two decades, private M&A transactions of airports globally have been concluded at valuations (EV/EBITDA multiples) which have been, on average, 40% higher than the valuations for listed assets, with individual premia on several transactions exceeding 100%;

- private takeovers in the UK water sector have, over the past three decades, been undertaken at an average valuation premium of c.30% over the target’s regulated asset base, while listed water networks have traded on average at a c.5% premium; and

- recent transactions in the renewables sector have been valuing offshore wind assets at nearly double the invested capital (often prior to any investment having taken place), which suggests that the divergence between public and private valuations can be particularly pronounced for “in-favour” assets.

Valuations for listed infrastructure stocks also appear attractive relative to their own recent history. Global listed infrastructure (indices of which comprise roughly 40-50% utilities and the balance other economic infrastructure) offers yields which are about 350bps in excess of average government bond yields (proxied by an average of US and European 10-year sovereign yields). By way of comparison, the equivalent spread was in the region of 50bps 10 years ago and troughed at negative 150bps in the period preceding the 2008 financial crisis. Jean-Hugues says that while P/Es have gone up, infrastructure yields are, on a relative basis, at their most attractive for 30 years. Furthermore, Jean-Hugues says that these dividends are very sustainable, and these companies also offer strong dividend growth prospects.

The Ecofin team acknowledges that – with its attractive cash yield and low correlation with equity markets – private infrastructure has appealed to investors, and returns have been supported by the flows of capital into the asset class. Listed infrastructure exposure has not been as highly valued thus far. The team thinks that this valuation gap is not sustainable over the longer term, presenting an opportunity for investors in listed infrastructure. The team sees three main drivers for the returns of listed and private infrastructure to converge:

- listed infrastructure screens as significantly “cleaner” environmentally, both from a static perspective and on a forward-looking basis. As ESG metrics become more and more important, investors may increasingly look to allocate capital accordingly;

- private infrastructure returns have been supported by substantial fund flows into the asset class, which, in turn, have increased competition for such assets. As returns compress due to higher valuations, investors may diversify their capital allocation into areas offering better value; and

- increasing numbers of transactions may have also reduced investors’ sensitivity to private infrastructure’s illiquidity, lowering required returns and boosting valuations.

In summary, Jean-Hugues says that it does not make sense for listed infrastructure assets to be trading at around 9x EBITDA while private assets are changing hands for around 20x. He acknowledges that private equity investors can put in higher levels of leverage and potentially extract a higher rate of return, but the valuation gap is still too large, even allowing for this.

Asset allocation

Portfolio activity

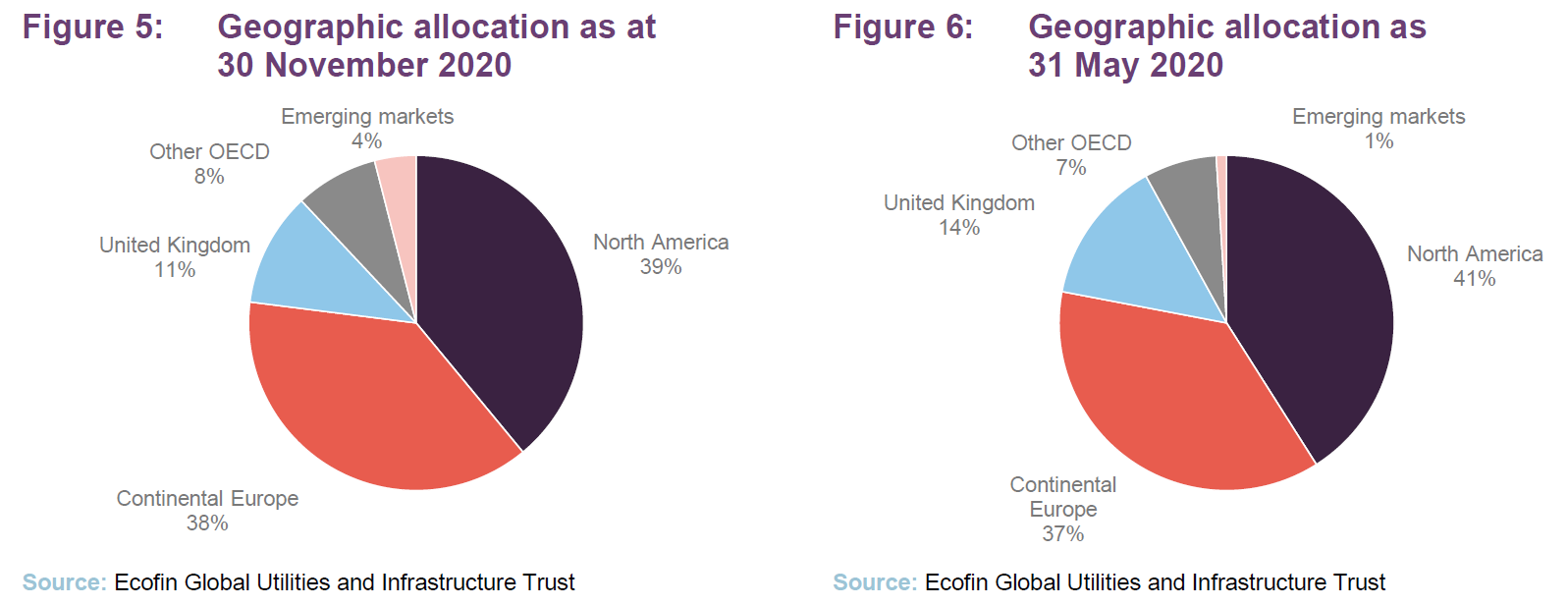

Comparing EGL’s exposures at the end of October 2020 and the end of May 2020 (the most recently-available data when we last published), the outstanding performance of China Longyuan and a new position in China Suntien are responsible for the increase in EGL’s emerging markets exposure. The UK weight has declined during this period – despite an increase in the SSE position – due to strength in other geographic regions of the portfolio and the recovery in infra/transportation services.

The allocation to renewables has increased by five percentage points to 26%, with pure regulated utilities falling by three percentage points to 21%, transportation falling by two-percentage points to 14% and integrated utilities holding steady at 39%. The number of holdings as at the end of October 2020 was 43, an increase of three relative to the end of May 2020.

Increasing exposure to transport names

We discussed toll road operator Ferrovial in our June 2020 note (see page 7 of that note), which has been an EGL holding for some time. Jean-Hugues has been increasing the position on weakness, and it benefitted from a substantial bounce in November following the positive news of a vaccine. Similarly, Atlas Arteria, another toll road operator held by EGL (an Australian company with exposure to French toll roads that we discussed in detail in our October 2019 note) is a company that Jean-Hugues has been adding to, which also benefitted in the November rally.

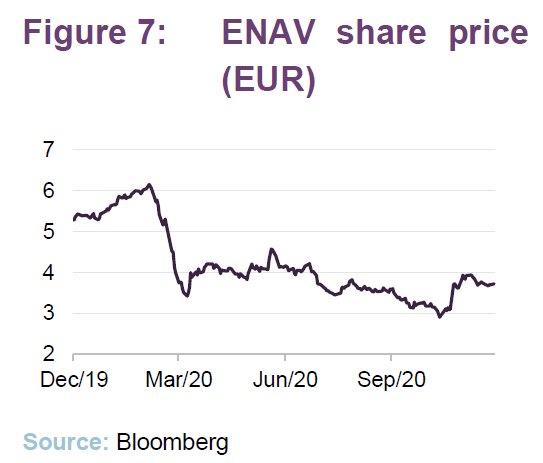

Jean-Hugues has also been increasing EGL’s investment in ENAV, the Italian air traffic controller. ENAV has a monopoly on air traffic control in Italy. Reflecting this, its revenues are regulated, and Jean-Hugues says that it operates within a pretty-solid regulatory context and has no issues with its concession. The company is not well-known, which is why Jean-Hugues was able to build a position at dividend yields of circa 6%, and has strong recovery and growth potential. Furthermore, air traffic control fees are determined by aircraft volumes and not by the number of passengers, meaning that its revenues are less sensitive to restricted passenger volumes. It is also a unique asset; ENAV is the only listed air traffic controller in the world.

Veolia – reinitiated a new position at three-year lows

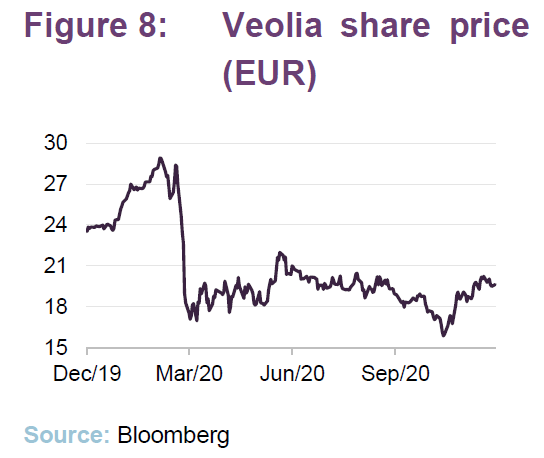

Veolia is a French utility with interests in water management, waste management and energy services. EGL previously held a position, but Jean-Hugues exited this in late 2019/early 2020, which benefitted the NAV as Veolia has been one of the worst performers in the utilities space this year. However, Veolia is a global leader in water and waste management services, placing it at the centre of the environmental sustainability and climate change themes.

Jean-Hugues says that Veolia’s share price performance decoupled from fundamentals in the second half of this year, declining to new year-to-date lows in October despite a circa 40% fall at the outset of the pandemic. This provided an attractive entry point.

Veolia’s share price has been driven, since the summer, by its bid for Suez, its main competitor. Veolia has been successful in acquiring a 30% stake in Suez from Engie. Jean-Hugues says that the market was struggling to buy into the story; Suez was saying that it would fight the acquisition and, even now that Veolia has acquired Engie’s 30%, it will still take time to get to 100%. The market was worried that this process will drag on, incurring costs, and that it will take time to see the benefits.

The Ecofin team spent a lot of time with both companies and decided that the absence of a counterbidder meant that Suez had limited options to find a way out. They concluded that if the acquisition were to proceed, this would imply significant cost efficiency savings and market share gains for Veolia, which would also imply much accelerated organic growth. They also concluded that Veolia was significantly undervalued and that with a solid earnings prospects going forward, there would be limited downside risk. Jean-Hugues began to build a new position in October, buying the stock near three-year lows.

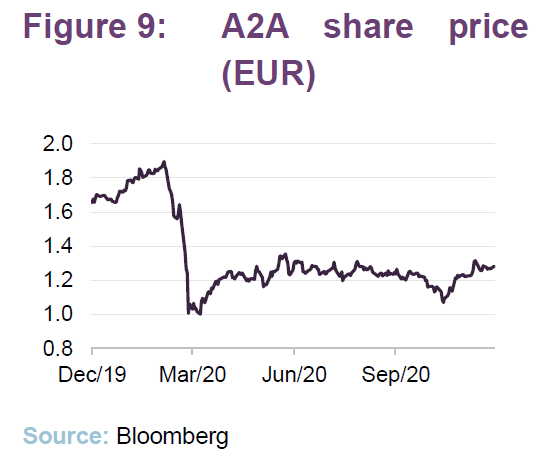

A2A – initiated a holding to benefit from strategy repositioning

A2A is an Italian utility, with a strong presence in Northern Italy, whose operations include renewable energy, electricity, gas, integrated water supply, and waste management services. A2A was created in 2007 with the merger of AEM (Azienda Energetica Municipale) of Milan and ASM Brescia (Azienda dei Servizi Municipalizzati). Partly because it is still partially owned by Milanese and Brescian municipalities (25% each), who also appoint 12 out of its 15 directors, A2A is a relatively complex company that has lagged behind in terms of rationalisation. A key concern for investors historically has been the company’s capital allocation (it has tended to apply its capital evenly across its various operating divisions, rather than focusing on the most profitable areas).

A2A saw a change of management in May 2020, and the new team are doing a full review of its capital allocation and growth trajectory, with the results expected in January 2021. It is expected that management will refocus the business on renewables and, over time, simplify the company’s operations.

A2A has been the third-worst performer in the utilities space this year (it is exposed to power prices, and while the power price in Italy has recovered, A2A’s share price has remained relatively flat), allowing Jean-Hugues to build a position on weakness. Jean-Hugues says that, there is substantial upside potential if the strategy change goes ahead as expected, and there is also upside to the standalone business.

Chinese decarbonisation

As discussed on page 6, China is also pursuing decarbonisation, and Jean-Hugues has added two new Chinese wind operators that provide exposure to this theme – China Longyuan Power Company and China Suntien. Both have performed well since entering the portfolio and are an illustration of how Jean-Hugues is able to draw on the wider Ecofin team. Matthew Breidert, a senior portfolio manager in London, spends considerable time in or analysing opportunities in Asia, and Ecofin also has a Mandarin-speaking analyst, which allows them to spend a lot of time with these companies and gives them an edge.

Jean-Hugues cites three state takeovers of Chinese renewables players in the last 18 months, which he considers shows clear political direction and the intention to develop renewables. It also means that both of these companies may be potential takeover candidates, although this is not the reason why they have been bought. China Longyuan has been particularly successful for EGL; the share price has increased by approximately 60% since the position was initiated in June. Jean-Hugues considers that both companies offer very good growth prospects from here.

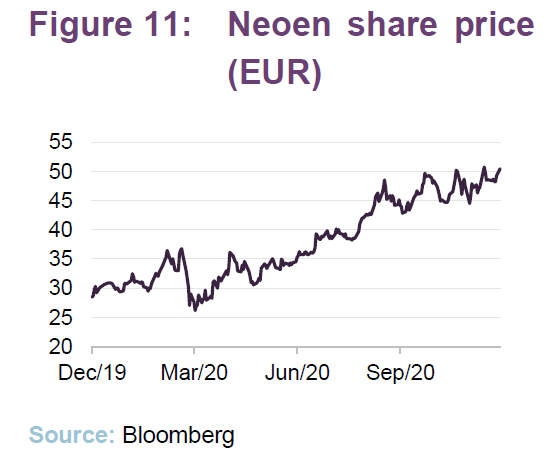

Recent exits – FirstEnergy, Neoen and Calisen

FirstEnergy, which we discussed in our June 2020 note as a new investment, has been sold. Jean-Hugues says that it has been disappointing. He initiated the position on the view that the company pays a good dividend and has a good regulatory framework, and he expected to see growth in earnings and then a rerating. However, FirstEnergy’s CEO was involved in a corruption scandal related to a subsidiary and the publicity was bad for the company. Jean-Hugues decided not to wait for justice clearance, and to exit the position. This was done gradually, over a month or two, and EGL did not lose much money on the holding.

Neoen, which Jean-Hugues describes one of their most successful investments ever, has been sold. Neoen is an independent renewable energy company that is headquartered in France and owns and operates solar and wind farms in 13 countries across four continents. Jean-Hugues purchased the position during Neoen’s IPO two years ago and, given the small size of the company and the absence of a dividend, held a relatively small position, despite its share price appreciation. Subsequently, Neoen agreed a tie-up with Tesla to deliver batteries in Australia. The tie-up created a lot of buzz around the stock and its share price increased very strongly (from €15 per share to €45.50 in just two years). Given its strong performance, its small allocation within EGL’s portfolio and the lack of dividend, Jean-Hugues reluctantly took the decision to exit.

Jean-Hugues has also taken the decision to exit Calisen, the UK smart meter installer. This had been held because of the significant prospects that the growth in smart meters should have offered, coupled with the belief that the company had a solid management team. However, Jean-Hugues says that Calisen has repeatedly failed to deliver on its targets and the market has been more challenging than expected. The standards and technology have changed, leading to additional delays in implementation, which has been a drag on budgets and has also hurt the prospects of the industry.

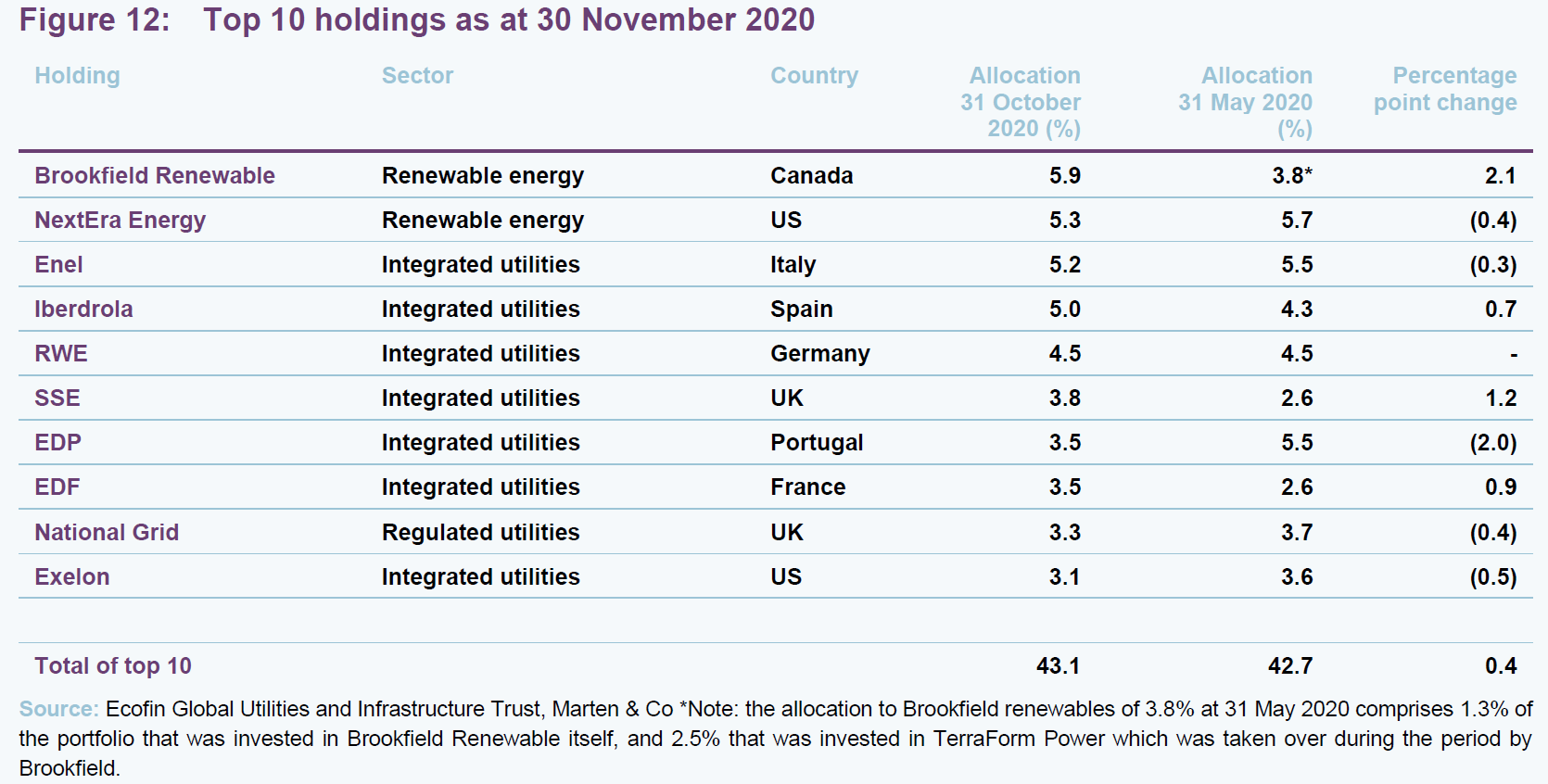

Top 10 holdings

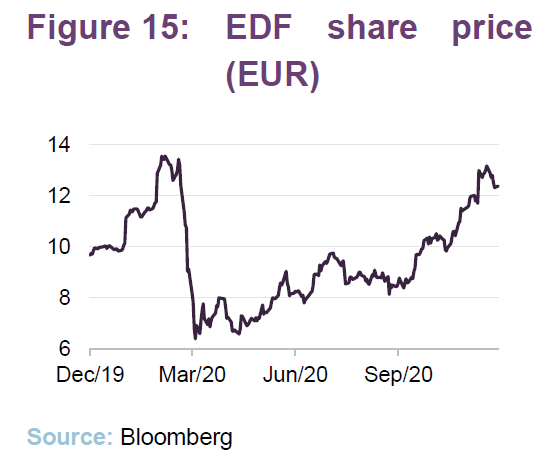

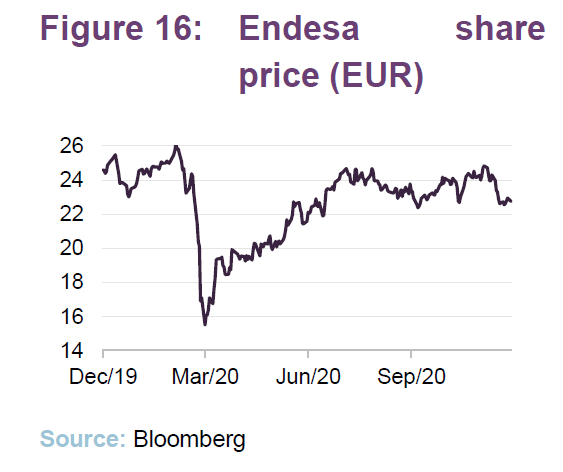

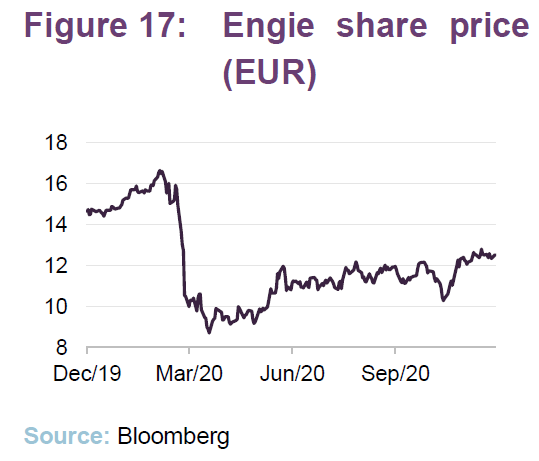

Figure 12 shows EGL’s top 10 holdings as at 30 November 2020 and how these have changed since 31 May 2020 (the most recently available data when we last published). New entrants to the top 10 are Brookfield Renewables, SSE and EDF. Names that have moved out of the top 10 are Endesa, Engie and Evergy. We discuss some of the more interesting changes in the following pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been previously discussed (see page 25 of this note).

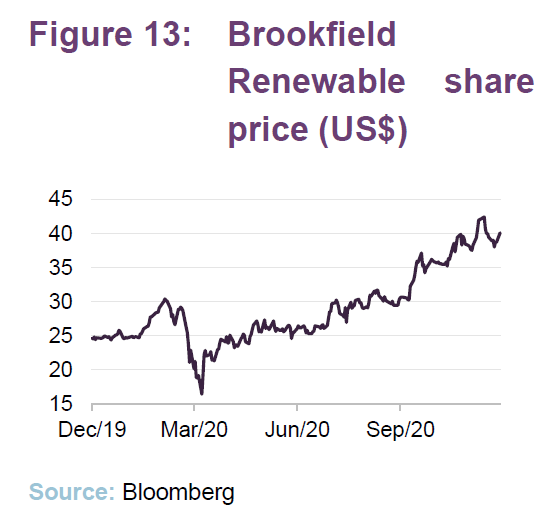

Brookfield Renewable Partners (4.4%)

Brookfield Renewable Partners (bep.brookfield.com) is a global renewable energy company with an emphasis on North American hydroelectric assets (these account for approximately 64% of its generating portfolio), which describes itself as “one of the world’s largest publicly-traded renewable power platforms”.

The company has grown substantially this year from its merger with Terraform Power, which saw Brookfield Renewables Partners (BEP) absorb Terraform Power’s operations. BEP now has a portfolio of 5,318 generating facilities in North America, South America, Europe and Asia, with approximately 19,400 MW of capacity. Its stated aim is “to deliver long-term annualised total returns of 12%–15%, including annual distribution increases of 5–9% from organic cash flow growth and project development”. In addition to its hydroelectric assets, its operations also include wind, solar, distributed generation, and storage facilities.

Jean-Hugues says that the combined company is now one of the largest in EGL’s portfolio. He says that, while the number is growing, compared to Europe there are comparatively few major renewables players in the US and BEP has a good strategy, is well managed and is well positioned in North America and further afield to benefit from the structural shift towards renewables. Jean-Hugues has been added to EGL’s position and EGL has benefitted from BEP’s continuing strong performance (BEP is up 89% since 1 April and up 38.5% since 1 July (both returns to 24 November). Reflecting this, BEP has been a big driver of the portfolio’s performance and EGL’s allocation to North America.

SSE (3.5%) – one of the best names you can hold in the UK utilities space

EGL has maintained a position in SSE (www.sse.com) for a significant part of its life. We first commented on SSE in our May 2017 initiation note, and it has regularly featured in our commentary since. SSE is the second-largest British energy utility and the UK’s largest generator of electricity from renewable sources. It supplies electricity and gas to some 9.1 million homes, offices and businesses in the UK and Ireland, and has a 33% interest in Scotia Gas Networks, the UK’s second-largest gas distribution company, which supplies gas to 5.8 million customers in Scotland and the South of England. SSE’s renewable energy production is from hydro-electric and wind sources.

The manager reduced the position in SSE some time ago, before the outbreak of COVID, reflecting various uncertainties surrounding the UK including Brexit. Compared to its own history, EGL has for some time run with a very light UK exposure, which, given the underperformance of the UK market, has been a good decision (note: EGL has still been overweight the UK versus the MSCI World Utilities Index). However, Jean-Hugues likes SSE, noting that it has a good-quality management team, assets and business model. He feels that the market has been valuing it as a heavily regulated business, and not properly taking into account that it has a growing contracted revenue base from its renewables business. He has long liked its dividend policy – SSE’s commitment to real dividend growth remains at the core of its financial targets. He also thinks that should some inflation re-emerge, this would be beneficial to the company’s bottom line.

In summary, Jean-Hugues thinks that SSE is one of the best names you can hold in the UK utilities space. He felt that it had been unfairly neglected by the market due to macro considerations such as Brexit and the uncertainty around UK equities (he says that the FTSE has underperformed global equities for over two years now). Jean-Hugues added slightly to the position following the market collapse in March, and was given the opportunity to increase this significantly in September when a major shareholder sold a large stake. This allowed Jean-Hugues to bring the SSE holding back to its previous level and, reflecting the lack of technical pressure following the sale, the stock is up c. 15% since the September purchase.

EDF (2.9%) – an opportunistic investment that requires a deep understanding of French politics

EDF (www.edf.fr) is a French multinational electric utility company that is largely state-owned. It operates a diverse portfolio and has operations in Europe, South America, North America, Asia, the Middle East, and Africa with some 120+ gigawatts of generation capacity combined. It operates France’s entire active nuclear generation fleet, which comprises some 58 reactors, across 19 sites, all of which are pressurised water reactors (PWR). In 2017, EDF took over the majority of New NP – Areva Group’s nuclear reactors business – following financial and technical problems at Areva, in what had been a state-sponsored deal.

The French government has ambitions to reduce France’s dependency on nuclear power and in July 2017, environmental minister Nicolas Hulot suggested that up to 17 of the country’s nuclear power reactors could be shut down by 2025 to help the government meet its targets. However, in 2019, the French government asked EDF to develop proposals for three new replacement nuclear power stations.

Jean-Hugues says the rationale underlying EGL’s investment in EDF is completely different to that of its investment in SSE. Jean-Hugues says that the stock is difficult for the market to understand – it is not driven by quarterly results and is instead driven by external factors. Jean-Hugues says that to understand EDF, first of all you need a deep understanding of French politics, then you need a deep understanding of the company itself.

Historically, EDF was a natural monopoly and, to ensure fair competition, the French state established the ARENH (Accès régulé à l’électricité nucléaire historique) mechanism, under which EDF is required to sell 100 terawatt hours per year (about a quarter of its annual nuclear output of electricity) to its competitors at the fixed ARENH price of 42 euros per MWh. This was a favoured price that ensured EDF’s competitors were not squeezed out of the market and got fair access to power that they could sell on. Historically, the ARENH price, which is politically determined, accounted for most of EDFs revenues and this is the big driver of EDF’s performance. However, while EDF still operates all of France’s nuclear reactors, the emergence of other generation capacity has led to the monopoly breaking down over the last decade.

It is being argued that that the ARENH mechanism, which expires in 2025, is now unfair to the heavily indebted EDF. When the power price is high, EDF is denied the upside and is forced to sell electricity to its competitors at the fixed ARENH price, but, asymmetrically, when the power price is low, EDF’s competitors are free to swap to a cheaper source. The French government is now looking at the ARENH framework and there is a proposal to allow this to operate within a band of €42-45 per MWh. It is believed that this would allow EDF to better cover its costs while still protecting the end consumers from larger swings when the electricity price spikes.

The French government is also looking into the possibility of spinning off all of EDF’s nuclear fleet into a separate company, thereby separating it from the renewables business. Under the proposals, EDF’s nuclear business would become a fully state-owned utility, with full regulation, as in the UK. Jean-Hugues believes that, once decoupled from the nuclear assets, the listed renewables business would attract a higher valuation, thereby extracting more value for shareholders. He feels that if these measures are approved, this could lead to a significant re-rating, and he topped up EGL’s position recently at attractive levels.

Endesa – a very successful investment for EGL

Endesa (www.endesa.com/en) is Spain’s largest energy utility and the second-largest in Portugal (after EDP). Around 70% of the company is owned by Enel of Italy. When we last discussed Endesa in our June 2020 annual overview note (see page 9 of that note), we commented that, historically, EGL had not had much exposure to Endesa. However, following a run of poor share price performance, the company was, in Jean-Hugues’ view, left trading at an attractive value (it offered around an 8% yield when he began to build the position in April 2020).

We commented in June that Endesa had performed strongly since acquisition, and it has continued to do so since. Following this further run of good performance, Jean-Hugues has taken some profits and reduced the size of the position. This is why it has moved out of EGL’s top 10 holdings.

Endesa fits with EGL’s focus on renewables as the company has been investing heavily in renewable energy generation (hydro, wind and solar) and areas such as smart meters and EV charging. Its remaining mainland coal plants are scheduled to be phased out by 2022, well ahead of even last year’s announced schedule.

Engie – very muted recovery compared to peers

Engie (www.engie.com), formerly GDF Suez, is a French multinational utility company that has three core businesses: power (electricity generation and distribution), gas, and energy services. Its electricity business has both thermal and renewable power-generation plants. These include solar, hydropower, offshore wind power, biomass, onshore geothermal, traditional thermal, and nuclear, and benefit from low CO2 emissions.

We last discussed Engie in detail in our October 2019 (see page 8 of that note), where we commented that its gas business is the largest in Europe. It fits nicely with EGL’s focus on clean energy and decarbonisation, having invested €800m in developing green gases during the last five years. Engie aims to have at least 10% of its gas derived from green sources by 2030 and, when we wrote in October 2019, Jean-Hugues considered that Engie was well-positioned to take advantage of the move to a low carbon economy.

However, since then the company has continued to struggle, having already had a difficult 2019 (Engie had suffered from above-average winter temperatures in France, lower nuclear power production in Belgium and a slower start in its client solutions business versus the previous year). EGL benefitted as the stock recovered in 2019, as most of these issues resolved themselves, but in 2020, the company was forced by the French government to cut its dividend, and whilst other utilities have bounced, Engie’s recovery has been muted in comparison. Reflecting this disappointment, Jean-Hugues reduced the position slightly in favour of other holdings, however he believes that there is potentially a good longer-term story for Engie.

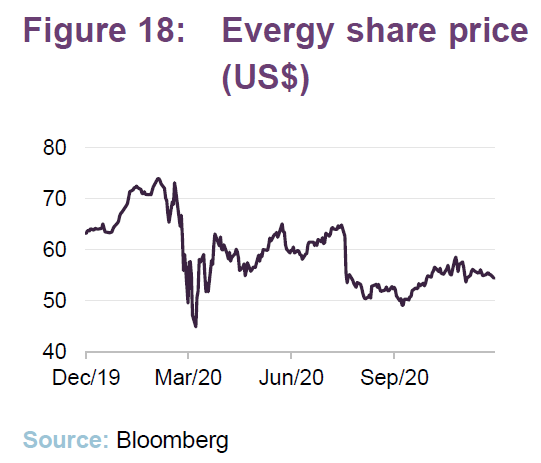

Evergy – lacklustre performance

Evergy (www.evergyinc.com), which was formed in 2018 with the merger of Kansas City Power & Light and Westar Energy Inc., generates and distributes power to 1.6m customers in Kansas and Missouri. Its generation mix is changing as the company invests in renewable energy (both on its own balance sheet and through PPAs) and also upgrades its power grid.

We last discussed Evergy in detail in our June 2020 note, where we explained that it was a new stock that had recently been added to the portfolio, with Jean-Hugues building the position during a period of share price weakness (power sales had been impacted by COVID-19 with commercial sales 13% lower and industrial sales 15% lower in April 2020 versus April 2019). However, Jean-Hugues saw a number of positive attributes to the Evergy story – the company plans to invest $7.6bn over the next five years, but says it has sufficient liquidity and no need to raise additional equity; it has a cost-cutting programme in place (linked to the merger) and is exceeding its targets in this area; and no new regulatory rate determination is planned until 2022.

Despite these positive attributes, Evergy has, like Engie, seen a very muted recovery with its performance remaining flat as peers have rallied. It is this lack of relative performance that has pushed it out of EGL’s top 10 holdings.

Performance

Strong long-term performance record

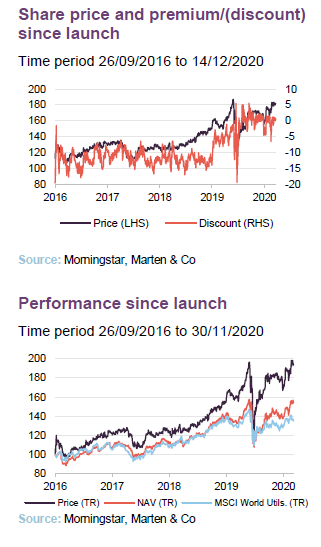

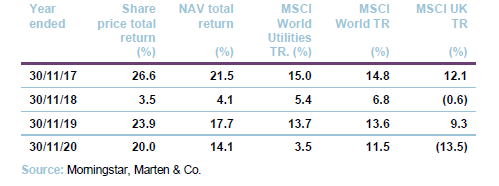

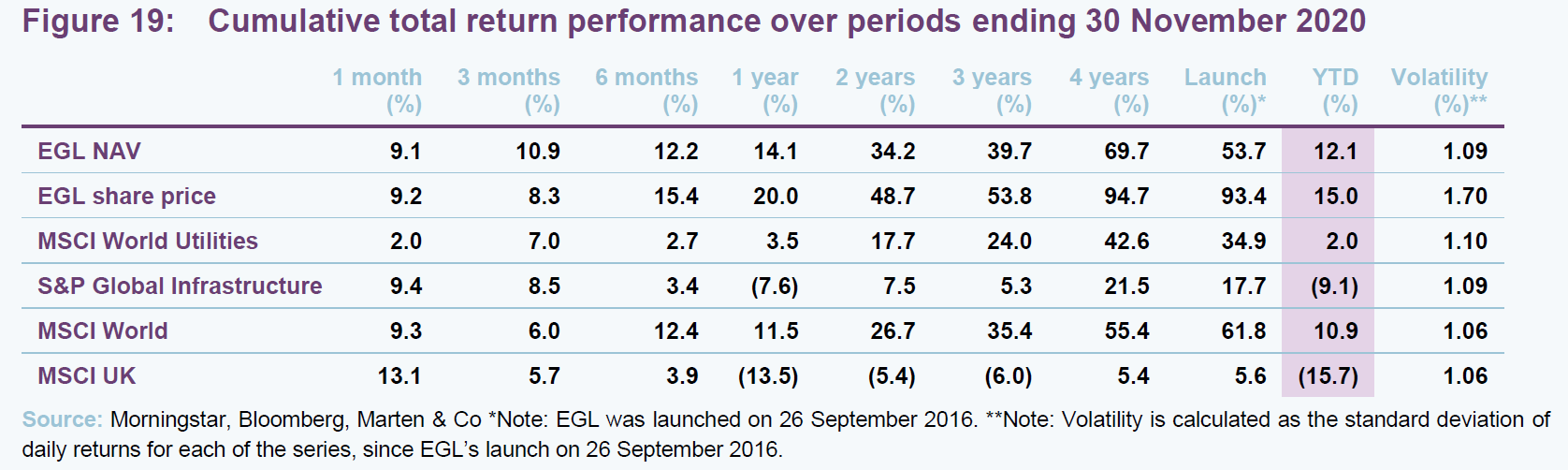

As illustrated in Figure 19, EGL has had a very good year so far, with its NAV and share price total returns beating those of the MSCI World Utilities Index and the MSCI World Index, while also being significantly ahead of the S&P Global Infrastructure Index and MSCI UK indices (see the light-purple-shaded column in Figure 19).

By the end of October, EGL’s NAV and share price total returns were ahead of most of the comparators for the longer-term periods shown in Figure 19 of one-year and above. EGL also performed very strongly in November’s risk-on rally (delivering NAV and share price total returns of 9.1% and 9.2% respectively), which has been further beneficial to its relative performance.

Taking a slightly longer perspective, EGL’s NAV has outperformed all of comparators over the one-year, two-year, three-year and four-year periods. Its share price total return is ahead of all of these comparators since launch, with the one exception of the MSCI World Index. Early in its life, EGL and its investment universe faced a number of headwinds, which we have discussed in detail in previous notes (for example, Trump’s election in the US reflated global markets, and investors’ attention moved away from global utilities towards growth stocks, while a similar effect happened following his tax cuts).

The superior share price performance, above that of the NAV for periods of six months and above, reflects the marked rerating that was very visible from September 2019. The narrowing continued well into 2020 and the superior rating has been sustained (this movement is discussed in the premium/discount section on pages 22 and 23).

The poor performance of the S&P Global Infrastructure Index that is visible in the one-to-three-year periods reflects sluggish global growth (pre-COVID) and perhaps also lingering negative sentiment towards some infrastructure following the collapse of the Morandi Bridge in Genoa in August 2018 (a topic we have discussed in our previous notes – see page 25 of this note). Since then, listed infrastructure (as measured by the S&P Global Infrastructure Index) has decoupled from utilities, which have continued to perform well, especially as investors became concerned about tail risks that can be present in infrastructure assets. It should be noted that while this affected infrastructure assets more generally, EGL did not own Atlantia Spa, the company responsible for the Morandi Bridge and so the impact on its portfolio was more limited. The US utilities sector also suffered in the aftermath of PG&E’s bankruptcy following dreadful wildfires (this was another stock that Jean-Hugues avoided).

European overweight has benefitted performance this year

As illustrated in Figure 19, YTD global utilities and global infrastructure have underperformed global equities. However, Jean-Hugues highlights that it is important to look more closely at the individual regions as performance has been markedly different between markets. For example, Continental European utilities have outperformed broader continental Europe equities by quite a margin (+17.8% vs +4.4%) and, while they have still lost value in absolute terms, UK Utilities have outperformed the broader UK market (-6.8% vs -13.1%). The exception to this trend has been the US, where US utilities have underperformed the S&P 500 by a margin (-0.8% vs S&P 500 +13.2%), as this index has been driven by the strong performance of technology and growth names. US Utilities have been lagging behind the S&P 500’s very strong performance, but have been catching up recently with Biden’s win, which is seen as a positive for the sector.

The US is behind the curve, compared to Europe, in the single-minded drive for decarbonisation and the switch to renewables. It is European utilities that have provided the most drastic evolution of their strategies, moving away from traditional thermal sources and regulated revenues to renewable energy sources and contracted revenues. Enel, RWE, Iberdrola, EDP (in Portugal) are all obvious examples, although over half of the top companies globally for renewable energy development are European names. Reflecting this, EGL is overweight Europe versus the MSCI World Utilities Index, which is why it has markedly outperformed global utility indices more generally. However, Jean Hugues thinks that growth from renewables investment and adoption in North America, could be a massive driver of performance in that market over the next few years; he thinks this could be a multi-decade trend.

Limited exposure to transport during 2020

Until November, EGL’s transport related holdings detracted from performance this year and, while a number of these have bounced dramatically lately as markets have risen in anticipation of vaccines and economic recovery, the market has nonetheless been savage towards transport names generally, reflecting the obvious impact COVID has had on airports, toll roads and the like.

The manager had trimmed EGL’s transport infrastructure exposure at the end of 2019 and in early 2020. Jean-Hugues says that, while Ecofin certainly didn’t anticipate the events of 2020, it was clear to the team at the end of 2019 that air traffic volumes were already slowing down. The decision was therefore taken to exit some names and reduce others, and so EGL navigated 2020 with little exposure to transport. When COVID-19 hit markets in March 2020, and transport names collapsed (airports fell around 50%, and toll roads fell around 30–40%), the impact on EGL was limited.

Economic recovery will drive a recovery in both air traffic and toll road traffic and Jean-Hugues is now watching the transport space closely. As illustrated in

Figure 19, while infrastructure moved up strongly in November (driven by positive news regarding the vaccine, which saw a lot of infrastructure names bounce by 15–20% on the day) the risks have not vanished. Jean-Hugues observed the dramatic share price moves that were delivered by a lot of infrastructure names on the day, and during the last several weeks, and expects significantly more recovery potential if vaccines permit a meaningful reduction in restrictions of movement and economic recovery. Consequently, he is now very gradually increasing EGL’s exposure to transport infrastructure, but he is more cautious on airports than toll roads.

The evidence so far shows that as people emerge from lockdown, they are quick to return to the roads (for example, traffic volumes in France, Italy and Spain were almost back to pre-COVID levels in July) but air traffic volumes, in comparison, are much slower to recover. There are two key reasons for this. First, the cabin of a commercial passenger aircraft is a confined space, which is perceived to increase the risk of COVID transmission. Second, crossing international borders has become more problematic as new restrictions, such as the requirement to quarantine, or outright closure of a border, can be imposed at short notice. Jean-Hugues says that France, for example, is not expecting air traffic volumes to recover to pre-COVID levels until 2024.

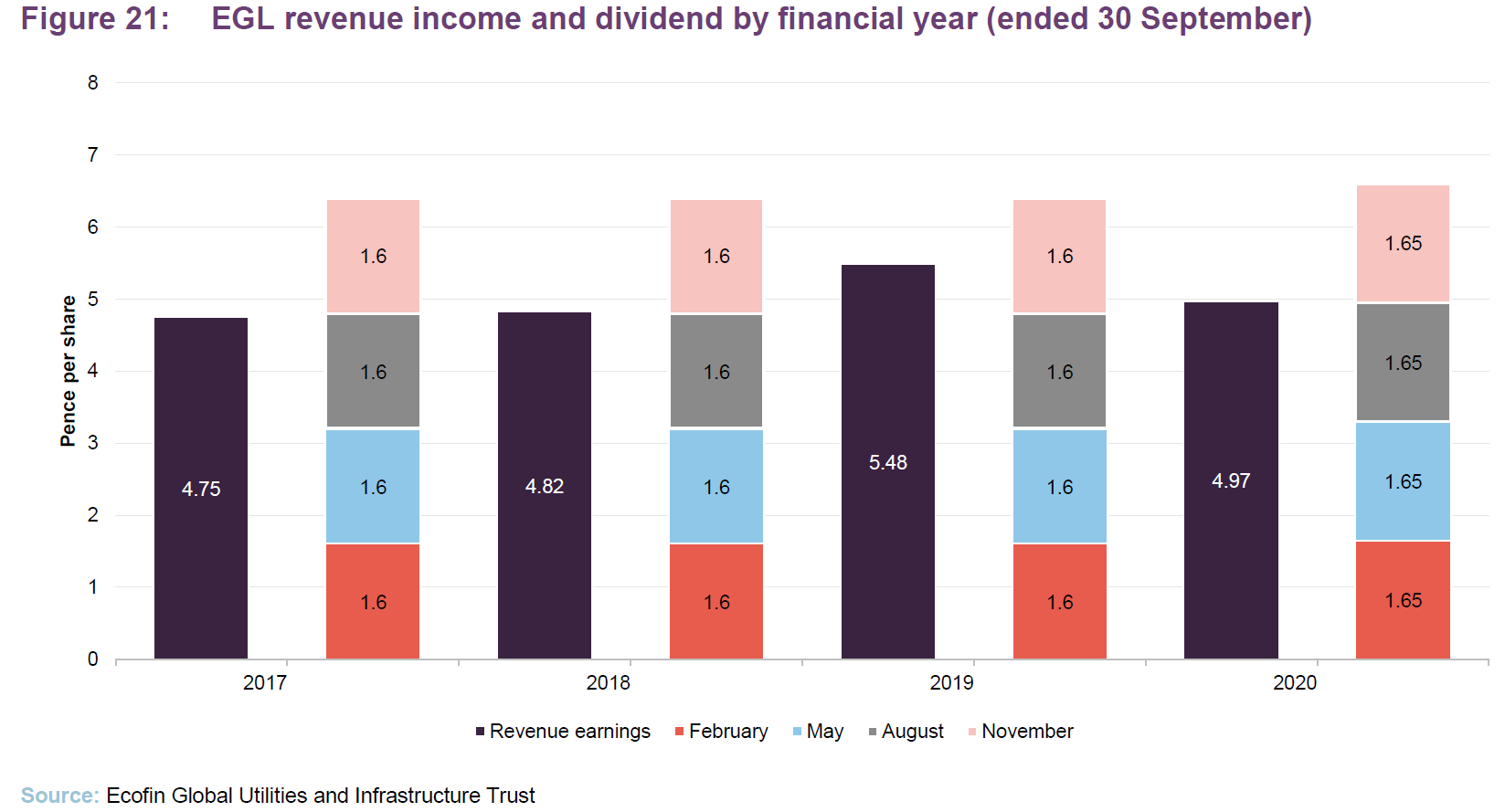

Quarterly dividend payments targeting at least 4% of NAV per annum

EGL targets a dividend yield of at least 4% on its net assets and can use gearing, and if necessary distributable reserves, to augment its portfolio yield. For a given financial year, the first interim dividend is paid in February, and the second, third and fourth interim dividends are paid in May, August and November, respectively. The board advises that it seeks to pursue a progressive dividend policy and so, barring exceptional circumstances, we expect that the board will only want to make upwards revisions to the quarterly dividend rate and will seek to ensure that any increases are sustainable.

Quarterly dividend rate raised to 1.65p per share

Having maintained its total dividend at 6.40p per share for its first three financial years, EGL’s board announced, at the end of 2019, an increase in the quarterly dividend rate to 1.65p per share (from 1.6p). This took effect from the first interim dividend of the year ended 30 September 2020, which was paid in February 2020. Despite the subsequent trauma in markets, the board maintained the quarterly rate at 1.65p per share for the second, third and fourth interim dividends, which were paid in May, August and November respectively.

Earnings and income receipts are proving to be resilient

Clearly, much has happened in global markets and the global economy since the board decided to increase the quarterly dividend rate. However, while the dividend has been uncovered by revenue income in recent years (see Figure 21 below), Jean-Hugues says that following the market collapse, earnings and dividends from EGL’s underlying holdings are proving to be resilient.

Only a few portfolio companies skipped their dividends and Jean-Hugues says that these were mostly state-owned groups (which came under pressure from their governments). There were also some cuts from EGL’s transport names, with toll roads and airports obviously struggling. Jean-Hugues says that this affected about 10% of EGL’s portfolio, but that 90% of their companies had confirmed their earnings guidance and dividends. Ecofin covered in some detail in their monthly portfolio updates how Jean-Hugues was organising the portfolio to minimise the reduction in income receipts for F2020 and to position it for post-COVID growth and opportunities.

Shortly after its launch, EGL was given permission to cancel its share premium account in order to establish distributable reserves (referred to as the special reserve in EGL’s accounts), thereby enabling it to immediately commence dividend distributions. The special reserve (£118.3m or 128.7p per share at the end of March 2020) is available to support the portfolio’s yield on an ongoing basis.

The current annual dividend rate of 6.60p is, which is equivalent to a yield of 3.6% on the share price of 182.00p as at 14 December 2020.

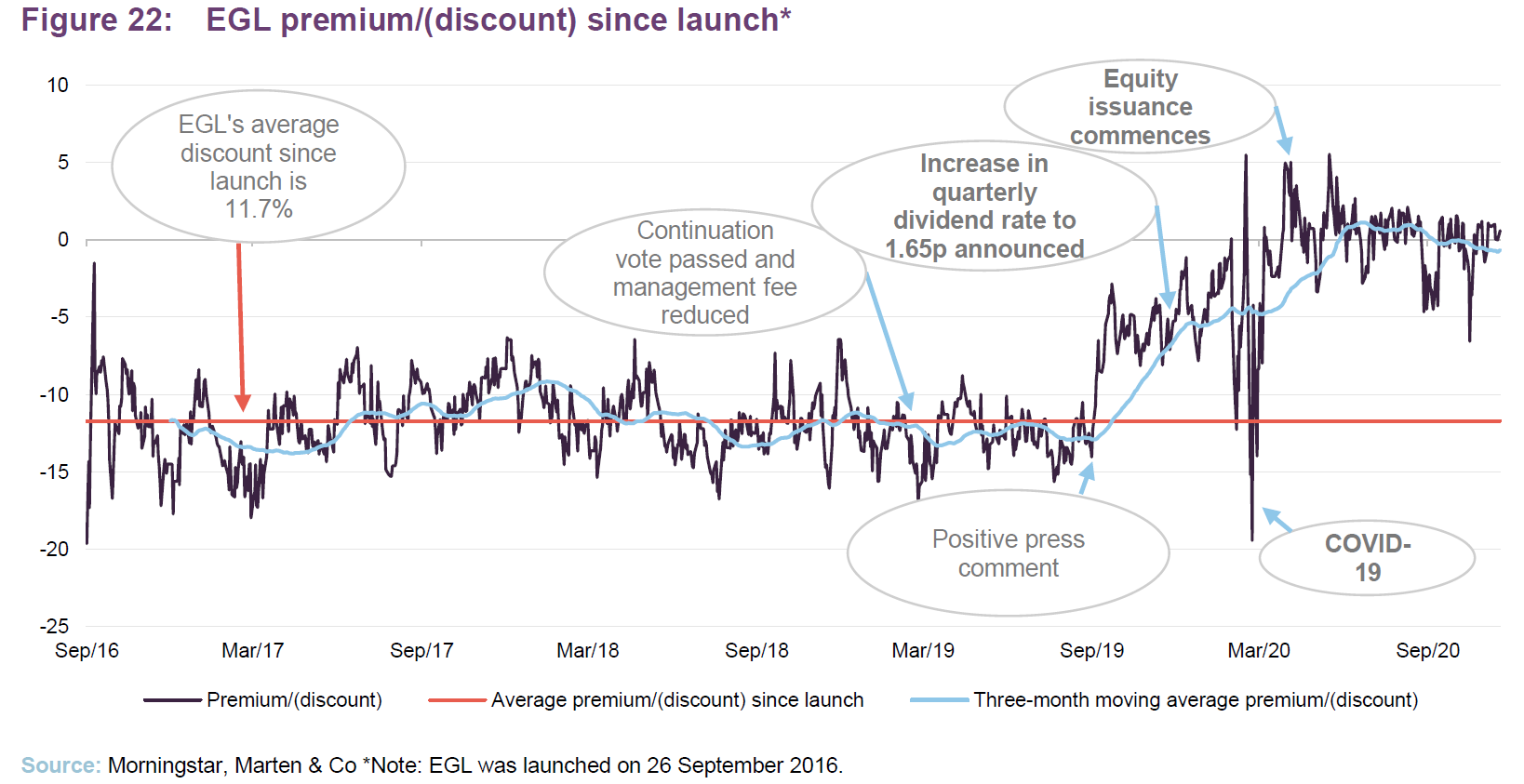

Discount/premium – reasons to be cheerful

Step change in rating has been maintained

We first started covering EGL in 2017, publishing our initiation note in May of that year, and a regular feature of the commentary during our first two years of coverage was that the manager and board were frustrated by the stubbornness of EGL’s discount. We observed that, for some time, the discount seemed to be somewhat out of step with the strong NAV performance, efforts by the manager and board to raise the profile of the trust, the continuation vote passing and the implementation of a 25bp reduction in the management fee (this took effect from 5 March 2019 – see page 11 of our April 2019 update note). However, as illustrated in Figure 22 below, which shows EGL’s premium/(discount) since launch, there was a step change in EGL’s premium/discount performance from the end of September last year, a subject first discussed in our October 2019 note.

EGL’s shares frequently trade at a small premium to NAV, allowing issuance of stock

In October 2019, we commented that EGL had recently benefitted from some high-profile coverage that helped raise awareness amongst investors, stimulating demand for EGL’s shares and narrowing its discount. We also said that we believed that the discount had the potential to narrow further, particularly if the manager continued to provide attractive sector beating returns. Twelve months on, EGL has moved to trade on a premium, allowing the trust to issue shares (something we had long believed EGL deserved to achieve).

Since April of this year, EGL has issued, 4.73m shares, or 5.1% of its issued share capital at the start of the period, to satisfy investor demand. All of these shares were issued at a premium to asset value in accordance with EGL’s policy on share issuance. This has the effect of enhancing the NAV for existing shareholders. Expanding the trust should also have the twin benefits of improving liquidity in the shares and lowering the ongoing charges ratio as fixed costs are spread over a wider base.

The track record that EGL has established, including during this year’s difficult markets, and the increased interest from investors in all aspects of ESG and renewables, should help provide ongoing demand for EGL’s shares, provided the trust continues to perform well.

During the last 12 months, EGL’s shares traded between a discount of 19.4% and a premium of 5.5%, and averaged a 1.4% discount. However, this includes the extremities seen during the market collapse in March, and more recently, EGL has tended to trade in a range between a 2% premium and a 5% discount, as illustrated in Figure 22. At 14 December 2020, EGL’s shares were trading at a premium of 0.6%, which is towards the middle of its recent trading range.

Fund profile

Developed markets utilities and infrastructure exposure with an income and capital preservation focus

Ecofin Global Utilities and Infrastructure Trust Plc is a UK investment trust listed on the main market of the London Stock Exchange (LSE). The trust invests globally in the equity and equity-related securities of companies operating in the utility and other economic infrastructure sectors. EGL is designed for investors who are looking for a high level of income, would like to see that income grow, and wish to preserve their capital and have the prospect of some capital growth as well.

Reflecting its capital preservation objective, EGL does not invest in start-ups, small businesses or illiquid securities, as these may involve significant technological or business risk. Instead, it invests primarily in businesses in developed markets, which have “defensive growth” characteristics: a beta less than the market average; dividend yield greater than the market average; forward-looking EPS growth; and strong cash flow generation.

It also operates with a strict definition of utilities and infrastructure as follows:

- electric and gas utilities and renewable operators and developers – companies engaged in the generation, transmission and distribution of electricity, gas, liquid fuels and renewable energy;

- transportation – companies that own and/or operate roads, railways, ports and airports; and

- water and environment – companies operating in the water supply, wastewater, water treatment and environmental services industries.

EGL does not invest in telecommunications companies or companies that own or operate social infrastructure assets funded by the public sector (for example, schools, hospitals or prisons).

No formal benchmark

EGL does not have a formal benchmark and its portfolio is not constructed with reference to an index. However, for the purposes of comparison, EGL compares itself to the MSCI World Utilities Index, the S&P Global Infrastructure Index, the MSCI World Index and the All-Share Index in its own literature. We are using a similar approach here, but are using the MSCI UK Index to represent the UK market. Of the three indices, we consider the MSCI World Utilities to be the most relevant – although it should be noted that this index has a strong bias towards US companies.

Strategy has much more room to grow

EGL had a market capitalisation of £175.8m as at 14 December 2020. The manager believes, and we agree, that its strategy could easily be applied to a much larger fund and its defensive growth characteristics should prove attractive to investors. Expanding the size of the trust should, all things being equal, have the dual benefits of further reducing the ongoing charges and improving liquidity in EGL’s shares.

Matteo Rodolfo – additional resource for EGL

Matteo Rodolfo is a recent addition to the Ecofin team in London. An investment analyst in the research team, Matteo joined in early September 2020 from Goldman Sachs in London, where he had spent three years as a sell-side analyst covering the European Utilities sector. Prior to Goldman Sachs, Matteo’s previous employment includes Mesirow Financial and the European Central Bank. He holds a B.Sc. (Hons) in Economics and Politics from the University of Bath. Jean-Hugues says that Matteo’s experience has allowed him to hit the ground running and he has been a very valuable contributor since his first day on the job.

Previous publications

Readers interested in further information about EGL, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Resillient income, published on 25 June 2020, as well as our previous update notes and our initiation note (details are provided below).

- “Resillient income”, published on 25 June 2020, focused on the defensive attractions of the sector and the resilience of the income from EGL’s portoflio companies.

- “Compelling three-year track record“, published in October 2019, focused on EGL’s track record since launch

- “Unrecognised outperformance”, published in April 2019, looks at how EGL has avoided the fallout from PG&E while also outperforming the MSCI and S&P indices

- “Staying nimble”, published in October 2018, EGL has manoeuvred through a period of rising interest rates and a focus on growth stocks by taking advantage of these swings

- “On the contrary”, published in March 2018, utilities and infrastructure had a rough start to 2018 EGL management looks to implement strategies to drive outperformance once again

- “Delivering the goods”, published in November 2017, looks at the company’s portfolio and stock selection as they enter a new phase of consolidation

- “Structural growth, low volatility and high income”, published in May 2017, with investments in less volatile equities and a favourable discount rate EGL looks to attract investors looking for stable income

The legal bit

This marketing communication has been prepared for Ecofin Global Utilities and Infrastructure Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.