Leveraging Asia’s rising star

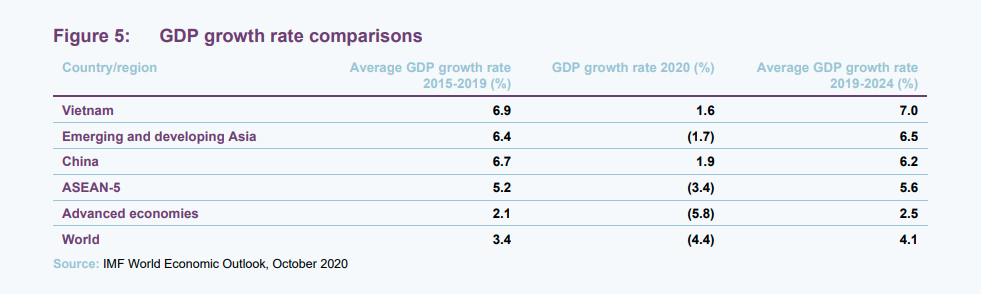

Vietnam’s response to the pandemic has been very effective and, reflecting this, the IMF has predicted that it will post positive GDP growth of 1.6% for 2020, increasing to 6.7% this year and averaging 7.0% for 2021 to 2025. Indeed, Dynam Capital, Vietnam Holding’s (VNH’s) manager, believes that Vietnam will be one the 20 largest economies in the world by 2050.

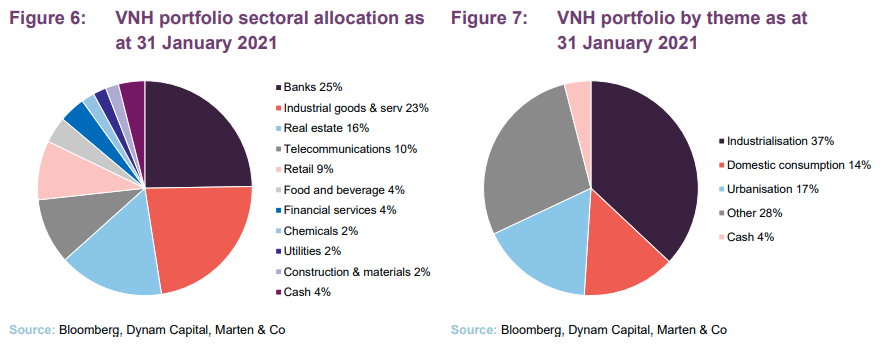

The manager has tilted the portfolio towards sectors such as banking (where exposure has moved from around 10% to 25%) and higher-quality real estate, which it believes are well-positioned to capture the benefits of this growth. This strategy has already reaped some rewards, as VNH’s banking stocks have been amongst its stronger performing holdings as markets have recovered.

Capital growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high-growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

Fund profile – listed Vietnamese equities with a strong ESG focus

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also – subject to certain restrictions – invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity-like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). More information on Dynam Capital, VNH’s investment manager, is provided on pages 30 and 31, while further information on the manager’s Environmental, Social and Governance (ESG)-orientated investment process, including investment restrictions, is provided on pages 10 to 13.

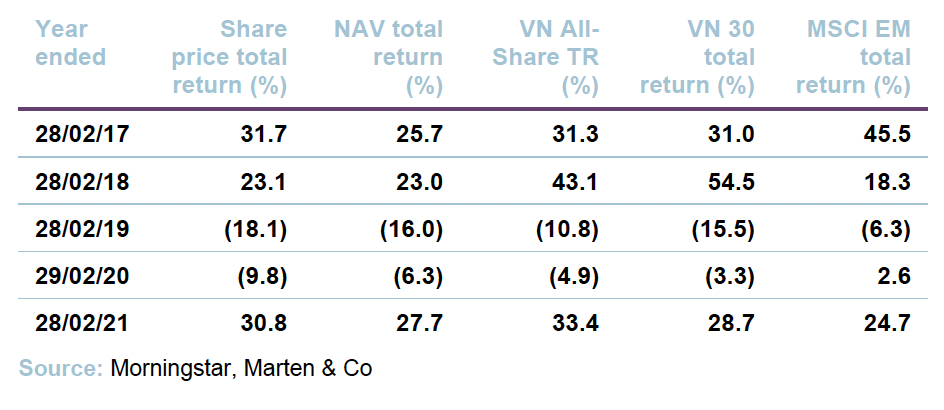

VNH does not have a formal benchmark. However, for the purposes of performance evaluation, the manager has traditionally included comparisons against the VN Index, the VN All-Share, the VN 30 Index and the MSCI Emerging Markets Index in its literature. We have used these as well as the MSCI Vietnam Index in this report.

Market outlook and valuations update

Recent history and valuations

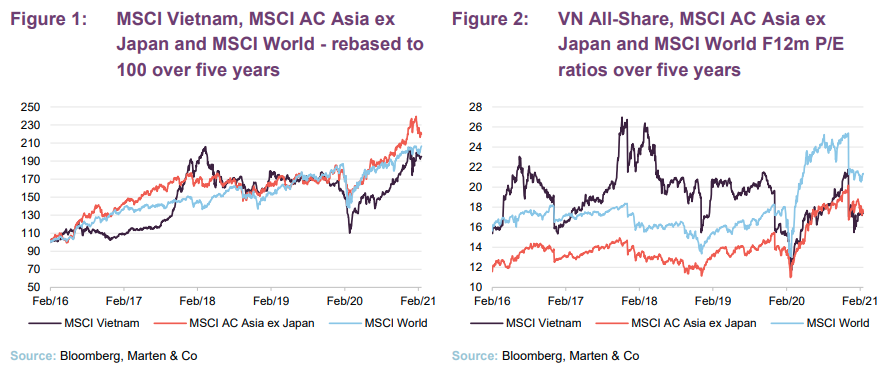

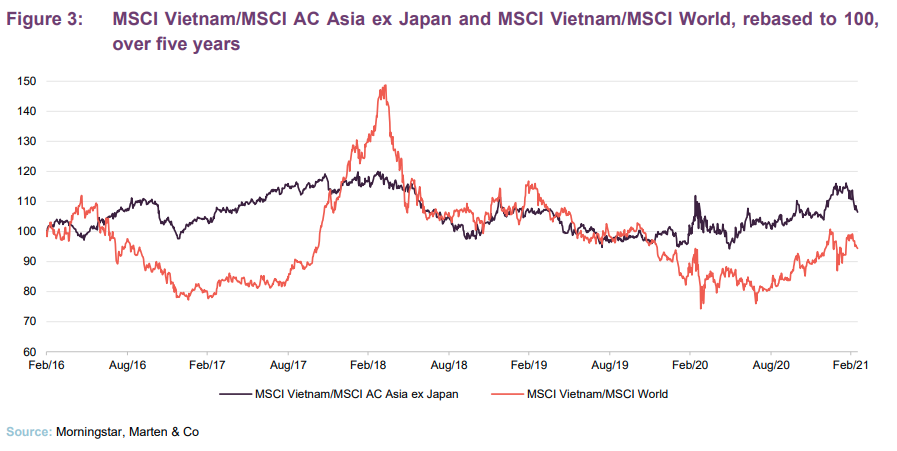

As is illustrated in Figure 1, Vietnam, emerging Asia and global equity markets have provided strong absolute returns over the last five years. Emerging Asia, with its superior growth prospects, has outperformed broader global equities, although Vietnam, a frontier market, has been the relative laggard. As also illustrated in Figure 1, the growth trajectories have been markedly different.

As fear of the pandemic grew, all markets suffered very heavily, but there has since been a marked recovery. All of these markets are now noticeably above their pre-pandemic levels, having had a shot in the arm as positive news on vaccine development emerged late last year. However, whilst the MSCI World and MSCI AC Asia ex Japan Indices are close to their five-year highs, the MSCI Vietnam is below this level and still offers greater catch-up potential. Furthermore, as illustrated in Figure 2, the Vietnamese equity market is cheaper than both broader global equities and emerging Asian equities on an F12m p/e basis.

Potential for synchronised global economic recovery

One effect of the pandemic is that it appears to have turned the tide on the global economic cycle, moving us from late-cycle to early-cycle in around six months. While long-term interest rates have crept up a little, short-term interest rate rises in more developed markets look a long way off, which should act as a tailwind for emerging Asia for some time. With many governments pumping significant stimulus into their economies simultaneously, in an attempt to stave off the economically crippling effects of the virus, there is now the prospect of synchronised global economic recovery. This could be particularly beneficial for less-developed countries such as Vietnam.

Furthermore, with President Joe Biden now firmly installed in the White House, there is the potential for a less-combative approach from the new US administration in engaging with China and the wider region.

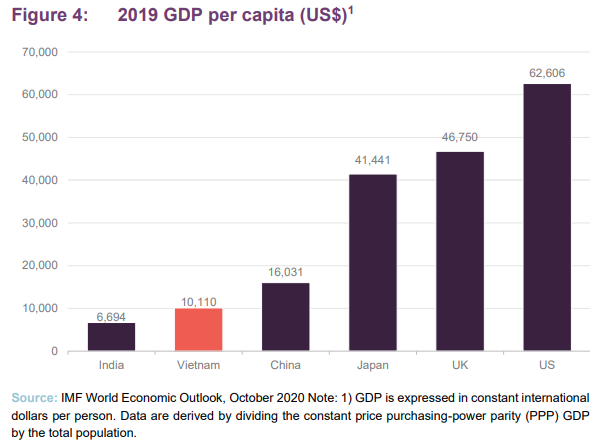

Vietnam – strong GDP per capita catch-up potential

As we highlighted in our May 2020 note (see ‘Covid19: Vietnam – a case study in epidemic management’ on pages 3 to 5 of that note), with the world understandably focused on addressing the challenges presented by the global pandemic, it is easy to forget the long-term structural growth opportunity that exists within Vietnam. However, Vietnam has been a standout success story in terms of its handling of COVID-19. To summarise, strategic testing followed by an aggressive approach to contact tracing and complemented by effective public messaging have been key to controlling the virus. Vietnam implemented all of these measures early, limiting transmissions and stopping the virus from taking hold. As we look through the remainder of 2021 and beyond, vaccine roll-outs should continue to allow the global economy to re-open and the long-term structural growth drivers to which Vietnam is exposed to remain in place.

Since we last commented on Vietnam’s GDP per capita relative to the other nations, Vietnam has overtaken India (its GDP per capita being around 45% above India’s), and it has closed the gap with China (Vietnam’s GDP per capita was around 63% of China’s). However, it is clear from both Figures 4 & 5 that Vietnam is still at a very early stage of development, and therefore continues to offer significant catch-up potential. The IMF’s World Economic Outlook for October 2020 forecasts average annual growth for Vietnam for the period 2019–2024 of 7.0%. This is in excess of China’s, above the average of ASEAN peer group and significantly above world and developed market averages. As we have highlighted previously, Vietnam has a favourable demographic profile (a median age of 30.5 years) and it is relatively resource-rich, with commercially-viable reserves in a range of metals and minerals.

Manager’s view – Vietnam, still a rising star in ASEAN

As illustrated in Figure 5 above, global economic growth was severely affected during 2020, and there is little doubt that the impacts are continuing to be felt this year and maybe into next. To give this some context, in its World Economic Outlook (WEO) for October 2020, the IMF projected that global GDP would contract by 4.4% for 2020 (up from 3% in its April 2020 publication). In comparison, the official rate of GDP growth for Vietnam’s economy was 2.91% for 2020.

Vietnam – on track to become a top 20 global economy by 2050

Vietnam has benefitted from a high and stable growth rate during the last 30 years, and with strong structural growth drivers firmly in place, the manager expects this to continue. Despite the short-term noise, the manager believes that Vietnam is still on track to become a top 20 global economy by 2050. Vietnam has benefitted from increasing exports in recent years, but its growth has been largely domestically driven, which gave it resilience as the global economy was slowed by the pandemic.

A growing middle class is driving consumption

A growing middle class and an increasingly consumer-driven society are driving GDP growth, which drives incomes, creating a virtuous circle. Dynam believes that by 2035, there could be an additional 35m middle-class consumers, around 50% of the population. It notes that car ownership has doubled over the last five years, while consumer loans have increased five-fold and now total over US$51bn. To capture the benefits of these developments, the managers are focusing on three major themes within the portfolio:

- industrialisation;

- the consumer; and

- urbanisation.

Structurally well-positioned for ongoing growth

Vietnam benefits from a number of structural growth drivers that suggest it is well-positioned for further economic expansion for years to come. For example, Vietnam:

- benefits from a large and youthful population;

- has a relatively well-educated workforce (Vietnam has a 95% literacy rate, ranking second-highest among the top 10 investable frontier-market countries);

- is an industrious nation. At 75.7%, it has one of the highest employment-to-population ratios globally (the global average is 57%, while the average for East Asia and the Pacific is 65% – all sourced from The World Bank);

- is benefitting from increasing urbanisation;

- is a natural manufacturing hub. It has a low manufacturing labour cost (around half that of China and around two-thirds of that of Mexico). It is also centrally positioned within ASEAN and is well-positioned relative to other major economies in the region (China, Japan and Korea);

- benefits from a relatively stable socio-political environment (85% of the population is ethnic Kinh, which reduces the likelihood of internal conflict);

- has high internet penetration compared to wider emerging markets (around 60%). Dynam comments that Vietnam’s internet economy is forecast to reach US$45bn by 2025;

- has an increasingly open economy, driven by a variety of free trade agreements. It moved from 77th place in 2018 to 67th place in 2019 in the global competitiveness index (this being the largest increase between these two years);

- has 13 free trade agreements in place and has concluded negotiations on a further two. The newly-signed RCEP and UKVFTA are expected to boost foreign trade;

- is well-diversified in terms of its foreign trade partners and is not overly reliant on any particular one. China is the largest partner at around 22% of foreign trade. The next-largest is the US, at around 15%;

- is a strategic alternative to China for global product sourcing. Despite concerns to the contrary, Vietnam has benefitted from a recent surge in exports as trade tensions have escalated between the US and China; and

- has seen healthy development within its capital markets in recent years. These have grown in size, boosted by new IPOs and privatisations of former SOEs. However, the foreign ownership limits (FOLs) remain a challenge (30% for banks and 49% for other listed companies). The manager says that draft revisions to Vietnam’s securities law may provide clarity.

As a consequence of the above, Vietnam has been attracting high levels of foreign direct investment in recent years.

The four pillars – continuity suggests policy broadly unchanged

Vietnam’s ruling communist party has just completed its five-year congress, which included the election of Vietnam’s four pillars (the four most important posts within the Vietnamese government) of president, prime minister, speaker of the national assembly and the general secretary of the party. The process produced results that were largely as expected, and VNH’s manager expects that the government will now continue to push forward on its key projects, with policy broadly unchanged.

A new five-year plan is in the making and the manager expects to see an increase in infrastructure spending, improvements in the real estate market and an improving environment for the banks. Reflecting this, the manager has been adjusting VNH’s portfolio, increasing exposure to all of these areas, to take advantage of these structural tailwinds.

Significant increase in banking exposure

The manager has broadened and increased VNH’s exposure to the banking sector. As noted above, Vietnam looks set for a strong recovery in GDP growth in 2021, but the manager believes that this is not likely to be fully captured by the stock market. In contrast, the banks, with their broader economic exposure, should be better-positioned to capture this. Furthermore, Vietnamese banks have cleared out their bad debts, have relatively strong balance sheets, and, in banking terms, Vietnam is an underpenetrated market with a strong structural growth opportunity. The manager is expecting to see increasing credit growth, and the growth of insurance products.

Vietnamese confidence is strong, domestic retail investor activity has seen significant uplift

From a macroeconomic perspective, the manager says that 2020 was a surprisingly strong year for the country. It highlights that Vietnam has a strong trade surplus, foreign exchange reserves are high (some US$100bn), GDP growth was positive, and Vietnam now has a larger economy than the Philippines. With GDP growth expected to be around 7% for 2021, the manager believes that Vietnam will be back on its 30-year growth trend and this will be accompanied by stronger financial markets. The manager says that, broadly speaking, sentiment is high in Vietnam, which it believes has been reflected in recent investment activity. During 2020, some 100,000 new stock exchange accounts were opened, most of which were for domestic retail investors. The manager believes that we should expect to see increased volatility as these people find their feet, but average daily trading volumes are approximately four times the level they were 12 months ago.

Investment process

In managing VNH’s portfolio, Dynam Capital (www.dynamcapital.com) is looking for high-growth, compounding businesses that it can hold for the long term. This can be summarised as growth at an attractive valuation. Dynam manages its portfolios using a mixture of top-down and bottom-up investment strategies. The top-down element of the investment process guides the manager towards the key sectors and sub-sectors on which to focus its attention, with the aim of achieving superior long-term returns. The bottom-up element of the process uses extensive fundamental research to select the best companies in those sectors and sub-sectors.

ESG incorporated into all investment and monitoring procedures

ESG criteria are central to Dynam’s approach, and have been part of its DNA since the beginning. Vu Quang Thinh, Dynam’s CIO, is very well-regarded in this area. He is a founding member and former chairman of the Vietnam Institute of Directors (VIOD). Established in April 2018, VIOD was the first private and independent organisation in Vietnam, aimed at promoting the highest standards and best practices in corporate governance among domestic firms.

Four-stage investment process: internal screening, due diligence, investment decision and investment monitoring

Dynam’s investment universe comprises around 1,500 companies split across three exchanges in Vietnam (the two major exchanges are Ho Chi Minh City and Hanoi), with a combined market capitalisation in the region of US$200bn. The overwhelming majority of these are deemed to be not suitable for investment. Many are too small, and others will not fit Dynam’s ESG criteria.

The initial screening process reduces the investable universe to around 150 companies. Further analysis reduces this to around 70, on which Dynam speaks to company management and conducts extensive due diligence. Ultimately, this is narrowed to a portfolio of around 23 that fully reflects Dynam’s philosophy.

Internal screening and due diligence

Dynam regularly screens the Vietnamese market against its investment screening criteria to identify new potential investments. This includes an assessment against the manager’s critical risk table and its initial ESG checklist. Companies that pass this phase undergo a concept discussion at the weekly team meeting. If they pass, they enter the investment pipeline.

Of the 70 or so companies that make it through the initial screening phase and enter Dynam’s investment pipeline, the manager conducts extensive due diligence to assess a company’s suitability for inclusion in Dynam’s portfolios.

In this phase, a company is assessed in detail against Dynam’s investment criteria (see below). The manager conducts site visits, interviews company management, scores the company against its ESG matrix in greater depth, and builds a detailed valuation model. Broker reports and sector reviews feed into this process. Dynam’s investment criteria can be summarised as follows:

- Compounding long-term EPS growth (approximately 20% per annum);

- Attractive valuation with built in safety margin;

- Strong balance sheet and cashflow management;

- Rigorous adherence to ESG principles;

- Industry leader with strong competitive position; and

- Best management teams amongst peers.

The due diligence process is fully documented and conclusions of all of this analysis are pulled together into a draft investment proposal, which is presented to the investment team. The investment team critically appraises the proposal and it is revised based on their feedback. Assuming that an investment clears this stage, the investment proposal is then finalised.

Investment decision and monitoring

Once an investment proposal has been finalised, it is reviewed by the investment committee at its weekly meeting and, where appropriate, the client. Assuming that an investment receives approval, it is passed to the trading team for execution.

Dynam operates a process of ongoing investment monitoring. This includes attending analyst meetings, regular company visits, reviewing results and periodically rescoring a company against Dynam’s ESG matrix. Following such an event, an internal update on the company is produced and this is reviewed by the investment committee. Where appropriate, this may lead to company engagement, to propose improvements or suggest remedial action. It may also lead to a divestment proposal, which is also reviewed by the investment committee, before being acted thereon.

Investment restrictions

VNH’s articles of association impose the following investment restrictions, VNH:

- will not invest more than 10% of its NAV (at the time of investment) in the shares of a single investee company;

- will not invest more than 30% of its NAV (at the time of investment) in any one sector;

- will not invest directly in real estate or real estate development projects. However, it may invest in companies that have a large real estate component, if their shares are listed or are traded on the OTC Market;

- will not invest in any closed-ended investment fund unless the price of such investment fund is at a discount of at least 10% to its prevailing net asset value (at the time of investment);

- may invest up to 25% of its NAV (at the time of investment) in companies with shares traded outside of Vietnam, if a majority of their assets and/or operations are based in Vietnam;

- may invest up to a maximum of 20% of its NAV (at the time of investment) in direct private equity investments;

- may invest up to 20% of its NAV (at the time of investment) in other listed investment funds and holding companies which have the majority of their assets in Vietnam;

- may borrow money, and grant security over its assets, provided that such borrowings do not exceed 25% of the latest available NAV (at the time of the borrowing);

- may also invest in securities that have equity features, such as bonds that are convertible into equity;

- may also invest its available cash in domestic bonds or international bonds issued by Vietnamese entities; and

- may utilise derivatives contracts for both hedging purposes and efficient portfolio management, but it will not utilise derivatives for investment purposes.

Investment restrictions – based on the United Nations Principles for Responsible Investment

VNH is a signatory of the United Nations Principles for Responsible Investment (UNPRI). This imposes a number of ESG-related restrictions. As a signatory, it will not invest in companies:

- known to be significantly involved in the manufacturing or trading of distilled alcoholic beverages, tobacco, armaments or in casino operations or other gambling business;

- known to be subject to material violations of Vietnamese laws on labour and employment, including child labour regulations or racial or gender discriminations; or

- that do not commit to reducing, in a measurable way, pollution and environmental problems caused by their business activities.

Asset allocation

Concentrated and low turnover portfolio of Vietnamese stocks

As at 31 January 2021, VNH’s portfolio had exposure to 26 securities (up from 22 securities as at 30 April 2020 – the most recently-available data when we last published). VNH’s portfolio is highly concentrated; it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%), but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction). As illustrated in Figure 10, the top 10 holdings accounted for 63.9% of VNH’s portfolio as at 31 January 2021, which is a mild reduction in concentration from the 66.8% as at 30 April 2020.

Distinctly different from the index

As we have highlighted in our previous notes, VNH’s portfolio is distinctly different from the VN All-Share (or any Vietnamese-focused ETF for that matter). VNH’s portfolio has a high active share – typically 75–80% – and it should be noted that the index does not benefit from the manager’s strong focus on ESG considerations. Traditionally, the portfolio has had a markedly higher allocation to mid- and small-cap stocks (the VN All-share, by contrast, is heavily weighted towards stocks with market caps in excess of US$1bn). However, it should be noted that during 2020, the manager generally took profits in small-mid cap holdings and reallocated capital into areas, such as the banks, which traditionally have higher market caps. The rationale is that the manager considered these to be better geared to an improving Vietnamese economy.

Increased exposure to banks and real estate

The most significant change has been the allocation to the banks. Previously, VNH was underweight the banking sector, with an allocation of around 10%. This is now around 25% as the manager has broadened the exposure beyond the couple of names that VNH previously held. The manager has also been adding to VNH’s real estate exposure. Since we last published, the manager has added both SABECO and Vinhomes to VNH’s portfolio. We discuss both of these positions below.

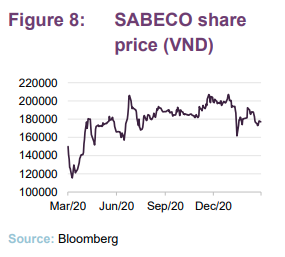

SABECO – ThaiBev investment has catalysed change

Saigon Beer – Alcohol – Beverage Corporation, or SABECO (sabeco.com.vn), is a new addition to VNH’s portfolio. SABECO’s primary focus is beer production – its flagship product is its ‘Bia Saigon’ range, which includes Saigon Special, Saigon Export, Saigon Lager, 333 Export and Saigon Gold. SABECO has an explicit focus on its social responsibility and sustainable production. It also supplies spirits, soda, and other products.

Having followed SABECO for some time, VNH’s manager felt that the former SOE had room for improvement, both in terms of its efficiencies and its corporate governance and this drove a decision not to invest. The key change occurred when ThaiBev acquired a majority stake, and gained control of SABECO’s board. ThaiBev quickly announced its intention to reform SABECO, and since then it has invested in initiatives around packing and logistics and in new production capacity, introduced performance-based incentives, and re-launched the flagship Bia Saigon brand. A similar rejuvenation is planned for SABECO’s other products.

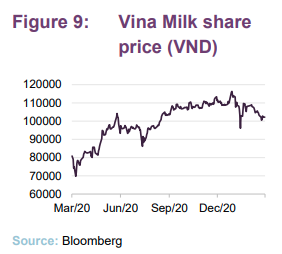

Vietnam Dairy Products (Vinamilk) – growing in China

Vietnam Dairy Products (vinamilk.com.vn), more commonly known as Vinamilk, is the largest manufacturer and retailer of dairy products in Vietnam. It is one of the largest companies in Vietnam (it is a top 20 company in terms of sales) and is generally considered to be a very high-quality company (it has a strong focus on sustainability and ESG considerations), making it a firm favourite amongst international investors, and is almost without exception a constituent of portfolios focused on Vietnam. However, it should be noted that VNH’s initial allocation is small; the manager has underweighted the company as it sees better growth prospects elsewhere.

Vinamilk has grown both organically (investing in new production facilities) and by acquisition (it has been consolidating the industry). Vinamilk’s strong reputation for the safety and quality of its product have been a key competitive advantage, allowing it to prosper in a region that remains very safety conscious following the Chinese milk scandal in 2008. In Vietnam, it is vertically integrated with its own farms and circa 200,000 outlets. It exports to over 15 countries including US and Australia. It is also permitted to sell products to the Eurasian Economic Union, including Russia, Belarus, Armenia, Kazakhstan and Kyrgyzstan.

Despite the challenges caused by COVID-19, Vinamilk was able to grow during 2020, increasing its consolidated net revenue by nearly 6% to VND59.6 trillion (Q4 consolidated net revenue increased by 1.3% to VND14.4 trillion). For 2020 as a whole, net revenue from domestic sales increased by 6.9% year-on-year to VND50.8 trillion, while net revenue from international sales increased slightly by 0.35% to almost VND8.8 trillion.

Top 10 holdings

Figure 10 shows VNH’s top 10 holdings as at 31 January 2021, and how these have changed since 30 April 2020 (the most recently-available data when we last published). Six of the top 10 holdings as at 31 January 2021 were constituents of VNH’s top 10 at the end of April 2020, although the relative positions have changed. New entrants to the top 10 are Vietin Bank, Gemadept Corp, Vinhomes and VP Bank, while Sai Gon Cargo Service, Dat Xanh Group, Phu Nhuan Jewelry and Vietcombank have all moved out.

We discuss some of the more interesting developments in the next few pages. However, readers interested in more detail on these top 10 holdings, or other names in VNH’s portfolio, should see our pervious notes. For example, in our initiation note we discussed FPT Group, Phu Nhuan Jewelry, Mobile World Corporation, Sai Gon Cargo Service, MB Bank and Khang Dien House in the asset allocation section. Our May 2020 note discussed ABA Cooltrans, Hoa Phat Group, Dat Xanh Group, Vietcombank, Thien Long Group and PV Trans (see the previous publications section on page 33 of this note).

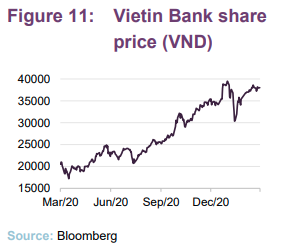

Vietin Bank (8.6%) – strong performance in H2 2020

Vietin Bank (vietinbank.vn), more formally known as the Vietnam Joint Stock Commercial Bank for Industry and Trade, is one of the country’s largest state-owned commercial banks, with around 140 branches and 700 transaction centres. It is backed by Bank of Tokyo-Mitsubishi UFJ (which has a 20% stake) and International Finance Corporation, and offers an extensive range of consumer and corporate banking products. VNH’s manager describes it as a high-quality bank that has been a consistently strong performer since its IPO in 2009. As illustrated in Figure 11, the manager’s decision to add to the holding at the bottom of the market has been beneficial for VNH as Vietin Bank has performed very strongly during the second half of 2020 and, despite a brief set back in January, remains significantly above its pre-pandemic price. As illustrated in Figure 17 in the performance section, Vietin Bank provided the fifth-largest positive contribution to VNH’s performance during 2020.

Vinhomes – one of the largest residential property developers

Vinhomes (vinhomes.vn) is one of the largest real estate developers in Vietnam. Originally founded as a subsidiary of Vingroup, one of Vietnam’s largest conglomerates, Vinhomes was spun off in 2018 and 10% of its shares were sold in its initial equity offering on the Ho Chi Minh stock exchange in May of that year. Following the offering, Vinhomes promptly became one of the largest listed companies in Vietnam – it currently accounts for around 8% of the VN Index. The manager considers that the urbanisation trend in Vietnam, aided by infrastructure improvements, and coupled with the growing middle class, are increasing the demand for the higher quality modern apartments that Vinhomes offers.

As illustrated in Figure 12, Vinhomes’s share price recovered strongly in the second quarter of 2020 as markets recovered following the COVID-related market crash in March. However, the share price moved up very strongly in the last two months of 2020 as the vaccine rally fed through to improved prospects of a rekindling of the residential real estate market in Vietnam which has been struggling.

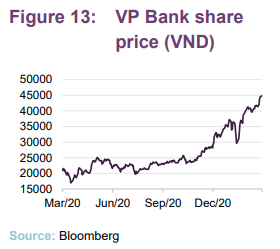

VP Bank (6.0%) – market leading consumer credit operation

Vietnam Prosperity Joint-Stock Commercial Bank, more commonly referred to as VP Bank (vpbank.com.vn) is an existing holding that VNH’s manager has been adding to as it has increased the portfolio’s exposure to the banking sector. Having initiated a position in 2019, the manager was adding to the holding at the bottom of the market, when there was a lot of indiscriminate selling, and so VNH has benefitted as VP Bank has performed very strongly during the second half of 2020. VNH’s manager says that VP Bank is well managed and, whilst it is more expensive than some of its peers, it has managed to achieve growth despite increasing loan provisions in the face of COVID-19, lower net interest margin and lower credit growth.

In addition to the banking exposure, VP Bank also plays into the manager’s theme of the consumer, due to its consumer credit operation, FE Credit, which is the market leader in consumer finance in Vietnam. Established eight years ago, VNH’s manager says that FE Credit is a strong motor for growth within the wider business. FE Credit is run by the former CEO of Prudential Consumer Finance (he left this business to set up FE Credit) and there has been chatter around a potential IPO of FE Credit as a standalone business. VNH’s manager thinks that such a move could crystallise additional value for existing shareholders.

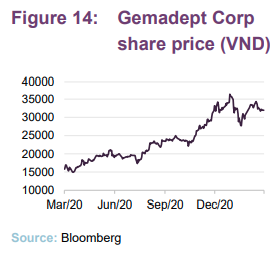

Gemadept Corp (7.4%) – exposed to growing international trade

Gemadept Corporation (gemadept.com.vn) is a marine freight transportation company that owns and operates ports and provides related logistics activities, both in Vietnam and internationally. This includes containers and oversize freight, as well as transportation by deep sea, inland water, land and air.

The manager started to build a position in Gemadept around two years ago (it plays into the managers industrialisation theme) and added to the holding during the pandemic. Craig says that Vietnamese sea freight has been growing at around 20% per annum for a number of decades and that this trend is expected to continue. Gemadept is soft-opening a new port, which is expected to see it increase its market share and with FDI expected to increase, VNH’s manager believes that Gemadept, as the cheapest operator in the space, is very well-positioned to benefit.

Gemadept owns around 30% of Saigon Cargo Services (or SCS, another VNH holding which we discussed in detail in our December 2019 note – see page 15 of that note), and, reflecting the fact that Gemadept is more liquid and SCS still faces challenges with COVID-19-related travel restrictions, VNH’s manager has sold down SCS as it has increased the holding in Gemadept.

Performance

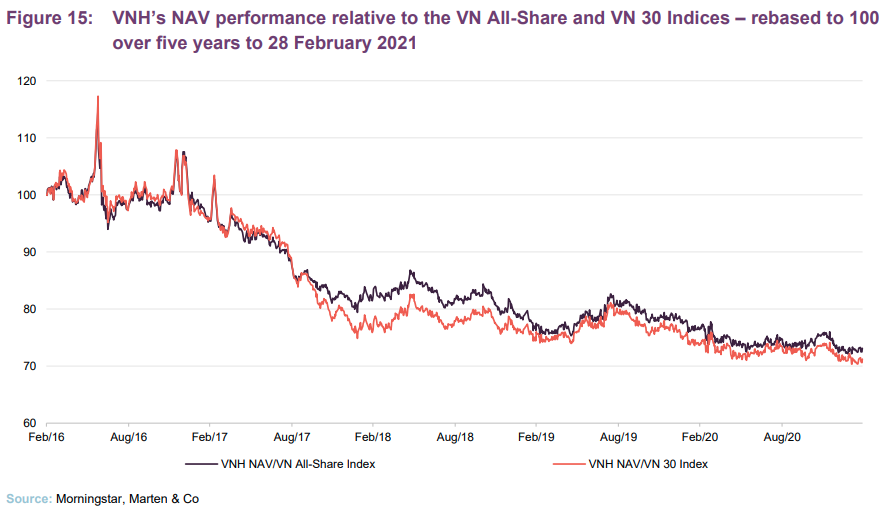

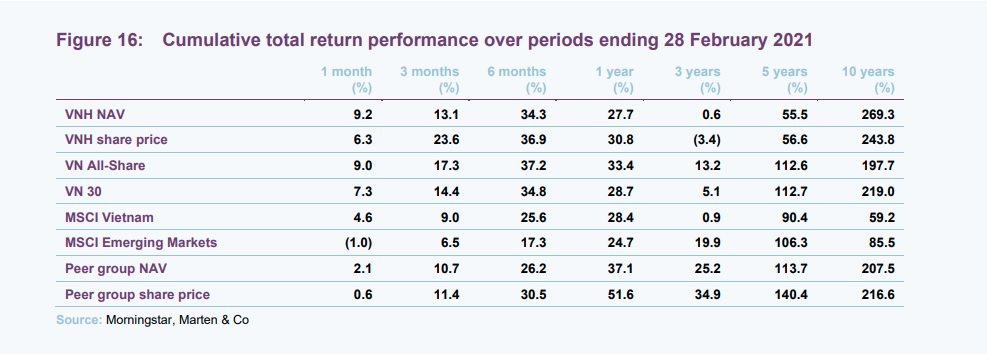

Figure 16 illustrates VNH’s share price and NAV total return performances in comparison with those of its country specialists: Asia Pacific ex Japan peer group, the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices. Absolute returns over the 10-year periods are very strong, particularly for VNH and its peers. Furthermore, over 10 years, VNH strongly outperforms all of the indices as well as the average of the peer group for NAV, albeit its share price has performed less strongly. and share price total returns). Over six months, VNH’s performance is particularly strong relative to the broader indices and its peers. This is a period in which the manager has been reducing the portfolios bias to small-to-mid-cap stocks in favour of larger companies, particularly the banks.

Performance during the second half of 2020

During the second half of 2020, VNH provided NAV and share price total returns of 25.4% and 24.7% respectively (in sterling terms), more than offsetting the losses of 10.2% and 11.5% that were incurred in the first half. In comparison, the VN All-Share and VN30 Indices provided total returns of 27.1% and 27.5%, also comfortably covering their losses of 5.0% and 5.8% respectively in the first half of 2020.

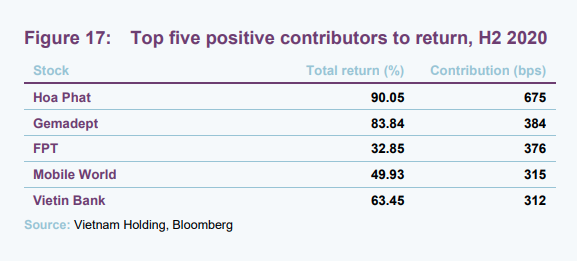

Taking a closer look at VNH’s performance, VNH’s asset allocation was strongly positive, adding 645bp to performance, although this was partially offset by negative stock selection which cost 508bp. Looking at VNH’s sectoral exposures, an underweight exposure to food and beverages, a nil exposure to travel and leisure, and an overweight exposure to retail were the largest positive contributors, adding 134bp, 77bp and 34bp respectively to performance. On the downside, an underweight exposure to financial services, an overweight exposure to industrial goods and services and an overweight exposure to utilities detracted 199bp, 90bp and 86bp respectively from performance. Overall, the manager says that larger cap stocks have performed more strongly than the small-to-mid-caps during the second half of 2020, and so VNH has benefitted from the manager moving up the market cap scale earlier this year. Banks have also performed well and so VNH has benefitted from the manager increasing its allocation to this area.

Top positive contributors to performance during H2 2020

Figure 17 provides the top five contributors to performance during the second half of 2020. Hoa Phat, FPT and Mobile World are discussed below, while Gemadept is discussed on page 17 and Vietin Bank is discussed on page 16.

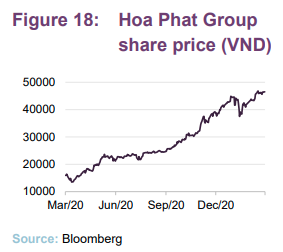

Hoa Phat – benefitting from new production capacity at a time when competitors have been struggling

We last discussed Hoa Phat Group (hoaphat.com.vn/en) in our May 2020 update note (see pages 9 and 10 of that note for more on Hoa Phat and its ESG credentials). To recap, Hoa Phat is a Vietnamese company that describes itself as “the leading industrial manufacturing group in Vietnam”. It is primarily engaged in the steel sector (this is the core of the business accounting for over 80% of revenue and profit), where Hoa Phat is the largest domestic manufacturer, and it also has some agricultural and real estate interests. The business is organised into four key areas:

- Steel – this manufactures steel and cast iron in a variety of forms. Its main products are construction steel, hot rolled coil (HRC), prestressed concrete steel, drawn steel wire, steel pipe and colour-coated corrugated iron. It also manufactures steel-making materials and steel drawing machinery.

- Industrials – this manufactures construction and mining vehicles and equipment; household appliances and refrigerators. It also manufactures home and office furniture and is the market leader in office furniture.

- Agriculture – this farms cattle and poultry; processes and preserves meat; and manufactures and distributes animal feeds, fertilisers and agricultural supplies.

- Real estate – this constructs civil engineering projects and leases houses, offices and land.

VNH’s managers say that Hoa Phat has a uniquely integrated operation in Vietnam (from iron ore and coking coke production through to its finished products). When we wrote in May of last year, we said that VNH’s managers were expecting to see a push on infrastructure spending following the pandemic, of which Hoa Phat is a major supplier. This appears to be playing out. The managers say that Hoa Phat has been very fortunate with the timing at which it has brought on new production capacity. Demand for its products has been strong at a time when other suppliers have been struggling due to COVID. This means that it has been able to utilise the new capacity very quickly, increasing both its exports and its domestic market share (the manager says that this has increased from around 25% to 35%). Reflecting this, net profits have increased by around 80%, cash flows are very strong and the company is in a position to pay a dividend, all of which has driven a rerating in the company’s shares. VNH’s manager says that phase 2 of the expansion is expected by the end of 2022, and it believes that the market is already pricing this in.

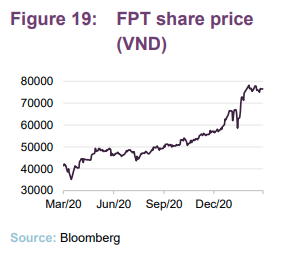

FPT – benefitting from strong growth in software outsourcing services

We last discussed FPT Group (fpt.com.vn/en) in our December 2020 initiation note (see page 13 of that note for more details on its ESG credentials). FPT is the largest IT services company in Vietnam. It develops software, provides IT and telecom services (including broadband internet), and is a distributor/retailer of IT and communication products. It is a long-term holding for VNH (it invested in FPT in January 2007, shortly after FPT listed in December 2006) that, with 49% foreign ownership, is at its FOL.

According to VNH’s manager, FPT employs the largest engineer workforce in Vietnam and offers outsourcing services to more than 650 global customers and partners, including 100 in the Fortune 500. Previously a conglomerate, FPT is now much more focused in its offering. Software outsourcing is the largest component of its business, followed by telecoms (it owns significant telecoms infrastructure, including a main north-south fibre link, and its private telecom network allows it to service all 64 of Vietnam’s provinces).

VNH’s managers say that the software outsourcing business is doing very well and, while it delivered just 15% EPS growth in 2020, they say the outlook for this segment of the business is very bright. It also continues to grow its overseas footprint with operations in the US, Japan, ASEAN, Europe and Australia.

The manager says that it continues to see very strong potential for FPT to grow both its domestic and international sales from here; it has a high degree of technical expertise and its labour costs are very competitive compared to India and China. At home, both the government and the private sector (for example banking and oil & gas) are increasing their spend on IT services. At 49% foreign ownership, the company is at its FOL, which the manager believes is continuing to depress the share price as is the outdated perception that it is a conglomerate. The managers expect to see a further rerating of this stock.

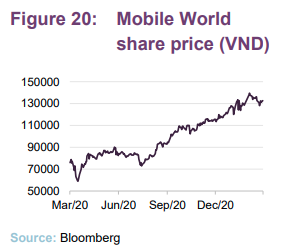

Mobile World – operating in structural growth areas with a strong track record of execution

We last discussed Mobile World (mwg.vn/eng) in our December 2020 initiation note (see page 15 of that note for more details on its ESG credentials), where we commented that the company was a ‘relatively’ new investment for VNH (VNH first invested in September 2017). To recap, the company is Vietnam’s largest retailer and is focused on three key areas: mobile phone retail (The Gioi Di Dong), consumer electronics retail (Dien May Xanh) and grocery retail (Bach Hoa Xanh). According to VNH, Mobile World has a 45% share of the domestic mobile phone market and a 40% market share of the consumer electronics market. It is aiming to achieve a 10% market share in grocery retail (its newest venture) by 2022. This market is worth around US$50bn per annum.

VNH’s managers say that it is succeeding in taking market share from the traditional wet markets in Vietnam and, from an operational perspective, the company continues to perform strongly. Despite this, the company was badly hit by negative market sentiment in the first half of 2020, as the pandemic accelerated, but has recovered very strongly in H2 2020. VNH has benefitted from having a significant holding in the stock. The manager reiterates says that Mobile World has proven itself to be very strong at executing, it is operating in structural growth areas, is demonstrably strong at identifying winning sectors to enter. It believes that innovation will allow the company to keep its growth momentum, both from new store openings and existing store sales growth.

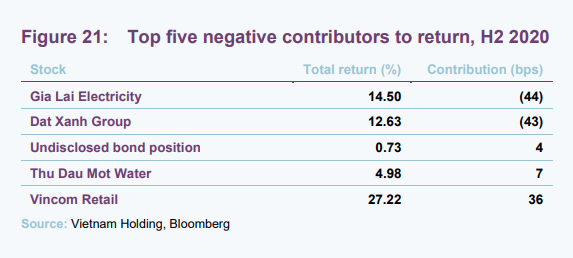

Top negative contributors to performance during H2 2020

Figure 21 provides the top five detractors from performance during the second half of 2020. The Gia Lai Electricity, Dat Xanh Group, ABA Cool Trans, Thu Dau Mot Water and Vincom Retail are discussed below.

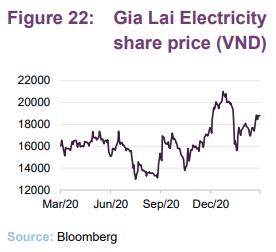

Gia Lai Electricity – misunderstood by the market but offers a compelling long-term structural growth opportunity

Gia Lai Electricity is an independent Vietnamese renewable energy provider that primarily produces electricity through its hydroelectric and solar power plants. It is the largest renewable energy player in Vietnam. The company is also engaged in the construction of grid infrastructure, such as power lines and public lighting systems, as well as the installation of electrical equipment and machinery for power plants. Furthermore, Gia Lai Electricity provides a range of construction and consultation services in relation to power plants, including architectural and engineering services, construction consultation and supervision services.

VNH’s managers say that it is a very good well-managed company that is operating very well but is not well understood by the market. Consequently, the benefits of its long-term contracted revenue base, as well as its scalability (VNH’s managers believe that it is very capable of expanding its operating capacity from around 200MW to 1GW) are not yet reflected in its share price. Utilities, with their contracted revenue bases, are inherently defensive stocks and these struggled in the second half of 2020 as the market recovered strongly. The managers say that they expect to see a rerating as the stock becomes better understood and the market recognises its strong long-term structural growth opportunity.

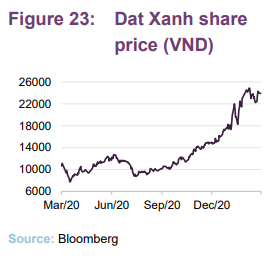

Dat Xanh – capital reallocated to other property positions

Dat Xanh Group (datxanh.vn) is a real estate development company that we last discussed in our May 2020 note (see page 10 of that note). The sector has been facing pressure recently as developers have been reluctant to commit new capital, while buyers were holding off on purchases on the expectation that prices would soften further. However, VNH’s managers observed that Dat Xanh had new property launches coming online in Mid-2020, which it felt could leave Dat Xanh well-positioned to recover as the Vietnamese economy starts to re-open.

Looking at Figure 23, this appears to have played out, although VNH did not participate as might have been expected, as the managers decided to sell down the holding. They acknowledge that Dat Xanh has a good landbank, and has been strong in terms of meeting its environmental and social objectives, but they decided to exit the position and allocate the capital to companies with comparable landbanks that currently fit their other criteria better (for example, Vinhomes).

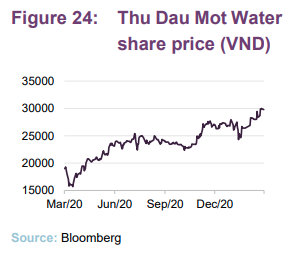

Thu Dau Mot Water – misunderstood growth opportunity

Like Gai Lai Electricty discussed above, VNH’s managers say that Thu Dau Mot Water (tdmwater.vn) is another very good business that offers a compelling with long-term structural growth opportunity that has struggled in the second half of 2020 as it is not well understood by the market and is treated as a defensive utility stock. As its name suggests, the company is primarily focused on the processing and supply of freshwater, for both domestic use and manufacturing purposes, in Thu Dau Mot City, Binh Duong province. The company is also engaged in the development and management of water supply systems; offers drainage and sewage treatment services; provides architectural services, engineering services and technical advice; testing and technical analysis services; and is a wholesale supplier of water meters and other industrial supplies. The managers say that freshwater supply is a big growth area in Vietnam, both as a function of increasing domestic incomes and growing manufacturing in the country. Therefore, like Gia Lai Electricity, they expect to see a rerating as the stock becomes better understood and the market recognises its strong long-term structural growth opportunity.

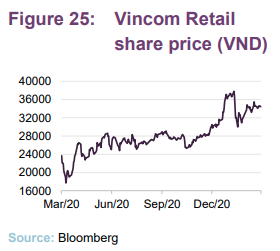

Vincom Retail – well positioned for recovery as COVID-related restrictions ease

Vincom Retail (ir.vincom.com.vn/en) is a real estate company that is primarily focused on the development and operation of retail real estate in Vietnam, where it is the largest shopping mall operator (it also has interests in the development of residential and office properties for both lease and sale). Its malls include Vincom Center, Vincom Mega Mall, Vincom Plaza and Vincom+. It offers premium retail destinations and is well-positioned to benefit from the long-term structural growth themes of growing personal incomes and an emerging middle class in Vietnam.

Lockdown restrictions imposed by the government, while very effective in controlling the spread of the virus, have impacted the company significantly. In VNH’s manager’s words, it has a massive footprint but is not seeing any customers through its doors. It is still incurring costs but has seen the rental environment soften as it has provided concessions to its retail tenants. However, the managers also say that the company has a strong balance sheet and so is well positioned to weather the storm and they expect to see it recover strongly as restrictions are eased.

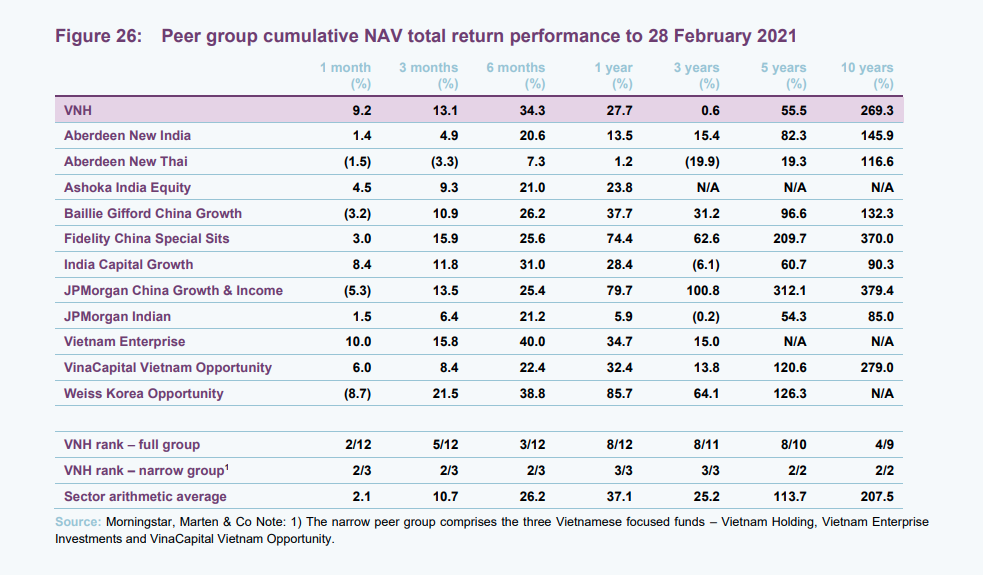

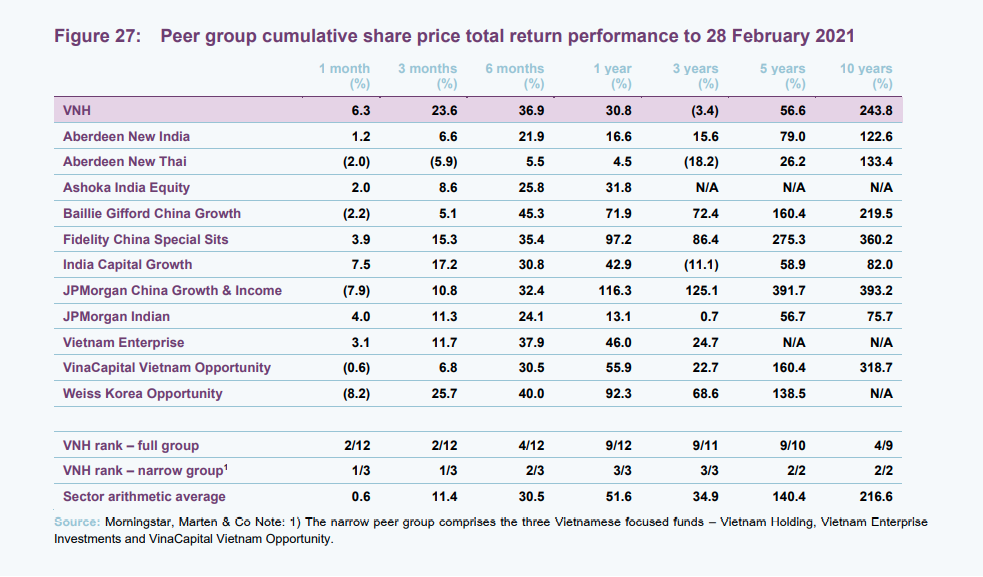

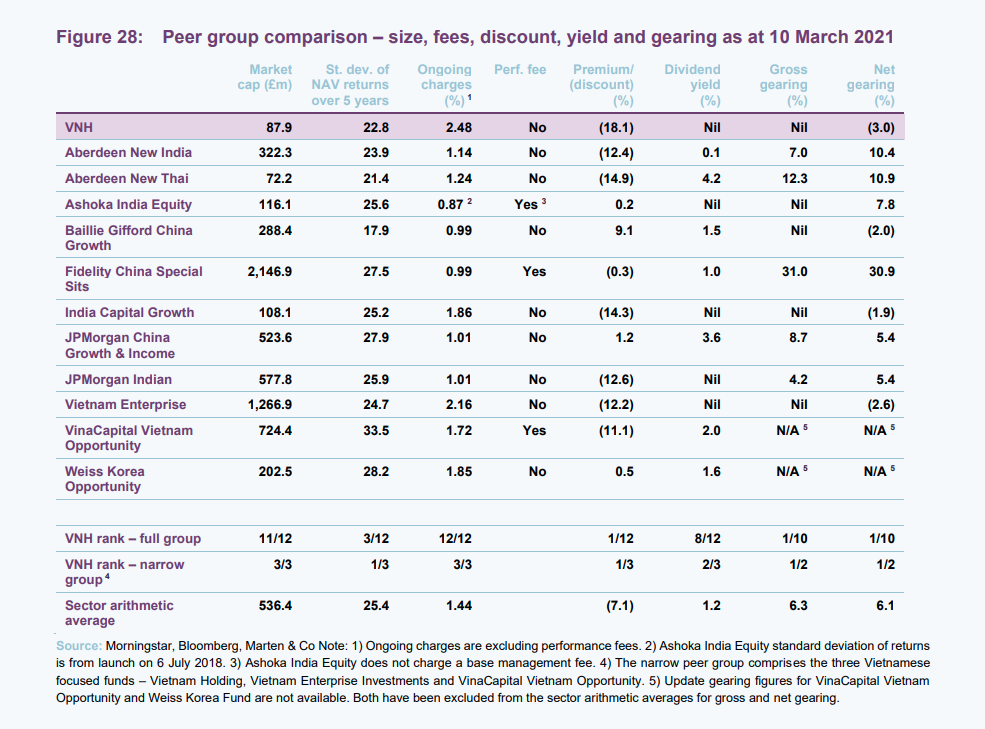

Peer group

VNH is a member of the Association of Investment Companies (AIC)’s country specialist: Asia-Pacific ex-Japan sector, which comprises 12 members. All of these are illustrated in Figures 26 through 28. However, whilst they are all members of the same peer group, the funds included in this peer group comparison are quite diverse and are imperfect comparators for VNH.

For example, four of the funds are focused on India, three are focused on China, one is focused on Thailand and one is focused on South Korean preference shares. Including VNH, there are three funds in the peer group that are focused on Vietnam; the others are Vietnam Enterprise Investments (VEIL) and VinaCapital Vietnam Opportunity (VOF). Of these two, VEIL is the closest peer; it is also primarily focused on listed investments with a modest allocation to unquoteds, but it is a significantly larger fund. VOF also invests in listed Vietnamese equities, although this allocation is lower than VNH’s or VEIL’s (70.2% as at 28 February 2021). To reflect these differences, the peer group comparisons in Figures 26 to 28 include rankings for VNH against the wider peer group as well as against these three Vietnam-focused funds.

As illustrated in Figure 26, most funds in the peer group are showing strong absolute returns over the three-months, six-months and one-year periods, VNH included. VNH’s NAV total return is behind the peer group over one-year, but ahead over one-, three and six months. As discussed in our previous notes, difficult performance from mid-2016 to earl 2018, and then in 2019, has eaten into its longer-term performance record, which is particularly apparent in its performance relative to the peer group over the three- and five-year periods. However, it continues to be ahead of the wider peer group over longer periods. A similar pattern is seen in VNH’s share price total return performance against the peer group, however, there is room for VNH’s discount to narrow, which could close the gap between its NAV and share price performance.

The volatility of VNH’s NAV returns is the lowest of its Vietnam’s focused peers and, of the wider peer group, it is the third-lowest. Aberdeen New Thai and Baillie Gifford China Growth (BGCG) have exhibited lower volatility but it should be noted that, for the majority of the five years over which this NAV volatility has been calculated, BGCG was Witan Pacific (this operated a multi-manager funds of funds approach, which is inherently more diversified, and therefore likely to exhibit lower volatility than a more focused single country fund, but returns are similarly diversified – it was Witan Pacific’s ongoing underperformance than saw the change of mandate and investment manager).

At 2.48%, VNH has the highest ongoing charges ratio, both for the wider peer group and for the three Vietnamese-focused funds. The higher-than-average ongoing charges ratio does in part reflect its relatively-small size. However, it is notable that VNH’s ongoing charges ratio is just 32bp higher than VEIL’s, yet VEIL is a significantly larger fund (VEIL’s market cap is 14.4x that of VNH). As discussed on page 28, the performance fee element has been removed from VNH’s management contract to simplify the fee structure, with the aim of making it more shareholder friendly.

Like many funds in the sector, VNH does not pay a yield reflecting both its capital growth focus and the underlying market in which it invests. In terms of gearing, whilst VNH is permitted to borrow, the managers have chosen not to and, instead, to maintain a modest cash balance that is sufficient to meet its ongoing cash needs. All of the Vietnam-focused funds tend to run with net cash position to some degree (up-to-date information on VinaCapital Vietnam Opportunity’s cash position was not available at the time of publishing) and while VNH’s is slightly large than VEIL’s, they are very comparable.

No dividend – capital growth focused

VNH’s investment objective is to achieve long-term capital growth by focusing on high-growth companies in Vietnam that demonstrate strong ESG principle awareness. VNH does not have a formal dividend policy and has not paid a dividend since its launch. As a Guernsey-domiciled investment company, there is no requirement to pay out a minimum of 85% of its net revenue income that would apply if it was a UK-domiciled investment trust. During the year ended 30 June 2020, VNH earned dividend income of US$2.77m (2019: US$4.63m), which is equivalent to USc85.44 per share (2019: USc8.04).

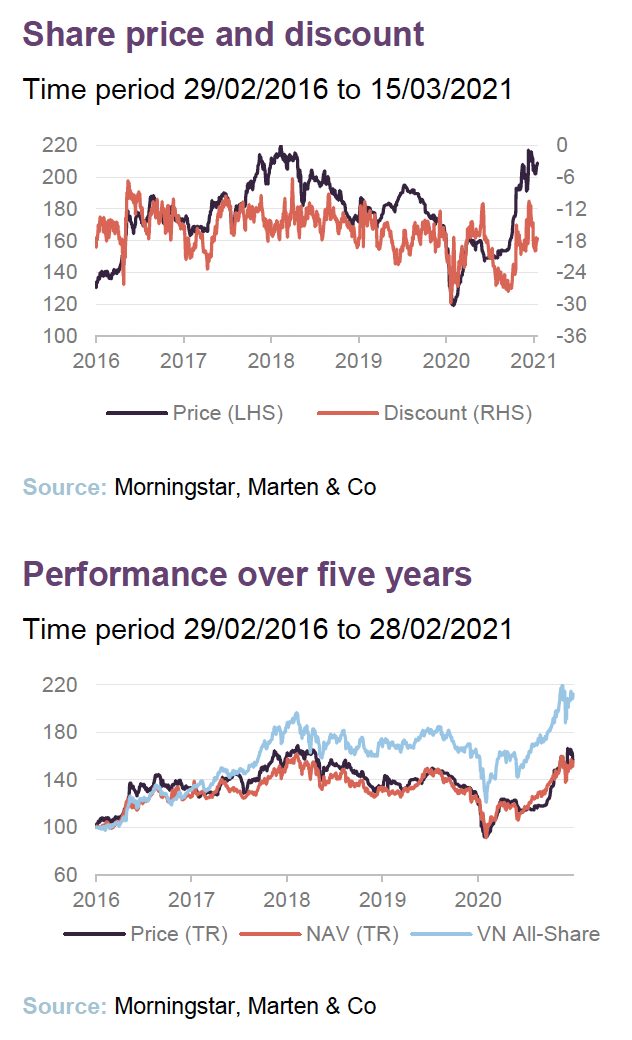

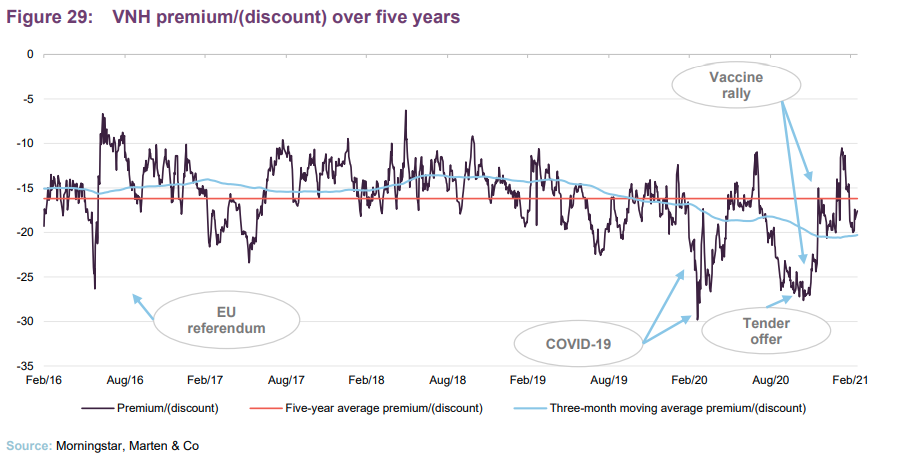

Premium/(discount)

As illustrated in Figure 29, VNH’s discount has exhibited strong mean-reversion tendencies during the last five years and, despite higher volatility in markets due to the pandemic, the last 12 months have broadly seen a repeat of this trend. The discount reached its five-year high of 29.8% on 18 March 2020, but the discount reverted strongly during the following four months so that, by the end of July, the discount was trading around 12%. However, on the back of no significant news, the discount widened markedly during August and the widening trend continued into September and October. November and the first half of December saw a marked turnaround in the performance of VNH’s discount, with it closing from around 27% in early November to around 15% by mid-December. The discount continued on its narrowing trend at the start of 2021, but has widened again since the middle of February. This is a period that has seen markets correct through a combination of investors taking profits in the face of rising long-term interest rates (a potential signal of rising inflation expectations, which can lead to higher near-term rates, all of which can be negative for equities) that have taken the steam out of markets globally.

Discount control and tender offer

VNH is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, as well as an active discount control policy that seeks to address the imbalance between the supply of and demand for its ordinary shares (this process is overseen by VNH’s broker, finnCap Ltd, and is monitored by the board). VNH conducted a 15% tender offer at the beginning of November. The tender was taken up by most shareholders (including both VNH directors and members of VNH’s management team) and was conducted at a 2% discount to NAV. As at

15 March 2021, VNH was trading at a discount of 17.6%, which is between its one- and five-year averages of 20.4% and 16.2% (one-year range: 10.5% to 29.8%).

Fees and costs

Simplified management fee structure with no performance fee

Since we last published, the structure of VNH’s investment management agreement has been revised, so as to remove the performance fee element. In compensation, the level of base management fee has been increased for the first two tiers, although the bands remain the same. Beginning with the current financial year, Dynam Capital is entitled to receive a basic management fee of:

- 1.75% (previously 1.50%) per annum of net assets up to US$300m;

- 1.50% (previously 1.25%) per annum for net asset in excess of US$300m up to US$600m; and

- 1% of net assets in excess US$600m.

The management fee is paid monthly in arrears, and the management agreement can be terminated on six months’ notice by either side. The ongoing charges ratio for the year ended 30 June 2020 was 2.48% (2019: 2.23%). Readers interested in more detail on VNH’s previous fee structure should see pages 22 and 23 of our December 2019 initiation note).

Fund administration and company secretarial services

Sanne Group (Guernsey) Limited was appointed as VNH’s administrator and company secretary with effect from 7 October 2019. The administrator receives a fee of 0.08% per annum for of net assets up to US$100m and 0.07% per annum for net assets in excess of this, subject to a minimum fee of US$140k per annum. The administration fees are accrued monthly and are payable quarterly in advance. VNH has also entered into a separate accounting services agreement with the administrator. The combined administration and accounting fees were US$259.2k for the year ended 30 June 2020 (2019: US$121.7k).

Custody and audit fees

Standard Chartered Bank (Singapore) Limited and Standard Chartered Bank (Vietnam) Limited are VNH’s custodian and the sub-custodian respectively. Custodian fees are charged at 0.08% on the assets under administration (AUA) per annum, subject to a minimum of US$12,000 per annum. Safekeeping of unlisted securities is charged separately at US$12,000 per annum for up to 20 securities (2019: US$12,000). KPMG is VNH’s auditor and audit fees were US$57.5k for the year ended 30 June 2020 (2019: US$120.1k)

Capital structure and life

VNH has a simple capital structure with one class of ordinary share in issue. It is also permitted to borrow up to 25% of its net assets, although, in practice, VNH does not have any debt facilities in place and maintains a small cash balance that is sufficient to meet its operating requirements. VNH’s ordinary shares have a premium main market listing on the LSE and, as at 15 March 2021, there were 42,908,538 of these with voting rights in issue with none held in treasury. VNH also listed on the Official List of The International Stock Exchange on 8 March 2019.

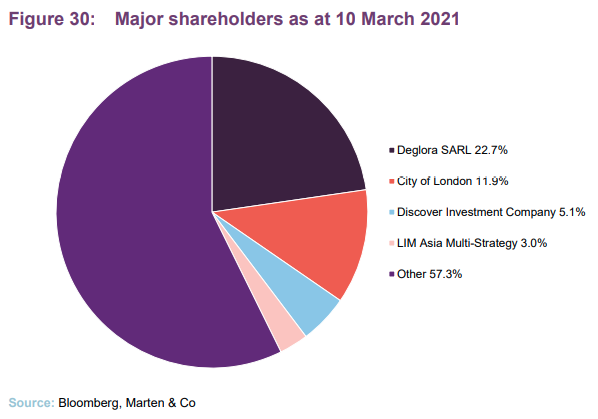

Major shareholders

Unlimited life; continuation vote in 2023

VNH does not have a fixed winding-up date, but previously, it offered shareholders a continuation vote at every third AGM. However, following the major overhaul that began in September/October 2017, shareholders were asked at the 2018 AGM to approve a resolution for VNH to continue for a further five years, if the company migrated from the Cayman Islands to Guernsey. Shareholders approved the resolution and the migration of the domicile was completed in February 2019. VNH’s next continuation vote is therefore scheduled for the 2023 AGM.

Financial calendar

VNH’s year-end is 30 June. The annual results are usually released in September/October (interims in March) and its AGMs are usually held in October/November of each year.

Management team

VNH is managed by Vietnam specialist Dynam Capital. Dynam is a partner-owned business whose sole focus is asset management in Vietnam. Its investment strategy is based on fundamental research, with a strong focus on companies that have a strong commitment to ESG principles. Vu Quang Thinh and Craig Martin (see biographies below) are both executive directors and founding partners of Dynam. The lead portfolio manager is Nguyen Hoang Thanh (see biography overleaf). He is supported by a portfolio analyst, a data analyst and a trader. Further information on Dynam Capital Investment process can be found on pages 10 to 13.

Vu Quang Thinh (CIO and managing director of Dynam Capital)

Vu Quang Thinh has over 30 years’ business experience, including 15 years in asset management, 12 years in corporate restructuring and seven years in an information technology business. He joined Vietnam Holding Asset Management (VNHAM) in 2011 as CEO and, he was appointed to the board of VNHAM in 2014.

Before joining VNHAM, Thinh served as chief executive officer of a local asset management company. Previously, he was managing partner of MCG Management Consulting, which he founded. Prior to this, he was head of the management consulting practice of KMPG Vietnam where he did extensive restructuring work with several state-owned enterprises.

Thinh holds an MBA from Washington State University and a BS degree in Mathematical Economics from Hanoi National Economic University. He is a Certified Asset Management Practitioner in Vietnam. As noted on page 11, he is a founding member and former chairman of the Vietnam Institute of Directors (VIOD).

Craig Martin (chairman of Dynam Capital)

Craig Martin has over 26 years’ investment and fund management experience in emerging markets. He has lived and worked in Southeast Asia since 1993. This includes seven years in Cambodia, five years in Vietnam and 13 years in Singapore.

Until early 2018, Craig was co-CEO of CapAsia, a Singapore headquartered private equity fund manager, focusing on investments in Asia’s emerging markets. He joined CapAsia in 2010, and served on the boards of companies in Thailand, Malaysia, Philippines, Vietnam, Singapore, Indonesia and Pakistan. Prior to CapAsia, Craig was head of private equity for Prudential Vietnam (now Eastspring), and he was previously part of the founding management team at Standard Chartered Private Equity.

Craig has a Masters degree in Engineering from the University of York and a MBA with Distinction from INSEAD. He is also a member of the Singapore Institute of Directors. Craig is also a non-executive director of several private companies.

As at 15 March 2021, Craig has a personal investment in VNH of 81,563 shares, representing 0.19% of VNH’s issued share capital. Prior to the tender offer in November 2020, he owned 100,000 shares but he was able to successfully redeem 18,437 shares as part of that process.

Nguyen Hoang Thanh (portfolio manager)

Nguyen Hoang Thanh has over 10 years of experience in banking and finance in Vietnam, including eight years in asset management and more than two years in banking. He started his career at LienVietPostBank, as a corporate banking officer, before joining Vietnam Holding Asset Management in 2011 as an analyst (he was promoted to manager in 2014). Thanh then spent one year at Dragon Capital as a senior banking analyst, and in late 2017, he worked at Pavo Capital as a Senior Investment Manager covering IPOs and pre-listing investment opportunities. He holds a Masters degree from Clark University, Massachusetts, and a BA in Finance from Can Tho University, Vietnam. He is also a CFA charterholder.

Board

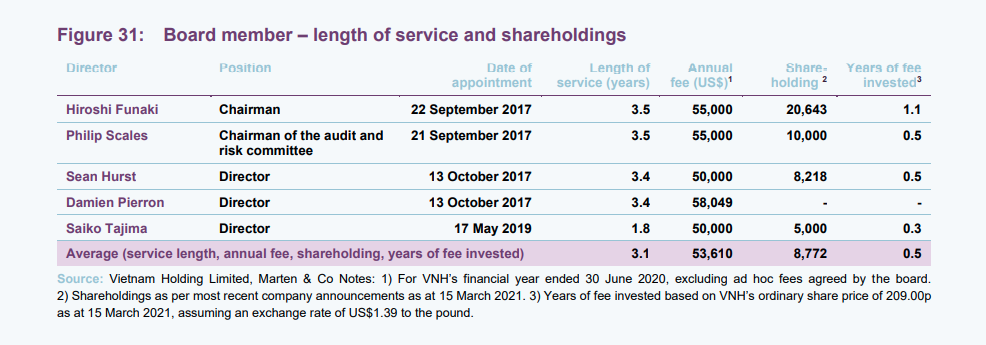

VNH’s board is comprised of five directors, all of whom are non-executive and considered to be independent of the investment manager. Other than VNH’s board, its directors do not have any other shared directorships. As part of the major changes that were made in September/October 2017, VNH’s board underwent a complete refresh. As a consequence, VNH has a relatively young board with an average length of service of just 3.1 years. Board policy is that all of VNH’s board members retire and offer themselves for re-election annually. VNH has adopted a formal policy that neither the chairman nor any other director shall serve for more than nine years. VNH’s articles of incorporation limit the aggregate directors’ fees to a maximum of US$350k per annum.

Recent share purchase and disposal activity by directors

VNH’s chairman, Hiroshi Funaki, and fellow director Sean Hurst participated in VNH’s tender offer in November 2020, redeeming 4,357 and 2,282 shares respectively. Discover Investment Capital, of which Hiroshi Funaki is also a director, redeemed 532,432 VNH shares, bringing its shareholding to 2,197,681 shares (or 5.1% of VNH’s issued share capital). More recently, Sean Hurst and family added 1,000 shares to their holding on 21 January 2021.

Hiroshi Funaki (chairman)

Hiroshi Funaki has been actively involved in raising, researching and trading Vietnam funds for 23 years. Previously, he worked at Edmond de Rothschild Securities (between 2000 and 2015) where he led the Investment Companies team, focusing on Emerging Markets and Alternative Assets. Prior to that, he was head of research at Robert Fleming Securities, also specialising in closed-end funds. He currently acts as a consultant to a number of emerging market investors.

Hiroshi has a BA in Mathematics and Philosophy from Oxford University, and is a UK resident. He became chairman at the conclusion of VNH’s AGM on 8 November 2019. Hiroshi has taken over the position from Sean Hurst.

Philip Scales (chairman of the audit and risk committee)

Philip Scales has over 40 years’ experience working in offshore corporate, trust, and third-party administration. For 18 years, he was managing director of Barings Isle of Man (subsequently to become Northern Trust), where he specialised in establishing offshore fund structures, latterly in the closed-ended arena (both listed and unlisted entities). He subsequently co-founded IOMA Fund and Investment Management Limited (now named FIM Capital Limited), where he is deputy chairman. Philip is a Fellow of the Institute of Chartered Secretaries and Administrators, and holds a number of directorships of listed companies and collective investment schemes. He is an Isle of Man resident.

Sean Hurst (director)

Sean Hurst was co-founder, director and chief investment officer of Albion Asset Management, a French regulated asset management company, from 2005–2009. He is an experienced multi-jurisdictional director, including roles at Main Market and AIM traded funds and numerous offshore and UCITS funds. In addition to advising companies on launching both offshore and onshore investment funds, he is currently non-executive chairman of JPEL Private Equity Ltd and a non-executive director at CIAM Opportunities Fund and Satellite Event Driven UCITS Fund. Sean was formerly a non-executive director of AIM listed ARC Capital Holdings Ltd. He holds an MBA in Finance from CASS Business School and is a resident of France.

Damien Pierron (director)

Damien Pierron is currently managing director at Société Générale in Dubai, where he heads the coverage for Family Offices and Wealthy Families in Middle East and Russia. He has 15 years’ experience in M&A, private equity, equity derivatives, wealth management and investment banking gained at, among others, Lafarge Holcim, OC&C Strategy Consultants and Natixis. Damien is a CFA charterholder and holds a Degree in Mathematics, Physics and Economy from Ecole Polytechnique in Paris. He also holds a Masters Degree in Quantitative Innovation from École Nationale Superieure des Mines de Paris. He is a Dubai resident.

Saiko Tajima (director)

Saiko Tajima has over 20 years’ experience in finance, including eight years spent in Asian real estate asset management and structured finance. She has worked for Aozora Bank and group companies of both Lehman Brothers and Capmark, where she focused on financial analysis, monitoring and reporting to lenders, borrowers, auditors, regulators and rating agencies. Over the last five years, she has invested in and helped develop tech start-ups in Tokyo, Seoul and Sydney.

Previous publications

Readers interested in further information about VNH may wish to read our previous notes by clicking on the links.

Silent revolution, initiation note, published December 2019

Early mover advantage, update note, published May 2020

The legal bit

This marketing communication has been prepared for Vietnam Holding Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.