Early mover advantage

Early mover advantage

The pandemic is having a devastating impact on the global economy and, while they have recovered from their lows, financial markets remain depressed. Emerging markets have been at the sharp end of these moves, but Vietnam, which was quick and tenacious in its response, is a bright spot in these difficult times.

Dynam Capital, the manager of Vietnam Holding (VNH), says that the authorities’ response to the virus is allowing Vietnam to exit from lockdown earlier than most and that it is well positioned to respond should a second wave occur. Most Vietnamese production was able to stay open. Cross-border trade with China, its largest supplier, is recovering and should continue to grow. With very supportive longterm structural growth drivers, cheap valuations and an elevated discount, now may be a good entry point for investors who can look through the volatility and are prepared to be patient.

Capital growth from a concentrated portfolio of high growth Vietnamese companies

Capital growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high-growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

Market outlook and valuations update

Market outlook and valuations update

Recent history and valuations

Recent history and valuations

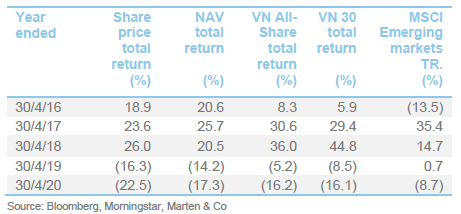

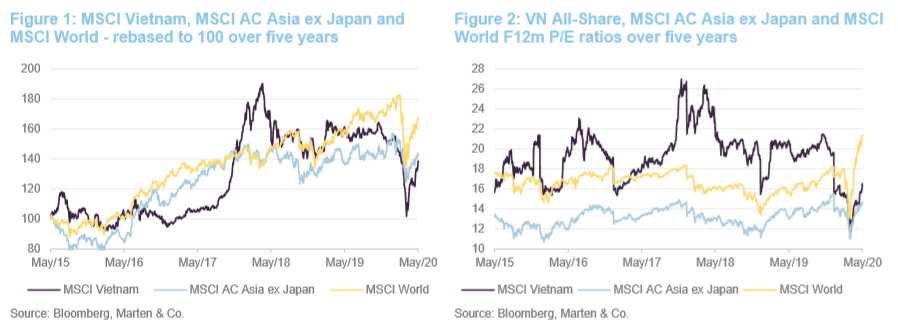

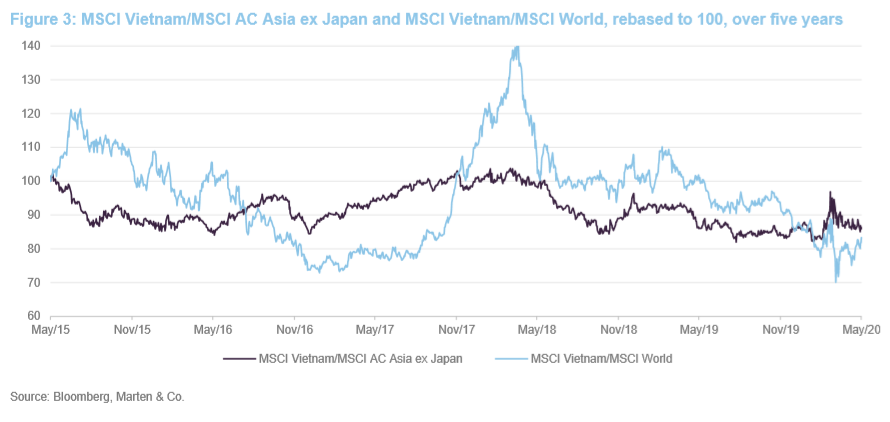

Vietnam, emerging Asia and global equity markets had provided strong absolute returns during the four years prior to the outbreak of covid-19. As fear of the pandemic grew, markets suffered very heavily, particularly during March. There has been a marked recovery since, although all of these markets are below their pre-crisis levels, reflecting the stalling of global economic output. However, Vietnam appears to have suffered more than most, both during the recent rout and over the last two years as a whole.

During the second half of 2017 and the early part of 2018, Vietnam’s stock market roared ahead on the back of its very own mini-China boom (that is, a communist state embracing private commerce and finance). However, following their peak in April 2018, Vietnamese equities slumped as growth slowed, inflation increased and concerns arose that, with a considerable trade deficit with the US, Vietnam might also face direct trade tariff action from the US, along with China.

As we have noted previously, global markets have been very macro-driven during the past few years, with top-down considerations frequently outweighing company fundamentals. This is partially illustrated in Figure 2, which shows marked movements in valuations. Vietnamese equities, whose medium to long-term prospects appear to be undimmed, are markedly cheaper than they were pre-crisis. This is despite the fact that the country appears to have been effective in dealing with the covid-19 outbreak. While Vietnamese equities are still trading at a premium to emerging Asia, the valuation premium has narrowed dramatically.

Covid:19 Vietnam – a case study in epidemic management

Covid:19 Vietnam – a case study in epidemic management

In Vietnam, the first cases were reported in late January, shortly after the outbreak in China became apparent. 16 people were initially reported as having contracted covid19 in Vietnam and all have now recovered. Furthermore, to date, Vietnam has reported around 320 cases from a population of some 90m and it has not reported any covid-19 related deaths. This is no small achievement for a developing country that has a 1,400km land border with China, where the virus originated; and has a GDP per capita of just $6,700 dollars, compared to China’s $16,100 dollars.

Lessons learned from SARS; testing, contact tracing and public messaging key to virus containment

Lessons learned from SARS; testing, contact tracing and public messaging key to virus containment

Like other south-east Asian countries, Vietnam has relatively recent experience of dealing with a major epidemic, with SARS between 2002 and 2004. The many lessons that were learned during that outbreak allowed most Asian countries’ health care systems to be better prepared and to make the best use of limited resources in dealing with covid-19.

The key to Vietnam’s standout success appears to have been strategic testing, followed by an aggressive approach to contact tracing, complemented by effective public messaging. All these measures were implemented early, limiting transmissions and stopping the virus from taking hold.

The manager believes that that the Vietnamese government was quick to recognise the potential seriousness of the initial outbreak and responded aggressively, recognising that its own limited healthcare system would be quickly overwhelmed if it failed to act decisively (Vietnam has around eight doctors per 10,000 people). Reflecting this, an anti-pandemic steering committee was established on 30 January 2020.

Splendid isolation

Splendid isolation

Vietnam’s policy has been to isolate all people that are suspected of being infected with covid-19 and, consequently, tens of thousands of people have been placed into quarantine. By 1 February, the national flag carrier, Vietnam Airlines, had announced that it had suspended all flights to and from China, Hong Kong and Taiwan. Land borders were closed shortly after this, and all international flights were suspended by 21 March. The government also made the wearing of masks outside compulsory on 16 March, with tough penalties for non-compliance. From this point, people were only allowed to leave their homes to buy food and all public gatherings were prohibited (prior to this, gatherings of up to 10 people had been permitted – a restriction that was imposed in January). The Vietnamese government has also been actively been trying to repatriate its citizens abroad; those returning have been quarantined for 14 days at government facilities.

Testing times

Testing times

By early March, Vietnamese scientists had already developed several low-cost test kits (which the country has subsequently been exporting) and the number of laboratories equipped to test for the virus was ramped up from three in January to 112 by April. Vietnam’s strategy has been to test those in isolation, rather than undertaking more expensive mass screening initiatives, although people deemed to be at a high risk of exposure have also been tested (for example, those who have visited markets in Hanoi). Whereas most countries have quarantined people known to have contracted the virus, and then tested their direct contacts, Vietnam has gone further by isolating everyone that is infected or suspected of being infected.

By way of illustration, individuals known to have contracted the virus are isolated and treated in hospital (we shall call these F0).

Those who are known to have had direct contact with an infected person (we shall call these F1) are also tested and are quarantined either at military camps or in hospital (the Vietnamese military has reportedly put aside facilities with a capacity of 60,000 people to contain the spread of the virus).

Those who have had direct exposure to persons classed as F1 (we shall call these F2) are automatically required to isolate themselves at home for a period of two weeks.

In the event that someone who is classed as F1 tests positive, they are then classed as F0 and their direct contacts move from being classed as F2 to F1 (which means that they are automatically subject to the more stringent restrictions associated with this class). Furthermore, the net automatically widens to include the direct contacts of those now who are now classed as F1, thereby creating a new batch of individuals classed as F2, who are then also subject to greater restrictions than they had previously been.

All people have been required to report their virus and contact history to the authorities, which has made the implementation of this process possible. It has given the authorities the best possible chance of identifying potential infections early and therefore limit their spread. By late April, the country had conducted more than 260,000 tests — 2,691 per million of population, which was more than the number of people it had in isolation.

The virus is your enemy!

The virus is your enemy!

The state’s famous propaganda machine has been cranked up to encourage the population to engage in positive habits to limit the spread. Slogans such as “staying home is loving your country”, “social distancing is a form of patriotism”, and “the virus is your enemy” have been deployed to great effect. There has been a consistent message though a range of channels, which has even included different departments of the government regularly texting Vietnamese citizens with information. The government even released a catchy pop song in February, which subsequently went viral and has clocked up around 50m views on YouTube to date (click here), encouraging people to wash their hands; not touch their eyes, nose and mouth; avoid public places; clean their environment; raise social awareness – all in an effort to beat the virus.

With the tide turning, Vietnam is back open for business

With the tide turning, Vietnam is back open for business

Vietnam has seen no new domestically transmitted cases of the virus reported in over a month (on Sunday 17 May it reported two new cases, but these were both imported). Reflecting this, the country has started to reopen businesses and tourist attractions. Subject to social distancing measures being maintained, school have been reopened with the further precautions of children’s temperatures being taken and students being provided with hand sanitiser. Vietnam’s largest city, Ho Chi Minh, has fully reopened its bus network and Vietnam Airlines has said that it will resume all domestic flights by the beginning of June. However, the government remains vigilant with regards to the threat of imported cases and has launched a campaign that roughly translates as “Vietnamese people travel to Vietnamese destinations”, which is designed to encourage domestic tourism as the country emerges from lockdown.

Vietnam – strong GDP per capita catch-up potential

Vietnam – strong GDP per capita catch-up potential

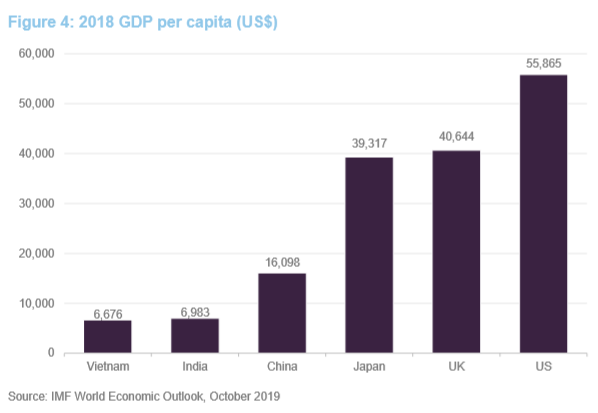

While the world is understandably focused on the effects of the global pandemic, and how best to manage this and limit its impact, it is easy to forget the long-term structural growth opportunity that exists within Vietnam. In our initiation note, we included data from the IMF’s World Economic Outlook from October 2019 to illustrate the catch up potential in GDP per capita for Vietnam and the difference in projected growth, over the five years 2019 – 2024, of Vietnam versus its Asian peers and more-developed nations.

Given the current uncertainty, the IMF have not provided renewed estimates of these in their April 2020 World Economic Outlook, but we would argue that the fundamental drivers that support this have not gone away. Reproduced from our December note, Figure 4 illustrates that Vietnam’s 2018 GDP per capita is a little below India’s, around 40% of China’s (see Figure 4), and significantly below that of more-developed nations. It should be noted that Vietnam has a favourable demographic profile (a median age of 30.5 years) and is relatively resource-rich (it has commercially-viable reserves in a range of metals and minerals).

Manager’s view – Vietnam, still a rising star in ASEAN

Manager’s view – Vietnam, still a rising star in ASEAN

Clearly, global economic growth will be severely affected this year, with the impacts being felt into 2021 and possibly beyond. For example, in its World Economic Outlook for April 2020, the IMF projects that global GDP will contract by 3% in 2020. This assumes that the pandemic fades in the second half of this year and that current restrictions designed to contain and limit the spread of the virus can be gradually unwound. It then projects that the global economy will grow by 5.8% in 2021 as economic activity normalises, with the help of policy support.

Although acknowledging that the covid-19 pandemic has been severely disrupting for the global economy, with Vietnam not immune to this in the near term, Dynam Capital remains positive on the long-term outlook for the Vietnamese economy and market. The manager highlights that Vietnam has benefitted from a high and stable growth rate during the last 30 years. With strong structural growth drivers in place, it expects this to continue, with Vietnam becoming a top 20 global economy by 2050. We explained the manager’s view, and the reasons why Vietnam is well-positioned for long-term structural growth, on pages 8 and 9 of our initiation note. We recommend that readers see this note for more discussion of this, while noting the near-term considerations noted below.

Reasons to be cheerful

Reasons to be cheerful

In the short term, there are a number of reasons to be positive. Vietnam was exposed to the virus early, but the authorities were quick to respond to this, which has limited its spread, allowing Vietnam to exit from lockdown earlier than most. While its borders remain largely closed to travellers (it continues to repatriate its nationals) they remain open for trade and goods are still flowing. Official volumes are reportedly down around 20%, but China has reopened some of its factories, which is positive as lots of Vietnamese finished goods use parts, components and materials that are manufactured there.

It should also be noted that, while Vietnam has been benefitting from increasing exports in recent years, its growth has been largely domestically-driven, which makes its economy more resilient in the current global slowdown. However, irrespective of this, cross-border trade has increased from its low and, although it slowed, most Vietnamese production was able to stay open.

The Vietnamese government has put a US$1.16bn assistance package in place that includes tax breaks, delayed tax payments and reductions in land lease fees to help companies impacted by the virus. The State Bank of Vietnam (SVB – Vietnam’s central bank) cut its key policy rates by between 0.5 and one percentage point in February and has scrapped transaction fees. SVB has also ordered commercial banks to follow its lead and has offered US$12.4 billion (VND 293 trillion) in preferential credit to businesses that are affected.

While banks in some quarters have been slow to respond to government requests to provide support to companies, Dynam notes that the government has a lot of ownership of the banking sector in Vietnam. It therefore expects the government’s actions, through the banks, to be strong and effective. A further consideration is that, as a net importer of oil, Vietnam will benefit from a lower oil price over the longer term. However, the government derives significant income from its oil taxes, and so its budget will be hit at a time where spending has surged.

The manager acknowledges that it is a difficult environment, but it says that this throws up opportunities and it has been adding to positions that it likes, while these are cheap. For example, they have added to two good quality banks recently.

Asset allocation

Asset allocation

Concentrated and low turnover portfolio of Vietnamese stocks

Concentrated and low turnover portfolio of Vietnamese stocks

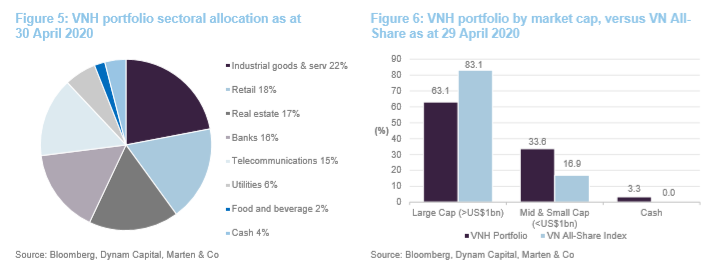

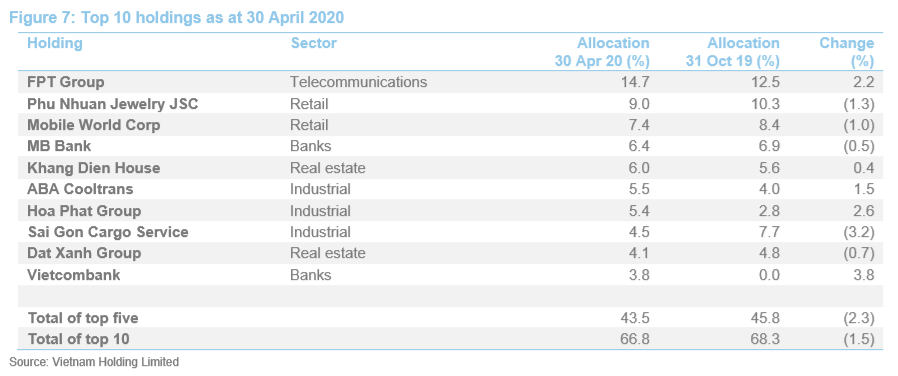

As at 30 April 2020, VNH’s portfolio had exposure to 22 securities (down from 23 securities as at 31 October 2019 – the most recently available data when we last published). VNH’s portfolio is highly concentrated; it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%) but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction). As illustrated in Figure 7, the top 10 holdings accounted for 66.8% of VNH’s portfolio as at 30 April 2020, which is a mild reduction in concentration from the 68.3% as at 31 October 2019.

As we highlighted in our initiation note, VNH’s portfolio is distinctly different from the VN All-Share (or any Vietnamese-focused ETF for that matter). VNH’s portfolio has a high active share – typically 75-80% and, as illustrated in Figure 6, VNH’s portfolio has a markedly higher allocation to mid- and small-cap stocks (the VN All-share, by contrast, is heavily weighted towards stocks with market caps in excess of US$1bn).

Readers interested in further detail on the manager’s bottom-up ESG-focused investment process should see pages 9 to 12 of our December 2019 initiation note.

Top 10 holdings

Top 10 holdings

Figure 8 shows VNH’s top 10 holdings as at 30 April 2020, and how these have changed since 31 October 2019 (the most recently available data when we last published). Eight of the top 10 holdings as at 30 April 2020 were constituents of VNH’s top 10 at the end of October, although the relative positions have changed. New entrants to the top 10 are Hoa Phat Group and Vietcombank, while Thien Long Group and PV Trans have moved out.

We discuss some of the more interesting developments later. However, readers interested in more detail on these top 10 holdings, or other names in VNH’s portfolio, should see our initiation note, where we discussed FPT Group, Phu Nhuan Jewelry, Mobile World Corporation, Sai Gon Cargo Service, MB Bank and Khang Dien House in the asset allocation section (see page 15 of this note).

ABA Cooltrans convertible bond (5.5%) – seeing resilient demand for the delivery of essential goods

ABA Cooltrans convertible bond (5.5%) – seeing resilient demand for the delivery of essential goods

ABA Cooltrans (aba.com.vn/en) describes itself as a “leading integrated cold chain service provider in Vietnam”. The core of its business is refrigerated transport (both long-haul and last-mile delivery), but it also offers multi-temperature storage, inventory management, cold chain solutions, and door to door delivery, distribution, and other related value-adding services. The company owns a large fleet of trucks (around 300) and has a capacity of 40,000 pallets of cold storage combined in Hanoi and Ho Chi Minh. VNH invested US$6m in ABA Cooltrans in August 2019 in the company’s Vietnamese dong-denominated convertible bonds. At the time of the investment, VNH said that its intention was to convert the bonds into ABA Cooltrans equity “ahead of a possible future stock listing of the company in Vietnam”.

In its most recent update, VNH said that ABA Cooltrans has been seeing resilient demand for the delivery of essential goods. In many respects, this is not surprising. Food, the bulk of the company’s business, is essential, and with supply chains disrupted, it is all the more important to minimise waste, which will support demand for the company’s services. However, hopes of the company going public are likely to have receded for now.

Hoa Phat Group (5.4%) – added to on weakness

Hoa Phat Group (5.4%) – added to on weakness

Hoa Phat Group (hoaphat.com.vn/en), is a Vietnamese company that describes itself as “the leading industrial manufacturing group in Vietnam”. The group has 11 member companies, with about 20,000 employees, and operates throughout Vietnam with one office in Singapore. Hoa Phat is primarily engaged in the steel sector (this is the core of the business accounting for over 80% revenue and profit), but it also has some agricultural and real estate interests. Its business is organised into four key areas:

• Steel – this manufactures steel and cast iron in a variety of forms. Its main products are construction steel, hot rolled coil (HRC), prestressed concrete steel, drawn steel wire, steel pipe and colour-coated corrugated iron. It also manufactures steelmaking materials and steel drawing machinery.

• Industrials – this manufactures construction and mining vehicles and equipment; household appliances and refrigerators. It also manufactures home and office furniture and is the market leader in office furniture.

• Agriculture – this farms cattle and poultry; processes and preserves meat; and manufactures and distributes animal feeds, fertilisers and agricultural supplies.

• Real estate – this constructs civil engineering projects and leases houses, offices and land.

In terms of its ESG credentials, Hoa Phat operates with a business philosophy of “harmony for joint development” and spends some VND10bn annually to “fulfil its corporate social responsibilities to the community”. It has a sustainable development strategy that governs its relationships. Its aims are as follows:

• Employees – to provide a safe working environment, free from discrimination, with equal opportunities. It seeks to ensure that all benefit from its policies.

• Shareholders – to make information publicly available, ensure that shareholders capital is effective, constantly enhance enterprise value, and make sure the company is well-managed.

• Vietnamese nation – to comply with state policies and laws, increase its contribution to the state budget and to play a pioneering role as a national brand enterprise.

• Partners – to co-operate on the basis of mutual benefit, with equal competition, while ensuring that obligations to suppliers and contractors are met.

• Community – to actively support welfare works in its local communities, implementing social responsibility in various forms, while also production and business goals are attached to environmental protection.

• Agent and customers – to provide flexible sales policies that ensure rights of agents and customers, while providing a variety of high quality, reliable and sustainable products at reasonable and competitive prices.

VNH’s managers are expecting to see a push on infrastructure spending following the pandemic. This has been held up during the last couple of years due to the party congress, but this is now out of the way and the policy is popular due to its multiplier effect. This should be positive for construction materials, of which Hoa Phat is a major supplier. For example, Hoa Phat is a major manufacturer of rebar, which is used to manufacture reinforced concrete and reinforced masonry structures. Reflecting these considerations, VNH’s manager added to the position on the back of covid-19-related share price weakness. As illustrated in Figure 8, the company has benefitted from a strong v-shaped recovery in its share price.

Dat Xanh Group (4.1%)

Dat Xanh Group (4.1%)

Dat Xanh Group (www.datxanh.vn), is a Vietnamese real estate development company. The company develops trade centres, office buildings, apartments, resorts, villas, and hotels. It also offers related real estate services including property management, brokerage, and leasing services.

After five years of rapid growth, in which real estate prices had become elevated, 2019 saw a marked reduction in transaction volumes over the year. Developers have been reluctant to commit new capital as the sector is not as profitable as it has been previously, while buyers have been holding off on the expectation of prices softening. With the outbreak of covid-19, transaction volumes have retrenched even further. This should affect both DAT Xanh’s development and brokerage businesses, although VNH’s manager notes in its most recent update that the brokerage business has been significantly impacted. However, Dat Xanh has new property launches coming online this month that could leave it well-positioned to recover as the Vietnamese economy starts to re-open.

In terms of its ESG credentials, VNH’s manager says that, as a major property developer in Ho Chi Minh City, Dat Xanh is an active promoter for affordable and midend housing segment in Ho Chi Minh City and its neighbouring areas. While this supports the sustainable growth of the company, this also has a significant social impact. Dat Xanh also a pioneer in complying with green building codes and regulations on energy efficiency projects in construction.

Vietcombank (3.8%)

Vietcombank (3.8%)

Vietcombank (portal.vietcombank.com.vn/en-us), more formally known as the Joint Stock Commercial Bank for Foreign Trade of Vietnam, is one of the largest commercial banks in Vietnam. It operates from around 600 locations (including 111 branches and 472 transaction offices), providing a full range of personal and corporate banking services.

VNH’s manager says that Vietcombank is one of two high-quality banks that it added, while these stocks were cheap following the market’s covid-19 related rout. It is worth noting that VNH is structurally underweight in banks. Banks account for around 26% of the index and even having a neutral allocation is far too high for VNH in the manager’s view. This is compounded as the portfolio has a bias towards the mid-caps, where the managers generally see better opportunities, and the good banking stocks tend to be large-cap in the manager’s view.

Looking at ESG credentials, Vietcombank has set itself a mission is to become one of Asia’s 100 best banks and amongst the 300 largest financial and banking groups in the world, run by global best practices. As part of this, it has set out five pillars that are central to its cultural identity:

• Reliability – maintaining trust and competency

• Standardisation – respecting principles and standards of conduct

• Innovation – always striving for new, modern and civilised products and services

• Sustainability – focus on sustainable development for long-term benefits

• Humanity – a culture of ethical working, that is close and sympathetic, with a focus on sharing.

It actively participates in programs to support the rural poor in remote areas of Vietnam, contributing to programmes to improve healthcare and education, for example.

Thien Long Group – reduced as growth slows

Thien Long Group – reduced as growth slows

Thien Long Group (thienlonggroup.com), is a Vietnamese stationery company. Its main four product areas are: pens, office supplies, student tools and fine art tools, and it has ambitions to distribute its products across the globe. At present, it has an extensive distribution system within Vietnam, with more than 60,000 retail points across the nation, allowing it to sell its products across 60 provinces and cities. It is also developing its export markets; it sells its FlexOffice and Colokit products in over 60 countries.

In terms of its ESG credentials, the company has enshrined a commitment to provide the best-quality products, stationery and services to its customers. It has also established five key pillars to its corporate culture to drive its development. These are:

• Pioneering – in creating the best products and services that are friendly to the environment and serve the radical needs of consumers.

• Dedication – to all activities to grow the business.

• Fairness – with customers, suppliers and partners.

• Honesty – and transparency in all activities and transactions.

• Humanities – seeing human beings is a key factor, unanimously uniting to build a thriving Thien Long Community that contributes to the progress of society with the spirit of kindness and humanity.

VNH’s manager also says that Thien Long is among a few listed companies investing in a solar power system (of some 1,900 square meters) on the roof of its factories to save energy. Thien Long estimates this solar system can save approximately 5.4% of its electricity consumption and reduce its CO2 emissions by about 221 tons. It is also among a few investee companies that effectively operates an integrated management system, in accordance with international standards, including an environmental management system and a health and safety management system.

However, Dynam says that while it still likes Thien Long fundamentally and the consumption trend of the middle class remains still intact, growth of the sector has been slowing down. Thien Long is looking for growth in overseas markets, especially in South East Asia areas, but the manager believes that a number of its product segments are unlikely to achieve the exciting growth rate that they have been, especially after the emergence of online working. It therefore reduced the holding to shift into other opportunities.

PV Trans

PV Trans

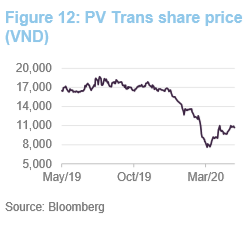

PV Trans (www.pvtrans.com/en_US/), or more formally PetroVietnam Transportation Corporation, is a marine transportation company that moves crude oil, petroleum and petrochemical products for its clients in Vietnam’s domestic waters. The company, which is 51% owned by Vietnam Oil and Gas Group, has circa 1,700 employees. It has a modern fleet of 25 ships built for liquid transportation with total weight capacity over 750,000 DWT. It is also Vietnam’s largest transporter of LPG.

In terms of its ESG credentials, PV Trans has set out a number of aims. These are: to contribute to Vietnam’s energy security; respond promptly to oil and gas transportation and maritime related service demand; to operate at a profit, maintain and enhance shareholders capital; to ensure utmost benefits for shareholders, to ensure the welfare of and provide a favourable working environment for its employees; and to make contribution to the community and to society.

While oil companies have struggled in the face of a lower oil price, oil shipping companies have been benefitting from high day rates as their vessels have been seen as a potential storage solution. Vietnam is a net importer of oil so, over the longer term, a lower oil price will be beneficial for the country, and this may stimulate demand for the company’s services. However, while it has shown some recovery, its share price suffered very heavily as markets retreated in the face of covid-19. It should benefit as economic activity increases as the economy reopens.

Disposal of garment manufacturer on ESG concerns

Disposal of garment manufacturer on ESG concerns

VNH’s manager disposed of its position in an unnamed garments manufacturer, in its entirety, during March. The manager says that ESG considerations drove its decision to the holding. The manager says that, in valuation terms, the company had been very cheap for some time, but that the flow of information from its management had dwindled to a trickle, which is a red flag for the manager (both communication and transparency are critical to Dynam’s process). Dynam monitored the company for some time, but saw no sign of improvement. It also felt that the virus could accelerate the deterioration of certain sectors and businesses that were experiencing problems prior to the pandemic and that, in the case of this particular company, it had a significant problem to deal with in the form of covid-19.

Performance

Performance

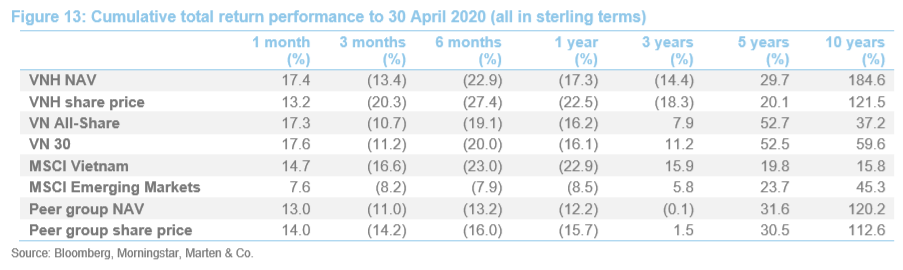

Figure 13 illustrates VNH’s share price and NAV total return performances in comparison with those of its country specialists: Asia Pacific ex Japan peer group, the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices. Absolute returns over the 10-year periods are very strong, particularly for VNH and its peers. Furthermore, over 10 years, VNH strongly outperforms all of the indices as well as the average of the peer group (for both NAV and share price total returns). However, while there has been a strong recovery in April, the severe falls in March have eaten into the performance records of VNH, its peers and the broader indices.

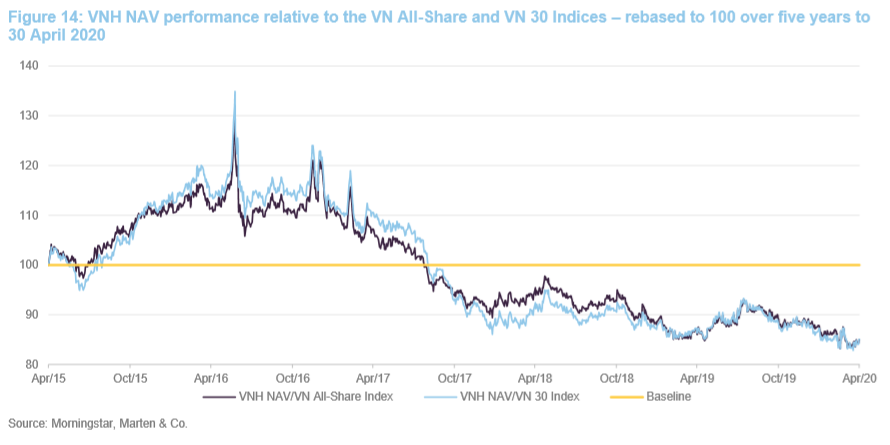

As we highlighted in our initiation note, while VNH’s long-term performance record has been strong, its absolute and relative performance during the last four years has clearly been more challenging. To recap, as illustrated in Figure 14, much of this occurred between mid-2016 and January 2018 (a period during which VNH began its overhaul). Relative performance subsequently improved, although some of this has been given back and we believe that VNH is yet to feel the full benefit of the changes that have been put in place. Nonetheless, VNH’s long-term performance record remains very strong and, in our view, it is over longer-term horizons that a strategy such as VNH’s is best assessed.

We would also reiterate that VNH is focused on the mid cap space, where performance is inherently more volatile due to reduced liquidity and that VNH also operates with a concentrated portfolio which tends to exacerbate this issue. However, VNH has undergone fundamental changes that mean that it is better placed to add value to shareholders going forward, Vietnam is weathering the crisis well and VNH is better positioned than most to grow once the pandemic has subsided. Furthermore, as explained in our initiation note, there is latent value in VNH’s portfolio due to the Vietnamese markets foreign ownership limits (see page 18 of our initiation note).

To recap, where companies are at their FOL, large foreign institutions tend to sit on their hands and the only stock that tends to trade freely is between domestic players. In the absence of these restrictions, demand would be higher, pushing up prices. Where foreign-owned stock does change hands (typically to another foreign investor), this will be at a premium, in ordinary market conditions, that reflects the fact that this stock allows another foreign investor to gain access (note: there has been some indiscriminate selling by foreign investors that has provided opportunities recently to VNH). Many of VNH’s positions are at their FOLs and so there is the potential for VNH to benefit from this.

Premium/(discount)

Premium/(discount)

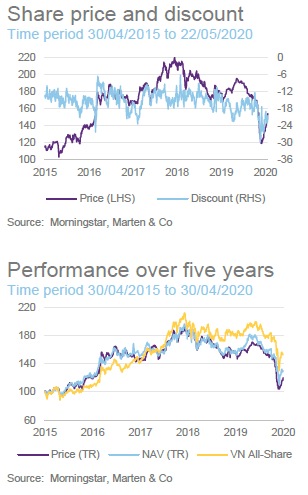

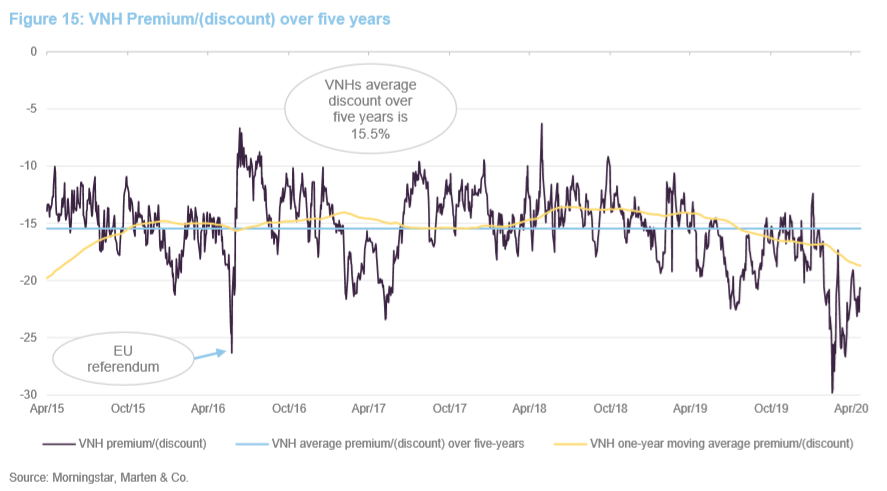

As illustrated in Figure 15, VNH’s discount has exhibited strong mean-reversion tendencies during the last five years. The discount reached its five-year high as markets receded sharply in the face of the covid-19 outbreak (even exceeding the previous high that that was achieved in the immediate aftermath of the UK’s referendum of EU membership) and while it has narrowed significantly since, it nonetheless remains elevated relative to both history and pre-pandemic levels. By way of illustration, as at 21 May 2020, VNH was trading at a discount of 20.7%, which is markedly wider than its five-year average of 15.5%.

While the current discount reflects a degree of uncertainty regarding the impact that the virus is having on Vietnam, its trading partners and the global economy, this seems anomalous given Vietnam’s highly effective response to the outbreak. This is already allowing Vietnam to re-open its economy and these measures put it in a strong position to manage any further waves of the virus.

As discussed in our initiation note, VNH is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, as well as an active discount control policy that seeks to address the imbalance between the supply of and demand for its ordinary shares (this process is overseen by VNH’s broker, finnCap Ltd, and is monitored by the board). At the peak of the market rout, VNH was able to undertake some limited repurchase activity, but the price moves have occurred on very limited volume, which has limited its ability to do more.

As we have noted previously, VNH’s discount has tended to narrow with improving performance and improving sentiment for Vietnam and emerging markets generally. Covid-19 has had a negative impact on the fund, which itself has undergone significant changes during the couple of years. As noted in the asset allocation section, VNH’s holdings are generally well positioned to weather the current storm (some may emerge stronger) and the fund’s overhaul has also put it on a much stronger footing for the future. However, the benefits of this and the greater resources being deployed to raise VNH’s profile amongst investors are yet to be felt given the overriding effects of the pandemic. We continue to believe that VNH could move to a structurally tighter discount, provided that the managers can provide a performance that is attractive to investors.

Fund profile – listed Vietnamese equities with a strong ESG focus

Fund profile – listed Vietnamese equities with a strong ESG focus

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also, subject to certain restrictions, invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). Further information on the manager’s ESG-orientated investment process, including investment restrictions, is provided on pages 9 to 12 of our December 2019 initiation note.

No formal benchmark index

No formal benchmark index

VNH does not have a formal benchmark. However, for the purposes of performance evaluation, the manager has traditionally included comparisons against the VN Index, the VN All-Share, the VN 30 Index and the MSCI Emerging Markets Index in its literature. We have included these as well as the MSCI Vietnam Index in this report.

Previous publications

Previous publications

Readers interested in further information about VNH, such as investment process, fees, capital structure, life and the board, may wish to read our initiation note Silent revolution, published on 11 December 2019. You can read the note by clicking on the link.

The legal bit

The legal bit

This marketing communication has been prepared for Vietnam Holding Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.