On the front foot

Even before its recent acquisitions, JLEN Environmental Assets (JLEN) could already boast the most diversified portfolio of its peers. A change in investment policy, approved by shareholders in March 2021, allowed it to invest in a wider universe of environmental infrastructure that supports the transition to a low-carbon economy. Since then, we have seen JLEN’s first investment in a biomass-fuelled combined heat and power plant, a co-investment in a battery storage asset, and the purchase of a stake in an Italian energy-from-waste plant. Each of these is discussed in this note.

JLEN is well-positioned to continue to expand, aided by an innovative three-year £170m RCF that, recognising the tangible societal benefits derived from its portfolio, has an interest rate that is tied to JLEN’s environmental, social and governance (ESG) performance.

Progressive dividend from investment in environmental infrastructure assets

JLEN aims to provide its shareholders with a sustainable, progressive dividend, paid quarterly, and to preserve the capital value of its portfolio. It invests in a diversified portfolio of environmental infrastructure projects generating predictable, wholly or partially index-linked cash flows. Investment in renewable energy projects is supported by a global commitment to support low-carbon electricity targets.

Looking beyond core renewables

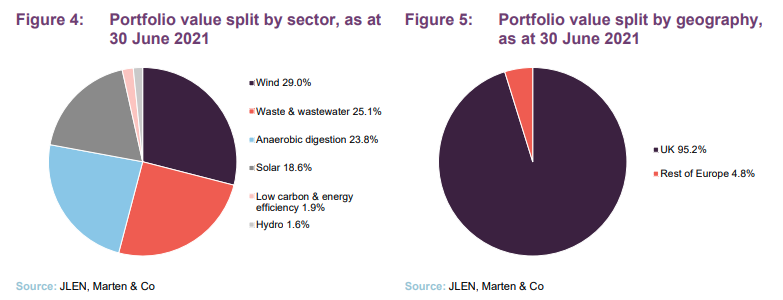

Diversification has been a hallmark of JLEN since its launch. Given that climatic conditions are variable and therefore often unpredictable, a portfolio built around assets that are exposed to many different technologies can diversify resource risk. Exposure to a range of assets that is not exposed to merchant power prices means that JLEN is much less exposed to falling forecast power prices than many of its peers. Drawing on the investment adviser’s depth of resource and considerable expertise, its geographic diversification is increasing too.

Following on from 2020, when JLEN made its first investments in the standalone battery and low-carbon transport sectors, March 2021’s shareholder approval to widen the fund’s remit (see page 4 of our most recent annual overview note) has since been followed by investments in new areas, the most recent acquisition being of a biomass-fuelled combined heat & power plant.

Power generation has led the efforts towards decarbonisation in the UK and will likely continue to be the bedrock of the wider decarbonisation of the economy. However, this needs to be complemented by the electrification of the transportation and heating sectors and a push towards much greater energy efficiency. JLEN notes that the government is planning for a doubling of electricity demand as transport and heat switch from petrol/diesel and gas to electricity, as was outlined in a recent White Paper.

Sustainability

Climate change and issues of sustainability are pressing long-term challenges. The UK Government’s commitment to net-zero emissions by 2050 will require considerable investment in renewable energy and energy storage, as it seeks to cut CO2 output associated with power generation.

JLEN’s investments sit at the heart of the solution to these problems. This has been recognised by the London Stock Exchange (LSE), which awarded JLEN its Green Economy Mark (recognising companies that derive more than half of their revenues from products and services that contribute to the green economy).

In our view, JLEN’s clear appeal to ESG investors is amongst the key factors behind the degree to which its shares trade at a premium to NAV (see the premium/(discount) section).

JLEN’s adviser, Foresight, is a signatory of the United Nations’ Principles for Responsible Investment (UNPRI) and ESG analysis is built into JLEN’s investment process (see our February 2021 annual overview note for more discussion). It is also incorporated into the ongoing monitoring programme for JLEN’s portfolio.

Environmental performance 2020/2021

JLEN’s board has set a series of ESG objectives and the adviser has identified a number of KPIs to measure the fund’s performance in this regard. Over the year to 31 March 2021, JLEN’s portfolio generated 977GWh of clean energy (enough to power 262,000 homes), avoided the emission of the equivalent of more than 445,000 tonnes of CO2, recycled more than 140,000 tonnes of waste, diverted more than 500,000 tonnes of waste from landfill, produced over 370,000 tonnes of organic fertiliser and treated more than 37.5bn litres of water. The company also contributed over £380,000 in community funding.

Other KPIs include the measurement of aspects such as the number of environmental incidents, the management of biodiversity, the number of health & safety incidents and the diversity of the directors of its SPVs.

The board places great emphasis on engaging with shareholders, and JLEN won awards for “Best communication of ESG” in the FTSE 250 category in the IR Society Best Practice Awards for 2020, as well as Investment Week Sustainability and ESG Investment Awards for “Best Sustainable & ESG Alternative Asset Fund”.

JLEN works with Aardvark Certification Ltd to undertake an independent, third-party assessment of the carbon impact of its assets. Individual reports for each asset, as well as a portfolio summary report, are published on the fund’s website. JLEN also aims to comply with the Task Force on Climate-related Financial Disclosures (TCFD) in its 2021/22 annual report.

ESG-linked credit facility

In May 2021, JLEN renewed its RCF that had been due to reach maturity in June 2022. National Australia Bank and Royal Bank of Scotland International joined incumbent lenders ING, HSBC, and NIBC. We note that the facility remains at a committed level of £170m for three years, expiring in May 2024, and also includes an uncommitted accordion facility of up to £30m.

The innovative feature is that the interest that will be charged in respect of the new facility is linked to the company’s ESG performance. JLEN’s interest rate will rise or fall based on performance against defined targets. Those targets include:

- Environmental: increase in the volume of clean energy produced;

- Social: the value of contributions to community funds; and

- Governance: maintaining a low number of work-related accidents, as defined under the Reporting of Injuries, Diseases and Dangerous Occurrences (RIDDORS) by the Health and Safety Executive.

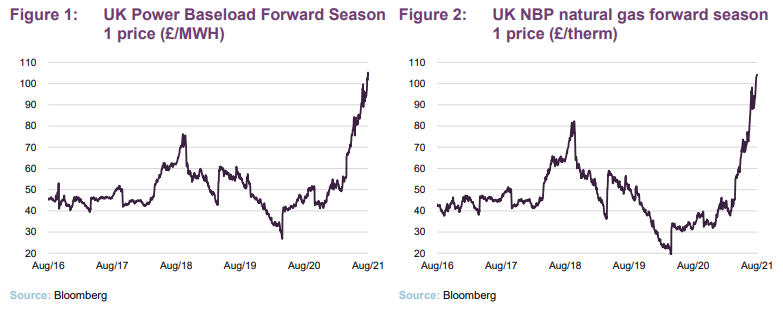

Locking in higher power prices

We note that, having fallen sharply in the early period of the pandemic last year, power and gas prices have rebounded over recent months, helped in part by a cold winter. This presented an opportunity for JLEN to lock in prices across its core wind, solar, and AD projects. As a result of this and also taking into account subsidies, 87% of the renewable energy portfolio’s electricity price exposure is fixed for the summer of 2021 and 78% for the upcoming winter period.

With respect to gas, JLEN has also secured pricing for 73% of the summer period and 75% of the winter period.

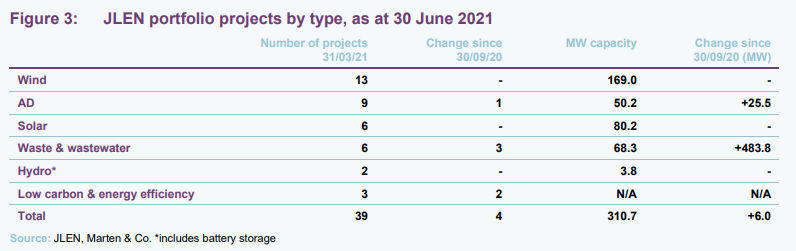

Asset allocation

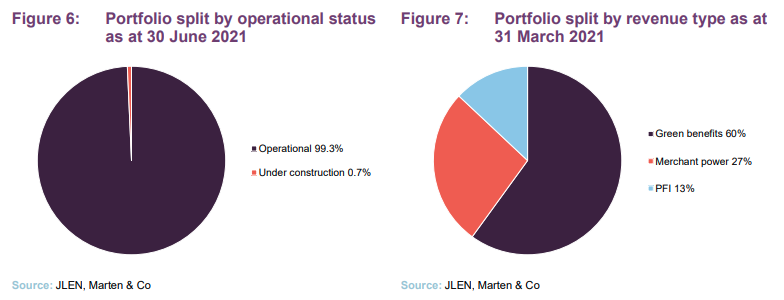

Figure 3 displays JLEN’s portfolio by project type, as at 30 June 2021 (this being the most recently available data). In aggregate, at that date there were 39 projects spread across the wind, AD, solar, waste & wastewater, hydro, and low carbon & energy efficiency technologies.

Between 30 September 2020 and 31 March 2021, JLEN added stakes in CNG Foresight and Codford Biogas (which were discussed in our last note), a 50MW battery storage project (Gigabox South Road), and an electrical exporting anaerobic digestion plant (Rainworth Energy). No new additions were made to the wind and solar portfolios. In the first quarter of the 2021/22 financial period, three new positions were added. These were Cramlington, ETA and Sandridge. Following these developments, the shape of JLEN’s portfolio as at 30 June 2021 was as shown in Figures 4 to 6. The revenue split data in Figure 7 is the most recently available data.

As at 31 March 2021, the weighted average remaining asset life of the portfolio was 18.1 years, with 91% of the portfolio having an asset life above 10 years. We also note that 73% of portfolio distributions were inflation-linked.

JLEN’s board approved a €25m commitment to Foresight Energy Infrastructure Partners (FEIP) in January 2020. The FEIP investment was discussed on page 17 of our most recent annual overview note. At 31 March 2021, €5.3m had been drawn down to fund a construction stage Swedish wind farm – Skaftåsen Vindkraft AB – and Torozos, an operational 94MW wind farm in Spain. FEIP also has exposure to Energie Tecnologie Ambiente (see below).

Having secured shareholder approval to expand the scope of its investment remit in March 2021, JLEN has been actively expanding the portfolio since the end of March with investments into the following projects:

- Cramlington Renewable Energy Developments Ltd, which owns a biomass-fuelled combined heat and power (CHP) plant;

- New exposure to Italy, with the purchase of a 45% stake in an energy-from-waste plant, Energie Tecnologie Ambiente (ETA); and

- A 50% equity stake in Sandridge Battery Storage which holds the development rights to construct the Sandridge Battery Storage project.

Gigabox South Road

On 3 March 2021, JLEN announced the acquisition of a 100% equity stake in Gigabox South Road which holds the development rights to construct the West Gourdie project, a 50MW lithium-ion battery energy storage plant-based in Dundee. JLEN will invest up to £21.2m in total. The project was fully-consented and construction-ready and expected to reach energisation and start commercial operations in March 2022.

The West Gourdie project will be connected to Scottish Hydro Electric Power Distribution Plc’s distribution network and has a 49.9MW import and export connection. The project will provide stability to the local network either through direct provision of balancing services to the National Grid, or by reducing volatility on the system via wholesale trading in the wholesale power markets and/or the Balancing Mechanism, a tool used by the National Grid to balance supply and demand in real-time.

Rainworth Energy

JLEN bought 100% ownership of Rainworth Energy Limited for £5.8m in March 2021. The company holds the rights and operational assets that make up the Rainworth AD plant, a 2.2MW electrical plant based in Nottinghamshire, UK, close to an existing AD plant held by JLEN, Biogas Meden.

The Rainworth plant has been operational since 2016 and supplies both heat and power to Center Parcs’ Sherwood Forest resort. The plant is permitted to accept up to 42,400 tonnes a year of feedstock and is accredited for subsidies under both the Feed-in-Tariff (FiT) and the RHI schemes.

Sandbridge battery storage

In May 2021, JLEN and Foresight Solar Fund Limited (FSFL) each acquired 50% equity stakes in Sandridge Battery Storage. It holds the development rights to construct the Sandridge Battery Storage project, a 50MW lithium-ion battery energy storage plant based in Melksham in Wiltshire, UK. JLEN and FSFL will each invest up to £12.7m.

The Sandridge project is fully-consented and construction-ready. The announcement notes that the project is expected to reach energisation and start commercial operations in October 2022.

The project will be connected to Southern Electric Power Distribution Plc’s distribution network and has a 49.9MW import and export connection. It will provide stability to the grid through provision of Dynamic Containment, or by reducing volatility on the system via wholesale trading in the wholesale power markets and/or the Balancing Mechanism, a tool used by the National Grid to balance supply and demand in real-time.

ETA

In May 2021, JLEN acquired a 45% stake in ETA, a 16.8MW energy-from-waste power plant. The plant processes refuse derived fuel (RDF) and is located in the municipality of Manfredonia, in the Apulia region of southern Italy. The €26.75m investment has been made alongside FEIP, which is also buying a 45% equity stake. The 10% balance is being retained by the vendor – Marcegaglia Investments S.r.l.

The plant uses proven technology and has been fully operational since 2012. It earns revenues from:

- gate fees paid by RDF suppliers;

- incentives related to producing electricity from renewable energy; and

- the sale of electricity to the market.

Altogether, about 74% of ETA’s revenues are considered to be backed by long-term contracts or subsidies.

Whilst this is JLEN’s first investment in Italy, the investment adviser has a team based in Italy that was instrumental in the execution of the acquisition and will remain closely involved in the management of the asset.

The adviser notes that there is a lack of energy-from-waste-plants in Southern Italy and that this is a sector it has been analysing for some time. The plant takes all local processed waste from households. On the environmental impact of energy from waste, JLEN believes that the benefits significantly outweigh the costs if the alternative is to send the waste to landfills. In terms of ETA’s revenue generation profile, it is described as bearing some of the hallmarks of a contract for difference (CFD), with a certain proportion of power income fixed, and paid for, by the regional government.

Cramlington

Cramlington Renewable Energy Developments owns a biomass combined heat and power plant (CHP plant) and its underlying contracts. The acquisition, for an undisclosed amount, was made on a debt-free basis.

The CHP plant, which has been fully operational since 2018, is located to the north west of the town of Cramlington in Northumberland and utilises proven technology to process a diversified biomass fuel mix, creating up to 28MW of electrical power and 8MW of heat for export via private wire to industrial customers and the grid.

The plant’s revenues are derived from subsidies in the forms of ROCs and the Renewable Heat Incentive (RHI), sales of electricity and the sale of heat and power via private wire to industrial customers. In aggregate, about two thirds of CRED’s revenues are backed by long-term subsidies and about an additional 10% is secured via long-term contracts.

JLEN’s managers note that biomass has been flagged by the UK government as contributing to de-carbonisation. The managers feel that there is the potential for significant value enhancement as they look to optimise the asset going forward.

Performance

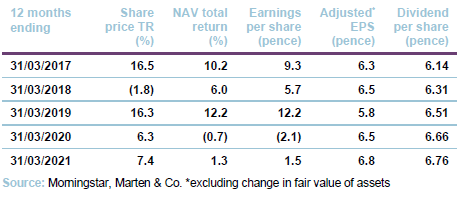

Results to 31 March 2021

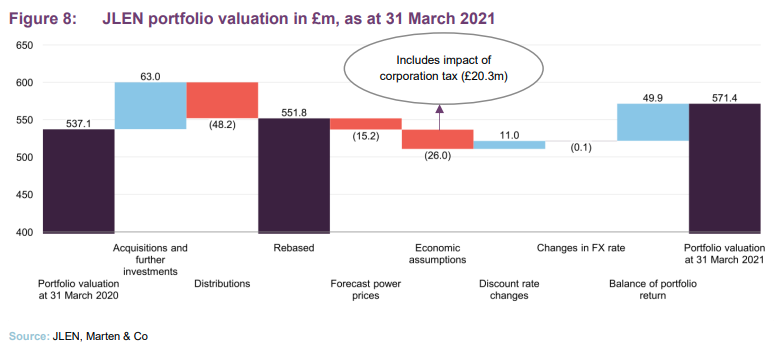

JLEN published results for the accounting year ended 31 March 2021 on 10 June 2021. JLEN’s portfolio increased in value by 6.4% to £571.4m, over the financial year. Figure 8 seeks to break down the major influences on JLEN’s portfolio over that period.

£63m of acquisitions were offset by distributions of £48.2m. Falls in power prices, and changes to economic assumptions were the main driver of a fall in NAV per share over the period. These were offset somewhat by a reduction in the weighted average discount rate used to value JLEN’s assets.

The balance of portfolio return includes:

- green gas certificates contributing +£4.0m to the year-end valuation;

- asset upgrades contributing +£4.9m: these include production increases from turbine upgrades and the deployment of optimisers at Amber Solar; and

- cost savings contributing +£3.3m.

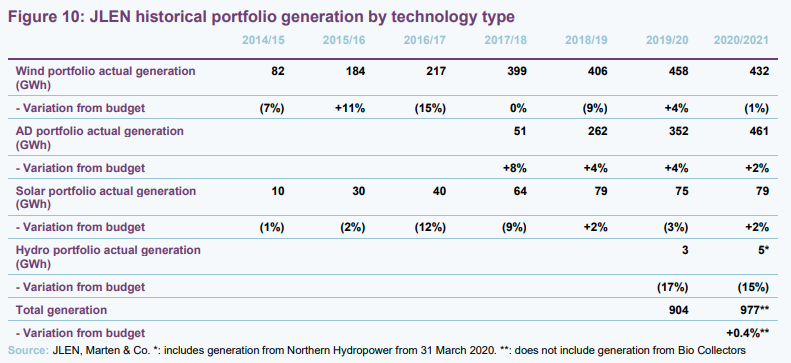

Operational performance – generation +0.4% above budget

Over JLEN’s annual results period to 31 March 2021, the greatest outperformance against budget came from the solar (1.8% ahead of budget) and AD portfolios (2.1% ahead of budget). Wind generation was 1.4% below budget as lower wind speeds weighed. In aggregate, generation was 0.4% ahead of budget.

Wind accounted for 44% of JLEN’s total generation for the period, down from 51% a year earlier. Performance was particularly impacted by low wind speeds during December and January of 2020. Operationally, availability was generally in line with what JLEN had budgeted for, with a significant improvement in the availability of the legacy Senvion sites. (Senvion was a German wind turbine manufacturing business that supplied O&M services to a number of wind farm owners including JLEN. As discussed in our September 2019 note, Senvion got into financial difficulties and subsequently filed for bankruptcy. The bulk of its business, including its intellectual property and onshore blade manufacturing facility in Portugal, was purchased by Siemens Gamesa in January 2020.)

Within solar, electricity generation was 79GWh, accounting for 8% of JLEN’s energy generated. The Branden assets performed especially well, with both sites outperforming their budgets by around 8%. The most significant detractor from performance came from network operator constraints applied to the Shoals Hook site through a period of extended maintenance. JLEN notes that adjusting for this would have seen generation performing 3.7% over budget.

In the AD portfolio, gas generation from the agricultural AD assets amounted to 47% of the energy generated, which marked a significant increase from the 39% a year previously. It was a good year for several plants in terms of gas production, while the Vulcan plant also completed its second major upgrade over the period before the targeted completion date. The year also saw value enhancements in the shape of disruptors (described as a piece of equipment that breaks feedstock into smaller pieces, increasing gas production), that have increased the portfolio’s resilience.

Following the Codford food waste business acquisition, waste & wastewater accounted for 17% JLEN’s portfolio in NAV terms. Compared to Bio Collectors, Codford is less reliant on the hospitality sector. The managers continue to hold a constructive view towards well-located food waste plants, shaped by upcoming regulatory changes in 2023 that will mandate the collection of source-segregated food waste from households.

Portfolio performance for the first quarter of the 2021/22 financial year

On 4 August 2021, JLEN announced that its NAV, as at 30 June 2021, was £577.1m, or 96.0p per share. This is an increase of 3.8p per share, or 4.1%, since 31 March 2021. JLEN says that the increase reflects an upward revision of power price forecasts and above forecast inflation during the period. It also reflects accretive share issuance in May 2021. The NAV announcement was also accompanied by a summary of the operational performance of JLEN’s assets during the quarter. Key highlights are as follows:

- generation for the solar portfolio was above target, attributed to higher than average solar irradiation early in the quarter;

- the anaerobic digestion portfolio performed ahead of target, continuing its trend of out performance;

- the wind portfolio performed below generation targets, due to poor wind resource in the UK over the quarter, although the assets experienced generally little downtime during the period;

- Bio Collectors (a food waste fed processing plant) continued to see lower levels of commercial food waste collections due to the pandemic. However, post the quarter end, feedstock levels have increased to higher levels; and

- in aggregate, the renewables portfolio saw generation below target. However, projects have benefited from increased revenue due to high power prices over the quarter and many of the projects also benefitted from a high level of fixed revenue over the short to medium term.

Financial performance

Over the financial year to 31 March 2021, the 5.4% decrease in JLEN’s NAV was principally the result of an increase in corporation taxes and downward revisions to long-term electricity and gas forecasts, based on analysis carried out JLEN’s independent forecasters.

Following the UK Chancellor’s budget statement, JLEN increased its corporate tax assumption increased to 25% (from 19% currently) from 2023. This had a negative £20.3m impact on the portfolio valuation.

JLEN’s adjusted (for unrealised movements in investments at fair value) profit before tax over the financial year was £37.0m, compared to £32.8m in 2020. Net of operating and financing costs, cash flows from operations were £39.5m. This amounted to 6.8p on a per share basis, which covered the full year’s cash dividends.

As noted above, in the second quarter of 2021, JLEN’s NAV increased by 4.1% due to upward revision of power price forecasts, higher than forecast inflation and accretive share issuance in May 2021.

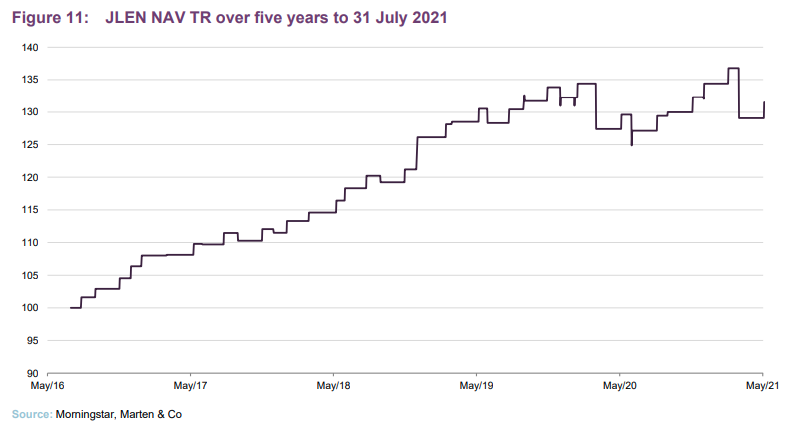

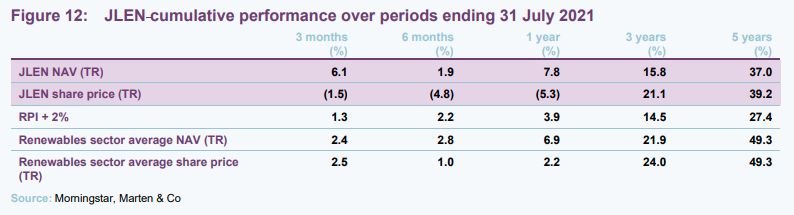

Over the five years to 31 July 2021, JLEN delivered total NAV and share price returns of 37.0% and 39.2% respectively, equivalent to annualised total returns of

6.5% and 6.8% for each. NAV and price returns have been well ahead of inflation (for comparison purposes we have used RPI +2% in Figure 12).

Peer group comparison

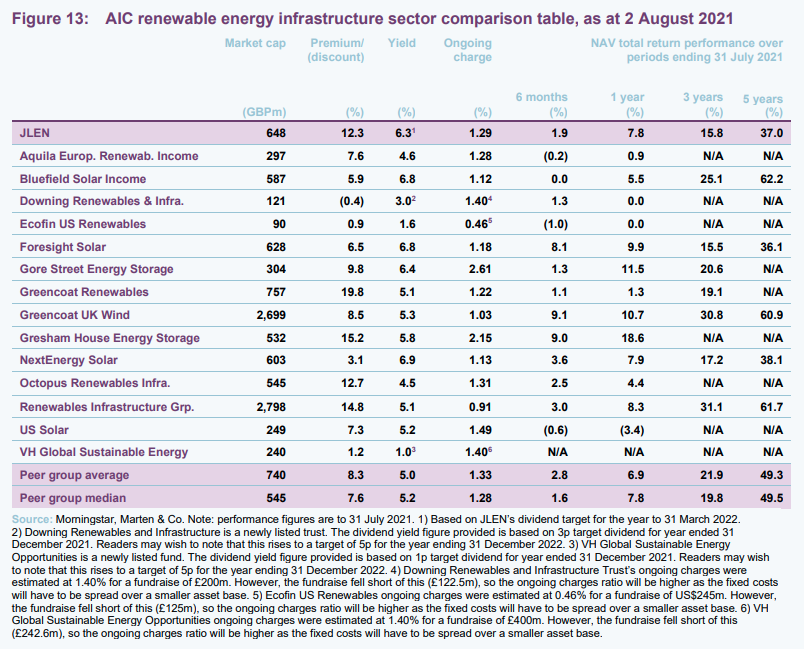

JLEN has the broadest remit amongst the 15 companies, displayed in Figure 13 below. The selected peer group comprise the members of the AIC’s renewable energy sector, excluding those funds focused on energy efficiency and companies that listed more recently (HydrogenOne Growth and Aquila Energy Efficiency). JLEN remains the only fund in the peer group to incorporate environmental infrastructure assets such as AD and water and waste projects within its portfolio. Furthermore, as discussed above, JLEN has been distinguishing itself further by adding assets such as the Cramlington biomass-fuelled (CHP) plant; the stake in the Italian energy-from-waste plant and the stake in the Sandridge Battery Storage project. These investments follow on from the investment in the portfolio of CNG biomethane refuelling stations, which is also a highly differentiated asset.

Another clear differentiating factor for JLEN is its low exposure to merchant power price of 27%. This compares to 39% for Greencoat UK Wind (as at 31 December 2020), and 48% for Foresight Solar (as at 31 December 2020) – these being the largest funds of their respective types.

The peer group includes Foresight Solar, NextEnergy Solar, and US Solar, which are all pure solar funds, as is Bluefield for now (its mandate was expanded in 2020 and it has recently announced plans to undertake a capital raising to finance the purchase of a portfolio of wind farms). Greencoat Renewables and Greencoat UK Wind are focused on wind generation; Octopus Renewables Infrastructure has a particular focus on onshore wind and solar, and Aquila European Renewables Income also has a diverse portfolio that includes solar. The Renewables Infrastructure Group (TRIG) holds both wind and solar farms.

Gore Street Energy Storage and Gresham House Energy Storage generate revenue from battery storage facilities.

Figure 13 compares the performance of the funds and illustrates some structural differences between them. JLEN is one of six funds that were in existence five years ago. All but one fund was trading on a premium to NAV, as at 2 August 2021, with JLEN’s being the fifth widest. JLEN’s ongoing charges ratio appears competitive in absolute terms compared to similarly-sized funds, especially when taking into account the extra diversification provided by its wider remit.

Variations in performance across the peer group tend to reflect differences in asset composition. Wind-focused funds performed well over three years, though conditions for generation were not as good over the past year. In addition to Greencoat Renewables and Greencoat UK Wind, TRIG has a heavy wind focus, with a combination of onshore and offshore assets making up close to 90% of its portfolio mix. Solar has benefitted from a significant uptick in irradiation over the peak months since 2018.

JLEN’s unique incorporation of environmental infrastructure assets means it is less vulnerable to a poor year of irradiation or weak wind generation than most of its peers. Technologies in which JLEN is actively expanding, such as AD and hydro, continue to benefit from a high proportion of inflation-linked cash flows that are backed by subsidies. JLEN is also pushing into non-mainstream technologies, which are also set to play an important role through in decarbonisation, while also arguably providing more compelling valuation dynamics.

Dividend – moving away from inflation link

In June 2020, JLEN amended its dividend policy by breaking the explicit link with inflation. This has now come into effect following the conclusion of the 31 March 2021 financial year. JLEN will aim to increase the dividend each year, without being tied to a formal inflation link. Whilst JLEN has a relatively higher proportion of fixed revenues compared to many of its peers, it is not immune to the effects of lower power prices on portfolio revenue generation.

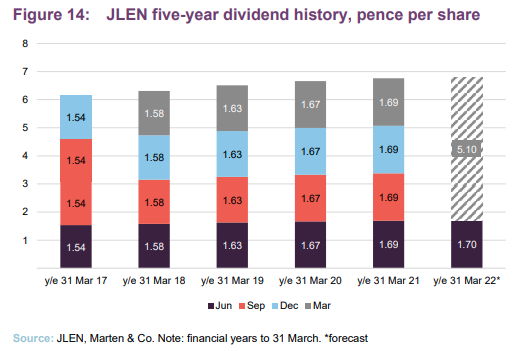

JLEN is targeting a total dividend of 6.80p for the year-end to 31 March 2022. The first quarterly dividend (for the quarter ended 30 June 2021) was declared at 1.70p per share, in line with the 6.8p target. This dividend will be paid on 24 September to shareholders on the register as at 3 September. Based on the prospective dividend target and a share price of 107.8p, as at 2 August 2021, the shares were yielding an attractive 6.3%.

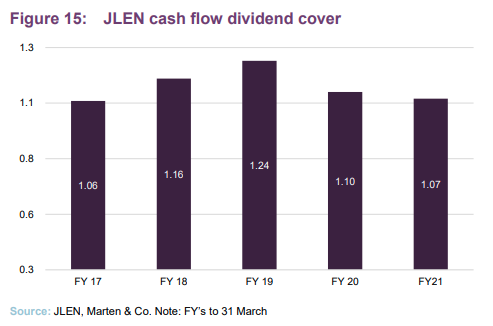

Cash flow dividend cover is arguably a more valid measure than earnings cover for a fund such as JLEN, as it is less subjective. Figure 15 shows that dividend distributions have been covered by cash generated by the portfolio, net of running costs, over the past five years. For the most recent annual results period to 31 March 2021, cash dividend cover was an impressive 1.07x. This underlines the defence provided by the protected revenues.

Premium/(discount)

JLEN’s attractive yield, supported by a high proportion of protected revenues and the broadest remit of any fund within its peer group, continues to appeal to investors. Premiums remain in place across the sector, with the uncorrelated government-backed income sources providing a compelling yield alternative to traditional equity income pathways that have come under strain.

The continued growth of ESG investing, and a view that the government will likely look to renewables to play a key role in a post-COVID economic recovery, have also shaped market sentiment.

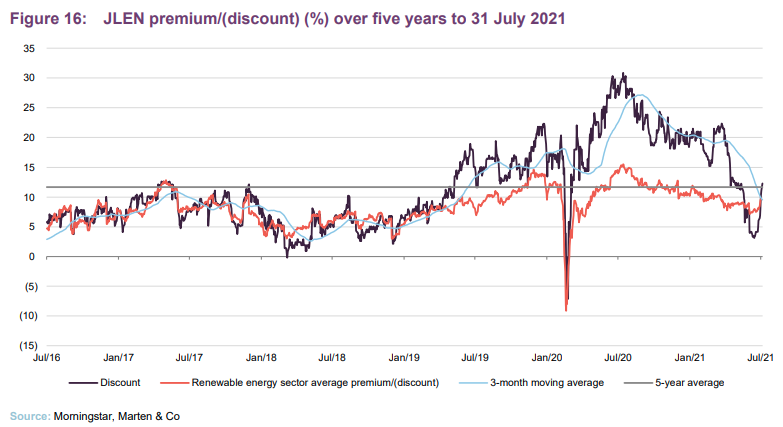

Over the year to 31 July 2021, JLEN’s shares moved within a premium range of 3.1% to 30.9%. The average premium over the year was 18.5%. By way of comparison, we note that over the same period, the funds that comprise the AIC renewable energy infrastructure sector traded at an average premium of 9.6%.

JLEN’s premium/(discount) over the five years to 31 May 2021 largely moved in lockstep with the average of the AIC’s renewable energy infrastructure sector until mid-2019. Having seen this premium to the peer group widen earlier in 2021, this differential has narrowed somewhat over recent months. As at 2 August 2021, JLEN was trading on a premium of 12.3%.

Fund profile

JLEN aims to invest in a diversified portfolio of environmental infrastructure projects that support more environmentally friendly approaches to economic activity whilst generating a sustainable financial return. It seeks to integrate consideration of sustainability and environmental, social and governance (“ESG”) management into its activities, which help to manage risks and identify opportunities. It aims to build a portfolio that is diversified both geographically and by type of environmental asset. This emphasis on diversification helps differentiate JLEN from its peers, which tend to specialise in solar or wind.

Reflecting its objective of delivering sustainable, progressive dividends and preserving its capital, JLEN does not invest in new or experimental technology. A substantial proportion of its revenues is derived from long-term government subsidies.

Investment adviser

JLEN is advised by Foresight Group LLP (Foresight). Foresight is one of the best-resourced investors in renewable infrastructure assets, with £7.2bn of AUM, as at 31 March 2021. This includes Foresight Solar Fund, which sits in JLEN’s listed peer group. Foresight manages over 300 infrastructure projects across Western Europe, with a total renewable energy generation of 2.9GW.

JLEN’s co-lead advisers are Chris Tanner and Chris Holmes. Foresight employs 244 staff and has 12 offices globally.

Previous publications

Readers interested in further information about JLEN, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note, ‘Increasingly diversified as green-led recovery looms’, published on 16 February 2021, as well as our previous notes.

Diverse renewables exposure, initiation note, published September 2017

Anaerobic diversification, update note, published March 2018

Diversification benefits shine through, annual overview, published September 2018

Life extensions to boost NAV?, update note, published March 2019

Battery storage potential, annual overview, published September 2019

Reliable source of income, update note, published May 2020

The legal bit

This marketing communication has been prepared for JLEN Environmental Assets Group Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.