Since we last published on Vietnam Holding (VNH), the Vietnamese economy has gone from strength to strength, lifting the country’s equity markets, which are among the best performing globally YTD. VNH has captured this and more – outperforming local and global indices, and its direct competitors. Despite this impressive performance, there is still much to go for – attractive valuations (despite the strong earnings growth potential); domestic income that has passed US$3,000 per capita (which the manager identifies as an inflexion point); a boom in exports as multinationals continue to diversify their supply chains; further benefits to come from privatisation; and, over the medium term, the potential for Vietnam’s elevation to the MSCI Emerging Market index. With its decent track record and strong ESG focus, we see room for VNH’s currently double-digit discount to narrow from here.

Capital growth from a concentrated portfolio of high growth Vietnamese companies

VNH aims to provide investors with long-term capital appreciation by investing in a portfolio of high-growth companies in Vietnam. These should come at an attractive valuation and demonstrate strong environmental, social and corporate governance awareness. It achieves this by investing primarily in publicly-quoted Vietnamese equities, but it can also invest in unlisted companies and can hold the securities of foreign companies if a majority of their assets and/or operations are based in Vietnam.

Market outlook and valuations update

Recent history and valuations

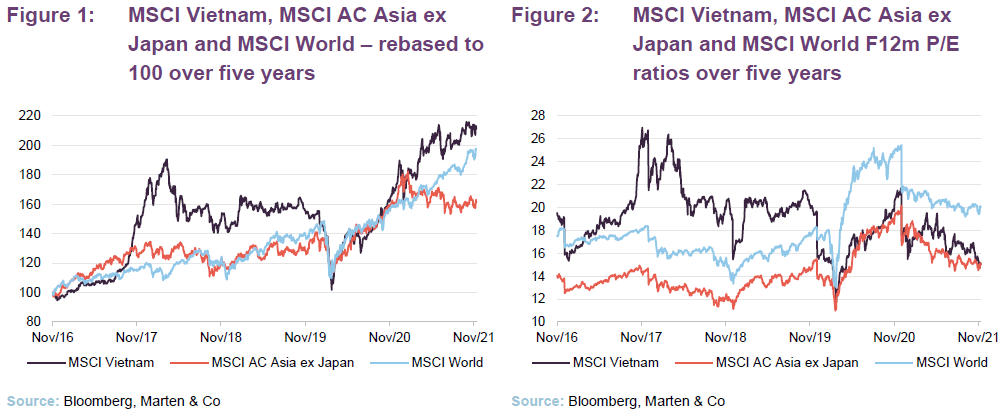

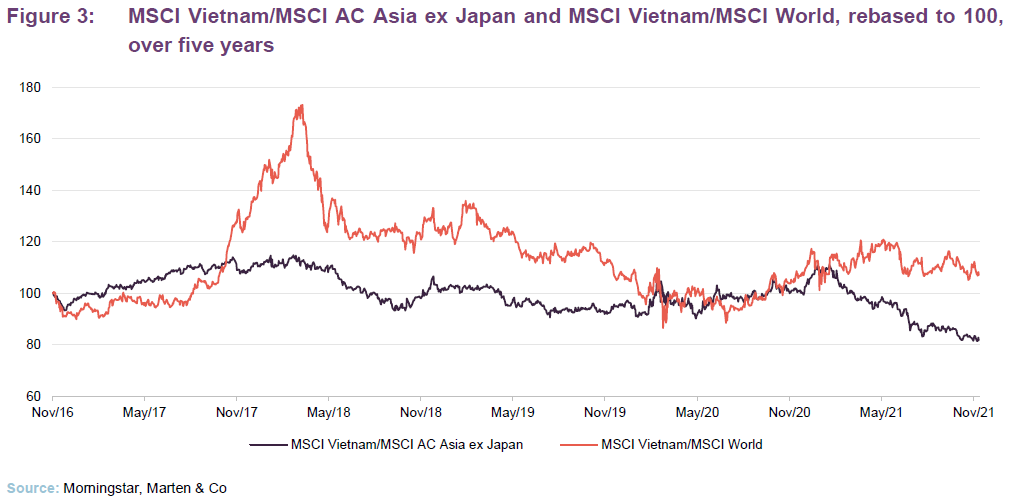

As is illustrated in Figure 1, Vietnam, emerging Asia and global equity markets have provided strong absolute returns over the last five years. However, since the onset of the pandemic, Vietnam, which had been a major laggard for most of the two years prior, has been a strong performer. This has been particularly true during the last 12 months when Vietnam has continued to grow strongly, while broader Asia ex-Japan equities as a whole have actually lost value (as illustrated in Figure 1).

Despite this strong performance, Vietnamese equities have grown into their valuations. As illustrated in Figure 2, despite superior growth prospects, Vietnamese equities are only fractionally more expensive than those of the broader Asia ex Japan region, and both are markedly cheaper than global equities more generally. It is also noteworthy that, despite recent concerns surrounding the Omicron variant, the Vietnamese market, as well as Asia ex-Japan peers and global markets more generally, remain markedly above their pre-pandemic levels.

Potential for further synchronised global growth

As we have discussed previously, one effect of the pandemic was that it turned the tide on the global economic cycle, moving us from late-cycle to early-cycle in around six months. When we last published in March 2021, we suggested that an absence of hawkish monetary policy and interest rate rises in more developed markets could act as a tailwind for emerging Asia, and this appears to have come to pass. Governments pumped significant stimulus into their economies simultaneously, in an attempt to stave off the economically crippling effects of the virus. This has since given rise to a broadly synchronised global economic recovery, that has been particularly beneficial for countries such as Vietnam.

Clearly, the pandemic is by no means over, but Vietnam was able to control its most recent wave with an effective lockdown that was not economically crippling. Whilst there are concerns around emerging variants, vaccination rollouts across the globe continue to increase the level of protection afforded to populations, which continues to erode the need for the most economically strangling restrictions.

Prior to the emergence of the Omicron variant, there were concerns from some commentators that inflation was picking up in the US and other developed markets and that this might be more than transitory. If so, this could lead to rising interest rates as well as more hawkish fiscal policy. The great inflation debate continues, but it would appear that Vietnam and its regional peers continue to benefit from a longer growth runway than most more developed nations, particularly the US.

Vietnam – growth drivers remain in place

As we discussed previously, with the world understandably focused on addressing the challenges presented by COVID, it is easy to forget the long-term structural growth opportunity that exists within Vietnam.

Vietnam has been a standout success story in terms of its handling of the virus (see ‘COVID19: Vietnam – a case study in epidemic management’ on pages 3 to 5 of our May 2020 note), which has been reflected in the rebound in its GDP growth and the performance of its stock market, so far this year.

Vietnam’s economy has undergone a transformation during the last few years. Initially famed as an alternative to China for garment and textiles manufacturing, Vietnam has since moved up the value chain – beyond simple manufacturing plants that assemble components made elsewhere, towards higher added value and higher tech products.

Vietnam continues to have strong GDP per capita catch-up potential (above the average of ASEAN peer group and significantly above world and developed market averages – see pages 7 and 8 of our March 2021 note) aided by factors such as a favourable demographic profile (a median age of 32.5 years), natural resource wealth (Vietnam is resource-rich, with commercially-viable reserves in a range of metals and minerals); and strong agricultural and (pandemic permitting) tourism sectors. Furthermore, while it would appear to have receded for now, there remains the prospect that Vietnam could be upgraded from frontier market to emerging market status, which VNH’s manager thinks could be achieved in two years.

Manager’s view – Vietnam: Asia’s emerging champion

Vietnam has benefited from a high and stable growth rate during the last 30 years, and with strong structural growth drivers firmly in place, the manager expects this to continue. Despite the short-term noise, the manager believes that Vietnam is still on track to become a top 20 global economy by 2050. With expected GDP growth of around 3 to 4% this year, and 6.5 to 7% in 2022, Vietnam is expected to be back on its 30-year growth trend very quickly. It can also boast a strong trade surplus and significant foreign exchange reserves (over US$100bn). Furthermore, while Vietnam has benefited from increasing exports in recent years, its growth has been largely domestically driven. This gave Vietnam’s economy resilience as the global economy was slowed by the pandemic.

VNH’s manager says that, broadly speaking, sentiment continues to be positive in Vietnam, which is reflected in ongoing investment activity. During 2020, some 393,000 new stock exchange accounts were opened, and, in the first 10 months of 2021, a further 1,086,000 have been opened, most of which were for domestic retail investors. The manager expects to see further growth in the number of market participants but cautions that volatility could increase as these new investors find their feet. However, there are significant new benefits to this evolution as average daily trading volumes have increased fourfold since 2019.

A growing middle class is driving consumption

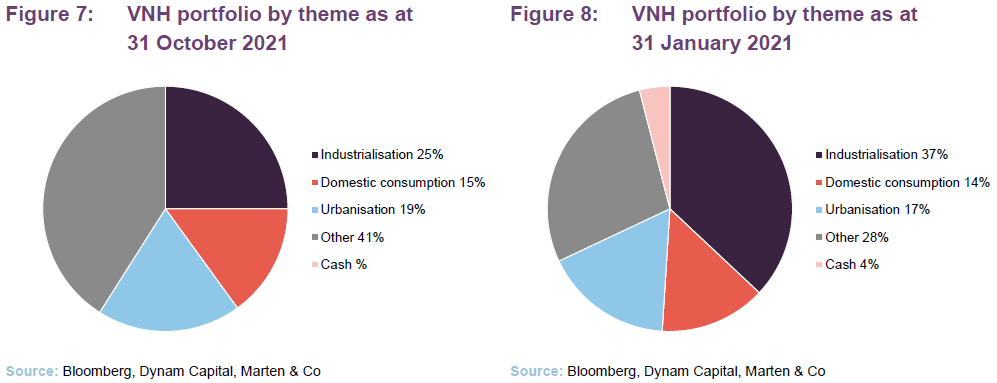

A central tenet of Dynam’s investment case is that Vietnam benefits from a growing middle class and an increasingly consumer-driven society, which is driving GDP growth. This in turn drives consumer incomes, which drives consumer spending and GDP growth, creating a virtuous circle. Dynam believes that by 2035, there could be an additional 35m middle-class consumers, around 50% of the population. It notes that car ownership has doubled over the last five years, while consumer loans have increased five-fold and now total over US$51bn. Air passenger traffic has increased six-fold during the last decade, while modern trade now accounts for around 30% of GDP and this is expected to reach 40% by 2025. To capture the benefits of these developments, the managers continue to focus on three major themes within the portfolio:

- industrialisation;

- the consumer; and

- urbanisation.

Structurally well-positioned for ongoing growth

Vietnam benefits from a number of structural growth drivers that suggest it is well-positioned for further economic expansion for years to come. For example, Vietnam:

- benefits from a large and youthful population (Vietnam has a median age of 32.5 years);

- has a relatively well-educated workforce (Vietnam has a 98% literacy rate, ranking second-highest among the top 10 investable frontier-market countries);

- is an industrious nation. At 76%, it has one of the highest employment-to-population ratios globally (the global average is 58%, while the average for East Asia and the Pacific is 65% – all sourced from The World Bank);

- is benefiting from increasing urbanisation (Vietnam has an urbanisation rate of 46%, which VNH’s manager say is rapidly increasing);

- is a natural manufacturing hub. It has a low manufacturing labour cost (around half that of China and around two-thirds of that of Mexico). It is also centrally positioned within ASEAN and is well-positioned relative to other major economies in the region (China, Japan and Korea);

- benefits from a relatively stable socio-political environment (85% of the population is ethnic Kinh, which reduces the likelihood of internal conflict);

- has high internet penetration compared to wider emerging markets (around 70% – Vietnam now has 72m social media users and has experienced high growth in e-commerce, boosted by the restrictions enacted during the pandemic). Dynam comments that Vietnam’s internet economy is forecast to reach US$45bn by 2025;

- has an increasingly open economy, driven by a variety of free trade agreements. It moved from 77th place in 2018 to 67th place in 2019 in the global competitiveness index (this being the largest increase between these two years);

- has 13 free trade agreements in place and has concluded negotiations on a further two. The newly-signed RCEP and UKVFTA are expected to boost foreign trade;

- is well-diversified in terms of its foreign trade partners and is not overly reliant on any particular one. China is the largest partner at around 22% of foreign trade. The next-largest is the US, at around 15%;

- is a strategic alternative to China for global product sourcing. Despite concerns to the contrary, Vietnam has benefited from a recent surge in exports as trade tensions have escalated between the US and China; and

- has seen healthy development within its capital markets in recent years. These have grown in size, boosted by new IPOs and privatisations of former SOEs. Foreign ownership limits (FOLs) remain a challenge (30% for banks and 49% for other listed companies), but progress has been made with FOLs removed in the food and beverage, pharma, and brokerage sectors. A new securities law, which took effect in January 2021, has provided greater clarity and draft revisions may improve this.

- Vietnam’s ruling Communist party completed its five-year congress in February 2021, which included the election of Vietnam’s four pillars (the four most important posts within the Vietnamese government) of president, prime minister, speaker of the national assembly and the general secretary of the party. The results were largely as expected and have provided continuity; the government has been able push forward on its key projects, with policy broadly unchanged. VNH’s manager says that government policy is focused on creating a modern industrialised economy and making Vietnam a key player in global supply chains.

- Vietnam has passed what VNH’s manager sees as an important development inflection with domestic income over US$3,000 per capita.

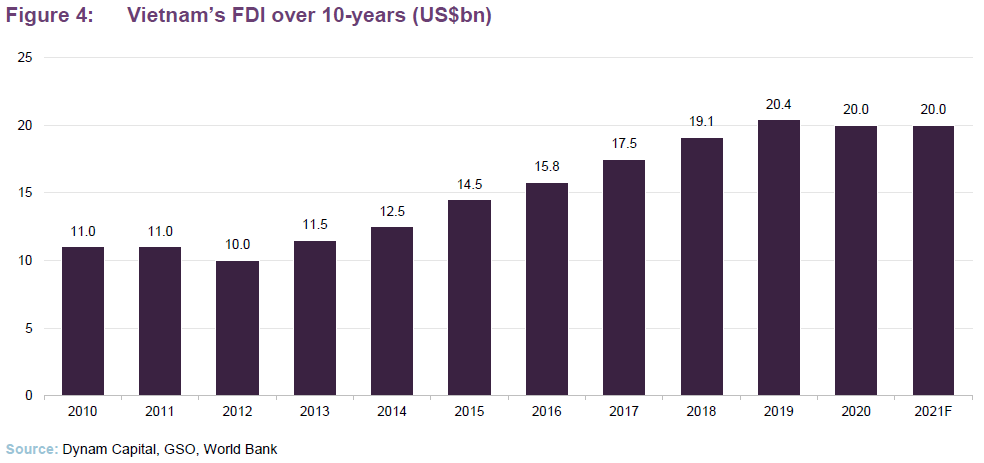

As a consequence of the above, Vietnam has been attracting high levels of foreign direct investment in recent years, which was undented by the pandemic. Despite the challenges of 2020, Vietnam saw some US$20bn of FDI in 2020 (the second largest in ASEAN) and looks set for another record year for 2021. This inbound investment is supportive of the outlook for Vietnamese equities over the longer-term.

Asset allocation

Concentrated and low turnover portfolio of Vietnamese stocks

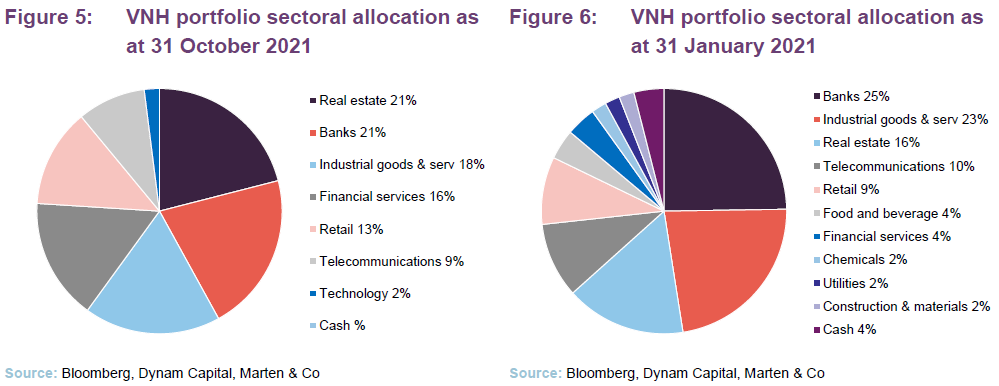

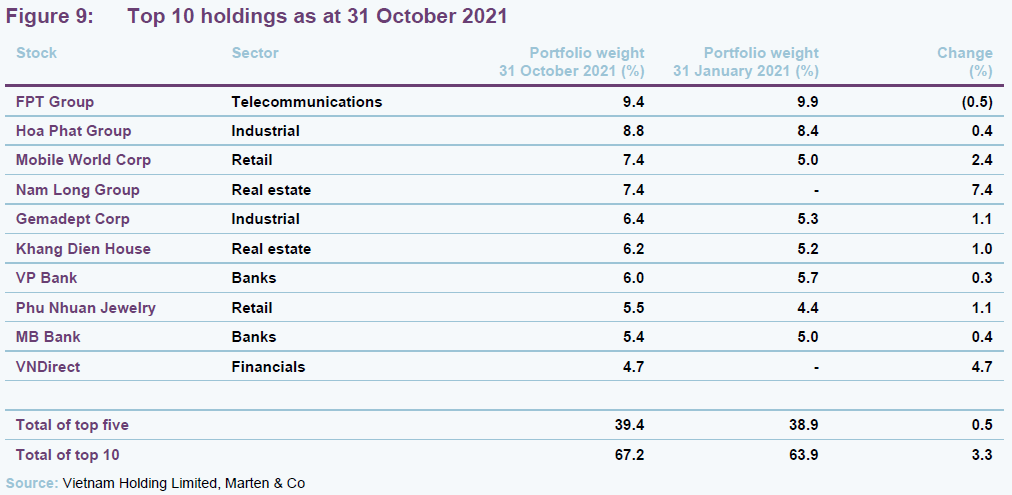

As at 31 October 2021, VNH’s portfolio had exposure to 24 securities (down from 26 securities as at 31 January 2021 – the most recently-available data when we last published). VNH’s portfolio is highly concentrated; it typically has exposure to between 20 and 25 securities (an average position size of between 4% and 5%), but actual position sizes can vary quite markedly (depending on valuation and the manager’s level of conviction). As illustrated in Figure 9, the top 10 holdings accounted for 63.9% of VNH’s portfolio as at 31 January 2021, which is a mild reduction in concentration from the 66.8% as at 30 April 2020.

Distinctly different from the index – strong ESG focus

As we have highlighted in our previous notes, VNH’s portfolio is distinctly different from the VN All-Share (or any Vietnamese-focused ETF for that matter). VNH’s portfolio has a high active share – typically 75–80% – and it should be noted that the index does not benefit from the manager’s strong focus on ESG considerations.

In our March 2021 note, we commented how the manager was expecting a strong recovery in GDP growth in 2021, but believed that this was not likely to be fully captured by the stock market (see page 10 of that note). This led it to significantly increase VNH’s allocation to the banks that, with their broader economic exposure, would be better-positioned to capture this. Vietnamese banks have performed strongly this year and these positions have been trimmed into strength. The manager also added to real estate during 2020.

VNH’s allocation to industrial goods and services has increased since we last published, primarily driven by these holdings’ strong performance. When we last wrote, we commented how the manager had been increasing VNH’s exposure to real estate. This process has continued but the increase in VNH’s allocation has also been driven by the performance of some of these holdings.

Traditionally, the portfolio has had a markedly higher allocation to mid- and small-cap stocks (the VN All-share, by contrast, is heavily weighted towards stocks with market caps in excess of US$1bn). However, as noted above, the manager generally took profits in small-mid cap holdings during 2020 and reallocated the proceeds into areas, such as the banks, which traditionally have higher market caps. As at 30 September 2021, VNH’s portfolio was split 34.4%/65.6% mid & small cap/large cap.

Top 10 holdings

Figure 9 shows VNH’s top 10 holdings as at 31 October 2021, and how these have changed since 31 January 2021 (the most recently-available data when we last published). Seven of the top 10 holdings as at 31 January 2021 were constituents of VNH’s top 10 at the end of January 2021, although the relative positions have changed. New entrants to the top 10 are Nam Long Group, Phu Nhuan Jewelry and VNDirect, while Vietin Bank, Vinhomes and ABA Cooltrans have all moved out.

We discuss some of the more interesting developments in the next few pages, and have also provided updates on long-time holdings, FPT and Mobile World Group, as well as an update on Gemadept, which was highlighted as a new holding when we last published. Readers interested in more detail on these top 10 holdings, or other names in VNH’s portfolio, should see our previous notes (see page 20 of this note).

Nam Long Group (7.4%) – benefiting from the urbanisation trend

Nam Long Group (www.namlongvn.com) is a Vietnamese property development company that is structured around three main business segments: land development, housing development and commercial property. It has a strong customer focus and sustainability is an integral part of its business (it lists ownership, professionalism and integrity as being its three core values).

Nam Long’s land development arm is focused on land, and land and township development. It has some 650 hectares of land that has been cleared in the south of Vietnam (within Can Tho, Long An, Ho Chi Minh City and Dong Nai).

Nam Long’s housing development arm has three key offerings: Valora, Flora, Ehome S and Ehome. Its Valora homes are townhouses and villas located in isolated compound areas “for successful individuals who seek a tranquil life”. These townships offer a full range of urban amenities including supermarkets, sports clubs, medical centres and educational centres in a “separated area with beautiful scenery, security, upgraded amenities and a sense of peaceful life”.

Flora is Nam Long’s main product line, which it describes as “the affordable condominium for the middle to high income earners”. The aim is to create a green living environment from high quality and environmentally friendly building materials with low construction density planning. By way of illustration the total green space at Flora Fuji is 27%, 28% at Flora Sakura, and 25% at Flora Kikyo.

Ehome and Ehome S are part of Nam Long’s affordable housing product line. Both are developed based on Vietnam’s national housing development strategy. EHome S is designed for first time buyers. Designed for middle income buyers, Nam Long claims that EHome S “is known as the cheapest apartment on the market”, while still offering the high-quality facilities of a modern township. It says that affordability, smart design and creating a civilised and friendly community are at the core of its designs.

VNH’s manager says that Nam Long, like Vinhomes (see page 17 of our March 2021 annual overview note), benefits the urbanisation trend in Vietnam. This is being driven by infrastructure improvements and a growing middle class in the country, which is fuelling demand for the quality modern apartments that Nam Long Offers.

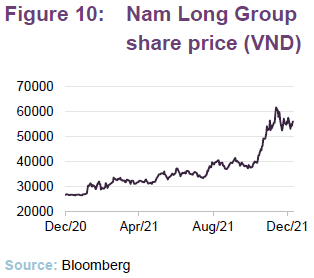

As is illustrated in Figure 10, Nam Long has seen a marked upswing in its share price since October 2021. VNH’s manager says that the market rerated a number of property developers that have large landbanks on the outskirts of Ho Chi Minh City, especially in the east of the city, where many national infrastructure projects, including Long Thanh International Airport, are under development. Specifically, Nam Long is launching a big township project in Dong Nai province, where VNH’s manager says that the demand for the products it offers are increasing. It thinks that this project will be the key growth driver for the company in the next 3 years.

Phu Nhuan Jewelry (5.5%) – lockdowns have driven growth online

We last discussed Phu Nhuan Jewelry (www.pnj.com.vn) in our December 2019 initiation note (see page 14 of that note) where we explained that the company is the leading jewellery manufacturer in Vietnam. At that time, it had a production capacity of 4m units per annum, although it was only producing some 2.5m units, suggesting the business had considerable operational leverage.

In addition to having a store network some four times the size of its nearest competitor, its operations cover the full value chain, giving it a key competitive advantage. It employs an experienced team comprising jewellery designers and over 1,000 skilled goldsmiths, which VNH’s manager says is one of the company’s strongest assets. The holding is an example of a consumer stock that benefits from a growing middle class in Vietnam. VNH’s managers say that, as their income grows, consumers tend to move up the value chain in search of better quality and, with a product range that covers the mid-end to luxury jewellery segments, PNJ is well positioned to benefit.

As illustrated in Figure 11, PNJ’s share price has performed very strongly during the last 12 months, which has pushed it back up VNH’s rankings and into its top 10 holdings. While its physical stores have been impacted by the lockdowns, PNJ’s online business has performed very strongly and it is one of a number of retail businesses that VNH’s manager believes could emerge stronger from the pandemic having increased market share. Whereas smaller retailers could struggle to provide both an online and offline offering, Dynam thinks that it has a long growth runway from here.

PNJ’s sustainable development strategy is based on the UN’s 17 sustainable development goals. It has five pillars:

- Economic growth via full concentration on core jewellery business;

- Social development by providing proper annual training to employees;

- Environmental protection through processing of toxic waste in an environmental-friendly manner and promotion of energy-efficient focused practices;

- Labour force development by creating a safe and unprejudiced working atmosphere to not only attract but also nurture talent; and

- Community building via effective investments in community projects.

VNH’s manager says that PNJ has firm policies to ensure that its precious stone purchases are from legitimate sources rather than conflict zones. Furthermore, its raw material waste is below the industry standard of 1%. VNH says that the company has been very open with its communications with stakeholders and is responsive to the managers’ enquiries regarding ESG issues.

VNDirect (4.7%) – benefiting from expanding liquidity and growing financial inclusion

Founded in 2006 by the IPA Investment Group, VNDirect Securities Corporation (www.vndirect.com.vn/en) offers brokerage and associated services to both retail and institutional clients in Vietnam. In addition to securities brokerage, the company provides depositary, corporate finance advisory, underwriting and portfolio management services. It also undertakes proprietary trading. The holding plays into the broad themes of both a growing middle class in Vietnam as well as increasing financial inclusion, aided by high and growing internet penetration in Vietnam. The manager added to VNH’s exposure to banking stocks earlier this year for similar reasons.

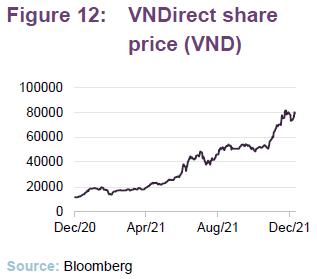

As we discussed in our March 2021 note, VNH’s managers reported that, despite the obvious challenges in 2020, confidence in Vietnam was and continues to be high. Reasons to be cheerful include a strong trade surplus, high foreign exchange reserves (in excess of US$100bn), positive GDP growth and stronger financial markets, which the managers believe has been reflected in the significant growth seen in domestic retail investor activity (for example, during 2020, some 393,000 new stock exchange accounts were opened, most of which were for domestic retail investors). This trend has continued into 2021 with financial markets exhibiting significantly higher trading volumes, of which VNDirect is a beneficiary. As is illustrated in Figure 12, VNDirect has experienced very strong share price appreciation during the last 10 months, which has pushed it up VNH’s rankings.

FPT Corporation (9.4%) – targeting growth in domestic SME segment with substantially higher margins

FPT Group (fpt.com.vn/en) is a long-time VNH holding, and currently its largest position, which we last discussed in detail in our March 2021 annual overview note (see page 21 of that note for further details). VNH invested in FPT in January 2007, shortly after it listed in December 2006. The company, which is Vietnam’s largest IT services company, has 49% foreign ownership, and so is at its FOL. FPT develops software, provides IT and telecom services (including broadband internet), and is a distributor/retailer of IT and communication products. It was previously a conglomerate but now has a much more focused offering.

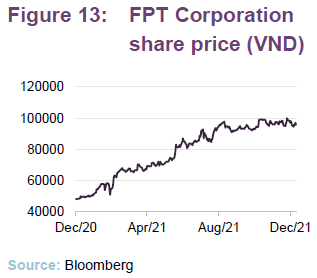

VNH’s manger says that FPT is transforming from an IT services company to an end-to-end digital solutions provider with an estimated CAGR in earnings of 17% over 2019-2023. The company employs the largest workforce of engineers in Vietnam and offers outsourcing services to more than 650 global customers and partners, including 100 in the Fortune 500. It is also the number one broadband (and pay TV) supplier in Vietnam and is targeting subscriber growth in excess of 15% per annum. VNH’s manager says that, in addition to working with its international clients, FPT aims to grow its product for domestic SMEs, which have substantially higher PBT margins, and it is also moving up the value chain to become the main consultant/contractor for projects. In addition, FPT’s management is targeting its ‘made-by-FPT’ products to grow 45% per annum between 2020-2025.

For its Q3 2021 results, FPT grew its revenue and earnings by 18% and 19% year-on-year respectively over the nine-months ended 30 September 2021. During this period, its technology and telecoms divisions increased their PBTs by 30% and 22% respectively, year-on-year. VNH’s manager says that digital transformation and cloud services are expected to increase by 40%, and new projects signed in the first half of 2021 were worth some US$500m. Despite forecast EPS growth of 21% for 2021, FPT’s shares trades at around 23x 2021 earnings, as opposed to 24x for its regional peers.

FPT has a sustainability strategy based on three core pillars:

- Profit, achieved by competitive enhancements.

- People, driven by developments of human resources and community activities, and

- Planet, via environmental protection.

VNH says that, together with having strong business development and corporate governance credentials, FPT has made significant contributions to the development of society through an education support program (which has a focus on youth development).

Dynam Capital continues to see very strong potential for FPT to grow both its domestic and international sales from here, noting that FPT has a high degree of technical expertise and its labour costs are very competitive compared to India and China. At home, both the government and the private sector have been increasing their spend on IT services. Overseas, FPT has a strong footprint in Japan and, increasingly, in China. At 49% foreign ownership, the company is at its FOL, which the manager considers is depressing its share price.

Mobile World (7.4%) – Improvements in the profitability of the retail segment could be a significant share price catalyst

We last discussed Mobile World (mwg.vn/eng) in our March 2021 annual overview note where we reiterated that it is Vietnam’s largest retailer by revenue (Dynam Capital describes it as a ‘retail champion’). The company is focused on three key areas: mobile phone retail (The Gioi Di Dong), consumer electronics retail (Dien May Xanh) and grocery retail (Bach Hoa Xanh). According to VNH’s manager, Mobile World has a 50% share of the domestic mobile phone market and a 40% market share of the consumer electronics market. It is still targeting a 10% market share in grocery retail (its newest venture) by 2022 – a market that is worth around US$50bn per annum.

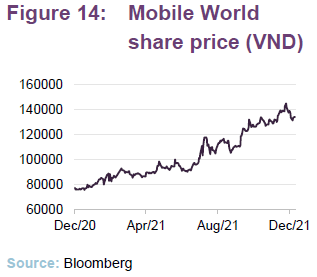

While COVID-19 hit the company’s retail sales in the first half of 2020, and then again in the third quarter of 2021, VNH’s managers say that it is succeeding in taking market share from the traditional wet markets in Vietnam and, from an operational perspective, the company continues to perform strongly. In particular, Bach Hoa Xanh (the grocery operation) has seen recent improvements in its gross margins. This segment also saw much high store traffic in July and August 2021 and is now targeting break-even, at the group level, in the first quarter of next year. VNH’s managers think this could be a significant catalyst for upside in Mobile World’s share price in Q1 2022.

For the nine months ended 30 September 2021, the company’s revenue and earnings rose by 7% and 12% respectively, year-on-year, which was despite around 2,000 of its stores either being shuttered, or operated under limited conditions, from July 2021 when the Vietnamese government imposed stricter lockdown restrictions. VNH’s manager says that the stock trades at around 20x 2021 earnings and 15x its 2022 forecast earnings, with EPS expected 13% year-on-year for 2021 and 38% for 2022, assuming that all segments recover.

In terms of its sustainability strategy, VNH’s manager says that consumer retail requires a high degree of customer satisfaction and Mobile World has built a consumer-centric corporate culture. All of its stores are equipped with LED lighting systems and, since 2013, all stores have installed optical sensors that feed into an automatic system that controls the lights and air conditioning. The company has also developed an internal e-learning program to help the induction of thousands of employees into its grocery chain.

In terms of Mobile World’s ESG challenges, VNH’s manager says that grocery retailers have high levels of food waste (which typically accounts for 2% to 3% of on-shelf goods). However, during 2019 the company implemented an advanced automatic SKU management system, with the aim of reducing this ratio to between 1% and 1.5%.

Single use packaging is another key issue facing retail chains globally. With over 400 grocery stores, serving nearly half a million customers daily, MWG is not immune to this. VNH’s manager acknowledges that this remains an ongoing challenge for the company, and for the industry as a whole. However, it reiterates its view that Mobile World has proven itself to be very strong at executing, it is operating in structural growth areas, has proven itself to be strong at identifying winning sectors to enter and it believes that innovation will allow the company to keep its growth momentum.

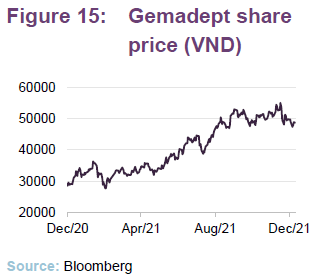

Gemadept (6.4%) – benefiting from strong growth in container volumes

We introduced Gemadept Corporation (gemadept.com.vn) as a VNH holding in our March 2021 note, where we commented that the manager had started to build a position around two years prior, adding to the holding during the pandemic when its valuation was depressed. Gemadept is a marine freight transportation company that owns and operates ports and provides related logistics activities, both in Vietnam and internationally (it plays into the manager’s industrialisation theme). This includes containers and oversize freight, as well as transportation by deep sea, inland water, land and air.

VNH’s manager says that Vietnamese sea freight has been growing at around 20% per annum for a number of decades (a trend that it expects to continue) and this has increased over the last five years with rates of 25-30%. With the soft-opening of its latest deep-water port (Gemalink) in January of this year, Gemadept became the second largest sea port operator in Vietnam and is well positioned to benefit from the continued growth in international trade, particularly as it is the cheapest operator. The new port reached 90% capacity utilisation early this year and, in July, posted its inaugural profits.

While COVID has impacted the business, container volumes in Gemadept’s southern ports have been resilient during the lockdowns in both 2020 and 2021, and in the first nine months of this year its ports in Hai Phong recorded a 25% increase in volume year-on-year. For the group as a whole, revenues and earnings have grown by 14% and 32% respectively, for the nine months to 30 September 2021, compared to the same period last year, and net profit after tax is projected to reach VND 600bn, which is a 64% increase year-on-year (recognising that the prior year was more heavily impacted by COVID, particularly Saigon Cargo Services – see below).

As we have previously discussed, Gemadept owns around 30% of Saigon Cargo Services (or SCS, another VNH holding which we discussed in detail in our December 2019 note – see page 15 of that note). Of the two, Gemadept has the more liquid stock and has been less affected by COVID-19 overall (SCS still faces challenges with COVID-19-related travel restrictions, although these are improving).

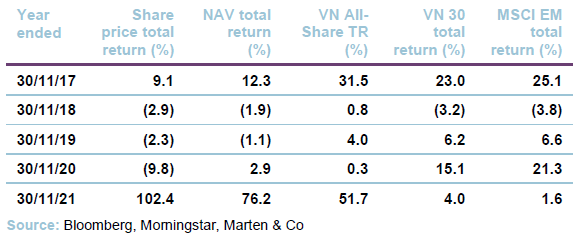

Performance

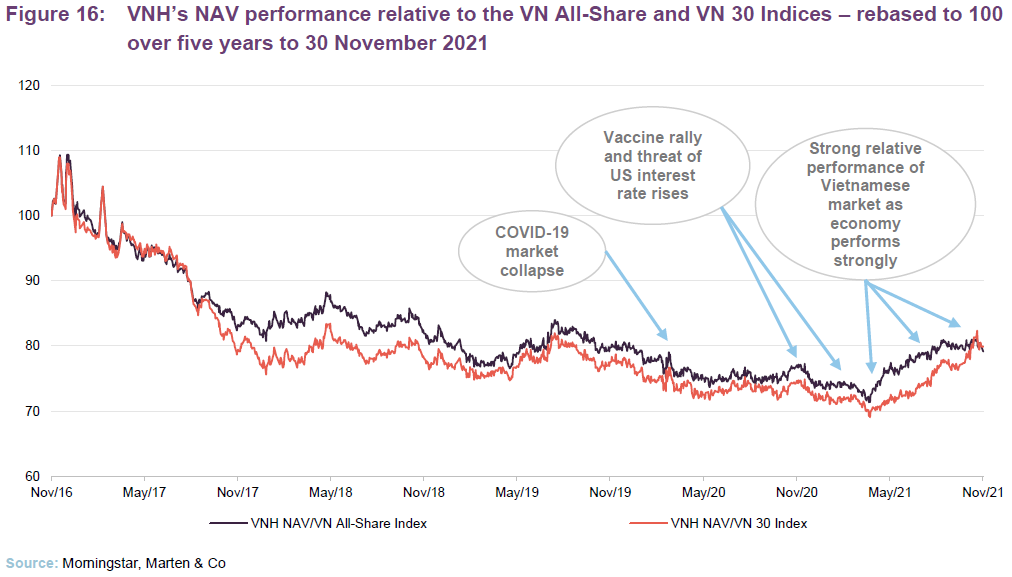

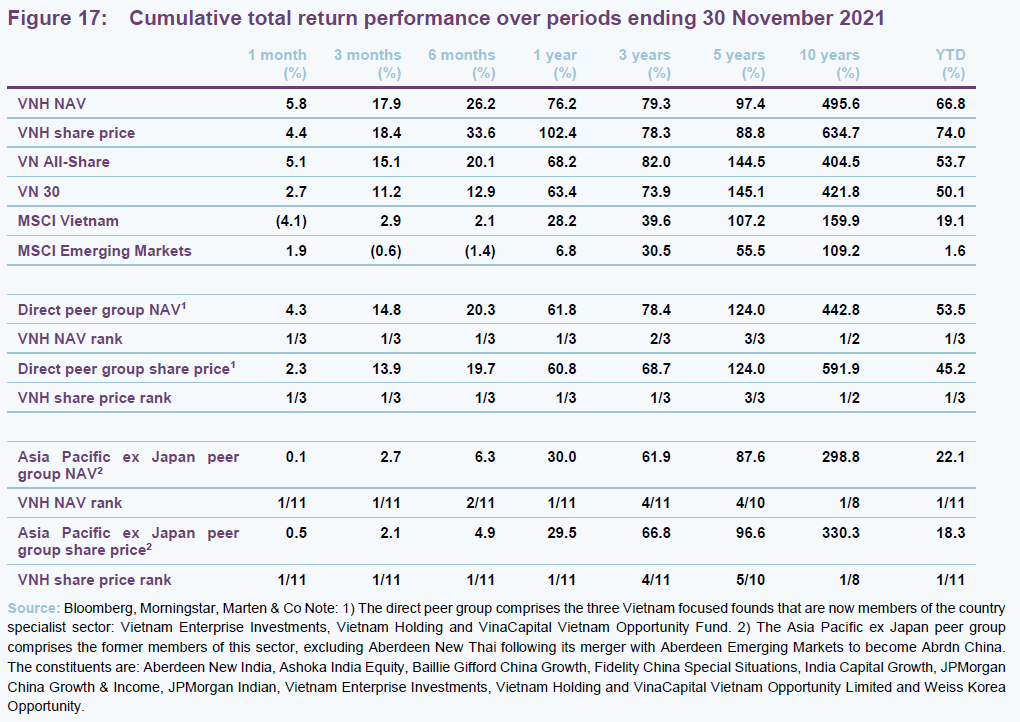

Figure 17 illustrates VNH’s share price and NAV total return performances in comparison with those of the VN All-Share, VN30, MSCI Vietnam and MSCI Emerging markets indices, as well as both its direct peers (see discussion below) and its peers within the Asia Pacific ex Japan peer group. Absolute returns over the 10-year periods are very strong, particularly for VNH and its peers (for example the 10-year returns for the direct peer group are significantly ahead of the broader Asia Pacific ex-Japan peer group – and VNH is the top performing fund over the ten-year period). Furthermore, over 10 years, VNH strongly outperforms all of the indices as well.

Figure 16 illustrates that while VNH lagged both the VN All-share Index and the VN30 Index following last year’s COVID-related market collapse in March, it has outperformed since the vaccine rally in November 2020 and its performance has been largely unaffected by the lockdown restrictions that have been imposed this year. As is explored in the peer group section below, while VNH’s long-term performance record has been strong, its absolute and relative performance between mid-2016 and January 2018 (a period during which VNH began its overhaul) was much more challenging. Relative performance subsequently improved, although some of this was given back during the early stages of the pandemic and we believe that VNH is now only now starting to feel the full benefit of the changes that have been put in place. We reiterate that VNH’s long-term performance record remains very strong and, in our view, it is over longer-term horizons that a strategy such as VNH’s is best assessed.

It should also be noted that VNH has traditionally focused on the mid cap space, where performance is inherently more volatile due to reduced liquidity and that VNH also operates with a concentrated portfolio which tends to exacerbate this issue. Earlier this year, the manager increased exposure to the banks, which tend to be larger cap holdings, as it felt these were better geared to the broader economic recovery in Vietnam, some of which was otherwise difficult to capture in listed equity markets. This strategy appears to have paid off and while VNH will continue to be biased towards the small and mid-caps, the move up the market cap scale may help to dampen volatility.

Peer group

Since the end of March, VNH has been a member of the AIC’s Country Specialist sector, having previously been a member of the discontinued Country Specialist: Asia Pacific-ex Japan sector. This change has had a limited effect on our peer group analysis as, reflecting the diverse range of funds in its previous sector (there were 12 different funds with a range of remits) we have previously provided figures for both the broader sector as well as a narrower peer group that looked at the three pure Vietnamese funds. In the analysis in Figure 17, we have included performance numbers for both the direct peer group as well as the former Asia Pacific ex Japan sector, as we continue to feel that this provides a useful basis of comparison. VNH’s new peer group comprise the three Vietnamese funds as well as JPMorgan Russian Securities and Weiss Korea Opportunity Fund. As we don’t believe that either the Russia focused fund or a fund of Korean preference shares provides a meaningful comparison for VNH, we have not included that sector here.

It can be seen from Figure 17 that, when compared to its direct Vietnamese peers, VNH’s performance during the last 12 months has lifted its performance over the longer-term time frames as well. For its NAV total return performance, VNH ranks first over all of the time horizons provided in Figure 17, with the exception of the three and five-year periods. The five-year period saw a restructuring of VNH’s board, alongside a range of other shareholder friendly initiatives (see our initiation note for more details) that successfully addressed a number of issues that had been weighing on VNH’s performance. It is also noteworthy that VNH is the top performing fund over the 10-year period as well. A similar pattern is seen when looking at VNH’s share price total return performance in Figure 17, where VNH is the top performing fund over all periods with the exception of the five-year period (the reasons for which are noted above).

Looking at VNH’s performance versus its Asia Pacific peers, it is also apparent that VNH’s performance during the last 12 months has lifted its performance over the longer-term time frames as well. However, VNH is a strongly performing fund, relative to its peer group, for both share price and NAV over all of the time periods provided.

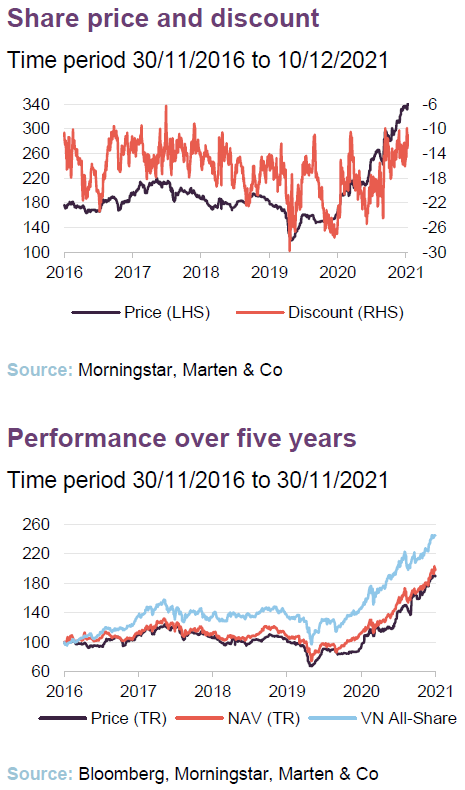

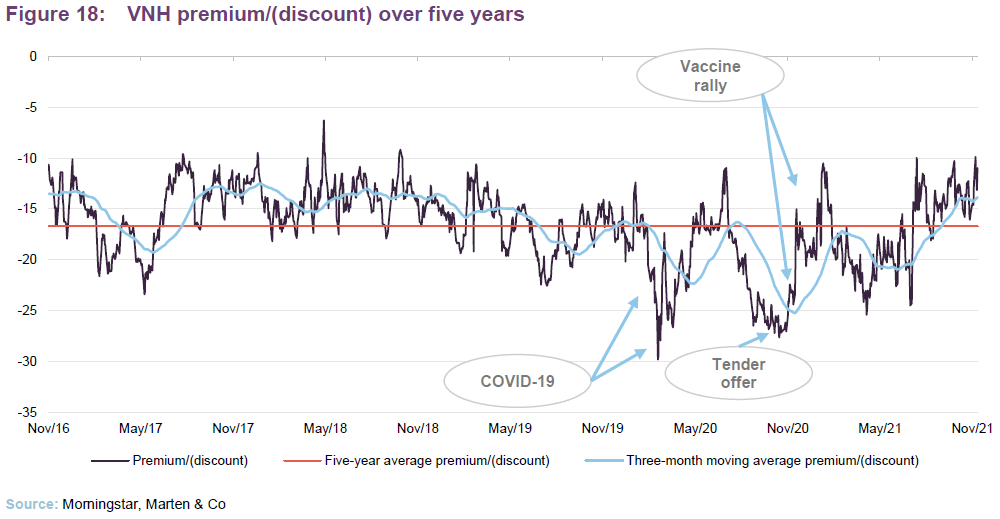

Premium/(discount)

As we have previously discussed, VNH’s discount has exhibited strong mean-reversion tendencies during the last five years and, as is illustrated in Figure 18, despite higher volatility in markets due to the pandemic, the last 20 months have broadly seen a repeat of this trend.

When we last wrote on VNH, we commented that discount continued on its narrowing trend from the previous year at the start of 2021, but then widened again since the middle of February. This is a period that has seen markets correct through a combination of investors taking profits in the face of rising long-term interest rates (a potential signal of rising inflation expectations, which can lead to higher near-term rates, all of which can be negative for equities) that took the steam out of markets globally. However, VNH’s discount has narrowed significantly since so that it is once again trading towards the tighter end of its pre-pandemic range.

We think this tightening reflects VNH’s strong performance during the last 12 months, an improvement in sentiment towards emerging markets more generally and Vietnam in particular as it has been effective in controlling the virus and keeping its economy running, as well as greater efforts by the manager and board to market the fund to potential investors and raise its profile.

We think that, given its performance record, VNH deserves to trade on a tighter discount and we think that there is the potential for further narrowing from here if the marketing efforts continue, assuming that VNH continues to provide a strong performance that is attractive to investors. Another potential catalyst for discount tightening would be signs that Vietnam could be elevated to emerging market status as this would open the country up to a significant additional swathe of investors.

Discount control

VNH is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, as well as an active discount control policy that seeks to address the imbalance between the supply of and demand for its ordinary shares (this process is overseen by VNH’s broker, finnCap Ltd, and is monitored by the board). VNH also uses tender offers from time to time to help control the discount. The most recent was a 30% tender offer at the beginning of November 2020 at a 2% discount to NAV, which was taken up by most shareholders (including both VNH directors and members of VNH’s management team). As at 10 December 2021, VNH was trading at a discount of 11.0%, which is markedly below its one- and five-year averages of 17.3% and 16.7% (one-year range: 9.9% to 25.4%).

Fund profile – listed Vietnamese equities with a strong ESG focus

VNH is a closed-end fund, domiciled in Guernsey, that aims to provide investors with long-term capital appreciation by investing in a concentrated portfolio of high-growth companies in Vietnam that demonstrate strong environmental, social and corporate governance awareness.

VNH invests predominantly in publicly-traded companies in Vietnam, but it may also, subject to certain restrictions, invest in foreign companies if a majority of their assets and/or operations are based in Vietnam (up to a maximum of 25% of its net assets). It can invest in equity-like securities, such as convertible bonds, and may also hold private companies (up to a maximum of 20% of its net assets). Further information on the manager’s ESG-orientated investment process, including investment restrictions, is provided on pages 10 to 13 of our March 2021 annual overview note (see previous publications section below). VNH has been a signatory of the UNPRI for over a decade.

Previous publications

Readers interested in further information about VNH, such as investment process, fees, capital structure, life and the board, may wish to read our annual overview Leveraging Asia’s rising star published on 17 March 2021, as well as our previous notes (details are below). You can read the notes by clicking on the links below.

Leveraging Asia’s rising star, annual overview note, published March 2021

Early mover advantage, update note, published May 2020

Silent revolution, initiation note, published December 2019

The legal bit

This marketing communication has been prepared for Vietnam Holding Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.