Henderson High Income

Investment companies | Annual Overview | 6 September 2023

There’s value in value

Thanks to its combination of both high-yielding stocks and debt, Henderson High Income (HHI) gives its manager, David Smith, the toolkit he needs to navigate the higher inflationary environment that has dictated the fortunes of the UK stock market. David believes that despite the recent macroeconomic uncertainty, the current market outlook could be supportive for HHI’s value-biased portfolio. History suggests that the combination of high inflation and a resilient UK economy may be a boon for the UK market and value stocks.

David has taken a cautious approach to asset allocation, increasing HHI’s allocation to fixed income. He is confident that HHI’s underlying revenues will support its income growth. We note that with a yield of more than 6% and the potential for near-term NAV uplifts, HHI stacks up favourably when compared with many of the higher-yielding assets that the higher-interest-rate regime has produced.

High income from a diverse UK equity income portfolio

HHI invests in a prudently diversified selection of both well-known and smaller companies to provide investors with a high income stream while also maintaining the prospect of capital growth. Gearing is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed-interest securities, which helps dampen the overall volatility of the trust.

Fund profile

Diversification, high income and the prospect of capital growth.

Henderson High Income Trust (HHI) invests in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high income stream while also maintaining the prospect of capital growth.

The majority of HHI’s assets are invested in the ordinary shares of listed companies, with the balance in listed fixed interest stocks (no unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked by investors and which offer the potential for capital appreciation over the medium term. A maximum of 30% of gross assets may be invested outside of the UK.

A portion of gearing is invested in fixed interest securities.

Gearing is used to enhance income returns, and to help achieve capital growth over time. A portion of gearing is usually invested in fixed-interest securities.

Janus Henderson Fund Management Limited is the company’s AIFM and it delegates investment management services to Henderson Global Investors (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

Blended benchmark

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index. For the purpose of this note, we have used the performance of the HSBC FTSE All Share Index Fund as a proxy for the FTSE All-Share Index. The HSBC fund closely tracks the performance of the FTSE All-Share index, although the two can differ over certain time periods.

Market outlook

You can read our last update note on HHI here.

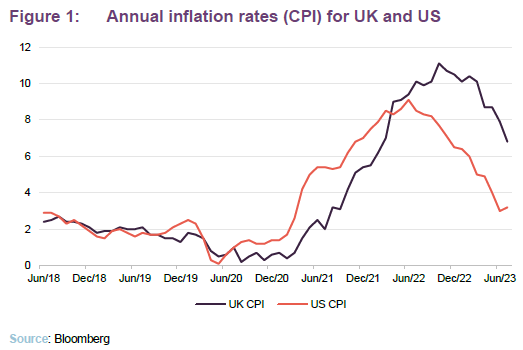

Readers might be forgiven for thinking that this note’s authors are a kind of broken record, discussing the same factors again and again. However, inflation and the Bank of England’s interest rate decisions still have top billing when it comes to determining the outlook of the UK equity market, especially domestic stocks.

UK inflation has remained unexpectedly sticky. Fortunately, July’s recent CPI figure came in at 6.8%, lower than the 7.9% printed in July, and in line with expectations. Nevertheless, UK inflation remains high relative to the US, and to EU averages. Whilst energy prices are no longer dogging UK consumers, having normalised from their 2022 highs, food price inflation and leisure costs remain elevated. The unexpected stickiness of inflation has been reflected in the interest rate policy of the Bank of England (BoE). Having recently set interest rates at 5.25%, analysts are now predicting at least a further 25bps increase in UK rates, reaching 5.5% by the year end, although that is better than forecasts before the June CPI figure was announced. The current swap markets, a form of financial derivative, are pricing a peak interest rate of 5.74% in 12 months’ time.

The UK’s battles with inflation are, unfortunately, more arduous than those faced by America’s Federal Reserve (Fed), which is seeing signs of falling inflation and may be past the worst of its rate-hiking-cycle, with a recent CPI of a mere 4% year-on-year. This means that UK investors are facing the prospect of comparatively higher interest rates than other developed market investors, which may weigh on sentiment given the increased discount rates it implies.

Whilst inflation has been a headache for investors, the UK economy has marginally outperformed its European peers. The UK has dodged a technical recession by the skin of its teeth, having yet to post two quarters of sequential negative growth since 2020. The Eurozone has been faring slightly worse over the past year, but also escaped a brief technical recession after revising up its last quarter of negative growth. It posted a slim 0.3% quarterly growth rate over the second quarter.

The UK economy’s resilience is likely the result of its strong consumer demand, something that can be attributed to the increasingly tight labour market, which is allowing UK workers to demand higher wages, and which in turn may prolong the inflation issue. The notion of a strong consumer is particularly important for HHI, as many of its holdings are geared towards capitalising on a strong consumer, with the likes of Tesco and Premier Inn (which is owned via the hospitality major Whitbread) being heavily correlated with domestic UK consumption.

Manger’s view

Manager David Smith has a quiet confidence in his strategy, given its preference for high dividend payers and value stocks. He believes that the current macroeconomic outlook may offer support for the trust, whereby a higher inflationary and interest rate environment has historically been supportive of UK equities and particularly valuation-based investment styles.

Value friendly

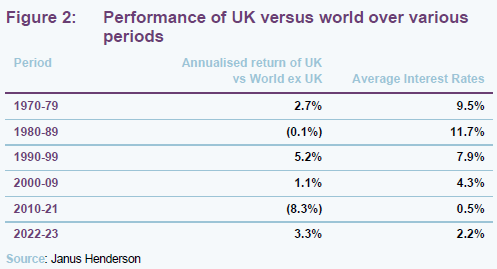

David notes that UK equities tend to do relatively well in higher interest rate and inflationary environments, and that is backed up by the data in Figure 2.

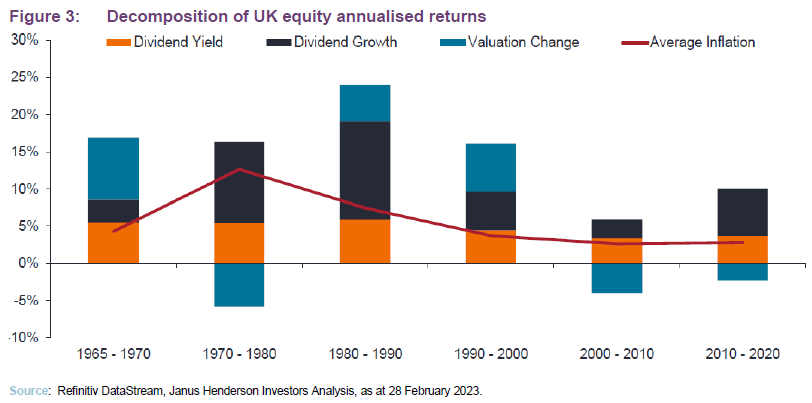

When interest rates are high, investors have a preference for near-term cash flows – such as dividends and share buybacks – over the promise of profits in the more distant future. In addition, as earnings growth and higher valuation multiples become harder to achieve in high inflation environments, dividend income becomes a more important component of returns, as Figure 3 illustrates.

David believes that UK growth investors now have to come to terms with a new reality of structurally higher discount rates. This may mean that companies experience a higher cost of capital sustained over the long term, which may prevent growth companies from commanding the same valuations that they did prior to the 2022 rate hiking cycle. In such an environment, a decline in the relative attractiveness of growth investing may in itself be a tailwind for UK value.

Rock solid fundamentals

The manager says inflation is likely to remain elevated, at least in the first half of 2022.

The case for HHI hinges on much more than the perennial battle between growth and value investing. Currently, the UK equity market offers investors the attractive combination of strong fundamentals and cheap valuations.

Global investors have been shunning the UK since before Brexit. The UK’s perception as a value-biased market – due to its large weighting to energy, resources, and banks – played a part in that, as more recently did the political turmoil that resulted from the UK’s heightened turnover in Prime Ministers.

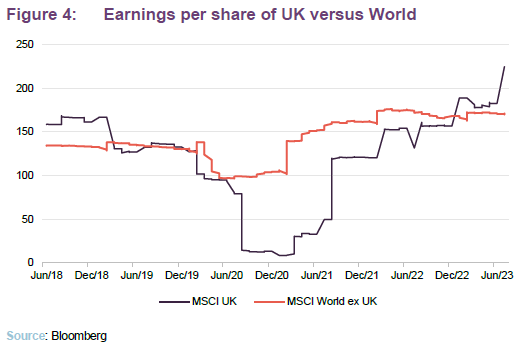

Sentiment be damned, however, as UK earnings have recovered from the effects of COVID-19, and faster than international peers (see Figure 4). Within this, weak sterling has been beneficial for exporters, but has added to input costs and flattered the earnings figures for international peers.

Clearing the hurdle

Higher rates are rewarding investors for sitting on cash, with one-year fixed deposits offering UK investors yields around 6%, and cash deposits yielding over 4%. Therefore, actively managed income strategies are facing an increasing hurdle when it comes to offering investors a truly ‘attractive’ level of income to justify the additional risk associated with their investment. Encouragingly, HHI passes that bar, with a current yield of 6.4%, and also comes with a 10-year track record of dividend growth, which should mean that the income gap between an investment in HHI and a deposit widens over time. Investors are also offered the potential of NAV growth alongside this, as well as a remarkably stable discount, as we describe on page 19.

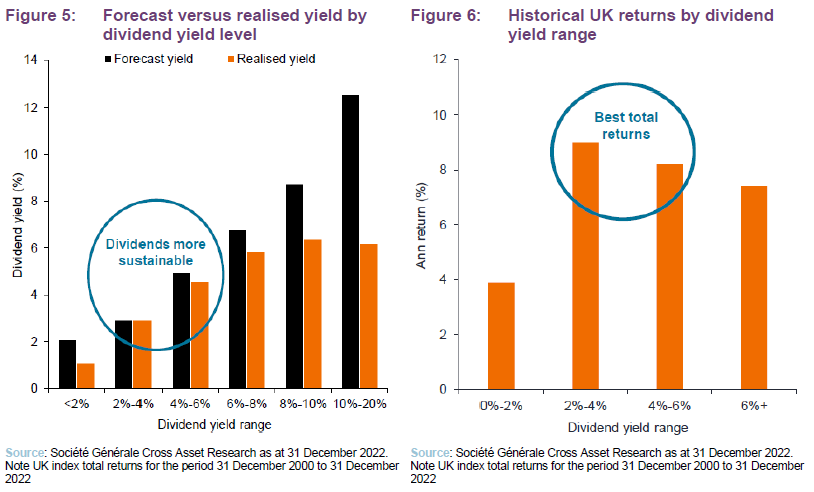

In theory, David could increase HHI’s yield further by tapping into the largest, cheapest dividend payers. However, he feels that in reality, such a course of action would most likely be disappointing for its shareholders. History suggests that the higher the forecasted yield, the more likely the company is to disappoint – either not paying promised dividends (Figure 5) and/or losing money in total return terms (Figure 6).

David believes that the HHI’s current blend of dividend payers is at the sweet spot. This band of 2% to 6% yielding stocks is also where the historically best-performing companies sit, so his approach may also be optimal for ensuring that HHI provides its shareholders with dividend and NAV growth, giving HHI the opportunity to provide inflation protection to its investors over the long term – something that fixed-income or cash deposits cannot provide.

Investment process

David is responsible for stock selection in the equity portfolio, asset allocating between bonds and equities and setting the day-to-day level of gearing. The split between bonds and equities in the portfolio varies, but is typically 20:80. The bond portfolio will usually be funded in whole or in part by gearing, which is limited to a maximum of 40% of gross assets. The margin achieved on the bond portfolio (HHI’s cost of long term fixed rate borrowing is about 3.7% and the yield on the bond portfolio is about 5.8%) supplements the income account and allows HHI to hold lower-yielding and higher-dividend growth equities, without compromising the trust’s dividend-paying ability.

The margin achieved on the bond portfolio allows HHI to hold lower yielding, and higher dividend growth equities.

The bond portfolio is managed by John Pattullo, Jenna Barnard, and Nicolas Ware, part of a five-strong strategic fixed-income team headed by John Pattullo and Jenna Barnard. They are supported by Janus Henderson’s wider fixed-income team. The team’s approach to managing bond portfolios and their views on the fixed interest market have been explored in depth in our notes on Henderson Diversified Income Trust, one of the other funds that they manage.

Within the global equity income team, which David is a part of, each manager has a good deal of autonomy and is accountable for the performance of their funds. The managers on the team are generalists and get to know investee companies directly rather than relying on analysts’ views. That said, there is considerable collaboration across the team and wider investment floor and significant proprietary research available to David – regular meetings and a centralised system enable the sharing of research across the whole group, including the global analysts based in the US.

Fundamentals, financials and valuation

For inclusion within HHI’s portfolio, each stock has to pass muster on each of three criteria – fundamentals, financials and valuation. If a stock fails on one criterion, it will be excluded from the portfolio.

- Fundamentals: the process places strong emphasis on companies that display market leadership, good visibility of earnings, strong franchises, proven management, and robust defensible business models with high barriers to entry that cannot be disintermediated.

- Financials: companies with the fundamental characteristics outlined above should also demonstrate sustainable returns. David is also looking for cash-generative companies with robust balance sheets, which have invested in their businesses, have a sustainable dividend policy – the payment of dividends should not compromise investment in the business – and where management is aligned with shareholders.

- Valuation: companies should be paying dividends and offer the prospect of dividend growth. They should be valued at a discount to David’s estimation of their fair value (offering upside in absolute terms) and attractively valued relative to their peers. The valuation should also be underpinned in some way (for example, by realisable assets) so that the downside is limited. David aims to own companies for the long term. He looks two to three years out when valuing businesses.

Sweet spot between yields of 2% and 6%.

David believes that there is a sweet spot for equity income investors of companies offering yields between about 2% and 6%. Within this range, companies tend to offer a good combination of yield and dividend growth. Above this level, it is more common to see dividend cuts/omissions and stocks that fall into value traps. Those very high-yielding companies that HHI does hold have strong cash-generative business models.

Stable growth, high yielders and quality cyclicals.

To achieve a balanced portfolio, David focuses on three types of stock: stable growth companies that can provide good dividend growth through a cycle; high yielders that provide a good base level of stable, predictable income; and quality cyclicals that provide strong dividend growth during economic upswings but, given their quality nature, can still pay and perhaps grow their dividend in more challenging times. Utilising gearing and owning bonds to boost income means HHI can own lower-yielding companies that offer more dividend growth; typically-stable growth companies; and quality cyclicals.

Responsible investment

Environmental, social and corporate governance (ESG) factors are taken into consideration when evaluating a company’s business model and prospects and in the ongoing monitoring of the portfolio. Janus Henderson uses a variety of sources to help identify and monitor material ESG risks including fund manager research and input from the specialist Janus Henderson ESG Research Team and independent Janus Henderson Governance and Responsible Investment Team as well as third-party data providers, such as Sustainalytics, RepRisk, Climetrics and ISS.

Whilst HHI is not an ESG-focused trust, ESG factors are an important consideration when it comes to determining whether a company’s business model is sustainable. The manager believes that those companies with good processes for managing ESG risk factors generally outperform.

The following four steps are integrated into HHI’s investment process:

- Identifying risks – determining the underlying ESG risks of a company.

- Analysing the controls and actions – gaining insight into the controls and actions a company performs to mitigate those risks.

- Assessing sustainability targets – this helps determine a company’s ability and willingness to adapt to ESG risks and a framework to hold management accountable.

- Engaging with management – having regular and ad hoc meetings with senior management teams on a variety of topics.

HHI does not exclude any companies solely on ESG grounds.

No company will be specifically excluded from investment on ESG grounds. However, the manager will actively engage with companies and their management teams and, if the manager believes that material ESG policies and processes are not sufficient or improving, or that change is not being embraced, the position in the company will be sold or no investment will be made.

Asset allocation

In a reversal of his 2022 activity, David has been increasing his bond exposure while reducing his equity allocation. His intention has been to lower the overall market sensitivity of HHI as we go into a potential economic downturn and take advantage of higher yield offered by bonds. He is also comfortable with the underlying revenue he expects HHI to generate over the current financial year, confident that the trust should be able to cover its growing dividend.

One trend in HHI’s allocation that will not be made apparent by its current allocation is David’s trading activity around cyclical stocks. Whilst he had previously increased HHI’s exposure to UK cyclicals during the disastrous mini-budget of previous UK Prime Minister Liz Truss, capitalising on their sell-off, he has since reduced his exposure during their subsequent rally – a rally which came on the back of decreased political risk and robust economic data.

David retains a c.20% exposure to overseas companies. This does not necessarily reflect his confidence in the performance of overseas equity markets relative to the UK, but rather represents an exercise in good portfolio construction whereby overseas equities offer additional diversification benefits.

Other sales since our last note include Vodafone and Nordea, while new purchases include HSBC and Conduit Re. We talk about these portfolio changes in more detail on page 11.

Portfolio breakdown

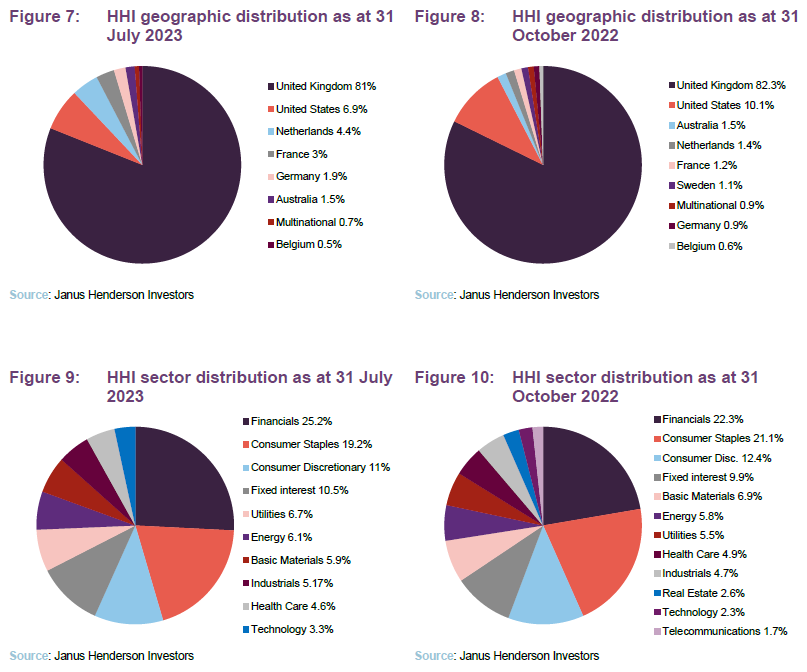

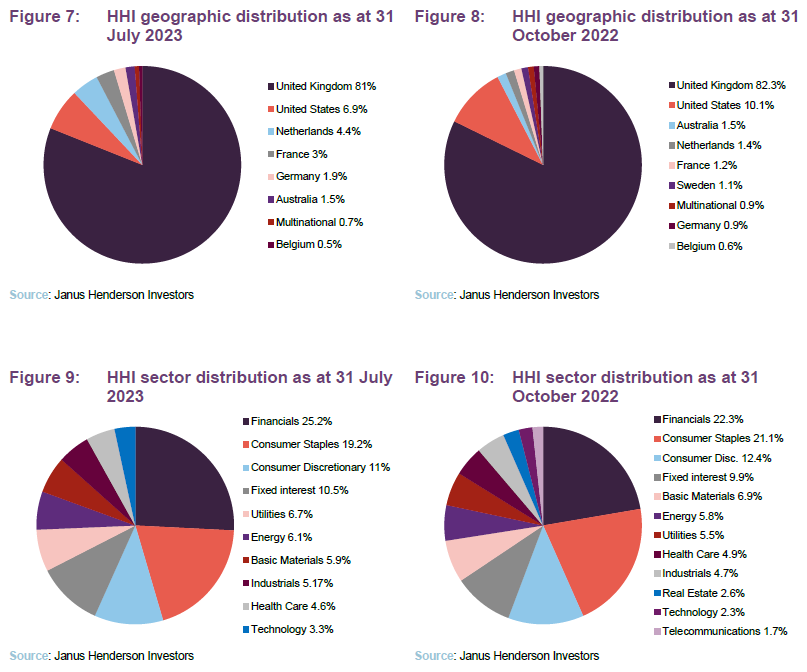

Since our last note, which looked at data for HHI as at 31 October 2022, there has been little change within the geographic distribution of the portfolio. HHI no longer has exposure to Sweden, and there has been a noticeable reduction to its American and UK holdings. The single largest increase has been to HHI’s exposure to the Netherlands.

Meanwhile, change within HHI’s sector distribution has also been minimal. Financials remain the biggest weighting, followed by consumer staples and consumer discretionary. Exposure to consumer staples and basic materials has reduced slightly, while the allocation towards utilities has increased, but only marginally.

Top 10 holdings

Turnover within the portfolio is low, reflecting the manager’s long-term approach. There are three new entrants to HHI’s top 10 holdings when compared to our last note: 3i Group, Tesco, and HSBC. These replaced AstraZeneca, Anglo American, Imperial Brands.

3i Group and Tesco have been longstanding components of HHI’s portfolio and have been amongst the top-10 holdings of HHI in some of our past notes. Their re-emergence in HHI’s list of largest positions is as much a reflection of their relative share price performance as David’s trading activity. HSBC, on the other hand, was the largest key purchase since our last note, and a new holding for HHI. Although there have been a number of disposals since our last note, none of them were amongst HHI’s previous top 10. There are currently 102 holdings in total.

Portfolio changes

The general narrative behind the changes to HHI’s portfolio has been the sale of more cyclically exposed companies which have rallied over recent months and recycling these proceeds into more defensive companies. David’s rationale has been to capitalise on the rallies to de-risk HHI’s portfolio.

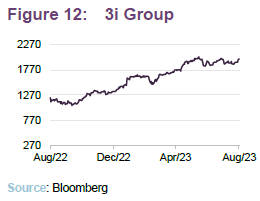

3i Group

3i Group (3i.com) is one of Europe’s largest private equity firms, and a mainstay of the FTSE 100. Whilst many listed private equity firms have struggled over the past 12 months, due to investors aggressively discounting their shares on the back of valuation uncertainty, 3i has come out largely unscathed, whereby it currently trades on a c.7% discount, compared to the rough 40-50% discounts that other private equity stalwarts trade on. 3i’s share price trajectory can be explained by the strong results it posted in its recent earnings announcement.

One particular bright spot in its portfolio was the discount wholesale retailer Action (similar to Costco in the UK), which was well-positioned to take advantage of the cost-of-living squeeze in Europe. Action is also the largest company within 3i’s portfolio, representing about 60% of its NAV. 3i’s performance has been so strong that its shares have hit all-time-highs, far surpassing their pre-pandemic level.

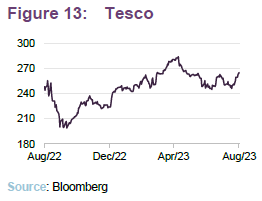

Tesco

Tesco (tesco.com) is the largest supermarket chain in the UK, and one of only two listed supermarket chains in the UK. At the time of our last note, Tesco’s share price was at a five-year low and has since seen a roughly 20% upwards re-rating. The rally in Tesco’s shares came as a result of resilient earnings, having reported a strong FY Q3 performance, thanks to robust Christmas sales.

Although it has not announced any upwards revisions in its earnings expectations, Tesco’s operations continue to be in line with the expectations of its management team. Being on-trend for Tesco is more important than it may initially seem, as 2022 saw investors question the wider UK economic outlook, thanks to spiralling food costs as well as fears of a weakened consumer.

Tesco is also an example of a company which offers ‘value’ to the UK consumer, given its aggressive discounting and price matching practices.

HSBC

HSBC (HSBC.com) is the only new purchase amongst HHI’s top 10. HSBC has been able to benefit from several tailwinds recently, the first being that, like all banks, HSBC has been a net beneficiary of higher interest rates, as it is able to generate a wider margin on its lending activities.

The second is that HSBC has a large exposure to Hong Kong, with it being the largest contributor to HSBC’s revenues. This means that HSBC is well-positioned to take advantage of the post-lockdown increase in economic activity within Hong Kong and mainland China. Given this, it is perhaps unsurprising that its Q1 2023 results were ahead of expectations, having upgraded its non-interest income guidance for the first half of the year, as well as increasing the pace of its share buybacks.

Other purchases

Whilst HSBC is the largest purchase since our last note, there have been several additional, smaller purchases made over the same period. Whilst not listed on a gradual level, David has been adding to the European utility companies within HHI, such as Eon, as part of his shift into more defensive companies.

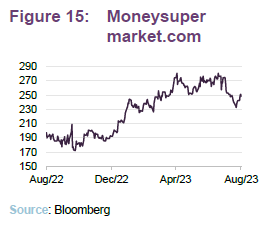

Moneysupermarket.com

David has increased his exposure to price comparison site Moneysupermarket.com (moneysupermarket.com), which offers a suite of comparison tools. By being a market leader in a highly profitable industry, it is also a hugely cash-generative business, which is conducive to a strong and growing dividend profile.

Beyond its high quality, one of the major factors in drawing David to the company has been an increase in insurance cost inflation, which should drive consumers towards comparison tools as they look to find cheaper alternatives. This is something that can be seen in the company’s 2022 results, which included a 22% rise in its full-year revenue.

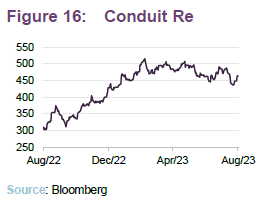

Conduit Re

Conduit Re (conduitreinsurance.com) is a Bermuda-based, UK-listed reinsurer, which has seen a substantial share price re-rating over the last year. Conduit Re is well-positioned within a structurally tight market. There is a shortage of capacity within the wider market, which has led to a c.50% increase in year-on-year gross premium income for the company (based on its Q1 2023 trading update).

David also bought into Conduit Re during a period of weakness, as in September 2022 it was trading at all-time lows, following a sell-off due to its perceived exposure to the Ukrainian conflict, and the consequences of the associated insurance claims. Conduit Re is also an example of a ‘dividend yielder’, with a current yield of 6.5% placing it on the higher end of HHI’s portfolio.

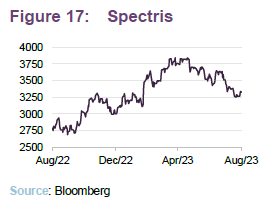

Spectris

Spectris (spectris.com) is a manufacturer of high-end precision instruments and testing equipment. Spectris is a market leader in several categories of sensors, software, data acquisition and virtual testing. This is a market worth over £5bn, of which Spectris alone accounts for c.10%. However, this is by no means the limit of Spectris’s product suite, and thanks to the fragmented nature of this highly-specialist market, it will continue to have opportunities to further expand its role as a market leader.

Its status as a growing leader in a very complex and specialist industry means that Spectris has been able to demonstrate strong ‘quality’ characteristics, with strong margins (which management are aiming to grow to 20% in the medium term) and high single-digit organic growth.

Spectris is an example of a ‘quality cyclical’ company, thanks to its dominant market position and reliable, yet strong growth. The quid pro quo for this is a relatively low dividend yield, which at 2.1% is at the lower end of those in HHI’s portfolio.

Disposals

There have been multiple sales made by David since our last note, both to fund the aforementioned purchases and to de-risk the portfolio. Given that, HHI’s overall equity exposure has fallen since our last note.

David has sold out of several cyclical companies, including Persimmon and Deutsche Post. Persimmon is a UK housebuilder, whose outlook is in David’s view deteriorating increasingly, with the stock performing poorly as higher interest rates and economic slowdowns weight on UK housing demand. This pain is being reflected in a poor dividend outlook for the company.

Deutsche Post operates the German postal service and a global parcel and freight transportation and delivery network. David sold out to crystalise his gains in the stock, fearing that the end of the COVID pandemic surge in parcel deliveries from online orders, plus Europe’s current economic slowdown, would means profits falling back towards pre-pandemic levels; this was not reflected in the valuation.

David’s single largest sale was of Vodafone, the UK telecom giant. While not an explicitly cyclical business, it has been a perennial underperformer since 2022. Whilst it does have an attractive dividend yield (over 10% at time of writing), David questions its sustainability given the large capital investment requirements needed by the company to remain competitive in a typically low returns industry. These issues include stagnating revenues and earnings, and a highly competitive market backdrop, with it having to compete with equal if not larger competitors in all the major markets it trades in. Even its merger with Three, a major competitor, has done little to stem its share price decline.

Other large disposals include Nordea, the Finnish bank, whose share price stagnated after the March selloff in the banking sector, following SVB’s collapse. David says that with fear of a recession in the Nordics, as well as credit downgrades and falling property prices, the outlook for regional Nordic banks is deteriorating. David also sold out of his holding in global fast-food giant McDonald’s, selling out of the company after a period of robust share price performance.

Devro sold to Saria bid.

Devro, the edible food casings manufacturer, was also a noteworthy exit. However, its removal from HHI’s portfolio was due to its takeover by German firm Saria. Saria purchased Devro for £692m, having gone through multiple rounds of bidding, and seeing off rival purchasers.

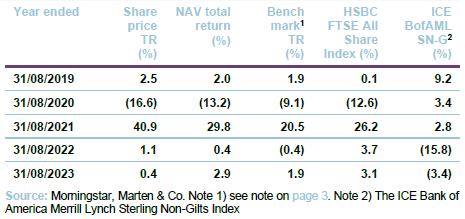

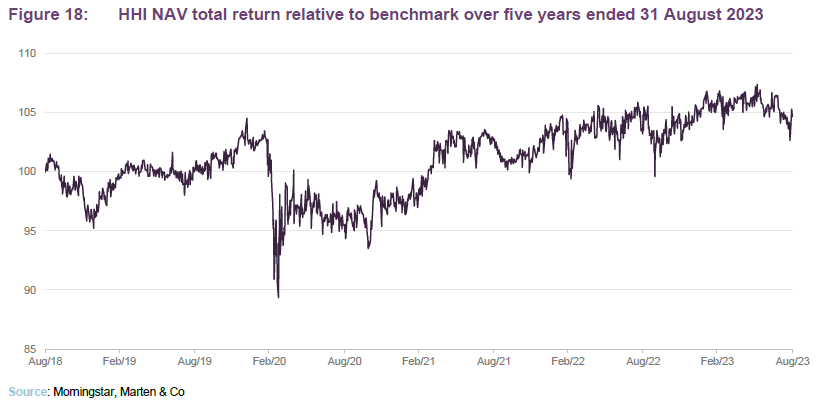

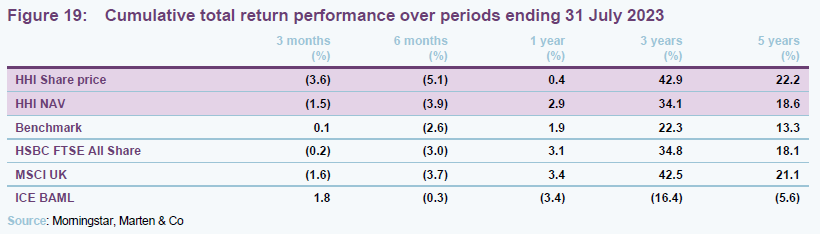

Performance

HHI saw its strongest period of relative performance during the latter months of 2020 and throughout the first half 2021, thanks to a rally in cyclical stocks brought about by the end of the COVID-19 lockdowns in the developed world and the rollout of vaccines. HHI’s cyclical exposure performed well in this environment.

While these tailwinds eventually subsided, HHI continued to extend its lead on its benchmark. This was thanks in part to David’s freedom to adjust his bond and equity weightings. David’s exposure to overseas companies has also helped him relative to his benchmark, as it has given HHI a positive currency uplift, given the weakness of sterling over the last five years.

We note that despite its bond allocation, HHI has kept up with the UK market over the last three and five years as its natural exposure to value-biased sectors within the UK market – specifically banks, energy, and materials – was supported by higher interest rates and energy prices over the period.

HHI’s NAV has been able to outperform its benchmark over one, three, and five years, and three and five years in share price terms.

Fixed-income portfolio

The fixed-income portfolio performed well over 2022, relative to its benchmark. While HHI’s bond portfolio lost 7.7% over 2022, it still significantly outperformed the 17.8% fall of the ICE BofAML Sterling Non-Gilts Index. It would have been near-impossible to generate a positive return from bonds over 2022, as rising global interest rates served to reduce the price of fixed income assets across all asset classes.

Bonds issued by financials performed particularly well.

The outperformance of HHI’s bond portfolio can be attributed to a variety of different factors, and points to a highly successful management of this sleeve of HHI. David was able to add value through issuer selection, duration management, and currency exposure. This part of the portfolio tends to be biased to the US, which was a driver of outperformance, thanks to the superior performance of its investment-grade bonds relative to UK, as well as the returns generated from an appreciating US dollar. HHI also held exposure to shorter duration assets going into the rate rise, which reduced the overall price-sensitivity of the bond portfolio, added to performance.

HHIs bond allocation has begun to creep up over 2023, with David capitalising on the recent falls in bond prices to purchase higher-yielding assets and lock in attractive yields. His trading activity is also in line with his intention of taking risk off the table, with the higher allocation to bonds dampening HHI’s risk exposure.

Peer group

Up-to-date information on HHI is available here.

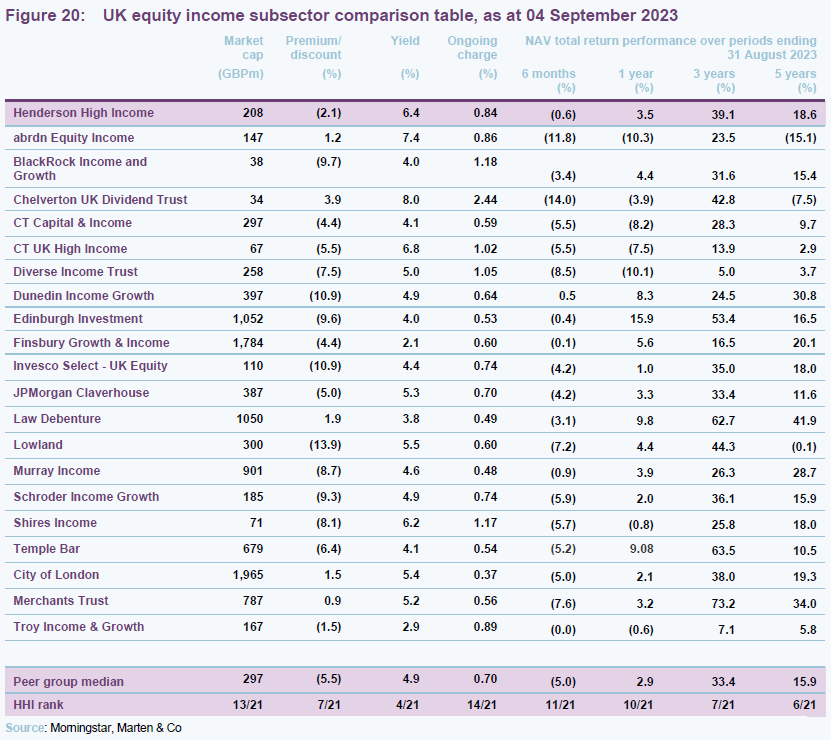

HHI sits within the AIC’s UK equity & bond income sector. However, given its investment objective, and the nature of its holdings, we believe it is fair to compare HHI to the UK equity income sector, which has similar equity exposures and yield profiles.

Over one, three and five years, HHI is in the top half of the table in NAV total return terms, even ranking in the top third for both three and five years. It also has one of the narrowest discounts and highest yields in the peer group, which may reflect its differentiated combination of assets. Whilst its 0.84% OCF may be competitive by other sectors standards, it ranks in the bottom half of its peers, a reflection of how competitive the UK equity income sector is. Its market cap also sits dead centre of the peer group, and is not small enough to warrant any concerns about the trust.

Dividend

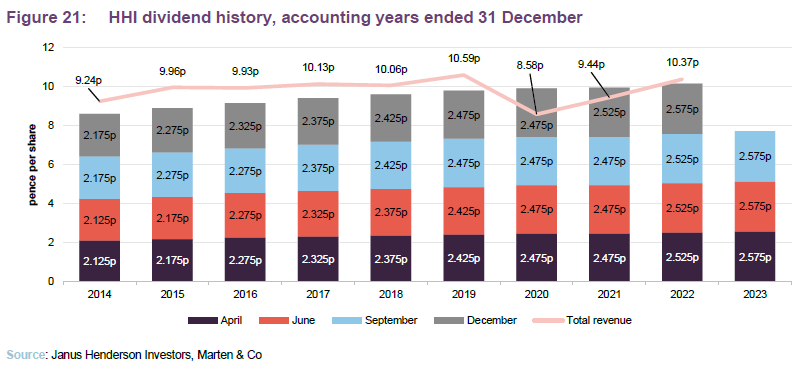

HHI’s revenue has recovered from its 2021 levels, reflecting the wider post COVID-19 recovery in dividends from equities and the increased yield from fixed-income investments. 2022’s dividend was fully covered as a result, and was the tenth consecutive dividend increase for the trust. Over those 10 years, HHI averaged a 2% annual compounding dividend growth rate, largely in-line with the UK’s long-term CPI. HHI’s most recent dividend, 10.15p per share, was also 2% higher than that of its prior year.

David runs frequent stress tests of HHI’s revenue account under different scenarios, looking several years ahead. Despite the recovery in HHI’s revenues, David models cautiousness when stress-testing the revenue account, given the more uncertain economic backdrop. Thankfully, however, he remains confident that the underlying revenues of HHI under the different scenarios, coupled with the robust level of revenue reserves, can continue to support dividend growth into the future.

At the start of 2022, HHI held £8.4m of revenue reserves and added an extra £384,000 of surplus income to reserves through the year. The first, second and third interim dividends remained at 2.525p, before increasing to 2.575p for the fourth and final interim dividend of the year. The dividend has remained at 2.575p for the first, second and third interim dividends already announced for 2023.

At the end of 2022, HHI had a revenue reserve coverage ratio of 0.7 times, slightly higher than the prior year and equivalent to eight months of dividend cover.

Premium/discount

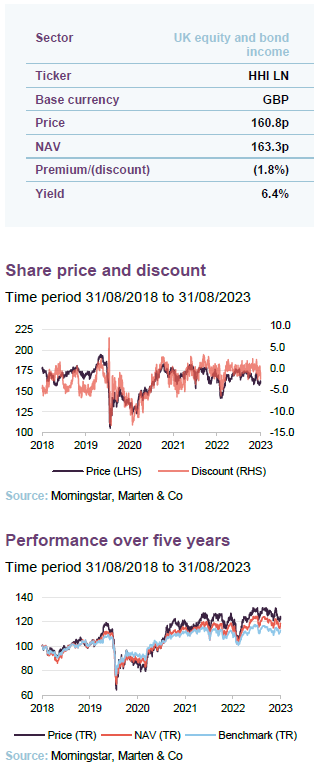

Over the past 12 months, HHI has traded between a discount of 6.5% and a premium of 2.3%. The median discount for the period is 0.3% while the average discount is 0.5%. As at 31 August 2023, HHI was trading at a 2.5% discount.

HHI has historically traded on a more volatile rating, as can be seen in Figure 23, whereby HHI flirted with a much wider discount prior to 2021. HHI was caught up in the COVID-19 sell off, with it, and many of its closest UK equity income peers, seeing their discounts widen over 2020 due to the extreme risk-off nature of investors. What sets HHI apart from the UK equity income peer group is that its discount narrowed quickly after the initial selloff, with most of the UK equity income sector still trading on an average discount of 5%.

The board considers the issuance and buy-back of the company’s shares where prudent, subject always to the overall impact on the portfolio, the pricing of other comparable investment companies and overall market conditions. The board believes that flexibility is important in this regard and that it is not in shareholders’ interests to set specific levels of premium and discount for its issuance and buy-back policies. At time of writing, no additional shares had been issued in the past 12 months. The last time HHI issued shares was on 21 June 2022.

Fees and costs

From 1 January 2022, HHI removed its performance fee, which the board says brings the company in line with other UK income-focused trusts. It also amended the level at which the management fee falls from 0.5% to 0.45% from £250m to £325m of average of two year adjusted gross assets. The board believes that the fee, which is payable quarterly in arrears, remains competitive.

HHI scrapped its performance fee in January 2022.

Janus Henderson and its subsidiaries provide accounting, company secretarial and general administrative services to HHI, and delegate some functions to BNP Paribas Securities Services.

The company’s ongoing charges ratio for the year ended 31 December 2022 was 0.84%, in line with the previous year.

Capital structure and life

HHI’s next AGM will be held in London in May 2024.

At 31 August 2023, HHI had 129,796,278 ordinary shares in issue and no other classes of share capital.

The company’s accounting year end is 31 December and AGMs are usually held in May, in London. HHI recently held its AGM on 16 May 2023, with the next one scheduled for 2024.

HHI does not have a fixed life, but shareholders are asked on a five-yearly basis whether they want to approve the continuation of the trust. The last continuation vote was held at the AGM in June 2020. Shareholders voted overwhelmingly (99.8% of those voting) to support continuation. The next such vote is scheduled for 2025.

Gearing

HHI is permitted to borrow up to 40% of gross assets, but in practice, gearing will usually be lower than this, and the majority of it tends to be used to finance fixed-interest investments rather than just gearing the equity portfolio. The trust should exhibit lower volatility of returns than a pure equity trust with similar levels of gearing.

Gearing is broken down into structural – which is allocated to HHI’s bond portfolio – and tactical, which is allocated to equities. Structural gearing is utilised to enhance the trust’s yield, by taking out long-term debt that is invested into higher-yielding fixed income assets, with the bond yield (at time of investment) being in excess of the cost of debt.

The trust has now drawn down around £37.6m of its £45m floating rate loan facility.

HHI has £45m floating rate loan facility with Scotiabank (with the option to increase it by up to £12m), combined with the long-term fixed rate senior unsecured note of £20m, which pays a sterling coupon of 3.67% per annum (split into two equal payments in January and July). The note will expire on 8 July 2034.

During the course of its most recent financial year the total level of borrowings decreased by £8m. Over the year, HHI added £7m to its fixed interest allocation, increasing the relative weighting of structural gearing versus tactical.

As a percentage of net assets, the overall level of gearing fell a little during the year from 22.4% to 21.4% at the end of 2022. At 31 July 2023, HHI’s gearing was 24%.

Board

HHI’s board consists of five directors, all of whom are independent of the manager, non-executive and who do not sit together on other boards. HHI implemented a board succession plan over a five-year time frame (between 2016 and 2021) and six new directors were recruited. The newest member of the board is Francesca Ecsery, who replaced Penny Lovell in December 2022. Penny’s tenure with HHI was short; unfortunately she had to retire from the trust due to other business commitments.

No director is expected to serve for more than nine years unless particular circumstances warrant it; for example, to facilitate effective succession planning, maintain continuity in post (particularly in regard to the chair) or promote diversity.

Jeremy Rigg

Jeremy has been chair of HHI’s board since taking over from Margaret Littlejohns in May 2021 after her retirement. He is currently an independent investment consultant. Jeremy has over 20 years’ experience within the investment management industry, having held roles at Schroder Investment Management (UK) Limited and as a senior investment manager at Investec Asset Management limited. In 2004, he was a founding partner of Origin Asset Management, a boutique equity investment manager, which grew successfully and was acquired by Principal Global Investors in 2011. Jeremy graduated from St Andrews University in 1989.

Jonathan Silver

Jonathan is the chair of the audit and risk committee at HHI. He has held various senior financial positions, including 21 years as chief financial officer on the main board of Laird Plc from 1994 to 2015. He is a non-executive director and chairman of the audit committee of Spirent Communications Plc, a position he has held since 2015. Since 2017, he has been a non-executive director of East and North Hertfordshire NHS Trust. Jonathan is a member of the Institute of Chartered Accountants of Scotland.

Zoe King

Zoe is a senior independent director at HHI. She is also a director of Evelyn Partners Investment Management Limited, specialising in the management of private client portfolios, and also acts as an independent director to the Dunhill Medical Trust investment committee as well as being a member of the Trinity College Oxford investment committee, the Carvetian Capital Fund investment committee and the Stramongate S.A. shareholder advisory committee. Zoe was formerly a vice president at Merrill Lynch Mercury Asset Management and a fund manager at Foreign & Colonial Investment Management. She graduated from Oxford University in 1994.

Richard Cranfield

Richard is a director on the board of HHI. He was a partner at Allen & Overy LLP, having joined them from university in 1978. He has now retired from this role but remains as a senior advisor. Richard is global chairman of the Corporate Practice and co-head of its Financial Institutions Group. He was appointed global head of Corporate in 2000, and in 2010 took a step back from management to focus on client relationships. In June 2019, he was appointed to the board of IntegraFin Holdings Plc, becoming chair in October 2019. IntegraFin Holdings Plc is a FTSE 250 company, the ultimate owner of the investment platform provider Transact.

Francesca Ecsery

Francesca has over 30 years’ experience working in both blue-chip companies and start-ups and has special expertise in multiplatform consumer marketing, branding and commercial strategies. She was previously a non-executive director at Marshall Motor Holdings PLC, Share PLC and Good Energy Group PLC and has held various senior positions in consumer-focused industries including the digital, retail and leisure and travel sectors. Francesca’s previous executive roles include at McKinsey, PepsiCo, Thorn EMI, Thomas Cook and STA Travel.

Previous publications

Readers interested in further information about HHI can read our previous annual overviews and update notes by clicking on the links in Figure 24 below. You can also read the notes by visiting our website.

Figure 24: QuotedData’s previously published notes on HHI

| Title | Note type | Publication date |

| The trust that delivers | Initiation | 26 November 2019 |

| Able to commit to the dividend | Update | 20 May 2020 |

| Robust high yield | Annual overview | 4 December 2020 |

| A taste of more to come | Update | 25 August 2021 |

| Last man standing | Annual overview | 26 April 2022 |

| Does what it says on the tin | Update | 21 December 2022 |

Source: Marten & Co

Legal

This marketing communication has been prepared for Henderson High Income Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.