Henderson High Income

Investment companies | Update | 21 December 2022

Does what it says on the tin

Whilst 2022 has been a harrowing year for many trusts, Henderson High Income Trust (HHI) has generated a positive 12-month NAV return and still offers an attractive yield, one of the highest amongst its peers. Manager David Smith remains quietly confident about the medium-term prospects for the UK, believing that the country will experience a mild recession, and has begun to rotate HHI’s portfolio into cyclical companies, where valuations are particularly attractive. While David is underweight the energy majors, which have driven the returns of UK indices, HHI has been well-positioned in consumer staples and other defensive companies, which have held up remarkably well over 2022. HHI’s rating has also held up, having traded close to asset value throughout the year. In addition, HHI has now built up a record of 10 consecutive years of dividend growth.

High income from a diverse UK equity income portfolio

HHI invests in a prudently diversified selection of both well-known and smaller companies to provide investors with a high income stream while also maintaining the prospect of capital growth. Gearing is used to enhance income returns, and also to achieve capital growth over time. A portion of gearing is usually invested in fixed-interest securities, which helps dampen the overall volatility of the trust.

Fund Profile

Diversification, high income and the prospect of capital growth.

Henderson High Income Trust (HHI) invests in a prudently diversified selection of both well-known and smaller companies, to provide investors with a high-income stream, while also maintaining the prospect of capital growth.

The majority of HHI’s assets are invested in the ordinary shares of listed companies with the balance in listed fixed interest stocks (no unquoted investments). Investee companies should have strong balance sheets that are capable of paying dividends. There is a focus on well-managed companies whose qualities may have been temporarily overlooked by investors and which offer the potential for capital appreciation over the medium term. A maximum of 30% of gross assets may be invested outside of the UK.

A portion of gearing is invested in fixed interest securities.

Gearing is used to enhance income returns, and to help achieve capital growth over time. A portion of gearing is usually invested in fixed interest securities.

Janus Henderson Funds Management UK Limited is the company’s AIFM and it delegates investment management services to Janus Henderson Investors UK Limited (both are subsidiaries of Janus Henderson Group Plc). The lead fund manager assigned to the trust is David Smith. He was made co-manager of the trust in 2014 and has been sole manager since 2015.

HHI sits alone in its own peer group, assigned to the AIC sector ‘UK Equity & Bond Income’, which is a reflection of its ability to offer investors the combination of income and capital growth derived from both UK high income stocks and fixed income investments.

Next Generation dividend hero

HHI’s total dividend for its financial year ended 31 December 2022 is 10.15p. This is expected to be fully covered by earnings. The dividend was 2.0% higher than the level for FY21 and this represents the 10th consecutive year of dividend growth for the company, qualifying it as a next-generation AIC dividend hero. HHI has, over the last decade, been able to generate a dividend yield well in excess of both the UK equity market and the UK 10-year gilt yield, while also delivering outperformance of its benchmark.

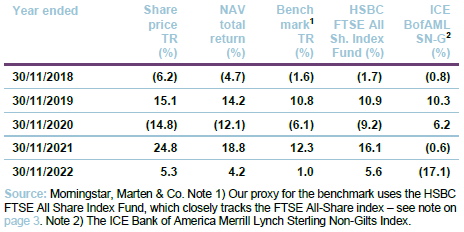

Blended benchmark

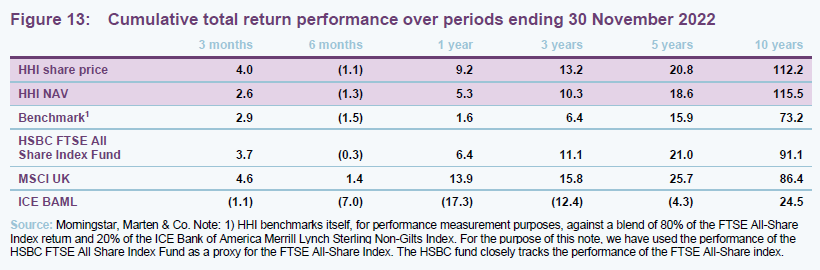

HHI benchmarks itself, for performance measurement purposes, against a blend of 80% of the FTSE All-Share Index return and 20% of the ICE Bank of America Merrill Lynch Sterling Non-Gilts Index. For the purpose of this note, we have used the performance of the HSBC FTSE All Share Index Fund as a proxy for the FTSE All-Share Index. The HSBC fund closely tracks the performance of the FTSE All-Share index although the two can differ over certain time periods.

Market outlook

You can read our last annual overview of HHI here.

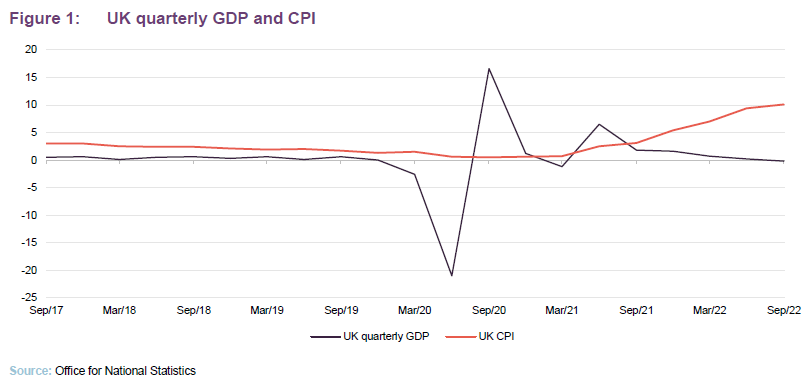

In our last note, Last man standing, we inferred that a lot had happened in markets over the half-year period covered by the note. However, the subsequent period has also thrown up an equal, if not greater level of volatility than the previous one. Not only has the UK market had to deal with the same accelerating inflation levels that were present earlier in the year, but it has also been gripped by the political turmoil brought about by the changing leadership and policies of the current government, which sent the UK government’s borrowing costs surging.

Steep rises in inflation and interest rates are now a reality for the UK, with inflation hitting double-digit territory in the months following our previous note. The Bank of England has responded by increasing interest rates to levels not seen since 2008. The underlying drivers of UK (and the wider US and European) inflation have remained the same: increasing energy and food prices as a consequence of the ongoing war in Ukraine, as well as the impact of the post-COVID-19 recovery in economic activity.

What was new, however, was the substantial increase in political risk surrounding the UK, with the resignation of Boris Johnson giving way to a tumultuous period. Liz Truss went down as the UK’s shortest-tenured prime minister (with the previous holder of the title having died in office less than half a year in), yet in her brief 45-day stint she implemented a liberal economic reform policy which sent UK borrowing costs surging above 4% for a few weeks (based on the 10-year gilt yield). Since the arrival of Rishi Sunak, the 10-year gilt yield has fallen back to its pre-Truss level, at the cost of a fiscally conservative budget.

Whilst rising inflation and political discord have been direct factors in adding to the risk-off environment facing UK investors, they have also had to grapple with numerous global issues, such as the US mid-term elections and China’s ongoing attempts to supress COVID-19. The culmination of this uncertainty has been a stagnation of UK GDP growth, with its most recent quarterly GDP figures indicating a minor (-0.2%) contraction in economic activity (though thankfully above the -0.5% drop analysts had predicted). The impacts of rising inflation and interest rates are unfortunately expected to weigh on the UK economy for the short to medium term, as the OECD expects the UK economy to contract over 2023, with the lowest growth rate of any G7 economy.

The UK index’s performance is driven as much by multinational giants as it is by the domestic economy.

However, the performance of the UK equity market is not a reflection of the UK economy. The UK index is dominated by giant international businesses, many of which are focused on energy, materials, financials and consumer staples. These are some of the best-performing sectors over 2022, be it due to their direct, positive correlation to rising energy and raw material prices; direct beneficiaries of rising interest rates in the case of the banks within the financials sector; or by selling price inelastic goods in the case of consumer staples, which includes tobacco companies by way of example. One factor which unifies these categories of companies – other than their outperformance – has been their high dividend profiles, and while David does not intend to simply overweight the largest dividend payers, he has none-the-less benefitted from the tailwinds supporting these companies, as we detail later in this note.

Thankfully, the last few weeks have seen a strong positive re-rating of the wider UK market, thanks to substantial reduction in political risk brought about by the Sunak government.

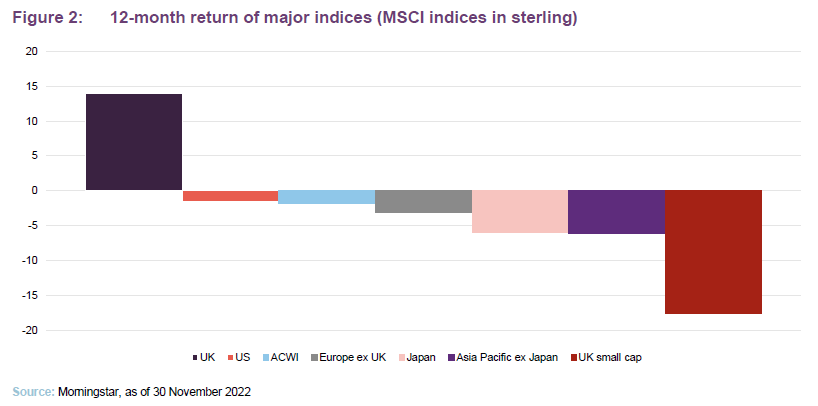

Manager’s view

HHI’s long-time manager, David Smith, has indicated in our recent conversations with him that the UK remains an attractive valuation opportunity, despite its recent outperformance. As David points out, the UK’s resilient performance this year hides large discrepancies in returns within the market, given the UK has been driven by a select few, very large companies. In fact, the 20-largest companies have returned 17.4% over the year to end of November, while the next 80 largest stocks have lost 15.8% over the same period, similar to the performance of UK medium and smaller sized companies. This has thrown up a lot of opportunities in some good quality, albeit cyclical business.

David does have a quiet confidence around the medium-term outlook for the UK economy. Whilst he does concede that a recession is likely, he feels that there are still a number of positive macroeconomic factors which indicate that any downturn in the UK economy is likely to be a mild one (i.e. a loss of c.1% GDP per annum). He highlights the UK’s tight labour market, strong corporate balance sheets, strong banking sector, and relatively resilient consumer spending as all being factors which can counterbalance any loss in economic output associated with rising inflation and interest rates.

UK dividends remain ahead of peers

As we outlined in our prior note, UK dividends have begun to return to form, with total 2022 dividends expected to grow from their 2021 levels. However, dividends are yet to fully recover from their pre-COVID levels, though a greater portion of the total dividends are coming from regular payments, a positive indicator of the increasing strength of UK corporate balance sheets.

UK forward 12-month yields remain ahead of other regions.

The 12-month forward dividend yields for UK companies remain ahead of all their developed market peers and are amongst the most attractive asset classes for income-seeking investors.

Value opportunities abound

David says that he is finding opportunities that are, based on varying metrics, attractive relative to history.

By way of example, David points to his holding in Vistry, the UK house builder formerly known as Bovis Homes. Across various metrics, Vistry’s valuation, as of the end of the third quarter, has only become more attractive over recent months. At the more conventional level, Vistry’s price-to-book ratio has fallen to its all-time low (based on a 20-year trading history), with the level comparable to that of the global financial crisis. The company offers a dividend yield of 10.5% currently. David feels that these are valuation levels which would imply a far more serious recession than the one currently forecasted. It also ignores the structural shortage of affordable housing in the UK, given the company has a Partnerships division that focuses on social housing for Housing Association and Local Authorities which should be more resilient in a downturn.

Backing the dividend growers

More information on the approach to managing HHI’s portfolio is provided in our last annual overview note. It is worth reiterating that David assigns potential investments into three broad categories: ‘stable growth’, ‘quality cyclicals’ and ‘high yielders’.

- ‘Stable growth’ reflects companies which can grow their dividend throughout the market cycle, with the global drinks giant Diageo being an example.

- ‘Quality cyclicals’ are companies whose dividend growth tends to reflect the wider economic cycle, though the ‘quality’ condition is key here as these companies’ cyclicality does not mean that their overall earnings profile is overly jeopardised by falling market cycles, such as Burberry, the high-end fashion company.

- ‘High yielders’ are those with above-average, dependable yields, though they may lack the same degree of share price appreciation potential of the latter two categories, with National Grid, the utilities company, being an example.

Inflation protection

HHI’s manager believes that his holdings are well placed to absorb inflationary pressures.

David believes that his process’s focus on the ‘quality’ of a company can ensure that the majority his holdings can, regardless of their category, weather the current inflationary storm. Diageo, for example, has strong pricing power within the drinks sector, being a leader in market share and having pricing power through its premium brands; it has the capacity to be a price setter. Burberry, on the other hand, has price inelastic products. Its premium fashion items see little change in demand when their prices are increased, and so its prices can be increased in line with inflation, as their consumers are either affluent enough to absorb the price increase or see its product as a must-have status symbol.

Asset allocation

In our prior note we highlighted David’s reduction in the cyclicality of HHI, in response to the increased market risk brought about by the Ukrainian crisis. While David has been reducing the overall equity exposure of HHI (via a reduction in gearing) he is now looking to reverse his previous position on cyclical sectors, by tapping into over-sold companies.

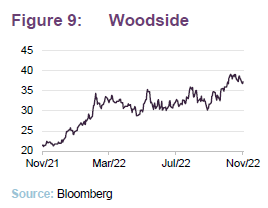

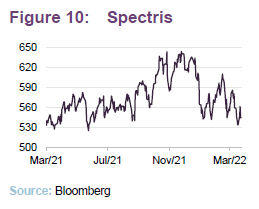

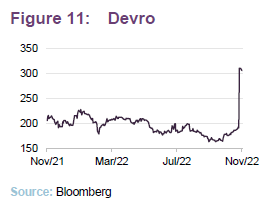

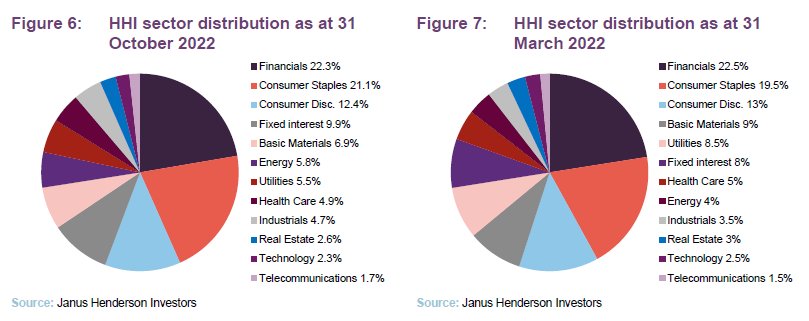

The key purchases since our last note include Woodside, a ‘high-yielding’ company; Spectris, another ‘quality cyclical’; and ‘stable growth’ Devro, with the overall larger increase being to the ‘quality cyclical’ allocation. David has also increased HHI’s bond exposure since our last note, a reflection of the increasingly attractive yields available in this area.

HHI’s portfolio has begun to rotate into cyclical companies.

Within some of the large cyclical sectors, David has closed HHI’s underweight to banks and materials over the last 12 months, although he remains underweight the energy sector despite the addition of Woodside.

While David’s mining allocation is across the major materials giants like Rio Tinto and Anglo American, he is more selective about which of the UK’s major banks he invests in, preferring to hold the domestic UK names, like NatWest, rather than the international giants like Standard Chartered and Barclays. David feels that analysts have likely more than fully priced in the impact of a recession on these banks. Their balance sheets are much stronger than they were at the time of the global financial crisis, helped by the extra provisioning undertaken in the face of COVID-19, and non-bank lenders have taken on higher-risk lending while regulators have forced the mainstream banks to be more conservative.

Portfolio breakdown

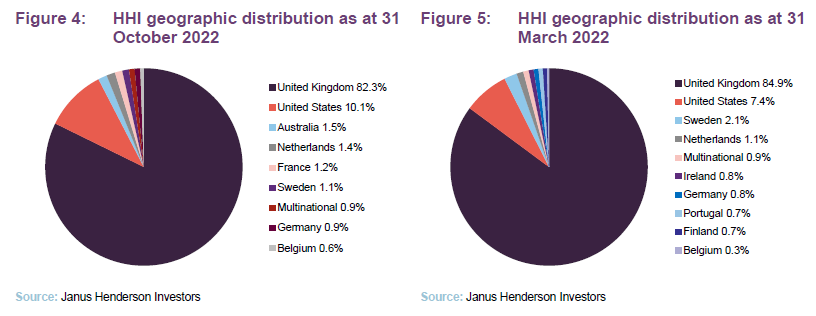

Since our last note, which looked at data for HHI as at 31 March 2022, the trust’s equity exposure and gearing have been reduced.

There have been a few minor changes to HHI’s geographic allocation. A number of European countries are no longer present within the portfolio, such as Portugal, Finland and Ireland. These countries represented less than 2% of the portfolio, and their absence reflects sales of entire positions.

The US exposure of the trust has increased, however, due in part to the relative strength of the regions, the rally in the US dollar relative to the pound over 2022, and a higher US fixed interest weighting.

HHI’s sectoral changes have also been subtle, with the overall portfolio closely resembling its makeup in our prior note. The major change has been the increased weighting to fixed income, a direct result of David’s trading actions, whereby he reduced the overall equity allocation and increased HHI’s fixed income investments.

Top 10 holdings

While the overall concentration of the top 10 remains the same, there have been some new entrants, with BP, Imperial Brands and NatWest entering HHI’s top 10 holdings over the last seven months, whereas 3i Group, GSK and National Grid have dropped out.

Portfolio changes

David has highlighted a number of key purchases and sales made recently which are worth outlining in further detail.

Woodside

David purchased Woodside (www.woodside.com) the UK-listed but Australian-based energy company, with a focus on hydrocarbon production in June. Post the company’s merger with BHP’s oil & gas assets, the business is well positioned in low cost, long life LNG assets in Australia and high margin oil production in the US Gulf of Mexico. Woodside’s leverage to LNG is particularly attractive as it is seen as a “transition” energy source due to it emitting less carbon than coal or oil but being more efficient than renewables. Demand for LNG has been steadily growing from Asia in recent years and is expected to strengthen further as Europe weans itself off Russian gas.

Spectris

Another new purchase made is Spectris (www.spectris.com), the precision instrument manufacturer. Spectris is a leading producer of a range of high-tech instruments, test equipment and software for a variety of technically demanding industrial applications. Despite its production of industrial equipment, Spectris’s business model is highly cash-generative and asset-light, given the high cost of their products and the value their intellectual property carries given their complexity.

David was attracted to Spectris by the structural growth opportunities presented in the life sciences and pharmaceutical sectors (major consumers of Spectris products) and the new management team, which was recently put into place – one which he expects to increase Spectris’s margin from 16% to over 20%. Given that Spectris’s share price was down by about 25% year-to-date when David initiated his position on September, he believed that the market had oversold the company relative to the upside it could achieve.

Devro

David purchased Devro, the sausage casing manufacturer, in May. David was attracted to Devro because of its defensive nature, as the consumption of sausage meat is less sensitive to income than higher-quality meat products. Yet it also benefits from the global increase in meat consumption, a reflection of growing incomes in the emerging markets, and the effect this has on protein consumption. At a stock-specific level, David was attracted to the discount Devro traded at, being significantly cheaper than all of its peers. Fortunately, David’s was not the only radar that Devro was on, with the company recently announcing that it will be taken over by Germany’s SAIRA, at about a 65% premium.

Disposals

Given that the overall level of gearing has fallen in HHI over 2022, sales outweighed purchases. The largest of these (as of 30 September 2022) was Informa, the publishing, business intelligence, and exhibitions group. Informa’s products, especially its exhibitions arm, are cyclical in nature and, given the forthcoming economic slowdown, David believed that the market had not sufficiently reflected this in its valuation and sold HHI’s position.

Other noteworthy sales include Coca-Cola. Whilst it has held up remarkably well in the current climate, with no material impairment to its long-term outlook, David has sold on valuation grounds. The downturn in markets created opportunities with greater long-term return potential.

By contrast, David’s sale of E.ON, the German utility, was due to fears over the impact of windfall taxes on the company’s profitability.

HHI’s position in Bellway was sold to help fund the purchase of Vistry. Vistry has more of a social housing focus which should help make it more resilient in a downturn.

Fixed-income allocations

HHI’s fixed-income allocation is funded via the use of gearing and, as such, it can be viewed as a ‘carry trade’, enhancing HHI’s yield and returns, while locking in a yield higher than that of the debt used to finance the purchase. The use of bonds not only enhances HHI’s income potential, but it also tends to dampen the portfolio volatility (relative to a purely equity portfolio), which is an attractive feature, especially for cautious investors with a lower risk tolerance.

Over 2022, David has purchased £5m in new bond positions, which reflects the increasing yield offered by the global fixed income markets in the wake of rising interest rates. Whilst the presence of US bonds does add currency risk to HHI (which has been a net positive for the trust over 2022), approximately 50% of the overseas exposure is hedged back to sterling via its non-sterling borrowings.

Performance

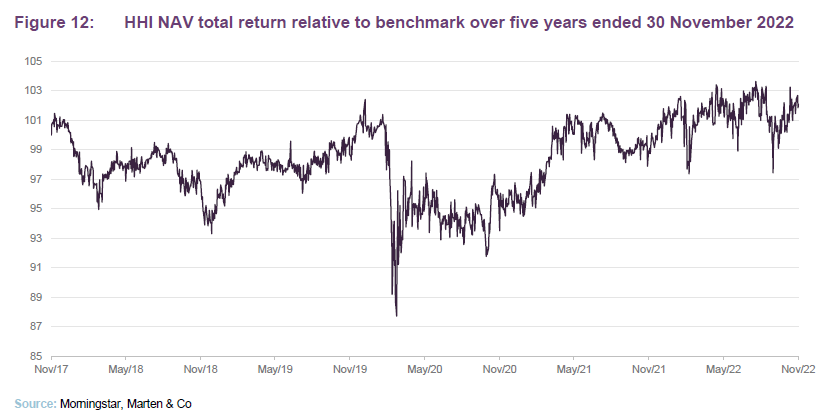

HHI generated a positive 12-month performance during a period which has been particularly harrowing for global equity markets. HHI’s 12-month NAV total return of 5.3% reflects a 3.5% outperformance against its blended benchmark, as of 30 November 2022.

HHI has in fact outperformed its benchmark over one, three, five, and ten year-periods. HHI’s near term outperformance has been achieved despite David’s long-held underweight to the UK’s major energy stocks, a result of his focus on the high-quality companies. These have been amongst the index’s best performing companies, thanks to the sharp rise in energy prices.

For comparison, we have included the MSCI UK index, which is utilised in our other research notes for competing trusts. The MSCI UK index has a higher weighting to large caps compared to the FTSE All Share, especially that largest cohort of companies, explaining much of its outperformance relative to HHI.

Positive contributors

HHI has benefitted from strong performance from tobacco and financial companies.

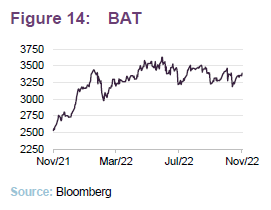

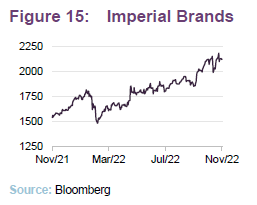

The top contributors to HHI performance came from the tobacco companies British American Tobacco and Imperial Brands, with NatWest, Woodside Energy, and ASR Nederland (the Dutch insurer) also being notable contributors. Devro’s recent buyout will also make it a major contributor to HHI’s 2022 performance although given the recency of the buyout, accurate attribution data is yet to be available to account for its impact.

Given the increasing impact of rising prices on global consumption, it may come as no surprise that HHI’s largest positive contributors were in the consumer staples sector, especially holdings in the two tobacco companies British American Tobacco (www.bat.com) and Imperial Brands (www.imperialbrandsplc.com). Any consumer staple is seen as a reliable source of demand during uncertain period, with the nature of tobacco consumption being largely price inelastic, thus allowing its manufacturers to easily pass on the impact of rising prices. The tobacco sector is a particularly unloved one, which means that the impact of a rotation into value stocks has had an impact (as we saw over 2022).

Irrespective of the market demand for tobacco, the companies are still able to generate very strong cashflows, and are a reliable source of sustainable dividends at attractive yields. With respect to British American Tobacco, David believes that it will see success from its increased capital expenditure on the next generation of tobacco products (e.g. vapourised tobacco).

Imperial Brands on the other hand has been a turnaround story, thanks to the presence of new management.

The presence of two financial companies, NatWest and ASR Netherland, should also come as no surprise, as both are positioned to benefit from rising interest rates. The market is increasingly pricing in higher earnings from both banks and insurance companies, thanks to the increase in interest rates. Whereas in the case of NatWest it will come via lending at higher rates, ASR Netherland will be able to lock in higher yields on its investments, increasing its ability to offset insurance liabilities. The positive contribution of Woodside Energy is indirectly linked to that of the two financial companies, as the increase in energy costs has been a major driver behind rising interest rates. This directly benefits Woodside Energy as a hydrocarbon extractor, as the increasing cost of oil and gas feeds directly back via higher revenues, and thus increasing the demand for its shares.

Detractors from performance

Outside of the impact of HHI’s underweight to Shell and AstraZeneca, which were amongst the FTSE’s best performing companies, positions in Hilton Food Group, Intermediate Capital, and Persimmon were noteworthy detractors.

Hilton Food Group has been hit by inflationary pressures, Intermediate Capital Group is affected by falling markets, and Persimmon is a casualty of rising interest rates and now falling house prices.

Fixed-income portfolio

The fixed-income portfolio detracted from returns as yields rose to reflect higher interest rates. The bond portfolio has fallen 6.9% year-to-date, while the bond benchmark has fallen 16.3%, with its outperformance being attributed to the relatively resilient performance of US investment grade bonds relative to the UK credit market, thanks in large part to the strength of the US dollar. With yields now looking more attractive, we would expect greater emphasis on this part of the portfolio than in recent years.

Peer group

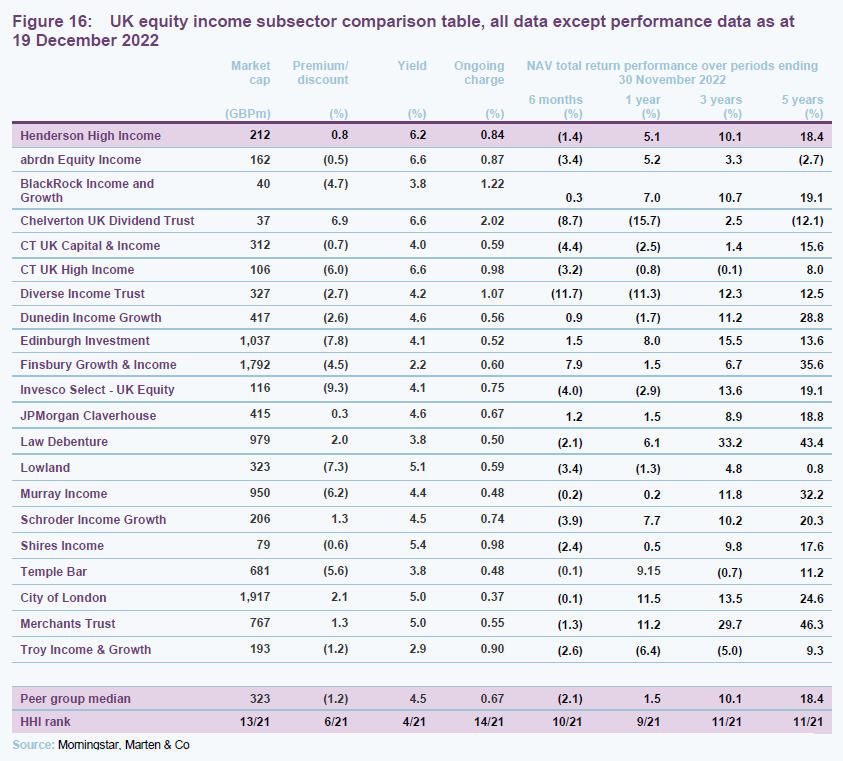

HHI has one of the highest yields of its peers.

HHI sits within the AIC’s UK equity & bond income sector. Until last year, there was only one other constituent in the sector, Acorn Income. However, the trust announced a scheme of reconstruction in September 2021, which saw investors offered a choice of cash or a rollover into an open-ended fund managed by Unicorn Asset Management. In this section, we have therefore compared HHI to the UK equity income sector, which has 21 constituents.

HHI has one of the highest yields amongst this peer group, ranking fourth of 21 funds. That is a likely factor in its rating – on premium/discount terms it ranks sixth. HHI’s size and ongoing charges ratio are within the middle of the pack for this peer group.

Despite offering comparatively high yield, this does not seem to have compromised its performance, which is close to the median for this peer group over most time periods.

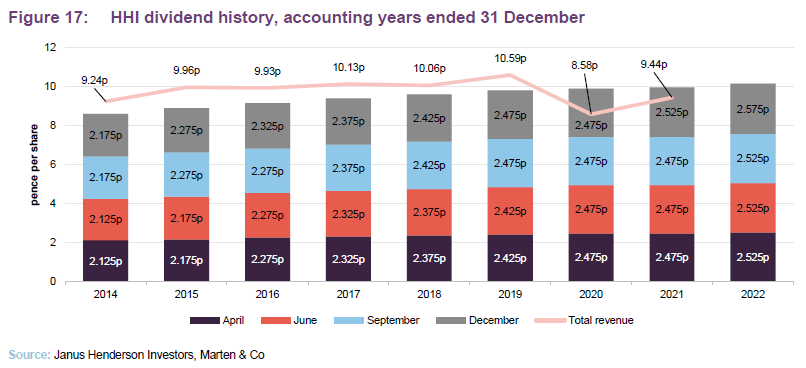

Dividend

HHI has recently announced its fourth, and final, quarterly dividend for 2022, making it its 10th consecutive year of dividend increases, becoming one of the AIC’s next generation of dividend heroes. HHI’s 2022 dividends will total 10.15 pence per share, a 2% increase over its 2021 pay-out.

While the financial year end results are yet to be published, David believes that it is likely that HHI’s dividend will be fully covered by its 2022 revenues. This should bring an end to the prior two years of uncovered dividends and bring HHI back in line with the trust’s longer-term trend of paying a progressive, yet fully-covered, dividend. Over the past 10 years, HHI has been able to provide investors with a compounded annual dividend growth rate of 2.0%.

However, as has been the case historically, HHI has a dividend reserve sufficient to cover its dividend during periods of crisis, where at the end of its 2021 financial year it has revenue reserves equal to approximately two thirds of its full-year dividend.

As of its half-year report, HHI has revenue reserves of £9.6m, a 10% increase on its 2021 half-year figure. With revenue of 5.57 pence per share in the first half of the year, HHI’s first two interim dividends (total 5.5p per share) were fully covered.

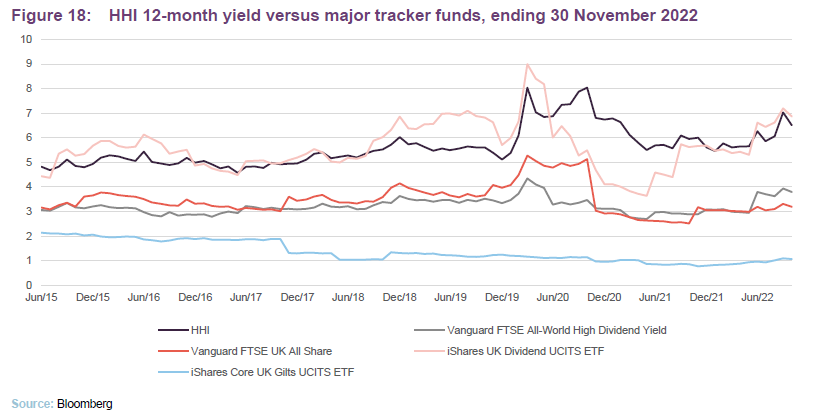

The attractiveness of HHI’s dividend profile can be seen clearly in Figure 18, which shows the 12-month share price yield of HHI since David has taken over as manager, compared to a variety of different, passive, income-focused strategies that an income seeking investor might consider.

HHI has advantages over all other strategies presented here, be it a consistently superior yield or, when compared to the UK high dividend stocks, a competitive but far more stable dividend profile. The proof is very much in the pudding when it comes to David’s approach, as not only has he been able oversee a progressive dividend profile since taking over, but his process has made HHI an arguably superior choice for income-seeking investors when compared to the conventional alternatives.

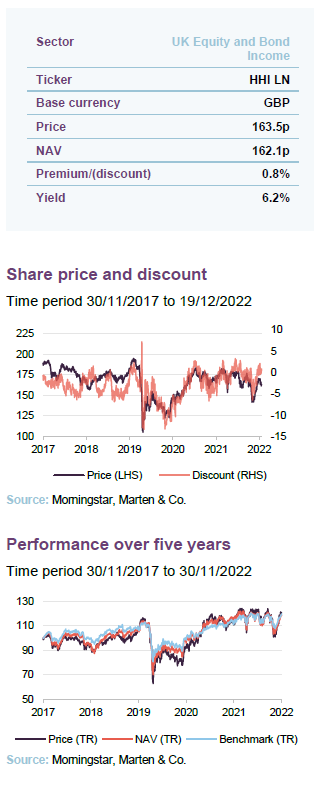

Premium/discount

HHI tends to trade fairly close to NAV, which may be a reflection of its decent track record and attractive dividend yield. Over the past 12 months, HHI has traded between a discount of 6.5% and a premium of 3.2%. The average discount was 0.6%. As at 19 December 2022, HHI was trading on a premium of 0.8%.

The board considers the issuance and buy-back of the company’s shares where prudent, subject always to the overall impact on the portfolio, the pricing of other comparable investment companies and overall market conditions. The board believes that flexibility is important in this regard and that it is not in shareholders’ interests to set specific levels of premium and discount for its issuance and buy-back policies.

Previous publications

Readers interested in further information about HHI can read our previous annual overviews and update notes by clicking on the links in Figure 20 below, including our most recent update which was published in April 2022 and our initiation note published in November 2019. You can also read the notes by visiting our website.

Figure 20: QuotedData’s previously published notes on HHI

| Title | Note type | Publication date |

| The trust that delivers | Initiation | 26 November 2019 |

| Able to commit to the dividend | Update | 20 May 2020 |

| Robust high yield | Annual overview | 4 December 2020 |

| A taste of more to come | Update | 25 August 2021 |

| Last man standing | Annual overview | 24 April 2022 |

Source: Marten & Co

Legal

This marketing communication has been prepared for Henderson High Income Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.