Real estate quarterly report

Stage set for recovery

Having fallen almost 6% in the first three months of the year, share prices among the real estate investment trust (REIT) and listed property sector ended the second quarter roughly where they started (as shown in the chart to the right). Positive inflation data, which fell to the Bank of England’s target of 2% in May, raised hopes that an interest rate cutting cycle may begin this year.

Even if that first cut is only a quarter point, it will send a message to lenders and borrowers that the trajectory is down and the forward yield curve should follow suit. Confidence that the bottom of the real estate market has been hit would facilitate more investment activity and a return to positive valuation growth. With REITs languishing on discounts to net asset value (NAV) last seen in the aftermath of the global financial crisis (GFC), the stage is set for a recovery.

The wide discounts continue to be a source of increased merger and acquisition (M&A) activity and boards, perhaps prematurely, chucking the towel in. Tritax Big Box REIT completed its acquisition of UK Commercial Property REIT – creating the UK’s fifth largest REIT, while several other corporate deals are in the wings. Confident that the market has reached a turning point in the cycle, London office developer Great Portland Estates raised £350m in a rights issue to deploy on prime development opportunities.

Performance data

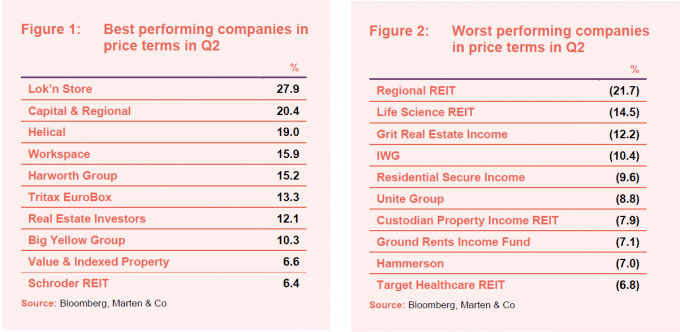

Best performing property companies

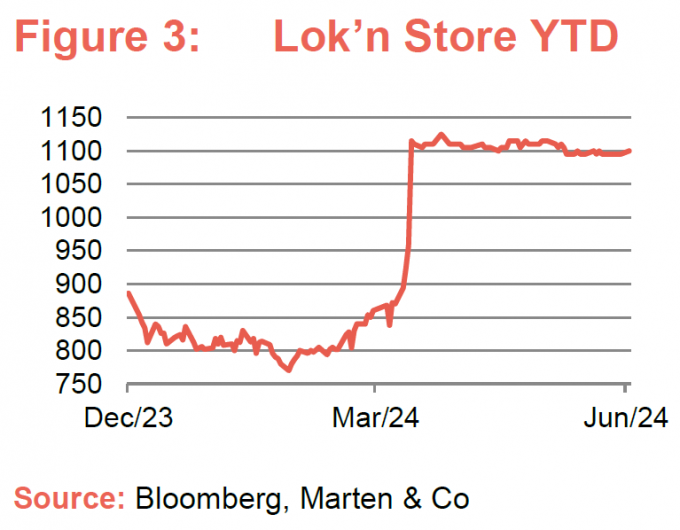

As has been the case for many months, merger and acquisition (M&A) activity dominated in the second quarter of 2024. Self-storage specialist Lok’n Store’s share price jumped on news that it had received an offer from Belgium-listed peer Shurgard at a 15.9% premium to its prevailing share price.

Small-cap shopping centre landlord Capital & Regional saw its share price bounce on news that it was an M&A target for peer NewRiver REIT.

The board of London office developer Helical decided to continue after conducting a strategic review into its future, confident in the growth opportunities in London as a supply pinch looms. In a much-needed boost for the company, the share price responded in kind.

Momentum in Harworth Group‘s shift to become a £1bn NAV company by 2027 is gathering pace. The company announced the bellwether sale of development land to Microsoft for a hyperscaler data centre at a huge profit, with the proceeds earmarked for developing out its logistics pipeline.

European logistics landlord Tritax EuroBox was the subject of private equity interest, with hopes of a bidding war growing after more suitors emerged.

Worst performing companies

Regional REIT’s share price dropped following the announcement of a capital raise (see below for more details). The trust intends to issue 15 new shares for every seven existing shares at an issue price of 10p per share. The fall in its share price is due to the impact of dilution, with the issue price below its prevailing share price.

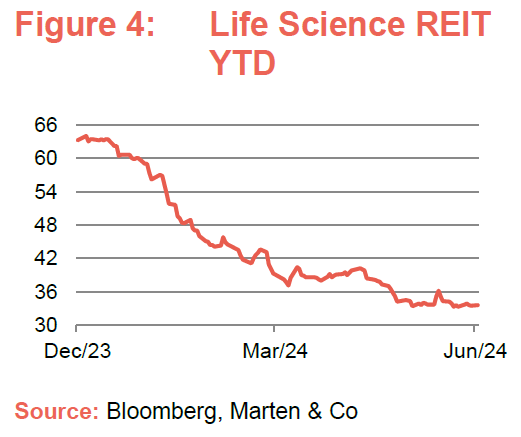

Share price pressure on Life Science REIT continued with another double-digit drop in the quarter. The company’s shares are now down 46.8% in the year-to-date, reaching an all-time low in its short existence in June.

Another company whose share price has come under persistent pressure is Residential Secure Income. It is down 23.1% in 2024 and is in need of a positive catalyst for a turnaround in fortunes.

Continued uncertainty relating to leasehold reform has plagued Ground Rents Income Fund, with the company now effectively winding down.

Significant rating changes

Discounts to NAV in the property sector remain some of the widest in the investment trust world. Figures 5 and 6 show how premiums and discounts to NAV have moved over the course of the quarter.

Figure 5: Biggest percentage point changes to ratings in Q2 2024 – the 10 greatest improvements

| Company | Sector | Premium/(discount) at 31/03/2024 (%) | Premium/(discount) at 30/06/2024 (%) | Difference (percentage point) |

| Lok’n Store | Self-storage | 12.6 | 44.4 | 31.8 |

| Helical | Offices | (49.1) | (25.2) | 23.9 |

| Workspace | Offices | (38.4) | (25.7) | 12.7 |

| Capital & Regional | Retail | (41.7) | (29.8) | 11.9 |

| Tritax EuroBox | Europe | (46.7) | (35.9) | 10.8 |

| Harworth Group | Development | (32.5) | (22.2) | 10.3 |

| Big Yellow Group | Self-storage | (12.7) | (5.3) | 7.4 |

| Schroder REIT | Diversified | (30.7) | (24.1) | 6.6 |

| abrdn Property Income | Diversified | (37.5) | (32.5) | 5.0 |

| Picton Property | Diversified | (34.2) | (29.5) | 4.7 |

Source: Bloomberg, Marten & Co

Many of the names listed here were mentioned in the previous section. The uplift in share prices of two of the companies going through M&A – Capital & Regional and Tritax EuroBox – saw their discounts narrow substantially, while Lok’n Store’s premium rating widened.

A boost in the share price and drop in the NAV during the quarter saw the discount of office landlords Helical’s and Workspace’s narrow considerably – with both now trading at roughly a 25% discount.

It was the same story for the diversified REITs – Schroder REIT, abrdn Property Income and Picton Property – which all saw incremental uplifts in their share prices while also reporting slight falls in NAV.

Figure 6: Biggest percentage point changes to ratings in Q2 2024 – the 10 biggest deteriorations

| Company | Sector | Premium/(discount) at 31/03/2024 (%) | Premium/(discount) at 30/06/2024 (%) | Difference (percentage point) |

| Regional REIT | Offices | (62.9) | (72.4) | (9.5) |

| Unite Group | Student accom. | 6.3 | (3.0) | (9.3) |

| Life Science REIT | Labs / offices | (50.8) | (57.9) | (7.1) |

| Target Healthcare REIT | Healthcare | (21.1) | (28.0) | (6.9) |

| Supermarket Income REIT | Retail | (11.8) | (17.6) | (5.8) |

| Sirius Real Estate | Europe | (9.7) | (14.6) | (4.9) |

| Custodian Property Income REIT | Diversified | (15.1) | (19.7) | (4.6) |

| Hammerson | Retail | (41.6) | (45.7) | (4.1) |

| Grit Real Estate Income | Rest of world | (69.9) | (73.6) | (3.7) |

| PRS REIT | Residential | (35.7) | (39.2) | (3.5) |

Source: Bloomberg, Marten & Co

The plunge in the share prices of Regional REIT and Life Science REIT saw their discounts to NAV widen further from already extreme levels.

Unite Group’s share price weakness may have been due to concerns over the introduction of policy removing the rights of family members of international students to working visas in the UK. In practice, this has had little to no impact on international student application numbers at the vast majority of universities in the UK.

Target Healthcare REIT reported an uplift in NAV during the period that was not reflected in its share price, which fell 6.8%. However, the company announced the sale of a portfolio of assets at end of the period at book value, which should give confidence in the NAV.

Private rented housing developer PRS REIT’s discount widened to almost 40%, an unfathomable level given the favourable dynamics and rental growth prospects of the private rented sector.

Major corporate activity

Fundraises

Great Portland Estates raised £350m through a rights issue – the only capital raise by a listed property company during the quarter

London office developer Great Portland Estates raised £350m in a rights issue – the only capital raise conducted in the second quarter of 2024. The company received acceptances for 96.8% of the total shares offered under the three for five rights issue. The rest were taken up by the sponsors of the issue under their underwriting agreement. GPE will invest the proceeds into office development sites in London. The company has a near-term acquisition pipeline worth £1.4bn within central London, and an additional watchlist worth another £1.4bn.

Special Opportunities REIT pulled its proposed IPO after falling short of its £500m target fundraise. The company planned to use the proceeds to acquire commercial property at distressed prices. It had lined up three cornerstone investors for up to £114m, but still fell short of its minimum level of target £250m. It is now thought the management team will look to raise equity in the private market.

Regional REIT announced a capital raising of £110.5m through a fully underwritten placing. The company also announced a 1 for 10 share consolidation. The capital raising, which is being underwritten by Bridgemere Investments, will enable the company to fully repay a £50m retail bond that is due to mature in August. The remainder of the proceeds will be split with £26.3m used to reduce bank facilities and £28.4m to fund selective capital expenditure on assets. As a result, the company’s LTV, which had ballooned to 56.8%, will reduce to 40.6% (on a fresh valuation of the portfolio on 21 June 2024). Following completion of the capital raising, and subject to shareholder approval at an extraordinary general meeting on 18 July, it is proposed that shares in the company will be consolidated at the ratio of one share for every 10 ordinary shares.

Mergers and acquisitions

Tritax Big Box REIT completed its merger with UK Commercial Property REIT

The merger of Tritax Big Box REIT and UK Commercial Property REIT became effective on 16 May after shareholders voted overwhelmingly in favour of the merger. The enlarged company has a market cap of just under £3.9bn, making it the fifth largest listed real estate company in the UK.

NewRiver REIT announced it was weighing up a bid for listed shopping centre landlord Capital & Regional. NewRiver approached Capital & Regional’s majority shareholder Growthpoint Properties (which owns 68.13% of the company) regarding a possible offer in cash and shares. No formal proposal has been made at this stage and NewRiver has until 18 July to announce a firm intention to make an offer. The company said that it believed that a combination would substantially accelerate its growth ambitions, whilst delivering significant value for both sets of shareholders and also maintaining its core operational expertise in retail real estate.

The board of Lok’n Store agreed the terms of a recommended cash offer from Shurgard to acquire the company. Under the terms of the acquisition, Lok’n Store shareholders will be entitled to receive 1,110p in cash for each share, valuing the company at £378m. This represents a premium of 15.9% to the prevailing price, 41.3% to the volume-weighted six-month average price, and a 2.3% to the all-time high closing price of 1,085 pence (on 6 January 2022). Shurgard has received irrevocable undertakings to vote in favour of the cash offer from Lok’n Store directors holding around 19% of the company.

Tritax EuroBox announced it was in discussions with a number of parties regarding the sale of the company. This followed an approach from Canadian private equity giant Brookfield Asset Management in early June over a possible offer for the company. Brookfield was granted an extension to its deadline to announce a firm intention to make an offer for Tritax EuroBox to 29 July.

Balanced Commercial Property Trust launched a strategic review in the future of the company, and later on the company stated that it had received interest from a number of parties to buy the company. It added that there can be no certainty that any proposal would merit a board recommendation. The company is also considering other options such as a managed wind down.

As expected and recommended by its board, shareholders of abrdn European Logistics Income voted against its continuation at its AGM. The company will now be put into a managed wind down.

abrdn Property Income shareholders also approved the managed wind down of the company.

Other major corporate activity

Home REIT failed to refinance its loan with Scottish Widows and will now look to sell more of its portfolio to repay the outstanding debt. The company said that extensive discussions with a new potential lender to refinance its debt facility (of just over £100m) fell through. It will repay the outstanding borrowings through further property sales. It will pay a higher additional interest fee on the outstanding amount (of 7% per annum up from 5%). After repaying the debt with proceeds of property sales, the company will be left with a portfolio worth around £200m.

Supermarket Income REIT increased its unsecured debt facility with Sumitomo Mitsui Banking Corporation by £37.5m to £104.5m. The interest-only facility matures in September 2026 and is priced at a margin of 1.55% above SONIA on the increased amount, with the existing £67m remaining at a margin of 1.40% above SONIA, and is fully hedged for the term of the facility. Following the deal, the company’s pro-forma LTV was 34%.

Major news stories

- Harworth Group sold the 48-acre Skelton Grange site near Leeds to Microsoft for £106.6m for the development of a hyperscale data centre.

- SEGRO acquired three fully let logistics warehouses in The Netherlands for €222m. The assets, located in Eindhoven, Heerlen, and Tilburg, total 172,300 sqm and generate €10m of rent, equating to a blended net initial yield of 4.6%.

- Land Securities acquired an additional 17.5% stake in Bluewater shopping centre from GIC for £120m, increasing its ownership to 66.25%. The acquisition increases the company’s net rental income by £10.3m.

- Warehouse REIT acquired phase 2 of Ventura Retail Park for £38.6m, venturing away from its core investment strategy. The 13-unit scheme in Tamworth, close to Birmingham, was bought at a net initial yield of 7.4%.

- Target Healthcare REIT completed the disposal of four UK care homes for £44.5m at a modest premium to the book value at 31 March 2024. Proceeds will be used to repay debt.

- LondonMetric sold seven properties for £31.3m (including £18.3m of non-core LXi REIT assets at a 5% premium to book values), reflecting a net initial yield of 7.0%. Separately, it acquired six reversionary urban warehouse assets for £45.0m, reflecting a net initial yield of 6.1%.

- Assura Group entered a £250m joint venture with Universities Superannuation Scheme (USS) to invest in NHS infrastructure. The JV (which is split 80:20 in favour of USS) will be seeded with an initial portfolio of seven assets (£107m) transferred from Assura’s existing portfolio. The £85m net cash proceeds received by Assura will be recycled into its pipeline of acquisition and development opportunities.

- British Land exchanged contracts to sell its 50% stake in the Meadowhall Shopping Centre to its joint venture partner Norges Bank Investment Management for £360m. The sales price was 3% above book value.

- Supermarket Income REIT acquired a portfolio of Carrefour supermarkets in France – its first foray into markets outside the UK – through a sale and leaseback transaction for €75.3m, reflecting a net initial yield of 6.3%.

- Sirius Real Estate acquired two industrial assets in the UK, in Banbury and Wembley, for just over £31m, representing a 9.2% net initial yield. The acquisitions add 492,000 sq ft of space to the group’s UK portfolio.

Selected QuotedData views

- Going off piste in search of yield

- Signals turn green for real estate

- Who’s next on the M&A conveyor belt?

Real estate research notes

A result analysis note on Urban Logistics REIT (SHED). The company reported resilient performance in a rising interest rate environment, with its focus on growing earnings to provide dividend cover.

An annual overview note on Lar España Real Estate (LRE SM). Impressive rental growth allowed the company to declare the largest dividend in its 10-year history.

An annual overview note on Grit Real Estate Income Group (GR1T). Its latest act of corporate engineering has opened the door for new NAV and earnings accretive developments.

An update note on Tritax EuroBox (EBOX). The company is sailing in calmer waters as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.