Vote against discontinuation

JLEN Environmental Assets (JLEN) and the wider renewable energy infrastructure sector have traded at a persistently wide discount to net asset value (NAV) with investor sentiment continuing to wane. This has triggered the activation of a discontinuation vote at JLEN’s annual general meeting (AGM) in September. We strongly believe shareholders should vote against discontinuation, taking into account the strong long-term track record of the company, which has produced NAV total returns of 119.5% since its launch just over 10 years ago to the end of June and delivered dividend growth every year.

The fundamental growth story for the sector remains as strong as ever, with investment in the energy sector continuing to swell – the majority of which is going to clean energy technology such as renewables, low carbon fuels, nuclear, grids and battery storage.

Progressive dividend from investment in environmental infrastructure assets

JLEN aims to provide its shareholders with a sustainable, progressive dividend, paid quarterly, and to preserve the capital value of its portfolio. It invests in a diversified portfolio of environmental infrastructure projects generating predictable wholly or partially index-linked cash flows. Investment in these assets is underpinned by a global commitment to support the transition to a low-carbon economy and mitigate the effects of climate change.

At a glance

Share price and discount

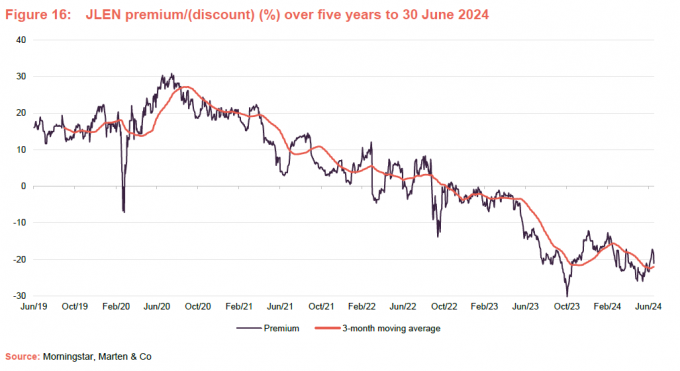

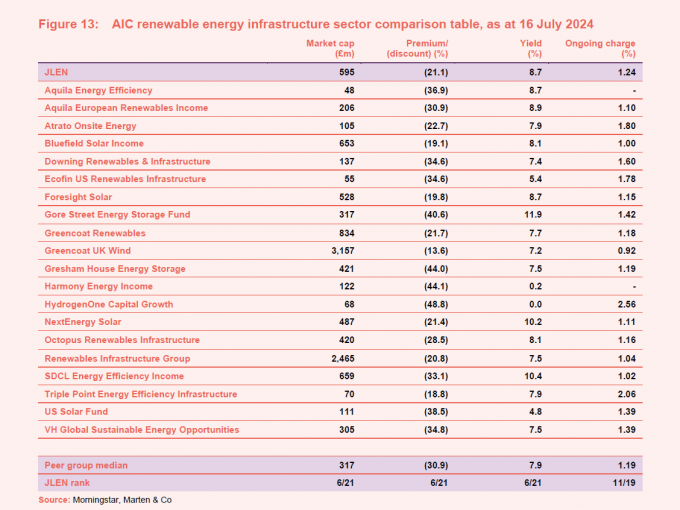

Investor sentiment towards alternative assets, including the renewable energy sector, has been dire since interest rates began to rise. This has contributed towards falls in the share prices of renewable energy trusts. Over the year to 30 June 2024, JLEN’s shares traded in range of a 11.5% and a 30.2% discount to NAV, and averaged a discount to NAV of 19.0%. At 16 July 2024, JLEN was trading on a discount to NAV of 21.1%.

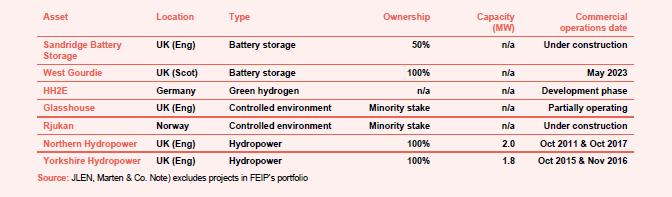

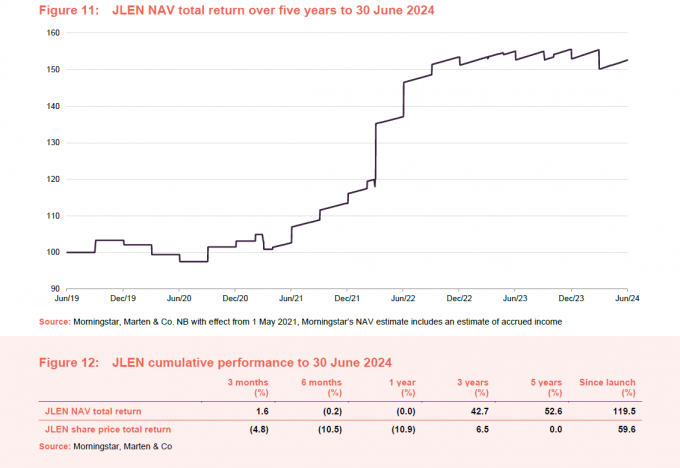

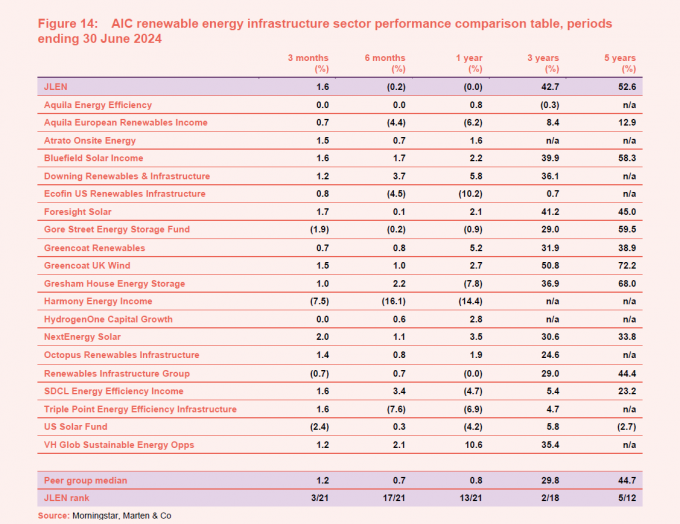

Performance over five years

JLEN has posted a NAV total return of 52.6% over five years and 119.5% since launch a little over 10 years ago. Share price total returns have been disappointing, but whilst it has de-rated substantially over the last year, its discount to NAV is still one of the narrowest in the sector, reflecting its strong NAV performance.

| Year ended | Share price total return (%) | NAV total return (%) | Earnings per share (pence) | Adjusted EPS (pence) | Dividend per share (pence) |

|---|---|---|---|---|---|

| 31/03/2020 | 6.3 | (0.7) | (2.1) | 6.5 | 6.66 |

| 31/03/2021 | 6.9 | 1.5 | 1.5 | 6.7 | 6.76 |

| 31/03/2022 | 7.3 | 34.1 | 30.6 | 7.0 | 6.80 |

| 31/03/2023 | 12.2 | 13.1 | 14.9 | 6.7 | 7.14 |

| 31/03/2024 | (15.8) | (1.8) | (2.1) | 7.5 | 7.57 |

Fund profile

Further information can be found at jlen.com

JLEN invests in infrastructure projects that use natural or waste resources or support more environmentally-friendly approaches to economic activity, support the transition to a low carbon economy, or mitigate the effects of climate change.

JLEN’s assets are broadly categorised as intermittent renewable energy generation, baseload (steady and predictable) renewable energy generation and non-energy-generating assets that have environmental benefits. Intermittent energy generation investments include wind, solar and hydropower. Baseload renewable energy generation investments include biomass technologies, anaerobic digestion (AD) and bioenergy generated from waste. Non-energy-generating projects include wastewater, waste processing, low carbon transport, battery storage, hydrogen and sustainable solutions for food production such as agri- and aquaculture projects.

JLEN aims to build a portfolio that is diversified both geographically and by type of asset. This emphasis on diversification reduces the dependency on a single market or set of climatic conditions and helps differentiate JLEN from the majority of its peers, which tend to specialise in solar or wind.

Reflecting its objective of delivering sustainable, progressive dividends and preserving its capital, JLEN does not invest in new or experimental technology. A substantial proportion of its revenues is derived from long-term government subsidies.

JLEN’s AIFM is Foresight Group LLP (Foresight). Foresight is one of the best-resourced investors in renewable infrastructure assets, with £12.1bn of assets under management as at 31 March 2024. This includes Foresight Solar Fund, which sits in JLEN’s listed peer group. Foresight has a highly experienced and well-resourced global infrastructure team with 175 infrastructure professionals managing around 4.7GW of energy infrastructure. It is a global business, with offices in eight countries. The co-lead managers to JLEN are Chris Tanner and Edward Mountney.

Annual results

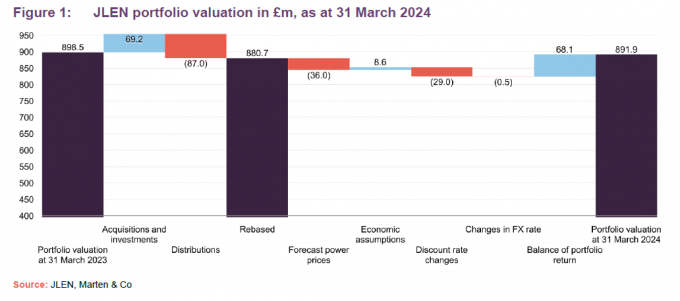

In annual results announced last month, JLEN reported a total NAV of £751.2m or 113.6p per share at 31 March 2024 – a 7.7% fall over the year. This equated to a NAV total return of -1.6% including dividends of 7.57p (which were 6% up on the prior year). JLEN’s NAV total return since initial public offering (IPO) is 115.9% (8.0% annualised).

Cash from projects at record high underpinning the dividend

Distributions received from projects were at a record high of £87.0m (2023: £83.6m) and underpinned the dividend with a coverage of 1.3 times. The value of the portfolio fell £6.6m over the period, as shown in Figure 1, due mainly to changes in power price and discount rate assumptions, offset by underlying growth in the portfolio.

Discontinuation vote

As with many of its renewable energy and infrastructure peers, JLEN’s shares have been trading at a wide discount to NAV since interest rates ballooned in 2022. With the discount having averaged more than 10% in the financial year, a discontinuation vote has been triggered, which will take place at the company’s AGM in September.

Somewhat counterintuitively, shareholders should vote against the resolution if they want the company to continue. We believe this is the course investors should take, given the strong long-term track record of the company (see page 16), including delivering dividend growth every year since its launch 10 years ago (see page 20 for the dividend section).

Change in name and cut in management fee proposed

A reduction in the investment management fee will come into effect from 1 October (see page 22 of this note for details), while the board has proposed to shareholders a change in name of the company to Foresight Environmental Infrastructure – to reflect the fact that it has been five years since Foresight acquired the management team of John Laing (which informs the current name). The board states that it has assessed the benefits available through a closer association with the investment manager – including the scale afforded by its broader marketing initiatives and strong market reputation – and believes that there are clear commercial benefits to renaming the company. Should shareholders approve the proposed change of name, the board is recommending the company’s ticker change to FGEN and its website address switch to FGEN.com.

Market backdrop

The timing and pace of the impending interest rate cutting cycle is unknown, but the general consensus seems to be that the first rate cut in the UK will come in August – despite inflation falling back to the Bank of England’s target 2% in May. The first downward move in the base rate will be an important moment for many sectors, not least renewable energy infrastructure, where the higher interest rate landscape has put a substantial downward pressure on NAVs and, even more so, investor sentiment.

A general acceptance that the eventual pace of cuts is likely to be slower than first thought, plus the impact of falling inflation on cash flows from energy-generating assets and continued geopolitical instability, has seen discounts across all infrastructure companies remain persistently wide.

Estimated $2.8trn invested in energy sector in 2023, the majority of which aimed at clean energy technology

However, the fundamental growth story for the renewable energy infrastructure sector and JLEN remains as strong as ever, with the green agenda an urgent priority of most global governments. The International Energy Agency (IEA) has estimated that investment in the energy sector amounted to $2.8trn in 2023, of which more than 60% was invested in clean energy technology such as renewables, low carbon fuels, nuclear, grids and battery storage.

There seems to be political support across the benches for boosting clean energy capabilities in the UK and in Europe (key markets for JLEN), despite the recent European Union elections. The new Labour government in the UK has pledged to ‘make Britain a clean energy superpower’ and has vowed to work with the private sector to double onshore wind, triple solar power, and quadruple offshore wind by 2030, while also investing in carbon capture and storage, hydrogen and marine energy to ensure the country has the long-term energy storage it needs. This is in contrast to the US, where a Trump administration seems likely to scrap the Inflation Reduction Act (IRA, which has worked well in incentivising investment in green technology).

JLEN’s diversified portfolio and the manager’s strong track record and expertise in the sector seems completely at odds with its current discount to NAV of 21.1%. JLEN’s board has set out its approach to capital allocation, which includes prudent management of debt and consideration of share buybacks if they are NAV accretive. We explore the factors impacting JLEN’s NAV in greater detail below, beginning with power prices.

Power prices

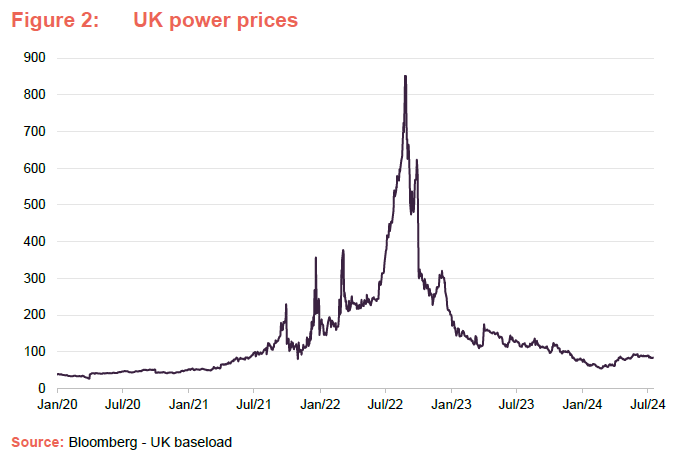

Despite having already fallen steeply from highs seen in 2022, electricity prices continued to fall further and faster than anticipated over the last year, as shown in Figure 2.

The overall change in forecasts for future electricity and gas prices compared to forecasts at 31 March 2023 negatively impacted JLEN’s NAV by £36.0m or 5.4p in the year to the end of March 2024.

Fixed prices secured on the majority of portfolio

JLEN looks to de-risk its exposure to volatile market prices and has fixed prices for the majority of its output. At 31 March 2024, the portfolio had price fixes secured over 61% for the Summer 2024 season and 58% for Winter 2024/25 season. Short-term market forward prices for the next two years are used to value the portfolio where contractual fixed price arrangements do not exist. After the initial two-year period, the project cash flows assume future electricity and gas prices in line with a blended curve informed by the central forecasts from three established market consultants.

Based on the portfolio at end March 2024, a 10% fall in power prices over the remaining life of JLEN’s assets would take off £37.4m or 5.7p from the NAV and a 10% increase would add £37.0m or 5.6p to the NAV. Even though the last months of the previous year had already seen electricity prices fall sharply from the highs seen during the energy crisis in 2022, electricity prices continued to fall further and faster than anticipated. In the year to March 2024, power prices reduced by a further £40/MWh – equivalent to approximately 40%.

JLEN’s manager states that in the extreme event that electricity prices fall to only £40/MWh, the company would maintain a resilient dividend cover for the next three financial years.

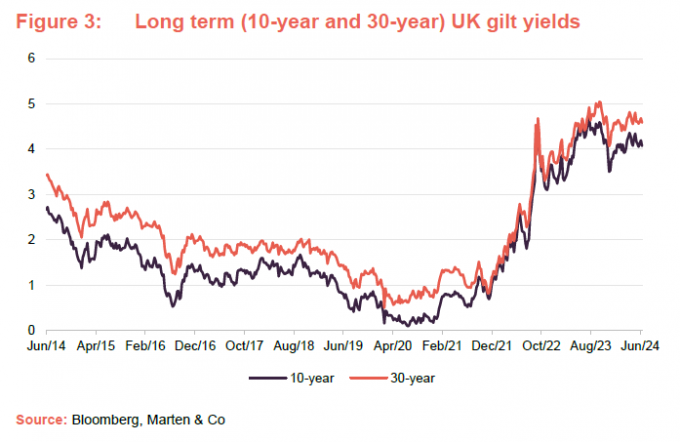

Discount rates

Gilt yields have remained at an elevated level for almost two years, as shown in Figure 3. Government borrowing costs rose sharply from the beginning of 2021 and accelerated in the fallout from the ‘mini budget’ of September 2022 and have remained elevated since.

The weighted average discount rate now sits at 9.4%

JLEN’s weighted average discount rate has remained unchanged over the six months to 31 March 2024 at 9.4%. This is 100 basis points (bps – equivalent of 1.0%) higher than a year prior due to an upward movement in the discount rate applied in June and September 2023, reflecting the sustained increase in UK gilt yields as well as continued investment into JLEN’s ongoing development and construction projects (which are valued using higher discount rates to reflect the development risk). However, the discount rate was reduced on some construction projects that achieved key milestones during the year.

The overall uplift in discount rate over the year took £29.0m off the NAV.

The discount rates that are used in the discounted cash flow calculations that inform the NAVs of many alternative assets funds, including those in the renewable energy sector, can be broken down into the risk-free rate – derived from the yield on a government bond with equivalent duration – plus a risk premium. The risk premium element of the discount rates calculation is influenced by various factors including the composition of the portfolio and investors’ risk appetite for these sectors and projects, based on recent comparable market transactions.

An independent verification exercise of the methodology and assumptions applied in JLEN’s NAV calculation is performed by a leading accountancy firm and an opinion provided to the directors on a semi-annual basis.

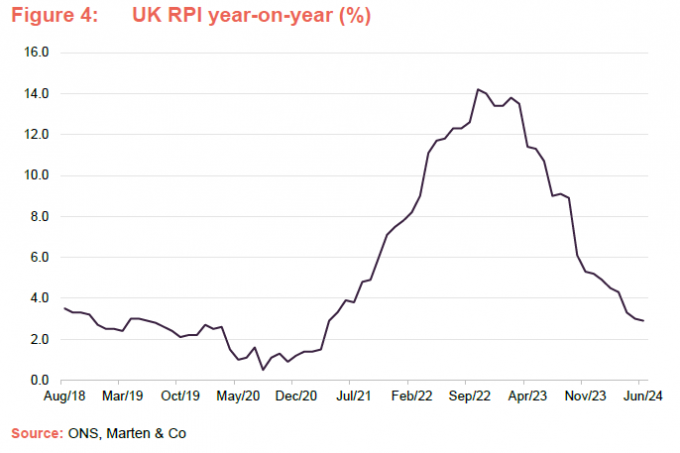

Inflation

Inflation assumptions upgraded slightly

62% of JLEN’s forecasted revenues are contractually linked to inflation (as measured by the RPI) through government-backed subsidies and long-term contracts. An uplift in inflation assumptions used to value JLEN’s portfolio (based on actual data and independent forecasts) to 3.5% RPI inflation for 2024 (from an assumption of 3.0% at 31 March 2023) – reverting to 3% until 2030, and then falling to 2.25% thereafter – resulted in an overall increase in value of £8.6m.

Figure 4 shows that RPI inflation fell to 2.9% in June 2024. JLEN’s sensitivity to changes in the inflation rate is about +£19.3m or 2.9p on the NAV for every 0.5% increase in the forecast inflation rate and a decrease of £18.9m or 2.9p on the NAV if rates were reduced by the same amount.

Useful economic lives

The assumption JLEN uses for the useful economic life of investments is the lower of lease duration and 35 years for solar assets, 30 years for wind farms and 20 years for anaerobic digestion (AD) facilities – being the life of the domestic renewable heat incentive (RHI) subsidy. JLEN applies a conservative valuation in regard to its AD assets, with the assumption that the facilities will simply cease to operate beyond the life of their RHI tariff. The manager says that it has seen a growing case of evidence, including several transactional datapoints, pointing towards a positive change in market sentiment for valuing these assets – including the potential to run anaerobic digestion facilities on an unsubsidised basis.

In light of this change, the manager has provided a sensitivity extending the useful economic lives of its AD portfolio by up to five years – capped at the duration of land rights already in place. Such an extension would result in an uplift in the portfolio valuation of £21.9m or 3.3p.

Taxation

As we discussed in more detail in previous notes (links to which can be found on page 25), the UK government introduced a temporary windfall tax on electricity generators – the Electricity Generator Levy (EGL) – in response to higher energy prices. JLEN’s wind, solar and biomass assets are affected by the levy, which saw the government take 45% of revenues above a price of £75/MWh from 2023 to April 2024, and thereafter adjusted each year in line with inflation (as measured by CPI) on a calendar-year basis until the levy comes to an end on 31 March 2028. JLEN paid £5.5m on the EGL tax in the financial year, with the annual liability for the 2025 financial year estimated to be lower, reflecting the drop in power price forecasts year-on-year.

Around 42% of JLEN’s assets at the end of September 2023 fell completely outside of the levy. The managers say that this is a strength of having a diversified portfolio that has a combination of assets that generate electricity (and fall in the scope of the levy), assets that generate gas (the anaerobic digestion plants), and assets that do not generate energy at all (batteries, CNG refuelling stations, and the controlled environment assets).

Investment process

Foresight selects projects for the portfolio based on its assessment of each project’s risk and reward profile that fit within its defined investment policy. The group operates within a limited set of investment restrictions. Assets are generally acquired in the secondary market acquired from third parties.

The manager aims to maintain the balanced and diverse nature of the portfolio. Its approach is a cautious one. Although JLEN can invest across all OECD countries, to date investments have predominantly focused on the UK, with a small but growing exposure to European renewables. The managers say that they prefer to concentrate on countries and regulatory/subsidy regimes that they know well or where they have relationships with established partners.

Investment restrictions

- No more than 25% of the portfolio is to be invested in assets under construction or that are not yet operational, and within that, up to 5% of the portfolio may be invested in development stage assets.

- At least 50% invested in the UK and the balance invested in other OECD countries.

- No new investment to exceed 30% of NAV (or 25% of NAV based on the acquisition price, taking the value of existing assets into consideration).

Purchases from third parties

Deals can be introduced by the wider Foresight team

The managers have built up good working relationships with project developers. Some opportunities are brought to the managers for appraisal by specialist consultancy firms operating in the area. Deals may also be introduced by the wider Foresight team.

Prices are negotiated at arm’s length and reflect the managers’ assessment of the potential risks and rewards from each project. This includes a review of the project’s capital structure.

Environmental, social and governance (ESG) assessment

Environmental criteria are embedded in the structure of JLEN’s investment and portfolio management activities.

Understanding of asset-level risks is driven in the first instance by pre-investment due diligence processes. This assessment is undertaken by the investment manager using their proprietary in-house tool, the Foresight Sustainability Evaluation Tool (SET).

The SET is applied in order to assess whether a potential investment scores appropriately against a broad range of ESG considerations. The SET is made up of five criteria that cover the key areas of sustainability and ESG considerations to be assessed:

- Sustainable development contribution. The contribution made towards the global sustainability agenda, including an assessment of its resilience to climate change-related risk and opportunity;

- Environmental footprint: The environmental impacts of an investment;

- Social welfare: The interaction with local communities and the welfare of employees;

- Governance: The compliance with relevant laws and regulations; and

- Third‑party interactions: The sustainability of key counterparties and the broader supply chain.

Ongoing management

The day-to-day facilities management, operations and maintenance of the projects is contracted to third parties

The day-to-day facilities management, operations and maintenance of JLEN’s projects are typically contracted to third parties, and part of the managers’ role is overseeing these arrangements, including approving payments.

The managers seek to identify opportunities for efficiency enhancements and capacity increases. The managers also aim to optimise the financial structures of the project special purpose vehicles (SPVs) that hold the assets.

Disposals

JLEN will usually hold its assets for the long term, but the company will sell assets when the managers feel the sale price justifies it or when there are other valid reasons for doing so.

Hedging

When they invest in assets in currencies other than sterling, the managers may choose to hedge the currency exposure back to sterling. The managers may also hedge interest rate risk, inflation risk, power, and commodity prices. All hedging is entirely at the board’s discretion.

Sustainability

There are obvious environmental benefits that derive from JLEN’s investment strategy, and the company is an Article 9 fund under the Sustainable Finance Disclosure Regulation (SFDR), which means that it has a sustainable investment objective.

In terms of measurable outcomes, over the year to the end of March 2024, the portfolio generated 1,358GWh of renewable energy (2023: 1,325GWh). It treated more than 40.2bn litres of wastewater (2023: 35.6bn litres) and its actions resulted in more than 680,825 tonnes of waste being diverted from landfill (2023: 684,181 tonnes), with 133,718 tonnes of waste recycled (2023: 129,114 tonnes).

Greenhouse gas (GHG) emissions avoided in the financial year 2024 was 212,917 tCO2e, while total emissions from the portfolio (scope 1, 2, and 3) was 142,738 tCO2e.

Foresight Group is a signatory of the United Nations’ Principles for Responsible Investment (UNPRI) and as we noted above ESG analysis is built into JLEN’s investment process. It is also incorporated into the ongoing monitoring programme for JLEN’s portfolio.

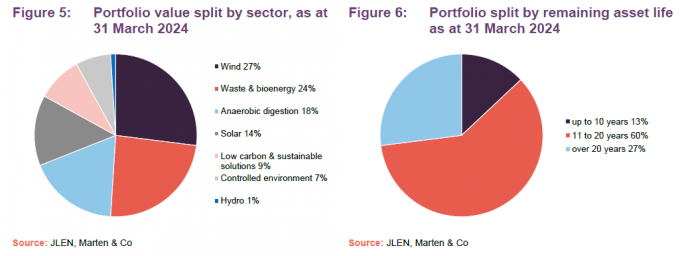

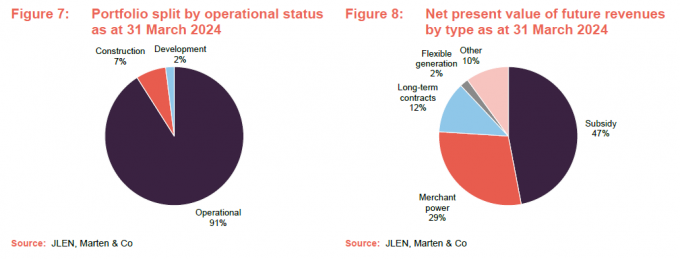

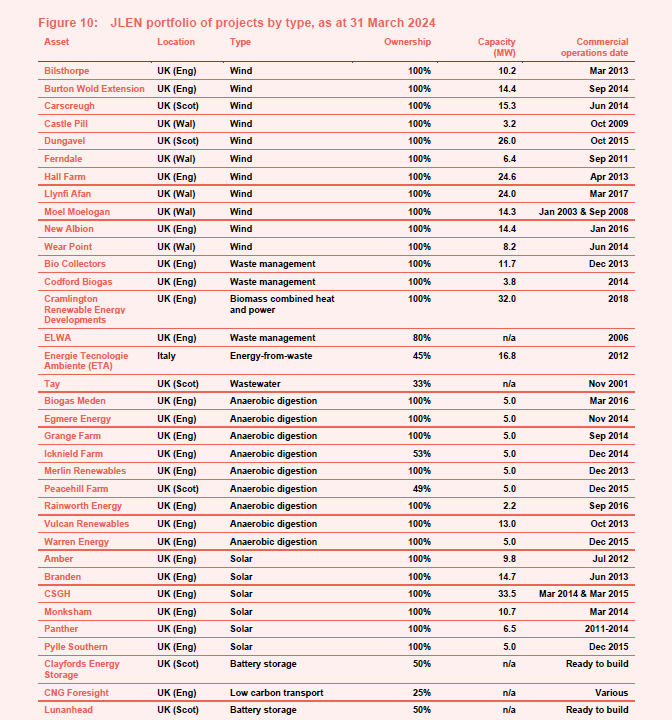

Asset allocation

Figure 5 displays JLEN’s portfolio by project type, as at 31 March 2024. In aggregate, at that date there were 42 projects spread across the wind, AD, solar, waste & bioenergy, hydro, controlled environment, and low carbon & sustainable solutions technologies. As at 31 March 2024, the weighted average remaining asset life of the portfolio was 16.3 years, although the manager feels it is being conservative in this area.

The majority of its portfolio (90%) is located in the UK, with the 10% outside the UK accounted for by JLEN’s Italian, German and Norwegian investments.

At 9%, JLEN’s construction exposure is not excessive. These projects offer the potential for NAV uplifts as the projects become operational and the discount rate applied to them can be reduced as they become de-risked.

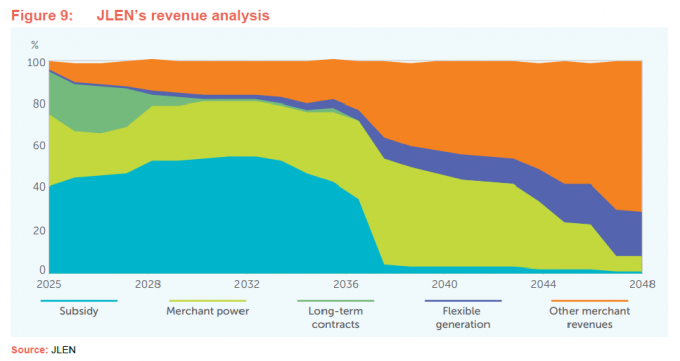

Whilst subsidies make up almost half of JLEN’s future revenues, they are time-limited. The chart in Figure 9 is taken from JLEN’s annual report and shows how the make-up of its future revenues between 2025 and 2048 changes over the life of the projects in its portfolio.

The top 10 largest assets make up 46.0% of the total portfolio value, down from 49.9% at 31 March 2023. Further investment into the portfolio and the ongoing buildout of construction-stage investments will further diversify the portfolio, the manager says. Figure 10 details the assets in JLEN’s portfolio, as at 31 March 2024.

The manager describes the overall operating performance of the portfolio during the year to the end of March 2024 as satisfactory. The renewables segment of the portfolio produced 1,358GWh (2023: 1,325GWh) of green energy, 4.1% below budget, primarily due to very low wind speeds experienced over the year and unplanned downtime at some of the assets. The AD portfolio, the largest part of the portfolio by generation, performed 1.2% above budget, the low carbon and sustainable solutions portfolio performed in line with its target, with West Gourdie (the battery energy storage asset) now contributing to distributions since coming online this year. The hydro, controlled environment and waste and bioenergy concession-based projects also performed in line with targets.

Capital allocation

Although a healthy pipeline of potential investments exists, including in the area of controlled environments and green hydrogen, the challenging market environment means that the company is prioritising existing commitments to construction-stage assets and opportunities in its current portfolio.

Targeting sales over the near-term

The manager says that it has initiated a targeted asset sales process. Potential additions to the portfolio will be weighed up against the benefits of paying down debt and possible share buybacks to enhance NAV. As a result, the manager expects new investment activity in the upcoming year to be limited.

The manager made a couple of investments during the year to the end of March 2024, which were related commitments at the start of the year.

Green hydrogen

As detailed in our last note on JLEN, Backing the green hydrogen revolution, one of the key investment focuses for the manager over the short-to-medium term is in green hydrogen following investment in a development platform with interests in German hydrogen opportunities in Lubmin and Thierbach. Both investments were made through its partnership with HH2E, a specialist in developing green hydrogen projects to decarbonise industry. Through the HH2E partnership, JLEN has the opportunity to invest in the buildout of green hydrogen production facilities in Germany.

Both investments were made through its partnership with HH2E, a specialist in developing green hydrogen projects to decarbonise industry. Through the HH2E partnership, JLEN has the opportunity to invest in the buildout of green hydrogen production facilities in Germany. JLEN owns a 33% equity stake in Foresight Hydrogen Holdco GmbH, which in turn holds a 7.6% stake in HH2E, and has priority funding rights over future projects.

The managers believe that green hydrogen has an important role to play in decarbonising many carbon-intensive sectors of the economy including heavy transport (HGVs and ships) and industry. Strong regulatory tailwinds exist, the managers add, that promote the rise of green hydrogen and therefore significant investment opportunities.

Bio Collectors

In December 2023, JLEN acquired the remaining 30% shareholding that it did not already own in Bio Collectors Holdings, which operates an AD plant and waste collections business.

JLEN initially acquired a 70% interest in Bio Collectors in December 2019, at which time, a mechanism was agreed for the acquisition of the remaining 30% following the expiry of an initial holding period. The manager expects the investment to deliver attractive returns and says that the deal allows it to have direct operational control, creating the potential for JLEN to deliver operational synergies across its portfolio of food waste AD plants.

Possible sale of the CNG portfolio

Stake in CNG portfolio may be acquired by joint venture partner

The majority owner of the CNG portfolio, ReFuels N.V., announced in April 2024 that it was in discussions with Foresight Group over the possible acquisition of the remaining part of the CNG station portfolio that it does not control. It said that it was exploring the possibility of raising £150m through a combination of equity and debt issuance to fund the transaction.

JLEN holds an interest in the CNG portfolio (representing 3% of the company’s portfolio), which comprises 12 of ReFuels’s 13 stations in operation and two stations in construction across the UK.

JLEN’s manager says that any transaction remains subject to the agreement of terms acceptable to Foresight and JLEN and there is no certainty that the ReFuels fundraising or the sale of the CNG portfolio will proceed.

Performance

JLEN’s NAV returns over the past 12 months to the end of June 2024 was flat. We explore the reasons for this over the next few pages. The share price has dropped almost 11% over the year, resulting in the discount widening, as discussed on page 21.

Operations – for the year ended 30 June 24

Anaerobic digestion

The AD portfolio was the largest producer of energy on a GWh (gigawatt hours) basis and generated 37% of the energy produced by the JLEN portfolio during the year. Gas generated 496GWh, 3.6% ahead of target, with eight of the nine plants outperforming or reaching their generation targets. The manager notes that the 2023 UK maize harvest (used as a feedstock for AD plants) produced good crop yields, leaving the portfolio in a stable position for the year ahead.

Wind

The wind portfolio generated 390GWh (2023: 383GWh), representing 29% of the total energy generated by the portfolio. This was 8% below target, primarily as a result of low wind speed. The average power price realised for the wind assets was 49% above the average variable price through the year due to the high level of fixes in place across the portfolio. More than 70% of the wind generational capacity is now hedged until March 2025.

Solar

Solar generation was also below budget, generating 73GWh (2023: 76GWh) – 3% below target. This represented 5.4% of the total energy generated by the wider portfolio. Generation from most sites was at or above the target during the year; however, the Amber and Branden sites experienced some lost generation due to distribution network operator works and technical issues at the inverters.

Waste and bioenergy

The renewable energy-generating segment of the waste and bioenergy portfolio is the second-largest producer of energy on a GWh basis and generated 29% of the energy produced by the wider portfolio. The waste and bioenergy portfolio generated 394GWh (2023: 334GWh), representing a 9% uplift over the prior year, though this was 8% below the sector target.

Battery storage

JLEN’s recently constructed 50MW battery asset, West Gourdie, located in Dundee, Scotland, went into the operational phase in May 2023. The asset has been participating in various services such as Dynamic Containment (DC), Moderation (DM), Regulation (DR), day-ahead (DA), intraday, and capacity market. The open balancing platform launched by the National Grid in December 2023 allowed the site to start earning revenues in the balancing mechanism market. Batteries continue to make up a small part of the portfolio and represent less than 4% of the total asset valuation at 31 March 2024.

Hydro

The hydropower portfolio generated 5GWh, which was 10% below target (2023: 4GWh). This is a very small part of JLEN’s portfolio and represents less than 1% of the total energy generation for the year. Though rainfall levels were in line with expectation, mechanical issues at two of the sites brought overall generation below the target for the year.

Peer group

You can access up-to-date information on JLEN and its peers on the QuotedData website.

JLEN has one of the broadest remits of the 21 companies that comprise the members of the AIC’s renewable energy sector. Most of these funds are focused on solar or wind or some combination of the two. Three of these funds are focused solely on energy storage.

There is variation of geographic exposure within the peer group too, with a number of funds that are heavily exposed to the North American market (which has a different risk/reward structure).

JLEN is one of the larger funds within this peer group, and whilst it has de-rated substantially over the last year, its discount to NAV is still one of the narrowest in the sector. We think that this may reflect its good track record – ranking highly in terms of its NAV total returns over longer periods – and the comfort that investors may derive from the diversification of its portfolio and high level of inflation linked income.

Wide discounts have distorted dividend yields across the sector. Nevertheless, JLEN’s dividend yield is attractive. Its ongoing charges ratio ranks middle of the pack, but is expected to fall if the proposed reduction in the management fee is implemented (see page 22 for details on the new management fee proposal).

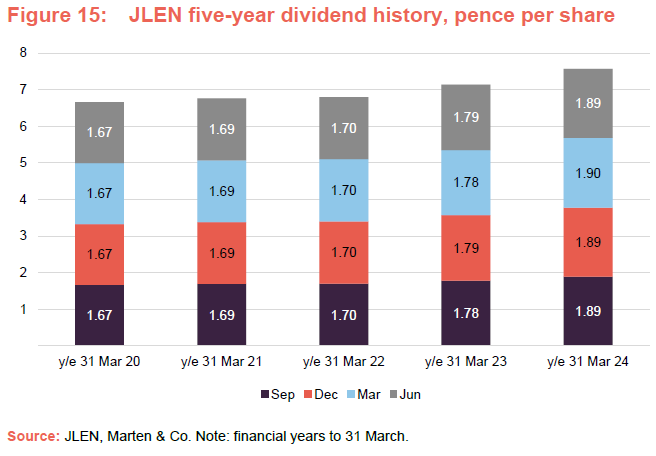

Dividend

JLEN has a progressive dividend policy. For the accounting year ended 31 March 2024, the company declared a dividend of 7.57p (up 6.0% from 7.14p in 2023), which was 1.3x covered by net cash flows from the portfolio. The board said that it was targeting a total dividend of 7.80p for the 2025 financial year, representing a 3.0% increase.

Capital structure

JLEN has 661,531,229 ordinary shares in issue and no other classes of share capital. There are no shares held in treasury.

JLEN has an indefinite life, but a discontinuation vote may be triggered if its shares trade at a discount in excess of 10% for a prolonged period (which was the case in the financial year 2024). The company’s financial year end is 31 March and AGMs are typically held in August or September.

Gearing

In June 2024, JLEN announced the refinancing of its multi-currency revolving credit facility (RCF), increasing the facility to £200m (from £170m) and maintaining a £30m uncommitted accordion facility. The facility is provided by National Australia Bank, Royal Bank of Scotland International, ING, HSBC, and Clydesdale Bank.

The RCF matures in June 2027, with an uncommitted option to extend for a further year. The loan bears interest of SONIA (for sterling drawdowns) and EURIBOR (for euro drawdowns) +210bps (2.1%). The RCF qualifies as a Sustainability Linked Loan, with interest rates linked to meeting certain agreed sustainability goals. JLEN’s interest rate will rise or fall 5bps (0.05%) based on performance against these ESG targets:

- Environmental: increase coverage of independent biodiversity assessments and implement initiatives to enhance biodiversity net gain across the portfolio;

- Social: increased volume of contributions to local communities; and

- Governance: maintaining a low number of work-related accidents, as defined under the Reporting of Injuries, Diseases and Dangerous Occurrences (RIDDORS) by the Health and Safety Executive.

As at 31 March 2024, drawings under the RCF were £159.3m.

At the project level, JLEN is constrained to a maximum of 65% gearing on gross project value for renewable energy generation projects and a maximum of 85% gearing on gross project value for PFI/PPP type projects. In practice, actual project gearing is much lower than this.

JLEN is permitted to borrow up to 30% of its NAV for short-term debt financing, such as the RCF.

Major shareholders

JLEN’s largest shareholders at 31 March 2024 were Gravis Capital Management (7.15%), Evelyn Partners (5.93%), and Hargreaves Lansdown (5.48%).

Lead managers

Chris Tanner

Chris has been the co-lead investment manager to JLEN since IPO. He joined Foresight in 2019 as a partner and currently works in the London office. He has over 20 years’ of industry experience. Chris is a member of the Institute of Chartered Accountants in England and Wales and has an MA in Politics, Philosophy and Economics from Oxford University. Chris also serves as chair of the Finance Forum for The Association of Renewable Energy and Clean Technology (REA).

Edward Mountney

Edward has been involved with JLEN since 2016, joining the management team in 2022. Prior to that, he was head of valuations for Foresight Group and, before that, for John Laing Capital Management. He has over 14 years’ experience in infrastructure and renewables, is a member of the Institute of Chartered Accountants in England and Wales and holds a BA (Hons) in Business and Management from Oxford Brookes University.

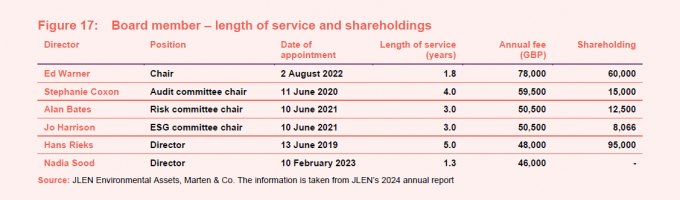

Board

JLEN’s board is currently composed of six directors, although the longest-serving director, Hans Rieks, is not seeking re-election at this year’s AGM. All of the directors are non-executive and considered to be independent of the investment manager.

Ed Warner

Ed gained extensive financial services experience from senior positions held at several investment banks and financial institutions, including IFX Group, Old Mutual, NatWest Markets and Dresdner Kleinwort Benson. He also has considerable investment trust experience, having been chair of both Standard Life Private Equity Trust Plc and BlackRock Energy and Resources Income Trust Plc. He is currently chair of HarbourVest Global Private Equity. Ed has also previously served as chair of Air Partner Plc and non-executive director and interim chair of Clarkson Plc.

Stephanie Coxon

Stephanie is a fellow of the Institute of Chartered Accountants in England and Wales and is currently a non-executive director of several London listed companies. Prior to her non-executive director career, she led the investment trust capital markets team at PwC for the UK and Channel Islands. During her time at PwC, Stephanie specialised in advising FTSE 250 and premium London listed companies on accounting, corporate governance, risk management and strategic matters.

Alan Bates

Alan is a Chartered Engineer, fellow of the Institute of Mechanical Engineers and a member of the Institute of Engineering Technology. He has over 32 years’ experience in the energy and infrastructure sectors, including electricity, gas and water utilities, and has assisted the government of Guernsey in developing its energy policy. Alan has been the chief executive of Guernsey Electricity and is currently a director of the Channel Islands Electricity Grid and Alderney Electricity Limited. He spent almost two decades in the oil and gas industry working for Mobil Oil/BP Oil and then International Energy Group before becoming managing director of Manx Gas in the Isle of Man.

Jo Harrison

Jo is a chartered member of the Institute of Water and Environmental Managers and is a Chartered Environmentalist. She has over 24 years’ experience working in the water industry and is the director of environment, planning and innovation at United Utilities, where she is accountable for leading the approach to environmental and long-term planning. Jo has worked for United Utilities since 1998 and has a BSc in Geography and Ecology from the University of Sheffield and an MSc in Pollution and Environmental Control from Manchester University. She is a trustee of the Rivers Trust and was previously a trustee of the Community Forest Trust.

Hans Rieks

Hans has over 27 years’ experience within the global wind industry and has previously worked for Siemens Gamesa and Vestas Central Europe. He formerly led the Siemens wind business in EMEA, crafting and implementing a growth strategy, as well as being directly involved in the merger with Gamesa. Prior to this, he was president and chief executive of Vestas Central Europe and a member of the group management of Vestas Wind Systems A/S.

Nadia Sood

Nadia has extensive experience of executing and managing complex infrastructure investments ranging in size across multiple international markets. She has held a senior role within a joint venture with Tata Power, has been a director at Nestlé and is a member of the governing council of the IFC/World Bank SME Finance Forum. She is currently the chief executive of CreditEnable, a global credit insights and technology solutions company. Nadia holds a BSc in Foreign Service from The Edmund A. Walsh School of Foreign Service at Georgetown University in Washington DC, and a Masters in International Affairs from Columbia University, New York. She is fluent in English, French and Norwegian.

Previous publications

You can read our previous notes on JLEN by clicking on them in Figure 18 below or by visiting our website.

| Title | Note type | Date |

|---|---|---|

| Diverse renewables exposure | Initiation | 6 September 2017 |

| Anaerobic diversification | Update | 6 March 2018 |

| Diversification benefits shine through | Annual overview | 12 September 2018 |

| Life extensions to boost NAV? | Update | 15 March 2019 |

| Battery storage potential | Annual overview | 9 September 2019 |

| Reliable source of income | Update | 14 May 2020 |

| Increasingly diversified as green-led recovery looms | Annual overview | 16 February 2021 |

| On the front foot | Update | 4 August 2021 |

| It’s all about renewables | Annual overview | 29 March 2022 |

| Further portfolio diversification | Update | 29 September 2022 |

| Laying the foundations for NAV growth | Annual overview | 31 March 2023 |

| Backing the green hydrogen revolution | Update | 28 November 2023 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JLEN Environmental Assets Group Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.