JLEN Environmental Assets

Investment companies | Update | 28 November 2023

Backing the green hydrogen revolution

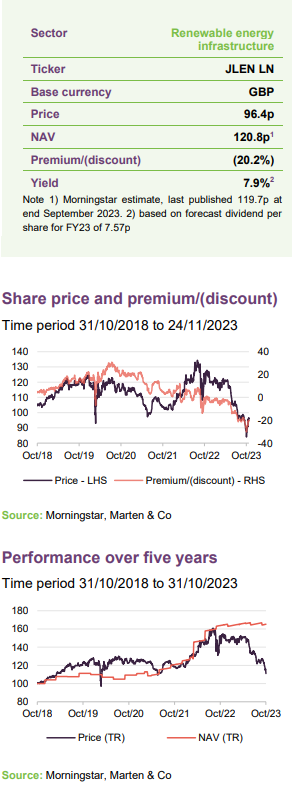

JLEN Environmental Assets (JLEN) and the wider renewable energy sector have seen discounts widen as investor sentiment has appeared to waver in the face of higher interest rates.

Undeterred, JLEN’s managers are focusing their efforts on laying what they hope to be the foundations for future NAV growth, with investments in green hydrogen, for example. This is a sector that is slated to grow 500 times by 2050, requiring $5trn of infrastructure investment. JLEN has around 10% of its portfolio in assets under construction or development, including two green hydrogen projects in Germany. As they reach maturity, such projects can act as a catalyst for capital growth, the managers say. Priority funding rights on further green hydrogen schemes could be valuable.

Progressive dividend from investment in environmental infrastructure assets

JLEN aims to provide its shareholders with a sustainable, progressive dividend, paid quarterly, and to preserve the capital value of its portfolio. It invests in a diversified portfolio of environmental infrastructure projects generating predictable, wholly or partially index-linked cash flows. Investment in these assets is underpinned by a global commitment to support the transition to a low carbon economy and mitigate the effects of climate change.

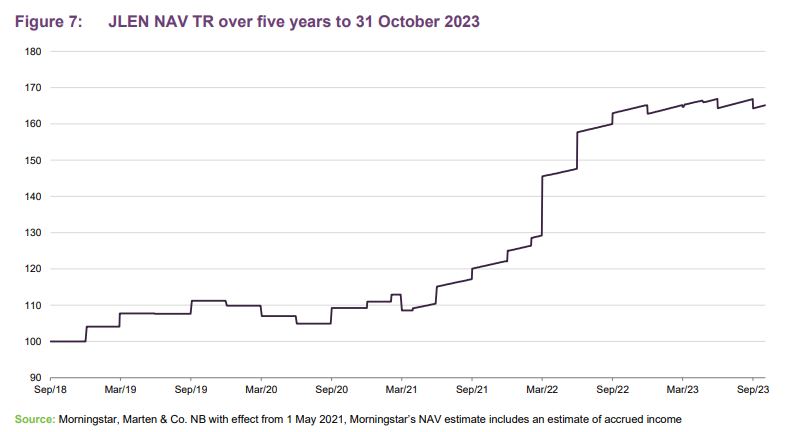

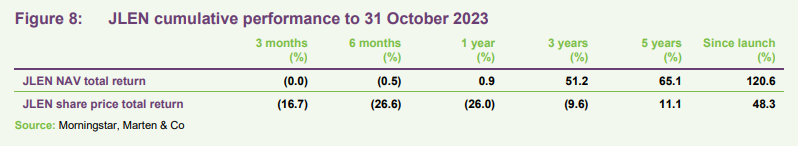

Half-year results

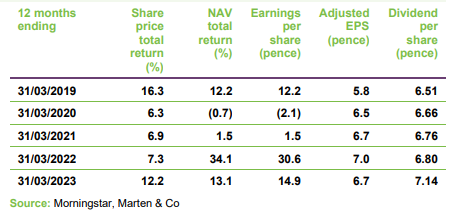

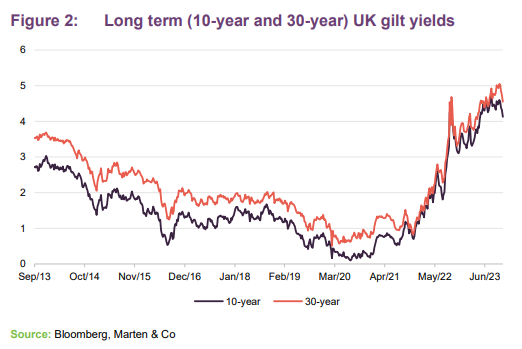

JLEN has this week announced results for the six-month period ended 30 September 2023. NAV was £792.1m or 119.7p per share – a 3.4p decrease since March 2023. Dividends declared for the half-year was 3.78p, up from 3.57p for the prior year period, in line with the target dividend for the current financial year of 7.57p (a 6% uplift). NAV total return for the period was positive, while NAV total return since IPO is 120.6% (8.8% annualised). Distributions received from projects was at a record high and underpinned the dividend with a coverage of 1.32 times. The value of the portfolio was flat over the period, as shown in Figure 1.

Market backdrop

Since we published our last note on JLEN six months ago, share prices amongst alternative investment trusts – including the renewable energy infrastructure sector – have plummeted. Higher interest rates appear to have increased concerns around the availability and cost of financing, and investors seemed concerned about downward pressure on NAVs.

JLEN’s board has set out its approach to capital allocation, which includes consideration of share buybacks where prudent to do so. It will consider whether a buyback programme presents a good investment opportunity as well as being NAV accretive. We explore the factors impacting NAV in detail below, beginning with discount rates.

Discount rates

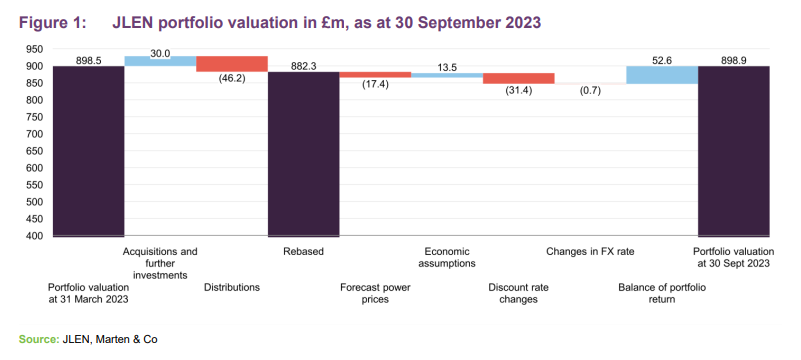

Gilt yields have remained at an elevated level for more than a year, as shown in Figure 2. UK Government borrowing costs rose sharply from the beginning of 2021 and accelerated in the fallout from the ‘mini budget’ of September 2022.

The discount rates that are used in the discounted cash flow calculations that inform the NAVs of many alternative assets funds, including those in the renewable energy sector, can be broken down into the risk-free rate – derived from the yield on a government bond with equivalent duration – plus a risk premium.

At 30 September 2023, JLEN’s weighted average discount rate increased 1.0% (a 75bps average uplift as a result of higher risk free rates, and the rest as a result of higher-returning construction commitments) to 9.4% from 8.4% at the end of March 2023 and that was factored into the NAV. The decision took £31.4m or about 3.9% off the NAV.

The risk premium element of the discount rates calculation is influenced by various factors including the composition of the portfolio and investors’ risk appetite for these sectors and projects, based on recent comparable market transactions. With the risk-free rate increasing between March and September 2023 (by almost 100bps on UK 10-year gilts and UK 30-year gilts), the 100bps uplift in JLEN’s discount rate suggests that the risk premium attached to its portfolio has been flat. This perhaps indicates that investors’ risk appetite for the sector has endured as they have become more familiar with these assets and prices that assets change hands at in the secondary market have remained stable.

An independent verification exercise of the methodology and assumptions applied in JLEN’s NAV calculation is performed by a leading accountancy firm and an opinion provided to the directors on a semi-annual basis.

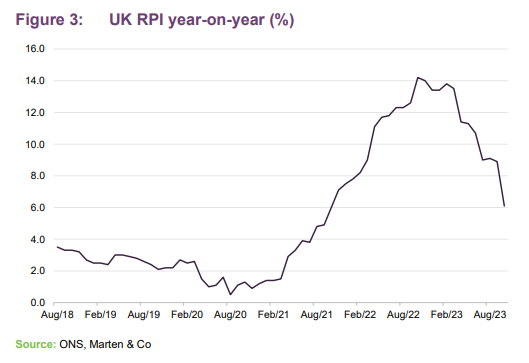

Inflation

Around 57% of JLEN’s forecasted revenues are linked to inflation (as measured by the RPI) through government-backed subsidies and long-term contracts.

At the end of September 2023, JLEN was assuming 6.7% RPI inflation for 2023 as a whole, 3.5% for 2024, reverting to 3% until 2030, and then falling to 2.25% thereafter. Actual inflation data for the six months to the end of September 2023 was in excess of valuation assumptions and added £13.5m or to JLEN’s NAV over the period.

Figure 3 shows that RPI inflation has slowed since March 2023, and was 6.1% at the end of September. On its own figures, JLEN’s sensitivity to changes in the inflation rate is about +£18.3m or 2.8p on the NAV for every 0.5% increase in the forecast inflation rate and a decrease of £19.5m or 2.9p on the NAV if rates were reduced by the same amount. Were near-term inflation is higher than JLEN’s valuation assumption by 2% for the next two years, NAV would be expected to increase by £18.0m or 2.7p.

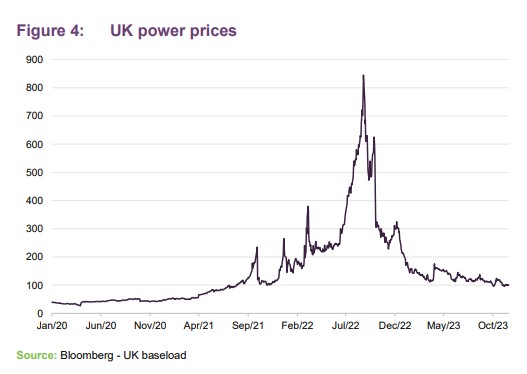

Power prices

UK power prices have fallen from the extreme peak of summer 2022, as have gas prices, but are still above pre-COVID levels.

JLEN looks to de-risk its exposure to volatile market prices and has fixed prices for the majority of its output. At 30 September 2023, the portfolio had price fixes secured over 68% for the Winter 2023/24 and 50% for Summer 2024 seasons. Short-term market forward prices for the next two years are used to value the portfolio where contractual fixed price arrangements do not exist. After the initial two-year period, the project cash flows assume future electricity and gas prices in line with a blended curve informed by the central forecasts from three established market consultants. The overall change in forecasts for future electricity and gas prices compared to forecasts at 31 March 2023 has negatively impacted NAV by £17.4m or 2.6p.

Based on the portfolio at end September 2023, the directors estimate that a 10% fall in power prices over the remaining life of JLEN’s assets would take off £38.7m or 5.9p from the NAV and a 10% increase would add £38.5m or 5.8p to the NAV.

Taxation

As we discussed in more detail in our previous note, the UK government introduced a temporary windfall tax on electricity generators – the Electricity Generator Levy (EGL) – in response to higher energy prices. JLEN’s wind, solar and biomass assets are affected by the levy, which sees the government take 45% of revenues above a price of £75/MWh from 2023 to April 2024, and thereafter adjusted each year in line with inflation (as measured by CPI) on a calendar-year basis until the levy comes to an end on 31 March 2028. JLEN paid the first instalment of the EGL tax of £5.2m over the first six months of the financial year, with the annual liability estimated to be £7.4m.

Around 42% of JLEN’s assets at the end of September 2023 fell completely outside of the levy. The managers say that this is a strength of having a diversified portfolio that has a combination of assets that generate electricity (and fall in the scope of the levy), assets that generate gas (the anaerobic digestion plants), and assets that do not generate energy at all (batteries, CNG refuelling stations, and the controlled environment assets).

Useful economic lives

JLEN’s managers say that it applies a conservative valuation in regard to its anaerobic digestion (AD) assets, with the assumption that the facilities will simply cease to operate beyond the life of their RHI tariff. The managers say that it has seen a growing case of evidence, including several transactional datapoints, pointing towards a positive change in market sentiment for valuing these assets – including the potential to run anaerobic digestion facilities on an unsubsidised basis.

In light of this change, the manager has provided a sensitivity extending the useful economic lives of its AD portfolio by up to five years – capped at the duration of land rights already in place. The manager says that such an extension would result in an uplift in the portfolio valuation of £22.8m or 3.5p.

Energy market reform

The UK government’s review of electricity market arrangements (REMA), which we discussed in our note published in September 2022 (a link to which can be found on page 15), is progressing and uncertainty still exists over the eventual outcome, the managers say. It is a wide-ranging assessment intended to deliver an appropriate framework for all non-retail electricity markets to deliver security of supply, cost effectiveness, and decarbonisation. The review was launched in July 2022 and an initial consultation period saw some of the more radical options for reforming the wholesale electricity market – such as a system of local imbalance pricing – scrapped. A number of options were taken forward for further assessment and a second consultation is expected this year.

The JLEN team recognises that there could be an effect on the basis on which its UK electricity-generating assets and battery storage assets receive their revenues and believes a realistic timeline for adoption will mean the current system remaining in place until the late 2020s. However, it feels that JLEN’s diversified portfolio could put it in a strong position relative to its peers.

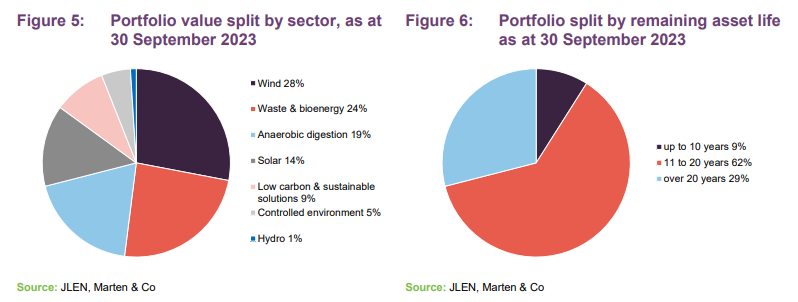

Asset allocation

Figure 5 displays JLEN’s portfolio by project type, as at 30 September 2023. In aggregate, at that date there were 42 projects spread across the wind, AD, solar, waste & wastewater, hydro, and low carbon & sustainable solutions technologies. As at 30 September 2023, the weighted average remaining asset life of the portfolio was 16.8 years, although the manager feels it is being conservative in this area, as mentioned earlier with the AD portfolio.

Although a pipeline of potential investments exists, including in the area of controlled environments and green hydrogen, the challenging market environment means that the company is prioritising using available cash to meet existing capital commitments and to minimise drawdowns from its revolving credit facility (RCF).

New investments – green hydrogen a key focus

One of the key investment focuses for JLEN over the short-to-medium term is in green hydrogen. The company’s only new investment since our last note published six months ago was the commitment of up to €9.2m into a green hydrogen development opportunity in Lubmin, Germany, announced in July. It is the second such project the company has invested in following its deal to invest in the Thierbach project near Borna, Germany, announced in January 2023.

The managers believe that green hydrogen has an important role to play in decarbonising many carbon-intensive sectors of the economy including heavy transport (HGVs and ships) and industry. Strong regulatory tailwinds exist, the managers add, that promote the rise of green hydrogen and therefore significant investment opportunities. The International Energy Agency predicts that the global low-carbon, green hydrogen market will grow exponentially (by 500 times) by 2050, which could equate to a $5trn investment requirement in hydrogen infrastructure to achieve net zero targets, according to Goldman Sachs.

Green hydrogen, which is produced from the electrolysis of water using renewable energy, generates no greenhouse gases – unlike grey hydrogen (which is extensively used in the existing hydrogen market – estimated to be worth $175bn annually – but emits 830m tonnes of greenhouse gases a year) and blue hydrogen. The diversion of excess production of renewable energy at times of peak supply (when intraday power prices are exceptionally cheap) into hydrogen generation also offers another form of energy storage that can be held indefinitely (unlike traditional battery storage) and used to fuel peaking power plants.

Regulatory tailwinds

Globally, governments seem to have accepted the need to accelerate the transition to green hydrogen and are providing significant support to this. In the US, the Inflation Reduction Act contained $9.5bn of funding for hydrogen to subsidise production tax credits of up to $3 per kilogram. In Europe, the EU strategy on hydrogen was adopted in 2020 and in 2022 the EU published its REPowerEU plan, which aims to produce 10m tonnes and import 10m tonnes of renewable hydrogen in the EU by 2030. The bloc has allocated €27bn to deploy on key hydrogen infrastructure and €3bn to invest from the EU Hydrogen Bank.

In Germany, where JLEN is currently focusing its green hydrogen investments, the coalition government is seeking to expand its reliance on green hydrogen to cut greenhouse gas (GHG) emissions for highly polluting industrial sectors. It is proposing new legislation that would change the accounting factor for green hydrogen to a triple crediting against GHG quotas in the fuel sector (instead of the current double counting). This could significantly enhance demand for green hydrogen in the transport sector. The proposal has been passed to the Federal Parliament for approval and could come into force as early as January 2024.

The German government is also considering the implementation of a green gas quota that would eventually see 100% of gas consumed in the country be green gas (green hydrogen and biomethane) by 2045. This would be implemented in stages, with initially 1% of gas being green in 2025, 7% in 2030, and 85% in 2040. Germany consumes 1,000TWh of natural gas per year, presenting an enormous opportunity for the scaling up of green hydrogen, the managers say. 1% of green hydrogen in the gas mix (10TWh) corresponds to 300,000 tonnes of green hydrogen. The legislation could become national law by mid-2024.

JLEN’s green hydrogen development projects

Through its partnership with HH2E, a specialist in developing green hydrogen projects to decarbonise industry (which we detailed in our previous note), JLEN has the opportunity to invest in the buildout of green hydrogen production facilities in Germany. JLEN owns a 33% equity stake in Foresight Hydrogen Holdco GmbH, which in turn holds a 7.6% stake in HH2E, and has priority funding rights over future projects.

The company has so far made two investments into HH2E development projects. The first, announced in January 2023, was a €5.7m initial investment in the Thierbach green hydrogen project near Borna, Germany, to bring it to a construction-ready stage. The second, announced in July 2023, was an investment in a green hydrogen production site in Lubmin, Germany, for up to €9.2m. The investment will be utilised for detailed engineering designs and the procurement of long lead items. Construction of the plant will commence following a final investment decision, which is expected shortly. JLEN now has around 10% of its portfolio in assets under construction or development. As these projects reach maturity, they can act as an engine for substantial capital growth, the managers say.

The design of HH2E’s plants uses alkaline electrolysis powered by green energy (based on the procurement of green energy supplied through the national grid rather than a direct supply). The plant incorporates battery storage, allowing it to deliver constant hydrogen production with a variable power supply – meaning that it can target buying power at intraday low prices.

The Thierbach plant will initially have a 100MW electrolyser capable of producing around 6,000 tonnes (200GWh) of green hydrogen per year. The plant is designed to be scalable to 1GW by 2030. The plant in Lubmin will also be capable of producing over 6,000 tonnes (200GWh) of green hydrogen per year during the first 100MW phase. Subsequent expansion phases are expected to increase capacity to over 1GW, with annual production exceeding 60,000 tonnes of green hydrogen.

The JLEN team says that both projects are very similar to a traditional infrastructure investment – a collection of long-term contracts covering both input costs and offtake agreements, most likely on a take or pay arrangement. It adds that they offer attractive return profiles compared to the portfolio average, including the prospect of NAV uplifts as the projects progress through to operation. Additionally, it adds that the discount rates on these projects should fall as investors become more familiar with them. The capital required for future funding obligations is likely to be met by asset sales.

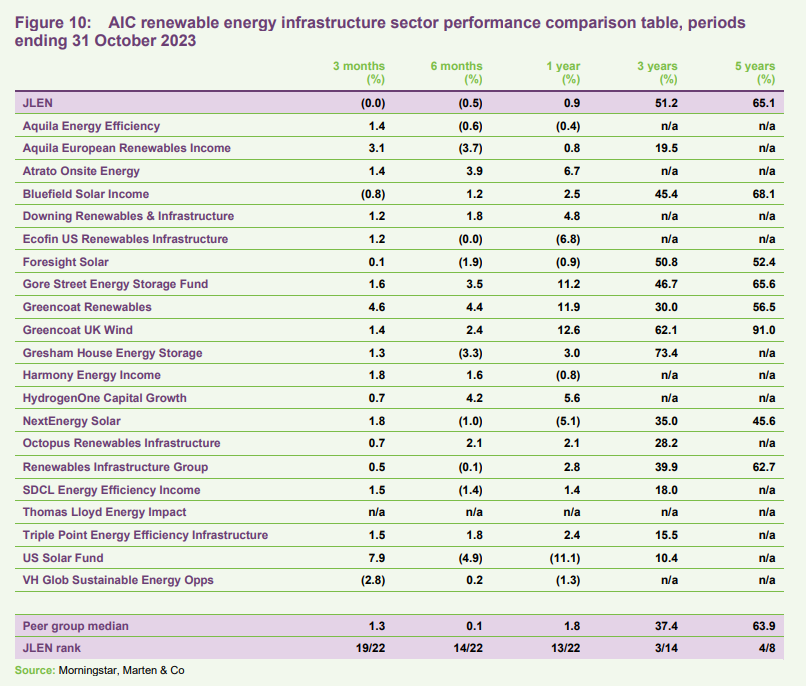

Performance

Peer group

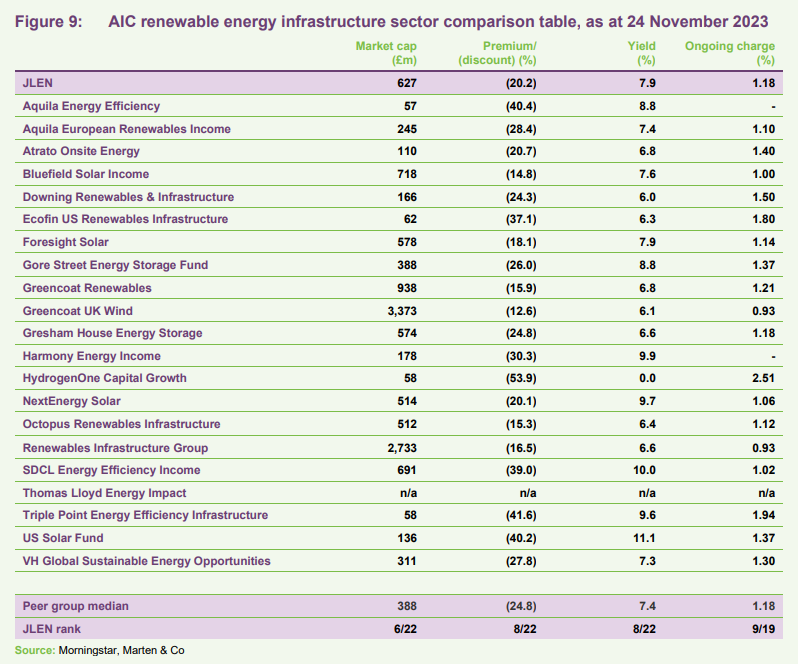

JLEN has one of the broadest remits of the 22 companies that comprise the members of the AIC’s renewable energy sector. Most of these funds are focused on solar or wind or some combination of the two. Three of these funds are focused solely on energy storage.

There is variation of geographic exposure within the peer group too, with a number of funds that are heavily exposed to the North American market (which has a different risk/reward structure) and one focused on Asia.

JLEN is one of the larger funds within this peer group, and whilst it has de-rated substantially recently, its discount is still one of the narrowest in the sector.

Wide discounts have distorted yields across the sector. JLEN’s ongoing charges ratio ranks middle of the pack.

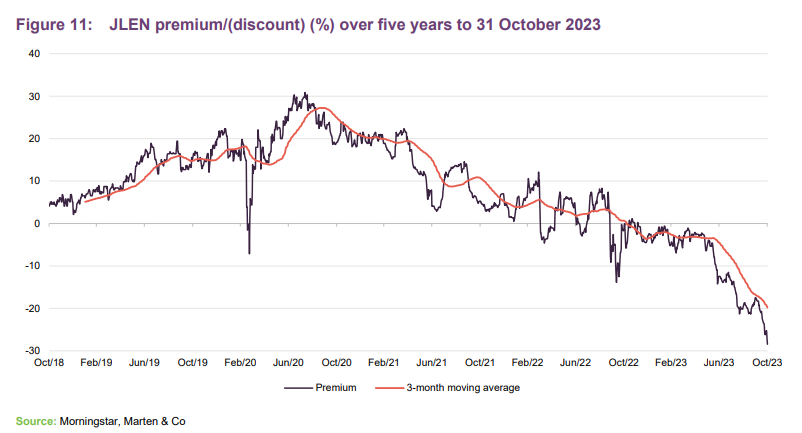

Premium/(discount)

The broader renewable energy sector has derated substantially over the past six months, with the peer group median discount moving from 13.7% at the end of March to 29.2% at the end of September. Over the year to 31 October 2023, JLEN’s shares traded in range of a 28.4% discount to NAV to a 1.1% premium, and averaged a discount of 8.4%. At 24 November 2023, JLEN was trading on a discount of 20.2%.

An average discount of 10% or more over the course of JLEN’s financial year would trigger a discontinuation vote. The average discount at which the shares have traded in the current financial year to the end of October has been 12.3%. If a discontinuation vote is triggered, it will be proposed as a special resolution at the 2024 Annual General Meeting.

Fund profile

JLEN invests in infrastructure projects that use natural or waste resources or support more environmentally-friendly approaches to economic activity, support the transition to a low carbon economy or which mitigate the effects of climate change.

JLEN’s assets are broadly categorised as intermittent renewable energy generation, baseload renewable energy generation and non-energy-generating assets that have environmental benefits. Intermittent energy generation investments include wind, solar and hydropower. Baseload renewable energy generation investments include biomass technologies, anaerobic digestion and bioenergy generated from waste. Non-energy-generating projects include wastewater, waste processing, low carbon transport, battery storage, hydrogen and sustainable solutions for food production such as agri- and aquaculture projects.

JLEN aims to build a portfolio that is diversified both geographically and by type of asset. This emphasis on diversification should reduce the dependency on a single market or set of climatic conditions and help differentiate JLEN from the majority of its peers, which tend to specialise in solar or wind.

Reflecting its objective of delivering sustainable, progressive dividends and preserving its capital, JLEN does not invest in new or experimental technology. A substantial proportion of its revenues is derived from long-term government subsidies.

JLEN’s AIFM is Foresight Group LLP (Foresight). Foresight is one of the best-resourced investors in renewable infrastructure assets, with £12.1bn of AUM as at 30 September 2023. This includes Foresight Solar Fund, which sits in JLEN’s listed peer group. Foresight has a highly experienced and well-resourced global infrastructure team with over 100 infrastructure professionals managing around 3.1GW of energy infrastructure. It is a global business, with 13 offices in seven countries. The co-lead managers to JLEN are Chris Tanner, Chris Holmes and Edward Mountney.

Previous publications

Readers interested in further information about JLEN may wish to read our previous notes. You can read the notes by clicking on them in Figure 12 below.

Figure 12: QuotedData’s previously published notes on JLEN

Source: Marten & Co |

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JLEN Environmental Assets Group Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.