The focal event of October was the announcement of the UK government’s budget, marked by sweeping changes such as a tax increase of £40bn a year (including £25bn for National Insurance), the largest hike in over thirty years. Chancellor Rachel Reeves says that ‘a strong economy depends on strong public finances’. In the wake of the announcement, the pound recorded its largest drop relative to the euro since the reveal of Liz Truss’ government’s ‘mini-budget’ in September 2022 (however, it has recovered since). According to the Office for Budget Responsibility (OBR), the economy’s growth will peak at 2% in 2025, with its size remaining ‘largely unchanged in five years’. In the meantime, the Bank of England is expected to cut its bank rate to 4.75%, following falls in inflation in September that surpassed the central bank’s goal of 2%.

“The Autumn Budget 2024 was a mix of good and bad

for businesses and individuals. The budget was a reflection of the global

challenges that many advanced economies are facing” – PwC UK

In the wake of Donald Trump’s win in the US election, global equities surged, alongside the dollar, which rose around 1.4% against several currencies. The FTSE 100 shot up 1.2% within the morning of the election result. US smaller companies reacted positively, with the Russell 2000 Index rising by 6%. Trump’s calls for protectionist policies are expected to feed through into higher inflation and hence higher for longer interest rates. That could spell good news for financials investors: US bank stocks such as Citigroup saw heightened returns following updates of the polling outcomes.

In the Eurozone, GDP grew by 0.4% over Q3, beating expectations of 0.2%. French growth came in at the same figure, fuelled by higher consumer spending during the Paris Olympics, whilst the Italian economy stagnated over the same period. The higher than anticipated growth data may mean that it is unlikely that the European Central Bank will make substantial cuts to interest rates, as Eurozone inflation rose to 2%. October ended with the European benchmark STOXX600 index sliding by 1%, its lowest point since the previous month, led by a turn down in mining and technology stocks that came after worse than expected corporate earnings.

The valuation of UK small and mid-cap companies is attractive on an historic basis

BlackRock Smaller Companies

Europe is fortunate to be the provider of the ‘picks and shovels’ of the big structural growth trends such as Artificial Intelligence, the ‘Green Transition’ and industrial automation

The European Smaller Companies Trust

The Chinese economy remains weak as consumer confidence is still extremely low, with this increasingly being reflected in poor retail sales and greater evidence of downtrading

Schroder Oriental Income Fund

At a glance

| Exchange rate | 31 October 2024 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2899 | (3.6) |

| Pound to euros | GBP / EUR | 1.1852 | (1.3) |

| US dollars to Japanese yen | USD / JPY | 152.03 | 5.8 |

| US dollars to Swiss francs | USD / CHF | 0.8641 | 2.2 |

| US dollars to Chinese renminbi | USD / CNY | 7.1180 | 1.4 |

Source: Bloomberg, QuotedData

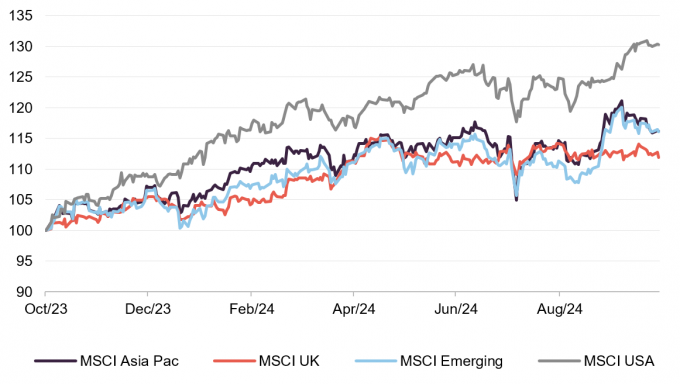

MSCI Indices (rebased to 100)

Major indices saw slight drops over October, with the S&P 500’s five consecutive months of gains ending, declining 1% from September, although some shares ended October on high notes, especially consumer discretionary companies.

Gold hit new highs, but continued conflict in the Middle East contributed to fluctuating oil prices, with prices at the end of October returning to the same levels from the beginning of the month. Government bond yields rose (and US yields have moved higher again since the election).

Time period 31 October 2023 to 31 October 2024

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 31 October 2024 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 73.16 | 1.9 |

| Gold (US$ per Troy ounce) | 2743.97 | 4.2 |

| US Treasuries 10-year yield | 4.28 | 13.3 |

| UK Gilts 10-year yield | 4.45 | 11.1 |

| German government bonds (Bunds) 10-year yield | 2.39 | 12.5 |

Global

Chairman, New Star Investment Trust, 31 October 2024

Inflation in the US, the UK and eurozone is likely to fall further towards the leading central banks’ 2% targets over the remainder of 2024. Amid this backdrop and at a time of weakening monetary trends within the Group of Seven major industrial nations and the seven largest emerging markets, there are likely to be further reductions in policy interest rates. Lower interest rates should be supportive for equities and bonds. There may, however, be increased volatility ahead of November’s US presidential election, especially given the conflicts in Ukraine and the Middle-East and as investors attempt to discern the potential for profit from advances in artificial intelligence.

. . . . . . . . . . .

Ben Lofthouse, fund manager Henderson International Income Trust, 30 October 2024

Now that global inflation appears to be under control, central banks have proceeded to ease monetary policy around the world. This year real wage growth has been positive and while wages continue to rise, this should provide support to the consumer and aid the global economy in 2025. Since the end of the period under review the US Federal Reserve has cut interest rates by 0.5% (a larger cut than their normal 0.25%) and the Chinese government has announced a number of stimulus measures in an effort to contain the severe property market downturn and provide support to the broader economy. If China succeeds in turning around its domestic consumption growth, it could be an additional positive for equity markets.

Long-term structural trends such as technological innovation, decarbonisation and supply-chain security are driving an increase in capital spending across a range of industries. While risks persist, in the form of a weakening employment picture and geopolitical tensions, the health of the global economy at this stage looks better than it has over the past year.

. . . . . . . . . .

Schroder BSC Social Impact Trust, 25 October 2024

In the twelve months to 30 June 2024, we have seen a return to stability in interest rates, with the Bank of England base rate remaining constant at 5.25% during the period, inflation decreasing to the 2% target and emerging signs of an economic rebound.

However, lagged and long-term effects of the market disruptions of the previous 18 months continue to impact the operating environment of companies in the UK, while we see a continued increase in the number of people affected by issues like poverty, deprivation and homelessness, with negative repercussions on long term health.

The year was also marked by political uncertainty, with the impending election in the UK leading to lack of clarity on the outlook for the policy environment. While a new Labour government came into power in July 2024, after the period end, the backdrop of a constrained fiscal environment and pressures on public spending remains, at a time when the need to address social issues continues to be as urgent as ever.

. . . . . . . . . .

Stuart Bridges, chair, UIL Limited, 8 October 2024

Several themes continue to dominate global events: heightened geopolitical tensions, elections, China’s emerging dominance, the outlook for inflation and interest rates, climate change, technology and Artificial Intelligence (“AI”). Most of these are well understood, but thinking evolves and opportunities emerge.

The emergence of a strong China focused on moving up the value chain is being achieved by encouraging innovation and technology, and seeking resilience for their economy and equality for their citizens. The Chinese government has actively supported businesses which achieve its aims resulting in China dominating a number of world class research and industrial manufacturing processes from solar to electric vehicles (“EV”). China has shifted from being the world’s supplier of high volume lower technology products (shoes to tennis rackets) to lower volume higher technology products (solar, wind and EV’s) investing to meet not only its own but the world’s demands.

The challenge for most economies is the inability to respond at scale. That has led to rising protectionism such as Canada’s imposition of 100% tariffs on EVs and Chile’s imposition of steel tariffs. China wants to build its middle class wealth while many of the world’s countries want to protect their middle class.

We fully expect the ongoing friction between the USA and China to continue to deepen and it is now difficult to see how this reverses direction. Given the USA and China are the two largest economies globally this must pose significant risks at some point in the future, especially for technology businesses on each side of the Pacific Ocean.

The wars in Ukraine and Gaza have both gone on longer than expected and today there continues to be no clear way forward. Over time a solution will emerge, but the risk of a wrong decision leading to escalation remains high.

Inflation has moved markedly lower for most economies over the year in the face of high interest rates and central banks are now starting to cut rates. This will no doubt be beneficial to markets as risk assets are priced higher.

Despite the high interest rate environment labour markets have remained remarkably strong. We believe that a number of factors are driving this such as nearshoring, green investments and the emerging digital economy which enable companies such as Airbnb and others to utilise underused economic assets to generate returns.

An ever increasing factor for investors is climate change. It has clearly had devastating impacts on a number of communities from wildfires in Canada to floods in Germany. We are seeing whole ecosystems being impacted by prolonged droughts and record temperatures. As investors we need to prepare for these outcomes to continue across our portfolios.

There is a very perceptible shift to embrace AI by most businesses and as with most technological developments, those without legacy businesses benefit the most, but eventually all businesses will need to adapt or risk failure. This has been our experience in the fintech sector.

. . . . . . . . . .

Zehrid Osmani, lead senior portfolio manager, Martin Currie Global Portfolio Trust, 2 October 2024

Generally, the market has regarded Big Tech as being the winners of AI, in a broad-brushed manner, which in our view is an overly simplistic conclusion to make, given the different exposures, investment needs, and varying degrees of growth prospects and return prospects that each of the businesses faces. This explains why we have been focused on only two of the ‘Magnificent 7’ stocks, Nvidia and Microsoft, given our focus on growth and returns assessments, and our valuation discipline. We believe that Nvidia and Microsoft have an attractive growth profile, and high and rising ROICs over our forecast period, and valuations remain supportive for both stocks in our view. These two companies are also best positioned to harness the AI opportunity, and the structural growth that is likely to come from that seismic thematic shift. We detailed the reasons for our preference in a report earlier this year, entitled “The Formidable Two amongst the Magnificent Seven”, which our shareholders can access on the Company’s website.

At the sectoral level, the strongest performing sectors during the period were Technology, up by +17%, Utilities +14%, and Financials +13%, whilst the weakest sectors were Consumer Staples, up only +4.3%, Materials +6.5% and Real Estate +6.5%. Some of these sectors, such as Utilities and Financials in general, remain unattractive to us, given their weak return profiles, low growth potential, and often challenging business dynamics, both in terms of competitive pressures, pricing pressures, and disruption risk.

The other focal point for the market during the period has been inflation, and the implications for interest rates. On the inflation front, the picture has remained mixed, with inflation showing an element of ongoing stickiness. This has led the major central banks to delay their intended interest rate cuts during the first half of the year, with the European Central Bank only initiating its first cut in June, followed by one more in September, whilst in the US the Federal Reserve only made its first move in September. The delay in major central banks moving towards rate cuts is in line with what we had predicted in our outlook for 2024. Now that major central banks have shifted into monetary policy easing, the focus will be on the speed of further rate cuts. The market is now looking for significant cuts in the second half of this year, and over the next 12 months, which could in itself create some short-term risks and increased volatility, depending on what the central banks decide to do. We remain of the view that central banks will be slower in cutting rates than is generally expected, as they understand only too well both the imperative of tackling stubborn inflation properly, and not letting the inflationary fire reignite, given that it is more difficult to extinguish inflation than it is to reignite growth.

On the growth front, as we write, the market has gone through a fear of hard landing, as some recent macroeconomic data points have come in weaker, notably in China and in the US, the two largest economies globally. Consumer spending has been generally weak across the US, Europe and China, weighing on sentiment and on economic momentum generally, whilst Industrial Production has also been generally soft. As we look forward, the leading indicators are pointing to weak activity generally, both on the manufacturing and services sides, and across most geographies. We see an ongoing risk of a slowdown in economic growth over the next 12 months, and maintain our probability of recession at c.35-40% – i.e. not our central scenario, but not a negligible risk. We note that some brokers have been increasing their probability of recession in the past months as well.

. . . . . . . . . .

UK

Ronald Arnold, BlackRock Smaller Companies, 24 October 2024

It is almost impossible to address the outlook without addressing the change of government in the UK. The Labour party swept to power with an overwhelming majority, a mandate for change, and an ability to set long-term economic policy. With the Labour party claiming to offer a more business-friendly outlook this should have been a perfect set up for a market friendly environment. Sadly, their early statements have instead generated increased uncertainty as the market tries to understand how the government will shape policy to fill the “£22 billion black hole”. With potential changes to inheritance tax, pensions, and capital gains tax, investors are doing what they traditionally do in the face of an information vacuum, selling. We, like everyone else with exposure to the UK stock market, await budget day with keen interest, and hope that once everyone has the certainty the budget will bring, they will be able to position for the long term. And this long term is where we have more conviction. As a consequence of the current uncertainty, consumer confidence has recently weakened. However, in the background real wages are rising, unemployment remains low, and household disposable income is increasing, all suggesting that as confidence returns the consumer maintains an ability to spend. Survey data suggests UK corporations are still positive and are themselves awaiting clarity before deciding to invest. And that clarity could (and should) come from the Labour Party, as they move away from the budget and start to enact their agenda; developing the framework to build one and a half million homes, investing in infrastructure and public services whilst at the same time reducing waste, lifting the skills and education of the workforce, and fostering innovation. On a global basis the more recent economic data suggests a soft landing is still the likely outcome. Finally, and importantly, the valuation of UK small and mid-cap companies is attractive on an historic basis. As we move through this near-term noise, the opportunity presented by the UK small and mid-cap market should be revealed, and maybe we will finally see investors looking to allocate back to an asset class that has historically been a profitable one.

. . . . . . . . . .

Angus Gordon Lennox, chair, Mercantile Investment Trust, 16 October 2024

After a long period of being out of favour with investors both in the UK and abroad, it is heartening to see UK equity markets benefiting from a resurgence in interest. This recovery began in late 2023 and has since gathered momentum, supported by several factors. Investors were relieved that the UK’s economic downturn proved shallow and brief and have welcomed mounting evidence that activity is now strengthening, supported by real wage growth and an improvement in business and consumer confidence. Investor sentiment has been further supported by a steady reduction in inflation pressures, which has given the Bank of England room to begin easing interest rates. Political uncertainty has also abated now that the general election is behind us.

UK mid and small cap companies tend to thrive and outperform larger companies in periods where growth is strengthening and interest rates are declining, and true to previous form, in the six months ended 31st July 2024, this section of the market returned +15%, outpacing UK larger capitalised companies. For instance the FTSE100 returned +12% over the same period.

. . . . . . . . . . .

Andrew Impey, chair, JPMorgan UK Small Growth & Income, 11 October 2024

Encouragingly, inflation is moderating on both sides of the Atlantic, however, monetary policy lags are notoriously difficult to forecast and they may be beginning to bite. Concern that the Federal Reserve had been too slow to cut interest rates contributed to a short but sharp market correction in early August. Whilst this was a short lived reaction, it is perhaps indicative that investors remain particularly sensitive to central bank policy and, by association, critical data releases. Subsequently, the Federal Reserve Board reduced rates by a larger than expected 0.5%, following previous cuts by the Bank of England and the European Central Bank, and the US equity market has now made new all-time highs. Most commentators expect to see global GDP growth move back towards trend levels after the volatility of recent years which, if true, will be welcomed by investors. GDP forecasts for 2024 have been revised down in the near term for the US but expectations for the UK and Europe are improving, albeit still below the US and anaemic in real terms. Politics looms large as the US election approaches, European politics remains in the spotlight and we will soon learn the actual economic plans of the new UK Chancellor of the Exchequer. Once the outcome is known, investors should welcome the greater degree of certainty.

. . . . . . . . . . .

Ben Ritchie and Rebecca MacLean, Dunedin Income Growth Investment Trust, 1 October 2024

Despite recent market volatility, the UK macroeconomic landscape is gradually improving, with growth set to recover slowly, inflation moderating, and consumer confidence picking up, painting a more encouraging picture than at the turn of the year. The recent change in government in the UK has brought a degree of political stability that reassures markets, although attention is now focused on the upcoming autumn budget, which is expected to have significant implications for various sectors.

The current valuation of the market and the portfolio reflects muted expectations, potentially providing a springboard for strong prospective returns. Mergers and acquisitions remain a prominent feature, while share buybacks continue to provide support. There have also been some encouraging early signs of international investors returning to the UK market. A confluence of a steadily improving economic landscape, declining interest rates, and a softer currency could present a compelling investment case for UK equities, particularly in the mid-cap sector, where the Company holds a strategic overweight position.

However, risks remain, and elevated tensions in the Middle East and Ukraine, along with their potential impact on energy prices, warrant close monitoring. Likewise, the Chinese economy continues to struggle and there are increasing signs of a slowdown in the United States, both factors to remain vigilant to.

. . . . . . . . . . .

Asia Pacific

Richard Sennitt, portfolio manager, Schroder Oriental Income Fund, 23 October 2024

I’ll start by looking at a couple of the concerns that the market has. Amongst these, geopolitics has continued to be a concern in the region, with tensions around US-China relations, Taiwan, Ukraine and the Middle East all contributing to investor caution. However, regional elections (Taiwan, Korea, Indonesia and India) have all passed reasonably smoothly, but it is the upcoming US elections which appear finely poised, that have potentially very divergent impacts on Asia depending on the result. Here, there is potential for increases in tariffs on Chinese (and anyone else importing into the US) exports if Trump is elected. Although there is uncertainty as to what further tariffs or restrictions are put on China’s (and other countries’) ability to do business in the US, it is clear that in such a tight electoral race there is likely to be quite a lot of noise on these issues, which could well increase volatility.

Within the region, the Chinese economy remains weak as consumer confidence is still extremely low, with this increasingly being reflected in poor retail sales and greater evidence of downtrading. This weak confidence in part reflects a weaker job market together with falling property prices. All this has meant the consumer has become more risk averse which has resulted in a meaningful increase in savings versus consumption.

The key domestic overhang remains the property market, where activity and prices are yet to recover from earlier significant falls. Although the government has made some announcements to try to put a floor under the property market, in reality the fiscal sums backing these interventions are (so far) very small compared to the scale of the problem, and unlikely to make more than a marginal difference. Given this, and the structural challenges facing stock-pickers in China (poor capital allocation, structurally lower nominal growth, unpredictable regulatory and policy shifts, high debt levels), we remain significantly underweight the market albeit less so than where we were 12 months ago with the biggest underweight there being towards the internet platform companies. Although these names have been increasing their returns to shareholders this is principally being done via buybacks, rather than through dividends, so it remains an area where we are likely to be underweighted.

It is noteworthy that the most recently announced stimulus measures, at the time of writing, appear more substantive and coordinated and have provoked a meaningful rally in the stock market. Whilst we also view the stimulus as positive, in our view, the rally has already started to discount further easing and, therefore, risks disappointing. Aside from the size of any further measures it is also how it is spent that is key with a need, in our view, to have more of a focus on the demand side of the economy if the consumer is to get out of its malaise.

The Hong Kong market continues to suffer from not only the spillover impacts of a weak China, but also the high level of interest rates, which are inappropriate for the weak domestic economy. Whilst we have reduced our overweight to real estate held via the Hong Kong market we have also taken advantage of weak stock prices to add into other areas, such as non-bank financials. With US interest rates now having started to be cut, this should help to ease monetary conditions which should be supportive for the economy and market.

Australia continues to be a market that has historically offered strong long-term returns, in large part due to the reinvestment of dividends, but valuations are not obviously cheap versus the rest of the region, given its outperformance. Our principal exposure continues to be through the materials and financial sectors, but a derating of the health care sector and underperformance of consumer staples has seen us add to exposure there. More recently, the prospects of a soft landing have also seen banks perform strongly, which has led us to reduce our exposure to them. We continue to maintain exposure to the commodities names via the diversified resource names, where capital expenditure has remained relatively restrained, limiting supply in what ultimately remains a sector that is expected to benefit from ongoing decarbonisation spend. In the South-East Asian region, we are most exposed to Singapore, which is benefitting from its increasing status as a regional wealth management hub, as well as the growth of its ASEAN neighbours.

. . . . . . . . . . .

Europe

Christopher Casey, chair, The European Smaller Companies Trust, 22 October 2024

I stated last year that I considered inflation to be close to settling near target. This has proved to be true and we have begun to see interest rates reduce to more appropriate levels across the globe, but most importantly in the United States. This, combined with reserve rate cuts and financial stimulus in China, is a welcome relief for the global economy and for European smaller companies.

It is a shame that political uncertainty has poked its head up in Europe again with the French election being unhelpful for growth and elections in the US have scope to create further doubt for our markets. Notwithstanding this, the very low valuations in Europe, the falling cost of capital and the improving economic optimism should outweigh the noise of politics. Europe is fortunate to be the provider of the ‘picks and shovels’ of the big structural growth trends such as Artificial Intelligence, the ‘Green Transition’ and industrial automation. It is an exciting time for the European smaller company space

. . . . . . . . . . .

Stefan Gries and Alexandra Dangnoor, BlackRock Greater Europe, 5 November 2024

Following the “AI Boom” at the beginning of 2024, at the time of writing the global investment community had begun a more critical assessment of the return on investment on the large amounts of money pouring into the build-out of AI infrastructure. Market concerns have centred around the sustainability of this AI capital expenditure cycle. While some of the initial excitement was clearly overdone, we remain of the view that new technological breakthroughs often follow a familiar pattern – investors overestimate their potential in the near term while underestimating what is possible in the medium to longer term. We suspect the adoption of AI and its different use cases are no different in that regard. The race to build leading AI infrastructure is still in its infancy, with significant competitive momentum pushing cash rich companies to continue to innovate and invest to stay ahead. It is clear hardware infrastructure roadmaps are not keeping up with the pace of development in AI, leading to a widening gap between model training computational needs and the key infrastructure that is available in compute, rack design, network, cooling systems and power. None of today’s technology leaders can afford to be left behind in delivering breakthrough technologies in what could be the defining technological development of this generation.

This is relevant to us because the European market is home to an ecosystem of companies which possess the enabling technologies required in these transformational changes – not just AI adoption, but also the energy transition and global efforts to reorganise supply chains. Many of these businesses sell to global customer bases and are the world leaders in their fields. These competitively advantaged and secular growth businesses have become an increasingly important component of the overall market whilst undifferentiated ‘older economy sectors’ like telcos, auto and energy producers have shrunk in size over the last decade.

Alongside the investment opportunities afforded by these structural forces, we detect a cyclical upturn in a variety of industries like construction, life-sciences and chemicals which have suffered from pronounced volume declines for the best part of two years. Global manufacturing Purchasing Managers Indices have stayed below 50 for the last 23 months, signalling the longest period of contraction since 1951; importantly, in many end markets management teams are now talking about stabilisation of demand with painful inventory adjustments having come to an end. European construction is a good example, where easing financial conditions are helping activity levels to recover following the 40-45% collapse in new built residential volumes over the past couple of years.

Against the backdrop of a structurally improved market composition and a cyclical recovery, we see valuations in the European market at a record wide discount relative to the US. This dichotomy does not make sense to us. A healthy market operates as a discounting mechanism and the investment community’s myopic focus on near term problems should soon make way for the medium- to long-term opportunities. We see 2025 as a recovery year for earnings and beyond that we envisage a multi-year period of healthy profit growth, alongside the potential for this historic valuation gap to the US to narrow. Those prepared to take the optimistic view should be rewarded over time.

. . . . . . . . . . .

Global emerging markets

Omar Negyal and Isaac Thong, portfolio managers, JPMorgan Global Emerging Markets Income Trust, 1 November 2024

Like their counterparts in developed markets, the attention of investors in Emerging Markets over the past year has been focused on Artificial Intelligence (‘AI’) and its potential to disrupt and reshape business practices in many sectors. Companies will need to increase capital expenditure to acquire and deploy new AI-driven technology and to stay competitive. Semiconductor manufacturers and related tech companies are already benefiting from strong demand, and their resultant share price gains have been a key driver for all markets. Within Emerging Markets, this influence has been most important in South Korea and Taiwan, which are home to many companies with exposure to the AI boom.

The excitement about AI has spilled over into other sectors of the market such as energy and materials. AI-driven tools and their related storage and processing requirements are energy hungry, and electricity companies and energy infrastructure suppliers are perceived as major beneficiaries. So too are the producers of commodities such as copper, which is essential to the manufacture of semiconductors and energy transmission systems.

Shareholder returns have been another key theme in both South Korea and China over the past year. In South Korea, the government launched a so-called ‘Value-Up’ initiative, which aims to encourage corporate managers to enhance shareholder value via increased dividend payments and share buybacks. The intention is to replicate the success of similar efforts by the Tokyo Stock Exchange, which have had a favourable impact on Japanese share prices.

In China, we saw a brief rally going into 2024, inspired by short-term government stimulus and attractive valuations. However, structural issues remain, with ongoing weakness in the property sector continuing to weigh on consumer sentiment and hence on domestic demand, though the government has recently announced stimulus measures which could help improve this. As growth slows, investors’ attention has shifted to more yield focused names. Additionally, companies, especially China’s internet companies, are distributing more to shareholders, rather than reinvesting for growth. Geopolitical tensions between China and the US continue to simmer, creating a further potential drag on growth, especially via increased US sanctions and tariffs on Chinese electric vehicles and advanced tech products.

The other predominant theme in Emerging Markets over the past year was the ongoing interest in India. The economy continues to grow at a fast pace, and optimism in India’s longer-term future is mounting amongst both domestic and international investors. This has resulted in further stock market gains.

. . . . . . . . . . .

Heather Manners, chair, Fidelity Emerging Markets, 8 October 2024

Although US financial markets have continued to suck liquidity from the rest of the world, your Portfolio Managers are positive on the outlook for emerging markets in the coming year and well beyond. Emerging market central banks have been ahead of the curve in raising interest rates, inflation is generally well controlled, and they have significant policy headroom as the US Federal Reserve continues to ease, which should be beneficial for emerging market equities. Moreover, while much of the US stock market performance has been driven by multiple expansion, emerging market equities remain very attractively valued on a relative basis.

With artificial intelligence (AI) stocks having dominated the investment headlines from the US, it is important to remember the role that emerging market companies, such as Taiwanese semiconductor makers and Korean memory suppliers, play in the AI value chain. Emerging markets are also among the largest producers of essential commodities such as copper and lithium, all of which are fundamental to the build-out of AI and low-carbon infrastructure.

Often the best investment opportunities can be found in smaller and medium-sized companies with a longer runway for growth. However, in far-flung emerging markets, these can be very hard for individual investors to identify.

. . . . . . . . . . .

China

Nicholas Pink, chair, Baillie Gifford China Growth Trust, 1 October 2024

After the 12.0% rise over the period, our benchmark MSCI China All Shares is still trading at an extremely low multiple relative to the last 20 years and at nearly a 60% discount to the US. At the same time, its forecast earnings growth is expected to be one of the highest among major equity markets. There are, of course, risks to those forecast earnings given that the economy continues to transition from its old model of property-led growth to one driven by technological development and scientific progress. In addition, geopolitics, particularly in the context of the US election in November, is likely to create additional volatility. We believe that the market has largely factored in a continuation of the current protectionist trend in US-China relations. Whilst a Harris win might lead to more predictable US policy towards China, a Trump win could, counterintuitively, result in the potential for greater positive surprise given Trump’s historic penchant for deal making and relative ideological flexibility.

Overall, we remain cautiously optimistic that China will successfully navigate this transition and that the companies it produces will become increasingly world-class as a result.

. . . . . . . . . . .

India/Indian subcontinent

Ashoka India Equity Investment Trust, 16 October 2024

India’s economy delivered solid, above expectation gross domestic product (‘GDP’) growth of 8.2% for the fiscal year ending March 2024. Its healthy macro-economic fundamentals, resilient corporate earnings as well as promising growth prospects continue to garner strong foreign direct investment (‘FDI’) as well as portfolio flows. A moderating inflation trajectory and benign current account deficit opens up room for RBI monetary easing. Fiscal policy will likely remain in consolidation mode, driven by a pickup in tax revenues and improved rationalisation of government outlays even as capex spending will likely remain robust. The ongoing inclusion of Indian government bonds into the JP Morgan Bond index will also be supportive of local debt markets.

The recently announced General Budget for FY25 signalled the government’s commitment to fiscal consolidation while continuing to fuel growth by boosting infrastructure investments. The gross fiscal deficit (‘GFD’) target was lowered to 4.9% of GDP for FY25 (5.1% in the Interim Budget) versus 5.6% in FY24. The Finance Minister also announced schemes to support fresh employment and skill development in manufacturing and other sectors, as well as a new credit guarantee scheme for supporting labour-intensive small and medium-sized enterprises. As part of the Indian government’s Finance (No. 2) Act, 2024, which became effective in July 2024, the short-term capital gains tax (“CGT”) rate increased from 15% to 20%, and the long-term CGT rate increased from 10% to 12.5% with no impact on returns/performance for the year ended 30 June 2024. However, it is expected that future returns/performance will be adversely affected to the extent of the CGT tax increases. The government also announced that it is working towards a comprehensive review of the Direct Tax Code, aimed at simplifying and consolidating the structure of direct taxes.

CPI inflation was broadly under control at 5.4% for the period June 2023 to June 2024 versus 6.1% in the period June 2022 to June 2023, driven by sharp moderation in core inflation. However, food inflation was volatile during this period. Nonetheless, RBI expects CPI inflation to further moderate to 4.5% in FY25, as core inflation is expected to remain benign. Commodity prices have also been modest in recent months. The progress of the monsoons has been normal and will aid in keeping food inflation in check.

India’s external sector balance was under check with the current account deficit (‘CAD’) to GDP (CAD/GDP) at 0.8% in FY2024, with a marked improvement in the second half of the fiscal year. Services trade surplus and remittances provided considerable tailwinds to the external sector, aiding in the current account surplus in 4QFY24. Overall, external risks remain contained as India’s external debt, at 19% of GDP, is amongst the lowest in the world, while RBI’s forex reserves, at approximately USD690bn, is amongst the highest. Further, an underappreciated aspect is that the vulnerability of macro variables such as CAD due to a higher oil import bill has reduced materially over the years due to faster growth in services exports.

India’s workforce is estimated to be nearly 600 million, of which 45% is employed in agriculture. To boost productivity, the government has prioritized investment-led growth to shift jobs from agriculture to higher value-addition in the manufacturing and services sectors. A large number of supply-side measures have also been initiated over the last decade such as (1) labor reforms, (2) reduction in corporate tax rates, (3) bankruptcy reforms, (4) strengthening financial and corporate balance sheets, (5) incentives for domestic manufacturing through Production Linked Incentive (PLI) scheme, among others. As a result, India has witnessed a steady increase in manufacturing gross value added (‘GVA’), especially in new-age sectors such as electronics. Continued government support coupled with a favourable geopolitical scenario gives India strong tailwinds to scale manufacturing in several sunrise sectors. At the same time, India has also achieved a considerable degree of success in leveraging its skilled workforce to increase its services exports.

India’s diverse corporate sectors and generally improving ROE suggests it will remain one of the best EM equity markets within which to capture sustained outperformance. Also noteworthy has been the corporate deleveraging and cleaning up of banks’ balance sheets with a marked decline in non-performing loans. This in turn has kickstarted a recovery in private sector capex further enhanced by the government’s extensive infrastructure investment upgrade. ‘Made in India’ is still in its very early stages, but the likes of Apple and Samsung are expanding local production with India clearly one of the major beneficiaries of global supply chain reconfiguration. Furthermore, the value of India’s IT exports continues to rise providing a cushion to the external sector. Moreover, unlike some of its other large EM peers, India’s economy is inherently much more consumption than investment driven, and the thrust of policymaking in recent years has been towards capacity building which is likely to ensure that economic growth is sustainable and broad-based and not propelled by a rise in leverage.

In view of these positives, the broader Indian equity market has seen a recovery rally over the last year. Valuations are at 22x one year forward earnings, as compared to the 10 year average of 20x for BSE Sensex. Although the market seems expensive, in the last 10 years, bar a few instances during market corrections between 2016 and 2020, India has consistently traded at a premium relative to other emerging markets.

India offers a diversified sector exposure relative to its international peers, with a good mix of cyclical and counter cyclical businesses. From a political perspective, the recent Indian election result was a disappointment for the ruling Bharatiya Janata Party (‘BJP’), although we are unlikely to witness any major change in the successful reform policies of recent years. At present, it looks like Narendra Modi will be the PM leading a stable coalition for the next five years which should be comforting for investors as it implies continuity of the policy framework and a pro-growth agenda. However, unlike the last 10 years when Modi’s BJP held a majority on its own, this time BJP will have to govern alongside its alliance partners in the National Democratic Alliance (‘NDA’). Given the dominance of BJP in the coalition, effective governance should not be a major issue, but might require more consensus building within the NDA coalition on some of the more pressing policy issues. Furthermore, any sustained weakness in global growth could weigh on market performance. On the other hand, a sharp reversal in anticipated global risk factors such as inflation, recession, or geopolitical tensions could boost investor sentiment. In conclusion, we remain optimistic and continue to believe the structural growth drivers of the Indian economy are deep rooted which, notwithstanding the near-term challenges, presents India as an attractive long-term investment opportunity.

. . . . . . . . . . .

Vietnam

Khanh Vu and Dieu Phuong Nguyen, co-portfolio managers, VinaCapital Vietnam Opportunity, 23 October 2024

Vietnam saw strong GDP growth of 6.4% over the first six months of the calendar year 2024, compared to 5.1% GDP growth for the full year in 2023. This growth was primarily driven by external factors, particularly by the strength of the US economy, which has boosted exports to the US – Vietnam’s largest export market – and driven by the recovery of Vietnam’s manufacturing sector. However, internal factors are detracting from growth, with domestic consumption remaining muted and with a slower pace of government spending on infrastructure development.

There are signs that public spending will continue to drive the country’s GDP growth in the second half of 2024. Export growth (+15%) outpaced manufacturing output growth (+9%) in the first half of 2024, which means that manufacturers will need to import more input materials to ramp up production for rising orders. This could lead to a modest trade deficit and potentially add further pressure on the VN Dong.

We expect GDP growth to remain at 6.5% in 2025, unchanged from 2024, despite signs of a slowing US economy and reduced demand for “Made in Vietnam” products. We are optimistic that the government will significantly increase new real estate project approvals, which will indirectly boost consumer confidence and spending, as well as accelerate infrastructure projects to support the economy in 2025. In other words, Vietnam’s GDP growth will likely transition from being driven by external factors in 2024 to being driven by internal factors in 2025.

The USD-VND exchange rate has continued to depreciate in 2024. Earlier this year, the SBV intervened in markets to support the VN Dong. We expect interest rates to remain low and accommodative as the US Fed takes a less aggressive stance on monetary policy, leading to a stabilization of the USD-VND exchange rate.

Vietnam will continue to be a prime destination for FDI, particularly for multinationals looking to produce for export and seeking an alternative manufacturing base to China. FDI inflows grew by 8% y-o-y to USD 10.8 billion in the first half of 2024, equivalent to about 5% of GDP. The value of newly planned projects jumped by 43% y-o-y to USD 13.5 billion, ensuring a strong pipeline of initiatives that will expand the country’s industrial production capacity for years to come. Furthermore, companies have now started relocating more complex manufacturing-related activities to Vietnam.

We believe that Government policies are likely to remain focused on attracting FDI and boosting Vietnam’s economy. These policies have been remarkably consistent over the past twenty years, and we firmly believe they will continue to drive the country’s development in the long-term

. . . . . . . . . . .

Vietnam Holding Limited, 1 October 2024

Evolving political risk is, of course, a global phenomenon, and Vietnam is no exception. Over the past year or so, there has been a significant push against corruption in Vietnam, a ‘blazing furnace’ established by General Secretary Nguyen Phu Trong targeted errant business-people and government officials, resulting in several resignations. For much of the year, there were also speculations about Trong’s deteriorating health, and he died on 19 July 2024, just a day after receiving a Gold Medal for service to the nation. The Politburo requested that President To Lam assume some of Trong’s duties on an interim basis, and he was unanimously elected as General Secretary on 3 August 2024.

We expect to see the government continue to pursue an open policy to economic development. Vietnam has entered into 16 free trade agreements over the past two decades and has an ambition to be a key manufacturing hub. This country continues to attract record levels of FDI which will further boost export growth. The government policies are pro-business, and pro-capital markets.

The Prime Minister and the Ministry of Finance want to see continued development of the stock and bond markets, with an ambition to increase the size of the stock market and bond market close to an equivalent size of 100 % and 50% of GDP respectively by 2025. The State Securities Commission is inviting feedback from market participants on a recently published final draft circular proposing to remove the pre-funding requirement on stock trading accounts. They hope to have this ready by September, ahead of the FTSE Russell review on Vietnam’s stock market status. Vietnam is on the FTSE Russell Secondary Emerging Market watchlist, and an upgrade would be very welcome. In the Interim Report this year we included a more detailed article on the benefits of a market upgrade, but in simple terms Vietnam would go from being part of a USD 90bn Frontier Market universe, to part of a USD 7-8 trillion-dollar emerging market universe. The World Bank estimates this could add a further USD 20-30bn of net indirect capital flow within three years.

Vietnam’s political structure can be perplexing for foreign investors, and its consensus-based approach to policy execution can sometimes result in measured (slow) decision making. In previous annual reports, we discussed the problems in meeting budgeted levels of government infrastructure spending. This was under-budget in 2022 and 2023, most likely due to certain officials’ reluctance to make difficult decisions. It is encouraging to see a five percent increase in public expenditure on new infrastructure year-to-date, with USD 10bn spent in the first six months of 2024, and a USD 28bn target for the full calendar year.

Visitors travelling by air to Ho Chi Minh City will have undoubtedly experienced the queues upon arrival (and departure). This is the result of a spike in international arrivals, which have already returned to pre-Covid levels, combined with increased domestic travel, putting strain on the airport, which is already overcapacity. The government has been putting pressure on authorities to speed up the construction of the new international airport at Long Thanh, roughly 50km away from Ho Chi Minh City’s District 1. It now appears that the initial phase of the airport will be completed in 2026, six months ahead of schedule. Before that, the third terminal at the existing Tan Son Nhat International Airport is due to be completed in the first half of 2025.

Recent developments in the power sector bode well for the rising adoption of renewable energy. Over the past decade, installed solar and wind in Vietnam has gone from almost zero to 20 Gigawatts. This was accomplished despite a relatively weak Power Purchase Agreement (“PPA”) framework and a single monopoly buyer, the state-owned utility EVN. The new Decree 80, passed on 11 July, now allows for the direct purchase of rooftop generated solar energy. This is essentially a soft de-regulation of the energy market. This is positive for growth in solar power in a country that has high solar irradiance. The government is also planning longer-term initiatives to tap into the country’s significant wind power potential through offshore, nearshore and onshore wind farms.

As with the rest of the world, the rapid technological changes and digitalisation initiatives in Vietnam require vast amounts of processing power and storage. In another encouraging development, data centres can now be wholly owned by foreign investors under new legislation enacted in November 2023, which came into recent effect. The growth of domestic data centres is a key aspect of Vietnam’s growing digital transformation, and FPT should also benefit as a technology enabler.

So, the outlook remains positive. Despite considerable domestic political changes, we do not see any change to the momentum related to policy. We also expect foreign exchange risks to reduce when the US Fed starts to lower interest rates, and the interest rate differential between the US and Vietnam (and other Asian countries) softens. The stock market growth over the past year has been domestically driven. Once the year of extraordinary global political turbulence is past, and markets are reassessed for relative attractiveness, we believe emerging markets and Vietnam in particular (albeit officially a frontier market) will rally further.

. . . . . . . . . . .

Biotechnology & Healthcare

Alisa Craig and Marek Poszepczynski, portfolio managers, International Biotechnology Trust

The year in review commenced with a further bout of weakness from the biotechnology sector, which revisited the lows of 2022 in November 2023, before staging a strong recovery in the last few weeks of 2023 and through the current year.

Initially, this recovery was led primarily by larger companies, but it has broadened out as the year has progressed, with small and mid-cap biotechnology stocks increasingly participating in the rally. Encouragingly, this reflects renewed confidence across the sector after three years of a bear market, with higher levels of private and follow-on financing, alongside tentative signs that the IPO window is gradually re-opening.

Consolidation in the sector has also continued, with many companies undergoing restructuring or M&A. Large pharmaceutical companies, in particular, have been keen to fill the revenue gap that stems from their impending patent expiries. Furthermore, the impact of the US Inflation Reduction Act which caps/limits the potential profits available for pharmaceutical companies from certain mature medicines has added further impetus to the need to identify the next generation of treatments. This, we believe, has created opportunities for active investors to benefit from the premia that are paid for innovative companies addressing high unmet medical need.

Innovation in the biotechnology industry has continued at a rapid pace. This is reflected in the number of new clinical trials being initiated, which has risen every year since 2011, and, if the current rate continues, 2024 is expected to be yet another record year. This year has, however, been slower for regulatory approvals, but this was expected after a record year in 2023 which worked through the COVID backlog of filings. Importantly, there are a number of imminent key product launches, product approvals and late-stage clinical read outs in areas such as oncology, neurology and obesity, all areas to which our portfolio is well exposed.

. . . . . . . . . . .

Commodities and natural resources

Ian ‘Franco’ Francis, Keith Watson and Robert Crayfourd, CQS Natural Resources Growth and Income, 23 October 2024

The energy sector was lifted by a rise in crude price premium resulting from Middle East tensions, particularly after the Hamas-Israel conflict began in October 2023 and in which Iran has a significant hand. While this helped drive performance of E&P investments, even more notable was the performance of energy shippers which have seen a marked improvement in day rates as they undertake lengthier routes to avoid hot spots such as the Strait of Hormuz that in the first 10 months of 2023 accounted for around 30% of seaborne crude oil traffic.

Against a backdrop of still sluggish GDP growth and rising international trade friction, exposure to less discretionary energy remains preferred over industrial metals which we feel will stay subdued. The energy sector appears to have absorbed the prospect of rising OPEC+ output, as production quota restrictions unwind, while the potential for more meaningful replenishment of the US Strategic Petroleum Reserve may offer support for incremental demand in future.

In a broader context, alternative energy, including nuclear power which has seen a wholesale shift in government and public opinion, also offers significant recovery potential. Its low carbon credentials have seen it brought back into the fold and embraced as a core part of global energy transition ambitions, as illustrated by the widespread international backing at COP28 at which a tripling of nuclear power generating capacity was targeted. After a decade of underinvestment in new developments, this sector continues to offer huge leverage to a sustainable increase in uranium prices. Representing only a small proportion of electricity generating costs, utility demand is largely insensitive to price moves. Despite the recent jump in prices, the outlook remains very positive for related mining equities.

Exposure to precious metal mining stocks has risen as a result of recent performance and also incremental investment. The attractively valued equities remain a preferred sector for investment allocations as a beneficiary of ongoing geopolitical friction, together with unproductive and irresponsible fiscal spending. In an environment of inward looking, nationalistic government, policy geopolitical risks are, if anything, rising. Against a backdrop of limited aggregate demand, disinflation trends have also been evident to varying degrees and a synchronised cycle of monetary easing appears to be approaching. This factor may encourage investment by physically-backed funds which have typically been an important indicator of metal prices as they transition from seller to buyer.

This contrasts with industrial metals which will have to contend with moderate growth prospects, especially as China continues to struggle with a weak property sector. In addition, industrial metal mining equities, to an extent, already discount an improved metal pricing environment arising from fiscal spending.

. . . . . . . . . . .

Hedge funds

John Birch and Marc Gabelli, co-chairmen, Gabelli Merger Plus+, 30 October 2024

The U.S. economy continues to expand. Some of this is due to productivity growth (thanks to AI), some is due to more workers in the labor force (thanks to workers who left the work force during COVID coming back). Also helping the economy is a huge amount of fiscal stimulus, which unfortunately means the U.S. government is running a deficit to GDP ratio of about 7%, unheard of in an economy near full employment. For now, the stock market does not seem to be concerned about the huge debt levels building up in the economy, but at some point politicians will need to address government debt levels.

Looking ahead, the trajectory of inflation and the resilience of the labor market will be crucial in shaping the Federal Reserve’s actions. Should inflation continue to trend downward and labor market conditions soften, the likelihood of rate cuts will increase. However, the Fed’s commitment to a data-driven strategy involves careful monitoring of various other economic indicators to avoid premature adjustments that could undermine the progress made so far.

Yields in the Treasury space will remain influenced by Fed policy and Treasury bill supply. With front-end yields elevated and the Fed still wary of inflation, we expect the investment environment for government money market funds to remain attractive. As with non-government debt, Government and Treasury fund yields have probably peaked and will continue to gradually decline as managers roll maturities into securities with lower yields that are pricing in future rate reductions. Additionally, any large supply changes in Treasury issuance may create yield volatility on the front end.

We expect M&A activity to remain strong with pent up demand likely to drive transaction announcements. Companies will gain further clarity into the Federal Reserve’s interest rate policy and the upcoming U.S. presidential election’s potential impact to regulatory changes, but perhaps the main issue which buyers and sellers continue to monitor is the more stringent antitrust environment. Within the U.S., the Federal Trade Commission (FTC) continued its watchful eye on deals, requesting additional information from merging parties including the energy and healthcare sectors. Deals continue to close as merging parties are drafting strong merger agreements with additional time to consummate deals, in the event of regulatory delays. The drivers for M&A activity to remain robust over the coming years include the need to compete on a global basis, acquire new technological advancements and enter new and growing business units.

In the current high-yielding environment, it is strategically advantageous to allocate a portion of the Company’s assets to U.S. Treasury bills due to the numerous benefits they offer. Treasuries stand out for their ability to provide competitive returns when compared to other fixed-income securities and given their short-term nature allows for frequent reinvestment at prevailing interest rates, potentially maximizing the overall yield of the portfolio over time. Moreover, Treasuries are highly liquid and can be easily bought and sold without significantly affecting their value. This liquidity not only enhances the flexibility of the Company’s investment strategy but also allows for swift adjustments in response to changing market conditions.

. . . . . . . . . . .

Private equity

Richard Hickman, managing director, HarbourVest Global Private Equity, 24 October 2024

The improvement in the global macroeconomic climate which began in late 2023 continued during the first half of 2024, as inflation pressures eased, the US and other economies expanded, albeit modestly, and interest rates began to fall in key markets. This relatively favourable environment, combined with mounting excitement about artificial intelligence (AI), spurred strong gains in global equity markets, to the extent that the Nasdaq, the S&P 500, and other market indices are trading around all-time highs.

As is typically the case in market upswings, private equity valuations have lagged the H1 2024 gains in public markets, although there are some early signs of recovery. Trade buyers are returning, and IPO and M&A activity is rising. For example, in Q1-Q3 2024, the Americas and EMEIA regions recorded double digit year-over-year growth in IPO activity, as GPs took advantage of improved public market sentiment. Increasing confidence in private markets is also reflected in the fact that mainstream asset managers are investing in publicly listed private equity managers such as KKR and Carlyle, whose shares have made strong gains since late 2023. Despite this, listed private equity funds have lagged the strong gains of both public equity markets and listed private equity managers, even though the trading performance within portfolios has generally been strong.

. . . . . . . . . . .

Debt

Volta Finance Limited, 22 October 2024

As anticipated, the last twelve-month period proved to be relatively volatile and unpredictable both on macro-economic and geopolitical levels. Major western Central Banks remained ambiguous in terms of forward rates guidance while macro data successively sent positive and not-so positive messages. On the political front, markets were shaken by rising tensions in the Middle East while supply chain issues were still a reality. A major takeaway though, was that western economies managed to soft land and avoided entering into recession.

In the US, consumer spending and employment remained strong and enabled the US economy to showcase stronger than expected data. Estimates for Q2 2024 GDP were revised up at 3.0% and forecasts for Q3 2024 were in the 2.5% context. In the meantime, fears stemming from the rebound in core inflation at the end of 2023 were brushed away as inflation steadily moved towards and eventually settled at 3.0% at the end of July. Markets were then pricing around 65bps Fed cuts by the end of the calendar year, although surprising payroll data in early August – to the downside – and cautiously dovish rhetoric from Jay Powell raised predictions towards 100bps of cuts by December end. This resulted in the ongoing decrease in sovereign bond yields, noticeable stock rotations and tighter credit spreads.

In both Europe and the UK, core inflation decelerated which enabled the respective Central Banks to initiate their rate cut cycle.

The European Central Bank lowered rates by 25bps in June. This decision marked a departure from nine months of stable rates, following a significant inflation decline of over 2.5 percentage points since September 2023. With headline inflation close to target (2.2% year on year in August) and core inflation decelerating at 2.8%, markets anticipated the ECB would reduce further its core rates in September. In terms of activity, Manufacturing continued to suffer while the services sector held well. Europe’s flash PMI numbers notably fell below consensus as concerns grew regarding the economy losing momentum into Q3 2024. The Euro Area composite PMI printed at 50.1 versus an expected 50.9, amid disappointing readings in Germany.

China’s dataflow continued to be average notably due to underwhelming consumer spending. In the absence of clear and strong action from policy makers or the Central Bank, the situation remains unclear and medium-term impacts on US and European exports could be significant.

The political calendar was (and still is) extremely busy this year with the European Parliamentary elections notably triggering the surprise announcement of snap legislative elections by French President Macron. Reaction from markets was largely negative, as a market sell-off across various asset classes took place: the spread between the French 10-year OAT and German Bund yields widened to levels unseen since 2016 while French bank stocks suffered a significant drop in price. A general election in the UK and the Labour victory ended 14 years of conservative governments. Significant changes in term of governance were expected there as Prime Minister Keir Starmer quickly warned of a “painful” budget to bring the country finances to a healthier state. Markets remembered PM Liz Truss’s mini budget from a couple of years ago and remained extremely attentive to potential episodes of volatility due to political decisions.

In the US, consensus was that the elections could be a non-event as they would lead to either a continuation of the Biden administration or a Trump takeover that markets had already experienced. Nonetheless, Joe Biden’s withdrawal from the presidential race and the endorsement of Kamala Harris as the Democrats’ candidate was a surprise. In that context, the race to the presidency is likely to be eventful and whoever becomes next president will put their own stamp on the direction of the country.

Like the market patterns experienced in 2023, periods of market stress and/or market euphoria were driven by markets interpretations of the rhetoric policy makers used to justify their actions – or lack of. It is fair to assume that efforts were focused on containing investor expectations for rate cuts on both sides of the pond. While the FED implemented a 50bps rate cut in October 2024, the lack of forward guidance from the ECB sent a rather hawkish message to investors.

. . . . . . . . . . .

Property

Edward Ziff, chairman and chief executive of Town Centre Securities

We have not seen meaningful rental growth in the commercial sectors in which we operate for a number of years, and don’t anticipate this to change for the foreseeable future. In the office sector, the work from home trend in the wake of the COVID pandemic seems to have stabilised with workers gravitating back to the office, which although slow is to be encouraged.

Across the country, prime space for retail and leisure is generally well occupied, although non-prime sites continue to struggle. Despite cost-of-living pressures, consumer demand in the food and beverage sector has remained buoyant. The retail sector has bottomed out and is where we see the opportunity for value to be found.

. . . . . . . . . . .

Martley Capital, investment adviser of Alternative Income REIT

The UK economy is finding its footing in 2024 after a robust post-pandemic recovery. Though the initial surge has subsided, the short recession of late 2023 seems to be over and a more stable period is taking hold. The slowdown in GDP growth is expected to level off, with gradual improvement expected throughout the remainder of the year. Political stability in the UK could further bolster economic growth following the Labour Party’s win of the General Election with a sizeable majority. Consequential changes to the Government’s policies will likely have implications for the UK economy, and thus real estate. Additionally, inflation, while still relatively high, is projected to continue its decline and it is expected to settle at more manageable levels.

The cost-of-living crisis continues to cast a shadow, with consumers remaining cautious about spending despite some recent signs of improvement. This could lead to stagnant, or even slightly declining, retail sales in the coming months. To maintain profitability, businesses may still consider cost-cutting measures, potentially impacting employment levels and making unemployment a bigger concern in the latter half of 2024.

Curbing inflation remains a key priority, but there are positive developments in this regard. High inflation rates have subsided over the past year, falling to 2.0% (CPI, June 2024), bringing inflation in line with the Bank of England’s long-term target. The Bank’s aggressive interest rate hikes in 2023, culminating in the 14th consecutive increase to 5.25% in August 2023, are credited with helping to cool domestic demand and influence import prices, ultimately bringing inflation under control.

Financial markets were betting on a rate cut by the Bank of England, which materialised in August 2024 when rates were cut by 0.25% to 5%, with Capital Economics predicting a further drop to 3% by the end of 2025. However, the Bank faces a balancing act: to curb inflation without restraining economic growth. The modest 0.7% growth in the first four months of 2024 underscores the importance of finding the right balance. Stalling economic activity could lead to adverse long-term consequences, including a reduction in business investment, higher long-term unemployment and a decline in key sectors.

Despite a difficult global real estate market, with declining values for the past two years, prime yields have remained steady in the first half of 2024. This suggests most markets may be nearing the bottom of the cycle, prompting cautious investor re-entry.

Previous forecasts for steeper interest rate hikes (up to 5.75%) have been overshadowed by strong expectations for further rate cuts in 2024 and 2025. This shift in sentiment, along with a more optimistic outlook, could make real estate a highly attractive investment proposition. However, several risks remain unaddressed, including borrowers facing stricter lending conditions, and structural challenges persisting. An additional factor to consider is the growing availability of distressed assets. Banks are increasingly taking ownership of properties where long-term borrowers have defaulted. This presents a significant opportunity for global capital seeking to diversify through UK real estate.

Investors are seizing the moment to reposition assets to align with changing occupier demand. This comes as the gap between asking prices and offers narrows. UK Investment volume in Q2 2024 surged 11% compared to an already strong Q1, reaching £11.1bn. As market conditions strengthen, we can expect activity to pick up further. However, the focus for 2024 is likely to remain on generating and securing stable income, rather than chasing capital appreciation.

Tough economic conditions further emphasise the importance of sustainability, quality, location and flexibility for attracting tenants. These factors remain crucial for occupiers who are still focused on complying with regulations, retaining staff and minimising operational costs. This focus, coupled with limited supply due to rising construction and borrowing costs, is contributing to a rise in nominal rental prices across most sectors.

The MSCI UK Monthly Capital Value Index continued its downward trend in Q2 2024. While office values saw slight declines, retail and industrial sectors showed more resilience. As economic stability appears likely on the horizon, this decline could signal the beginning of a cyclical buying opportunity as new properties become available later this year.

Rising temperatures are driving renewed focus on physical climate risks from both investors and occupiers. This has led to a growing appreciation for the value of sustainable features in buildings. Investors and occupiers are increasingly interested in accurate measurement of these “green” features and how they translate to improved energy efficiency, ultimately impacting the corporate bottom line. As a result, we can expect stricter regulations, including mandatory disclosure of net zero transition plans.

. . . . . . . . . . .

Stephen Smith, chairman of PRS REIT

The Build to Rent (BtR) sector in the UK is playing an increasingly important part in overall housing delivery. Its value as an accelerant in the delivery of mixed-development sites (those including private for sale, private rental and affordable homes) is well recognised and BtR is adding thousands of extra new homes to overall UK housing delivery. The UK BtR market still remains relatively undeveloped, especially when compared to more mature markets such as the USA and Germany.

The growth of UK BtR is being driven by the structural problems of the owner-occupied and rental markets, both of which are impacted by a severe shortage of properties, leading to strong rental growth. Over the last 20 years rental growth has averaged 3.2% compared to earnings growth that has averaged 3.1% over this period.

The new Labour Government is intending to reintroduce annual home delivery targets through the National Planning Policy Framework and has increased the previously discarded target of 300,000 new dwellings per annum to 370,000 new dwellings per annum. We believe that BtR has the potential to be an important contributor in the new drive for new homes.

The BtR sector has grown strongly over the last year. According to data compiled by Savills for the British Property Federation’s and published in July 2024, BtR completions in Q2 reached record levels, with the sector starting to make an appreciable difference to housing delivery across a growing number of locations within the UK. The total number of completed BtR units at the end of Q2 stood at 115,778 and the total number of BtR homes in planning was 57,000 homes, a near record level. However for the third quarter in a row the number of completions remained above the number of starts on sites. The continued slow-down in new starts is ascribed to ongoing sector challenges, including build cost inflation, cost of debt and the impact of economic and political uncertainty on investors. The British Property Federation called for more action to convert planning consents to starts on site and to bring forward new schemes through the planning proceed in order to service the huge rental demand.

There is a substantial shortage of properties in the UK for both the owner-occupied and rental sectors. CBRE, the global real estate adviser, reported that the UK’s private rented residential sector has lost about 400,000 rental homes since 2016 due to growing cost pressures and higher mortgage costs. Private landlords in the buy-to-let sector are still the largest provider of rental properties in the UK. They have been under pressure from an increasingly unfavourable tax regime, growing regulatory burden as well as base rate rises, and this pressure is set to continue. According to a report by UK Finance, the banking trade body, the value of lending into the buy to let sector fell by 52% over the course of 2023 equating to a reduction in loans from 25,280 in the last quarter of 2022 to just over 12,000 at the same point in 2023. Savills also reported in August 2024 that sales of second homes and buy-to-let properties had risen by 34% in the period 2021-2024 compared to the preceding three years, with these sales accounting for one-in-six of all property disposals, compared to one-in-fifteen in 2013-2014.

Challenges in the home ownership market have also continued to fuel demand in the rental sector. The median house price to income ratio at the end of 2023 was 8.1, according to the Office for National Statistics, which although lower than the preceding year (8.3), is still at historic highs while mortgage rates have also risen sharply over the previous two years. The deposits required for most mortgages still remain beyond the reach of many. By comparison, the PRS REIT’s homes remain very affordable. At 30 June 2024, the average household income of a PRS REIT tenant was £52,500 (30 September 2023: £51,000) and the average rent was £1,005 per calendar month (2023: £934), meaning that annual rent as a proportion of household income was 23% (2023: 22%). This reflects a combination of stronger wage inflation and the emergence of a wealthier cohort of potentially disenfranchised would-be home buyers who have entered the rental market.

The shortage of rental properties, with low stock levels and relatively low availability, remains evident. A report from TwentyCI and TwentyEA in early July 2024 stated that whilst some of the previous year’s pressure in the rental market was easing, availability remained at historic lows and that demand is still outstripping supply. CBRE’s Mid-Year Market Outlook 2024 forecasts that stretched affordability will exert a downward pressure although this will take time to feed through, and as such forecasts strong rent growth of 6% in 2024 for the remainder of the year. A report from the Office for National Statistics, published in July 2024, noted that average UK private rents increased by 8.6% in the 12 months to June 2024.

In summary, it is clear that the market opportunity in BtR remains significant and that the sector remains an important means of fulfilling a social need and meeting demand for high-quality, well-managed rental housing in the UK.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.