Significant catch-up potential?

After three years of underperformance, there are now indications that sentiment towards both growth stocks and the wider UK market is improving. Baillie Gifford UK Growth Trust (BGUK) may have been a beneficiary of this, it has delivered an uptick in performance over the past year. However, UK equities in general – and growth names in particular – continue to trade at a discount relative to global peers. This creates the possibility of performance convergence if conditions continue to improve, particularly as BGUK’s managers still observe that, in aggregate, its companies are performing well at the operational level.

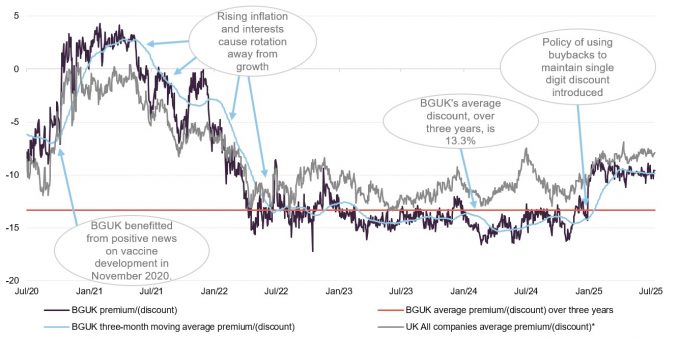

BGUK’s new single-digit discount control policy already appears to have had an impact. There is also an additional continuation vote in 2027 (as well as the regular five-yearly vote in 2029) and a performance-linked tender offer in 2029 should the trust’s NAV per share lag the FTSE All-Share over the five years to 30 April 2029.

Focused portfolio of UK growth equities

BGUK aims to achieve capital growth by investing in a concentrated portfolio (35–65 companies) of predominantly UK equities, with the aim of providing a total return in excess of the FTSE All-Share Index

| 12 months ended | Share price TR (%) | NAV total return (%) | MSCI UK TR (%) | MSCI UK Growth TR (%) | MSCI World TR (%) |

|---|---|---|---|---|---|

| 31/07/2021 | 39.8 | 33.8 | 23.4 | 18.7 | 28.1 |

| 31/07/2022 | (24.4) | (20.4) | 12.8 | 5.2 | 4.3 |

| 31/07/2023 | (0.7) | 4.4 | 6.8 | 5.6 | 7.9 |

| 31/07/2024 | 7.5 | 8.1 | 13.5 | 7.8 | 19.1 |

| 31/07/2025 | 18.5 | 13.2 | 12.7 | 8.8 | 12.8 |

Fund profile

Focused UK growth equities portfolio

Further information can be found at Baillie Gifford’s website: www.bailliegifford.com

BGUK aims to achieve capital growth predominantly by investing in a portfolio of UK equities, with the aim of providing a total return in excess of the FTSE All-Share Index. The company invests in a relatively concentrated portfolio of between 35 and 65 companies, the majority of which are constituents of the FTSE 350 Index, but where appropriate, it may also include constituents of other indices.

Baillie Gifford took over the management of BGUK’s portfolio at the end of June 2018 and has been managing it for just over six years now. The managers take a stock-picking approach, and the size of individual stock holdings depends on the managers’ degree of conviction, not the stock’s weight in any index. BGUK may, if appropriate, use convertible securities, and equity-related derivatives for efficient portfolio management purposes. BGUK may also invest up to 10% of its total assets in unlisted investment opportunities (measured at the time of initial investment).

About the managers

Well-resourced investment team.

Baillie Gifford has 175 investors/analysts, spread across 23 teams, most of whom are based in its Edinburgh office. It is structured as a partnership and encourages a collegiate approach to managing money, although it allows its portfolio managers the freedom to have the final say about their portfolios. It managed or advised on about £209bn of AUM at 30 June 2025, of which £9.6bn was invested in UK equities. BGUK is co-managed by Iain McCombie and Milena Mileva (see page 24 for brief biographies of the managers).

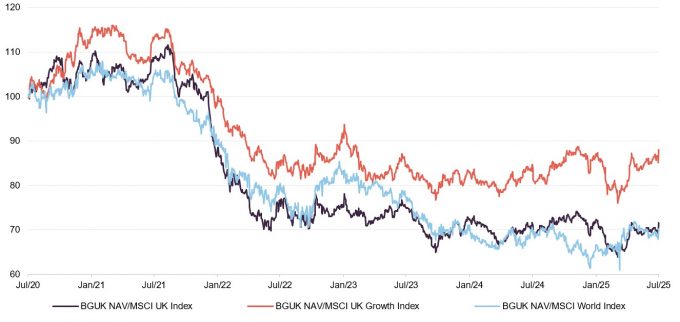

Constructed without reference to a benchmark

BGUK’s benchmark is the FTSE All-Share Index, although the portfolio is not constructed with reference to this or any other benchmark index. We have substituted the MSCI UK Index for the All-Share in this report and have also included comparisons against the MSCI UK Growth Index and the MSCI World Index.

Managers’ view

Sentiment towards growth stocks and the UK market continues to improve

Interest rate cuts are still coming through.

When we last published on BGUK in August 2024, there were indications of improving sentiment towards UK growth stocks. After a period driven by rising interest rates and compressed valuations, inflation was beginning to stabilise. The Bank of England had just delivered its first rate cut and the expectation was that there would be more to come, which has since been fulfilled.

BGUK’s managers note that whilst the geopolitical landscape remains unsettled – particularly following the change in US administration and the implementation of Trump’s “Liberation Day” tariffs – there have been no major surprises since we last wrote on the trust. Operational performance across the portfolio remains stable in aggregate. Moreover, they say that with US tariffs feeding inflation and dampening growth prospects domestically, global capital has started to shift towards other developed markets, including Europe and the UK. Despite this, UK equities – and UK growth stocks in particular – continue to trade at a significant discount relative to both historical levels and global peers.

Mid- and small-cap stocks still being left behind

The trust’s bias towards mid- and small-cap stocks has been a performance headwind. In the recent upswing, larger UK stocks appear to have benefitted disproportionately and the managers believe that whilst UK stocks continue to look cheap across the market cap spectrum, some of the strongest potential remains with the mid- and small-cap stocks that BGUK has exposure to.

Managers remain confident in the long-term merits of their approach

BGUK’s managers reiterate that, whilst it has become more valuation-aware, there has been no fundamental change to the approach used to manage the trust’s portfolio. Baillie Gifford previously reviewed the trust’s performance to assess whether materially-better outcomes could have been achieved within its mandate in the period since it peaked in August 2021 (something we looked at it in detail in our last note). The conclusion was that: without deviating from the trust’s growth-focused remit – for example, by adding large-cap index names – a materially different result would not have been possible.

A year on, and BGUK’s managers continue to see no reason to shift from BGUK’s established philosophy and remain confident in the long-term merits of the style. They maintain strong conviction in the portfolio and argue that markets continue to misprice quality. BGUK’s managers think that for investors with a longer time horizon, this represents a compelling opportunity.

Managers’ long-running themes remain intact

BGUK’s managers are fundamentally bottom up in their approach to selecting stocks, but as discussed further in the next section, they are looking for companies that have a number of key attributes. As a result, when looking across the portfolio, it is possible to group BGUK’s holdings into broad themes that the managers highlight as key areas of focus. Regular readers of our research on BGUK may observe that these broad “buckets” are unchanged, with the exceptions of BGUK’s small exposure to commodities.

Key portfolio areas are as follows:

- Growth financials – Legal & General, AJ Bell, St James’s Place, Helical, Wise, Prudential, Lancashire Holdings, Just Group, and IntegraFin.

- Market share gainers – Ashtead, Bunzl, 4imprint, Inchcape, Volution Group, and Howden Joinery.

- Big brands – Games Workshop, Diageo, and Burberry.

- R&D innovators – Genus, Wayve, Oxford Nanopore, Creo Medical, and Renishaw.

- The digital enterprise – Kainos, FDM, Softcat, Molten Ventures, and FD Technologies.

- The digital consumer – Rightmove, Moonpig, and Auto Trader.

- Niche industrials – Bodycote, Halma, and PageGroup.

- Data, data everywhere – RELX and Experian.

Investment philosophy and process

The underlying approach

Markets are inefficient at pricing long-term growth

Baillie Gifford believes that markets are inefficient at pricing long-term growth, especially over a time horizon of at least five years, and that this creates an opportunity to generate alpha. For this reason, it aims to encourage a culture of long-term thinking within the firm. Baillie Gifford believes that there is persistence of good company management, business models and stock prices. One might note that this translates into a culture of “sticking with the winners”.

Three-stage team-based approach

As an investment house, Baillie Gifford has a strong emphasis on using a team-based approach, as it believes that teams make better decisions than individuals. Integral to this is a culture of debate, with a challenge-driven mentality across the firm. Baillie Gifford could be considered as effectively being made up of a small number of investment teams with different growth strategies. The UK equities team uses a consistent three-stage approach that comprises:

- discovery;

- debate; and

- decision.

There are two lead portfolio managers on the team: Iain McCombie (the head of the team) and Milena Mileva. The team also has two permanent investment analysts as well as a number of graduates from the company’s graduate programme (these rotate every 12 months). In addition, dedicated ESG analysts are embedded within the UK team’s investment framework.

Stage 1 – Discovery

This is the idea-generation part of the process. Every six weeks the team has its prospects meeting, which sets the research agenda for the following six weeks (the UK stock universe is 500+ stocks and the team has a priority list of around 200 companies). Baillie Gifford holds the view that it is important for both portfolio managers and analysts to carve out time to do their own research. This is part of their objectives and helps to keep them accountable for their investment decisions (as discussed below, although there is considerable debate around stocks, the lead portfolio managers make the final decision).

For the prospect meeting, team members bring along “half-formed” ideas to discuss (an analyst or PM may have seen something that has caught their eye and open it up to the wider group). The discussion is intended to be open-minded and constructive. Baillie Gifford does not believe in coverage for the sake of having coverage. For example, even if a stock is large, the team will not cover it unless it has a credible long-term growth investment case. That is not to say that the team does not keep an eye on the broader market; they will look at such stocks when looking at the competitive landscape, for example. These discussions are the starting point for more in-depth research.

In the discovery stage, the team can draw on external research providers and other in-house teams, but Baillie Gifford encourages analysts to hunt for new ideas. They are encouraged to follow their interests and look at things they are inclined to explore. This approach provides analysts, who are all generalists, with the ability to gain a broader perspective. It is noteworthy that the analysts are not divided along sector lines and there is no concept of “maintenance research” at Baillie Gifford. When the team is talking to companies, the conversations with their management teams focus on the long-term prospects of the business.

Iain and Milena are able to draw on the resources of the whole investment team when analysing companies, and can sit in on meetings with companies outside their geographic remit. This is used when trying to identify how companies compare with competitors domiciled in other markets.

Stage 2 – Debate

The debate stage is a central component of the investment process. It is structured around a concise investment note which, for the UK equities team, is limited to a maximum of three pages, to keep the arguments focused with a clear recommendation at the end (there is, however, no limit on the number of supporting pages that can be attached to the back of the note). Notes are structured around Baillie Gifford’s five-question framework:

Edge – why is a stock interesting? This focuses on the industry background, company-specific factors, competitive position, and key issues pertinent to the investment case.

Growth – what will it look like in five years? This focuses on sales, profit margins and the capital allocation.

Sustainability – what, if any, ESG factors are material to the investment case? Consider both opportunities and risks. This focuses on climate impact, sustainable business practices, board structures, and management alignment.

Valuation – should we own it? This focuses on the company’s valuation, the reasons why a company should trade well, and the likely valuation in five years and beyond.

Discipline – what would make us sell? This focuses on the key risks and any non-negotiables of the investment case.

In addition, another member of the team will be appointed to play the role of devil’s advocate ahead of the discussion. The purpose of this is to uncover assumptions and challenge these so that ultimately a perceivably superior recommendation can be reached. One member of the team takes detailed minutes of these discussions, which provide an anchor for the team for future discussions. Specifically, these minutes record the risks identified around a stock, as well as the reasons for selling. This is intended to help maintain analytical consistency, as it acts as a barrier against analysts’ and portfolio managers’ altering decision criteria on stocks over time, thereby supporting objectivity.

Stage 3 – Decision

In terms of portfolio construction, whilst the team actively discusses all of the stocks, the final decision as to what enters the portfolio is down to the lead managers of the BGUK portfolio. This is designed to give individual accountability on top of the team discussion.

Sell discipline

In terms of sales, loss of faith in a company’s management is an immediate reason for a sale. The managers also sell if they feel that a business model is not working, or if the market has aligned with their expectations for a company.

Asset allocation

Small-to-mid-cap-biased growth portfolio

As at 30 June 2025, BGUK’s portfolio had 36 holdings, a decrease of five from 41 holdings as at 30 June 2024 (the most recently-available information when we last published). As illustrated in Figure 6, the portfolio has become further concentrated, with the top 10 stocks accounting for 48.3% of BGUK’s total assets as at 30 June 2025, a noticeable increase of 5.4 percentage points over the 42.9% of BGUK’s total assets as at 30 June 2024. The concentration has also increased in the top five stocks. The reflects the managers’ efforts to focus the portfolio.

Figure 1: Industry allocation as at 30 June 2025

Source: Baillie Gifford UK Growth Trust

Portfolio is radically different to the benchmark.

Figure 1 provides a breakdown of the portfolio by industry as at the end of June 2025. This illustrates the diverse nature of the investment ideas within the portfolio, which has been a feature since Baillie Gifford took over management in 2018. Although the portfolio is inherently long-term and low-turnover, these allocations change gradually over time. Whilst this is a UK all-cap portfolio, there are large chunks of the market to which BGUK offers no exposure, as should be expected of a concentrated growth portfolio that is not constructed with any regard to the benchmark.

Given the aim of maintaining a focused portfolio of individual growth ideas, the active share tends to be high (it was around 90% at the end of June 2025, which is in line with its long-term average).

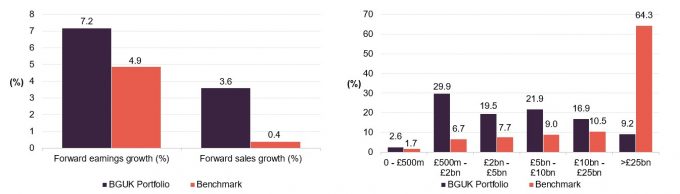

Portfolio characteristics

As illustrated in Figures 2 and 3, BGUK has a markedly different portfolio to the benchmark.

Traditionally, BGUK’s portfolio has tended to trade at a noticeable premium to the benchmark, reflecting its higher projected earnings and sales growth. As illustrated in Figure 3, BGUK’s portfolio continues to have a strong bias to mid-cap stocks when compared to the benchmark.

The size bias is not something that its managers set out to achieve, but is a result of their stock selections and, moreover, reflects where they have identified opportunities.

Figure 2: BGUK portfolio valuations versus benchmark as at 30 June 2025

Figure 3: BGUK portfolio market cap split versus benchmark as at 30 June 2025

Source: Baillie Gifford, Marten & Co. Note Historic earnings growth is trailing five years. Return on equity and Price/earnings is based on 12-month forward estimates. Debt/equity excludes financials.

Source: Baillie Gifford, Marten & Co

Portfolio activity

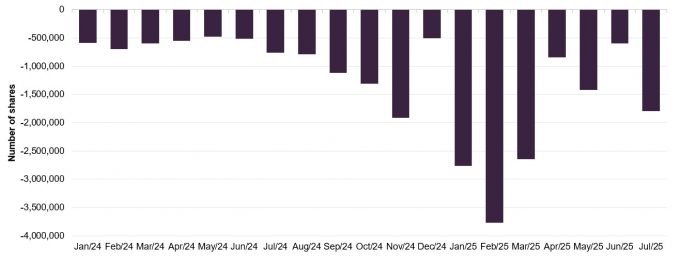

Reflecting the managers’ low-turnover approach, the number of stocks entering and exiting the portfolio in a given year is likely to be limited. For example, during the year ended 30 April 2025, two positions were exited: Hiscox and Rio Tinto. The managers say that having to fund the buybacks has contributed to a more concentrated review process, with the managers trimming positions in which they have lower conviction.

In the case of Hiscox, BGUK’s managers still have a high opinion of the company’s management, but have been disappointed by the lack of growth in its retail business. For Rio Tinto, the managers feel the demand outlook is unexciting.

They have also increased existing positions where they have stronger conviction and valuations have been considered favourable – for example, Moonpig and 4imprint.

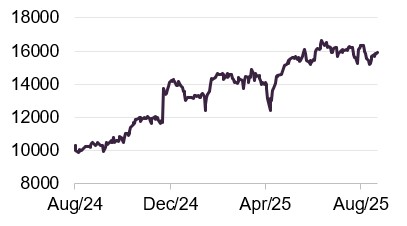

Moonpig – still benefitting from a permanent shift towards online

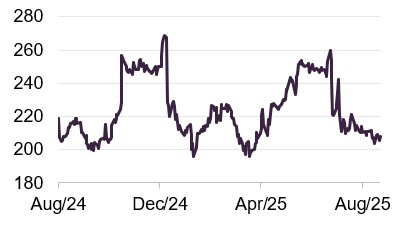

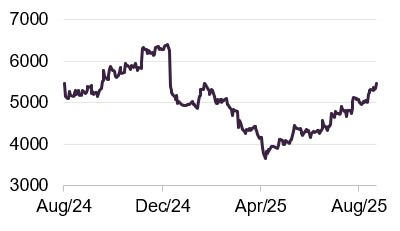

Figure 4: Moonpig share price (GBp)

Source: Bloomberg

Moonpig Group (moonpig.group) is an online retailer of greetings cards and gifts, with a leading position in the growing online market for greetings cards. As discussed in our previous notes (see our August 2024 note, where the investment rationale was covered in detail), BGUK’s managers met the Moonpig team when the company had its IPO in February 2021, but felt that it was not the optimal time for a listing and that the valuation looked appeared elevated (Moonpig had been a major COVID beneficiary). However, they continued to follow the company and, following conversations with management and a site visit, concluded that whilst new customer growth had slowed, they had increased confidence in the company’s ability to drive sales growth, on the back of the significant investment it has made in data science.

BGUK’s managers have continued to increase the position size as they have gained confidence. They think that the company’s data science can be combined with AI to really improve the overall proposition. However, they believe that the market does not appreciate this growth potential and continues to value it as a bog-standard retailer.

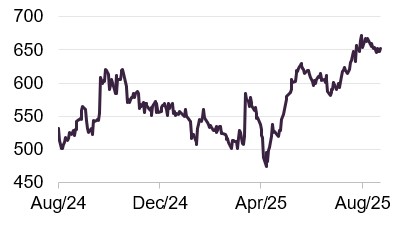

4imprint – a tougher environment plays to its strengths

Figure 5: 4imprint share price (GBp)

Source: Bloomberg

4imprint (4imprint.com) is a direct marketer of promotional merchandise for corporates. It describes itself as the world’s leading distributor of promotional gifts and has operations in the US, UK, and Europe, with the vast majority of its sales in the US. 4imprint was discussed in detail in the September 2023 note, which explained that its key US market is highly fragmented, but 4imprint has differentiated itself by focusing extensively on marketing its own offering (from 2018 the company began allocating significant spend to advertising itself, and it did not cut the budget during COVID).

This allowed 4imprint to take advantage of opportunities when others were slashing advertising, and its marketing efficiency subsequently improved. Then, as many smaller operations ceased trading, 4imprint was able to increase its market share, which allowed its business to grow, creating further marketing synergies.

Reflecting its heavy exposure to the US and the fact that promotional merchandise is a highly cyclical business, 4imprint’s shares derated on concerns about the outlook for the US economy. However, BGUK’s managers think that it is very overly discounted, unless there is a very severe US recession, and that a tougher environment could again support 4imprint’s positioning, allowing it to lay the groundwork to accelerate growth when the economy recovers, as it has in previous downturns.

Top 10 holdings

Figure 5 shows BGUK’s top 10 holdings as at 30 June 2025 and how these have changed since 30 June 2024 (the most recently available data when we last published). Reflecting the managers’ long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular followers of BGUK’s portfolio announcements and our research on the trust.

| Holding | Sector | Business | Portfolio weight 30 June 2025 (%) | Portfolio weight 30 June 2024 (%) | Percentage point change |

|---|---|---|---|---|---|

| Games Workshop | Consumer discretionary | Tabletop games manufacturer/retailer | 6.7 | 5.1 | 1.6 |

| Volution Group | Industrials | Ventilation equipment supplier | 6.1 | 4.7 | 1.4 |

| Auto Trader | Technology | UK second had car advertising portal | 5.7 | 5.6 | 0.1 |

| Experian | Technology | Financial information services | 5.1 | 5.4 | (0.3) |

| AJ Bell | Financials | UK wealth manager | 5.0 | 3.6 | 1.4 |

| Wise | Financials | Online global FX money transfer | 4.7 | 3.0 | 1.7 |

| St. James’s Place | Financials | UK Wealth management | 4.2 | 1.9 | 2.3 |

| Howden Joinery | Industrials | Manufacturer/distributor of kitchens to trade | 4.1 | 4.1 | – |

| Softcat | Technology | IT reseller and infrastructure solutions | 3.5 | 3.6 | (0.1) |

| Just Group | Financials | Retirement income products and services | 3.4 | 2.7 | 0.7 |

| Total of top five | 28.6 | 24.9 | 3.7 | ||

| Total of top 10 | 48.3 | 42.9 | 5.4 |

Wise, St. James’s Place and Just Group have moved up into the top 10.

New entrants to the top 10 are Wise, St. James’s Place and Just Group. Names that have moved out of the top 10 are Ashtead, 4imprint (discussed above) and Kainos.

Some of the notable portfolio changes are discussed in the next few pages. Other holdings have been discussed in our previous notes and readers may wish to refer to these (for example, Volution, AJ Bell, Autotrader, Wise, St. James’s Place and Howden Joinery were covered in detail in our August 2024 note – see page 29 of this note).

Wise (4.7%) – long runway for continued market share gains

Figure 7: Wise share price (GBp)

Source: Bloomberg

Wise (wise.com) is a London-based fintech company that provides an online platform to send and receive money internationally at low cost. We last discussed it in our August 2024 note (see page 15 of that note) where we highlighted it as being the third largest contributor to performance for the year-ended 30 April 2024.

Wise continues to disintermediate the international money-transfer services of the traditional banks, which have traditionally charged a premium for a relatively simple service. Wise’s share price has performed strongly since we last published, largely reflecting a continuation of its underlying operational performance. BGUK’s managers still believe that Wise is on track to become another SWIFT. They say that its customer-focused model provides the potential for sustained market share gains in what is a large, global, cross-border market.

St. James’s Place (4.2%) – benefitting from move to self-directed investing

Figure 8: St. James’s Place share price (GBp)

Source: Bloomberg

We last discussed St. James’s Place (sjp.co.uk) in our August 2024 note. The UK’s largest wealth manager had experienced a difficult year following the announcement of changes in its pricing structure and further provisions for potential client refunds “linked to the historic evidencing and delivery of ongoing servicing”.

At the time, BGUK’s managers felt St. James’s Place’s pricing was too high and needed to be adjusted to maintain competitiveness. They felt that this should allow it to retain customers and keep its sales momentum. They also felt that, with St. James’s Place then trading around 0.4 x its embedded value, negative expectations were already reflected in its share price and that the actual outlook was more favourable than implied (the company was still seeing net inflows, for example).

BGUK’s managers’ report that the position has since improved. The company’s franchise remains intact, and the stock has since rebounded. The managers like St James’s Place as they see it as a beneficiary of the move to more self-directed investment decisions for UK-based savers, most notably those saving for retirement. They believe this tailwind should persist for decades to come.

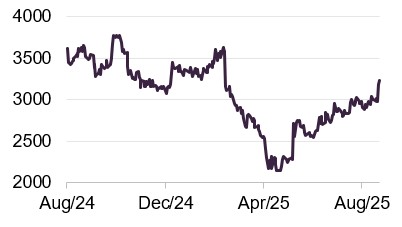

Just Group (3.4%) – Brookfield Wealth Solutions offer at 75% premium to undisturbed price

Figure 9: Just Group share price (GBp)

Source: Bloomberg

Just Group (justgroupplc.co.uk) is a specialist UK financial services company focused on providing retirement income solutions, notably bulk annuities for defined benefit pension schemes, individual annuities, and lifetime mortgages. The group has established a position in the market by combining deep actuarial expertise with a stable capital base, enabling it to deliver secure, long-term cash flows for both institutional and retail clients. Recent years have seen the group benefit from increased market conditions in bulk annuity demand, with trustees increasingly looking to de-risk pension schemes in a higher-yield environment.

BGUK’s managers felt that with changes in personal finance, Just Group’s end market was strong, the company was well-positioned in its sector, and they could see significant upside potential, even though it had already done very well. The managers were proven to be correct as on 30 July 2025, it was announced that terms had been agreed for Just Group to be acquired by Brookfield Wealth Solutions, at a 75% premium to the prior day’s close, in a deal valuing Just Group at £3.2bn. The managers believe that Just Group still has a favourable outlook but feel that the offer is at an acceptable price and provides a boost to BGUK’s performance.

Performance

Up-to-date information on BGUK and its peers is available on the QuotedData website.

As discussed in previous notes, a lot has impacted financial markets since Baillie Gifford took over the management of the trust in June 2018 – including Brexit, the pandemic, Ukraine, rapid interest rate rises to tackle significant inflation increases, and then cuts as it was brought under control, the dominance of the magnificent seven stocks in the US as excitement around AI grew; and – most recently – the market effects associated with the new Trump presidency.

Figure 10: BGUK’s NAV total return relative to various indices, over five years to 31 July 2025

Source: Morningstar, Marten & Co

It was the impact of higher interest rates in 2022 that had the greatest impact on growth stocks and hence BGUK’s relative NAV and share price performance. While this has stabilised since, as inflation was brought under control and interest rates receded, there remains potential for performance recovery.

Baillie Gifford undertook some analysis of the trust’s performance in advance of last year’s continuation vote to try and establish whether, since its peak in August 2021, significantly superior outcomes could have been achieved within the remit of the trust’s strategy. The conclusion was that this would not have been possible without BGUK taking new positions in large index constituents, which would not have been consistent with its investment objective and would have represented a material departure from managers’ active, bottom-up, long-term growth-focused approach. The managers also concluded that, while recent years have seen growth stocks underperform, they believe it will reverse, and expect growth should have a long runway for outperformance. As a consequence, they did not change their style.

Figure 11: Cumulative total return performance over periods ending 31 July 2025

| 3 months (%) | 6 months (%) | YTD (%) | 1 year (%) | 3 years (%) | 5 years (%) | BG tenure1 (%) | 10 years (%) | |

|---|---|---|---|---|---|---|---|---|

| BGUK NAV | 15.9 | 6.3 | 12.9 | 13.2 | 27.7 | 36.1 | 27.4 | 57.5 |

| BGUK share price | 16.1 | 6.4 | 17.1 | 18.5 | 26.5 | 33.7 | 24.5 | 56.6 |

| MSCI UK | 7.8 | 7.4 | 13.8 | 12.7 | 36.6 | 90.1 | 56.4 | 99.5 |

| MSCI UK Growth | 5.0 | 5.3 | 11.7 | 8.8 | 23.8 | 54.6 | 66.7 | 106.8 |

| MSCI World | 13.1 | 0.8 | 5.2 | 12.8 | 44.9 | 93.5 | 125.6 | 240.1 |

| Peer group average NAV2 | 11.2 | 7.6 | 11.6 | 6.5 | 30.1 | 78.1 | 45.7 | 89.8 |

| Peer group average share price2 | 12.5 | 10.5 | 15.5 | 7.5 | 34.1 | 82.8 | 45.3 | 93.9 |

Results for the year ended 30 April 2025

For its financial year ended 30 April 2025, BGUK achieved NAV and share price total returns of 7.1% and 13.6% respectively. In comparison, the broader MSCI UK Index returned 8.1% and the MSCI UK Growth Index 5.7%. BGUK’s NAV was modestly below the return of its All-Share benchmark, which BGUK’s annual report says returned 7.5%, while its share price total return was ahead, reflecting its reduction of the discount (from 15.3% to 10.5%), following the introduction of the new discount control policy.

Relative performance was strong during the first half of the financial year. This continued well into the second half until February and March 2025 when both uncertainty around US trade policy and a drop in confidence in UK economic growth impacted UK equities and growth companies in particular. Attribution numbers for the year show that stock selection was the primary driver, with 4Imprint and Renishaw the largest detractors. BGUK’s managers say that, whilst the backdrop has improved, the market remains sensitive to unexpected bad news, particularly for growth businesses.

Top positive contributors for the year to 30 April 2025

Figure 12 lists the top five contributors to performance for the year ended 30 April 2025. Games Workshop and Volution are discussed below, while St. James’s Place is discussed in the asset allocation section on page 11. Shell and Glencore International feature in the list because both performed poorly during the period, and neither was held within BGUK’s portfolio.

Figure 11: Cumulative total return performance over periods ending 31 July 2025

| 3 months (%) | 6 months (%) | YTD (%) | 1 year (%) | 3 years (%) | 5 years (%) | BG tenure1 (%) | 10 years (%) | |

|---|---|---|---|---|---|---|---|---|

| BGUK NAV | 15.9 | 6.3 | 12.9 | 13.2 | 27.7 | 36.1 | 27.4 | 57.5 |

| BGUK share price | 16.1 | 6.4 | 17.1 | 18.5 | 26.5 | 33.7 | 24.5 | 56.6 |

| MSCI UK | 7.8 | 7.4 | 13.8 | 12.7 | 36.6 | 90.1 | 56.4 | 99.5 |

| MSCI UK Growth | 5.0 | 5.3 | 11.7 | 8.8 | 23.8 | 54.6 | 66.7 | 106.8 |

| MSCI World | 13.1 | 0.8 | 5.2 | 12.8 | 44.9 | 93.5 | 125.6 | 240.1 |

| Peer group average NAV2 | 11.2 | 7.6 | 11.6 | 6.5 | 30.1 | 78.1 | 45.7 | 89.8 |

| Peer group average share price2 | 12.5 | 10.5 | 15.5 | 7.5 | 34.1 | 82.8 | 45.3 | 93.9 |

Figure 13: Games Workshop share price (GBp)

Source: Bloomberg

Games Workshop is a British manufacturer of products for playing fantasy tabletop games, using figurines that the customers paint themselves, and is best known for its Warhammer and Warhammer 40,000 series of products. We last discussed Games Workshop in detail in our September 2023 note (see page 11 of that note), where we explained how the company had been a COVID beneficiary and, while there had been concerns that this benefit would unwind, that the increased earnings and revenues have proven to be sustained. This continues to be the case.

BGUK’s managers say Games Workshop’s “raw material is compelling”. It continues to deliver on the operational side (for example, the new Space Marine II game has been well received, with both the company and its partners executing well on this) and is tracking well ahead of where they expected it to be.

The company continues to have expansion plans on the licensing side and, while BGUK’s managers acknowledge that much will depend on execution, it is the licensing deals that have driven recent strength (these deals are very high-margin and revenues doubled this year) and managers expect this will be a key area of growth over the next 10 years. The company is working on an Amazon TV series, and whilst there is naturally some uncertainty around this, the managers believe the chances of success are high as Games Workshop is heavily involved in its production.

The managers also believe that licensing success could create a virtuous circle as others in the space will see the success and want to partner with the company and utilise its IP. That said, BGUK’s managers have recently trimmed the position on valuation grounds. They still retain a positive view on the company, but acknowledge that the shares have performed very well and the valuation is therefore more elevated.

Figure 14: Volution share price (GBp)

Source: Bloomberg

Volution is a manufacturer and supplier of ventilation products from simple extractor fans to more complex heat recovery solutions. We discussed it in detail in our August 2024 note – see page 11 of that note – where we explained that BGUK’s managers see a long-term structural trend of efforts to improve air quality, with demand for Volution’s products benefitting from environmental regulations in building and construction – for example, heat recovery ventilation solutions are already helping customers to meet new energy efficiency building standards.

As is illustrated in Figure 14, Volution’s share price responded positively following the announcement of its half-year results in March, which showed adjusted operating profit of £42.6m, up 10.4% on the prior year, with expansion of adjusted operating margin to 22.7% (H1 2024: 22.4%) driven by operational performance. This allowed a 21.4% hike in the interim dividend to 3.4p. The share price was impacted by uncertainty caused by US trade policy but has since rebounded and continued to strengthen, hitting new highs.

The interim results showed 4% organic growth in revenue, and BGUK’s managers continue to believe the structural tailwinds Volution benefits from could boost organic growth for years to come. Volution is another example of a BGUK holding that has maintained its market position by consistently reinvesting in its business to drive innovation.

Top detractors for the year to 30 April 2025

Figure 15 provides the top five detractors for the year ended 30 April 2025. Renishaw and Ashtead are discussed below, while 4imprint is discussed in the asset allocation section on page 9. HSBC and Rolls Royce feature in the list because both performed well during the period, and neither were held within BGUK’s portfolio.

Figure 15: Top five negative contributors to return

| Stock | Total return (%)1 | Contribution (%) |

|---|---|---|

| 4imprint | (44.2) | (2.2) |

| Renishaw | (44.7) | (1.9) |

| Ashtead | (30.4) | (1.2) |

| HSBC2 | 30.7 | (1.1) |

| Rolls Royce2 | 84.1 | (1.1) |

Figure 16: Renishaw share price (GBp)

Source: Bloomberg

Renishaw (a long-standing BGUK holding) is a world-leading British engineering group specialising in precision measurement, additive manufacturing, and analytical instrumentation. The company has built a diversified portfolio serving industries from aerospace and electronics to healthcare, where its metal 3D printing and neurosurgical systems deliver high-value products.

While Renishaw’s manufacturing is firmly anchored in the UK, it has a global sales and service footprint, and benefits from the resilience offered by having vertically integrated model. It is another BGUK holding that has a long-term commitment to R&D, potentially leaving it well-positioned to benefit from structural growth drivers in automation, advanced manufacturing, and life sciences.

The market reacted negatively to its interim results in February, which missed analyst expectations. Currency headwinds, supply-chain costs and issues with the product mix weighed on profitability and pre-tax profits of £57.5m – around £7m below forecasts – and a dividend freeze, pushed the share price down to around eight-year lows.

The company is economically sensitive and is particularly exposed to the semiconductor and electronics sectors (it appears that when demand for these areas softens, so does demand for Renishaw’s precision measurement tools), which has also been another factor amid a weakened economic outlook in the context of changing US trade policy, although the share price has rebounded financial year end as some of these risks have receded.

In contrast to its interims, the company’s third-quarter results were received more positively by the market. These included the decision to close the loss-making drug delivery part of the company’s neurological business, which is expected to lead an annual increase in group operating profit of around £3m once complete.

While acknowledging recent frustrations, BGUK’s managers say that the long-term drivers underpinning Renishaw’s growth remain unchanged and whilst the business is cyclical, the company has demonstrated operational flexibility – a combination of diversification in its product base and the vertical integration and control of its manufacturing – allowing it to exit downturns in a strong position.

Figure 17: Ashtead share price (GBp)

Source: Bloomberg

Ashtead is an international equipment rental company. It has national networks in the US, UK, and Canada; although over 80% of its business is in the US, where it is the second-largest provider with stores in 49 states. In our August 2024 note we noted that it had been one of the strongest contributors for the 2024 financial year.

At that time, BGUK’s managers described it as one of the most exciting growth stories in the UK market, believing that it could double its market share again over the following decade. Their rationale was that Ashtead is benefitting from a long-term trend towards renting plant and equipment, rather than owning it, and acting as a consolidator in a highly fragmented industry where smaller operators face competitive pressures.

However, rental growth has slowed, reflecting weakening US construction on the back of higher interest rates and supply chain issues. In late December 2024, the company issued a profit warning citing this as the primary driver.

As with Renishaw, BGUK’s managers acknowledge Ashtead’s challenges, but see this as a cyclical issue that it is well-positioned to navigate. They think its long-term structural growth drivers remain intact, and that a more challenging period could, as with 4imprint, accelerate Ashtead’s rate of consolidation and market share gains as smaller market participants face constraints.

Peer group

Please click here to visit QuotedData.com for a live comparison of the UK all companies peer group.

BGUK sits in the UK All Companies sector, which now has five members, down from seven in our last note, following Artemis Alpha’s merger with Aurora to create Aurora UK Alpha, and the wind-up of Henderson Opportunities. Members of UK all companies will typically have:

- over 80% invested in quoted UK shares;

- an investment objective/policy to generate majority of returns from capital growth.

- a majority of investments in medium- to giant-cap companies;

- a majority of expenses allocated to capital; and

- a UK benchmark.

A range of styles within the peer group

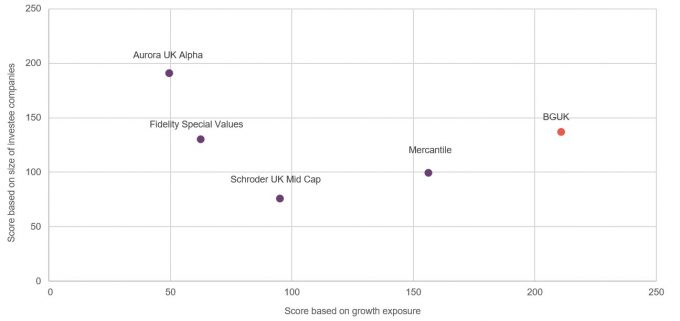

Figure 18: Holdings-based style map1

Source: Morningstar, Marten & Co. Note: 1) Scores use information retrieved on 22 August 2025.

Whilst the peer group is fundamentally capital-growth-focused, Morningstar’s analysis suggests that the Baillie Gifford approach is characterised by a particularly high emphasis on growth, which is a differentiating factor when comparing BGUK to its peers.

Figure 18 provides a graphical representation of BGUK’s investment style versus its UK All companies peers. The Y-axis (or vertical axis) is a size score – the larger the score, the larger the underlying investments in the portfolio, while the X-axis (or horizontal axis) is a measure of the growth and value factors (the larger the score, the more growth-orientated the trust’s portfolio).

BGUK potentially has the most growth-orientated strategy in its peer group.

BGUK remains the most growth-orientated strategy. Its size exposure is towards the larger end of the peer group, although there is clear distance between BGUK and Aurora UK Alpha, reflecting the fact that BGUK operates with more of an all-cap strategy than Aurora UK Alpha.

It is also apparent that the UK all companies sector offers a range of different propositions, in terms of their value-growth tilt and size bias. Fidelity Special Values and Aurora UK Alpha have a much stronger bias towards value, while Schroder UK Mid Cap’s and Mercantile’s portfolios are focused further down the market cap scale.

Peer group performance

Baillie Gifford took over the management for BGUK at the end of June 2018 following a period of poor relative performance under the previous manager. It has, therefore, managed the portfolio for a little over seven years, which has been a particularly challenging period for markets in general, but particularly for BGUK and growth-orientated peers, as interest rates have risen in response to rising inflation.

Figure 19: Peer group cumulative NAV total return performance to 31 July 2025

| 1 month (%) | 3 months(%) | 6 months (%) | YTD (%) | 1 year (%) | 3 years (%) |

5 years (%) |

BG’s tenure*(%) | |

|---|---|---|---|---|---|---|---|---|

| BGUK | 6.2 | 15.9 | 6.3 | 12.9 | 13.2 | 27.7 | 36.1 | 27.5 |

| Aurora | (3.1) | 3.1 | 4.0 | 8.2 | (2.8) | 25.0 | 90.6 | 42.3 |

| Fidelity Special Values | 3.3 | 12.3 | 12.1 | 15.9 | 14.1 | 46.1 | 131.0 | 74.7 |

| Mercantile | (0.3) | 8.2 | 6.1 | 9.1 | 2.8 | 31.9 | 65.5 | 44.8 |

| Schroder UK Mid Cap | 2.0 | 16.7 | 9.4 | 12.3 | 4.8 | 19.9 | 67.2 | 39.3 |

| BGUK rank | 1/5 | 2/5 | 3/5 | 2/5 | 2/5 | 3/5 | 5/5 | 5/5 |

| Sector arithmetic avg. | 1.6 | 11.2 | 7.6 | 11.6 | 6.5 | 30.1 | 78.1 | 45.7 |

| Sector arithmetic avg. exc. BGUK | 0.5 | 10.1 | 7.9 | 11.3 | 4.8 | 30.7 | 88.6 | 50.3 |

This has also been a period where UK equities have been less favoured by international investors, with small-cap equities disproportionately affected, which has also weighed on these funds’ performance, impacting their longer-term track records, BGUK perhaps being more impacted than most because of its strong bias to growth.

However, more recently, as investors’ attention has shifted away from the US (possibly due to increased political and economic uncertainty, including the implementation of new trade policy under the current administration), the UK has seen increased investor interest. Larger stocks have seen the strongest gains so far. In addition, while there has recently been an uptick in inflation, the trend still appears to be towards lower interest rates as central banks look to stimulate slowing economies, which is also supportive of growth stocks. These trends may continue.

As is illustrated in Figure 20, BGUK ranks fourth out of five in terms of market capitalisation, although its size is not dissimilar to either Aurora (which is much bigger than it was, having absorbed Artemis Alpha) and Schroder UK Mid Cap. Despite a trend towards repurchasing shares, most of the funds have seen a notable increase in market capitalisation since we last published, reflecting their performance.

BGUK has the widest discount in the sector, although its discount broadly comparable to those of Aurora and Mercantile.

BGUK’s ongoing charges remain slightly above the average for the peer group, although the peer group average of 0.68% is pulled down by Aurora (which has a lower ongoing charge due to the absence of a base management fee, offset by a performance fee) and Mercantile (which benefits from its significantly larger scale – its market cap is 2.4 times the sector average).

Figure 20: Peer group comparison – size, fees, discount, and yield as at 22 August 2025

| Market cap (£m) | St. dev. of NAV returns over 5 years | Ongoing charges (%) | Perf. fee | Premium/ (discount) (%) | Dividend yield (%) | Gross gearing (%)3 | Net gearing (%)3 | |

|---|---|---|---|---|---|---|---|---|

| BGUK | 252 | 21.1 | 0.71 | No | (10.6) | 2.8 | 8.4 | 7.3 |

| Aurora | 287 | 21.4 | 0.451 | Yes1 | (9.4) | 1.3 | Nil | (1.0) |

| Fidelity Special Values | 1,255 | 17.6 | 0.70 | No | (3.3) | 2.5 | 13.7 | 5.9 |

| Mercantile | 1,816 | 23.7 | 0.48 | No | (9.9) | 3.0 | 14.6 | 12.5 |

| Schroder UK Mid Cap | 240 | 22.3 | 1.05 | No | (7.3) | 3.1 | 7.8 | 10.0 |

| BGUK rank2 | 4/5 | 2/5 | 4/5 | 5/5 | 3/5 | 3/5 | 3/5 | |

| Sector arithmetic avg. | 770 | 21.2 | 0.68 | (8.1) | 2.5 | 8.9 | 6.9 | |

| Sector arithmetic avg. exc. BGUK | 899 | 21.3 | 0.67 | (7.5) | 2.5 | 9.0 | 6.9 |

Gearing is another consideration, and this can be more of a concern for investors when markets are at more elevated levels. BGUK’s gearing levels (data as at the end of July 2025) are broadly in line with the sector averages.

BGUK, like most of the funds in this peer group, does not pay a performance fee.

Traditionally, in what is a capital-growth-focused sector, BGUK’s yield has tended to be low and modestly below the sector average. However, the yield is currently modestly above the sector average. As discussed in the dividend section below, BGUK’s board has decided to draw on the trust’s reserves to increase the dividend by 0.1p to 5.7p per share.

The volatility of BGUK’s NAV has tended to be one of the lowest in its peer group over the longer term, a feature that has been retained since the management contract moved to Baillie Gifford.

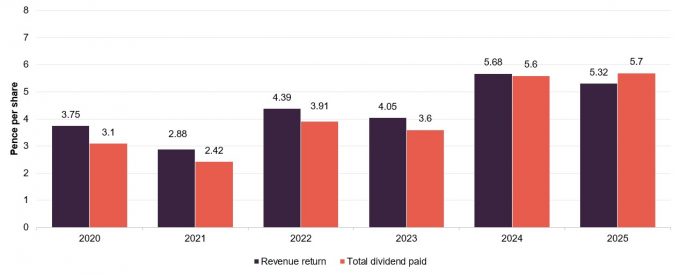

Dividend

BGUK’s investment strategy focuses on generating capital growth for shareholders and dividends are paid to the extent that they are required to maintain BGUK’s investment trust status. As such, whilst the UK has traditionally been one of the higher-yielding markets, dividends are likely to form a small component of shareholders overall returns and BGUK pays one dividend after the AGM each year. This is paid as a final dividend, following shareholders’ approval at the AGM (now usually in September).

For the year ended 30 April 2025, BGUK’s board is proposing the payment of a final dividend of 5.7p per share (2023: 5.6p per share), which is equivalent to a yield of 2.8% on the trust’s share price of 204.0p per share as at 22 August 2025. With revenue income of 5.32p per share for the year (partly due to reduced dividends from 4imprint and St James Place, and the sale of positions in Rio Tinto and Hargreaves Lansdown), the FY25 will require a small drawdown from revenue reserves but the trend has been one of BGUK paying a covered dividend.

Figure 21: BGUK revenue income and dividend by financial year (ended 30 April)

Source: Baillie Gifford UK Growth Trust

BGUK’s revenue income has exceeded its dividend in recent years, allowing the trust to build on its revenue reserve. As at 30 April 2025, BGUK had a revenue reserve of £17.6m or 13.57p per share (30 April 2024: £18.2m or 12.41p per share). BGUK is also permitted to pay dividends out of its capital profits.

Structure

Fees and costs

Low base fee of 0.5% per annum; no performance fee

Baillie Gifford earns a management fee of 0.5% per annum of net assets, calculated and paid quarterly in arrears. There is no performance fee. The agreement can be terminated by Baillie Gifford with six months’ notice and by BGUK with three months’ notice.

Secretarial and administrative services

Baillie Gifford & Co Limited also provides company secretarial and administrative services, all covered by the management fee. The Bank of New York Mellon (International) acts as depositary and custodian. Its fees are not disclosed, but are included in the trust’s administrative expenses.

Allocation of fees and costs

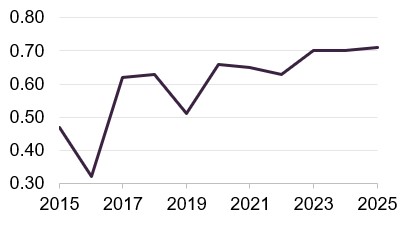

Figure 24: BGUK ongoing charges ratio (%)1

Source: Baillie Gifford UK Growth Trust Note: 1) For financial years ended 30 April.

The management fee is split 30% to revenue and 70% to capital, reflecting the board’s view of the long-term balance of returns. The ongoing charges ratio for the year to 30 April 2025 was 0.71%, marginally higher than 0.70% a year earlier, reflecting a slight increase in costs and the impact of share buybacks. Baillie Gifford took over management in 2018 and waived its fee for 2019, cutting the ongoing charges ratio to 0.51% (which could otherwise have been 0.76%).

Growth in assets and share issuance drove BGUK’s ongoing charges ratio lower between 2020 and 2022, before weaker markets pushed it higher in 2023. It held steady in 2024, with recovering capital values offsetting the impact of buybacks.

Capital structure and life

Simple capital structure

BGUK has one class of ordinary share in issue. It can gear up to 20% of net assets.

BGUK has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 22 August 2025, there were 160,917,184 in issue with 37,495,000 of these held in treasury and 123,422,184 in general circulation.

BGUK can borrow, but net gearing is capped at 20% of net assets. The board sets and periodically reviews limits to ensure that gearing levels are appropriate to market conditions. As at 31 July 2025, BGUK had gross gearing of 8.4% and net gearing of 7.3% of net assets.

Major shareholders

BGUK has a significant retail presence on its share register.

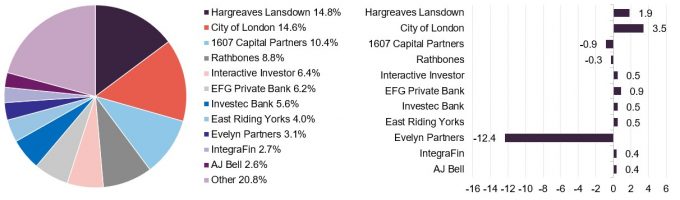

Major D2C platforms make up around 25% of the register. Wealth managers and intermediaries account for roughly 40%. Since our last update, the main change is the reduction in holding by Evelyn Partners, but otherwise, most institutions and wealth managers have been modestly increasing their positions.

Figure 25: Major shareholders as at 13 August 2025

Figure 26: Percentage point changes in shareholdings since 5 August 20241

Source: Bloomberg, Marten & Co

Source: Bloomberg, Marten & Co. Note: 1) The date of the shareholder data used when we last published on BGUK.

Unlimited life with a five-yearly continuation vote

BGUK has no fixed life, but shareholders vote on its continuation every five years via a special resolution at the AGM. If not approved, the board would put forward proposals to liquidate or otherwise restructure the trust. The last vote, in August 2024, passed. The next is due in 2029, although an additional vote will be held in 2027. A performance-triggered tender is also planned for 2029 if BGUK’s NAV per share underperforms the All-Share over the five years to 30 April 2029.

Financial calendar

The trust’s year-end is 30 April. The annual results are usually released in June or July (interims in November or December) and its AGMs are usually held in September of each year – this year’s is on 3 September. As discussed earlier, BGUK pays one final dividend a year after the AGM if one is required to be paid.

Corporate history

Baillie Gifford has been managing BGUK for just over seven years.

BGUK is a UK investment trust that was originally incorporated on 28 January 1994 as the Schroder UK Growth Fund Plc. The trust, which listed on the London Stock Exchange following its IPO on 10 March 1994, has a premium main market listing. On 13 April 2018, the trust’s board announced that it had decided to terminate the management arrangements with Schroder Unit Trusts Limited and appoint Baillie Gifford & Co Limited in its stead. Baillie Gifford was appointed with effect from 30 June 2018, with the trust changing its name to Baillie Gifford UK Growth Fund Plc at the same time. On 25 May 2021, the trust changed its name again to Baillie Gifford UK Growth Trust Plc. Baillie Gifford has now been managing BGUK for just over six years.

Management team

Iain McCombie

Iain joined Baillie Gifford in 1994 and has spent the majority of his career as an investment manager in the UK equity team. He became a partner in 2005. Iain graduated with an MA in Accountancy from the University of Aberdeen, and qualified as a Chartered Accountant.

Milena Mileva

Milena joined Baillie Gifford in 2009 and is an investment manager in the UK equity team. She became a partner in 2022. Milena graduated with a BA in Social & Political Sciences from the University of Cambridge in 2007 and an MPhil in Politics from the University of Oxford in 2009.

Board

All directors retire and stand for re-election annually.

BGUK’s board currently comprises five directors, all of whom are non-executive and considered to be independent of the investment manager. BGUK’s articles of association require that newly-appointed directors offer themselves for election at the next AGM. It is board policy that all directors retire and offer themselves for re-election at each AGM.

Figure 27: Board member – length of service and shareholdings

| Director | Position | Date of appointment | Length of service (years) | Annual fee (GBP) 1 | Shareholding2 | Years of fee invested3 |

|---|---|---|---|---|---|---|

| Neil Rogan | Chairman | 1 January 2024 | 1.7 | 46,500 | 84,861 | 3.7 |

| Andrew Westenberger | Chair of the audit committee | 5 May 2017 | 8.3 | 36,000 | 20,000 | 1.1 |

| Ruary Neill | Senior independent director | 15 November 2018 | 6.8 | 32,500 | 36,707 | 2.3 |

| Cathy Pitt | Director | 5 August 2021 | 4.1 | 31,000 | 16,487 | 1.1 |

| Seema Paterson | Director | 2 January 2025 | 0.6 | 31,000 | 10,000 | 0.7 |

| Average (service length, annual fee, shareholding, years of fee invested) | 4.3 | 35,400 | 33,611 | 1.8 |

The average length of service is 4.3 years, with Andrew Westenberger, the chair of the audit committee, being the longest-serving, with 8.3 years of service under his belt. Other than BGUK’s board, its directors do not have any other shared directorships. The company’s articles of association limit the aggregate fees payable to the directors to a total of £200,000 per annum, shareholders will be asked to increase this to £250,000 at the forthcoming AGM. The average fee rates for the individual director positions for the current financial year have increased by 4.4% over FY25.

Recent share purchase and disposal activity by directors

Since we last published, there have been investments by BGUK’s directors in the company’s shares by four of its directors, with Neil Rogan increasing his shareholding over 5x during FY25; Ruary Neill 3.1x; Cathy Pitt 2.1x; and Seema Paterson, BGUK’s newest director, making her inaugural purchase of shares. There have been no share sales since we last published. As illustrated in Figure 38, all of BGUK’s directors have personal investments in the fund. The average interest is equivalent to 1.8 years or more of their fees, which is an increase over the 0.7 years when we last published.

Neil Rogan (chairman)

Neil was appointed to BGUK’s board in January 2024 and subsequently became its chairman on 14 June 2024. He is chairman of Invesco Asia Trust Plc and a director of JPMorgan Global Growth & Income Trust Plc. Prior to this, he was an investment manager with Touche Remnant, Flemings and most recently Gartmore/Henderson where he was head of global equities. He was also previously the chairman of Murray Income Trust Plc and a director of The Scottish Investment Trust Plc.

Andrew Westenberger (chairman of the audit committee)

Andrew was appointed a director in 2017 and became chairman of the audit committee in 2017. He is the chief executive officer of Hurst Point Group. Previously, he was chief financial officer of Tysers Insurance Brokers, a leading independent specialist broker and risk management firm. He was also group finance director of Brewin Dolphin Holdings Plc and Evolution Group Plc, a non-executive director and trustee of the Chartered Institute of Securities and Investments and held senior finance roles at Barclays Capital and Deutsche Bank. He is a Chartered Accountant.

Ruary Neill (senior independent director)

Ruary was appointed a director in 2018 and became senior independent director in 2021. He is currently a director of JP Morgan Emerging Markets Investment Trust Plc. Previously, he worked in investment banking at UBS Investment Bank, prior to which he spent several years in the financial sector working in Asian Equity Markets for UBS Investment Bank and Schroder Securities.

Cathy Pitt (director)

Cathy was appointed a director in 2021. She is a former consultant partner at international law firm CMS and has over 20 years’ experience advising boards and asset managers on a broad range of corporate matters. She is a non-executive director of Gresham House Energy Storage Fund Plc and the Association of Investment Companies.

Seema Paterson (director)

Seema Paterson was appointed a director in 2025. She is currently chief financial officer and board director of This Works Products Limited. She sits as chair of the audit committee of CQS Natural Resources Growth and Income Plc and also serves on the board of Resurgo Trust, a youth employment charity based in London. She previously worked in mergers and acquisitions at Société Générale and in corporate finance at Collins Stewart. She is a Chartered Accountant.

Previous publications

Readers interested in further information about BGUK may wish to read our previous notes, which are detailed in the table below. You can read the notes by clicking on the links in the table or by visiting our website.

Figure 30: QuotedData’s previously published notes on BGUK

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Baillie Gifford UK Growth Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.