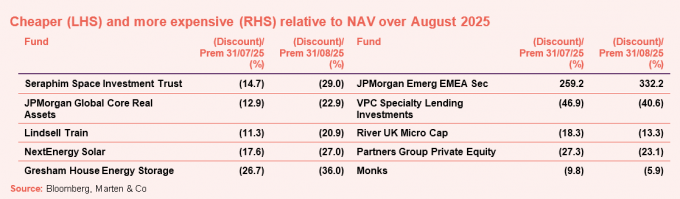

Cheaper trusts

Looking at August’s biggest discount shifts, Seraphim Space (SSIT) appeared to plunge from a 14.7% discount to a 29.0% discount over the month. Today, the discount stands at 31.5%. At first glance, the reason for this is hard to fathom. Andrew McHattie mentioned the trust on the show on Friday (13:07) – highlighting the volatility of its share price, but he wasn’t sure what has caused it apart from a general selloff of growth stocks.

However, there may be a clue in the table as two of the other trusts that saw their discounts widen markedy over the month were NextEnergy Solar (NESF) and Gresham House Energy Storage (GRID).

What links these is their sensitivity to long-term UK interest rates. The Bank of England cut short-term rates to 4% in August, but – as you can see in the chart below – the yield on 30-year gilts (the price of government borrowing over 30 years) rose by 0.224 percentage points to levels that we haven’t seen in decades.

The problem is that assets that provide a stream of cash flows into the future (as renewables do) are less valuable when rates rise (as the NAV is worked out by discounting those cash flows back into present day terms and the discount rate used for that is sensitive to government borrowing costs).

That also pulls down the value of growth stocks such as Seraphim, where cash flows that they will generate over their lives is skewed towards the future rather than the present.

So, maybe this feels a bit scary, but – if you are as old as me (knocking 60), it feels much more like a return to more normal levels of interest rates after a period (after 2008’s financial crisis) of abnormally low rates. That takes a bit of adjusting to, but does not spell the end of the world.

Crucially, for Seraphim, the demand for the services of the companies that it has backed is in no way diminished. A vast leap in defence spending underpins an attractive outlook and could help more of its companies hit decent levels of profitability earlier – reducing the impact of higher long term rates.

While reductions in power price forecasts have been weighing on this sector, the renewables companies already looked oversold to us anyway. We could be in for an exciting few months, if – as I suspect – we see more corporate activity in the sector. Remember, we have already had bids for Harmony Energy Income (HEIT), and Downing Renewables and Infrastructure (DORE). Saba is stalking SDCL Energy Income (SEIT). Achilles (AIC) is out there too.

These discount moves feel like overreactions. As a clue to this, NextEnergy’s discount spiked out by 9.4%. Based on its forecasts in its end March 2025 annual report, if that was the only factor moving the NAV, that is equivalent to a 1.9% permanent increase in its discount rate or more than 8x the move we saw in the 30-year gilt over August.

Lindsell Train (LTI) also needs a mention. The run of poor returns on its flagship UK equity income funds has pushed its 10-year figures down to the bottom of the second quartile. In share price terms, Finsbury Growth and Income (FGT) now ranks 10th of 18 UK equity income trusts over 10 years. That is weighing on the valuation of the asset management company within Lindsell Train’s NAV.

More expensive

JPMorgan Emerging Europe, Middle East and Africa (JEMA) rallies on hopes of an end to the war (like the Putin/Trump meeting in Alaska) and then sells off again when nothing happens. However, it is important to remember that it also remains embroiled in a tussle over the ownership of its Russian assets with VTB Bank ; it could still end up with nothing.

River UK Micro Cap (RMMC) said it would offer investors a 100% exit in three years’ time if it hadn’t handed back at least £10m in the meantime – see our story here.

Partners Group Private Equity (PEY) promised to do something about its discount – you can read our story here