Hi Fidelity!

AVI Japan Opportunity (AJOT) has published proposals for a combination with Fidelity Japan Trust (FJV) that could improve liquidity in AJOT’s shares, lower its ongoing charges ratio, and give the manager greater resources to encourage beneficial change within AJOT’s portfolio.

FJV shareholders are being offered the opportunity to switch into a trust with a better performance track record, and greater emphasis on discount control. While they have a cash option available to them as part of the deal, AJOT’s annual exit opportunities – the next of which is due shortly – suggest that this is not a one-off chance to cash in their investment, and so the cash option may be undersubscribed.

In addition, AJOT’s managers say that they have no shortage of potential investments, and that they see plenty of upside from the existing portfolio.

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a concentrated portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors (AVI) leverages its four decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

| 12 months ended | Share price total return (%) | NAV total return (%) | MSCI Japan Small Cap TR (%) | MSCI AC World total return (%) |

|---|---|---|---|---|

| 30/09/2021 | 16.8 | 12.0 | 10.2 | 22.8 |

| 30/09/2022 | (11.5) | (4.3) | (12.0) | (3.6) |

| 30/09/2023 | 7.7 | 4.1 | 8.1 | 10.7 |

| 30/09/2024 | 22.9 | 26.3 | 9.0 | 20.5 |

| 30/09/2025 | 29.5 | 27.3 | 19.7 | 17.3 |

Fund profile

More information is available at the fund’s website www.ajot.co.uk

AJOT is an investor in Japanese companies. Its focus is on small- and mid-cap listed companies that have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage with these companies to realise value. Further detail on AJOT’s investment philosophy and approach was included in the last note on the trust, a link to which is provided on page 14.

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund, who is part of a seven-person team focused on Japan, with one member based permanently in Japan and the majority of whom are Japanese-speakers. There is a plan to continue to grow the team in the near future.

AVI and its employees are aligned with shareholders

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has total AUM of about £2bn. AVI began investing in Japan over four decades ago and AJOT was launched in October 2018 to focus on opportunities in that market. At the end of September 2025, AVI and its employees owned over 3.3m shares in AJOT.

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in sterling terms. The index does not inform AJOT’s portfolio construction. AJOT reports a high active share relative to the performance benchmark.

The merger

S110 combination with FJV, 50% cash exit at 1% discount for FJV shareholders who want it

On 12 August 2025, AJOT announced that it had entered into non-binding heads of terms with the board of Fidelity Japan Trust (FJV) regarding a proposed combination of the two trusts’ assets. The structure of the deal involves a s110 reconstruction and members’ voluntary winding up of FJV. New AJOT shares would be issued for FJV shares based on the ratio of the formula asset values (NAV less costs) of the two trusts. A cash exit facility is available for FJV shareholders, priced at a 1% discount to NAV and capped at 50% of FJV’s issued share capital.

Costs offset against uplift from providing cash exit at a discount and AVI contribution

The costs of the transaction that are attributable to the FJV rollover into AJOT shares will be capped at £1m. An amount equivalent to the cash exit charge will be set against costs. 1% of half of FJV’s net assets at the time of publication would be about £1.3m. Depending on the size of the rollover (and hence the cost contribution from this source), AVI will also make a contribution, capped at £1m, towards the costs of the deal.

Shareholders of both trusts are scheduled to vote on the deal at meetings to be held on 6 November 2025 (AJOT), and 7 November 2025 and 27 November (FJV).

The AVI team has outlined the potential benefits of investing with AJOT in a video, which can be viewed here. As discussed below, there are several reasons that the team believes FJV and AJOT shareholders may wish to support the deal.

Track record and prospects

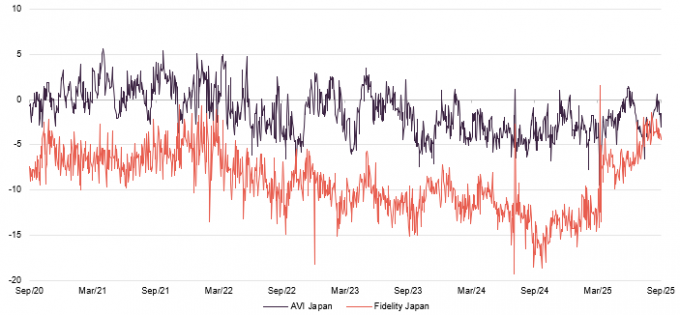

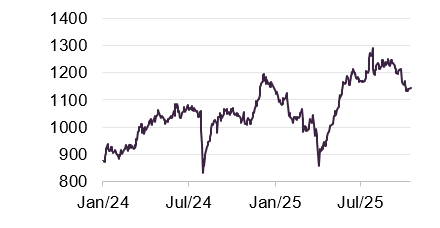

Figure 1: AJOT and FJV share price total returns over five years ended 30 September 2025

Source: Bloomberg, Marten & Co

The gap between AJOT and FJV’s returns to shareholders over the past five years is notable. If investors in FJV had held AJOT instead, their returns would have been more than 50% higher.

However, this begs the question, is AJOT’s run of good performance sustainable?

No shortage of potential investments, FJV cash redeployed within 10 weeks

AJOT’s managers state that there is no shortage of potential investments for the trust, and they report that they are increasingly finding it easier to engage with companies with the aim of unlocking value and improving returns.

The manager estimates that the extra resources that a merger with FJV would bring could be deployed within 10 weeks and may allow AJOT to take larger and potentially more influential positions in some target companies.

The opportunity appears to persist, in part, because the pool of stocks in the investment universe is large (there are around 4,000 listed companies in Japan) and these stocks often have little or no analyst coverage, so mispricing may persist longer than it otherwise would.

Attitudes towards corporate governance are shifting

Initiatives that the government, regulators, and the stock exchange have taken to improve corporate governance appear to be having an impact. AJOT’s manager says that the culture appears to be shifting, and companies are recognising that change may be needed. Buybacks and dividends are becoming more prevalent, they add, commenting that domestic investors appear to be becoming more activist and AJOT often finds that it is investing alongside shareholders with similar objectives.

Japanese equities are undervalued relative to peers

Japanese equities appear undervalued relative to developed market peers and foreign investors have an underweight exposure to what is, based on MSCI index weightings, the second-largest market in the world

The Japanese economy appears to be changing in the context of persistent inflation and rising interest rates. Domestic investors, who have held sizeable cash reserves, now have a greater incentive to switch some of that into stocks. Wages are rising, which may boost consumer spending over time. The tourism sector is also experiencing growth.

Trump’s tariff policies appear to have caused some setback in the market earlier in the year, but a trade deal was agreed in the summer.

The choice of Sanae Takaichi as the new leader of the LDP, the senior party in Japan’s governing coalition, seemed to be received positively by the market, although the subsequent collapse of that coalition also provided what appears to have been a temporary hit to confidence. The LDP has since built a new coalition without the Komeito party, which may be supportive to Japan’s defence sector.

Tighter discount

The AJOT board states that it is in the interests of shareholders to maintain a mid-market price for its ordinary shares that is as close as possible to NAV. The board monitors the discount over rolling four-month periods and will buy back stock if the average discount exceeds 5%. The discount may also be limited by the annual exit opportunity (see below).

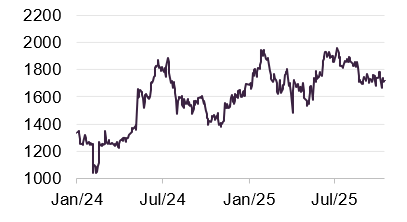

Figure 2: AJOT and FJV premium/discount for the five years to 30 September 2025

Source: Bloomberg, Marten & Co

Over the 12 months ended 30 September 2025, AJOT’s shares traded between a 1.5% premium and a 9.5% discount. The average discount over the period was 2.6%. For FJV, the range was 1.6% premium to 18.6% discount and an average of 9.9%.

The discounts on both trusts have been volatile, which appears to be related to macroeconomic events such as “Liberation Day”. AJOT has maintained its discount within a certain range, while FJV’s discount only began to narrow in April 2025, after AJOT expressed an interest in merging with it and following FJV’s failed continuation vote.

At 22 October 2025, AJOT was trading at a 3% discount.

Scale benefits

Even if the cash option is taken up in full, AJOT should end up with assets of about £360m (based on assumptions made around the time of the announcement), making it approximately 50% larger than its current size. All else being equal, this should help to improve the liquidity in AJOT’s shares and could lower the ongoing charges ratio (as discussed below).

Lower fees for AJOT shareholders

AJOT’s management fee is currently 1% of the lower of market capitalisation and net assets. Under the proposals, AJOT will adopt a new tiered fee structure, still based on the lower of market capitalisation and net assets, with a fee of 1.0% on the first £300m, 0.95% on the next £50m, and 0.90% on assets above £350m. AVI will continue to invest a quarter of its fees back into AJOT shares.

The AJOT board estimates that the ongoing charges ratio following the deal will be 1.25% on a normalised basis.

100% exit opportunity available

AJOT has an unlimited life; however, shareholders have a regular opportunity to exit the company at a price close to NAV. The most recent opportunity was announced in October 2024 and took the form of a tender offer for 100% of shares in issue at NAV (after costs associated with providing the tender) less a 2% discount. 3,637,759 shares were tendered at 152.37p per share. These shares were repurchased and cancelled.

In 2024, the board amended the 100% exit opportunity schedule, increasing the frequency from biennially to annually. Details of the next opportunity will be announced soon, and it is expected to be available within the current quarter. The board states that this part of AJOT’s structure may provide additional options for FJV shareholders considering whether to take cash or rollover into AJOT shares.

Asset allocation

At the end of September 2025, AJOT’s gearing was 7.2%, slightly higher than it had been seven months earlier. The gearing was due to JPY6.6bn of drawings on a revolving credit facility that is priced at TONAR+1.55%.

On 30 September 2025, AJOT held 21 positions, four fewer than at the end of February 2025.

The average stock in the portfolio was valued at 8.8x EV/EBIT and had net cash as a percentage of market cap of 12.8%. According to the manager’s assessments, over 44% of the average stock’s market cap was accounted for by net cash, investment securities, and stakes in other companies that were not required for the business.

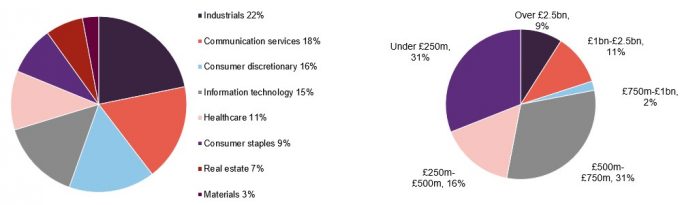

The split by sector appears to reflect AVI’s stock selection decisions. Compared to data as at 28 February 2025, exposure to consumer discretionary has decreased (from 33% to 16%) and exposure to communication services and consumer staples has increased (by nine and seven percentage points, respectively). The split by market cap suggests a continued shift towards smaller companies, as noted in previous reports; although the managers have also invested in some companies towards the top end of AJOT’s target range.

Figure 3: AJOT sector breakdown as at 30 September 2025

Figure 4: AJOT portfolio split by market cap as at 30 September 2025

Source: AVI Japan Opportunity Trust

Source: AVI Japan Opportunity Trust

10 largest holdings

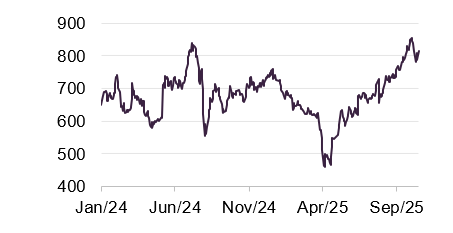

Since the last publication, using data as at end February 2025, four positions – Beenos, TSI Holdings, Tecnos Japan, and Konishi – have exited the top 10, to be replaced by Wacom, Rohto Pharmaceutical, Mitsubishi Logistics, and Broadmedia. As discussed in the previous note, Beenos was subject to a bid and AJOT exited its position in May 2025, crystallising a 127% profit for the trust, which was achieved in less than 18 months. TSI Holdings was sold following a 16% share buy back in July, crystallising a return on investment for AJOT of 92%. The managers noted that the business sold surplus real estate earlier in the year, which they state triggered a significant increase in the share price, as shown in Figure 5. TSI then made a JPY28.3bn acquisition that absorbed much of its cash reserves.

Figure 5: TSI Holdings (JPY)

Source: Bloomberg

Konishi was another stock that was sold to a buyback during the summer. It had been held by AJOT since the inception of the trust and generated a 74% profit for AJOT.

Tecnos Japan is an IT services company that appears to be benefitting from the increasing digitalisation of businesses in Japan. In February, Ant Capital Partners offered a 39% premium to the prevailing share price to acquire AJOT’s stake. In total, AJOT made a 61% profit on its investment.

Figure 6: 10 largest holdings at 30 September 2025

| Holding | Industry | AVI ownership (%)1 | EV/EBIT(x)1 | NFV as % of market cap1 | ROI in JPY(%)1 | Percentage of NAV 30/09/25 | Percentage of NAV 28/02/25 | Change(%) |

|---|---|---|---|---|---|---|---|---|

| Raito Kogyo | Construction groundworks | 4.7 | 7.1 | 33 | 34.5 | 10.9 | 4.9 | 6.0 |

| Wacom | Digital pens | 12.9 | 7.5 | 12 | 12.9 | 10.3 | ||

| Eiken Chemical | Diagnostics | 6.1 | 22.6 | 13 | 36.9 | 9.9 | 8.1 | 1.8 |

| Rohto Pharmaceutical | Pharmaceuticals | 2.8 | 11.3 | 11 | 5.5 | 9.8 | ||

| Mitsubishi Logistics | Logistics | 2.4 | n/a | 183 | 4.0 | 8.1 | ||

| Atsugi | Apparel, stockings | 22.1 | n/a | 112 | 23.0 | 7.8 | 5.9 | 1.8 |

| Kurabo Industries | Conglomerate | 4.8 | 4.9 | 62 | 74.2 | 7.8 | 9.5 | (1.7) |

| Aoyama Zaisan Networks | Wealth management | 8.0 | 11.3 | 11 | 37.2 | 7.3 | 7.3 | – |

| SharingTechnology | Service matching platform | 14.5 | 12.5 | 12 | 28.7 | 7.3 | 6.2 | 1.1 |

| Broadmedia | Online education | 29.1 | 10.9 | 40 | 8.0 | 6.3 | ||

| Total | 9.02 | 463 | 85.5 |

Wacom

Figure 7: Wacom (JPY)

Source: Bloomberg

Wacom (investors.wacom.com) was at one time AJOT’s largest holding (see our February 2022 note, link on page 13). It is a leading manufacturer of digital tablets and pens.

AVI has been engaging with Wacom’s board for some time. In May this year, it launched a public campaign – Draw Wacom’s Future – which included setting out recommendations relating to Wacom’s branded business, governance, capital allocation policy, and investor relations. AVI also put forward a number of resolutions at Wacom’s AGM. These included:

the appointment of one outside director with capital markets background;

the establishment of a Transformation Plan Supervisory Committee;

an amendment to the Articles of Incorporation regarding the handling of acquisition proposals based on the ‘Guidelines for Corporate Takeovers’ by the Ministry of Economy, Trade and Industry;

granting general meetings of shareholders the authority to determine dividends of surplus earnings;

conducting a JPY5bn share buy-back in FY2026; and

defining that total shareholder return (TSR) shall be used as an indicator for the stock-based compensation for internal directors.

A 100+ page presentation on a dedicated website sets out AVI’s thinking on this. You can read this here.

In September, another activist declared a stake in the company, which may help AVI achieve its agenda.

Rohto Pharmaceutical

Figure 8: Rohto Pharmaceutical (JPY)

Source: Bloomberg

We covered Rohto Pharmaceutical (rohto.co.jp) in our last note, noting that the share price decline shown in Figure 8 made it one of the largest detractors to AJOT’s performance over the second half of 2024. In April 2025, AVI launched a public campaign called Awakening Rohto, in which it called for the company to focus on its core business rather than allocating resources to its regenerative medicine business, and to engage with shareholders in a manner that would comply with the Tokyo Stock Exchange’s request for management to be conscious of the cost of capital and stock price.

AVI has prepared an explanation of its stance, which can be read here.

In May, Rohto published its medium-to-long-term growth strategy, covering the period from 2025 to 2035, which included targets for sales growth and margins. This included an increase in its dividend payout ratio to at least 30% and a dividend on equity ratio of 3.5%.

Mitsubishi Logistics

Figure 9: Mitsubishi Logistics (JPY)

Source: Bloomberg

Mitsubishi Logistics (mitsubishi-logistics.co.jp) appeared in Figure 6 as the lowest priced among AJOT’s current top 10 holdings, based on a comparison of its market cap and its net financial value. It is one of the major logistics distribution companies in Japan. AVI states that it considers the operational side of the business to be well-run. The company owns significant real estate, including logistics and distribution warehouses as well as a separate real estate investment portfolio. The properties are generally not revalued in the company’s accounts. AVI reports that it has worked with third-party valuers to estimate the value of these assets. AVI believes that the real estate assets may be worth almost twice the current share price.

Japanese companies are being advised that they should be trading above book value, and there is another value-driven investor on the register. It appears likely that Mitsubishi Logistics may consider monetising its surplus property portfolio.

The company realised JPY11.5bn from the sale of cross-shareholdings earlier this year, which may indicate that it is open to change.

Broadmedia

Figure 10: Broadmedia (JPY)

Source: Bloomberg

Broadmedia (broadmedia.co.jp) is primarily an online education business, although it also operates ancillary businesses, including a fishing channel. Broadmedia’s Renaissance High School Group offers courses in areas such as eSports, entertainment, and beauty.

AVI states that there are two other activist investors on Broadmedia’s share register. AVI has indicated that it would like to see Broadmedia rationalise its conglomerate structure to focus on education, which it believes has significant potential. AVI reports that initial meetings with management have been positive.

Performance

Up-to-date information on AJOT and its peers is available on our website

Although the short-term periods have been more challenging, AJOT’s NAV and share price returns remain ahead of its performance benchmark, the MSCI Japan Small Cap index, over most time periods.

Figure 11: Total return cumulative performance over various time periods to 30 September 2025

| 3 months(%) | 6 months(%) | 1 year (%) | 3 years(%) | 5 years(%) | |

|---|---|---|---|---|---|

| AVI Japan Opportunity share price | 2.6 | 14.1 | 29.5 | 71.4 | 77.1 |

| AVI Japan Opportunity NAV | 5.5 | 11.2 | 27.3 | 67.4 | 79.4 |

| Comparator benchmark | 11.5 | 17.8 | 19.7 | 41.2 | 36.9 |

The nature of AJOT’s investment approach means that returns tend to be influenced by the manager’s stock selection and the outcomes of its campaigns to unlock value.

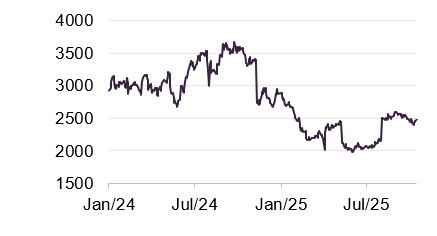

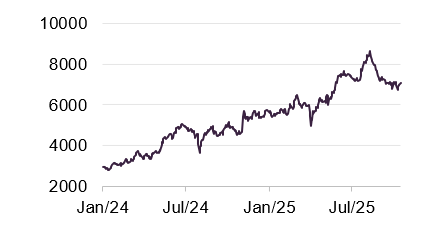

Figure 12: AJOT NAV total return performance relative to MSCI Japan Small Cap index for the five years to 30 September 2025

Source: Bloomberg, Marten & Co

Performance attribution

AVI provided us with data on the leading contributors and detractors from AJOT’s returns over 2025 up to the end of August. The detractors had a relatively minimal influence on returns.

Figure 13: Leading contributors and detractors from AJOT returns 2025 year to end August

| Contribution (GBP %) | Share price return (%) | Contribution (GBP %) | Share price return (%) | ||

|---|---|---|---|---|---|

| Kurabo Industries | 3.57 | 33.0 | Aichi | (0.36) | (10.9) |

| Raito Kogyo | 3.08 | 49.6 | Konishi | (0.30) | (4.6) |

| TSI Holdings | 2.10 | 9.5 | Jade Group | (0.21) | (9.7) |

| Tecnos Japan | 1.79 | 45.7 | SK Kaken | (0.16) | (6.8) |

| SharingTechnology | 1.37 | 23.8 | Helios Techno | (0.11) | (13.1) |

Kurabo Industries

Figure 14: Kurabo Industries (JPY)

Source: Bloomberg

Kurabo Industries (kurabo.co.jp) was the leading contributor to returns over the second half of 2024, which was discussed in the previous note. It is a conglomerate that started as a textile company and now has a presence in chemical products, advanced technology, food and services, and real estate. AVI states that it was attracted by Kurabo Industries’ core business and overcapitalised balance sheet.

The share price has declined from its peak, which may reflect the completion of a JPY6bn share buyback programme that was initiated in November 2024.

AVI noted that the company announced in March that it would close its most unprofitable textile plant and then, in May, announced plans for a 4% dividend on equity target and a new JPY20bn share buyback.

Raito Kogyo

Figure 15:Raito Kogyo (JPY)

Source: Bloomberg

Raito Kogyo (raito.co.jp) operates in the specialist construction sector, with core operations and significant market shares in slope construction and ground improvement, which together account for about 70% of sales orders. Trading appears to have been positive, with results reported ahead of market expectations.

AVI is asking the company to improve its capital efficiency, corporate governance, and shareholder communication.

Previous publications

Readers interested in further information about AJOT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 15 or by visiting our website.

| Title | Note type | Date |

|---|---|---|

| Progress on a number of fronts | Initiation | 20 July 2021 |

| The tortoise triumphs | Update | 15 February 2022 |

| Maintaining its firepower | Annual overview | 21 October 2022 |

| Good governance, better returns | Update | 19 July 2023 |

| The sun has risen | Annual overview | 20 February 2024 |

| Pushing on an opening door | Update | 6 August 2024 |

| Reforms at a tipping point | Annual overview | 24 March 2025 |

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Japan Opportunity Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.