Maintaining its firepower

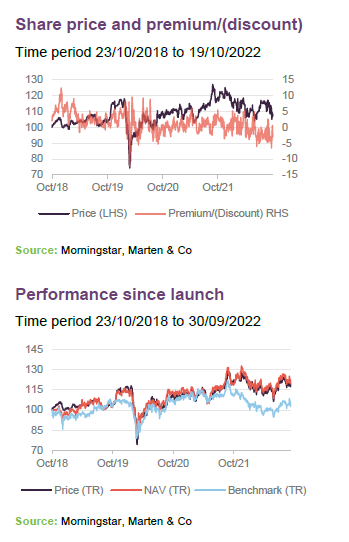

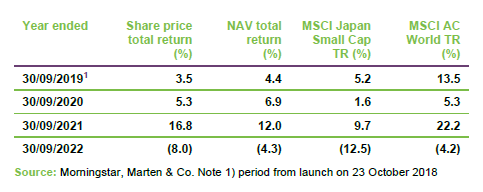

Over the period since it launched, AVI Japan Opportunity Trust (AJOT) has delivered returns well ahead of comparable indices and competing funds. Perhaps encouraged by these good returns, AJOT’s shares have been tending to trade close to NAV.

In light of this, the board, following consultation with major shareholders, felt able to dispense with the 2022 exit opportunity (a two-yearly exit opportunity at a price close to NAV has been a feature of the fund since launch). That means that AJOT’s managers still have considerable firepower to put behind their efforts to continue unlocking value from mispriced Japanese equities.

Unlocking value in Japanese smaller companies

AJOT aims to achieve capital growth in excess of the MSCI Japan Small Cap Index by investing in a focused portfolio of over-capitalised small-cap Japanese equities. Asset Value Investors leverages its three decades of experience investing in asset-backed companies to engage with company management and help to unlock value in this under-researched area of the market.

Why AVI Japan Opportunity?

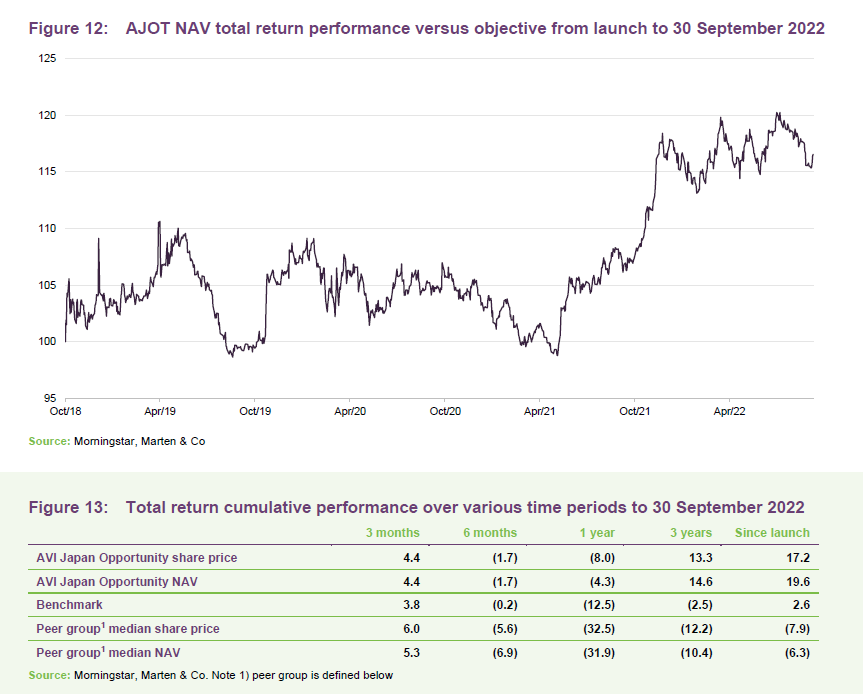

Since its launch in October 2018, AJOT has been building a track record of outperformance of both its performance benchmark (MSCI Japan Small Cap Index) and its peer group, delivering an NAV return of 19.6% from launch to the end of September 2022. Notably, it has done so against a headwind of a weak Japanese yen and a local stock market that has made little progress in four years.

The manager feels that:

- the Japanese market is undervalued;

- smaller capitalisation stocks, AJOT’s hunting ground, have lagged larger cap stocks by a significant margin;

- it is able to identify a deep pool of cash/asset-rich, good quality companies whose valuations do not reflect these attributes;

- AJOT is a beneficiary of a trend towards improved corporate governance and higher levels of corporate activity within Japan; and

- demonstrably, its engagement activities are unlocking the latent value within the companies in its portfolio.

As an indication of the scale of the opportunity, at the end of September 2022, the portfolio was trading on 5.7x EV/EBIT versus a median for the MSCI Japan Small Cap Index of 15.8x. In addition, as an indication of just how much excess cash was sitting on the balance sheets of portfolio companies at the end of June, on a weighted average basis 60% of the market cap of the portfolio was comprised of cash, investment securities (less capital gains tax) and the value of treasury shares less debt and net pension liabilities.

Fund profile

AJOT is an investor in Japanese companies. Its focus is on small and mid-cap listed companies that the manager feels are of good-quality and have a large portion of their market capitalisation in cash, listed securities or other realisable assets. AJOT’s manager seeks to engage proactively with these companies to unlock their value potential.

AJOT’s AIFM and investment manager is Asset Value Investors Limited (AVI). The lead manager working on AJOT’s portfolio is Joe Bauernfreund, one of a seven-strong team focused on Japan, one of whom is based permanently in Japan, and the majority of whom are Japanese-speakers. The team is also complemented by a secondment from a leading Japanese law firm (see page 20 for more detail).

AVI was established in 1985 to manage what is now AVI Global Trust (AGT) and has AUM of about £1.1bn. AVI began investing in Japan over two decades ago and AJOT was launched in October 2018 to focus on the opportunities presented by that market. At the end of September 2022, AVI owned 1,275,000 shares in AJOT.

AJOT compares its performance to the MSCI Japan Small Cap Total Return Index, expressed in Sterling terms. The index does not inform AJOT’s portfolio construction. AJOT will have a high active share relative to the performance benchmark.

Market backdrop

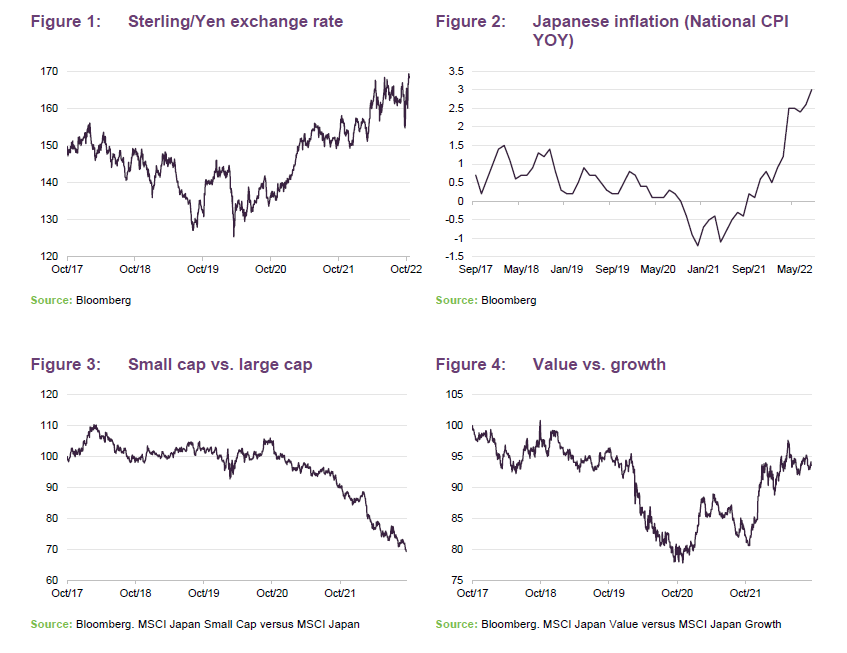

Japan has not been immune to inflationary pressures, but these appear to be much less of a problem than they have been in the US, UK and Europe. At the end of August, Japanese inflation was running at 3.0%, the highest level since September 2014, largely driven by higher food and fuel prices. The manager believes that Japanese monetary policy remains extremely accommodative – Japan is the only country in the world that still has a negative official interest rate. That is in stark contrast to the situation in the US and this has weighed on the Japanese yen. Daniel Lee, AVI’s head of Japanese research, points out that until very recently, Yen weakness has been a significant headwind to sterling performance.

The manager feels that the policy stance has been beneficial to corporate Japan (a weak yen makes exports cheap, for example, and low interest rates keep debt servicing costs low).

Japan is also experiencing food price inflation, which Daniel says that the government has not been handling well. It is not terrible – around 3%, but 3% feels much higher in a country that is used to falling prices.

There is a sense in some quarters that it would be helpful to get some inflation into the system to reverse the deflation of the last 20 years. Daniel says that if there is a shift away from the mindset that prices will continue to fall and a recognition that, with inflation, the value of people’s savings can be eroded, this could drive an increase in aggregate demand and wage growth (which would be good for ‘animal spirits’ in the economy).

He notes that Japan lags the global post-COVID economic recovery too. Sectors such as tourism have a long way to go before they return to pre-pandemic levels, for example. The weak yen should help with sector-recovery.

Daniel says that Japan has been struggling to meet its power requirements and there have been some blackouts. Japan is not importing coal from Russia due to sanctions. The new Prime Minister appears to be more positive on nuclear than his predecessors. Plants that were turned off following the Fukushima disaster may now be reactivated rather than decommissioned and there is even talk of developing a new generation of reactors.

In the face of a weaker global economy, the Japanese market has been more volatile. However, Daniel says that this is creating opportunities to add to positions at attractive prices.

Much value to unlock

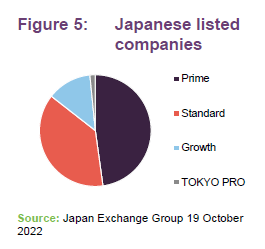

According to the Japan Exchange Group, there are over 3,800 listed stocks in Japan (the classification of these has changed since we last published). AVI believe a significant number of these are mispriced by virtue of their inefficient balance sheets and holdings of surplus cash or listed securities in particular.

A substantial proportion of Japanese stocks have little or no analyst coverage. Even where analyst coverage exists, AVI feels that the market does not price companies efficiently because analysts tend to draw conclusions and set price targets based on earnings multiples, rather than using a sum of the parts approach. The rationale for this is that, historically, the chance of persuading companies to optimise their balance sheets and getting any excess cash distributed to shareholders has been unlikely. Instead, these surplus assets and often-unproductive assets sit on the balance sheet for years; sometimes value has been destroyed.

In the 2000s, the aggressive actions of hedge funds trying to unlock value through activism met with mixed results and strong resistance. In the face of action taken by Steel Partners against Bulldog Sauce, Japan’s Supreme Court ruled in favour of ‘poison pill’ defences. However, over the following decade, attitudes to corporate governance in Japan appeared to change for the better.

Improving corporate governance

The Japanese government recognised the sclerotic effect that this hoarding of assets was having upon the Japanese economy. In 2012, then-Prime Minister Shinzo Abe proposed a stewardship code, which was adopted in 2013. Signatories to the code are encouraged to disclose voting records and enter into constructive engagement with investee companies. A review of the code in 2020 introduced a focus on ESG and a request that institutions disclose why they voted the way they did.

Shareholder advisor service ISS recommends that shareholders vote against the re-election of directors of companies whose ROE has been less than 5% per annum over the previous five years.

A corporate governance code was introduced in 2015 and strengthened in 2018. This included measures aimed at minimising cross-shareholdings, stressing the importance of companies earning more than their cost of capital, bringing in more independent directors, establishing independent nomination committees for new directors, improving disclosure and greater dialogue with shareholders, and maintaining a level playing field in the treatment of shareholders.

AVI says that the Japanese asset management industry has shifted its attitude since the introduction of the stewardship code. It feels that the industry is less passive than it was. However, it is rare that domestic institutions will criticise companies publicly. These asset managers tend to work behind the scenes rather than submitting proposals publicly.

A 1% shareholding is enough to submit a proposal to shareholders at an AGM. In practice, this happens relative rarely – AVI estimates that, across the entirety of the Japanese market, there are around 50 proposals a year. Daniel says that their rarity can make them more powerful in a way, as they tend to attract media attention. AVI says that the companies do not like the adverse publicity. Whilst AVI tends to use these as a last resort, it aims that AJOT is at least a 1% shareholder in its target companies so that the option is available. AVI notes that with a 3% stake, a shareholder can call an EGM.

Companies can squeeze out minorities with a two-thirds majority. Two-thirds is also the threshold to get special resolutions passed.

The manager highlights that its emphasis is on building consensus rather than forcing the issue. In AVI’s experience, other foreign investors are usually supportive of proposals, but often are not prepared to be public in their activism.

The manager notes that structures bolstered by cross-shareholdings are often difficult to penetrate and there is resistance to change being imposed from outside. In particular, the big banks and large industrial conglomerates have a tendency to close ranks against outside interference. This does not necessarily rule out such companies from AJOT’s portfolio, but the extra work involved must be justified by the opportunity available.

It is important to emphasise that AVI’s aim with investee companies is not just about getting cash returned to shareholders. It is happy to see sensible M&A, or action that improves margins and sales. Takeovers are just one potential catalyst, whether by private equity or a parent company. Consolidation within sectors is needed too.

The manager feels that it helps AJOT’s cause that it is prepared to make sensible strategic suggestions.

Investment process – how the portfolio is selected

AVI begins by screening the market for companies with excess cash/listed securities. A simple metric for this is to identify companies with greater than 30% of cash relative to their market cap. The data is not always accessible – it has taken a lot of work for the analysts to clean up the figures – for example, sometimes the cash has been lent to the parent company. Screening out the most illiquid companies leaves a pool of about 900 companies.

AVI says that not all of these are great businesses – many are effectively zombie companies existing just to provide employment or to service pension payments. It can take time for activism to bear fruit. A poor-quality investee company could destroy value faster than AVI can unlock it.

The next step is to exclude loss-making and highly-cyclical businesses. AVI wants to invest in companies of reasonably good quality, with resilient business models and the prospect of healthy profit growth. The targets are solid and sometimes high-margin businesses. This leaves about 200 companies.

AVI quantifies the fundamental value of these companies using measures such as EV/EBIT – sometimes these are negative and almost all are at least low single digits.

The next question is how might AVI go about unlocking value; for example, are there like-minded shareholders? This step includes dialogue with other key stakeholders. Following this part of the process, the target list will have been whittled down to fewer than 100 companies.

Portfolio construction

From the target list, the manager maintains a single digit number of ‘ready to go’ opportunities on which it has performed detailed due diligence.

Each stock in the portfolio should, in AVI’s opinion, have the potential to outperform the market on its quality and growth merits. It says that additional alpha comes from the events that unlock the underlying value.

AJOT is managed with about 20–30 positions and AVI is happy for AJOT to be at the low end of this. The manager applies a risk overlay to ensure that the portfolio is not over-exposed to any one sector or group of companies. The constituents of the portfolio would be roughly equally weighted, but position sizes vary with respect to the strength of the manager’s conviction and the stock’s liquidity. In addition, positions in stocks in which AJOT is engaged in an active campaign to unlock value may be higher.

There is some modest overlap between AJOT’s portfolio and AGT’s. The Japanese strategy was incubated in AGT before AJOT’s launch, and AGT has about 26% in Japan, but only half of its holdings are also represented in AJOT’s portfolio. The overlap has been falling with AJOT becoming more differentiated.

AJOT tends to focus on smaller companies, whereas AGT is constrained to larger opportunities by virtue of its size. AGT can provide additional firepower where this makes sense. Also, AGT can buy large stocks such as Sony which would not suit AJOT’s portfolio.

Ahead of a purchase, the analysts will prepare an internal note on the suitability of a stock for either or both of the portfolios and an allocation decision will be made based on liquidity.

Generally, AVI is prepared to be patient – it can take time to bring other stakeholders around to their way of thinking. The manager would exit a position if it became clear that the desired result was not achievable or if it felt that the quality of the stock had deteriorated markedly.

Investment restrictions

There are no limits on sector weightings within the portfolio. It is not expected that, at the time of investment, any single holding (including any derivative instrument) will represent more than 10% of AJOT’s gross assets. However, AJOT has discretion to invest up to 15% of its gross assets in a single stock if a suitable opportunity arises.

There are no restrictions on AJOT’s exposure to stocks with any given market capitalisation, but the portfolio will normally be weighted towards small- and medium-sized companies.

Derivatives can be used for efficient portfolio management purposes and to provide gearing.

AJOT’s current campaigns

Fujitec

AJOT has had some success with Fujitec (fujitec.com) in the past (see page 4 of our last note for more detail). In particular, AJOT was keen that the company improve its profitability, by focusing on new installations in growth markets while building on its aftermarket (repairs and maintenance) business in more mature markets.

Progress is being made on both fronts, for example, on 30 September 2022, the company acquired Takagi ESC, a company focused on maintenance, inspection, repairs, testing and renovation (upgrades) of elevators and escalators; and on 22 August 2022, the company acquired Express Lifts, which has a leading market share in India and operates a factory based in Gujarat.

However, more recently Oasis Management (a Hong Kong-based investor with 9.7% holding in Fujitec) launched a public campaign to oust the company’s president, Takakazu Uchiyama, who is the son of its founder and who assumed control of the company in 2002.

Mr Uchiyama is accused of serious corporate governance failings; primarily, he is accused of undertaking transactions that are favourable to him and his family at the expense of shareholders. Oasis’s case is set out here.

A campaign to remove Mr Uchiyama as president of the company at the most recent AGM appeared to be gathering support. However, his candidacy was removed one hour before the vote. The company then appointed him as chairman of the board immediately following the AGM. Shareholders appear to be unhappy with the board’s actions.

AVI says that it will not sit by passively while shareholder rights are being ignored. AJOT has about a 2% stake in Fujitec, but there are a number of like-minded investors. It may be that Mr Uchiyama is forced to step down before next year’s AGM. You can read more about AVI’s views on Fujitec here.

Asset allocation

At the end of September 2022, AJOT’s gearing was -0.1%. The manager says that it has firepower available to take advantage of any market weakness.

At 30 September 2022, AJOT had 25 holdings. The portfolio has continued to become a little more concentrated, with a higher percentage of the portfolio accounted for by the top 10 since we last published. This is a product of a deliberate strategy by the manager to exert greater influence over the companies in its portfolio.

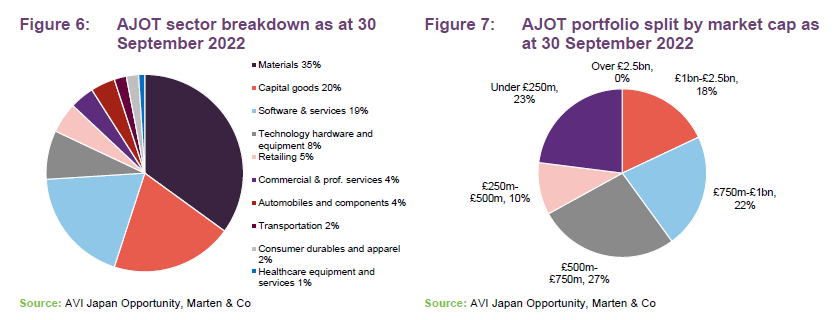

The sector breakdown is a function of the manager’s stock selection decisions and changes since our last note was published (mainly increases in exposure to materials at the expense of exposure to capital goods and food and staples retailing) reflect that.

Likewise, the shift from companies in the £500m-£750m range to those in the £750m-£1bn is a consequence of stock selection and market movements.

10 largest holdings

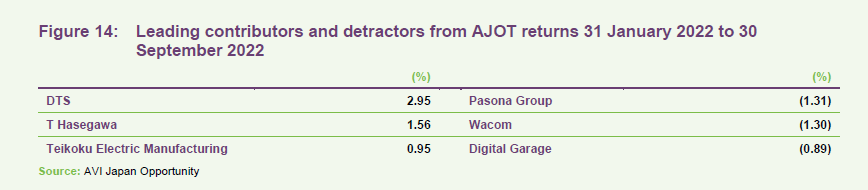

Many of AJOT’s 10-largest companies were discussed in our previous note. Since we last published, Pasona Group, SK Kaken, and Digital Garage have fallen out of the list of the 10-largest holdings, to be replaced by Shin-Etsu Polymer, NC Holdings and Konishi. Each of these new entrants is featured below.

Pasona and Digital Garage were amongst the leading detractors from AJOT’s performance and are discussed on pages 14–15. AVI feels that its engagement with SK Kaken has fallen on deaf ears, but AJOT’s manager is persisting with the investment, given that net cash on SK Kaken’s balance sheet exceeds its market cap, and it believes the shares have the potential to at least double.

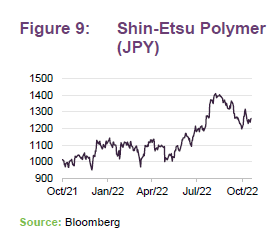

Shin-Etsu Polymer

AVI has been adding to the position in Shin-Etsu Polymer (shinpoly.co.jp) and it is now AJOT’s fourth-largest holding. The company is a listed subsidiary of Shin-Etsu Chemical. Daniel says that AJOT has often done well out of these types of relationships. In addition, the companies’ business operations are intertwined, and the management of both companies have made indications that they are open to addressing the structure.

Shin-Etsu Polymer is the world leader in manufacturing semiconductor casings – these allow semiconductor wafers to be moved around during the production process. This is a niche high-tech business – a dust-free environment is absolutely critical, and the casings are disposed of after a number of uses as the manufacturer cannot risk contamination. The holding is effectively a play in the volume of the semiconductor market. Furthermore, these cases are needed irrespective of whether it is old or new semiconductor technology (which basically comes down to size – the new technology packs everything into a much tighter space). Chips become increasingly complex as the size shrinks, but AVI says that there is still good value in old chip designs.

AVI thinks that the parent company should buy out Shin-Etsu Polymer’s minority investors at a large premium to the prevailing price. AVI has been engaging heavily and has sent letters and presentations to both parties. The government is critical of these sorts of arrangements, and so there is a political tailwind to help bring a resolution to the problem.

In the meantime, AVI is very happy with the operating business, which is operating in a structural growth area. It notes that the company saw sales and profits rise by 20% and 55% year-on-year respectively during its first quarter.

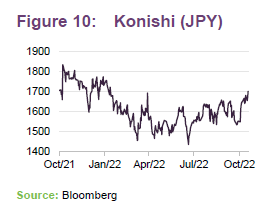

Konishi

Konishi (bond.co.jp) is a synthetic adhesives and sealants business. AVI likes the management team, led since April 2021 by Keiichi Oyama. However, in recent months Chinese lockdowns have had an impact on demand for the company’s products. In addition, raw material cost increases are putting pressure on the company’s margins.

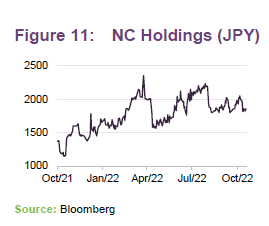

NC Holdings

NC Holdings (nc-hd.jp/) is a conglomerate with diverse interests in areas such as conveyor belts, management of multistorey car parks (3D parking equipment and mechanical parking equipment), renewable energy (solar power) and charging equipment for the electric vehicles. AJOT first invested in June 2021 and, at the end of September 2022, funds managed by AVI controlled a 17% stake in the company. AVI says that a like-minded US investor owns a further 22%.

AVI’s preference is that the company focuses on its multistorey car park division. NC Holdings has cancelled its treasury shares and added new independent directors to its board. It has also sold its minority stake in Meiji Machine.

AVI is targeting a share price of JPY2,600–2,700, around a 50% upside, and has been adding to the position on weakness.

Performance

After a period of very strong relative performance in 2021, AJOT has more or less matched the return on the MSCI Japan Small Cap Index in 2022. The share price and NAV have moved in tandem in recent months.

Concerns over the strength of the global economy may be weighing on some of the share prices of companies in AJOT’s portfolio, but the manager feels that the potential to add value from corporate governance improvements should be unaffected by this.

Performance attribution

AVI provided us with data on the leading contributors and detractors from AJOT’s returns over the period from 31 January 2022 (the data used in our last note) and the end of September 2022.

DTS

https://quoteddata.com/wp-content/uploads/2022/10/j15.png

Daniel says that DTS (dts.co.jp) has been a great success story for AJOT. The company is an IT systems integrator. As we have discussed in previous reports, Japan is a laggard when compared to other developed economies in terms of its IT equipment and infrastructure. The government has recognised the problem and efforts are being made to address it, which should ensure that there is significant demand for IT infrastructure going forward. Notwithstanding the business opportunity for DTS, it also had a highly inefficient balance sheet when AJOT made its investment.

AVI has built a 10% stake in the company and engaged intensely with the company’s management, putting forward a number of recommendations in over 250 pages of presentations. This all took place behind closed doors.

In May 2022, DTS published a long-term outlook and medium-term management plan which said that it would proactively invest into digital, solutions and service business as well as the human resources to realise this. Its aim is to double its EBITDA by 2030. Daniel says that this reflected all of AVI’s recommendations.

The market has re-rated the company, which has gone from trading at 6x EV/EBIT when AJOT first invested to around 10x EV/EBIT today.

AJOT has sold a small part of the position, but this was purely for portfolio management purposes (it had reached 11% of AJOT’s portfolio), but AVI still believes that the company offers further upside.

When quizzed as to why this one had worked so well, Daniel said that in the first instance AVI is DTS’s largest shareholder, which gives it some influence. Furthermore, there are no large shareholders that are allied to management that potentially could have blocked its proposals. Daniel also feels that DTS’s management appreciated AVI’s efforts to understand why the market was not recognising the company’s potential.

AVI was delighted that it was able to achieve this result, to the benefit of the company, its shareholders and other stakeholders, without having to resort to a public disagreement with the board. It feels that this is absolutely the best outcome for everyone.

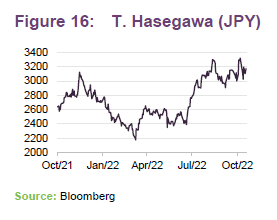

T. Hasegawa

T. Hasegawa (t-hasegawa.co.jp) is a leading flavour and fragrance company. Daniel notes that while it is a high-quality company, it is trading on a forward P/E of just 11x when its global peers are trading on around 20x.

He says that share price strength year-to-date has been driven by earnings growth rather than multiple expansion. Sales for the first three quarters of its financial year are up 30% on the previous year and returns on capital continue to climb. An easing of COVID-19 related restrictions has boosted areas such as beverages as the food service industry recovers. The company’s new US plant began operations in June 2022.

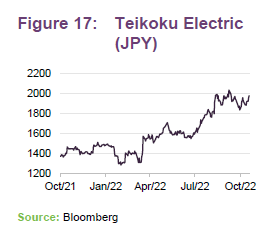

Teikoku Electric

Teikoku Electric (teikokudenki.co.jp) is a relatively new position which the manager started building in December 2021. The company makes pumps for petrochemical plants, in which it is the leading global player in this niche market. The company has a defensive moat in that its pumps are important components within its customers’ plants as they are handling hazardous materials.

AJOT established a 3% position, AVI would have liked to acquire more but the share price ran up by about 40% before falling back in recent weeks. Nonetheless, AJOT has done well out of the holding.

AVI has been engaging with the company’s management in private. They say that the market is already recognising the company’s improvements in its approach towards shareholders.

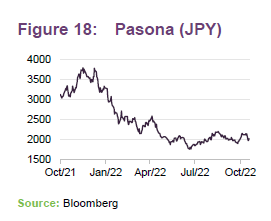

Pasona

Staffing business Pasona (pasonagroup.co.jp) was discussed in our last note where we observed that its share price had been hit as market sentiment turned against growth stocks. The main attraction for AVI was Pasona’s 51% stake in Benefit One, which manages employee benefit programmes on behalf of a number of companies. Its shares have fallen by more than 60% from their peak last September.

AVI notes that Pasona’s business is doing well, having reported record operating profits. Encouragingly, Pasona has also disposed of minority stakes in other businesses. AVI believes that Benefit One is now fairly valued and is optimistic that the considerable gap between its estimation of Pasona’s value and its share price can be narrowed.

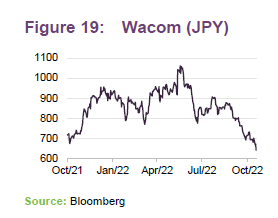

Wacom

Digital pen maker Wacom (wacom.com), which we have discussed in previous notes, is another stock that seems to have been hit because of investors’ perception of it as a growth stock.

In its annual report, published at the end of August 2022, Wacom foresaw a 22% increase in revenue for its fiscal year ended 31 March 2023, but only a modest increase in net profits of about 2%. The company is maintaining its dividend but continuing with its share buyback programme.

Digital Garage

Digital Garage (garage.co.jp) has a 21% stake in a price comparison website Kakaku.com, which is a listed company. Kakaku’s share price has been weak and that has likely contributed to the fall in Digital Garage’s share price.

AVI has had some success in engaging with the company. Proposals in presentations that it sent to management were reflected in the management’s decision to emphasise growth in fintech, backing startup businesses in India and Indonesia as well as Japan, and collaborating with businesses in North America and Europe. However, AVI still feels that the company’s strategic direction remains unclear and this is reflected in its share price. At the end of September 2022, AVI said that it saw potential for a 59% upside; its engagement continues.

Teikoku Sen-I

In its recent interim report, AJOT also highlighted the reduction of its stake in Teikoku Sen-I, which manufactures disaster prevention equipment, for example fire trucks and hoses.

Daniel says that, while the reopening of nuclear reactors in Japan should be beneficial for the company, AVI was frustrated by a lack of progress in its engagement with the company (which is protected from more aggressive action by a large allegiant shareholder). Given the weakness in Teikoku Sen-I’s share price, sales of stock have paused for now.

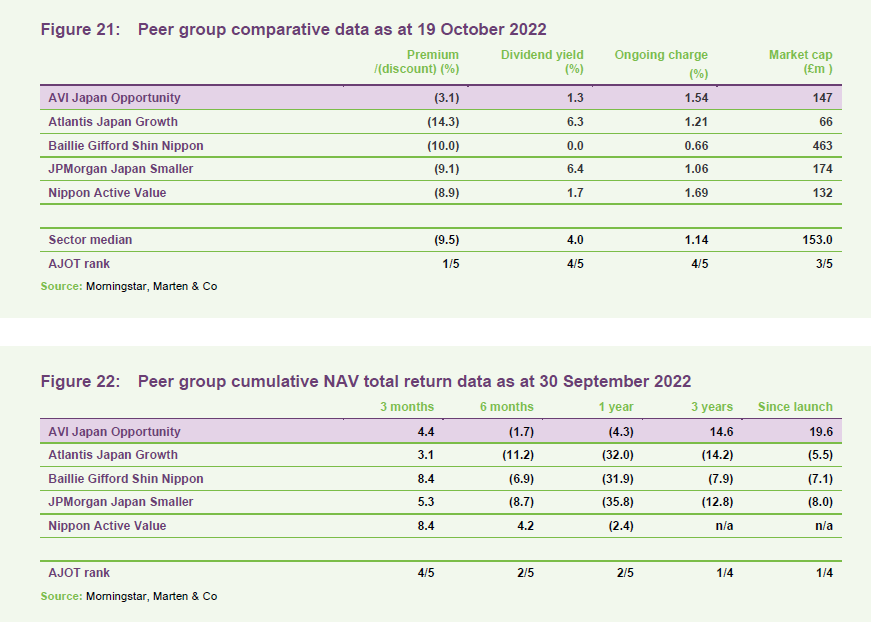

Peer group

AJOT is a constituent of the AIC’s Japanese smaller company sector. Within this peer group, the closest comparator is Nippon Active Value, which has a similar investment approach to AJOT. The other three are more focused on growth stocks, and this accounts for much of the disparity in the performances of these funds.

Relative to Nippon Active Value, AJOT is a bit larger and trades on a higher rating but has a lower ongoing expenses ratio.

Over three years, AJOT’s returns lead those of the peer group by some margin. More recently, some of the more growth-oriented trusts have experienced a modest recovery in their NAVs. AJOT and Nippon Active Value’s concentrated portfolio and differentiated approach may mean that their returns tend to deviate more from benchmark indices and the wider peer group in the short term.

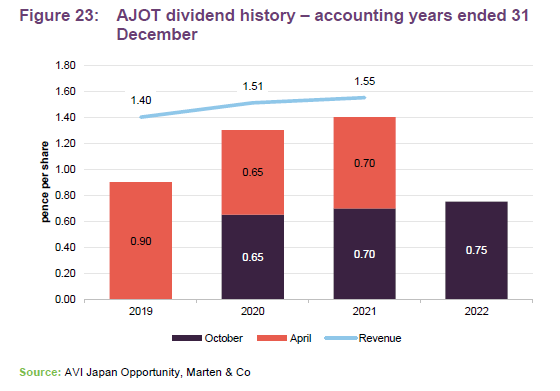

Dividend

AJOT is not managed to produce any target level of income. The board distributes substantially all of AJOT’s net revenue. Since last year, this has taken the form of semi-annual dividends declared in April and October.

At 31 December 2021, AJOT had accumulated revenue reserves of £1,461,000 (1.06p per share), which have been building since launch as revenue has been consistently ahead of the level of distribution.

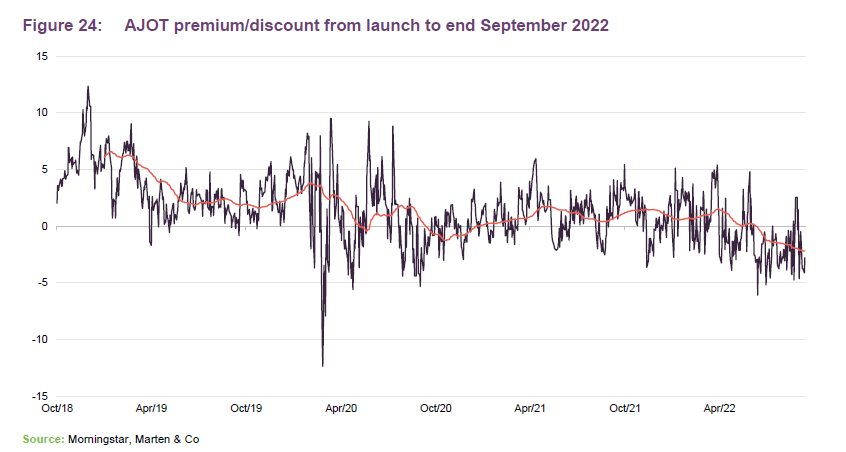

Premium/(discount)

Over the 12 months ended 30 September 2022, AJOT’s shares traded as high as an 5.5% premium and as low as a 6.1% discount. The average premium over the period was just over 0.0%. At 19 October 2022, AJOT was trading at a 3.1% discount.

In common with other trusts, the discount has moved a fraction wider in the recent market turmoil.

The board recognises that it is in the interests of shareholders to maintain a mid-market price for the ordinary shares that is as close as possible to NAV. The board monitors the discount over rolling four-month periods and will buy back stock if the average discount exceeds 5%. The discount may also be limited by the regular exit opportunity (see page 19).

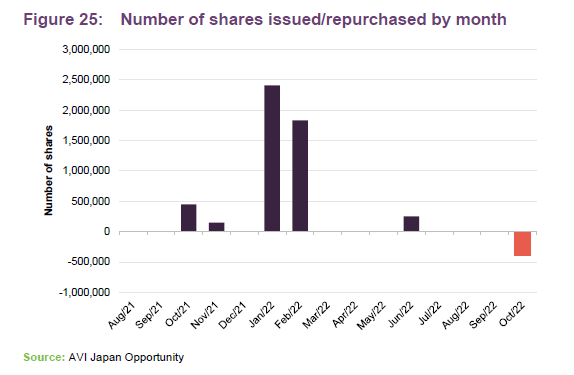

At the AGM held in April 2022, shareholders gave the directors authority to issue up to 27,442,300 ordinary shares (then, 20% of AJOT’s issued share capital) over the following 15 months (or up to the next AGM, whichever is the earlier). Shares will only be issued (or reissued from treasury) at a price equal to NAV plus a premium at least sufficient to cover the costs associated with issuing the shares.

The board was also granted permission to repurchase up to 14.99% of the ordinary shares in issue in March 2022. Shares repurchased may be held in treasury.

Figure 25 shows the issuance and repurchase of shares by month over the period since 31 July 2021. When the discount very briefly spiked out in the market turmoil following the ‘mini’ budget, the board acted swiftly to repurchase 400,000 shares into treasury.

Fees and costs

Asset Value Investors Limited is AJOT’s AIFM and investment manager. The manager is entitled to a fee of 1.0% of the lower of AJOT’s market cap or its NAV at each quarter end. A quarter of the management fee is reinvested in AJOT shares (through open-market purchases), which are held for a minimum of two years. The manager’s contract can be terminated by one year’s notice by either party.

The fee structure gives the manager an incentive to work with the board to keep the discount narrow.

AJOT’s depositary is JPMorgan Europe Limited, and JPMorgan Chase Bank, London Branch is the company’s custodian. Link Company Matters Limited is the company secretary and Link Alternative Fund Administrators Limited is AJOT’s administrator.

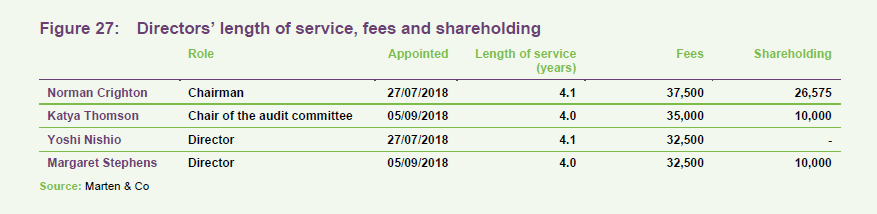

For the year ended 31 December 2021, the management fee amounted to £1.4m, directors’ fees (detailed on page 22) totalled £130,000 and other expenses totalled £393,000. AJOT’s ongoing charges ratio for this period was 1.45%, down from 1.56% for 2020.

Capital structure

At 19 October 2022, AJOT had 137,461,702 ordinary shares in issue, 400,000 of which were held in treasury. Therefore, the number of shares admitted to trading and with voting rights was 137,061,702 and no other classes of share capital. No ordinary shares were held in treasury at that date.

The company’s accounting year end is 31 December, and its AGMs are usually held in March/April.

AJOT has an unlimited life, but following the decision not to offer an exit facility in 2022 (see front page), the directors intend to offer shareholders an opportunity to exit the company at a price close to NAV in October 2024 and every two years thereafter. The exact mechanism for this will be determined around six months in advance, following consultations with shareholders.

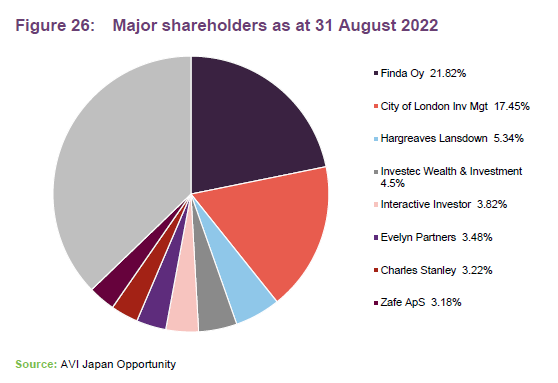

Major shareholders

Gearing and hedging

AJOT’s gearing is capped at 25% of NAV, at the time of drawing down any borrowings, but, in practice, should average around 10%. AJOT has an unsecured revolving credit facility provided by The Bank of Nova Scotia, London Branch. The JPY2.93bn facility matures on 2 February 2024. The interest rate on amounts drawn is TONAR +1.15%. When less than 50% of the facility is being utilised, commitment fees of 0.375% are charged on undrawn balances. If over 50% is drawn down, 0.325% is payable on the undrawn amount.

AJOT does not currently intend to hedge its underlying currency exposure, but the board and manager keep this under review.

Management team

AVI is fielding quite a large team (seven in total, five of which are Japanese nationals) on AJOT.

In addition to the seven individuals listed below, AVI has seconded a person from a leading Japanese law firm for six months. He is assisting with the team’s engagement efforts and is based in London.

Joe Bauernfreund (CEO and CIO)

Joe is the portfolio manager of AJOT and the named portfolio manager of AVI Global Trust. He joined Asset Value Investors in July 2002 as an investment analyst, following completion of a Masters in Finance from the London Business School. At first, Joe worked closely with John Walton in focusing on the European Holding Companies. He then covered the entire portfolio and became joint manager with John Pennink. Prior to joining Asset Value Investors, Joe worked for six years for a real estate investment organisation in London.

Tom Treanor (head of research)

Tom joined AVI in February 2011. He works closely with the analyst team providing support and guidance on prospective and current investments across the portfolio, in addition to taking responsibility for all investments in closed-end funds.

Tom spent nine years working for Fundamental Data/Morningstar in various roles involving closed-end fund analysis. He has a degree in Economics from the University of Leicester.

Daniel Lee (head of Japan research)

Daniel joined AVI in February 2015. He focuses on researching Japanese companies.

Before joining AVI, Daniel completed internships at Pamplona Capital Management and Mercer. He has passed all three levels of the CFA exam, and graduated with a First Class Honours degree in Physics from the University of Bristol.

Kaz Sakai (senior investment analyst)

Kaz has been working with AVI since May 2020 researching Japanese companies as he completed his MBA at Harvard Business School and formally joined AVI’s investment team in June 2021. Prior to Harvard, he was engagement manager at McKinsey & Company’s Strategy and Corporate Finance Practice in Tokyo. Kaz had previously been with McKinsey & Company from 2011–2016 as a general consultant in Tokyo and an RTS Practice Associate in Melbourne. He also gained valuable private equity experience from 2016-2018. He holds a B.S. in Geochemistry from the University of Tokyo and an MBA from Harvard Business School.

Jason Bellamy (investment consultant)

Jason joined AVI in March 2020. He works closely with the analyst team and leads on the engagement efforts in Japan. Jason brings more than 30 years’ experience in the financial services industry, working for and engaging with global companies, government bodies, regulators and international investors including Sumitomo Mitsui Trust Bank, First Trust Advisors and Aberdeen Standard Investments. He is based in Tokyo.

Jason has a BSc in Economics from The London School of Economics & Political Science (University of London).

Makiko Shimada (investment analyst)

Makiko joined AVI in January 2021 from Goldman Sachs, where she was a member of the Advisory Group in Investment Banking Division in Tokyo for over three years. She holds a BA in Economics from the University of Tokyo.

Collin Batte (junior investment analyst)

Collin joined AVI in October 2021. He researches Japanese companies and provides support to the investment team.

Before joining AVI, Collin completed internships at Standard Chartered Bank and Goldman Sachs. He has a MEng in Civil Engineering from University College London (UCL).

Yuki Nicholas (Japan team assistant)

Yuki joined AVI in February 2020 as a Japan team assistant to provide translating support, desk research and other secretarial support to the members of the Japan team.

Yuki previously worked for BZW Tokyo as an assistant to the investment strategist and the economist.

Board

AJOT has four directors, all of whom are non-executive and independent of the manager. No director sits on another board together with another member of AJOT’s board. The directors stand for re-election at each AGM.

Norman Crighton

Norman is an experienced public company director having served on the boards of eight closed-end funds and one operating company. He has extensive fund experience having previously been head of closed-end funds at Jefferies International and investment manager at Metage Capital Limited, leveraging his 31years of experience in investment trusts. Norman’s career in investment banking covered research, sales, market making and proprietary trading, servicing major international institutional clients over 15 years. His work in many countries included restructuring closed-end funds as well as several IPOs. As a fund manager, Norman managed portfolios of closed-end funds on a hedged and unhedged basis covering developed and emerging markets.

Following on from his long-term promotion of best corporate governance practice, Norman has more recently been focussing on expanding his work into environmental and social issues. He holds a Master’s degree from the University of Exeter in Finance and Investment.

Presently, Norman is non-executive chair of RM Secured Direct Lending Plc, Weiss Korea Opportunity Fund Limited and Harmony Energy income Trust Plc.

Ekaterina (Katya) Thomson

Katya started her career at Deloitte LLP, where she qualified as a chartered accountant in 1996. She is a corporate finance, strategy and business development professional with over 25 years of experience with UK and European blue chip companies. Katya is a non-executive director and audit committee chairman of Miton Global Opportunities Plc and Henderson EuroTrust Plc, and a non-executive director of Allianz Technology Trust and The New Carnival Company CIC. She is a member of the Institute of Chartered Accountants in England and Wales.

Yoshi Nishio

Yoshi began his career at Goldman Sachs International, where he had overall responsibility for the trading of Japanese equities and equity derivative products. Since then, he has combined his twin specialisations of finance and media as an investor, advisor and consultant. Much of his work has had a Japanese focus, with clients ranging from family offices to the office of the chairman of Columbia Pictures in Hollywood in the period following the studio’s acquisition by the Sony Corporation, to the Ministry of Finance of the Russian Federation. Yoshi is fluent in Japanese and in English.

Margaret Stephens

Margaret was a partner at KPMG until 2016 having qualified as a Chartered Accountant in 1988. From 2007, she played a key role in building KPMG’s Global Infrastructure Practice, also leading UK and international due diligence and structuring services on major merger and acquisition transactions and public private partnerships. Margaret was also a board trustee of the London School of Architecture until April 2020 and a non-executive board member and chair of the audit and risk committee at the Department for Exiting the European Union until its closure in January 2020.

Currently, Margaret is a non-executive director and chair of the audit and risk committee of VH Global Sustainable Energy Opportunities Plc and a trustee, director and chair of the audit committee of the Nuclear Liabilities Fund.

Previous publications

QuotedData’s initiation note on AJOT – Progress on a number of fronts – was published on 20 July 2021 and an update note – The tortoise triumphs – was published on 15 February 2022. Both can be accessed by clicking the link or via the QuotedData website.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Japan Opportunity Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note

until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.