abrdn Private Equity Opportunities

Investment Companies | Update | 10 April 2024

On the way to greener pastures

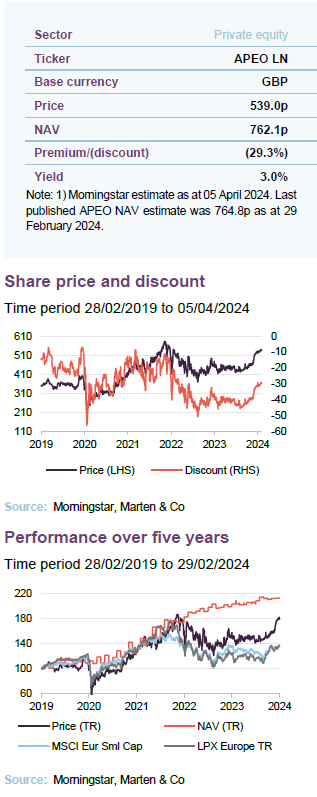

Despite navigating through challenging conditions in 2023, abrdn Private Equity Opportunities (APEO) achieved remarkable success with recently published annual results reporting both positive NAV growth and double-digit share price returns. APEO’s discount has narrowed by more than 10% in recent months, so that it is trading on a 28.9% discount currently, narrowing from about 45% last October. This resilience came in spite of a slowdown in activity in European private equity markets in 2023, dampened by a residual fear of rising interest rates and geopolitical tensions. However, as interest rates come down, the market could bounce back quickly.

Furthermore, APEO will shortly come under the umbrella of Latin American asset manager Patria Investments, with abrdn’s private equity division due to be acquired by Patria in the first half of 2024. Importantly, there will be no change to APEO’s process, and the deal may in fact open up new appetite for APEO’s shares.

Private equity fund of funds with a European bias

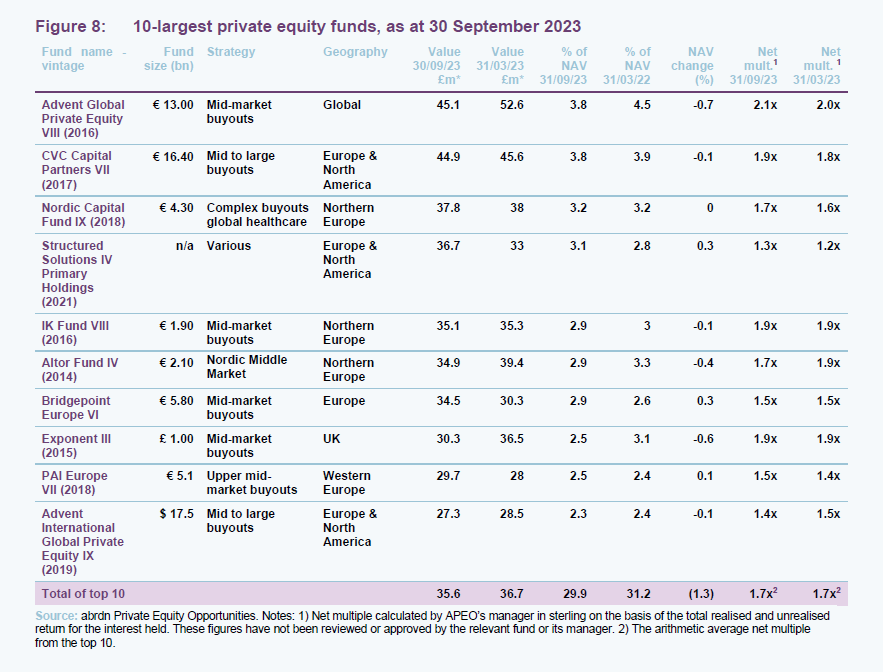

APEO aims to achieve long-term total returns through a diversified portfolio of private equity funds and co-investments, the majority of which will have a European focus. Its portfolio is more focused than many of its peers: the top 10 underlying private equity funds accounted for 35.6% of NAV, as at 30 September 2023. Like many private equity funds, APEO has no formal benchmark. Historically, the portfolio has been most-closely correlated to European small-cap indices.

Manager changes hands

Whilst there are macroeconomic and company-specific issues of note, an important change to abrdn Private Equity Opportunities (APEO) since our last note, published on 8 September 2023, is the planned sale of abrdn’s private equity division (the manager of APEO) to Patria Investments, an alternative asset manager that has its roots in Latin America but now has a global footprint and is listed on Nasdaq. The purchase of APEO was announced in October 2023 and is expected to be completed by the first half of 2024.

abrdn’s private equity division, and by extension APEO’s management team, are being purchased by the Latin American asset manager, Patria Investments

Patria has pre-transaction assets of $21.5bn in private markets and private equity investments, more than half the $38.4bn AUM it is expected to have post transaction. These assets are predominantly invested in North and South America. Given the regional complexities of private equity investing, Patria’s acquisition of abrdn’s private equity division is an elegant way for it to build its presence in the UK and European private equity markets.

The APEO team foresees no changes to APEO’s approach as a result of the buyout. Patria may, however, open up access to APEO for new potential shareholders, through its strong networks of private equity investors.

Market update

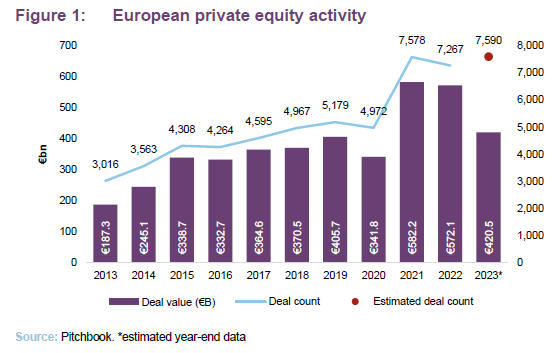

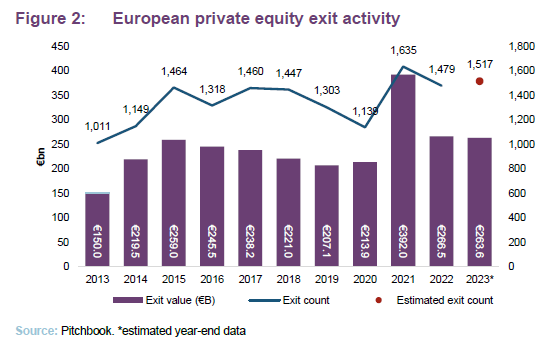

Whilst 2023 ended up being a solid year for global equities, with the MSCI Europe recording a 13.1% return (in sterling terms), the private equity market was less robust with European dealmaking down 26.5% year-on-year (YoY). The fall in activity (by value) reflected the reality of higher interest rates, as well as the ongoing fallout from the Ukrainian conflict. Although these effects were already reflected in public equity markets, the private equity sector experienced this with a lag. However, this does mean that the European private equity market could be primed for a renewed uptick in 2024.

European private equity activity has fallen over 2023

However, the volume of deals did increase by 4.4% over 2023. This reflected a higher volume of smaller deals, such as add-on investments, which accounted for the majority of dealmaking activity. Large ticket deals, those over €500m, fell to their lowest levels since 2017, evidence of a more uncertain environment in 2023. The only sector that saw a rise in deal value over 2023 was the financial services sector, though this reflected a degree of consolidation in the sector. Trends in European private equity were echoed in the wider global market.

Regionally, the UK and Ireland continued to dominate the European private equity space, as they have for several years, with France and the Benelux taking second place. France, Benelux, and the Nordic regions proved more resilient over 2023, however.

European fundraising however remained robust

Despite the fall in the total value of deals, 2023 was one of the best years for European fundraising, almost €120bn across 117 funds. Although realisations were low, reducing the amount of cash available to private equity funds to reinvest, five European mega-funds from CVC, Permira, KKR, PAI Partners and Bain Capital managed to raise record sums, accounting for more than half of the total.

The asymmetry between fund exits and capital raising was so stark that it was the highest ratio of the two since 2010 (i.e. fundraising divided by total exit value).

The value of 2023 sales was also driven by mega deals, with 59% of the €263.6bn total exit value of PE deals made up by transactions worth over €1bn. The IPO of ARM, the UK semiconductor designer, alone accounted for €48.7bn of the total value. The majority of the exits made by European private equity funds in 2023 were through trade sales, with buyouts a close second. Buyouts have been the primary form of exit for the last decade. The IPO market almost entirely dried up, however, with only 15 made in the year, reflecting the difficulty of the market environment. Any IPO recovery in 2024 is expected to be muted as recessionary fears weigh on markets.

Managers’ view

Chiming with the rest of the market, APEO’s managers also saw a slowdown in activity surrounding the trust. 2023 was the first financial year since 2010 in which fund drawdowns exceeded distributions, as we outline in more detail on page 19. This slowdown is likely the result of a reduction in overall private equity activity, with the lingering effects of rising interest rate and geopolitical tensions, rather than a symptom of wider economic weakness. Their underlying companies remain operationally robust.

In his report to shareholders, the chairman noted that neither the board nor the manager are anticipating a sharp rebound in private equity markets, and a return to ‘normal’ private equity activity levels might be some way off yet. The manager noted that the current ‘bid-ask’ spread between buyers and sellers of private equity assets and availability and pricing of debt to finance new transactions will continue to be challenges for the sector over the short-term, albeit both issues should ease as the market gains more certainty around interest rates over the course of 2024.

The good news is that weaker markets are a good time to be deploying capital. The manager cites the experience of the vintages that followed the aftermath of the dot.com bubble and the global financial crisis. It could be that investments made in 2023 and 2024 prove similarly lucrative.

Asset allocation

The increased focus on co-investment continues to drive APEO’s investment activity

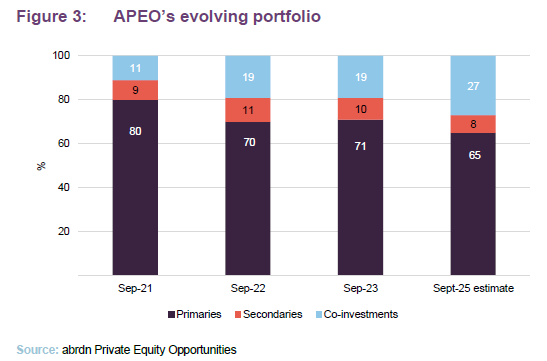

Readers interested in APEO’s investment process should see our September 2023 annual overview note, which describes this in more detail. However, to summarise, APEO’s manager tends to build a portfolio of core underlying managers whom it knows and trusts and has established relationships with over many years. Since 2019 this has been complimented by co-investments, and APEO’s allocation to co-investments has seen a significant expansion over the last two years, touching new highs year-on-year. Fund turnover is inherently low, although opportunities from new and existing managers for APEO are under constant scrutiny. Near-term changes in allocations tend to be driven by realisations and the pace of reinvestment, as well as best-practice portfolio construction, with the recent reduction in its exposure to Action being an example of the latter.

Co-investments power forward

While APEO has made several new commitments to funds over 2023, the expansion of its co-investment portfolio remains the primary driver of new investments. We believe that the increasing allocation to co-investments solidifies APEO’s identity as a ‘one-stop-shop’ for private equity exposure, as it offers its investors meaningful exposure to the full range of private equity structures, allowing the team the freedom to achieve attractive levels of diversification while still delivering competitive NAV returns, thanks to its unrestricted investment approach that allows for both direct and fund investments. The team’s co-investments remain focused on Europe, believing that it offers superior ‘alpha’ potential, given the lower penetration of private equity compared to the US.

The team expects APEO have a c.25% direct exposure in the medium term

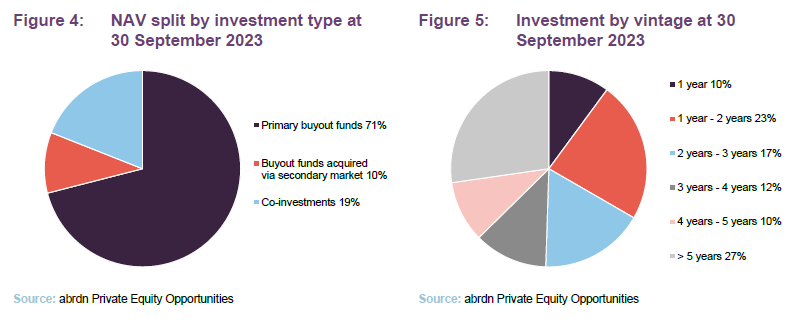

As of 30 September 2023, 57% of the fund’s NAV was attributable to 12 core European private equity managers, which comprise the ‘primaries’ component of the portfolio. This number and allocation weight have remained static since our last note, although the team still intends to increase APEO’s direct investment exposure to c.25% over the medium term, as can be seen in Figure 3.

Broad private equity exposure

As of 30 September 2023, the portfolio provided exposure to over 720 underlying private companies, through around 80 funds. Out of these funds, the top 10 funds account for 29.9% of NAV, while the co-investments portfolio had 26 investments (up from the 22 of its 2022 financial year end) and accounted for 19% of NAV.

As can be seen in Figures 4 and 6, APEO remains well diversified by vintage, sector, and geography, with no single allocation dominating another. With respect to vintage, 37% of the underlying portfolio is over four years old, with just over a quarter in excess of five years old (this being the sweet spot for realisations). This is up slightly on our previous note, reflecting the natural maturing of APEO’s holdings and a general slowdown in exits over the period.

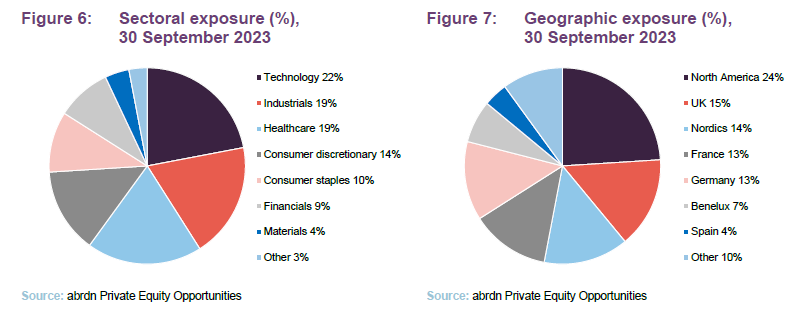

APEO has a broadly similar country and sector allocation to our last note, with a slight increase in technology exposure and retaining its strong preference for northern Europe. We note that APEO’s direct co-investments are all in Europe, with its non-Europe exposure coming as the result of its fund investments.

On a sector level, APEO retains a largely even split between cyclical and non-cyclical sectors, with non-cyclicals making up just over half of APEO’s allocation. Whilst non-cyclicals do tend to have the stable revenue streams which investors often prize, having a diversified exposure not only offers APEO the benefits of exposure to a potential European ‘soft landing’, but it also allows APEO to capitalise on the comparative lack of competition (relative to the US and UK) across all aspects of Europe’s private equity market.

Top 10 fund exposures

Short-term changes to fund allocations tend to be driven by realisations, the pace of reinvestment, and the frequency of revaluation by the underlying managers. Reflecting the managers’ long-term fund-of-funds approach, the names of the underlying managers and their funds will be familiar to followers of the trust and regular readers of our notes on APEO. There are just two new names in the top 10 since our last note: PAI Europe VII and Advent International Global Private Equity IX. Both of these were just outside the top 10 when we wrote our last note and have since crept up. They replaced Sixth Cinven Fund (2016) and HgCapital 8 (2017), which were then 9th and 10th respectively. As of the 30 September 2023 they are 11th and 15th.

APEO’s 10 largest fund exposures account for 29.9% of the portfolio. We should expect this figure to slowly creep down as the team continues to increase their direct investment exposure, until APEO reaches its c.25% target allocation.

FY 2023 saw APEO commit to four new funds

Over APEO’s 2023 financial year, there were seven new fund commitments, to funds from HgCapital, Vitruvian Investment Partners, Seidler Equity Partners, Montefiore Investments (Montefiore VI and Monte Expansion I), and IK Partners.

HgCapital is a giant within the private technology space and would be counted as one of Europe’s largest technology firms. Its investments cover a wide range of software companies, and its funds offer investors the ability to access companies at varying stages of their maturity. A large portion of its investments is associated with professional services, offering tax and accounting, wealth and investment services, and legal services, which can generate large efficiency savings by disrupting incumbent markets.

Seidler Equities is a US mid-market specialist, typically investing with a tilt towards consumer companies, business services, and specialty manufacturing sectors. Usually, its target companies have an EBITDA of between $15m to $60m at the time of investing. The vintage in which APEO participated was able to secure funding in less than 90 days, despite the more difficult fundraising conditions in 2023, a testament to the confidence investors have in its approach.

Montefiore Investments is a French firm focusing on mid-market buyouts, with a preference for the European services market. Montefiore saw a 100% re-participation (the percentage of previous investors who reinvested in their new fund) in its most recent fundraising, the VI vintage in which APEO also participated, which launched at a total fund size of €1.4bn. The VI fund will target businesses with a value of €100m to €500m, which is on the larger end of its target company size.

IK partners is another leading mid-market firm, based in the UK but targeting European companies, with a preference for companies based in northwest and central Europe.

Vitruvian Investment Partners is a global private equity firm, with a focus on growth buyouts and providing growth capital investments which typically target mid-market companies. The most common value-add achieved by the firm is expanding the global presence of European companies. Vitruvian Investment Partners V is a buyout fund focused on Western Europe.

The team notes that in the case of its new investments, they are all differentiated, specialist managers, focused on specific niches (though APEO’s new investments are all across mid-market funds). Given the increased difficulty the private equity market faced over 2023, the team believes that such characteristics will be key for these strategies’ success.

Post year-end commitments

Three additional commitments were made between the financial year end and end February 2024. One was a £30m commitment made to the IK X fund, which focuses primarily on investing in lower-middle market businesses in Northern Continental Europe across business services, consumer/food, healthcare and industrials. A £25m commitment was made to Bowmark VII. Bowmark Capital is a high-quality and longstanding mid-market manager focused on the UK software and services sector, operating in four core areas of the technology sector: data and insight, managed IT services, software, and technology-enabled business services. €15m was also committed to the Altor Climate Transition Fund, a fund focused on decarbonising hard to abate industries across Northern Europe. Altor Equity Partners typically focuses on leveraged buyout and growth capital investments in the Nordic regions.

Underlying holdings

APEO realised more than half of its stake in Action over 2023

Changes to the list of the 10 largest underlying company exposures tend to be uncommon. Movement is often a function of holdings within the underlying funds moving closer to realisation. There is, however, one major change since our last note: a reduction in APEO’s exposure to Action, the low-cost European retailer. The team took advantage of a redemption opportunity to reduce its position size to 2.1% for the purposes of good portfolio construction, as Action was approaching 6% of the trust’s NAV prior to the sale. Part of the proceeds of this sale will be used to fund APEO’s buyback programme.

The only new entrant to APEO’s top 10, as of APEO’s financial year end, is Funecap Groupe, France’s second-largest funeral company, which replaced CDL in the top 10. Funecap’s appearance in the top 10 reflected a follow-on investment made by APEO in 2023.

Over its 2023 financial year, APEO made six new investments in direct and secondary transactions, two of which were follow-on investments. These follow-on investments were European Camping Group, a leading operator of outdoor accommodation in Europe, and Funecap.

The three new direct investments APEO made are: Docplanner, a digital tool for patients to find local doctors; GoodLife Foods, a maker of meat-free ready meals; and HRworks, a cloud-native software provider for human capital management to small- and medium-sized companies.

There was one secondary transaction made over the finical year; a £4.6m investment into capiton Quantum. The ream rolled its existing commitment to the capiton V fund into two underlying private companies held within the capiton Quantum continuation fund. APEO has also made an addition €0.7m commitment to support additional M&A opportunities.

Post year-end activity

From between the end of September 2023 and the end of February 2024, APEO has made two new direct co-investments, one re-investment, and three follow-on investments. The two direct investments were a €10.5m investment into European Digital Group, which is an integrated services provider in the digital transformation and digital marketing segments; and a €6.0m investment was made alongside IK Partners into an undisclosed company, which is a leading manufacturer of frozen snacks in Europe. APEO also reinvested €6.9m into Procemsa, a producer of food supplements, medical devices and cosmetics.

In terms of follow-on investments, APEO made a $6.0m follow-on commitment into Visma, a Norwegian software developer focusing on business solutions, made alongside Hg. A follow-on commitment of €4.4m was also made into an undisclosed European-headquartered technology business in the healthcare sector. A final follow-on commitment of $1.0m was made to a US-headquartered consumer business alongside one of APEO’s core private equity managers, the details of which remain undisclosed.

Co investment example – HRworks

HRworks, founded in 1998, is a leading provider of HR software to Germany, the Czech Republic, and Austria, though German small-and-medium-enterprises (SMEs) are its primary focus. APEO invested alongside lead manager Maguar, a software-focused German PE firm. Since Maguar initially invested in HRworks in 2020, it has achieved an annual revenue growth of 27%.

What drew APEO to HRworks was both the structural opportunity represented by HR digitisation and the company-specific opportunities. Only 30% of the firms within HRworks’ target regions utilise a HR software suite. This comes alongside the ever-tightening labour market within Europe, as well as the increasing working population of the regions, which adds further pressure onto corporate HR departments.

HRworks is an example of a high-quality business, in the team’s mind, highlighting its strong earnings quality, high cash generation, and excellent margins. In its current five-year growth plan, HRworks plans to increase its marketing expenditure, focusing on its existing regions, while also modularising its software, with the intention being to increase its penetration within its existing client base. Given this quality business model, and its runway for growth, the APEO team is bullish about a future profitable exit when the time comes.

Portfolio performance

The APEO team comments that all its top 10 holdings have performed at least in-line with, or ahead of, what the team expected over 2023. Examples of companies performing ahead of expectations include FRONERI, which continues to solidify its position as the world’s third-largest ice cream maker, having built on a history of strong M&A activity and cost awareness. The APEO team describes it as one of its ‘crown jewel’ assets. Other noteworthy performers included European Camping group, which we covered in detail in our last note, and Uvesco, a regional leader in Spanish food retailing.

Underlying revenue and earnings growth remain robust over 2023

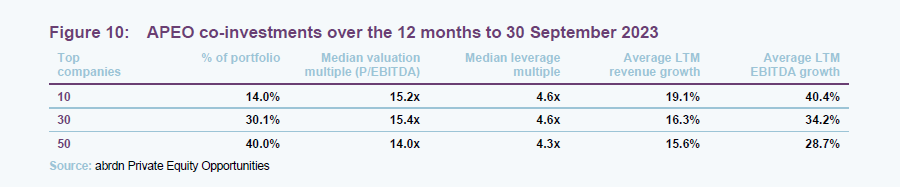

Figure 10 shows the current breakdown of the portfolio’s valuation and its earnings growth. Despite the slowdown in European private equity, APEO’s valuation multiples have remained largely flat year-on-year, while still retaining strong underlying growth, including over 20% EBITDA growth. It is also worth highlighting the strong revenue growth of the top 10 companies, as these companies represent a large portion of APEO’s direct investments. Revenue reflects a company’s total income, while EBITDA also includes the costs of operations.

The team comments that the large majority of APEO’s companies use debt facilities based on floating interest rates, with most of them hedged, as well as the majority of them having covenant-lite debt. This reduces the overall interest rate risk of each of APEO’s overall portfolio, as the underlying debt structures should mitigate the pain from increased costs of debt. The team also notes that more than 60% of APEO’s portfolio companies have debt that matures after 2027, limiting the refinancing risks.

Commitment levels

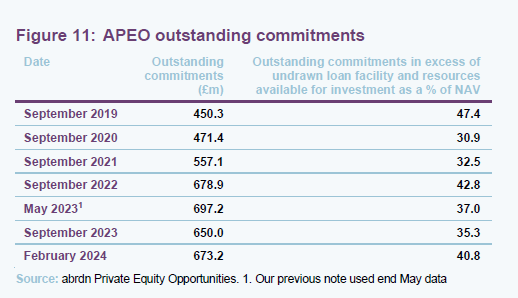

Outstanding commitments remain at the low end of APEO’s target range

As is illustrated in Figure 11, as of 28 February 2024, APEO had total outstanding commitments of £673.2m, including an estimated £91.6m unlikely to be drawn. This equates to an over-commitment ratio of 40.8% (this being the value of APEO’s outstanding commitments that were in excess of its liquid assets, as a percentage of net assets). This figure is up slightly from our last note, which used May 2023 data, but in line with the long-term average and at the bottom-end of its target range of 30% to 75%, giving the team more than enough flexibility to make new commitments.

During the 12 months ending September 2023, its financial year end, APEO made new commitments totalling £174.8m (2022: £340.3m). This is composed of seven new primary fund commitments, one secondary transaction, three direct investments, and two follow-on investments.

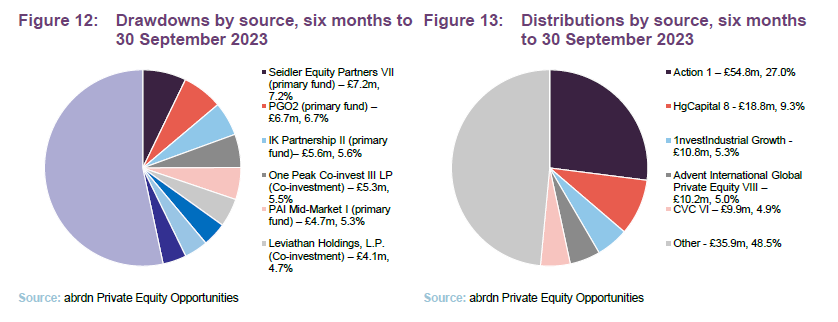

During the 12 months ending September 2023, £193.2m was drawn down, with £154.2m going into primary funds, and the rest into co-investments or secondaries, with the largest fund drawdowns being as follows:

- Safic Alcan (IK Partnership II) – Global speciality chemicals and ingredients distributor

- Access (Hg Saturn 3) – Leading Enterprise Resource Planning (“ERP”) software provider

- GWI (Permira Growth Opportunities II) – Global consumer data and analytics provider

- GEDH (IK Partnership II) – Leading higher education group in France

- Theramex (PAI VII) – Global specialty pharmaceuticals focused on women’s health

Drawdowns may exceed distributions in the near term, as market activity slows

APEO received £149.9m in distributions from its funds during the year. This was the first time since 2010 that the trust that fund drawdowns exceeded distributions, a reflection of the difficulty the market faced over 2023. The team believes that this is a short-term trend that will revert once exit activity in the private equity market picks up again. Total realisations for the year were £202.9m, thanks to an additional £53.9m being returned to the trust after APEO realised part of its stake in Action, taking advantage of a liquidity window.

Post year-end

In the five months since its financial year end (as of 29 February 2024) a total of £56.9m in drawdowns were made, with APEO receiving £27.0m in distributions. We note that in each of the five months, drawdowns exceeded distributions, continuing the trend.

Co-investments – ever more important

APEO is approaching its 25% target allocation to co-investments

During the last 12 months to 30 September 2023, APEO committed £22.6m to five co-investments, three of which were new and two of which were follow-on investments. The number of co-investments now stands at 26, equal to 19.4% of APEO’s portfolio. This weighting has declined slightly since our last note, though this weighting excludes the partial selldown of the co-investment in Action. If the Manager chose not to proactively realise part of APEO’s position in Action, then co-investments would have increased to around 23% of the portfolio during the period. The manager expects APEO to have a c.25% allocation to co-investments over the long term.

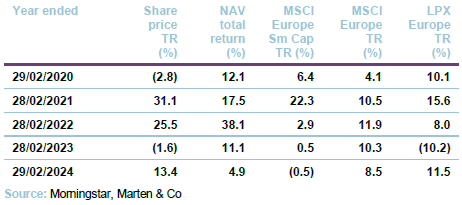

Performance

As per APEO’s most recent financial year end, its NAV is 777.7p per share as of valuations on 30 September 2023, up 1.2% from the 768.4p of our last note, based on data as of 31 March 2023. The most recent NAV published by APEO was for the 29 February 2024, with the trust reporting a NAV per share of 764.8p, equal to an estimate NAV of £1,173.1m. This represents a 1.7% decrease from the 30 September 2023 figures. The fall in APEO’s NAV over the last five months can be mainly attributed to a weakening of the Euro, which is down 1% versus sterling over the period.

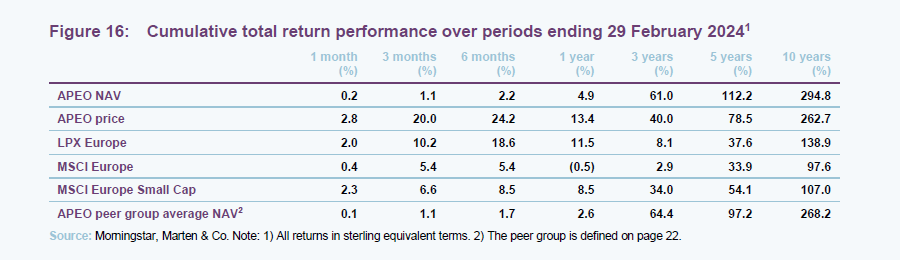

APEO has demonstrated impressive NAV outperformance over both the medium and long term, with 10-year NAV returns of nearly 300%

We note that since 30 September 2023, European equity markets have continued to make gains – the MSCI Europe has returned 8.7%, the MSCI Europe small cap 7.3%, and the LPX Europe 17.6% (all in sterling terms). This suggests that APEO’s NAV returns still have the potential to improve by the time of their next quarterly valuation.

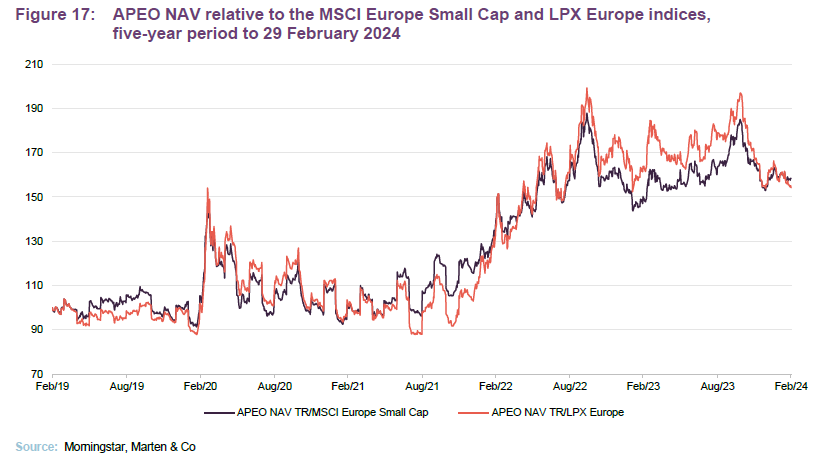

As can be seen in Figure 16, APEO’s five- and 10-year NAV performance continues to be well ahead of the LPX Europe, MSCI Europe and the MSCI Europe Small Cap indices (the LPX Europe is an index of listed private equity companies in Europe and its returns reflect the share price returns of those companies, rather than NAV).

APEO’s relative performance has fallen from its October 2023 peak, aligned with the year-end rally we saw in risk assets, as investors have become more bullish on the back of dampening interest rate expectations. Relative to both indices, APEO’s NAV will move at a slower pace, and is thus unlikely to fully reflect the improved near-term demand. The surge in risk appetite also explains why Europe’s private equity and small-cap sectors have outperformed the MSCI Europe in the near term.

APEO’s NAV total returns have also outperformed the average wider peer group, over all sampled periods bar three years (though this is due to the outsized impact of a single trust, Literacy Capital, which generated an anomalous return of over 200%). APEO’s near-term outperformance reinforces the importance of diversification during periods of heightened volatility.

Annual results – 12 months to 30 September 2023

APEO reported an 18% average uplift even in the face of a challenging market

Over the six months to 30 September 2023, APEO delivered a NAV total return of 5.4% (2022: 14.1%) and a share price total return of 13.8% (2021: -4.0%). Fund distributions totalled £149.9m, below the £210.2m it received in the prior financial year, a reflection of the decline in private equity market activity over the year. However, APEO still recorded an 18% average uplift in valuation upon the sale of an investment over 2023, which may imply that the slowdown in private equity activity has been relegated to transaction volumes, and has not impacted the underlying values of APEO’s holdings.

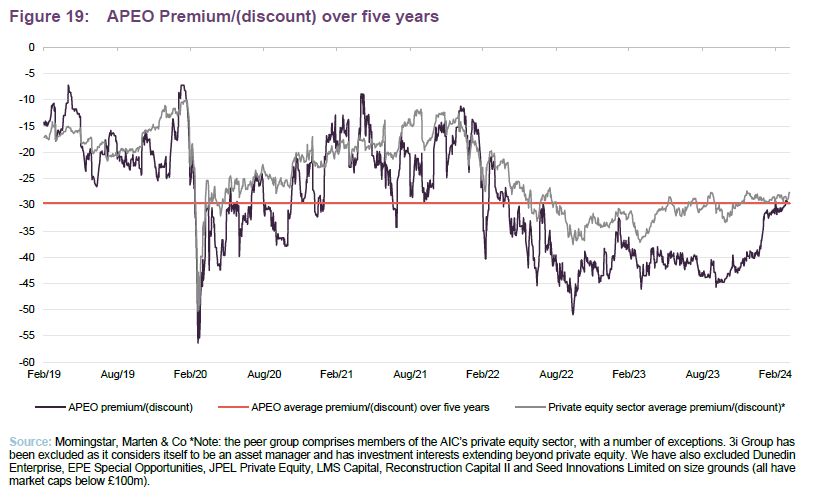

Peer group

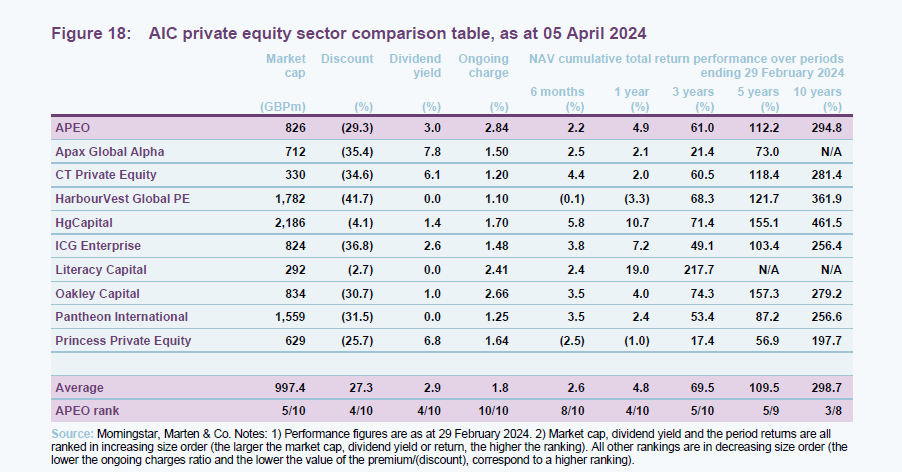

APEO is a member of the AIC’s private equity sector, which comprises some 19 members. Members will typically have over 80% of their assets invested in private equity/unquoted shares; and an investment objective/policy to invest in private equity or unquoted shares. For the purpose of this analysis, we have narrowed down the wider peer group to 11 funds illustrated in Figure 19. 3i Group is among those excluded, as it considers itself to be an asset manager and has investment interests extending beyond private equity. We have also excluded Dunedin Enterprise, EPE Special Opportunities, JPEL Private Equity, LMS Capital, and Seed Innovations Limited on size grounds, as all have market caps below £100m, making them less-relevant comparators. In addition, Dunedin Enterprise and JPEL Private Equity are both in wind-down mode, which also reduces their usefulness as comparators.

Given the inherently longer-term nature of private equity investing, APEO’s relative performance is best examined over at least five years

We remind readers that APEO’s – and indeed the wider sector’s – strategies are inherently longer-term, with the manager’s unlisted vehicles typically having multi-year lockup periods. This, along with APEO’s indefinite life structure, means that the longer-term periods (five- and 10-year) provide the best basis for a comparison of NAV returns. Whilst the 10-year performance of the peer group is very competitive, with no material underperformers, APEO has achieved a 10% outperformance relative to the average, with only HarbourVest Global PE and software specialist HgCapital outperforming it.

As of 05 April 2024, APEO’s discount was 29.3% (based on Morningstar’s NAV estimate), wider than its peer group average. APEO’s ranking has improved since our last note.

Excluding non-dividend payers, the average private equity sector yield remains enhanced by their wide discounts. As a result of its narrowing dividend, APEO’s yield has declined relative to its peers, though at 3.0%, APEO’s trailing dividend yield is just above average.

APEO does not charge a performance fee at the fund level, unlike many of its peers

APEO’s ongoing charges ratio of 2.84% is the widest reported in the sector. However, its expense ratio of 1.06% (which does not include the fees of the underlying funds) is much more competitive.

APEO is an example of the issues surrounding investment trust cost disclosures, which effectively double count their fees (as the costs of APEO’s underlying funds are reflected in their NAV performance). There is currently a campaign to reform the cost disclosure regulation which, if implemented, will see APEO’s reported fees substantially fall.

We note that APEO, unlike most of its peer group, does not charge a performance fee at the fund level (although these will be incurred by the underlying funds in which it invests). Comparing APEO’s management fee, we find that its 0.95% is at the lower end of its peers.

Premium/(discount)

As we highlighted earlier in this note, APEO’s discount has narrowed meaningfully in the near term, closing by 12% over the last four months. This has brought APEO’s current discount in line with its long-term average.

APEO’s discount has quickly narrowed over the last few months, on the back of more bullish sentiment and an increase in share buybacks

APEO’s discount has also narrowed quicker than its peers, though this has been the case historically for APEO, as its discount has tended to react more strongly to market movements, widening further on the downside and narrowing quicker on the up. What is noteworthy is that APEO’s discount has yet to recover to its pre-2022 levels, despite European inflation having returned to its mid-2021 levels. This, in conjunction with the increasing buybacks by the board, may imply that there is further potential for its discount to narrow.

As at 5 April 2024, APEO was trading on a 29.3% discount. Over the 12 months to end March 2024, APEO traded on an average discount of 39.4%, with a 12 month low of 45.7% and high of 29.2%. APEO’s discount is narrower than that of the entire listed private equity sector peer group average, which stood at 27.4% as of 5 April 2024.

The board has utilised the proceeds of the Action sale to repurchase APEO’s shares at historically wide levels.

APEO retains the authority to repurchase up to 14.99% of its issued share capital, which is renewed annually. Following the partial realisation of APEO’s stake in Action, the board has elected to use a large portion of this newly raised cash to initiate a new series of share buybacks for the trust. The catalyst for this has been the persistence of APEO’s discount over recent years, with the board commenting that “during the company’s 22-year history, the share price discount to NAV has only been wider during the Global Financial Crisis and the onset of the Global Pandemic”. The APEO team also comments that relative to the opportunities they are observing within the private equity market, being able to repurchase APEO’s shares at their current c.30% discount is arguably a compelling use of capital and should be accretive to shareholder returns.

Fund profile – underlying focus on primary commitments and Europe

Additional information is available at APEO’s website: www.abrdnpeot.co.uk

APEO invests in what it deems ‘best-in-class private equity funds’; predominantly by making primary commitments, with a core focus on the European mid-market. The aim is to maintain a broadly diversified portfolio by country, industry sector, maturity, and the number of underlying investments.

Historically, APEO has been a fund of funds, making both primary and secondary investments. In January 2019, shareholders approved changes to the investment objective and policy to allow for co-investments, and since then it has seen continuous year-on-year growth in its direct investments. As at 30 September 2023, APEO had 26 co-investments.

APEO’s objective is to hold around 50 ’active’ private equity fund investments. This allows for greater diversification, which counterbalances the additional concentration risk from the increasing allocation to co-investments (which is permitted to account for up to 25% of NAV).

Previously, APEO’s name was Standard Life Private Equity Trust Plc (ticker: SLPE) but, following shareholder approval at its AGM on 22 March 2022, the trust adopted its current name with effect from 1 April 2022 and its ticker became APEO at the same time. The name change was undertaken to align the trust with its manager’s new brand.

Previous publications

Readers interested in further information about APEO, such as investment process, fees, capital structure, trust life and the board, may wish to read our previous annual overview note, Unrecognised success, published on 8 September 2023, as well as our previous notes (details are provided in Figure 20 below). You can read the notes by clicking on them in Figure 20 or by visiting our website.

Figure 20: QuotedData’s previously published notes on APEO

Source: Marten & Co

IMPORTANT INFORMATION

This marketing communication has been prepared for abrdn Private Equity Opportunities Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.