Standard Life Private Equity Trust (SLPE), has made its first co-investment in Mademoiselle Desserts, alongside IK Investment Partners – see page 9, with more set to follow (up to 20% of NAV over time).

Shareholders approved a change to the investment policy in January to permit co-investments (an area in which the manager has a successful track record), which has increased SLPE’s opportunity set. This, combined with a stronger US team, provides a foundation on which the manager can continue to build SLPE’s record of outperformance. SLPE’s manager (a top 10 private markets manager globally) says that it aims to ensure that 70% of the portfolio continues to be invested with managers whose funds’ performance is first or second quartile. It believes that this approach will allow it to generate strong returns over the longer term.

Private equity fund of funds with a European bias

Private equity fund of funds with a European bias

Standard Life Private Equity Trust aims to achieve long-term total returns through a diversified portfolio of private equity funds, and direct investments into private companies alongside private equity managers (co-investments), the majority of which will have a European focus. Its portfolio is also more concentrated than those of most of its peers; the top 10 underlying private equity fund managers comprise 55.1% of the net asset value as at 31 March 2019. Like many private equity funds, SLPE has no formal benchmark. Historically, the portfolio has been most closely correlated to European small cap indices and we expect this to continue. We have used the MSCI Europe Small Cap Index as a means of comparison.

Increased opportunity set through co-investments

Increased opportunity set through co-investments

Historically, SLPE has been a fund of funds, with the manager making both primary and secondary investments but, until recently, its investment policy excluded co-investments (direct investments into private companies alongside private equity managers).

Following a strategic review, SLPE’s board concluded that it would be beneficial to increase the opportunity set available to the manager by broadening SLPE’s investment objective and policy, to allow it to make co-investments. These co-investments would be mainly alongside managers of private equity funds which SLPE and/or Aberdeen Standard Investments (ASI) has invested in. Shareholders approved the necessary changes to SLPE’s investment objective and policy at the trust’s AGM on 22 January 2019.

ASI has a dedicated co-investment team, run by Colin Burrow. SLPE’s new lead manager, Merrick McKay (see below), says that this team has a strong track record and benefits from high quality deal flow. SLPE is permitted to purchase co-investment deals in the secondary market, but the manager says that, for now, it is focusing on new investments.

The manager highlights a number of benefits to SLPE from allocating to co-investments:

- the ability to generate outsized returns versus fund investments;

- lower fees;

- providing increased exposure to particularly attractive assets; and

- the opportunity to put more capital to work.

The manager also says that one of the advantages of its co-investments approach is it generally allows plenty of opportunities to meet the management team and ‘kick the tyres’ on the business. It also says that, while making investments into secondaries has been useful, it has not been able to deploy as much cash as it had hoped. A very buoyant private equity market is good for exits, and SLPE has benefitted from strong realisations, but it drives up the price for secondary transactions, making it difficult to find investments of the right quality, at a price that represents good value. SLPE’s manager does not want to compromise on quality and this has been a factor behind the move to expand the opportunity set to include co-investments.

Targeting 20% allocation to co-investments over the medium term

Targeting 20% allocation to co-investments over the medium term

The intention is that SLPE’s allocation to co-investments will be built up gradually to represent 20% of the portfolio’s NAV. Rather than selling existing investments to fund this change, SLPE’s manager will recycle the cash it receives as distributions from its underlying funds into the co-investments; SLPE’s debt facilities can also be employed where the manager considers this to be appropriate.

SLPE’s manager is confident that it can invest 5-6% of the portfolio per annum to develop this segment, which suggests that the 20% target could be achieved in threeto four years (the manager expects this will be achieved by 2023). It plans to do this by investing in five to six positions of around 1% of NAV each (in the £5m-£6m range) per year. It wants the fund to remain sufficiently concentrated that investments have the ability to meaningfully add value (it thinks that the ticket size needs to be above £3m) but not overly concentrated so that diversification is reduced and the co-investments become a concentration risk.

SLPE has now completed its first co-investment. This is an investment, alongside IK Investment Partners, in Mademoiselle Desserts that was completed on 15 February 2019 (see page 9 for further discussion). IK Investment Partners is a private equity house with which SLPE’s manager has a very long-standing relationship. Its funds will likely be familiar to regular followers of SLPE and readers of our research on the trust.

Revised investment policy

Revised investment policy

SLPE’s principal focus is to invest in leading private equity funds; and to manage exposure through the primary and secondary funds markets, and co-investments. It aims to maintain a broadly diversified portfolio by country, industry sector, maturity and number of underlying investments. A majority of SLPE’s portfolio will have a European focus.

Historically, SLPE’s portfolio has comprised some 35 to 40 active funds, these being funds that are in their investment periods. It excludes funds that have recently been raised, but have not yet started investing, and funds that are close to or being wound up. However, SLPE’s investment policy was amended last year, so that its objective is now to hold around 50 ’active’ private equity fund investments. This allows for a greater diversification within the funds element, which counter-balances the additional concentration risk from the increasing allocation to co-investments (which is permitted to account for up to 20% of NAV).

Previously, SLPE has been making commitments in the £40m–£50m range, but £25m–£30m will be a more typical range going forward. It is worth noting that, because of its fund-of-funds structure, SLPE has exposure to around 400 underlying companies.

Team development at Aberdeen Standard Investments

Team development at Aberdeen Standard Investments

Boosted investor relations resource

Boosted investor relations resource

Prior to the merger of Aberdeen Asset Management and Standard Life Investments, the investor relations activities for SLPE were undertaken internally by a small team at SL Capital Partners. However, following the merger, the investor relations activities are the responsibility of the wider ASI team. This team has a deeper resource and a broader distribution network, allowing SLPE’s investor relations efforts to be conducted on a more industrial scale.

Merrick McKay is now the lead manager

Merrick McKay is now the lead manager

The baton of lead manager has passed from Roger Pim (who has moved to focus on other areas within the business) to Merrick McKay, who is head of Europe – Private Equity for ASI. Merrick is supported by Alan Gauld and Patrick Knechtli, with backup coming from the rest of ASI’s private equity team.

Merrick has over 27 years of experience in European private equity, five of which have been with ASI. Merrick’s career has included stints as an LP, GP, corporate financier and working within other private equity related services.

Merrick has previously worked for Macquarie’s Private Markets division, where he was head of European Investments; and Primary Capital (a London-based, lower mid-market private equity firm) where he spent 13 years as a partner and investment committee member. During his time at Primary Capital, Merrick was responsible for leading, originating and managing numerous private equity investments in the UK. He also spent five years in lead MBO and M&A advisory services.

Merrick is a regular speaker at private equity conferences and is a member of Invest Europe’s Limited Partner Council. He also holds Bachelor of Commerce and Bachelor of Law degrees from the University of Queensland.

Better resourced private equity team – particularly in the US

Better resourced private equity team – particularly in the US

Since the merger, ASI’s private equity investment teams in Europe and the US have been combined. Historically, SL Capital had a very strong European private equity team and a small team focused on the US, with Aberdeen having a stronger US presence. Combined, the two teams now have much better global coverage and, from SLPE’s perspective, a superior platform from which to make US investments.

Investment process unchanged

Investment process unchanged

Despite the change in lead manager and the superior private equity resource that can be drawn on for US investments, the process by which SLPE is managed remains unchanged. Merrick says that ASI has a large private equity team and all members are very familiar with the fund. Furthermore, all team members know all of the underlying managers; Merrick, for example, has been involved with SLPE since 2014 and has led on many of its primary commitments.

Manager’s view

Manager’s view

Private equity managers are returning to the primary market quickly and in size

Private equity managers are returning to the primary market quickly and in size

Merrick says that one of the biggest challenges the ASI private equity team is facing is the speed at which the underlying managers (including some of SLPE’s core managers) are returning to the primary market and the amounts that they are seeking to fundraise.

Finding the capacity to make these new commitments is not in itself a problem, and it is not uncommon that, having successfully deployed a fund, GPs will tend to look to increase the size of the fund the next time around. However, the ASI team are concerned that with the size of some fundraises, the underlying managers are maybe over-stretching themselves in terms of what they will be able to deploy effectively.

Merrick cites the example of a core European manager, focused on France, in whose funds ASI has invested for much of the last 20 years. While the ASI team continue to like this manager, and may invest with them again in the future, it was unable to get comfortable with the jump in size between the last two funds (the latest fund at €4bn, is around twice the size of its predecessor). This is by no means an exception. SLPE’S manager reviewed 36 funds in 2018 for SLPE, and the trust only participated in six of these.

Late cycle challenges

Late cycle challenges

Reflecting the lessons learned during the GFC, private equity houses are generally injecting less debt into the capital structures of their investments, on better terms, and focusing more on operational improvements (this has always been an approach that the manager favoured when selecting managers). This generally means lower returns, but less risk as a result.

Merrick comments that in the current easy-money, low-interest-rate environment, there is a wall of money looking for investments, which has driven strong pricing in private equity transactions. It has therefore been a good market for exits but a more challenging one when making purchases, and he expects this to depress returns, in absolute terms, going forward (he expects alpha of 2% to 5% per annum).

Furthermore, a significant proportion of recent gains has been driven by multiple expansion, some of which has been cycle-driven, and the global economic cycle looks long in the tooth. Market timing in private equity investing is difficult (particularly for a fund such as SLPE, as the underlying managers ultimately control this) but arguably is reflected in SLPE’s current net cash position. Furthermore, SLPE also has an undrawn credit facility on which it can draw should the pricing environment improve, for example once the economic cycle has turned.

Despite Merrick’s concerns about the size and timing of some fundraises, he says that many private equity houses are putting sensible funding structures in place. He says that some ”home run” opportunities will not be so prevalent going forward, but, if you have backed long-term sustainable businesses with secular growth and are able to maintain control and trade through the downturn, decent returns should still be achievable, albeit a longer holding period may be required. In this regard, Merrick notes that in addition to lower debt levels in general, covenant-light debt is now much more prevalent and this should make private equity investment more resilient than it was during the GFC, should the growth weaken.

Pricing in the UK market doesn’t reflect risks

Pricing in the UK market doesn’t reflect risks

SLPE’s manager had expected that Brexit uncertainty would create some opportunities to acquire UK businesses at compelling valuations, particularly those that are globally-focused. However, Merrick says that the UK private equity market has remained quite hot, with pricing not appearing to reflect the risks involved. As discussed in the asset allocation section, exposure to the UK is broadly unchanged since we last published. Merrick also notes that it is difficult to market time primary commitments, as the underlying general partners ultimately have control of this. However, Merrick expects that SLPE will ultimately benefit as it has exposure to European funds (for example, Equistone) that include the UK, and these should be well-positioned to take advantage of these opportunities when they arise.

Asset allocation

Asset allocation

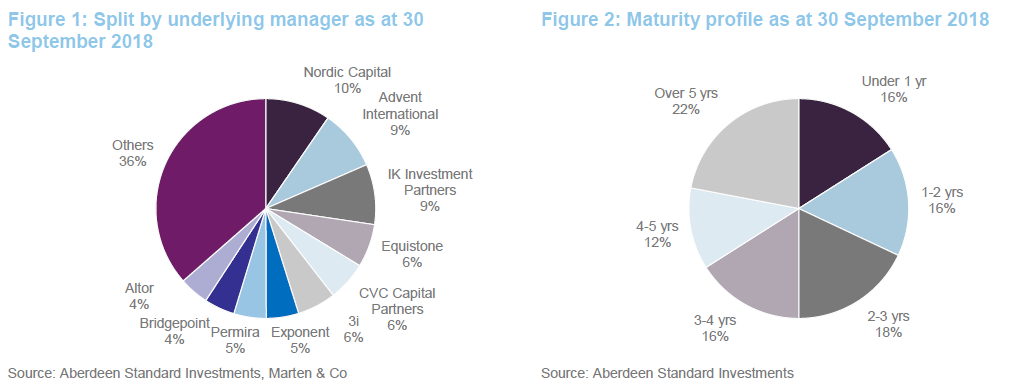

Readers interested in SLPE’s investment process should see our July 2018 annual overview note, which describes this in more detail. However, to summarise, SLPE’s manager tends to build a portfolio of core underlying managers whom it knows and trusts, albeit opportunities from new and existing managers for SLPE are under constant scrutiny. In terms of underlying managers, the portfolio is concentrated; the top 10 underlying managers account for approximately 64% of SLPE’s investment portfolio (see Figure 1 overleaf). Near-term changes in allocations tend to be driven by realisations and the pace of reinvestment.

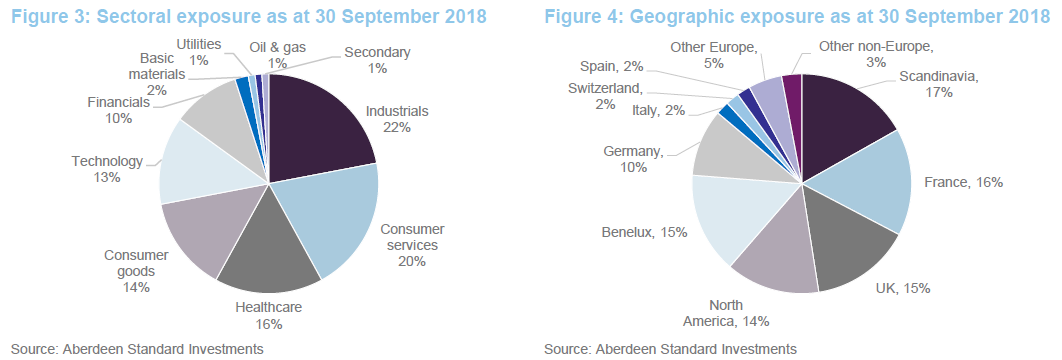

As at 30 April 2019, SLPE had total net assets of £626.3m (407.3p per share); £547.4m invested in 67 private equity funds and one co-investment; and cash of £78.9m. The portfolio provides exposure to about 400 underlying private companies and, as at 31 December 2018, the top 10 underlying private equity funds accounted for 55.1% of SLPE’s NAV. SLPE’s manager is comfortable with the trust’s portfolio – it considers the portfolio to be well-diversified but not overly so. Looking at Figures 1 to 4, SLPE’s portfolio appears to be reasonably well-balanced, but it should be noted that it can take time to shift these exposures (the underlying investments are illiquid and long-term in nature).

The fund continues to be biased towards northern Europe and has a focus on buyout managers. Exposure to the UK has held steady. Exposure to the US remains in line. Previously, this exposure has been achieved by investing through European-based managers or global groups, but in H1 2018, SLPE made its first commitment to a US-based fund, ONEX (this secondary purchase was discussed in our July 2018 note – see page 11 of that note). 2018 also saw SLPE make its first US primary commitment to Atlanta-based MSouth Equity Partners (see page 12 of our July 2018 note). More recently, SLPE’s made its second US primary commitment to operationally focused American Industrial Partners. SLPE’s manager expects to see the allocation to the US continue to move up gradually over time, aided by the additional resource that the combined ASI team has dedicated to this area.

Looking at Figure 2, SLPE’s portfolio continues to be reasonably well-balanced in terms of its maturity profile. 22% of the portfolio is in the ‘five years or older’ segment, which suggests that there is still a good level of exposure to companies in the ‘exit zone’. This could bode well for SLPE’s NAV development; SLPE’s manager says that it tends to see, on average, an around-20% uplift relative to the last relevant valuation when a company exits.

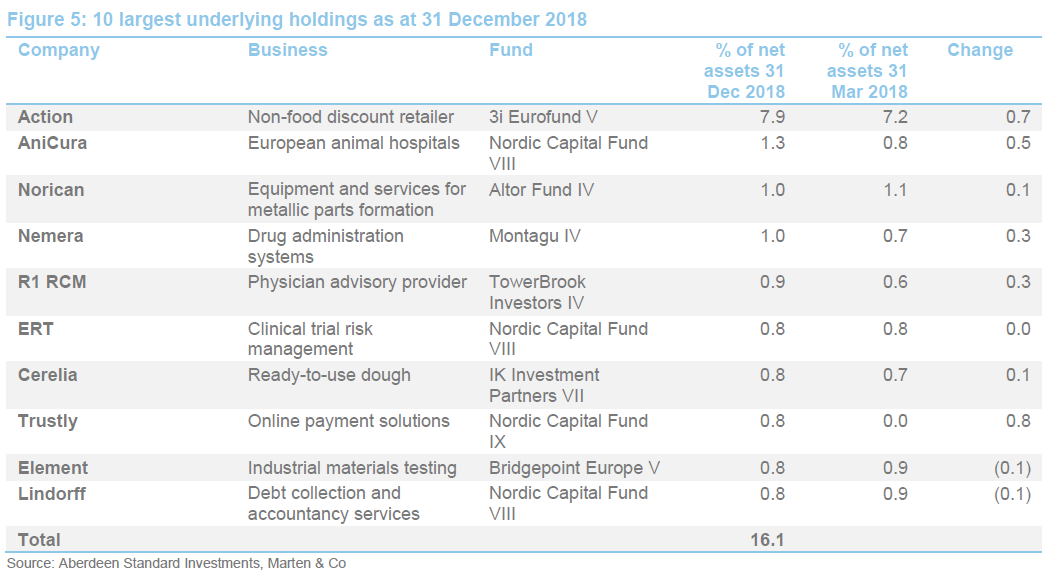

Figure 5 shows the top 10 underlying investments in the portfolio at the end of December 2018. Comparing this against the top 10 holdings as at 31 March 2018 (this being the most recently available data when we last published), four new names have entered the top 10. These are Nemera, R1 RCM, Cérélia and Trustly, and these positions are discussed in more detail below. The four names that have exited the portfolio are Scandlines, Handicare, Nordax Bank and an undisclosed holding. The largest company in the portfolio continues to be Action; a brief commentary on this is provided below. Healthcare and technology are allocations that have grown.

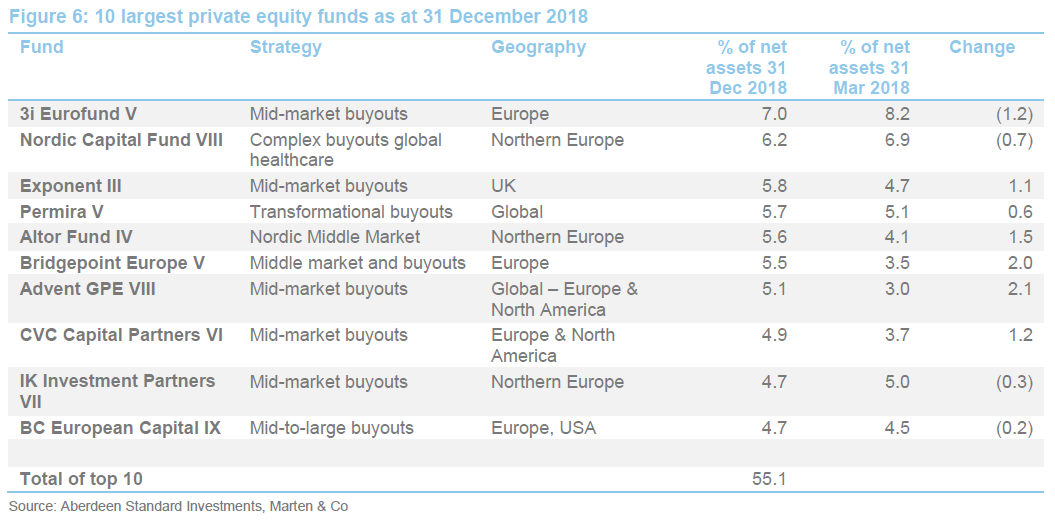

Figure 6 shows the top 10 largest private equity funds in the portfolio at the end of December 2018. Comparing this against the top 10 largest private equity funds in the portfolio as at 31 March 2018 (this being the most recently available data when we last published), two new names have entered the top 10. These are Bridgepoint Europe V and Advent GPE VIII. These have replaced Equistone Partners Europe Fund V and Nordic Capital Fund VII.

Portfolio activity and outstanding commitments

Portfolio activity and outstanding commitments

During the fourth quarter of 2018, SLPE made a new £30m commitment to Triton V and, up to the end of April 2019, SLPE had made a new €35m commitment to Altor V, a $20m commitment to American Industrial partners capital Fund VII, a €25m commitment to InvestIndustrial VII, a €25m commitment to the Seventh Cinven Fund and a €6m co-investment in Mademoiselle Desserts. Brief commentary is provided on some of these below.

During the first four months of 2019, SLPE received distributions of £27.1m; these generated net realised gains and income of £18m. As at 30 April 2019, SLPE had total outstanding commitments of £432.1m (2018: £360.0m), cash and equivalents of £78.9m and an unused credit facility of £80m. Of the outstanding commitments, SLPE’s manager expects that £60m will never be called and that through a combination of cash, the credit facility and future distributions from its investments, SLPE’s outstanding commitments will be funded readily.

Triton V

Triton V

December 2018 saw Triton Partners’ latest fund, Triton V, close with €5bn of commitments. This included a £30m commitment from SLPE. Its manager says that the new fund will continue Triton’s ‘all weather’ mid-market private equity investment strategy and will seek to generate value in the geographies in which Triton has strong local knowledge, such as the Nordics, Germany, Austria, Switzerland, Spain, Italy, France, UK and Benelux.

SLPE’s manager says that Triton is an established buyout manager focused on Northern Europe and Benelux, which has delivered consistently strong performance across cycles. It is a value-oriented investor that targets fundamentally-sound businesses that have been mismanaged. It uses its significant industrial and operational expertise to drive operational improvements in the business. SLPE’s manger says that this investment strategy comes into its own during times of market dislocation, allowing the manager to acquire mismanaged companies at relatively low entry prices.

Altor V

Altor V

After a brief fundraising that was substantially oversubscribed (93% of the capital was provided by existing investors), Altor V was closed at its hard cap of €2.5bn in February 2019. This included a €35m commitment from SLPE, which is SLPE’s second commitment to an Altor fund.

Altor V is the latest fund from Altor Equity Partners, a private equity firm focused on leveraged buyout and growth capital investments in Sweden, Denmark, Finland and Norway. SLPE’s manager says that Altor has delivered consistently strong performance across cycles, with a strategy of targeting situations where it can capitalise on the team’s experience with complex transactions involving the potential for fundamental performance improvement.

Altor says that, as with its prior funds, Altor V fund has a 15-year investment term; and investments will generally be made in private companies with revenues typically in the range of €50 to €500 million. Like its predecessors, Altor V has a flexible investment mandate that allows for minority investments in publicly traded companies and distressed debt.

Mademoiselle Desserts – SLPE’s first co-investment

Mademoiselle Desserts – SLPE’s first co-investment

SLPE’s made its first co-investment, alongside IK Investment Partners, on 15 February 2019 in Mademoiselle Desserts (www.mademoiselledesserts.com). Headquartered in France, Mademoiselle Desserts is a European frozen pastry business that has some 4,300 products that it manufactures at its 12 bakeries (eight in France, three in England and one in the Netherlands), employing 1,900 people. Annual turnover is in the region of €326m, a third of which is generated in France. Half of its output is delivered to food service companies, while the other half is delivered to supermarkets. SLPE’s manager says that Mademoiselle Desserts benefits from a market leading position in France and the UK, is led by an excellent management team, and benefits from the backing of a high-quality sponsor.

Action (7.9% of NAV as at 31 December 2018)

Action (7.9% of NAV as at 31 December 2018)

Action (www.action.com) is a 3i-backed fast-growth non-food discounter with more than 1,000 stores across the Benelux, French and Germanic markets. We last discussed this holding in our September 2016 note. At that time, we commented on how the company had grown revenues by more than 30% the previous year and was seeing strong organic growth. It has continued to grow strongly since.

Merrick considers that Action is a very high-quality company and one that is otherwise difficult to get exposure to in the listed market. Standard Life Aberdeen is one of the largest holders of 3i and 3i is the largest holder of Action (3i owns 44.3% of Action and also manages Eurofund V, which owns 33.2% of Action). Merrick says that he cannot see any obvious external threats to Action. Given the scale of its organic growth, there is always a degree of execution risk, but Merrick continues to see strong upside potential.

Action could also be a realisation opportunity for SLPE. 3i made its investment in 2011 and in November 2019, the final extension of Eurofund V is scheduled to end (Action is one of two remaining companies in Eurofund V). 3i Group’s results for the year ended 31 March 2019 say that 3i is working closely with the team at Action to facilitate a transaction that will allow those investors who wish to realise their interest in Action by November 2019 to do so. However, 3i also says that it intends tomaintain its current level of exposure in Action and it expects that a number of other investors are likely to retain a substantial part of their holdings.

Nemera (1.0% of NAV as at 31 December 2018)

Nemera (1.0% of NAV as at 31 December 2018)

Nemera (www.nemera.net) is a leading European manufacturer of plastic drug administration systems that SLPE has exposure to through its investment in Montagu IV. The investment is a 2014 vintage (it was formed as a carve out from REXAM Plc) putting it into the exit zone. October 2018 saw Montagu reach an agreement to sell Nemera to Astorg (a manager whose funds SLPE has invested in continuously since 2002, although SLPE’s manager decided not to participate in the most recent fundraise) with an option for Montagu to reinvest as partner so as to participate in the next stage of Nemera’s growth. The deal is subject to regulatory approval, but represents a potential realisation opportunity for SLPE through its investment in Montagu IV.

Nemera sells a range of drug delivery devices including auto-injectors, inhalers, insulin pens, eye-droppers and pumps, which it produces at four manufacturing sites in France, Germany and the US. SLPE’s manager says that the company has developed rapidly, driven by a focus on research and development, innovation and manufacturing excellence. The company has expanded its geographical reach and product portfolio through targeted acquisitions.

R1 RCM (0.9% of NAV as at 31 December 2018)

R1 RCM (0.9% of NAV as at 31 December 2018)

R1 RCM (www.r1rcm.com) describes itself as a leading provider of technology-enabled revenue cycle management services across hospitals, health systems and physician groups. The company offers its healthcare customers a fully outsourced solution that spans the entire revenue collection cycle from patient registration through to collection from patients and other third-party payers. In essence, it standardises processes to enable these to be completed more efficiently and therefore at lower cost. It says that its proprietary workflow and methods reduce variation to minimise errors, provide automation opportunities and standardise analytics across an enterprise.

Its approach has four key strands:

- standard methodology – over 150 detailed, standard methods supported by over 100 core operating measures designed for operational excellence;

- proprietary workflow solutions – order intake, scheduling and claim reimbursement;

- financial alignment – R1 RCM is aligned to the financial outcomes it produces for its customers; and

- technology enabled solutions – processes are hard-wired into customers operations using R1 RCM’s technology.

The Chicago-based company is a 2015 vintage investment for TowerBrook Investors IV. TowerBrook Capital Partners is an investment management firm headquartered in both London and New York, whose private equity strategy is to pursue control-oriented investments in large and mid-market companies, principally on a proprietary basis and often in situations characterised by complexity.

Cérélia (0.8% of NAV as at 31 December 2018)

Cérélia (0.8% of NAV as at 31 December 2018)

Cérélia (www.cerelia.com) describes itself as a dough- and batter-based food specialist. It is a leading manufacturer of ready to-use dough and has a wide product range that includes rolled pie dough, pizza dough, exotic dough, pastries, cake batter and organic dough. Its products are sold both through private labels and through its own brands (Croustipate and Pop! Bakery). The investment is a 2015 vintage for IK Investment Partners VII. IK acquired the company in July 2015 from Sagard, Capzanine, Cerea Capital and BNP Développement. Sagard had been the majority shareholder since 2012, when the company was formed from the merger of EuroDough and L’Alsacienne de Pâtes Ménagères. IK Investment Partners strategy for Cérélia has three key strands:

- expand into adjacent segments through various innovation projects;

- buy-and-build to accelerate European expansion and product range diversification; and

- continuous operating improvement.

Cérélia has production plants in France, Belgium, the UK, the Netherlands and the US. It markets its products in 50 countries globally and has sales offices in France, the Netherlands, Belgium, Italy, Spain, the UK, Malaysia, the US and Canada. There has been a marked uptick in growth since IK Investment Partners took its stake in 2015, with annual turnover increasing from €213m in 2015 to over €400m in 2017 (between 2012 and 2015 turnover increased by about 9% cumulatively – from €196m to €213m). Cérélia has over 1,500 employees, who, combined, hold over 30% of the company’s capital.

Trustly (0.8% of NAV as at 31 December 2018)

Trustly (0.8% of NAV as at 31 December 2018)

Trustly (www.trustly.com) is an online payment provider that enables direct account-to-account payments. It aims to make online payments that are fast, simple and secure for all– merchants, consumers, and banks. Headquartered in Stockholm, Sweden, with regional offices in Spain, Malta, Germany and the UK, Trustly has approximately 200 employees and processes more than 3.5 million payments, with payment volumes of SEK 6 billion, each month. It has a presence in 29 European countries with connections to more than 3,000 banks.

The investment is a 2018 vintage for Nordic Capital Fund IX. Nordic Capital says that it views Trustly as a highly strategic payment platform with unique capabilities, and that it will support Trustly’s management in its plan to establish the company as the leading global online banking payments provider. Nordic Capital sees significant potential in supporting management to accelerate Trustly’s growth agenda in current and new geographies, as well as expand the product portfolio. Part of the strategy is to support Trustly by investing in its bank network and technology platform, in order to drive payment innovation and leverage, what Nordic Capital describes as Trustly’s ‘first mover advantage’.

Performance

Performance

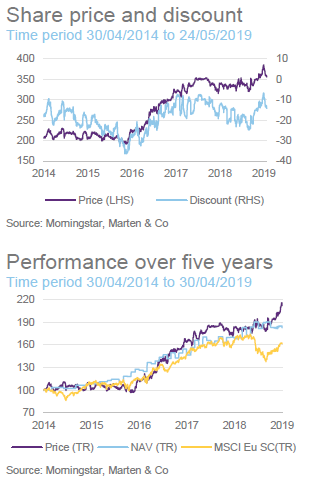

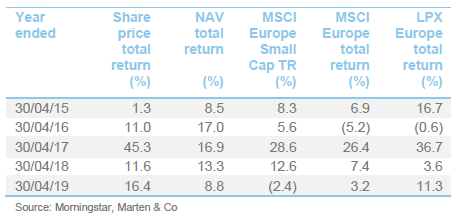

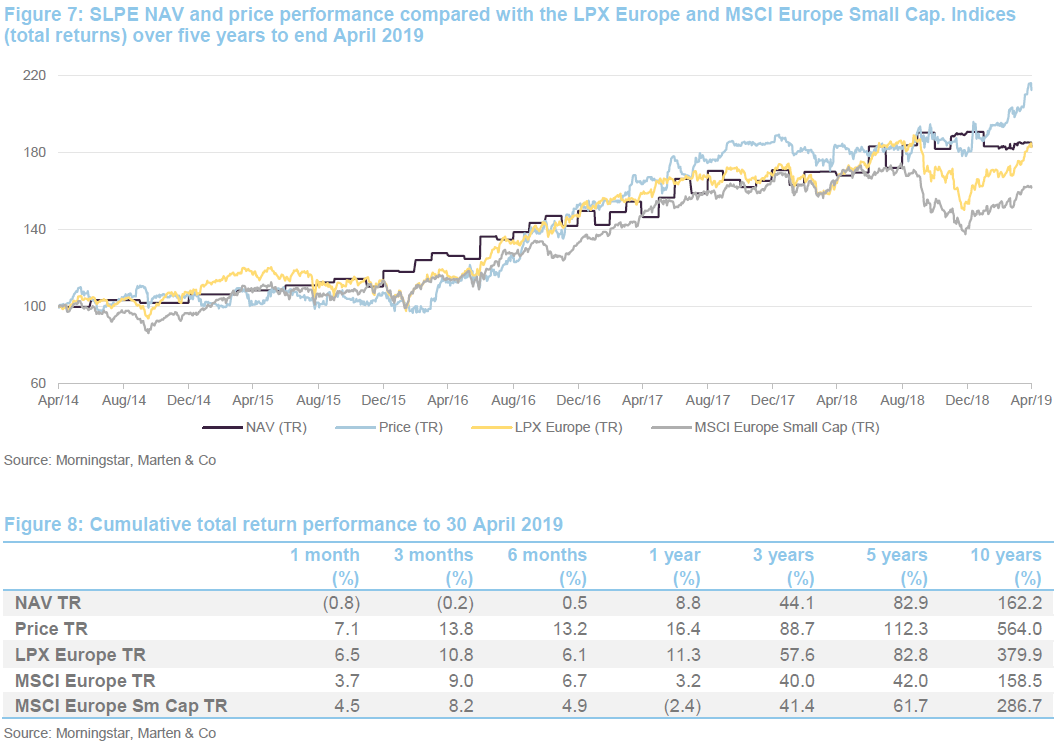

Further discussion of SLPE’s long-term performance record can be found in our previous notes, while longer-term performance figures can be seen in Figure 8 below. However, as illustrated in Figure 7, during the last five years SLPE’s NAV and share price total returns have exceeded the returns provided by the LPX Europe and MSCI Europe Small Cap Indices by comfortable margins. These have also outperformed the MSCI Europe by a significant margin during the same (see Figure 8). SLPE’s superior share price performance against its NAV reflects a narrowing of the discount during the period.

For a strategy s uch as SLPE’s, which is inherently long-term in its investment horizon, we consider that longer-term horizons are the best in terms of assessing performance. We do, however, caution that the 10-year numbers provided in Figure 8 have been distorted by the effects of the global financial crisis (GFC). In this instance, returns are calculated using a starting point of 31 March 2009, which is close to the trough of the values of these assets in the post GFC period.

During the preceding boom, a significant number of private equity houses were following highly-leveraged strategies (by utilising debt both in their funds and in the underlying investments). When the GFC came, asset values collapsed and the debt suddenly accounted for a much larger proportion of the capital structure, with equity being squeezed as a result. Many funds broke their covenants; some were unable to meet their commitments, and some inevitably went bust, all of which was very damaging for sentiment for the sector. This drove asset values down even further, but for those that were able to survive the downturn, this laid the foundations for the high levels of returns shown for the 10-year period in Figure 8.

These returns are therefore extraordinarily high and are not likely to be repeated on this scale, but it is fair to say that some of the best returns can be achieved by investing during a downturn when asset values are depressed. There is a variety of indicators that suggest that we are late in the economic cycle and that a recession maybe approaching. We also observe that while the exit environment is buoyant, many private equity GPs have been raising new funds, and levels of dry powder in the sector remain high. If the cycle turns, opportunities may be available more cheaply which could once again lay the foundations for a period of strong long-term performance. SLPE’s manager says that it remains focused on best-in-class European managers and that it aims to ensure that 70% of the portfolio is invested with managers whose funds’ performance is first or second quartile. It believes that this approach will allow it to generate very good returns over the longer term.

Premium/(discount)

Premium/(discount)

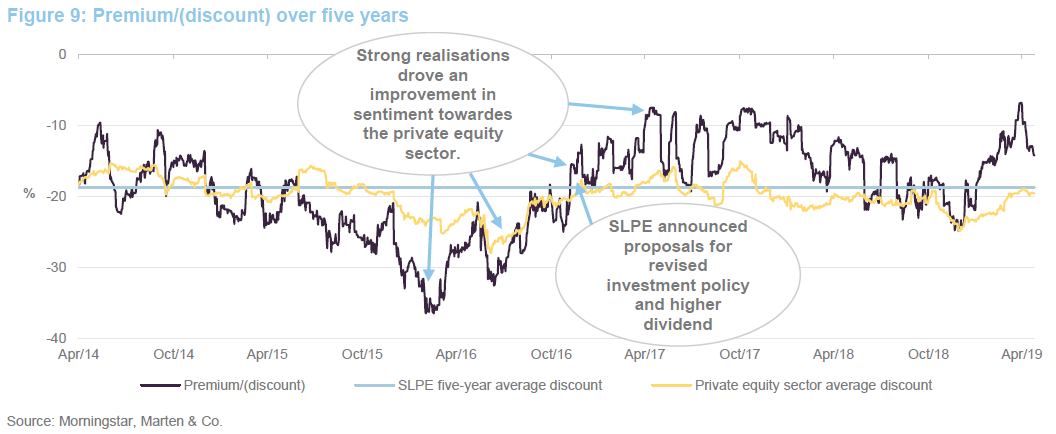

As illustrated in Figure 9, having previously been on a markedly narrowing trend between March 2016 and May 2017, driven by strong realisations, SLPE’s discount has been moving within a range of mid-20s to mid-single figures. During the narrowing phases, the pace of SLPE’s narrowing has generally been stronger than that of the broader private equity sector. We think this reflects the strength of its own NAV performance; the new dividend policy, revised investment policy and simplified fee structure that were announced in late 2016; and increased efforts to raise awareness of the trust with investors during this period. Marketing for the trust has recently been given a boost following the merger of Standard Life Investments and Aberdeen Asset Management, with SLPE benefitting from an increased investor relations resource.

The general widening and narrowing trends appear to be in part driven by broader market sentiment. There is evidence to suggest that the trust has benefitted during periods of market turbulence, when investors become more focused on assets that are less correlated with traditional equity markets.

However, we also think that should SLPE’s discount narrow further, this could create the opportunity for the board to consider expanding the fund. An increased asset base should benefit all shareholders by both increasing liquidity and reducing the ongoing charges ratio. We reiterate our view that the manager’s approach could be readily applied to a larger asset base without diluting returns, and so we would welcome such a move. Any issuance would need to be balanced against SLPE’s cash needs, although the trust continues to retain a significant cash balance that it could deploy in the event of a market dislocation.

Fund profile – European private equity

Fund profile – European private equity

SLPE is predominantly a fund of private equity limited partnerships (‘LPs’ or ‘funds’). It has a strong bias to (western) Europe and an increased focus on North America. Until recently, SLPE has followed a two-pronged approach that has involved making primary commitments to new funds managed by firms and teams that its manager rates highly, and purchasing private equity funds in the secondary market at attractive values. However, 2019 has seen the introduction of co-investments. The first was in Mademoiselle Desserts (see page 9), made in February 2019 but, as discussed on page 2, the manager expects to reinvest cash from realisations over the next few years, so that co-investments represents around 20% of SLPE’s NAV.

History

History

SLPE was listed in May 2001. The trust’s portfolio was seeded with a portfolio of 19 private equity funds from Standard Life’s (as it was then) balance sheet and Standard Life Aberdeen remains a significant supportive shareholder in the company. SLPE’s manager is SL Capital Partners (SL Capital) which is part of the Standard Life Aberdeen group.

Previous publications

Previous publications

Readers interested in further information about SLPE, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note Putting capital to work, published on 17 July 2018, as well as our previous update notes (details are provided in Figure 10 below). You can read the notes by clicking on them in Figure 10 or by visiting our website.

The legal bit

The legal bit

This marketing communication has been prepared for Standard Life Private Equity Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.