abrdn Private Equity Opportunities Trust

Investment companies | Annual Overview | 07 September 2023

Unrecognised success

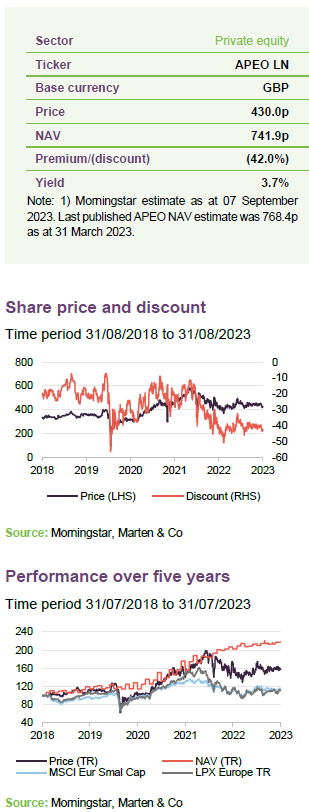

Given that abrdn Private Equity Opportunities Trust (APEO) is one of a limited number of ways in which investors can access a diverse pool of private equity managers, and that it has also produced long-term returns ahead of comparable equity indices and its peer group average, it might be reasonable to think that its shares would trade reasonably close to NAV. However, that is clearly not the case currently. APEO continues to trade on a stubbornly wide discount of 42.0%, possibly due to investors’ fears around valuations or market outlook, both of which could be misplaced.

The APEO team has been increasing its allocation to co-investments, which, all things being equal, should make the fund a more attractive opportunity, by reducing its underlying fees, and making APEO a better reflection of the team’s highest conviction investments.

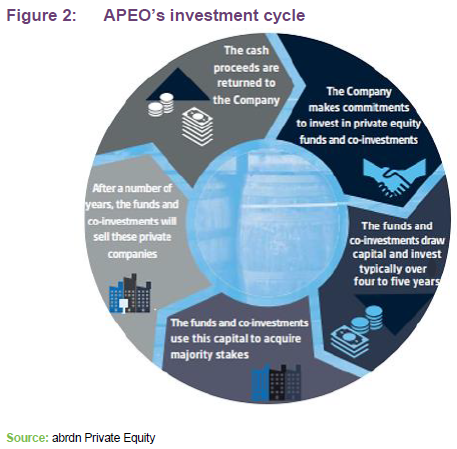

Private equity fund of funds with a European bias

APEO aims to achieve long-term total returns through a diversified portfolio of private equity funds, and co-investments, the majority of which will have a European focus. Its portfolio is more focused than many of its peers: the top 10 underlying private equity funds accounted for 31.3% of NAV as at 30 June 2023. Like many private equity funds, APEO has no formal benchmark. Historically, the portfolio has been most closely correlated to European small-cap indices.

Market backdrop – misplaced caution?

It appears to have been a somewhat perplexing period for private equity strategies. Despite their potentially resilient NAV returns, the market has seemingly fled from the sector, placing many trusts on some of their widest discounts in recent memory.

Private equity trust demand has been impacted by valuation uncertainty.

A reasonable question is: why? Many private equity managers and professional investors remain bullish on the outlook for their investments, with some trusts initiating share buybacks for the first time in order to capitalise on their discount.

One possible reason could be higher interest rates. 2022 saw the start of a period of rapidly rising interest rates across the developed world, which has increased the cost of capital applied to investments of all kinds. Against this backdrop, investors appear to have become increasingly concerned about the accuracy of the valuations for unlisted companies, which report less frequently – fears that may have been compounded by the falls in global equity markets, which sold off ubiquitously in the face of increasing inflation expectations and the responses of central banks.

Smoke but no fire?

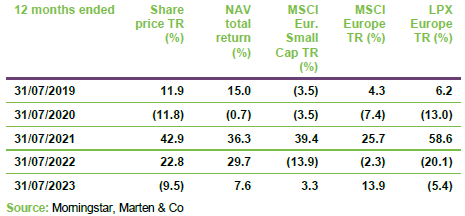

Private equity NAV performance has been commensurate with that of global equities.

Whilst it would probably be incorrect to dismiss the concerns of investors, it might also unfair to paint the entire sector with the same brush. The rise in market headwinds does not appear to have impacted the average private equity fund’s investment thesis, at least in NAV terms. Rather, it seems to have hit venture and early-stage growth funds, particularly those exposed to loss-making companies that are likely to find it harder to raise additional finance. Higher rates are also weighing on overly indebted companies, especially those that will have to pay a much higher price to refinance existing debt.

Even in the context of these issues, the private equity sector has exhibited some resilience. As can be seen in Figure 1, the private equity sector NAV returns have kept pace with those of listed equities over the last five years, albeit it with a weaker post COVID-19 boom, and a smoother rise (due to the periodic nature of their NAV valuations).

Rising deposit rates and bond yields may be encouraging a flow of capital out of all alternative assets. Sectors as diverse as infrastructure, renewables, royalties and property have been de-rated. Private equity appears to have been caught up in this.

The possibility of a reversal of very wides discounts could enhance shareholder returns.

This has the potential to create an attractive mis-valuation opportunity. Wide discounts offer investors a route to powerful share price returns in the event of a discount narrowing. The catalyst for this narrowing – a widespread belief that interest rates have peaked, perhaps – could have a sector-wide effect, particularly given how ubiquitous the share price declines seem to have been. However, APEO is trading on one of the widest discounts amongst the conventional listed private equity funds (excluding very small funds).

In the meantime, the manager’s focus remains on generating NAV growth from its well-diversified portfolio.

Valuations – proof is in the pudding

APEO’s focus on established businesses may reduce the risk of valuation uncertainty.

APEO is predominantly a buyout-stage, mid-market strategy. This means that APEO’s underlying companies do not sit at the more speculative end of private market investments, as one would find in venture capital strategies, but are generally mature companies that generate tangible, positive, and importantly long-term, cash flows. These positive cashflows allow for less-subjective valuation approaches, which gives the APEO team greater confidence in its valuation process.

The team’s preferred method is to use a bottom-up approach to valuation, whereby companies’ values are based on the cash flows they deliver, as well as the valuations their closest peers trade on, rather than on latest funding rounds or discounted cash flow models. The manager says that valuations are inherently conservative and this may be reflected in NAV returns, with the trust reporting no annual NAV loss since 2010.

APEO’s companies have seen a c15% uplift in their values when sold in 2023.

Further confirmation of this conservatism can be seen in the uplifts achieved on exits, with an average uplift of c.15% over the first half of 2023 when an underlying company has been sold.

Valuations – proof is in the pudding

APEO’s board provides oversight and challenges the investment strategy.

APEO’s board has oversight of strategy, gives guidance to the manager and challenges investment strategy annually. Day-to-day management of the fund is delegated to abrdn Capital Partners, a wholly-owned subsidiary of abrdn Plc.

A mix of top-down and bottom-up

APEO’s portfolio construction committee drives the top-down element of the investment process.

An important element in the top-down overlay process is the quarterly Portfolio Construction Committee (PCC) that considers the European macro-environment. Its views inform asset allocation decisions. In practice, asset allocation evolves slowly. The PCC directs geographic focus and generates views on each country to develop convictions on where the best opportunities are.

APEO’s European remit includes the UK. The manager estimates there are about 1,500 funds in its European universe. It believes about 800 of these are ‘institutional grade’ and theoretically a fit for its strategy. Through both its origination efforts and its regional experts, the manager aims to track and maintain a deep understanding of all of these funds. Private equity firms in Europe raise capital, on average, every three to five years, so it considers about 150 funds a year. In practice, the filter is tight and few managers make it through to the final investment list.

The manager goes on to identify its preferred funds in each market (between five

and 10) and typically the best of these will form a pipeline. It has a predisposition towards funds specialising in northern Europe, which has the most developed private equity markets. Each week, APEO will review a list of about 20 funds, which are discussed at a committee meeting. If a fund is deemed worthy of more detailed due diligence, the team will spend three to six months on due diligence for a potential primary fund investment, and from one to two/three months for secondaries and co-investments.

APEO looks for ‘operational alpha’.

The most important differentiator that APEO’s manager is looking for from a fund is ‘operational alpha’– the added value generated by the LP managers in their underlying portfolio companies. It seeks to partner with firms that are very active in improving the businesses they invest in, rather than simply being passive financial investors. Most of their favoured managers have considerable in-house industrial expertise that they can make available to portfolio companies.

Beyond that, APEO’s manager assesses factors such as whether a fund has a unique strategy or unique resources for originating deals, as well as the strength and depth of their investment team. Managers that focus on sectors where they have proven expertise are preferred, and any sign of drift in strategy will trigger a review of the investment. APEO’s manager does not like concentration of risk within a fund portfolio.

APEO looks for motivated and stable underlying managers.

APEO wants to invest in funds run by motivated, stable teams so its manager looks at issues such as team growth, development and succession planning. This means that APEO’s manager will typically avoid firms with an ‘investment bank’ model, where there is usually a higher turnover of personnel.

APEO’s manager looks at a broad range of fund managers and fund sizes but is focused on funds investing in companies with enterprise values of between €100m and €1bn.

Looking at past performance, a fund with a high ratio of loss-making investments is not a good sign. APEO’s manager comments that it is unrealistic to expect zero losses – like all investment strategies, private equity investing is a trade-off between risk and reward. It prefers managers who have learned from their mistakes.

Long-term bias towards Europe

We note that while APEO is not a ‘pure play’ European private equity strategy, it has a strong focus on European companies, as this is where the managers believe the greatest opportunities lie over the long term. Despite the comparability of Europe’s economy to the rest of the developed world, the APEO team believes that Europe’s private equity market, due to its heterogenous nature (e.g. different languages, cultures, legislation, etc), is less straightforward to transact in. This provides barriers to entry and better protection to incumbent private equity firms that have ‘boots on the ground’, which face less competition from other firms operating a ‘fly in’ model. The advantage of this is that private equity firms within Europe face less competition and are able to acquire companies at more modest entry prices, in APEO’s manager’s view. Furthermore, it says that Europe is the ‘birthplace’ of ESG and so European private equity firms are generally leading the way in the industry in this area.

Fees on the underlying funds

APEO focuses on potential returns, net of fees.

APEO’s manager spends significant time analysing fund structures and ensuring that they are acceptable. This includes ensuring that fees are in-line with market norms for the relevant region, while incentivising the underlying managers appropriately, and confirming that the underlying managers’ interests are aligned with those of investors. However, when weighing up one potential investment against another, it will opt for the one that offers the best risk-adjusted net return (after fees). This might not necessarily be the one with the lowest headline fees.

APEO does not levy a performance fee at the fund level, on top of fees paid out to the underlying managers. More details on APEO’s fee structure can be found on page 23.

Managing commitment levels

APEO’s policy is to carefully manage over-commitments to minimise cash drag.

abrdn manages APEO’s portfolio to ensure that it has a spread of maturities. It uses a detailed cash flow model to forecast the timing of potential drawdowns and distributions.

We discuss the fund’s borrowing facilities on page 24. The manager does not hedge currency in the portfolio. It considers that the cost of doing this would likely outweigh any potential benefit. Uninvested cash is held in euros, sterling or US dollars, in line with the trust’s underlying exposure.

Total outstanding commitments were £699.7m at the end of March 2023.

APEO has followed an over-commitment strategy since inception 2001. As at 31 March 2023, its total outstanding commitments amounted to £699.7m. We note that the majority of capital calls from underlying private equity are spread over three-to-five years.

Portfolio construction

APEO targets returns of 1.7x cost/15% IRR on primary transactions as a minimum.

All of this activity boils down to around six to eight new primary fund commitments in the region of €30-35m each year. The target net return on these investments is a minimum of 1.7x cost over the life of the investment, and a 15% IRR, although most fund investments in recent times have materially outperformed this.

Secondaries and co-investments

The second element of the investment focus is on secondary transactions. Whilst this was once an area of increasing importance, it has seen its weighting within APEO’s portfolio fall in the last two years.

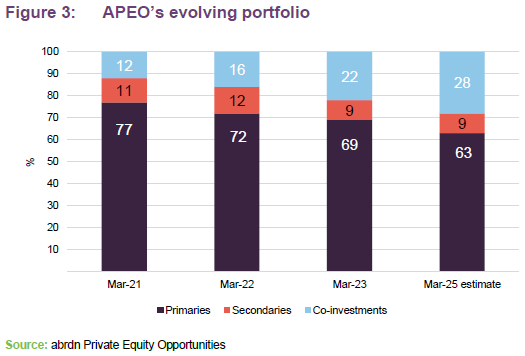

Rather, as is evidenced in Figure 3 on page 9, the team is placing greater importance on the third component of the portfolio, co-investments, where the APEO team invests directly into companies alongside underlying private equity firms, rather than through their LP funds.

The use of co-investments and secondary transactions has several potential benefits. The APEO team is afforded greater control over the pace of capital deployment, including the ability to invest at a later stage when the success or otherwise of the firm’s approach to the investment is more evident. APEO also has greater capacity to target specific sectors and subsectors which it believes have attractive characteristics, as well as specific deals from amongst the best opportunities present within a firm’s portfolio. By investing directly, APEO can reduce its look-through ongoing charges ratio, as these types of transactions do not typically come with management fees.

The manager monitors the portfolio closely. Members of APEO’s team often sit on advisory boards of funds (not interfering in day-to-day decision-making, but providing strategic oversight and other ad-hoc advice) and they have quarterly meetings with the underlying managers.

APEO will typically hold funds to maturity unless there is a compelling secondary market opportunity.

APEO’s manager says that it is given a high level of transparency on the underlying portfolio. Unfortunately, it cannot share all of this information with shareholders, but it can publish useful aggregate information such as earnings growth and debt levels within the portfolio. APEO usually holds funds to maturity, but will occasionally sell funds in the secondary market if it believes the returns on these funds will not meet its minimum target future returns, or if it believes maximum value has been achieved.

Asset allocation

APEO is increasingly allocating toward co-investments, which should reduce its underlying fees.

As at 31 March 2023, 57% of the fund’s NAV was attributable to 12 core European firms, which comprise the ‘primaries’ component of the portfolio. The core manager line-up has been reduced by one since our last update, published on 8 September 2022. The increasing emphasis on co-investments is apparent.

This shift to more co-investments is a reflection of the team trying to capture the benefits they perceive, outlined on page 8, with the fee advantages being highlighted in particular. The team believes that shareholders can expect the co-investments element to become an increasing component of APEO over the near-to-mid-term, although the team also believes funds will always have a role in APEO. The team also believes that it is through these funds and the relationships that APEO has with its underlying managers that the team is able to source attractive co-investments.

Well diversified by vintage sector and geography

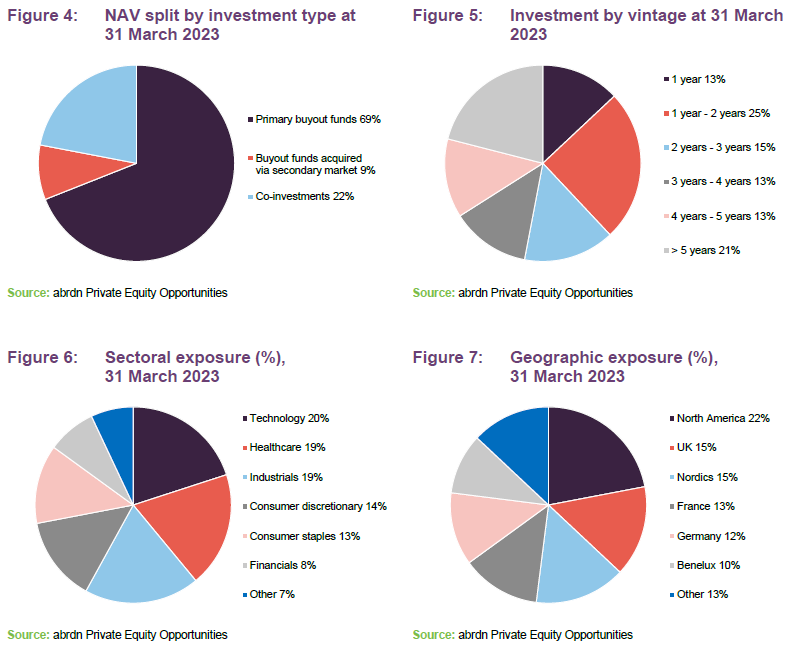

As at 31 March 2023, the portfolio provided exposure to over 650 underlying private companies, through around 80 funds. Out of these funds, the top 10 funds account for 37.5% of NAV, while the co-investments portfolio had 25 investments and accounted for 22% of NAV.

As is illustrated in Figure 5, the portfolio remains well diversified by vintage. 34% of the underlying portfolio is over four years old, with around a quarter in excess of five years old (this being the sweet spot for realisations). The less-mature vintages typically drive value accretion. We note that there has been a reduction in the sub-one-year vintages, and increase in the 1–2 years, which reflects the natural maturity in the early investments.

APEO has a broadly similar country and sector allocation to our last note, showing a strong preference for northern Europe, as well as a preference for less-cyclical businesses such as those in healthcare, technology, and select industrials (we note that the industrial category spans both cyclical manufacturing and non-cyclical specialist practices). Despite this, it continues to have what could be considered a balanced portfolio, whereby no single sector or country is too dominant, and there is no obvious risk-factor that seems likely to dictate the fortunes of the portfolio.

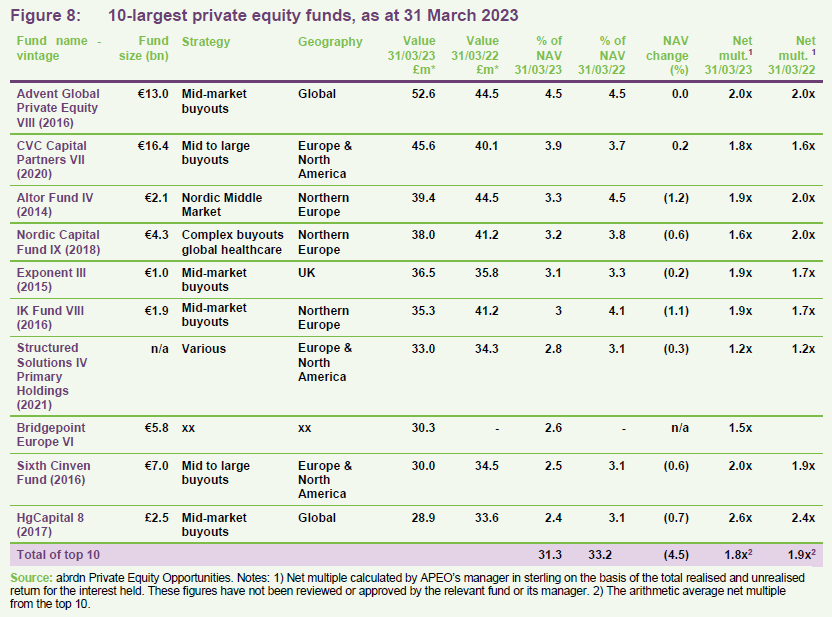

Top 10 fund exposures

Short-term changes to fund allocations tend to be driven by realisations, the pace of reinvestment, and the frequency of revaluation by the underlying managers. Reflecting the managers’ long-term fund-of-funds approach, the names of the underlying managers and their funds will be familiar to followers of the trust and regular readers of our notes on APEO. Only one name in the top 10 is new from our last note; Bridgepoint Europe VI. TowerBrook Investors IV (2013) has moved out of the top 10 and it now takes the 13th-largest fund place within APEO.

APEO 10 largest fund exposures continue to account for a smaller proportion of the portfolio, at 31.3%. This is largely a reflection of the increased allocation to co-investments, which has reduced the relative weighting of funds.

Top 10 underlying company exposure

Changes to the list of the 10 largest underlying company exposures tend to be common. Movement is often a function of holdings within the underlying funds moving closer to realisation. The bottom six names of APEO’s top 10 are all new entrants since we last published: European Camping Group, Uvesco, Froneri, CFC, Trioworld, and CDL. Names that have moved out of the top 10 are R1 RCM, Benvic, Visma, Trustly, Binding Site, and insightsoftware.

Action remains the largest underlying company exposure.

Action continues to be APEO’s largest underlying company exposure, as it has been for several years. Action is a non-food discount retail business in the Benelux, French and Germanic markets. The team comments that Action’s performance has been strong over the last six months, which could increase its weighting during future revaluations. APEO has taken opportunities to trim its holding in Action for what the team believe is the purposes of good investment management, and not having too large a position in any single investment.

European Camping Group

The APEO team has explained its investment case for one of its new co-investments, European Camping Group (ECG, europeancampinggroup.com/uk), France’s fourth-largest tour operator. APEO invested alongside PAI Partners, initially investing €11.0m in 2021, with a further €3m invested in a follow-on investment in 2023. The team notes that PAI has a successful track record of dealmaking within Europe’s leisure industry, which the APEO team thinks makes made them a natural partner to invest with. APEO saw ECG as a natural way to play the post COVID-19 recovery in travel and tourism.

Though based in France, ECG is a pan-European operator with over 23,000 mobile homes located across camp sites in Europe. ECG has recently acquired Vacanceselect, the number three operator in France’s outdoor accommodation market. After the acquisition, ECG represented c.11% of France’s outdoor accommodation market.

The APEO team was also attracted by what it sees as the structural tailwinds supporting the expansion of Europe’s outdoor accommodation sector, such as the diversification of campsites and their up-scaling to a premium offering, as well as what it thinks is a trend towards greater outdoor vacationing. The team hopes to add value to ECG through yield management techniques such as occupancy and pricing optimisation, the expansion of ECG’s geographical footprint, or achieving better diversification within its portfolio of assets.

Other new co-investments

Uvesco

Uvesco (uvesco.es, in Spanish) is a regional leader in Spanish food retailing. Headquartered in the Basque Country, it has a strong retail presence in the area as well as in in Cantabria, Navarra and La Rioja (all located in northern Spain). Uvesco’s stores operate under two brands; Super Amara and BM Supermercadoes, both of which offer a high-quality selection of food, according to the manager. Regional leadership is key it adds, as the Spanish supermarket industry is highly fragmented, with Uvesco’s large northern presence potentially offering a strong position to expand from.

Froneri

Froneri (froneri.com) was born out of a strategic merger of Nestle and R & R ice cream brands in South Africa that was put together by PAI Partners. PAI has since acquired numerous other regional firms, such as Tip Top Ice Cream in New Zealand, Noga Ice Creams in Israel, and Nestlé USA’s ice cream business. The company now holds numerous brands, including international names like Haagen-Dazs, as well as regional specialities. Froneri is now the second-largest ice cream company in the world, with a highly diversified set of brands.

CFC Underwriting

CFC Underwriting (cfc.com) is an insurance platform based in the UK that focuses on cyber security risks. This is a niche section of the market that has yet to see widespread coverage, despite the obvious risks associated with it. APEO’s manager comments that there are structural growth opportunities underpinning CFC, given the increasing sophistication of cyber-attacks and fraud. However, the complexity of the space has meant that major insurers have been slow to provide coverage and CFC may have secured itself a first-mover advantage.

Trioworld

Trioworld (formerly Trioplast, trioworld.com) is a Swedish polyethylene films maker, known for its recycling of plastics and the use of renewable raw materials. Its products are used when transporting industrial, farming and forestry products, as well as in medical sanitation. Recent accretive acquisitions made by Trioplast include its purchase of Iriworld, which expands Trioplast’s presence in the load stability and food packaging markets.

CDL

CDL Nuclear Technologies (cdlnuclear.com) is a leading US-based provider of Nuclear Cardiology diagnostic services, allowing physicians to provide in-office Nuclear Cardiac Imaging Services. CDL aims to deliver the highest-quality Cardiac PET and PET/CT equipment, service, and support to cardiology groups. Its on-demand Rubidium-82 delivery service provides imaging agents. CDL uses its economies of scale to deliver competitively priced solutions to its customers.

Commitment levels – plenty of room for more commitment

As is illustrated in Figure 10, as at 31 May 2023 (the most-recently available data), APEO’s over-commitment ratio sat at the bottom-end of its target range of 30% to 75% and in line with its 12-month average, giving the team plenty of flexibility to make new commitments. The team is also confident in APEO’s current position.

As at 31 May 2023, APEO had total outstanding commitments of £697m, including an estimated £83.4m that the manager believes is unlikely to be drawn. This equates to an over-commitment ratio of 37% (this being the value of APEO’s outstanding commitments that were in excess of its liquid assets, as a percentage of net assets), in line with the figure reported in its interim results, and on trend for its long-term average.

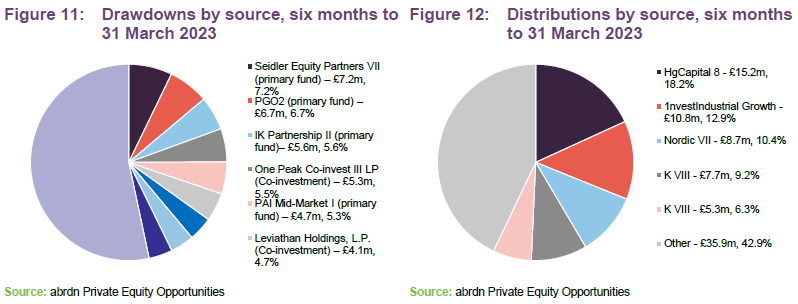

During the six months ended 31 March 2023, APEO made new commitments totalling £140.8m (2021: £239.7m). This comprised of five now primary fund commitments, two new direct co-investments, two follow-on investments in existing co-investments and one secondary investment.

During the six months to 31 March 2023, £104.4m was drawn down, with £83m going into primary funds, and the rest into co-investments or secondaries, with the largest fund drawdowns being as follows:

- Cold Jet Technologies (Seidler Equity Partners VII) – dry ice technologies utilising recycled CO2;

- Unither (IK Partnership II) – pharmaceutical CDMO serving the ophthalmology and respiratory end-markets;

- The ACES (Excellere Partners Fund IV) – Arizona-based school operator focused on special needs education;

- Medix Staffing Solutions (MSouth Equity Partners IV) – leading US provider of healthcare staffing services; and

- Ascot Lloyd (Nordic Capital X) – leading UK independent financial advisor platform.

Drawdowns may exceed distributions in the near term, as market activity slows.

APEO received £83.6m in distributions from its funds during the interim period, down from the £120.6m a year prior. The team does expect drawdowns to exceed distributions in the near term, as private equity M&A activity begins to slow down in light of a weakening economic outlook, however the manager says that trade and financial buyers have remained active. The net result may be an increase in the percentage of commitments.

Below are the largest distributions made during the period. Note that just after the end of March, APEO made a partial realisation of its holding in Action, which generated €26.0m in cash.

- Access (HgCapital 8) – a provider of business management software to mid-market organisations;

- Benvic (Investindustrial Growth) – a developer and producer of highly customised, innovative thermoplastic solutions;

- The Binding Site (Nordic VII) – a global leader in speciality diagnostics;

- Linxis (IK VIII) – global manufacturer of industrial equipment for the food, pharma and cosmetic industries;

- Exxelia (IK VII) – designer and manufacturer of electronic components and rotary joint assemblies for aerospace and defence industries.

Co-investments remain a key part of APEO’s portfolio, offering its managers greater control of portfolio construction and the opportunity to invest with lower fees. While the secondary investment activity has been muted in recent years, the team has nonetheless made one secondary investment over the period, in line with the activity of the previous year. The team made a $4.6m investment into Capiton Quantum, which it already had an existing commitment to. APEO rolled its position of €4.5m in two underlying private companies into the Capiton Quantum continuation fund, with an additional top-up commitment of €0.7m for additional M&A opportunities.

Co-investments – ever more important

APEO is approaching its 25% target allocation to co-investments.

During the last financial year, APEO expanded its allocation to

co-investments. APEO committed £14.9m to four co-investments, two of which were new and two were follow-on investments. The number of co-investments now stands at 25, equal to 22% of APEO’s portfolio. The manager expects APEO to have a c.25% allocation to co-investments over the long term.

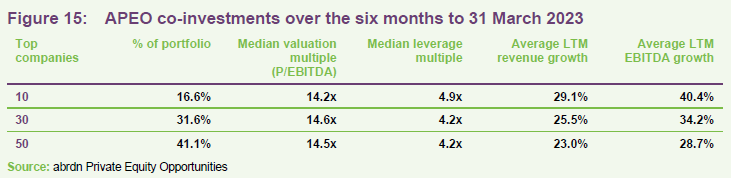

Key metrics – a robust portfolio

Thanks to the combination of accretive manager selection (vis-a-vis the primary funds) and what appears to be increasingly robust portfolio construction (enabled by the trust’s greater usage of secondary and co-investments), APEO’s portfolio demonstrates attractive earnings growth coupled with reasonable valuation multiples, as shown in Figure 15.

APEO’s valuations remain comparable to the more expensive end of the listed equity market.

While public-private comparisons are difficult, due to much of the public equity valuations being hinged on their listed shares, we can at least compare APEO’s median valuation multiple of 14.5x of EBITDA, of its top 50, to those of the MSCI Europe and MSCI Europe Small Cap indices – 7.3x and 6.0x times respectively.

It does appear, then, at a cursory glance, that while the valuations of APEO’s portfolio are elevated relative to listed equities, these do not appear excessive. Given the strong growth of the top 50 (23% LTM revenue and 29% LTM EBITDA growth), this cohort could be viewed as being somewhat comparable to those of higher quality or high-growth listed equities, which can afford to command a higher premium. Where, for example, the MSCI Europe Growth Index trades on a valuation multiple of 14.1x EBITDA. We also note that APEO’s top 50 holdings represent only 41% of the portfolio, which means it is highly diversified by listed equity standards, with its closest comparable being highly diversified small cap equity strategies.

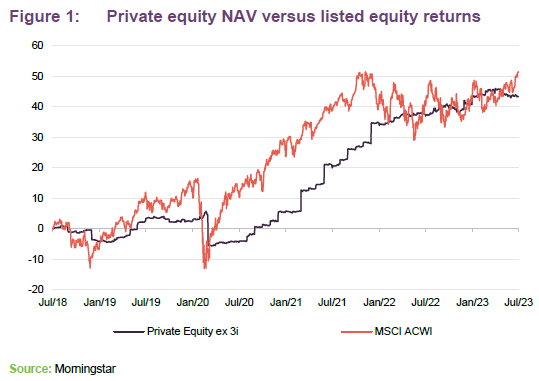

Performance

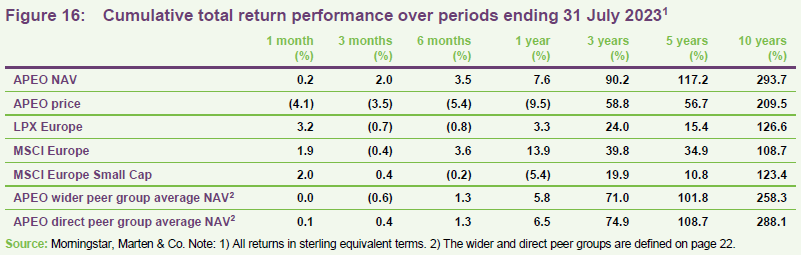

APEO has demonstrated impressive NAV outperformance over both the medium and long term.

Over the last two years there appears to have been a divergence of APEO’s NAV from its share price, possibly a reflection of the wider trend in private equity, as we described on page 8. APEO’s NAV returns have been robust and whilst they have not quite kept pace with the wider equity listed equity market over the last 12 months, they have not been significantly impaired by the recent market turbulence.

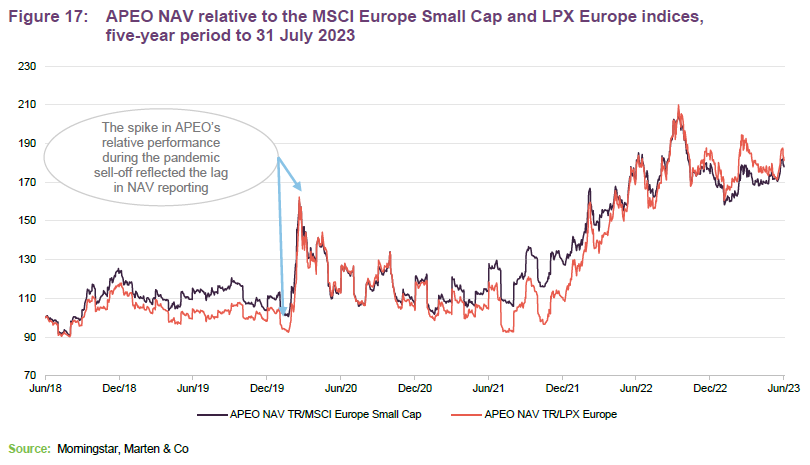

APEO’s last fully revalued NAV is 768.4p per share as of valuations at 31 March 2023. Since that date, European equity markets have been largely flat – the MSCI Europe has returned -0.2%, the MSCI Europe small cap -0.9%, and the LPX Europe 3.0% (all in sterling terms). This suggests that, all else being equal, APEO’s NAV should not have moved excessively.

It could be argued that, for a long-term strategy such as APEO’s, longer-term periods are more relevant in assessing its performance and it is noteworthy that APEO’s NAV has outperformed the LPX Europe, MSCI Europe and the MSCI Europe Small Cap over the three-, five- and 10-year periods (the LPX Europe is an index of listed private equity companies in Europe and its returns reflect the share price returns of those companies, rather than NAV).

Both APEO and the MSCI Europe Small cap Index have lagged MSCI Europe recently, as a narrow group of large-cap companies have dominated market returns, particularly those associated with AI. When markets are recovering, liquid large-cap stocks tend to move before all other classes, given their liquidity and investors’ familiarity with them.

APEO’s NAV total returns have also outperformed those of its wider peer group, over all sampled periods. APEO’s near-term outperformance gives weight to the importance of diversification during periods of heightened volatility.

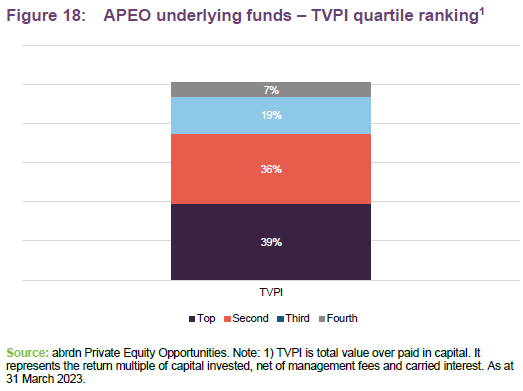

As illustrated in Figure 18, a key driver of APEO’s superior performance over the long term is the manager’s process for selecting investments – 75% of APEO’s fund investments lie within the top or second quartile from a total value to paid-in multiple (TVPI) perspectives of all private equity deals.

Interim results – six months to 31 March 2023

The managers believe their realisations are indicative of strong performance against a challenging market.

Over the six months to 31 March 2023, APEO delivered a NAV total return of 3.0% (2022: 6.8%; 2020: 5.8%) and a share price total return of 2.3% (2021: 5.8%). Realisations amounted to £83.6m (2022: £120.6m), which the manager considered to be indicative of strong performance considering the market backdrop of a slowdown in private equity M&A. There remains €26.0m in cash proceeds from the partial realisation of APEO’s holding in Action, which is not reflected in the end-March NAV.

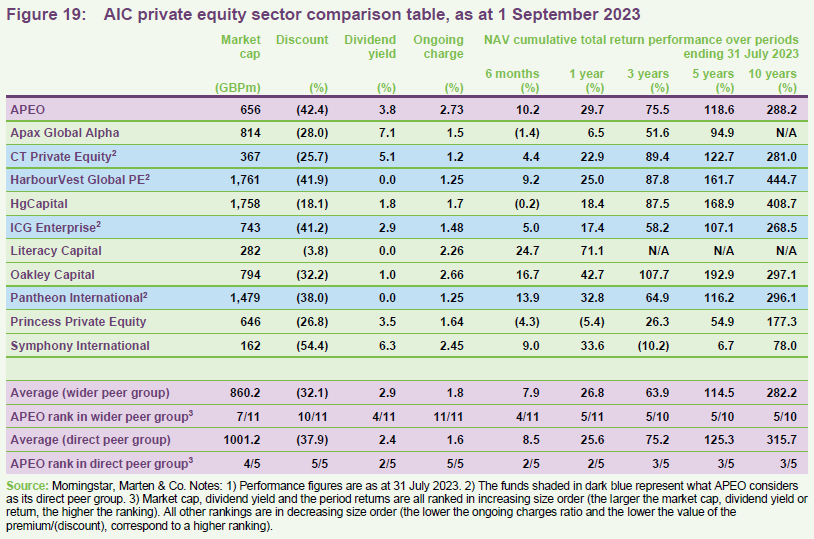

Peer group

APEO is a member of the AIC’s private equity sector, which comprises some 19 members. Members will typically have over 80% of their assets invested in private equity/unquoted shares; and an investment objective/policy to invest in private equity or unquoted shares. For the purpose of this analysis, we have narrowed down the wider peer group to 11 funds illustrated in Figure 19. 3i Group is among those excluded, as it considers itself to be an asset manager and has investment interests extending beyond private equity. We have also excluded Dunedin Enterprise, EPE Special Opportunities, JPEL Private Equity, LMS Capital, Reconstruction Capital II and Seed Innovations Limited on size grounds, as all have market caps below £100m, making them less relevant comparators. In addition, Dunedin Enterprise and JPEL Private Equity are both in wind-down mode, which also reduces their usefulness as comparators.

As shown in Figure 19, we have also included rankings against a subset of fund of funds that APEO considers to be its direct peer group: CT Private Equity (formerly BMO Private Equity), HarbourVest Global Private Equity, ICG Enterprise and Pantheon International.

Given the inherently longer-term nature of private equity investing, APEO’s relative performance is best examined over at least five years.

APEO ranks as middle of the pack across all periods, which is somewhat unsurprising given that it is a diversified approach to private equity investing. However, given that APEO’s – and indeed the wider sector’s – strategies are inherently longer-term, and also given APEO’s indefinite life structure, one could argue that the longer-term periods (five- and 10-year) provide the best basis for comparison. Among its closest peers there is little difference in the long-term performance, as a sub-10% difference in returns is arguably negligible over longer time horizons, and rankings can change substantially with even a small movement in the sampling period. However, APEO is currently trading at a wider discount than the other private equity funds in its peer group.

As at 1 September 2023, APEO’s discount was 42.4% (based on Morningstar’s NAV estimate), which is wider than the average of its direct peer group, and wider than the average of its wider peer group. As discussed in further detail on pages 4 and 23, APEO’s discount – and that of the wider private equity peer group – are wide relative to their own histories.

With the obvious exception of the non-dividend payers, the private equity sector yields have been driven up by the widening of their discounts, which effectively enhances the share price yield of a trust. We note that at 3.6%, APEO’s trailing dividend yield remains above the averages of both its wider and direct peer groups.

APEO does not charge a performance fee at the fund level, unlike many of its peers.

APEO’s ongoing charges ratio of 2.73% is the widest OCF reported by the sector. However, its expense ratio of 1.05% (which does not include the fees of the underlying funds) is much more competitive. We note that APEO, unlike most of its direct peer group, does not charge a performance fee at the fund level (although these will be incurred by the underlying funds in which it invests). Comparing APEO’s management fee, we find that its 0.95% is in line with close peers (which range from 0.9%-1.25%). What may set APEO apart is its lack of performance fees, which means it could be cheaper during periods of high performance.

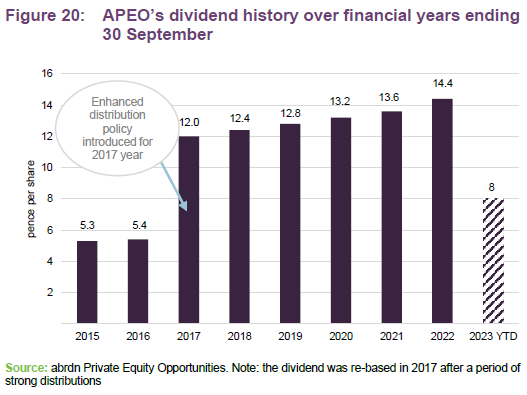

Dividend

Dividend of 3.6p per quarter represents a 5.8% increase in the quarterly dividend rate year-on-year.

APEO paid a total dividend of 14.4p per share for the year to 30 September 2022, which represented a 5.8% increase on the previous financial year (2020: 13.6p per share). The first and second dividends for the current financial year have been declared at 4.0p per share (versus 3.6p per share for the prior financial year), which represents a 11.1% increase in the quarterly dividend rate year-on-year. Assuming that APEO maintains its quarterly dividend at 3.6p per share for the third and fourth quarters of the current financial year, this suggests a total dividend of 16.0p per share, which is a yield of 3.8% on APEO’s share price of 427p per share as at

1 September 2023.

APEO’S dividend policy sets it apart from its peers

Historically, APEO’s has aimed to retain the real, inflation-adjusted, value of the total annual distribution.

Other than its fund-of-funds approach, one of APEO’s other distinguishing features is perhaps its dividend policy, as many of its peers fail to pay a dividend. For a given financial year, the first interim dividend is paid in April, with the second and third payments made in July and October. The fourth payment remains a final dividend and is paid in January following shareholder approval at the AGM. Ex-dividend dates and record dates occur the month prior to payment. The fund has historically aimed to retain the real, inflation-adjusted, value of the total annual distribution.

APEO’s relatively mature portfolio generates relatively high levels of cash.

Over the longer term, the manager expects that approximately 50% of the dividend will be covered by current year revenue, although the level of coverage will vary from year to year. The rest will be paid out of capital. It is noteworthy that APEO has a relatively mature portfolio and so generates relatively high levels of cash.

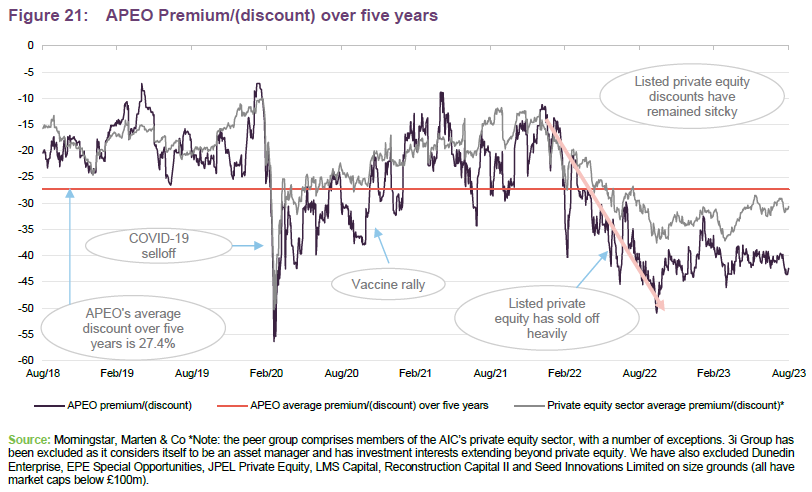

Premium/(discount)

As we highlighted earlier in this note, whilst APEO’s discount has narrowed by around 10 percentage points since peaking towards the end of October last year, it remains significantly wider than its longer-term five-year average. This is despite the resilience of its NAV, its yield, a focus away from venture capital towards cash-generative growth businesses and APEO offering a diversified approach, which could be all the more compelling in uncertain markets. APEO’s discount widening quite possibly reflects that which has occurred within its peer group, but despite the positive attributes noted above, APEO’s discount has widened further than the peer group average and has exhibited less recovery. This is perhaps out of step with the benefits offered by its investment proposition.

Prior to COVID-19, APEO’s strong NAV performance and attractive dividend policy (along with other shareholder-friendly changes like a simplified fee structure, increased marketing efforts, and a revised investment policy) may have led to APEO trading on a structurally tighter discount from mid-2017.

APEO’s discount has yet to narrow after its 2022 sell off.

As at 31 August 2023, APEO was trading at a discount of 42.4% (based on Morningstar’s NAV estimate) and a 43.1% discount to APEO’s last published NAV as at 31 March 2023, which is broadly in line with the discount it traded on in our last note, published in September 2022. APEO’s discount is wider than that of the listed private equity sector peer group average, which stood at 30.6% as at

31 August 2023. Both APEO’s discount and that of the listed private equity sector peer group are wider than their longer-term averages (APEO’s five-year average discount is 27.4%, while the peer group’s average discount is 22.9%). APEO’s one- and three-year averages are 41.3% and 30.7% respectively.

APEO retains the authority to repurchase up to 14.99% of its issued share capital, which is renewed annually. However, the board’s policy is generally to preserve cash for investment purposes, and the trust has not repurchased any shares since August 2016.

Fees and costs

APEO’s investment management agreement does not include a performance fee.

Under the terms of its investment management agreement with abrdn, APEO pays a base management fee of 0.95% per annum of its total net assets. The investment management agreement does not include a performance-fee element and is terminable on 12 months’ notice by either side. The total investment management fee for the year ended 30 September 2022 was £10.60m (2021: £8.84m), and the ongoing charges ratio (OCF) was 2.73% (compared to 2.79% a year earlier). The OCF is broken down into a 1.05% expense ratio (charges related to the operations and management of APEO) and a 1.67% look though expense (which reflects the expense of APEO’s underlying investments, excluding performance-related fees). The investment management fee is allocated based on a 90:10 capital/revenue split.

abrdn provides company secretarial services to APEO, while IQ EQ Administration Services (UK) Ltd provides administrative services. The fees for both are adjusted annually in line with the retail price index. The secretarial agreement and administrative agreement can be terminated by either side on six months’ and three months’ notice respectively.

Capital structure and life

Simple capital structure with one class of ordinary shares.

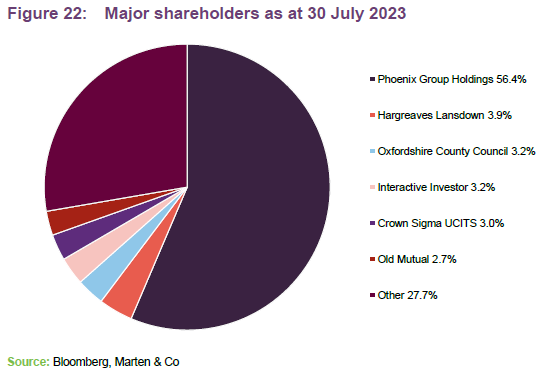

APEO has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 31 August 2023, there were 153,746,294 shares in issue with none held in treasury. abrdn has voting rights over 56.7% of the shares, by virtue of the initial transaction that launched APEO (see Phoenix Group holdings in Figure 22).

Unlimited life

Arguably reflecting the longer-term nature of its underlying investments, APEO has been established with an indefinite life and there is no specific mechanism, such as a regular continuation vote, to wind up the company.

Major shareholdings

Gearing

The loan facility has been increased to £300m.

APEO announced in its interim results that it had increased its existing multicurrency syndicated revolving credit facility from £200m to £300m. The facility’s financial covenants and expiry date were increased by a year to December 2025. The interest rate on this facility is LIBOR plus 1.625%, rising to 2.0% depending on utilisation, and the commitment fee payable on non-utilisation is 0.7% per annum.

APEO has plenty of credit available to fund future investments.

The facility is provided by RBS International, Société Générale and State Street Bank International. APEO’s articles of association permit it to borrow up to 100% of net assets, although the board has said that it does not expect bank borrowings to exceed 30% of net assets.

APEO had £207.2 million remaining undrawn on its £300.0m revolving credit facility at 31 March 2023, with £19.9m in cash.

APEO’s board has agreed that the over-commitment ratio (outstanding commitments less resources available for investment and available debt facility/ NAV) should sit within the range of 30% to 75% over the long term. APEO had an over-commitment ratio of 37.6% as of 31 March 2023, which is well within the target range of 30% to 75%.

Financial calendar

APEO’s financial year-end is 30 September. The most recent annual results were released in January, while interim results are typically released in June. The most recent AGM was held on 22 March 2023. As discussed on page 21, APEO usually pays dividends in January, April, July, and October of each year.

Management

The lead manager, Alan Gauld, is a senior investment director in the private equity team at abrdn. Alan is supported by Patrick Knechtli (head of secondary investments), Mark Nicolson (head of primary investments), and Simon Tyszko (portfolio director). Backup is provided by the rest of abrn’s private equity team (which has 39 investment professionals – as at 31 March 2023).

Alan has a strong network and extensive experience with leading private equity funds, particularly pan-European and French, Nordic, and Iberian GPs. He is involved in sourcing, appraising, and executing investments as well as portfolio monitoring. Alan is a qualified chartered accountant and holds a BSc (Hons) in Genetics from the University of Edinburgh. He joined Aberdeen Standard Investments in 2014 as part of the Scottish Widows Investment Partnership (SWIP) transaction.

Board

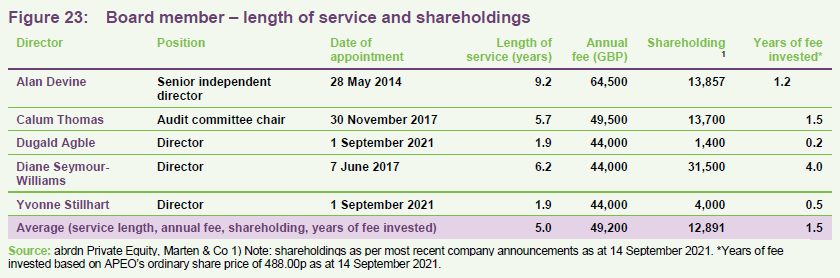

APEO’s board comprises five directors, all of which are non-executive and considered to be independent of the investment manager (details of their individual experience are provided below).

APEO’s previous chair, Christina McComb, retired from the board in March 2022 and was replaced by Alan Devine. At the time of writing, Alan is the longest-serving director, having provided 9.2 years of service. The average length of service is 5.0 years and all directors stand for re-election annually.

Alan Devine (chair)

Alan has over 40 years of experience in both commercial and investment banking, having spent his entire career working for The Royal Bank of Scotland Group. He was appointed as senior independent director on 1 January 2019. Alan held a variety of senior roles and was CEO of RBS Shipping Group. He holds an MBA, is a Fellow of the Institute of Bankers in Scotland and is a non-executive director of Capital Flow Holdings DAC. Alan is also chair of the private equity-owned

Irish-based cash logistics company known as GSLS.

Calum Thomson (independent director and chair of the audit committee)

Calum is a qualified accountant with over 25 years of experience in the financial services industry. He has been with Deloitte LLP since October 1988, and for 21 of those years, he was a partner in the firm. Calum is a non-executive director and the audit committee chair of the Diverse Income Trust, the AVI Global Trust and Baring Emerging EMEA Opportunities. He is also a non-executive director and audit committee chair of BLME Holdings and Bank of London and The Middle East Plc.

Dugald Agble (independent director)

Dugald was appointed on 1 September 2021. He holds a PhD in Chemical Engineering from Imperial College London and has over 20 years’ direct investment experience in private equity. He started his career at Nomura Principal Finance Group, which later evolved into Terra Firma Capital Partners. More recently, Dugald has been involved in investing in emerging and frontier markets at Helios Investment Partners and 8 Miles. He is a supervisory board member at FMO, the Dutch finance institution.

Diane Seymour-Williams (independent director)

Diane worked for Deutsche Asset Management Group (previously Morgan Grenfell) for 23 years from 1981 until 2005, during which time she held various senior positions, including CIO of Asian Equities, CEO of the Asian asset management business, head of European client relationships and head of global equity product. Diane then spent nine years from 2007–16 at LGM Investments, a specialist global emerging markets manager, where she was global head of relationship management. She is a non-executive director of Baillie Gifford China Growth Trust and Brooks Macdonald Group, where she has also chaired the remuneration committee since 2012. Diane is also a pro-bono member of the investment committees of Newnham College, Cambridge and the Canal & River Trust.

Yvonne Stillhart (independent director)

Yvonne was appointed on 1 September 2021. She was a co-founding senior partner and member of the Investment Committee of Akina AG, a Swiss-based specialised private equity manager which merged in 2017 with Unigestion S.A. Yvonne has over 30 years’ senior executive experience in business building, transformational leadership, private equity and infrastructure investment, finance, banking as well as risk- and investment management across broad industries and geographical regions.

Yvonne serves currently as a non-executive director and member of the Audit and Risk committee at UBS Asset Management Switzerland Ltd., and is the chairperson and member of the Social and Ethics committee of the South African EPE Capital Ltd. She holds a Director Certificate from Harvard Business School and the ESG Competent Boards Certificate. She is fluent in German, English, Spanish and French.

Previous publications

QuotedData has published 10 notes on APEO. You can read these by clicking the links in the table below or by visiting our website.

Figure 24: QuotedData’s previously published notes on APEO

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn Private Equity Opportunities Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.