Aquila European Renewables

Investment companies | Update | 8 March 2024

Powering through

A number of factors have combined to have a small negative effect on Aquila European Renewables’s (AERI’s) net asset value (NAV) and the share price discount to NAV in recent weeks, including nerves about when interest rates will be cut, lower power prices, and the imposition of new taxes on renewables in Norway and Spain. These have added to the broader economic pressures that have weighed on the share price over the past year, but the adviser observes that these are now mostly de-risked.

The entire renewable energy infrastructure sector has been affected by widening share price discounts to NAV and, for the most part, we believe this is entirely unjustified, having gone well past the mechanical impact of rising interest rates on the sector. This is especially true of AERI, considering the diversified nature of its portfolio and the stability of its cash flow generation. In the short term the company’s shares will likely be tied to the trajectory of interest rates, however as sentiment improves, we believe there is a considerable opportunity for these to re-rate and the discount to narrow.

Diversified European renewable energy infrastructure

AERI seeks to generate stable returns, principally in the form of income distributions, by investing in a diversified portfolio of renewable energy infrastructure investments.

At a glance

Fund profile

More information is available at the fund’s website aquila-european-renewables.com

AERI seeks to generate stable returns, principally in the form of income distributions, by investing in a diversified portfolio of renewable energy infrastructure investments.

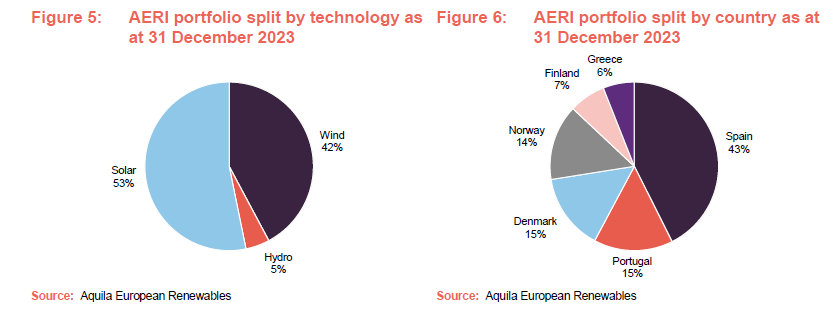

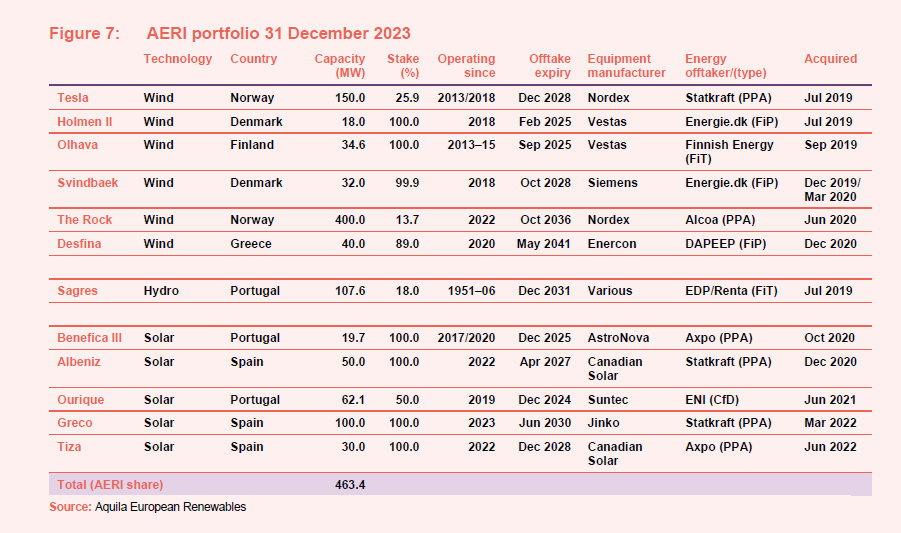

From the beginning, the aim was to construct a portfolio with a balance of technologies and asset location, and therefore less exposed to weather patterns, with the intention of smoothing out the power production profile of the portfolio over any given year. AERI’s portfolio is focused on resource-rich areas for the given technology – wind in Scandinavia and Greece, solar in Spain, and hydro on Portugal’s Atlantic coast, for example. The quid pro quo for this is that these tend to be areas where projects are viable without subsidy, and so subsidy income is less a feature of AERI’s portfolio than some other competing funds.

Targeting 6.0–7.5% per year over the long term

AERI’s functional currency is the Euro and accounts are prepared and dividends declared in that currency. This note uses returns in euros throughout.

AERI’s AIFM is FundRock Management Company (Guernsey) Limited.

AERI’s investment adviser is Aquila Capital Investmentgesellschaft mbH (referred to in this note as “Aquila” or “the adviser”), which is regulated in Germany by BaFin, and is focused on clean energy and sustainable infrastructure. At the end of September 2023, Aquila Capital managed €14.6bn including 16.6GW of capacity installed or under development in wind energy, solar photovoltaic (PV) and hydropower assets. Aquila Capital also invests in energy efficiency, forestry, and data centres. The adviser has over 650 employees spread across 19 offices in 16 countries.

Day-to-day oversight of AERI’s portfolio is the responsibility of the adviser’s Partnerships and Portfolio Advisory team. The lead on AERI is Michael Anderson.

It was recently announced that German bank Commerzbank is acquiring a 74.9% stake in the adviser. We believe this is a good fit for Aquila with the bank’s collection of boutique asset management businesses. Whilst Aquila’s natural source of funds is institutions, Commerzbank brings potential access to considerable numbers of retail investors. AERI also has its Euronext quote, which may help attract additional investors.

Q4 update

AERI’s update for the three months ended 31 December 2023 (the fourth quarter or Q4), published on 6 February, showed a NAV total return of -2.6% and a total shareholder return of -4.1% with the discount widening to 20.3%. The company noted several key factors which contributed to the negative returns. These included the following:

- The impact of changes to Norway’s taxation of onshore wind farms, which impacted AERI’s investments in both Tesla and The Rock (-4.4 cents per ordinary share).

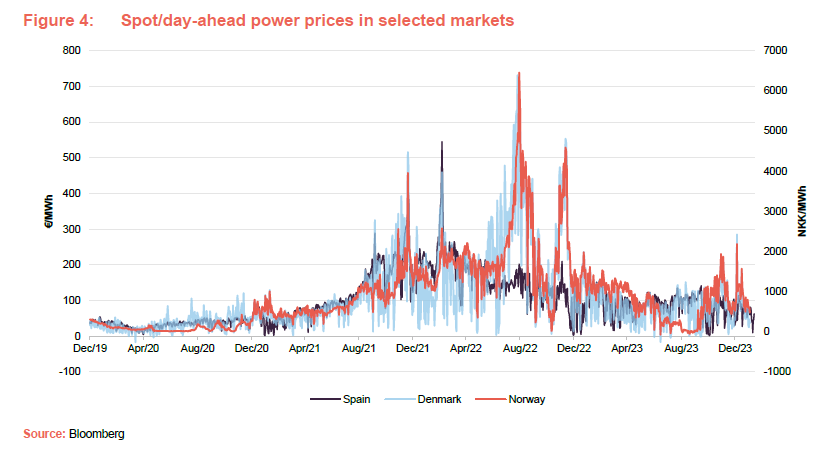

- A medium- to long-term increase in power prices in the Nordics due to higher winter demand, lower renewable output, lower hydrologic conditions and delayed offshore wind build-out in northern Europe. This was offset by a decrease in power prices in Iberia due to lower demand resulting from milder than expected weather and lower projected commodity prices (-0.5 cents per ordinary share).

- Following completion of external due diligence, an asset life extension was applied to the company’s Finnish wind farm Olhava (+2.5 years to a total of 30 years, +0.5 cents per ordinary share).

- A decrease in the portfolio discount rate (used to calculate the NAV) from 7.4% to 7.2% (excluding fund level borrowing), largely due to a decrease in the risk-free rate (the yield on equivalent government debt) which was partially offset by an increase in the market risk premium (the additional premium in returns demanded by investors to compensate them for the risk associated with that investment).

The company also noted underperformance from its wind portfolio which resulted in total portfolio production being 9.6% below budget over the quarter. With the share price discount continuing to widen, AERI is pursuing a variety of initiatives to ensure the value of the underlying portfolio is fully reflected, including an additional allocation to share buybacks on top of its previously announced €20.0m programme. In aggregate, AERI acquired €27.8m worth of its shares in 2023, reducing the number of shares in issue by 7.4%, reflecting its confidence in the underlying value of its existing portfolio.

While challenging economic conditions continue to weigh on performance in the short term, the outlook for the trust remains positive. Notably, the company is now fully invested and has completed a significant portfolio transformation, increasing the resilience of its generation through a more balanced mix of solar, wind, and PV technology. Additional measures have been taken to improve the stability of its balance sheet during the quarter and with a well-covered dividend yield of 7.1% and an increasingly visible earnings outlook, the current discount to NAV of 20.8% looks increasingly attractive, particularly as inflation and interest rates trend lower.

Merger proposal

During Q4 2023, AERI received an unsolicited proposal from the Octopus Renewables Infrastructure Trust regarding a possible combination. The deal would create one of the largest LSE-listed diversified renewable energy investment trusts and certainly has its appeal. However, given the nature of the proposal, AERI has chosen to consider this as part of a wider assessment of its options going forward, including the possible combination with another listed investment company.

On 26 February 2024, following a number of indications of interest the board instructed its advisers to commence a process of mutual due diligence with multiple interested parties. This remains at a relatively early stage and therefore there can be no certainty that this process will result in a combination. The board expects to announce AERI’s full year results to 31 December 2023 in April 2024 at which point it will provide a further update, if not earlier.

Market backdrop

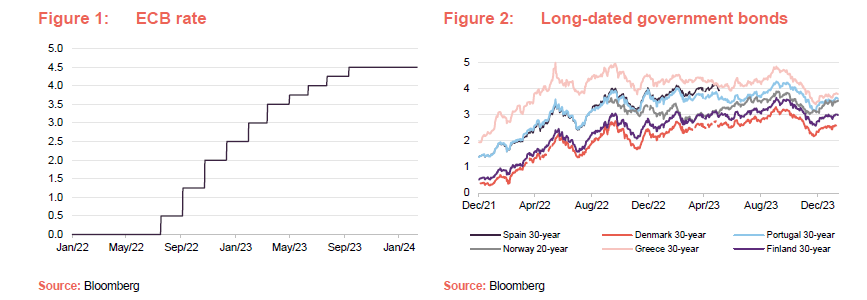

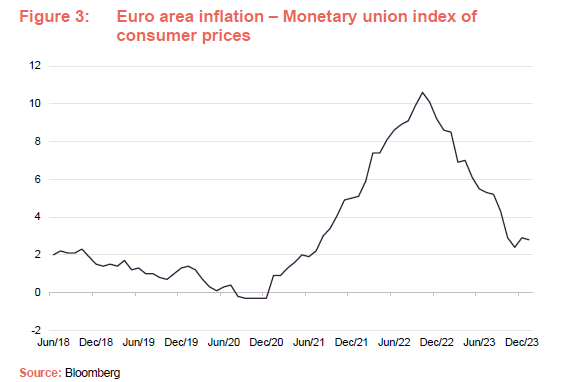

The main driver of share prices in the listed renewables sector has been investors’ perception of where bond yields (interest rates) are headed. To that end, higher interest rates imposed over the last year appeared to have done the job, with the rate of inflation dropping well below its peak. However, recent disappointing inflation data has caused yields to inflect higher once more.

Figure 1 shows the pattern of interest rate rises imposed by the European Central Bank (ECB). Figure 2 charts the yields on a selection of long-dated debt issued by various European countries.

Share price discounts to NAV on renewable energy companies have followed suit with the prevailing view that rising interest rates have an outsized impact on the capital-intensive nature of the sector and a belief by the market that this will pull the NAV down. However, with shares again tracing record lows, it is clear that the sell-off has gone well past the mechanical impact of rising rates.

Notably, with both the UK and Europe slipping into recession, the market’s focus is now switching to the health of the economy and the likelihood that interest rate cuts will be brought forward to alleviate recession. However, expectations must be balanced with the danger of cutting rates while inflation remains elevated, which increases the risks of it becoming further embedded.

Figure 3 (overleaf) shows the move in the inflation rate in the EU since June 2018.

In our view, AERI and the broader sector provide an attractive hedge for this delicate conjuncture. The sector continues to generate fairly stable NAV growth, and in many cases, increasing earnings thanks to a structural increase in energy prices. In the long term, inflation-linked contracts provide reliable, and highly visible cash flows regardless of the economic cycle, allowing companies like AERI to maintain impressive dividend payouts. These utility-like characteristics are crucial during periods of rising inflation and stagnant growth, and have historically delivered the best returns during similar periods of economic stagnation.

Regulatory developments

In our view, AERI and the broader sector provide an attractive hedge for this delicate conjuncture. The sector continues to generate fairly stable NAV growth, and in many cases, increasing earnings thanks to a structural increase in energy prices. In the long term, inflation-linked contracts provide reliable, and highly visible cash flows regardless of the economic cycle, allowing companies like AERI to maintain impressive dividend payouts. These utility-like characteristics are crucial during periods of rising inflation and stagnant growth, and have historically delivered the best returns during similar periods of economic stagnation.

The overall rise in power prices we have seen since 2020 has led to a number of government interventions, and the introduction of new taxes and levies, which has had some knock-on effect on the AERI portfolio.

New resource rent tax in Norway

In Norway, a resource rent tax is being imposed. This will affect net cash flows from AERI’s Tesla and The Rock projects. The tax is calculated as 25% of the cash flows from those projects and it applies to both new and existing wind farms. Aquila was at the forefront of efforts to respond to the initial proposals, which had envisaged a tax as high as 40%. Aquila says that there is a fairly even impact on the two assets.

External analyst power price forecasts used to support the end December 2023 valuations of The Rock and Tesla do not include any potential impact of Norway’s resource rent tax on the country’s medium and long-term power price forecasts. The tax is expected to result in a reduction in the build-out of renewable energy in the country. BlackRock has already sold two assets in Norway and others may also vote with their feet.

There is some possibility, then, that either the government backtracks on this decision, or power prices rise to reflect the extra cost of production – although there is nothing in the forecast for this at present.

The adviser does note that one positive outcome from the new resource tax, which replaces a pre-existing windfall tax, is it removes any additional regulatory uncertainty around power prices.

Spain reinstates production tax

Elsewhere, Spain has also reinstated a production tax of up to 7% of revenue. This was removed for a couple of years from 2022 but is back for 2024. The percentage levied starts low and gets higher. This was not reflected in the Q4 2023 valuation of AERI’s solar assets.

Other developments include an update to the Sami challenge to wind farm projects (discussed in our last note), which is getting closer to a resolution. The adviser observes that the reindeer herders’ dispute is really with the government that permitted the wind farms, rather than with the developers. In the legal case that relates to Fosen Vind (not one of AERI’s projects), the Supreme Court has ruled that the deal should be renegotiated.

The adviser also notes that the de-icing problem that AERI had with its Norwegian and Finnish wind assets is largely behind it. The fund should get compensation under the operations and maintenance (O&M) agreement. Payment in relation to the Finnish asset has already been received and the contractors are now dealing with Norwegian asset The Rock.

Asset allocation

463MW portfolio distributed across six different European power markets

Since launch, AERI has had permission to invest up to 30% of its portfolio in assets under construction. This has helped drive the company’s solid NAV growth, given the higher returns generated by these investments. Early in 2023, the last of these projects – a 50MW solar farm in Andalucia, Spain – was completed, with the company now boasting a portfolio of fully deployed assets with a total operating capacity of 463.4MW. The technology split for these is shown in Figure 5 below.

With the current discount to NAV limiting the ability to raise capital in the short term, and a focus on share buybacks, which are seen as offering a better return on capital than is currently achievable on new assets, the composition of the portfolio has changed little from our last note.

Despite this, the advisers have remained active, optimising existing sources of capital within the portfolio. Utilising its previously unlevered Spanish solar PV assets (with 180 MWp of operating capacity, coupled with existing PPA’s), AERI entered into a €50m five-year non-recourse debt facility with ING Bank N.V. Sucursal en España. The loan was secured on attractive terms, particularly in relation to its existing revolving credit facility (RCF), and the net proceeds were used to repay this, resulting in available capacity under the RCF of €68.2m. Consequently, the company’s overall gearing (borrowing) level remains unchanged at around 34.3% of its gross asset value (GAV).

Following this, 90% of AERI’s debt finance is on fixed rates. This will be reflected in the Q1 2024 NAV and should be positive, although it is not likely to have a big impact.

Whilst the adviser remains flexible, given the current composition of the portfolio, which now consists fully of operational assets, AERI is keen to explore opportunities to further enhance the NAV through the purchase of assets in the construction phase, potentially through the use of additional gearing. However, as noted, this decision must be balanced against investment in its existing portfolio through buybacks, and the relative hurdle rate of the RCF. Another potential option is through disposals from its portfolio. On balance, though, this is viewed as less desirable given the developing nature of the portfolio and the downstream potential of these investments.

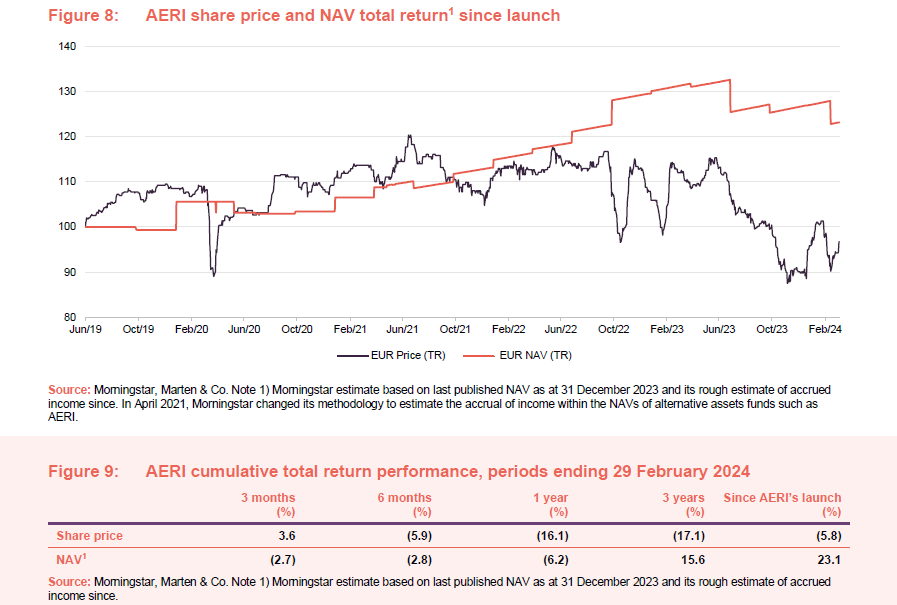

Performance

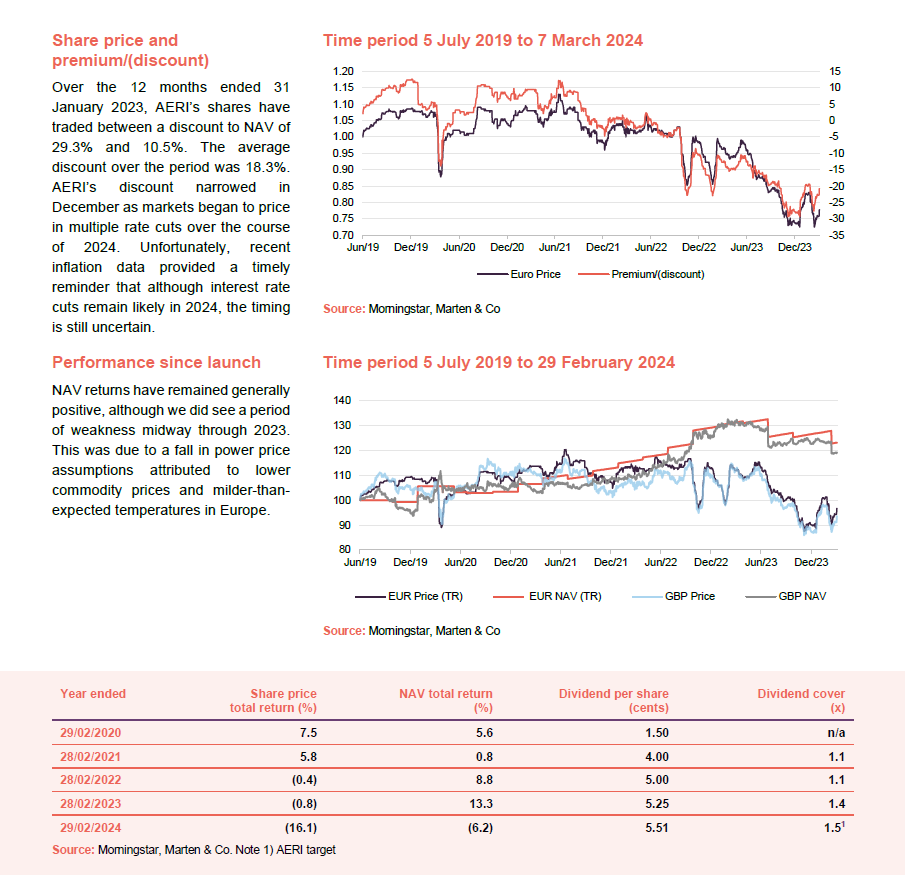

Despite the relentless downward pressure on the company’s shares, NAV returns have remained positive, although we did see a period of weakness midway through 2023. As noted from page 4, this was due to a fall in power price assumptions attributed to lower commodity prices and milder-than-expected temperatures in Europe. This alone took 8.1 cents off the NAV.

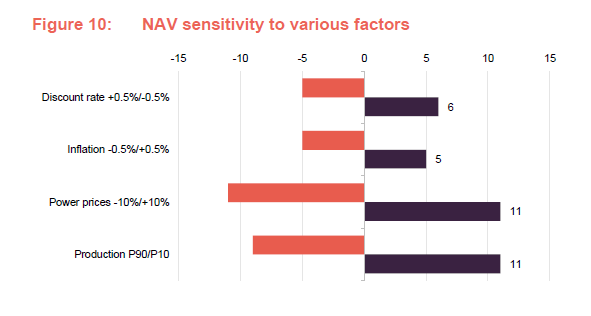

Sensitivities

Figure 10 shows the portfolio sensitivity to changes in various factors. AERI’s weighted average discount rate (used to help calculate its NAV using a discounted cash flow model) edged down over the quarter, driven by a lower risk-free rate (the yield on an equivalent government bond). The adviser highlights that the end of December 2023 was close to the lowest point on the recent yield, which has bounced back a little since. However, the discount rate does not move entirely in line with bond yields. The valuers factored in some extra risk premium at the year end, which gives AERI a cushion if bond yields stay elevated for longer.

AERI’s diversified portfolio cushions it from the effects of localised weather patterns

Low wind speeds are not unique to AERI and seem to be an ongoing problem for northern Europe. This is where AERI’s portfolio diversification policy proves its worth. AERI’s solar assets and its Greek wind assets are clearly unaffected by this issue.

Peer group

Up-to-date information on AERI and its peer group is available on the QuotedData website

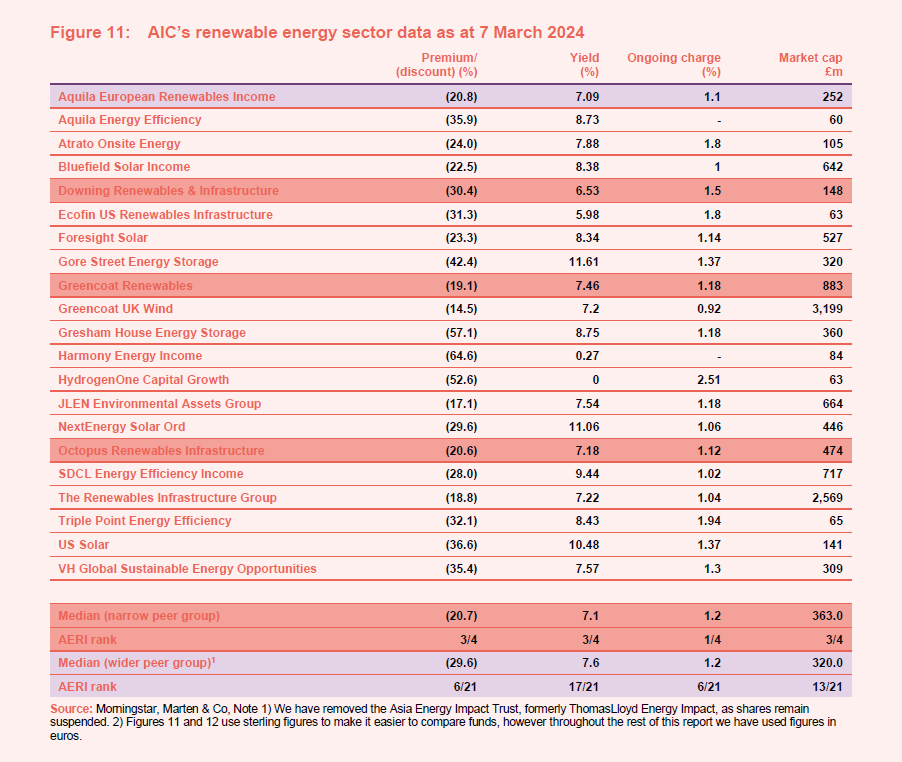

AERI is a constituent of the AIC’s renewable energy sector. There are now 22 members of this peer group, although we have excluded the Asia Energy Impact Trust, given that its shares remain suspended from trading. Of AERI’s peers, three funds focus exclusively on battery storage assets. Three funds are focused on energy efficiency projects. Two funds invest exclusively in US projects, which tend to have long-term PPAs. One invests in hydrogen-related assets and has more of a capital growth focus.

Of the remainder, those with significant European exposure include Downing Renewables & Infrastructure, Greencoat Renewables, and Octopus Renewables Infrastructure and we have included these separately to provide a more concentrated peer comparison.

Median share price discounts of almost 30% highlight how challenging economic conditions have been for renewable energy infrastructure assets – although, as we have noted, we do not believe these discounts are a fair reflection of the quality that exists within the sector. Whilst every company has been affected, the sell-off has been particularly harrowing for those with weaker balance sheets and less-stable cashflows, and this will likely limit the competitiveness of these funds going forward. Given the quality of its portfolio, AERI is well positioned in this regard, and a discount in the top half of the peer group reflects this.

Although the company’s dividend yield is towards the bottom of the peer group, readers should factor in its high forecast dividend cover. The company’s ongoing charges ratio is also competitive, especially for its size.

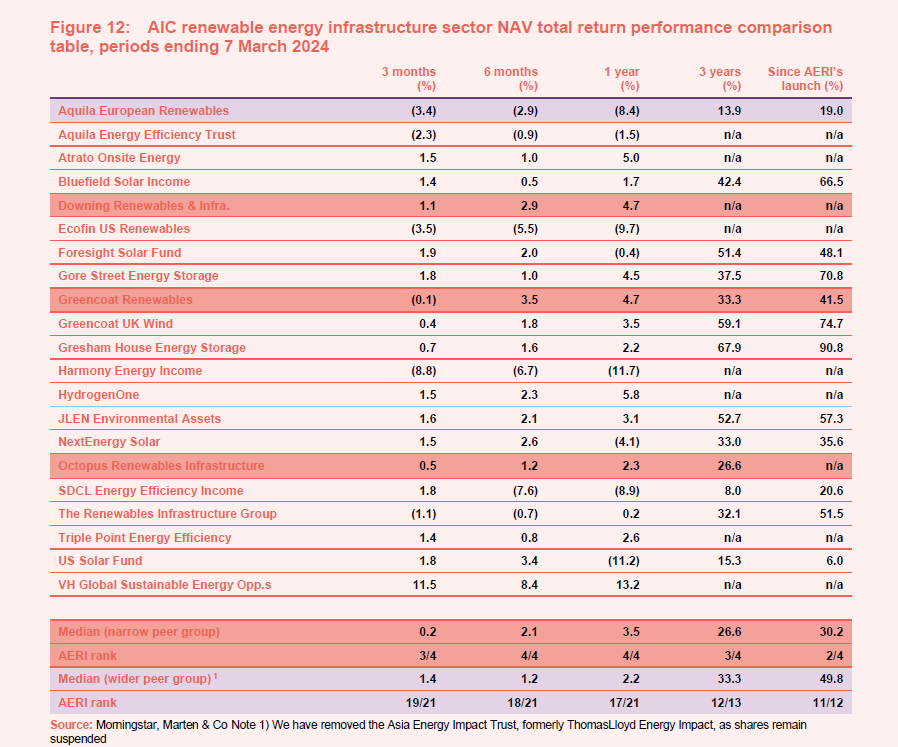

Looking at Figure 12, one of the main differentiators between the performance of these funds is the maturity of their portfolios. There was a degree of cash drag that is reflected in AERI’s returns and may have been one of the reasons that its discount opened up towards the beginning of 2023. Returns have been steadily improving more recently, boosted by the uplifts that it achieved as projects moved from the construction phase to being operational, although these were offset to a degree by weaker European returns, creating a relative drag between it and some of the UK- or US-focused funds. Such volatility is part and parcel of these investments however, and over the long term, AERI’s diversity will help moderate equivalent regional fluctuations in energy output.

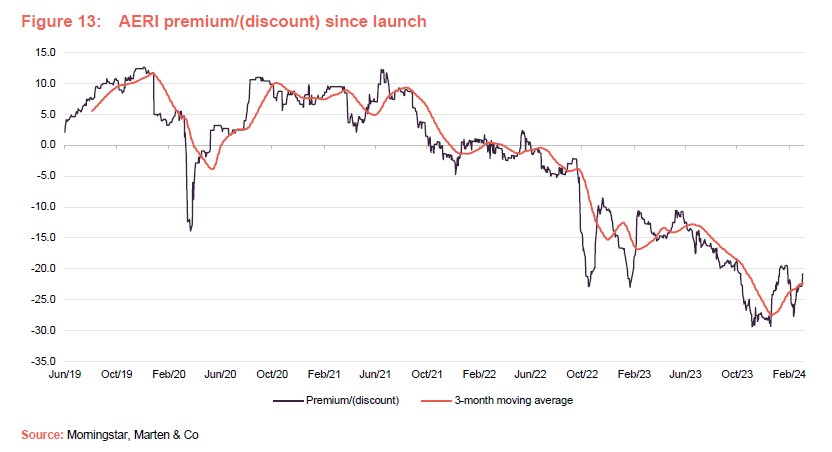

Premium/(discount)

Over the 12 months ended 31 January 2023, AERI’s shares have traded between a discount of 29.3% and 10.5%. The average discount over the period was 18.3%, and as of publishing, this sat at 20.8%. Having fallen steadily over the last 18 months, discounts for AERI narrowed in December as markets began to price in multiple rate cuts over the course of 2024. This momentum was maintained even as yields bounced higher in January, suggesting the negative correlation between discounts and yields may have moderated. Unfortunately, over the last few weeks, these have fallen steadily once more as fresh inflation data provided a timely reminder that although rate cuts remain likely in 2024, the timing of this is uncertain.

Whilst the recent widening of discounts to NAV in the sector is disappointing, the initial resilience in the face of rising bond yields provides some optimism that sentiment towards the sector has improved and over the last few days prior to publishing this note, we have begun to see a positive inflection once more. Whilst it pays not to read too much into short-term price movements, we maintain that the structural resilience of many of these companies, and AERI in particular, is significantly underappreciated, especially given prevailing economic conditions in the UK and Europe. With contracted cash flows, inflation linkage, conservative leverage profiles and strong regulatory tailwinds, these companies should be able to generate stable returns no matter what happens with the economy. If things do continue to deteriorate, we expect these characteristics will become increasingly attractive to investors.

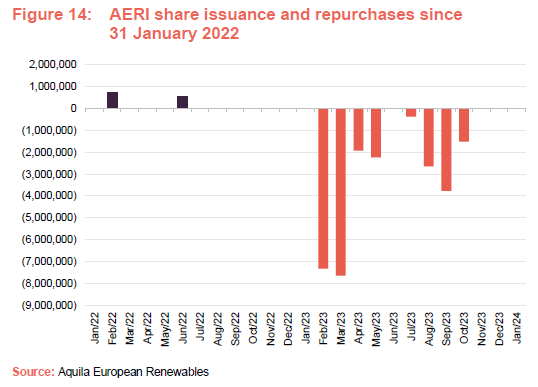

As we have noted, the current large and sustained discount to NAV does not appear to reflect the underlying quality of the portfolio. To help address this, AERI’s board authorised a buyback programme on 3 February 2023, with a total consideration of up to €20m. Additional capital was allocated to this programme in July 2023, and in aggregate the company acquired €27.8m in shares in 2023, reducing its shares in issue by 7.4%. As Figure 14 shows, no additional repurchases have been made in 2024. However, current cash dividend cover guidance of 1.4 times to 1.5 times implies that there may be surplus cash. This could fund accretive investments, but the board will also weigh these up against further buybacks.

AERI deserves to be rewarded for being proactive in tackling its discount

Our view is that given current discounts, additional buybacks likely offer higher returns on capital than is currently achievable on new assets, particularly as sentiment towards the sector appears to be improving.

Previous publications

Readers interested in further information about AERI may wish to read our initiation note on the company Sunny days are here again, published on 14 June 2023.

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aquila European Renewables Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.