Aquila European Renewables

Investment companies | Initiation | 14 June 2023

Sunny days are here again

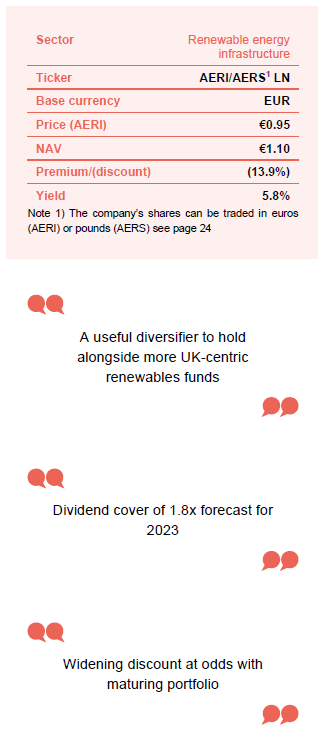

Aquila European Renewables (AERI) is about four years old. Since launch, it has built up a 464MW portfolio of operational solar, wind and hydropower projects, spread across six European power markets. It has also generated returns in line with the target that it set at launch, returning an average of 7.2% per year against a target of 6.0–7.5%.

For 2023, AERI is targeting a dividend of 5.51 cents per share (that is euro cents – given that it invests in Europe, it presents its figures in euros), 5% ahead of the target it had for 2022. Importantly, the board reckons that this will be covered 1.8x.

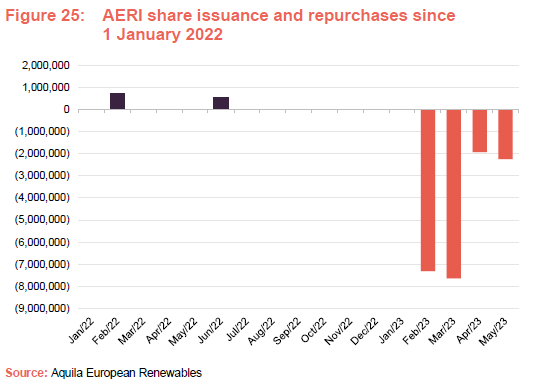

Like all other renewable energy funds currently, AERI’s shares trade on a discount to net asset value (NAV). However, its board has been proactive in addressing this through share buybacks. On 14 June, shareholders voted in favour of the continuation of the company at this year’s annual general meeting (AGM). Commendably, mindful of the share price discount to NAV, the board has brought forward the next vote scheduled for 2027 – to 2024.

With an established cash-generative portfolio, the prospect of adding further cover to the dividend, a healthy pipeline of new projects, and calmer conditions returning to markets, AERI’s future looks bright.

Diversified European renewables energy infrastructure

AERI seeks to generate stable returns, principally in the form of income distributions, by investing in a diversified portfolio of renewable energy infrastructure investments.

Why AERI?

A useful diversifier to hold alongside more UK-centric funds.

AERI was launched in July 2019 and has grown to a reasonable size, with a market cap well in excess of £300m and with a 464MW portfolio of renewable energy projects (see page 9). Its focus on the European renewables market makes it a useful diversifier to hold alongside the more UK-centric funds that make up the majority of the UK-listed renewables sector.

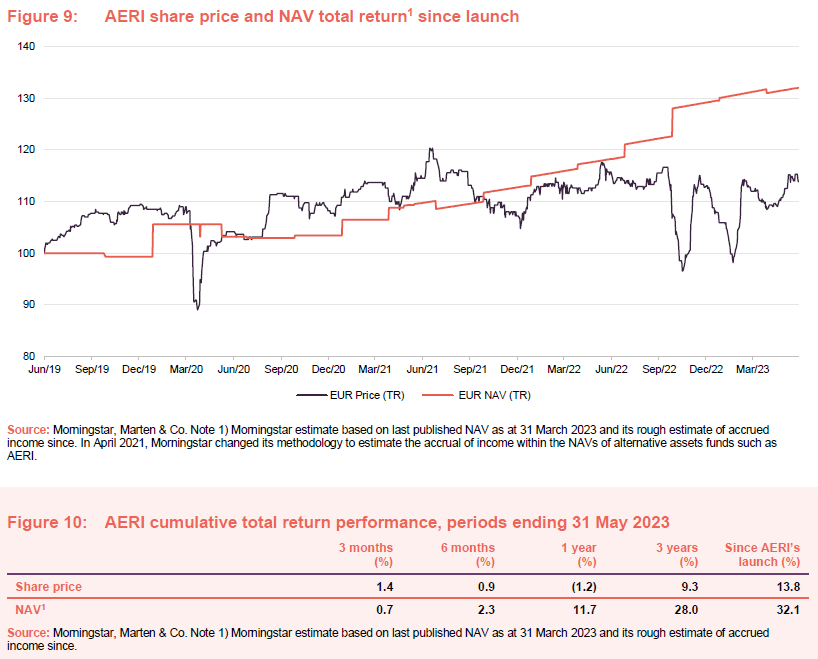

AERI had permission from the outset to invest up to 30% of its portfolio in assets under construction. That was beneficial for the NAV, as the assets were written up in value as they moved from the construction phase to the operational phase (becoming less risky and therefore allowing for a lower discount rate to be applied to a projects future cashflows when its value is calculated). This has been one of the factors that has helped drive AERI’s NAV from 98 cents post its initial public offering (IPO) to 110.1 cents at end-March 2023 (see page 13) and contributing towards its 28.4% NAV total return since launch.

The last of AERI’s construction-phase assets, Guillena a 50MW solar farm in Andalucia, Spain, became operational in April 2023. In the context of AERI’s portfolio, it and sister plant Jàen are likely to generate a significant proportion of AERI’s power output in future periods. The adviser managed to secure long term power purchase agreements (PPAs) for these plants at €66/MWh, around twice that budgeted at the time that these assets were being acquired.

Dividend cover of 1.8x forecast for 2023.

The extra revenue that these solar plants and the other assets that came on stream in recent quarters will bring to AERI’s revenue account mean that AERI’s dividend cover is set to soar, from 1.4x in 2022 to an estimated 1.8x in 2023 (see page 21). The excess cash is estimated at a cumulative €73m over the next five accounting periods.

The investment adviser has a 400MW pipeline (see page 12) covering hydropower, solar and battery storage assets. As we discuss in this note, AERI has some options to fund this pipeline, but any potential acquisition will be weighed against the benefit of buying back more shares.

Discount narrowing helped by buyback.

AERI launched a €20m buy back in February 2023, and at the same time, directors and members of the advisory team also bought shares. This, and the other measures that the board has introduced are helping to bring its discount under control. Our hope is that AERI will soon return to trading at a premium and be able to expand through share issuance once again.

Fund profile

More information is available at the fund’s website aquila-european-renewables.com.

AERI seeks to generate stable returns, principally in the form of income distributions, by investing in a diversified portfolio of renewable energy infrastructure investments.

From the beginning, the aim was to construct a portfolio with a balance of technologies and asset location, and therefore less exposed to weather patterns, with the intention of smoothing out the power production profile of the portfolio over any given year. AERI’s portfolio is focused on resource-rich areas for the given technology – wind in Scandinavia and Greece, solar in Spain, and hydro on Portugal’s Atlantic coast, for example. The quid pro quo for this is that these tend to be areas where projects are viable without subsidy, and so subsidy income is less a feature of AERI’s portfolio than some other competing funds.

Targeting 6.0–7.5% per year over the long term.

The target is to produce net returns of 6.0–7.5% per annum over the long term and, as at 31 May 2023, AERI had returned 7.2% per annum on average in NAV terms.

AERI’s functional currency is the euro and accounts are prepared and dividends declared in that currency. Unless otherwise stated, this note uses returns in euros throughout.

AERI’s AIFM is FundRock Management Company (Guernsey) Limited.

AERI’s investment adviser is Aquila Capital Investmentgesellschaft mbH (Aquila Capital or the adviser), which is regulated in Germany by BaFin (the financial regulatory authority for Germany), and is focused on clean energy and sustainable infrastructure. At the end of 2022, Aquila Capital managed €14.7bn including 13.9GW of capacity installed or under development in wind energy, solar photovoltaic (PV) and hydropower assets. Aquila Capital also invests in energy efficiency, forestry, and data centres. The adviser has over 650 employees spread across 17 offices in 16 countries.

Day-to-day oversight of AERI’s portfolio is the responsibility of the adviser’s Partnerships and Portfolio Advisory team. The lead on AERI is Michael Anderson (see page 26 for more detail).

At IPO, AERI’s name was Aquila European Renewables Income Fund Plc; it changed this to Aquila European Renewables Plc on 31 October 2022 “to maximise the appeal of the company across a broader range of investors and other stakeholders”.

Market backdrop – storm clouds receding

Widening discount at odds with maturing portfolio.

After a period of rapid growth when most constituents were trading at a premium, most funds in the renewable energy sector had a difficult 2022, and AERI was no exception. However, this ran contrary to the increasing maturity of its portfolio, as the last of AERI’s cash was deployed, its projects became operational, cash flow increased, and its NAV climbed.

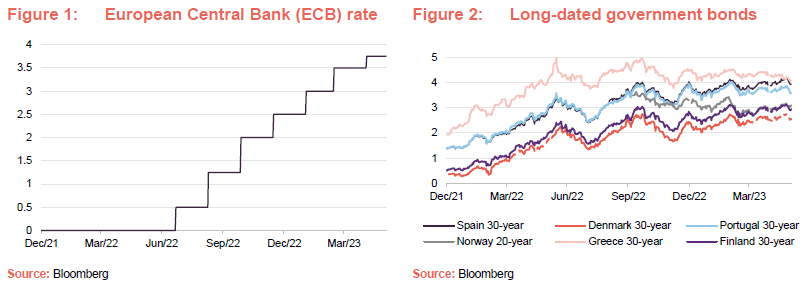

The main negative for the sector in 2022 was rising interest rates, which you can see climbing in Figure 1. It was reckoned that this would put upward pressure on the discount rates used to calculate the NAVs of AERI and its renewable infrastructure peers (to work out the NAV, forecast future cash flows are discounted back into a net present value – a higher discount rate means a lower NAV).

As Figure 2 shows, yields on long-dated government bonds in AERI’s chosen markets appear to have stabilised after rising sharply in the early part of 2022, even though most commentators suggest that there will be one or possibly two more quarter-point rate hikes from the European Central Bank (ECB) this year.

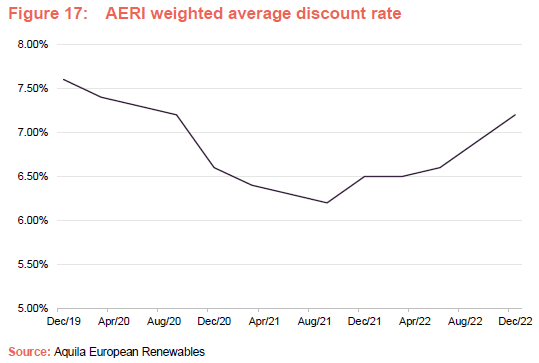

As we show in Figure 17 on page 16, AERI’s weighted average discount rate has been rising despite a falling (currently zero) exposure to projects under construction, which would otherwise have driven it lower.

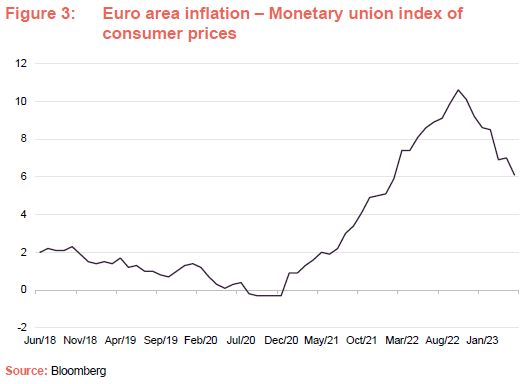

Falling inflation could mean lower interest rates and easing pressure on discount rates.

Higher interest rates were a response to rising inflation. However, in the Euro area this appears to have peaked in October last year and is falling steadily. AERI’s revenues are positively correlated with inflation, but less sensitive to this factor than many of its peers. Its focus on power generation from resource-rich (sunshine hours and wind speeds, for example) regions means that it has less of a reliance on inflation-linked subsidies.

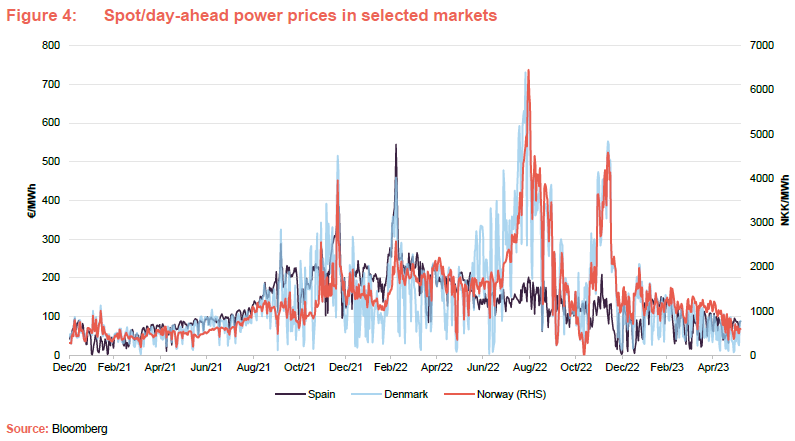

One of the main factors that contributed to rising inflation was the sharp increase in the absolute level and volatility of power prices that accompanied Russia’s invasion of Ukraine. Iberian power prices eased relatively early in 2022. However, as Figure 4 illustrates, power prices in all of these markets remain well-above levels seen at the start of 2021.

As we describe on page 17, the response of many governments to soaring power prices was to look to renewable energy generators as an additional source of revenue and many have imposed windfall taxes. Fortunately, many of these are now rolling off or set with reference to power prices well above current levels. Of AERI’s chosen markets, only Norway is potentially introducing new taxes in 2024.

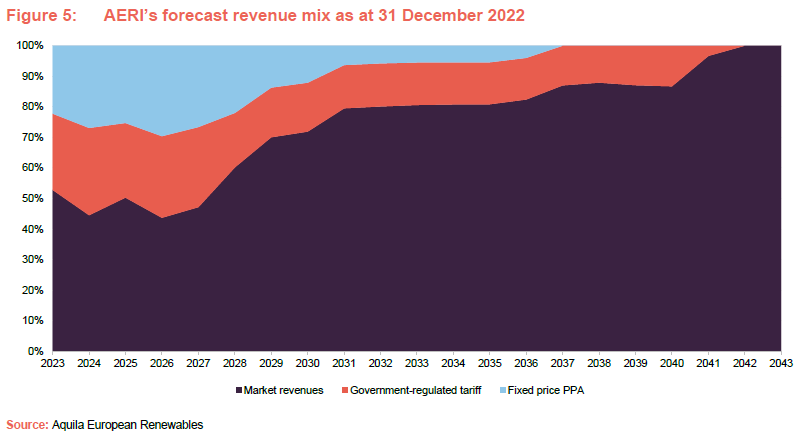

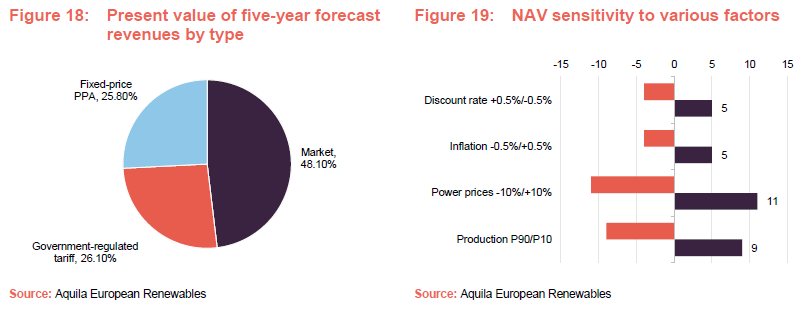

AERI’s adviser improves the predictability of its revenues and seeks to lock in attractive prices for the trust’s assets by negotiating power purchase agreements (PPAs) with offtakers. Figure 5 shows the mix of AERI’s forecast revenue as it was at the end of December 2022. AERI is likely to negotiate new PPAs as existing ones roll off, extending the light blue shaded area.

Investment process

Well-resourced investment team.

An investment management team of over 90 individuals reviews and assesses potential investments for Aquila Capital’s clients. An initial screen asks, is this a transaction that meets clients’ return targets? It seeks to identify specific legal issues, and other key risks and includes basic know-your-client (KYC) background checks. Relatively few potential investments make it through this initial screen.

The next stage considers the potential structure of the investment, tax and legal implications and deeper KYC checks. If the potential investment passes these criteria, it will move into the internal due diligence phase where a wider group of people will examine it, including Aquila Capital’s legal, compliance, risk and structuring teams. This is also the stage at which the Partnerships and Portfolio Advisory team becomes involved. If everyone is comfortable with the investment proposition, the idea is presented to the adviser’s investment committee.

Outside experts augment the team’s expertise.

If it is satisfied, the investment committee will authorise a budget for the external due diligence process to confirm the assumptions in the model. Aquila Capital employs a range of Tier 1 advisers with local and asset-specific expertise. A technical adviser will assess the potential energy yield and review the technical aspects of the project including plant and equipment. Legal advisers will trawl through contracts, permits and leases. Tax and structuring experts aim to ensure that the structure is optimised. Independent valuation experts may be brought in at this stage. Any potential red flags will be investigated in detail.

Every potential investment assessed against ESG checklist.

The project is assessed against an internal environmental, social and governance (ESG) checklist, and specific ESG due diligence may be performed by an external adviser. The aim is to identify both risks and opportunities in this area and document the degree to which they will need to be monitored post-investment.

Then the potential investment goes back to the investment committee for its final approval. At this stage, each Aquila Capital team – legal, tax, compliance etc, including the Partnerships and Portfolio Advisory team, prepares a detailed statement on the deal, essentially signing it off from their perspective and including information to justify their decision.

Projects may be suitable for a number of Aquila Capital’s clients. Clients take it in turns to have first refusal of a project. Projects that are too large for one client may be syndicated across a number of suitable clients (as is the case with a number of AERI’s holdings – see page 10).

Early-stage projects may be financed with by Aquila Capital managed funds with a higher risk appetite than AERI until they have been substantially de-risked and are a suitable investment for a fund such as AERI. In these cases, when they are sold onto other clients’ portfolios, the deals are negotiated on an arms-length basis between two separate teams within Aquila Capital. In AERI’s case, both the AIFM and the board also have to approve the terms of the deal. AERI can invest up to 30% of its gross asset value in assets that are not yet operational. It considers ‘shovel-ready’ projects, taking on construction risk but ensuring the contracts are in place to cover all aspects of the deal, which de-risks the project significantly.

For each potential investment, a detailed pack, including the departmental statements, is presented to the AIFM for its approval. If this is secured, the potential investment is put before the AERI board who make the final decision. The adviser told us that the board has rejected potential investments more than once.

The whole process can take up to five months.

AERI is also free to buy assets from third parties. Svindbaek (see page 12) is an example of this.

A separate team is dedicated to securing PPAs on attractive terms.

The Partnerships and Portfolio Advisory team is responsible for the ongoing oversight of the portfolio. In anticipation of the shift towards subsidy-free renewable energy production, Aquila Capital established its Merchant Markets Desk, a 10-strong team tasked with negotiating PPAs. The adviser says that its expertise has helped optimise the prices achieved for AERI’s output. It also says that it would be unlikely to buy an asset that did not have a PPA in place.

PPAs are typically at fixed prices and do not incorporate any inflation linkage. However, the adviser points out that power price trends tend to run ahead of inflation and so higher inflation is captured over time as PPAs are renewed.

Investment restrictions

The adviser operates within the following investment restrictions:

- Investments to be located within continental Europe and the Republic of Ireland.

- No more than 25% of gross asset value (GAV) in a single asset.

- No more than 20% to be invested in technologies other than onshore wind, solar and hydro.

- No more than 30% in assets that are under construction.

- Structural long-term debt not to exceed 50% of GAV.

Hedging and risk management

AERI does not hedge its currency exposure. However, it may (and has) hedge its interest rate exposure. PPAs are only agreed with creditworthy counterparties. Almost all revenues are in euros as Nordpool permits power to be traded in euros. Some revenues in are retained in Nordic currencies to meet operating expenditure.

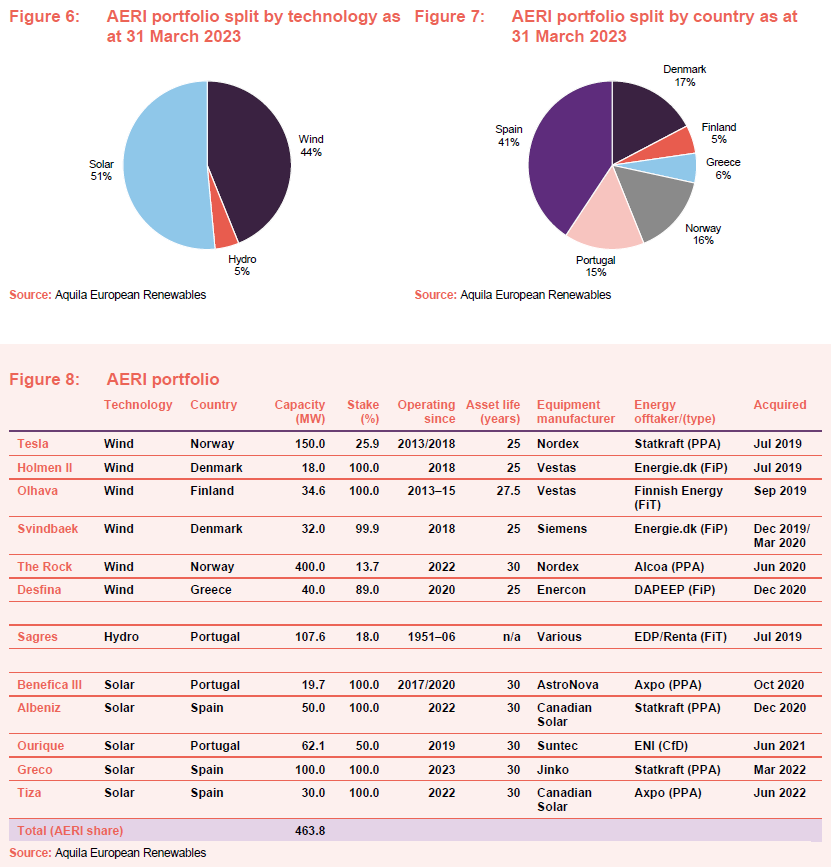

Asset allocation

464MW portfolio distributed across six different European power markets.

AERI’s portfolio is now fully operational with a total operating capacity of 463.8MW. The wind and solar exposure within the portfolio is roughly comparable, with a much smaller allocation to hydro. The adviser would like to add more hydro to the portfolio, but these are relatively scarce assets.

AERI has exposure to six different power markets within Europe, adding further diversification. In the north, prices tend to be lower than EU averages, and commodity price volatility has less of an impact. However, Spanish power prices are heavily influenced by the price of natural gas (as they are in the UK) and this means that they are closer to EU norms.

Looking at some of AERI’s larger positions in more detail:

Greco (15.3% of AERI’s assets at 31 March 2023)

Aquila Capital has an extensive team based in Iberia covering all aspects from early-stage project development through to operations and maintenance (O&M). AERI’s Iberian assets are managed by this team.

Greco is the most recent of AERI’s assets to become operational. It is comprised of two solar PV assets – Jaén, which became operational in November 2022, and Guillena, which became operational in April 2023. Together, these assets have a capacity of 100MW and AERI owns all of the equity in the projects.

AERI bought the Greco portfolio while construction was underway and, as the projects are now operational it has been able to write up the value of them to reflect the lower risk associated with them. This is a pattern that has been repeated for other assets across the portfolio. In addition, at acquisition, the solar projects – including Greco – had an assumed life of 30 years, but this has since been extended to 40 years (see page 17), which provided a further NAV uplift.

The Greco projects did not have a PPA in place when they were acquired but the deal was structured to protect the fund if the price of the PPA was less than a target level (undisclosed). In October 2022, AERI announced that the adviser had secured a five-year pay-as-produced PPA for Jaén with Statkraft, whilst hedging 70% of P50 production (P50 is the midpoint on the distribution of expected forecast annual generation). Then in December 2022, AERI said Guillena had entered into a seven-year pay-as-produced PPA, also with Statkraft, whilst hedging 60% of P50 production. The PPAs average at about €66/MWh, which is well-ahead (about double) of the adviser’s targets when the acquisition was in the due diligence phase.

With both Greco assets operational, the original aim of balancing AERI’s power output across different asset-types and locations has been achieved.

Albeniz (12.5%) of AERI’s assets at 31 March 2023)

Albeniz was acquired in December 2020 just ahead of the start of construction at the site. The project came with a fixed price engineering, procurement and construction (EPC) agreement, and in addition to 50MW of solar PV includes a shared interest in a local substation.

A fixed price, five-year PPA was agreed ahead of construction, covering 60% of P50 production. However, in December 2021, with higher power prices in Iberian power markets, the adviser negotiated a five-year PPA covering an additional 20% of P50 production at a higher price. Unfortunately, completion delays (related to delays securing permits to operate, given high volumes of new projects) meant that a one-off PPA penalty was incurred at Albeniz in 2022 at a cost of €1.5m. The initial PPA had a starting date during May 2022 and Albeniz became operational in June 2022 while final commissioning occurred in August 2022.

The Rock (9.6% of AERI’s assets at 31 March 2023)

The Rock (oyfjelletvind.no/en) is AERI’s largest wind investment and the largest individual onshore wind farm in Norway. It is located on Øyfjellet mountain outside the town of Mosjøen, about 390km northeast of Trondheim. The Rock is a 400MW asset that was developed under the ownership of Aquila Capital by Eolus and became operational in 2022. It is comprised of 72 Nordex N149/5.X TS105 turbines. Power is sold under a 15-year (to September 2036) PPA to Alcoa and used to power its aluminium smelter in Mosjøen, which is a key employer in the region. Alcoa invested an additional $51m in the plant last year to expand its capacity.

The Rock is part-financed by €42.9m of debt, of which €11m is repayable in September 2026 and the balance amortises up to June 2035.

The company recently reported that The Rock has had some teething issues with gearboxes and anti-icing systems however these are expected to be rectified shortly and losses are covered by the original equipment manufacturer provider, which in this case is also the equipment provider, Nordex.

The Øyfjellet project attracted headlines in 2021 when Sàmi reindeer herders launched a legal action against it on the grounds that it interfered with migration paths. The Norwegian courts will not hear the case until May next year, but the adviser thinks that production is unlikely to be affected and says that the developer would be liable for any compensation payments that are required to be paid to the Sàmi. A small provision (equivalent to about 0.25% of NAV) has been taken against the valuation of the project, which is already reflected in AERI’s NAV.

In September 2022, the Norwegian government said that it was considering introducing windfall taxes on onshore wind and hydropower production. The plan was for a 40% resource rent tax on cash flow generated by onshore wind farms, as well as a 23% tax for wind and hydropower on revenues above NOK700/MWh. However, in the face of strong opposition, this is subject to further consultation and a final decision will not be made until 2024.

Svindbaek (9.1% of AERI’s assets at 31 March 2023)

Danish windfarm Svindbaek was acquired in two stages, an initial seven turbines in December 2019 for €25.3m and the remaining three turbines in the project in March 2020 for €13.2m.

The project comes with a Danish feed-in premium tariff that had about nine years left to run in December 2019. The feed-in premium tariff is structured as a contract for difference on a fixed volume of production and gives AERI a floor on power prices achieved for this asset. As these tariffs roll-off (which in the case of Holmen II and Olhava is expected to be from 2025 onwards), they will be replaced with PPAs.

The project is part-financed by €7.8m of debt which amortises up to December 2037.

Sagres (5.2% of AERI’s assets at 31 March 2023)

Sagres is a portfolio of 21 small-scale hydropower plants spread across northern and central Portugal that was purchased from EDP. Moisture-laden wind coming off the Atlantic normally means high rainfall levels on these river systems, especially in winter months.

AERI acquired a 17.99% stake in the holding company Aguia Enlica in July 2019. The portfolio is comprised of 14 run-of-the-river plants and seven reservoir plants spread across 10 river systems. Hydropower plants have indefinite lives and some of these assets had been operational for more than 50 years when AERI acquired them.

Aquila Capital had plenty of experience with small-scale hydropower ahead of the deal, and following the acquisition, the adviser’s team undertook an asset optimisation exercise, upgrading control systems, refurbishing/replacing equipment and optimising response times (to allow the reservoir assets to produce at times of peak demand, capturing higher prices). This created the conditions to allow a 1.1% increase in average annual production.

On acquisition, about 75% of the portfolio was eligible to receive subsidies in the form of Feed-in-Tariffs, but these are gradually rolling off. Power is sold through a PPA with EDP/Renta.

Sagres was refinanced in October 2022.

Pipeline

The adviser reports having a pipeline of assets for construction in Europe totalling 10GW. The immediate pipeline which is being monitored by the board and the investment adviser spans hydropower, battery storage and solar PV and has a total capacity of 0.4GW.

Within the existing portfolio, the adviser has identified opportunities to enhance returns with complementary investment. Examples include a 20MW two-hour co-located battery storage opportunity at Ourique (a potential €5–10m investment), and floating solar on the reservoirs for Sagres.

AERI’s portfolio is now 100% operational and the adviser is keen to explore opportunities to further enhance the NAV through the purchase of assets in the construction phase. However, there is no plan as yet to recycle funds with disposals of operating assets.

In an ideal world, AERI would be trading at a premium and raising fresh capital to fund new renewable energy generation capacity that is so badly needed in Europe. In the meantime, the adviser says that AERI has about €30m of capital that it could deploy, funded by its revolving credit facility (RCF, see page 25) and notes that the RCF has a €50m accordion facility that gives additional flexibility if needed. The portfolio is also generating surplus cashflow that can, in time, be reinvested in new projects.

The largest source of additional capital could be to introduce gearing (borrowing) on AERI’s €250m solar portfolio, which is currently unlevered. This is an option that the adviser and the board are actively exploring in discussions with lenders. Part of the proceeds of such debt issuance could be used to reduce the RCF in the first instance.

Importantly, and commendably in our eyes, any opportunities to add to the portfolio would be weighed against extending AERI’s share repurchase programme.

Performance

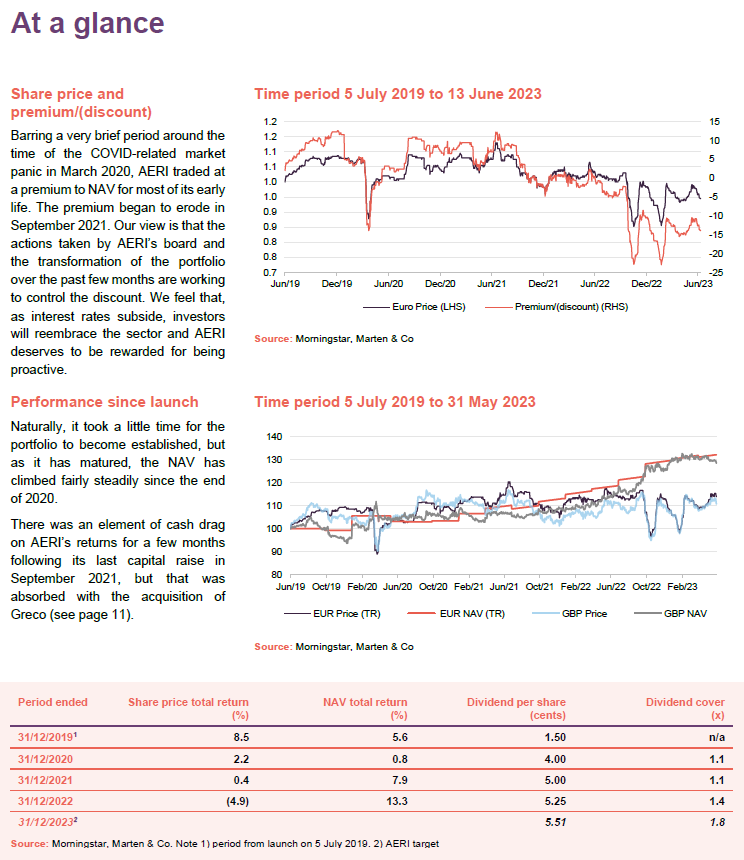

Naturally, it took a little time for the portfolio to become established, but as it has matured, the NAV has climbed fairly steadily since the end of 2020.

There was an element of cash drag on AERI’s returns for a few months following its last capital raise in September 2021, but that was absorbed with the acquisition of Greco.

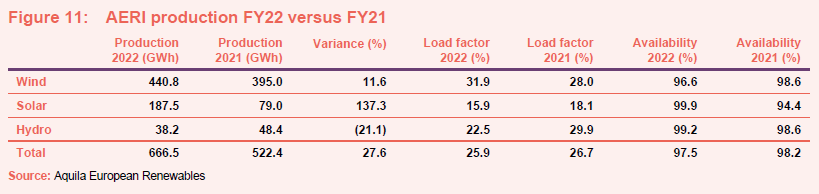

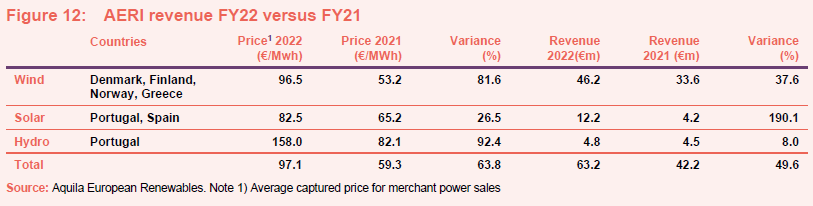

Operational performance

The result for AERI’s financial year that ended in 2022 (FY22) reflects AERI’s increased exposure to operating assets. Over 2022, AERI’s power production was 6.9% below budget. This variance in production is not extreme, especially as not all the assets were completed during this period so the portfolio was less diversified and robust as it would be now. Ultimately the adviser can only ensure that assets are available and optimised. Since launch the availability has been over 98%, weather conditions dictate the rest. The principal reason for 2022’s outcome was drought conditions in Portugal affecting AERI’s hydropower plants, but low wind speeds in the Nordic region had an impact too. Whilst we note that The Portuguese Institute for Sea and Atmosphere (IPMA) says that much of the country is in drought once again, the regions where AERI’s hydro plants are located seem to be experiencing normal/near normal conditions so far in 2023.

By contrast, thanks to capturing the benefit of much higher power prices, AERI’s revenue for FY22 was 24.2% above budget. Even Sagres beat its budget, despite its low production.

Looking forward to FY23, while power prices have eased, PPAs will mitigate the effect of that. Full-year contributions from assets such as Tiza, Albeniz and The Rock plus a partial contribution from Greco should have a substantial positive effect on AERI’s profitability and cash generation relative to FY22. If production comes in closer to budget at Sagres, this could also have a meaningful positive impact.

Valuation assumptions

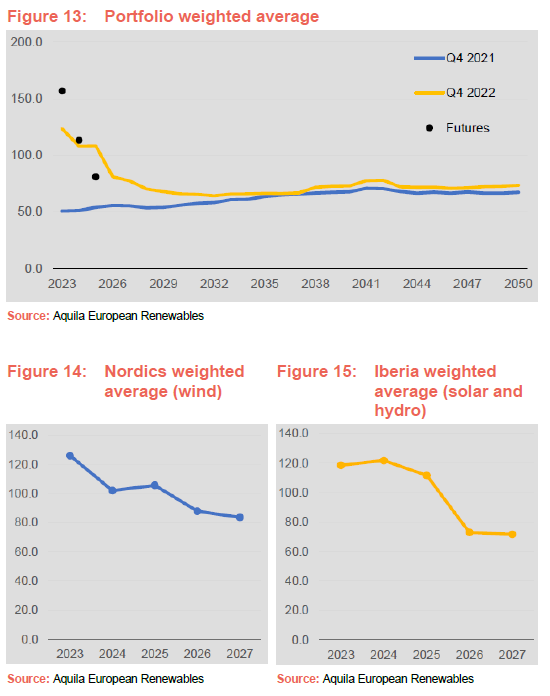

Power prices

Wind and solar power price forecasts are an average of two independent forecasters, and hydropower price forecasts are an average of three independent forecasters.

Figures 13 to 15 show the power price assumptions in euros per MWh used in the end-December 2022 NAV.

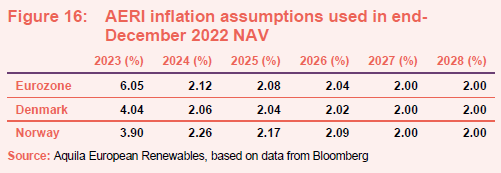

Inflation

Elevated inflation has had a significant impact on many renewable energy generators. However, AERI – with its relatively low exposure to inflation-linked subsidies – has been less affected. Nevertheless, higher inflation is positive for AERI’s NAV.

Asset life extensions

The assumed asset lives of AERI’s Spanish solar assets have been extended from 30 to 40 years. This added 2.1 cents per share to the NAV (see below). The board and the adviser see opportunities to extend the assumed asset lives of the other assets in the portfolio, suggesting that there could be further NAV upside to come.

Discount rates

While rising interest rates have put upward pressure on discount rates in recent years, the reduction in the discount rate since the fourth quarter of 2019 is a reflection of the increased maturity (lower risk profile) of AERI’s portfolio and lower overall gearing levels.

Taxation

In the wake of the surge in power prices over 2022, many countries in Europe introduced taxes designed to recover some of the windfall benefit from renewable energy generators. All of these are already recognised within AERI’s NAV, with the exception of the proposed resource taxes in Norway, which have not yet been finalised. AERI’s portfolio diversification strategy mitigates regulatory and fiscal risks given Europe’s power markets are not homogenous.

In Spain: For the period from September 2021 to December 2023, the government introduced a 90% clawback for market revenues and new PPAs set above a €67/MWh threshold. Existing PPAs were unaffected.

There is also a 0.5% tax on revenues from electricity production which applies to end December 2023. VAT on power sales was cut from 10% to 5%.

In Norway: Norway has a clawback tax of 23% for electricity prices exceeding €70/MWh which is scheduled to apply this year and next. A permanent production tax of about €2/MWh has been introduced. In addition, a resource rent tax on existing and new onshore wind farms of 40% and a natural resources tax of about €1–2/MWh have been proposed, but no decision has been made yet as to whether these will go ahead.

The Rock is currently unaffected by the clawback tax, but Tesla’s power sales are affected.

In Denmark: There is a clawback in pace on revenues above €180/MWh but this ends in June 2023.

In Finland: For 2023, there is a clawback in place for 30% of net income earned over the course of 2023. VAT on electricity was cut from 24% to 10%.

In Greece: there is a clawback on power sold above €85/MWh which ends in June 2023. Desfina is not affected.

Sensitivities

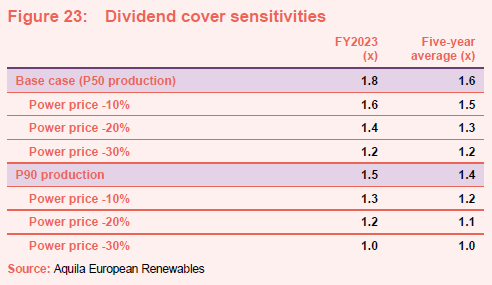

Contracted revenues are expected to cover AERI’s 2023 dividend target 1.2x in FY23. Some large PPAs (Olhava, Benfica III, and Ourique) roll-off over the next five years, but it is reasonable to expect that they will be renewed or replaced. This reduces AERI’s sensitivity to power price fluctuations.

Peer group

Up to date information on AERI and its peer group is available on the QuotedData website.

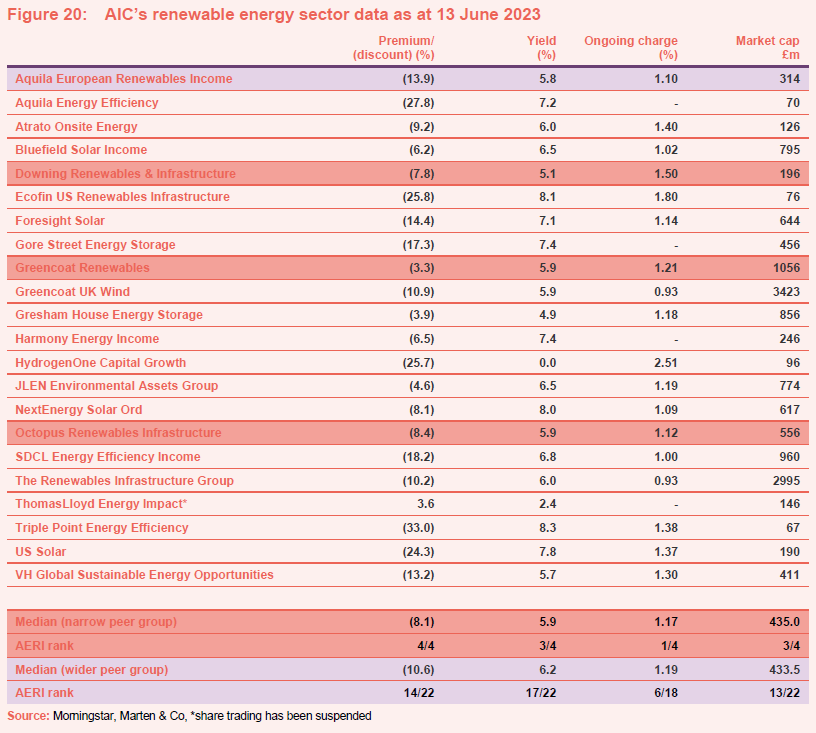

AERI is a constituent of the AIC’s renewable energy sector. There are now 22 members of this peer group. Three funds focus exclusively on battery storage assets. Three funds are focused on energy efficiency projects. Two funds invest exclusively in US projects, which tend to have long-term PPAs. One invests in hydrogen-related assets and has more of a capital growth focus.

Of the remainder, those with significant European exposure include Downing Renewables & Infrastructure, Greencoat Renewables, and Octopus Renewables Infrastructure.

The adviser notes that while AERI is a relatively new fund, it has a longer track record of investing in renewables projects in multiple jurisdictions across Europe than competing managers in the sector, and a larger team.

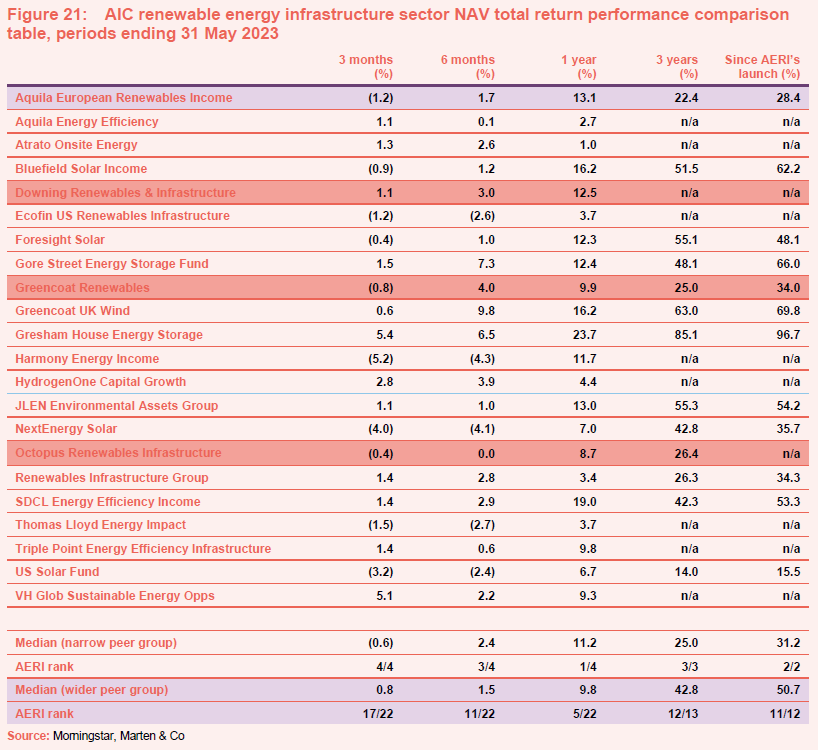

Whereas throughout the rest of this report we have used figures in euros, in Figures 20 and 21, we have used sterling figures to make it easier to compare funds.

AERI’s share price discount to NAV is, as we discuss on page 21, on a narrowing trend and is closer to the middle of the pack. AERI’s dividend yield is lower than the median of this peer group. However, if we just looked at the funds with significant European exposure, it would rank joint-second. Readers should probably also factor in AERI’s high forecast dividend cover. AERI’s ongoing charges ratio is competitive, especially for a fund of its size.

Looking at Figure 21, one of the main differentiators between these funds is the maturity of their portfolios. There was a degree of cash drag (uninvested cash weighing on returns) that is reflected in AERI’s performance statistics and may have been one of the reasons that its discount opened up to the extent that it did. However, AERI’s figures for the 12-month period ended 31 May 2023 are much better and this was driven in part by the uplifts that it achieved as projects moved from the construction phase to being operational.

Dividend

AERI pays quarterly dividends in respect of each accounting period that tend to go ex-dividend in May, August, November and February, and are paid in June, September, December and March, respectively.

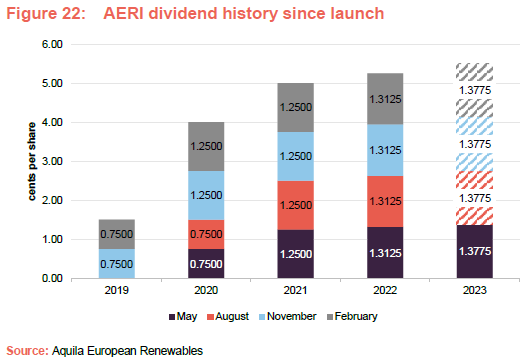

On 3 February 2023, AERI announced that it would target a dividend of 5.51 cents for its accounting year ended 31 December 2023, a 5% increase in the level for 2022. Figure 22 shows the 1.3775 cent dividend announced for March and assumes that these payments continue in subsequent quarters.

Dividend cover

In February 2023, AERI also said that cash flow dividend cover, net of debt amortisation, was expected to be 1.8x in 2023 and about 1.6x over the following five years. On its base case assumptions, AERI could generate a cumulative €73m of excess cash flow over the next five accounting periods (FY23–FY27).

AERI’s board has adopted a range of methods to calculate dividend cover. The first of these looks at the dividend relative to the net result generated at the SPV level; the second is based on the company’s revenue account; and the third – which we feel is most useful – is based on the consolidated cash flow of the company and its holding company.

The adviser has also published a range of sensitivities for dividend cover in different scenarios based on the adjusted net cash flow method.

As Figure 23 shows, even in the worst-case scenarios assumed in this exercise, the dividend would be covered by adjusted net cash flow.

Premium/(discount)

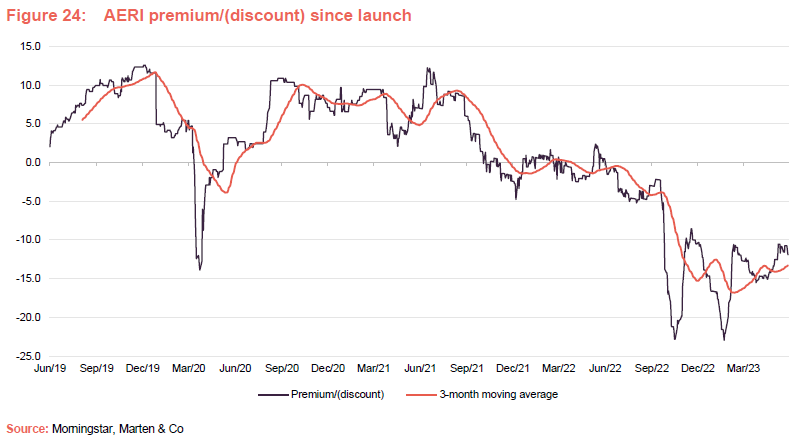

Over the 12 months ended 31 May 2023, AERI’s shares have traded in a range from a 23.0% discount to NAV to a 0.5% premium and have averaged a 10.8% discount. On 13 June 2023, AERI was trading on a discount of 13.9%.

Barring a very brief period around the time of the COVID-related market panic in March 2020, AERI traded at a premium for most of its early life. The premium began to erode in September 2021, around the time of the last fundraise.

The money raised in September 2021 was not deployed straightaway, as a project that the adviser had hoped to secure proved unsuitable. The small amount of cash drag associated with this has been cited by some commentators as a reason why the discount emerged. Coincident with this, interest rates looked as though they might start rising, which it was reasoned would put upward pressure on discount rates. There was also adverse press comment in relation to The Rock windfarm.

Nevertheless, in February and June 2022, AERI was trading at a small premium and issuing shares in connection with the settlement of its advisory fee (see below). However, as the discount widened, on 3 February 2023 the board announced a share buyback of up to €20m. In addition, members of the board and employees of the investment adviser announced a commitment to buy additional shares in AERI. The share buyback is substantially complete. By 31 May 2023, 19.2m shares had been bought back at a cost of €18.4m (an average cost of about €0.96 per share).

AERI deserves to be rewarded for being proactive in tackling its discount.

Our view is that the actions taken by AERI’s board and the transformation of the portfolio over the past few months are working to control the discount. We feel that, as interest rates subside, investors will reembrace the sector and AERI deserves to be rewarded for being proactive in tackling its discount.

Fees and expenses

AERI has the lowest base fee in its peer group.

The adviser is entitled to a tiered fee calculated as 0.75% on the first €300m of assets, 0.65% on the next €200m and 0.55% thereafter. The advisory agreement had an initial four-year term and is now terminable on one year’s notice. The adviser does not receive any additional fees in connection with acquisitions made by AERI. This is the lowest base fee in AERI’s peer group.

The adviser agreed to be paid in shares up to 30 June 2023. While the company was trading at a premium, AERI would issue new shares to satisfy the fee, but since it has been trading at a discount, shares for the fee are being acquired in the market. Following the purchase of shares to settle the fee for the first quarter of 2023, the adviser holds 8,959,109 shares in AERI or about 2.3% of the company.

For the financial year ended 31December 2022, the other main expenses that AERI incurred included audit fees of €352,000 (FY21 €237,000), secretary and administrator fees of €254,000 (FY21 €227,000), legal fees of €162,000 (FY21 €157,000) and AIFM fees of €147,000 (FY21 €112,000). For the most part, the increase in fees reflects the increased size of AERI’s portfolio.

The secretary and administrator role is fulfilled by Apex Listed Companies Services (UK) Limited. The auditor is PricewaterhouseCoopers LLP. Legal advice is provided by CMS Cameron McKenna Nabarro Olswang LLP.

For FY22, AERI’s ongoing charges ratio was 1.08% (FY21 1.11%).

Capital structure

AERI has 408,225,705 ordinary shares in issue, of which 20,823,043 are held in treasury. Consequently, 387,402,662 ordinary shares in circulation and this represents the total of shares with voting rights.

The shares are listed in London on the premium segment of the main market. The shares can be traded in euros (under the AERI ticker) or sterling (AERS). The two lines are otherwise identical and exchangeable one for the other. The board is exploring the possibility of securing a secondary listing for the company on a European exchange as a way of broadening the potential investor base and increasing liquidity.

AERI’s accounting year runs to 31 December and its AGMs are normally held in June.

AERI invests through Tesseract Holdings Limited (a wholly owned subsidiary of AERI), which in turn invests in special purpose vehicles (SPVs) that own the underlying assets.

At IPO, AERI raised €154.3m from investors at €1.00 per share. Then in 2020, it raised €40m in March at €1.05 per share, and a further €127.5m at €1.0375 per share in September 2020. AERI’s last capital raise was in September 2021, when it raised €90m at €1.03 per share.

Gearing

AERI is permitted to take on long-term structural debt provided that at the time of entering into (or acquiring) any new long-term structural debt (including limited recourse debt), total long-term structural debt will not exceed 50% of GAV. In addition, AERI can use short-term debt, such its revolving credit facility (RCF), to assist with the acquisition of suitable opportunities as and when they become available. This short-term debt is subject to a separate gearing limit of 25% of GAV at the time of entering into (or acquiring) any such short-term debt.

As at 31 March 2023, AERI had gearing of about 31.5%. This included €76.6m drawn down on its €100m RCF. As discussed earlier, AERI’s €250m solar portfolio is unlevered and the company is talking to lenders about borrowing against it.

AERI’s €100m RCF is provided by RBS and ING to Tesseract Holdings Limited and has a maturity date in April 2025.

Continuation vote

In accordance with its prospectus, AERI’s first continuation vote was put to shareholders at the AGM on 14 June 2023. Shareholders voted in favour of continuation by 74.1% to 25.9%.

In the prospectus, it was envisaged that continuation votes would be held every four years. However, given the current discount that AERI and the wider peer group trade at, the board has decided to bring forward the next continuation vote from 2027 to 2024. Furthermore, Aquila Capital has said that it will not vote its shares at that meeting.

Our feeling is that, if the discount narrows and AERI meets its impressive dividend cover target for 2023, next year’s vote will be carried even more convincingly.

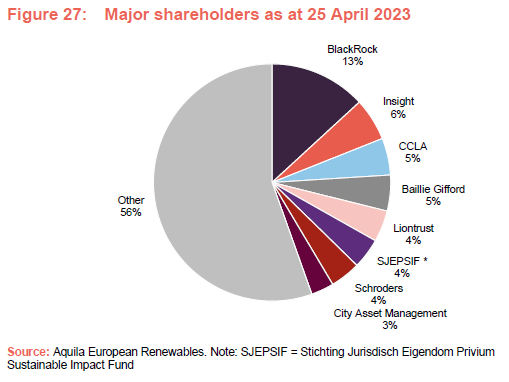

Major shareholders

Adviser

Four members of the adviser’s Partnerships and Portfolio Advisory team take the lead in overseeing AERI.

Michael Anderson

Michael who is an investment professional within Aquila Capital, is responsible for the portfolio management of AERI and its new energy infrastructure opportunities. Prior to joining Aquila Capital in 2020, he worked in the corporate finance and treasury team at Transurban Group in Australia, where he focused on the execution of financing and mergers and acquisitions activities. Before that, he was an associate at Greenhill, an independent investment bank. Michael holds a Bachelor’s degree in economics and a Bachelor’s degree in business management from the University of Queensland in Australia.

Christine Brockwell

Christine is responsible for Aquila Capital’s investment partnerships and for the overall performance of Energy & Infrastructure across Europe, the Middle East and Africa’s (EMEA’s) long-term funds. She has more than 15 years of relevant experience. Prior to joining Aquila Capital in 2018, she held positions at Global Capital Finance and UK Green Investment Bank, the world’s first green bank. As head of offshore wind at the UK GIB, Christine had overall responsibility for the offshore wind sector and its related investments. Under her management, UK GIB invested for the first time in construction-phase offshore wind assets and made investment commitments of 600m euros. Christine holds a Master’s degree in economics from the New York University and a Bachelor’s degree in biology from the Georgia Institute of Technology.

Nicole Zimmerman

Nicole is responsible for ensuring that documents comply with the legal and economic requirements that apply to funds or mandates. She is also responsible for the management of investment structures and structural entities. Nicole has worked in the areas of fund controlling, asset and structure management since 2012. She graduated as a State-Certified Business Manager with focus on Controlling from the Economic and Social Academy in Bremen. She is also a trained banker.

Pascal Herrmann

Pascal is responsible for the assessment of new investment opportunities and the coordination of the investment process. He joined Aquila Capital in 2021. Pascal has completed an apprenticeship as an investment fund management assistant and holds a Bachelor’s degree in business administration and a Master of Finance with corporate finance specialisation from the Frankfurt School of Finance & Management.

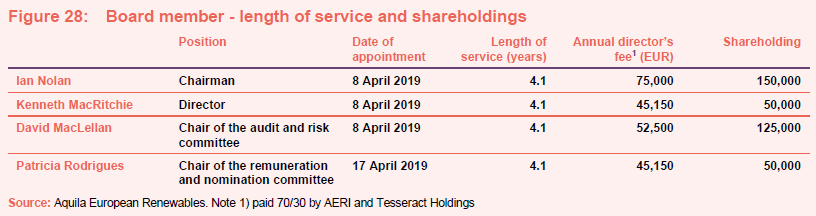

Board

There are four non-executive directors on AERI’s board, each of whom are independent of the adviser and were appointed ahead of the IPO. In February 2023, Patricia Rodrigues was appointed chair of the remuneration and nomination committees in place of Kenneth MacRitchie as part of the board’s ongoing commitment to ensure that it maintains suitable diversity and representation.

We note that each of the directors holds shares in the company and that Ian Nolan and David MacLellan bought 50,000 shares each on 3 February 2023.

Ian Nolan

Ian led the team that was recruited by the UK Government in 2011 to establish the UK Green Investment Bank, and was its chief investment officer until 2014. Previously, he held the position of chief investment officer at 3i Plc and was a director of Telecity Group Plc.

Ian is currently a partner and chairman of the investment committee of Circularity Capital LLP. He has three decades of experience in finance, private equity and investment management.

Ian qualified as a chartered accountant with Arthur Andersen and graduated with a BA in Economics from Cambridge University.

Kenneth MacRitchie

Kenneth has over 30 years’ experience of advising on the financing, development and operation of independent power projects across EMEA. He was a partner at global law firm Clifford Chance and thereafter at Shearman & Sterling, where he served on their management board. Kenneth also has experience of advising the UK Government on renewable energy policy and led the establishment of Low Carbon Contracts Company Limited, the UK Government-owned company that provides subsidies for the UK renewables industry.

Kenneth is a graduate of the Universities of Glasgow, Aberdeen and Manchester.

David MacLellan

David is the founder and currently chairman of RJD Partners, a private equity business focused on the services and leisure sectors. He is a non-executive director of Custodian Property Income REIT. Previously, David was the chairman of John Laing Infrastructure Fund and an executive director of Aberdeen Asset Managers Plc following its acquisition in 2000 of Murray Johnstone, where he was latterly chief executive, having joined the company in 1984.

David has served on the boards of a number of companies and is currently a non‑executive director of J&J Denholm Limited. He is a past council member of the British Venture Capital Association and is a member of the Institute of Chartered Accountants of Scotland.

Patricia Rodrigues

Patricia has over two decades of leadership experience in infrastructure and real asset investment and investment banking. She is a non-executive director for several companies and funds investing in real assets globally with a focus on ESG, including Legal & General Assurance Society Ltd, and is an investment committee member of GLIL Infrastructure and AIIF4 (Africa Infrastructure).

Patricia began her finance career at Morgan Stanley and subsequently worked for Macquarie, including as a managing director where she led new infrastructure and real asset products globally. She was head of portfolio management for the UK Green Investment Bank, before leading the growth strategy of the non-real estate real assets business for Townsend (part of AON).

Patricia graduated with an M.Eng-equivalent in Engineering from the University of Porto and a PhD in Engineering from Cambridge University.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aquila European Renewables Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.