AVI Global Trust

Investment companies | Update | 8 March 2023

Doubly blessed

AVI Global Trust (AGT) offers investors an opportunity to access a portfolio of what the manager feels are good-quality investments trading at a discount to their intrinsic value. Thanks to recent market movements, AGT’s ‘double discount’ – the share price discount to NAV plus the manager’s estimation of the discount on the underlying portfolio – now sits on an abnormally wide level. The team has been tactically increasing AGT’s market exposure, with the aim of tapping into these discount-opportunities. It feels that this gives AGT’s shareholders the potential for a powerful combination of NAV gains and discount closing.

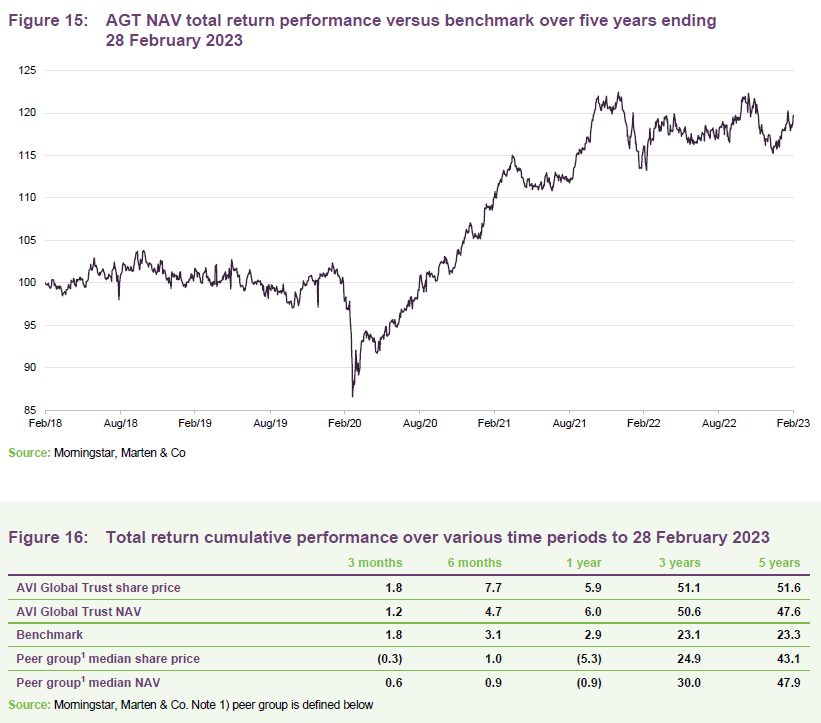

AGT has generated good near-to-mid-term performance, ranking first of its peer group over three years to end February 2023 (see page 14).

Extracting value from discounted opportunities

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in quality assets held through unconventional structures that tend to attract discounts; these types of companies include holding companies, closed-end funds, and asset-backed special situations.

Fund Profile

AGT aims to achieve capital growth through a focused portfolio of investments, particularly in companies whose shares stand at a discount to estimated underlying net asset value. It invests in what the manager believes are quality assets held through unconventional structures that tend to attract discounts; these types of companies include family-controlled holding companies, closed-end funds, and asset-backed special situations such as asset-rich Japanese operating companies.

For performance measurement purposes, the company compares itself to the MSCI All Country World ex-US Total Return Index, expressed in sterling terms. Whilst it has some exposure, relative to an unconstrained global index, the trust has a sizeable underweight exposure to the US, primarily because there are fewer opportunities to invest in family-controlled holding companies.

More information is available at the trust’s website: aviglobal.co.uk.

AGT’s AIFM is Asset Value Investors (AVI). AVI was established in 1985, when the trust’s current approach to investment was adopted. At that time, AGT had assets of just £6m and was known as the British Empire Securities and General Trust, later shortened to British Empire Trust. The trust adopted its current name on 24 May 2019.

Since October 2015, the lead manager on the trust has been Joe Bauernfreund, CEO and CIO of AVI. Joe has over 25 years’ experience in the finance industry. After six years working for a real estate investment organisation in London, he joined AVI in July 2002 as an investment analyst. AVI’s head of research is Tom Treanor, who joined the company in February 2011. His previous role was in closed-end fund analysis for Fundamental Data/Morningstar. We talked to Tom when putting together this note.

Market overview

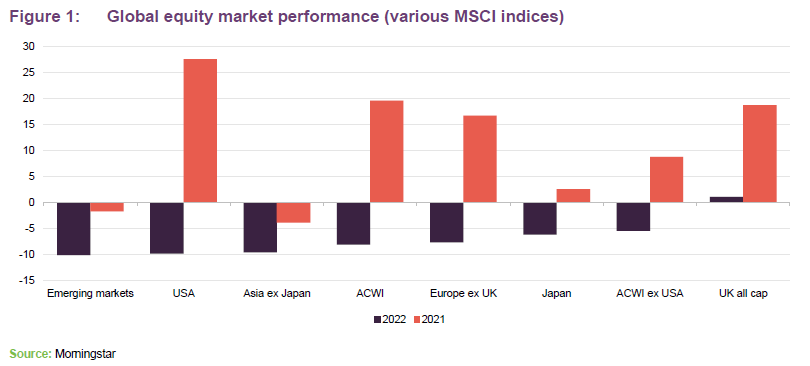

We published our last note on 20 May 2022, and global equity markets have been volatile since then, with 2022 turning out to be one of the most painful bear markets in recent memory. Whilst the AVI team did acknowledge the forthcoming difficulty when we wrote our last note, it was unable to shield AGT from the market fallout completely.

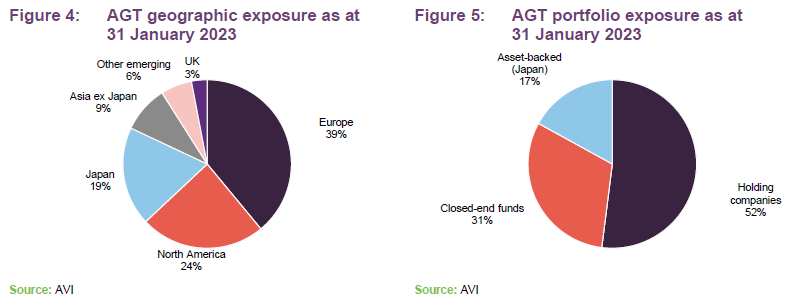

As can be seen in Figure 1, 2022 was clearly a difficult year for markets. On a look-through level, AGT has its largest exposures in Europe (39%), North America (24%) and Japan (19%), regions which all underperformed AGT’s benchmark index. Tom acknowledges the challenges that the recent market environment had presented for AGT’s style of investing, with AGT’s major regional exposures seeing a powerful reversal in their performance between 2021 and 2022. However, he feels that AGT’s idiosyncratic portfolio does present other factors that have driven its performance, which we outline later.

Tom notes that markets have been driven by macro factors and highlights the impact of rising inflation and the corresponding global monetary policy response as being major headwinds over 2022. The combination of this with stagnating economic growth may have led investors to adopt a risk-off stance. In retrospect, global equities were perhaps not particularly cheap, relative to their recent history, going into 2022. The selloff was broad, impacting a multitude of sectors, and AGT’s investments were not immune. By the end of 2022, AGT’s target companies were trading at, or close to the widest end of their historic discount range.

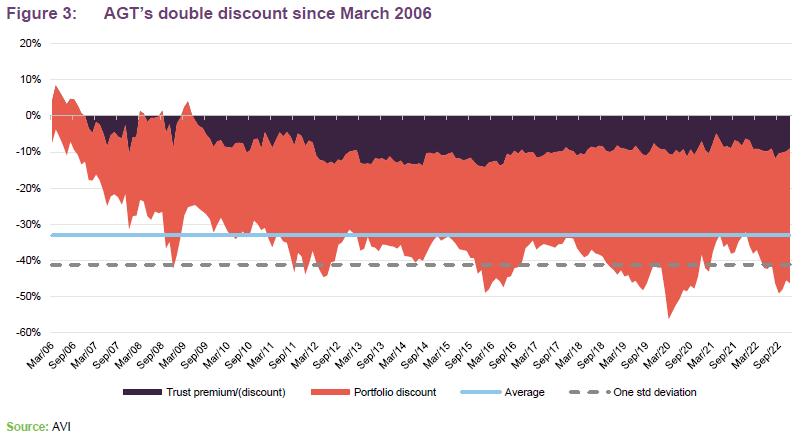

Double discount

Whilst investment trusts often offer investors the opportunity to buy assets below market valuations, currently AGT appears to offer investors the opportunity to capitalise on a ‘double discount’. In this scenario, investors have the potential to benefit from the valuation opportunity presented by a narrowing of AGT’s underlying holdings’ discounts as well as the potential for AGT’s own discount to narrow as well.

However, the manager feels that just because AGT could represent a valuation opportunity, it should not be viewed as a conventional ‘value fund’. Its underlying holdings are not the typical financials, resources, and aging industrials which can often characterise the value-stock sector. Rather, the manager believes that they are all high-quality businesses operating across a range of sectors, and bridging many of the conventional investment styles that AGT’s competitors may be labelled with.

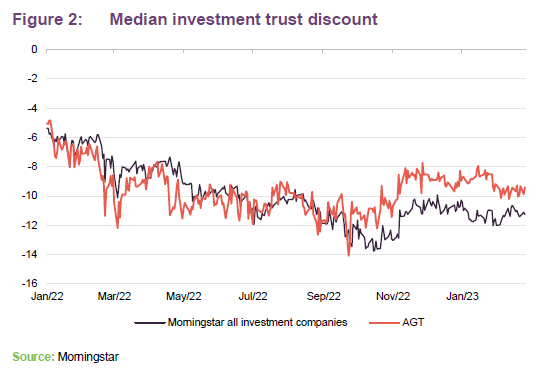

Figure 2 shows how the median discount of UK listed investment companies has widened since the start of 2022 and overlays that with AGT’s own discount. AGT’s discount did widen, but it held up relatively well and has been on a broad narrowing trend over the last five months.

However, if we factor in the discount to intrinsic value on the underlying portfolio, it is clear that AGT’s double discount at about 43% currently is close to its lowest point – more than one standard deviation below the long-term average of about 33%.

Tom stresses that this wider discount is not the result of AGT aggressively pursuing the cheapest possible investments – though AGT has reduced exposure to certain European holding companies due to their narrow discounts – but says it is rather due to discounts usually being pro-cyclical and widening out during bear markets. Over the period covered by the chart, there have only been 16 month-end periods (out of a possible 117) where its discount has been wider than its current level, nine of which occurred during the COVID-19 pandemic. One implication might be that under more ‘normal’ market conditions, investors have seldom had opportunities to buy AGT’s portfolio of ‘high-quality assets’ at such attractive levels.

Market-timing is often said to be more art than science. However, whilst AGT’s double discount may widen further, the team at AVI is increasingly bullish on the opportunity presented by the portfolio, and has increased the trust’s exposure to markets in recent months.

Asset allocation

AGT’s holdings are divided into three distinct asset classes: family-controlled holding companies, closed-end funds (and asset managers), and Japanese asset-backed securities. AGT’s allocation is also characterised by an almost structural underweight to the US, with a relative lack of family-controlled holding companies in North America. However, as Figure 4 shows, AGT’s look-through geographic exposure, accounting for the economic exposure of its investments rather than simply their registered domicile, is more diverse. Nevertheless, ultimately it remains underweight to North America, which does set it apart from its global equity peers.

There have been two major top-level changes to AGT’s asset allocation since our last note, with the majority of these changes having occurred in the last two months.

Over most of 2022, the portfolio remained fully invested, but the manager tended to maintain a net cash position, wary of being geared into falling markets. However, at the end of January 2023, AGT had gearing of 5.8% as the manager had increased exposure, seeking to take advantage of wide discounts.

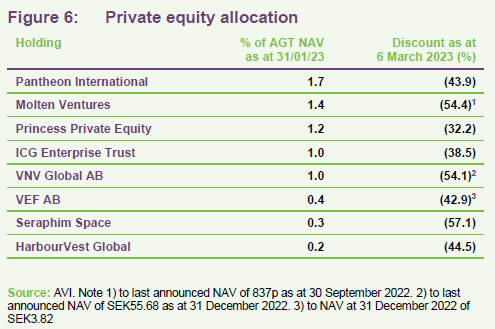

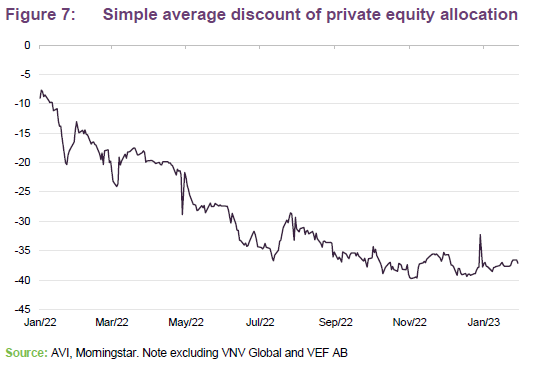

The other major change has been the introduction of a basket of listed private equity funds. While these fall under the closed-ended funds category, the team’s investment into these companies is a slight departure from its typical approach to the asset class. Rather than take long-term positions in these companies, either based on high conviction in the underlying assets or as part of a process of governance reforms (as it would typically), this small subset of companies represents what the team believes is near-to-medium term mispricing. We note that the team does not consider Oakley Capital Investments as part of this bucket, given its higher conviction in that trust’s long-term outlook.

As public equity markets tumbled, private equity discounts widened, which may have been due to investors’ general risk-off attitude or to concerns around future valuations, as private equity firms typically only provide NAV valuations on a quarterly basis. The AGT team believes that the market has now overly discounted private equity NAVs, either failing to appreciate strong underlying operational performance, or overly discounting the apparent risks in the portfolio.

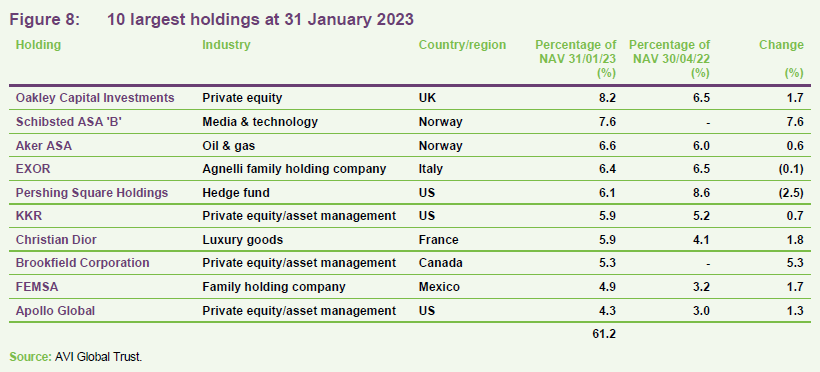

Top 10 holdings

Given the team’s recently increased bullishness, there has also been a fair amount of activity within AGT’s top 10 holdings since our last published note, with position sizes often being increased on their relative attractiveness. We note that AGT’s approach means that it has an active share of nearly 100%.

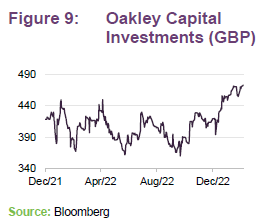

Oakley Capital Investments

Oakley Capital Investments (OCI) has risen to become AGT’s largest position. OCI represents the best-performing UK listed private equity strategy over the last five years, based on NAV returns at time of writing. AVI says that OCI is set apart by its highly entrepreneurial approach to private equity, with a focus on mid-to-small-size assets, typically buying educational, technology and consumer businesses. Tom notes that, because of its manager’s network of entrepreneurs, it often finds itself uncontested when investing in new positions. He also says that OCI’s managers are also unafraid of ‘rolling up their sleeves’ and taking on companies that are often overlooked by other private equity firms, such as complex corporate carveouts.

OCI has long been one of the team’s preferred investments in the closed-ended fund category. However, the team’s long-term conviction in the stock has increased alongside the wider opportunity the team sees in listed private equity, with OCI trading at a wide discount that is close to 30%. The team also highlights several governance tailwinds supporting increased investor interest in OCI, saying that its management and directors seem committed to improving the fund’s governance standards. It has also been operating one of the largest share buyback schemes of its peers over the last three-to-five years.

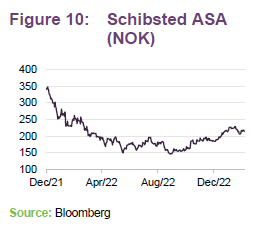

Schibsted ASA

The team first initiated its position in Schibsted in the second quarter of 2022, and has increased it since. Schibsted is a Norwegian holding company that owns a number of online classified and media-related assets. However, the AVI team considers that its two most valuable assets are Finn, a uniquely dominant classified marketplace in Norway (think of it as Rightmove, Autotrader and much more combined), and a stake in Adevinta, a publicly-listed company that owns a number of online classified business in Germany, France and other parts of Europe, having acquired many of these from eBay in 2020.

The investment manager thinks that the global tech sell-off, earnings downgrades, and growing investor frustration at the inefficient group structure created a perfect storm. Shares in Schibsted declined by than 60%, allowing AGT to pay a cheap price for what it sees as great businesses. The team believes both Finn and Adevinta can compound in value for many years to come, benefitting from dominant market positions, high levels of pricing power and wide margins. In the near-term, a recovery of second-hand car sales – hitherto limited by low inventory following the semi-conductor chip shortage – could be a key catalyst for earnings growth.

Tom says that Schibsted’s upside potential not only comes from a reversal of the recent selloff, but also from the discount the market has assigned to it based on the complexity of its structure. The AVI team believes that there is an opportunity for Schibsted to spin out its listed assets, either through a partial or full sale of its Adevinta stake. The potential for this was illustrated in December 2022 when Schibsted monetised a 5% stake in Adevinta through a block-trade and by entering into a total return swap, using the proceeds to fund a buyback programme for about 4% of its shares.

Notwithstanding the rally in its share price over the last few months, AVI sees considerable upside from NAV growth and from Schibsted management taking further steps to simplify the group structure.

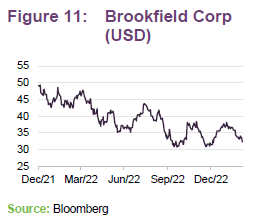

Brookfield Corporation

Brookfield is a balance sheet-heavy alternative asset manager (i.e. it has sizeable investments in its own funds, like KKR) and is one of the world’s largest alternative managers, with about $700bn in assets. AVI acquired a position in the company ahead of the spin-off of a 25% stake in its asset management business, with its view being that the company was trading at a dislocated valuation and that either (i) the asset management business was being valued on too cheap a multiple or (ii) the discount on the other assets/holdco discount on Brookfield Corp was too wide. AVI says that it expected the asset management business to attract a high valuation post-spin given its earnings being entirely from management fees (as opposed to more volatile and lowly-valued carried interest); its high (90%) dividend pay-out policy; its light balance sheet; its estimated five-year fee-related earnings CAGR of +17%; and its advantaged AUM mix focussed on real assets, power, and renewables with BAM the best-placed of all of its peers to exploit the multi-trillion dollar climate transition opportunity over the next decade.

Valuations subsequent to the spin-off appeared to highlight that the discount on Brookfield Corp is very wide, with the spun-out asset management business trading well. To take advantage of the relative valuations, AGT sold AVI’s Brookfield Asset shares received in the spin and used the proceeds to buy more Brookfield Corp which at the time of writing trades on a 46% discount.

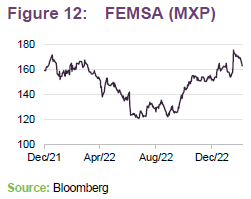

FEMSA

FEMSA is a Mexican family holding company, and a mainstay of the AGT portfolio, having been covered in previous notes. The manager has increased conviction in the story since our last note, as FEMSA’s board conducted a strategic review to address FEMSA’s undervaluation. In February 2023, the board concluded its review, which will see the company exit its stake in Heineken, sell other non-core assets, and return excess capital to shareholders. The team at AGT sees this as a fantastic outcome, which will help the market better value FEMSA’s highly attractive unlisted convenience store business.

Other new holdings

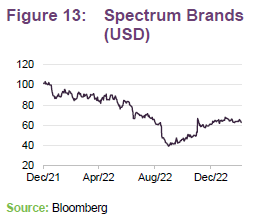

Spectrum Brands is a new addition to AGT’s portfolio. Spectrum is a diversified conglomerate which contains a variety of businesses, which include pet care, home improvement hardware, garden equipment, and consumer electronics.

AGT’s manager says that Spectrum represents a good example of the optionality that it often sees within AGT’s portfolio. The company is in the process of selling its hardware and home improvement arm to ASSA ABLOY for $4.3bn in cash. However, the sale has been held up by the US’s Department of Justice, based on competition concerns. AVI believes that the sale will likely go through, as ASSA ABLOY has offered to dispose of some of its existing assets in order to prevent it achieving excess market share.

While a positive resolution could lead to an uptick in the share price of Spectrum, AVI thinks that the potentially greater upside would come from Spectrum’s use of the proceeds to buy back up to about half of its outstanding shares. Even if the sale falls through, there is a break-fee built into the negotiations equivalent to 13% of Spectrum’s market cap in the event that the sale falls through.

Japan

While there have been some major disposals within the team’s Japan bucket, which we outline later, it has been increasing the number of Japanese holdings within AGT. The team has purchased a basket of four regional banks within Japan, equal to about 3% of the portfolio. It feels that these would be beneficiaries of any relaxation of Japan’s yield curve control policy, which it thinks may now be possible as inflation is creeping up in the country.

Tom says that, following the sale of Sony and Nintendo (see below), AGT’s Japanese assets now reflect a more ‘core’ set of holdings, which represent the smaller, underreached discount opportunities that investors typically associate with AGT. We note that AGT’s Japan holdings only have a small overlap with the holdings of AVI Japan Opportunity Trust, reflecting the latter’s smaller size.

Sales

There have been a few sales since our last note, some of which were present in the previous list of top 10 holdings.

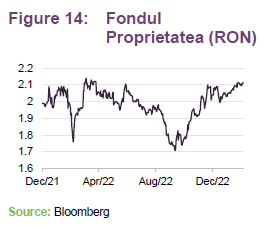

Fondul Proprietatea

Fondul Proprietatea is a Romanian holding company that is in the process of listing its largest holding, Hidroelectrica. Whilst the team had once believed that it would be dual-listed on both the Romanian and London exchanges, the government seemed determined to restrict the IPO to a single listing in Bucharest. The lack of liquidity in that market, which would then be dominated by Hidroelectrica, would likely make the company less attractive to investors. Following a rally in Fondul’s share price, AGT’s manager opted to realise gains and exit the position entirely; an action that was quickly vindicated as the Romanian government has confirmed that Hidroelectrica will trade solely on the Bucharest exchange. This comes on top of increasing political risk in Romania, including the possibility of further windfall taxes on energy producers.

EXOR

The team has also reduced AGT’s exposure to EXOR, the Italian holding company, to fund some other purchases, based on the relative outlook for these stocks. However, EXOR remains a top-three holding for AGT, thanks to a combination of its wide (c.40%) discount and the recent sale of its insurance business. Tom says that this disposal has left EXOR with a substantial pile of cash that it may use to purchase a luxury goods brand which could be the potential catalyst for a narrowing of its discount.

Japan holdings

AGT has exited its positions in both Nintendo and Sony, the two largest Japanese positions in the portfolio when we last published our note. Part of the reason given for the sale was the team’s increased pessimism around the video game market. It notes that Nintendo is facing stiff competition from the more advanced consoles, having yet to announce its next generation of console, as well as the possible slowdown in demand resulting from a global economic downturn.

Sony was in a similar position, given that its PlayStation arm forms a large portion of its revenues. Sony also seemed to be hit particularly hard by the announcement of Microsoft’s planned purchase of Activision Blizzard, which could dramatically increase the competition that PlayStation faced from Microsoft’s Xbox console, but still needs clearances from competition authorities.

In the case of both Sony and Nintendo, the team also believed that other opportunities, both in new and existing holdings, represented greater upside potential and so capital was drawn from these positions to fund purchases elsewhere in the portfolio.

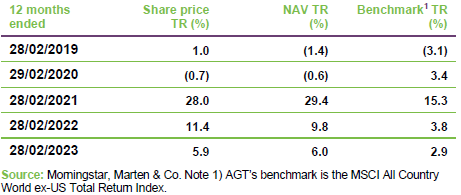

Performance

2022 was a year of modest underperformance for AGT, likely due to the more risk-off environment encouraging discounts to widen (as was discussed on page 5).

AGT does, however, retain its long-term outperformance relative to both its benchmark and its peer group. Much of this can be attributed to the post-COVID bounce period during 2020 and 2021. In AGT’s case, it benefitted from the ‘double-whammy’ effect of both surging asset values and narrowing discounts.

Peer group

Up-to-date information on AGT and its peers is available on our website.

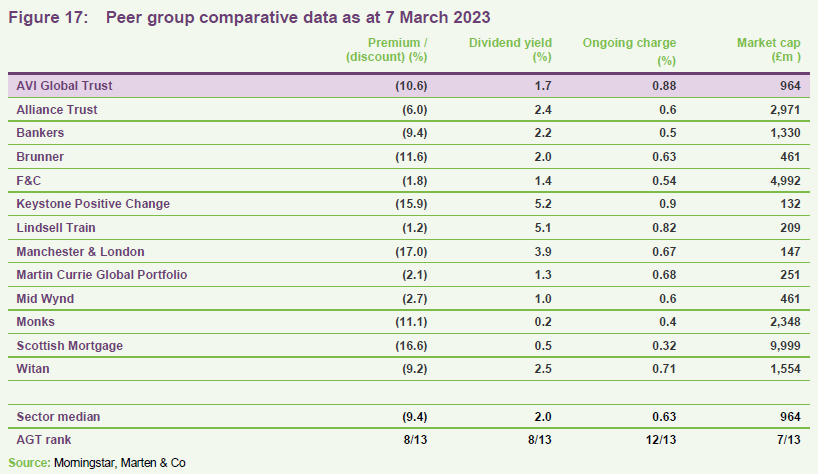

AGT is a constituent of the AIC’s Global sector and, for the purposes of this note, we have compared AGT with the other members of this sector. The members of this peer group invest predominantly in listed global equities with the aim of generating the majority of their returns from capital growth.

AGT’s discount is marginally above the median level, with its yield being below average. AGT’s ongoing charges ratio is second-highest of its peers. It is possibly a reflection of the complexity of AGT’s approach to investment, which at times requires the team to take an activist approach with some of its holdings.

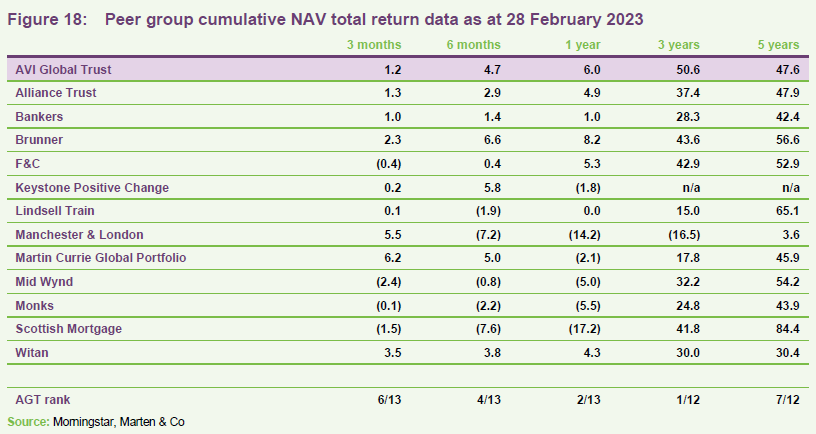

The success of AGT’s approach to investing can be seen in Figure 18. While the trust ranks as average over the last five years, it has pulled ahead over the near and medium term (one and three years respectively), leading the pack over three years.

Contributions to returns

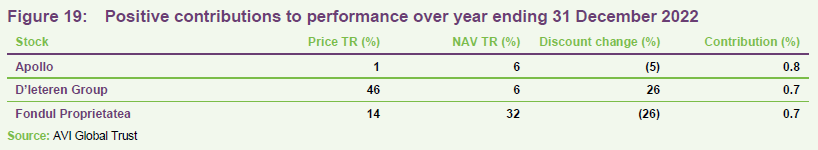

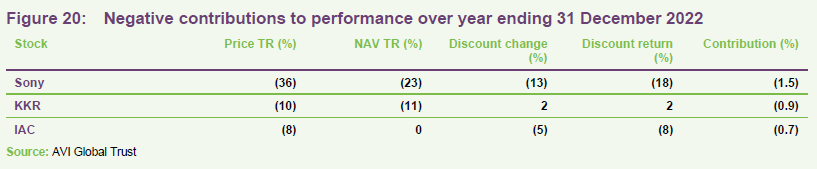

AVI has shared some information on the stocks that contributed to AGT’s returns over the 2022 calendar year, which we reproduce in Figures 19 and 20.

Tom says that Apollo (apollo.com), the alternative asset manager, saw a bumper year over 2022, having generated record fee-related earnings, as well as record inflows into its strategies. Apollo’s share price saw a substantial uptick in the fourth quarter of 2022, reversing the impact of the market selloff earlier in the year.

D’Ieteren Group (dieterengroup.com) is a Belgium-based holding company whose largest investment is Belron, the global leader in automotive glass repair and replacement. AGT was able to pick up a stake after Belron announced disappointing results in March 2022. It then rode the recovery in Belron’s share price as investors appeared to reappraise the company’s prospects. D’Ieteren has been building its exposure to the automotive sector with acquisitions of spare parts business for both industrial machinery and cars. AVI thinks an IPO of the automotive businesses might be a possibility longer-term.

Sony was discussed above. In the case of IAC, a US holding company focusing on internet and media services, its share price fell, likely as a result of the wider sell-off in growth stocks over 2022. KKR is a global alternative asset manager. Tom says that these tend to behave like leveraged financial plays in terms of share price performance in bear markets, which AVI believe is a misperception given the capital they manage is very long-duration.

Dividend

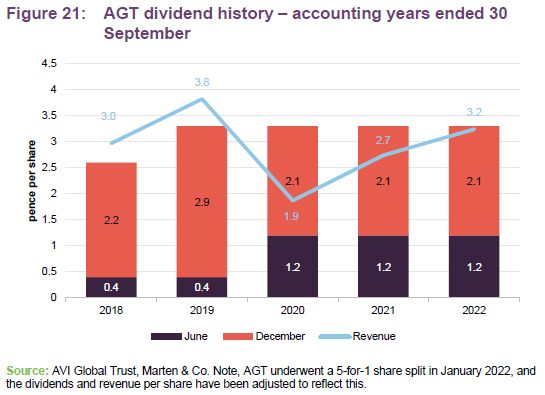

AGT normally declares two dividends per year, an interim in June and a final in December. Whilst it has not done so in recent years, AGT has paid a handful of special dividends over the last decade.

AGT’s underlying revenue has recovered since the pandemic, after the trust was required to dip into its reserves to fund its 2020 and 2021 dividends. Its most recent 2022 dividend was a hair’s breadth away from being fully covered, paying a dividend of 3.30p per share compared to revenue of 3.24p per share.

The board does not constrain the investment manager by setting a revenue target. The board’s current intention is to maintain the dividend at current levels. However, the dividend policy remains under careful and regular review.

At the end of September 2022, AGT’s revenue reserve stood at £28.3m, equivalent to 5.7p per share, and growing slightly from its 2021 level. In addition, AGT’s articles permit the distribution of realised capital gains.

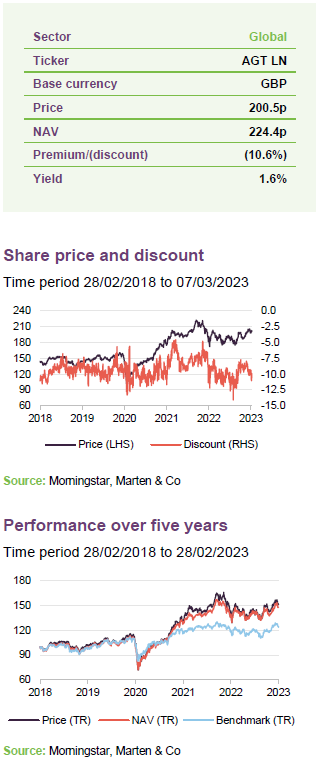

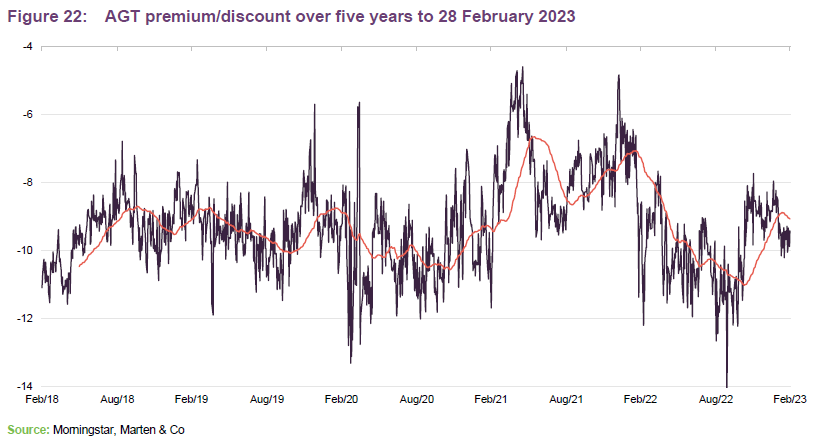

Discount

Over the 12 months ended 28 February 2023, AGT’s discount moved within a range of 14.1% to 7.7% and averaged 9.9%. At 7 March 2023, AGT’s discount was 10.6%.

AGT saw its discount materially narrow over Q4 2022. AGT’s discount reached its five-year low as recently as September 2022.

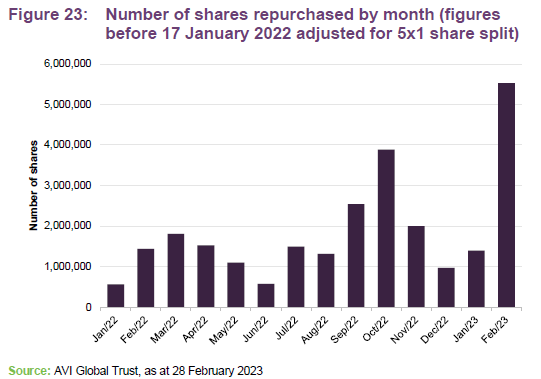

AGT underwent a five-for-one share split in January 2022, which should in theory help improve the liquidity of the trust’s shares. AGT currently has 481m shares outstanding.

At the AGM in December 2022, shareholders approved resolutions empowering the board to buy back up to 14.99% of its then-issued share capital and issue up to a third of its then-issued share capital. A separate resolution granted permission for 5% of the then-issued share capital to be issued without pre-emption. AGT’s board uses share buybacks with the intention of limiting volatility in AGT’s discount. Over the 12 months ended 28 February 2023, the equivalent of around 24.1m shares were repurchased.

The board also employs a marketing budget (administered by the investment manager) with the aim of stimulating demand for the trust’s shares.

Previous notes

Readers interested in further information about AGT may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 24 or by visiting our website.

Figure 24: QuotedData’s previously published notes on AGT

Source: Marten & Co |

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on AVI Global Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.